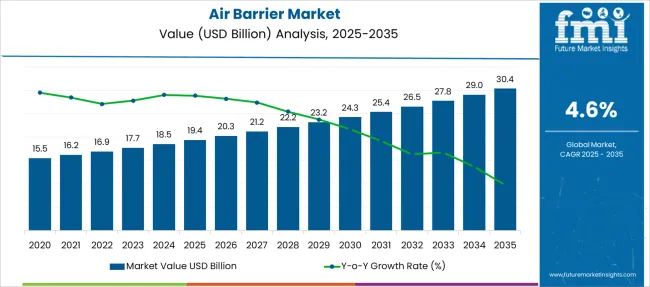

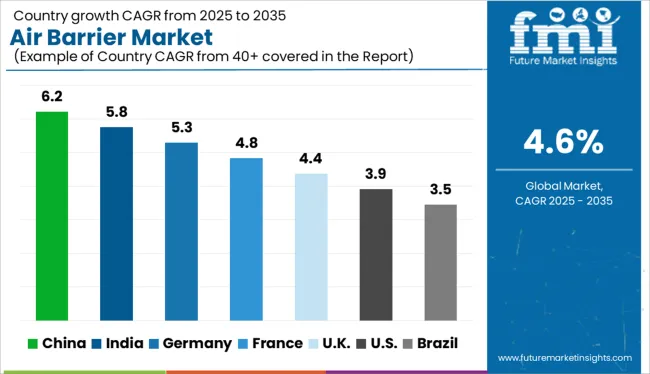

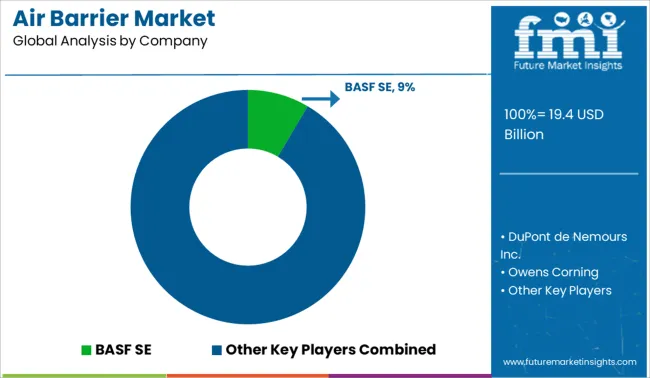

The Air Barrier Market is estimated to be valued at USD 19.4 billion in 2025 and is projected to reach USD 30.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Air Barrier Market Estimated Value in (2025 E) | USD 19.4 billion |

| Air Barrier Market Forecast Value in (2035 F) | USD 30.4 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The air barrier market is experiencing steady growth as the construction industry places greater emphasis on energy efficiency and building envelope performance. New building codes and sustainability standards are encouraging the adoption of air barriers to improve indoor air quality and reduce energy consumption.

This has increased demand for advanced materials that prevent air leakage and enhance thermal insulation. Industry trends point to rising investments in green building projects and retrofitting of existing structures to meet stricter regulations.

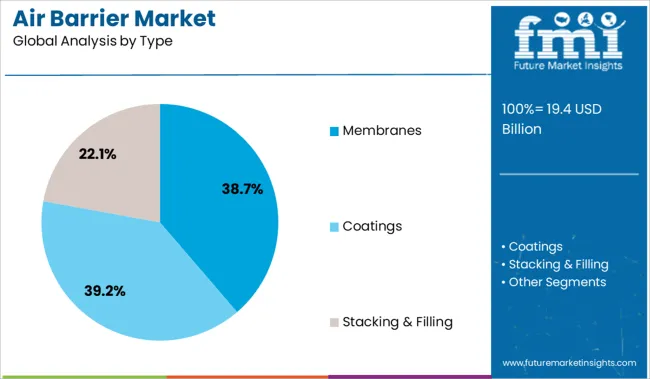

Growing awareness about the environmental impact of buildings has also fueled interest in air barriers as critical components of sustainable construction. Future market growth is expected to be supported by ongoing innovation in product formulations and increasing focus on reducing carbon footprints in the built environment. Segment growth is anticipated to be led by membranes in product type, membranes as a type, and external applications, reflecting their effectiveness in controlling air infiltration on building exteriors.

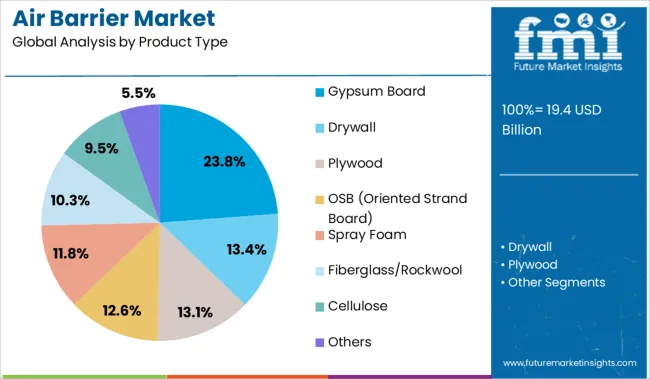

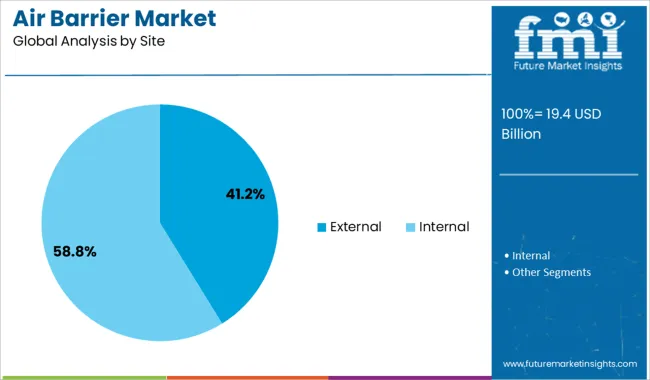

The market is segmented by Product Type, Type, Site, Application, and End Use and region. By Product Type, the market is divided into Gypsum Board, Drywall, Plywood, OSB (Oriented Strand Board), Spray Foam, Fiberglass/Rockwool, Cellulose, and Others. In terms of Type, the market is classified into Membranes, Coatings, and Stacking & Filling. Based on Site, the market is segmented into External and Internal. By Application, the market is divided into Insulation, Corrosion Resistance, Material Packaging & Stacking, and Microbial & Fungal Resistance. By End Use, the market is segmented into Residential Buildings, Commercial Buildings, Industrial Facilities, Car Parks & Underground Basements, Military Buildings & Bunkers, Green Houses, and Metal Buildings. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gypsum board segment is projected to account for 23.8% of the air barrier market revenue in 2025, establishing itself as a significant product type. Its growth is supported by its widespread use in interior walls and ceilings where it acts as a secondary air barrier. Gypsum board offers good fire resistance and ease of installation, making it popular among contractors.

It complements primary air barrier materials by providing additional air tightness and improving overall building envelope performance. Increasing adoption in residential and commercial construction projects has driven demand.

As builders continue to focus on comprehensive air sealing strategies gypsum board is expected to maintain an important role in the product mix.

Membranes are expected to hold 38.7% of the market revenue in 2025, making them the leading air barrier type. Their growth is driven by superior flexibility and durability which make them suitable for a variety of building designs and climates. Membranes create a continuous air seal over structural components effectively preventing air leakage and moisture ingress.

Their adaptability to complex architectural shapes and ease of application have made them preferred choices among contractors and architects. Additionally membranes contribute to energy savings by improving thermal performance.

As demand for high-performance building envelopes increases membranes are projected to sustain their market leadership.

The external site segment is projected to contribute 41.2% of the air barrier market revenue in 2025, reflecting its importance in preventing air infiltration and moisture penetration at the building exterior. External air barriers are critical in protecting the building envelope from environmental factors and enhancing energy efficiency.

The focus on reducing heating and cooling costs has driven widespread use of external air barriers in new constructions and retrofits. Builders and designers emphasize external air sealing to improve durability and occupant comfort.

The segment benefits from building codes that require continuous air barrier installation on building exteriors. With increasing emphasis on sustainable construction and energy conservation the external segment is expected to maintain its dominant position.

| Market Statistics | Details |

|---|---|

| H1,2024 (A) | 4.7% |

| H1,2025 Projected (P) | 4.9% |

| H1,2025 Outlook (O) | 5.0% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | (+) 10 ↑ |

| BPS Change : H1,2025 (O) - H1,2024 (A) | (+) 30 ↑ |

A half-yearly comparison of the growth forecast for the market of air barrier along with market dynamics and current industry trends influence market growth has been presented by Future Market Insights. Growth in the economies of various countries along with development in the construction sector is influencing the growth of the market.

The type of air barrier to be employed depends significantly on the temperature, the overall climate, and an examination of the dew point fall inside the wall cavity.

The market for air barrier is estimated to witness a growth rate of magnitude 5.0% over the first half of 2025, which is about 10 basis points higher as compared to the earlier projected magnitude.

The market's expected growth outlook has risen by about 30 basis points in H1 2025. There is a sizable need for air barrier systems in buildings as a result of the steadily increasing demand for functional and energy-efficient structures. To attain sustainability objectives, environmental officials are enforcing strict regulatory frameworks and building rules, which is attributing to higher growth prospects.

A number of significant market developments, including product development, product launches, technological improvements, and others, are the strategy employed by key market players in the air barrier market.

Sales of air barrier increased at a 4.0% CAGR, between 2014 to 2024, with countries such as the USA, China, India, Germany, Canada, and GCC Countries accounting for a substantial portion of the global market. Sales prospects in 2024 to 2024 were dampened due to the outbreak of the COVID-19 pandemic, which reduced the demand for air barrier from several application areas such as insulations, corrosion resistance, and material packaging and stacking.

Increasing stringent building codes and energy regulations as well as growing demand for eco-friendly insulations and barriers to enhance the consumption of this material across its various application areas.

The residential construction industry is recovering, which is also expected to bode well for the global market of the air barrier in the forthcoming years. As a result, the air barrier industry is projected to grow by value, at a 4.6% CAGR during the forecast period of 2025 to 2035.

In accordance with the trend of sustainability, manufacturers are focusing on the utilization and upgradation of manufacturing techniques to enable the manufacture of environment-friendly insulating materials. As a result, the market for natural and eco-friendly insulation is anticipated to remain highly attractive during the forecast period. Insulation materials such as cellulose and fiberglass are preferred, owing to their higher recycled content and superior eco-friendly nature.

Cellulose insulation is commonly manufactured from recycled newsprint, cardboard, or other forms of waste paper, and blown fiberglass insulation with about 40% to 60% recycled glass content is gaining traction in the global air barrier business.

As the building and construction sector grows, the need for eco-friendly air barriers will grow tremendously. This is expected to provide an impetus to the demand for air barrier and urge manufacturers to boost their production and supply of the material.

The impact of the COVID-19 pandemic on the material industry was significant. Several production facilities in various countries were entirely shut down because of lockdown restrictions, which had a direct impact on the sales of the air barrier. However, the pandemic led to a severe increase in demand for medical-grade air barriers that could aid in containing the spread of the virus.

This increase ensured that in order to create a barrier enclosure and contain aerosol emissions from COVID patients, adequate production is necessary for air barriers in these places. Hence, this has saved the overall downfall of the market of the air barrier.

As numerous production facilities have reopened, the industry is progressively rebounding from losses, resulting in positive sales prospects in the air barrier business. Increasing prospects of gypsum air barriers are also expected to boost demand for the material in the forthcoming years.

As per FMI, China is projected to account for nearly 4.0% of the global market share, creating an incremental opportunity of above USD 30.4 Million in 2035.

China is expected to remain a key producer of air barrier across the globe. Noteworthy mining activities, unprecedented spurring production in the upstream oil and gas sector, and private construction investments put the material in high demand in the coming years. This is expected to augment the growth of the sales of the air barrier in China.

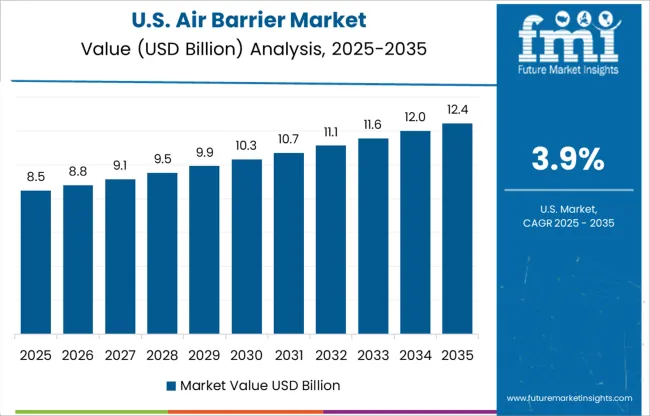

The USA is projected to account for approximately 84.4% of the North American market air barrier in 2035. In 2025, the market is expected to grow by 6.0% year-on-year, reaching a valuation of USD 3,801.1 Million by the end of 2025.

High investments in research and development to produce innovative barriers and insulations, such as cellulose and OSB material barriers will augment the increase in air barrier sales. The private construction sector is growing at a significant growth rate and contributes to more than 70% share in the construction industry. Moreover, the presence of leading companies like DuPont, Owens Corning, 3M Company, and Carlisle Companies is expected to bolster the growth of this material in the country.

India is projected to account for 39.5% of the South Asia air barrier consumption share in 2035. The government in the country is keen on the major remodeling of public infrastructure, and further development of roads and national highways to ensure better connectivity, which is in turn catapulting the development in the construction sector. Alongside this, profit-bearing growth strategies and product innovations by many key players are expected to propel sales of air barrier over the assessment period.

Sales of gypsum air barriers are expected to grow at a significant value of 4.1% CAGR, over the forecast period of 2025 to 2035.

Gypsum board is a premier building material for walls, ceilings, and partition systems in residential, institutional, and commercial structures. These are designed to provide a monolithic surface when joints and fastener heads are covered with a joint treatment system.

There has also been a growth in preference for gypsum air barrier in South Asia and Latin America. Owing to these factors, sales of gypsum air barriers are projected to increase over the forecast period.

Amongst the various end uses, the residential segment is projected to create an absolute dollar opportunity of more than USD 1,710.8 Million during the period of 2025 to 2035 and account for close to one-third market share in the global air barrier business.

Rising adoption of insulations in residential or home buildings is one of the major factors fuelling the demand for insulation installations, consequently also contributing to the growth of the global market of the air barrier. Globally, recovery in most of the construction industry is being accelerated by the steady growth in the population of the county’s cities and growing demand for construction materials for both residential buildings. This will continue providing tailwinds to air barrier sales over the assessment period.

The insulation application segment is projected to account for more than 13.7% of the total market share by 2035. The sales are anticipated to experience a year-over-year rate of 4.8% in 2025.

Inadequate insulation resulting in heat gain or loss is a leading cause of energy loss. Adding insulation and sealing air leaks can contribute significantly towards making homes more comfortable and increasing their value. Further, studies show proper insulation and sealing techniques can contribute towards energy savings of 10% - 20%.

These significant energy savings equate to a direct reduction in energy costs, which in some cases, amounts to several hundred dollars in savings per annum. Therefore, the growing need for energy efficiency is expected to stimulate the sales of air barriers in the upcoming years.

Leading players operating in the global market of air barrier are focusing on innovative product launches and operational efficiency. Apart from this, players are focusing on strategic acquisitions and mergers to serve more end users in the domestic market, in order to gain a competitive edge.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2014 to 2024 |

| Market Analysis | USD Million for Value and Square Meters for Volume |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, Germany, United Kingdom, France, Spain, BENELUX, Russia, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Australia, New Zealand, GCC Countries, Turkey, and African Countries |

| Key Segments Covered | Product Type, Type, Site, Application, End Use, and Region |

| Key Companies Profiled | BASF SE; DuPont de Nemours, Inc.; Owens Corning; Coromandel International Limited; SOPREMA; Compagnie de Saint-Gobain S.A.; Carlisle Companies; Atlas Roofing Corporation; GCP Applied Technologies; Firestone Building Products Company, LLC; Huber Engineered Woods LLC; GAF Materials Corporation; Johns Manville; W. R. Meadows, Inc.; Norbord Inc.; Sika AG; Bostik Inc.; 3M Company; Knauf Insulation; Laticrete International Inc.; The Sherwin Williams Company; Henry Company; Tremco Incorporated; Dryspace Inc.; Enershield Europe |

| Report Coverage | Market Forecast, Brand Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global air barrier market is estimated to be valued at USD 19.4 billion in 2025.

The market size for the air barrier market is projected to reach USD 30.4 billion by 2035.

The air barrier market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in air barrier market are gypsum board, drywall, plywood, osb (oriented strand board), spray foam, fiberglass/rockwool, cellulose and others.

In terms of type, membranes segment to command 38.7% share in the air barrier market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Barrier System Market Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Barrier Packaging Market Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Papers Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Barrier Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA