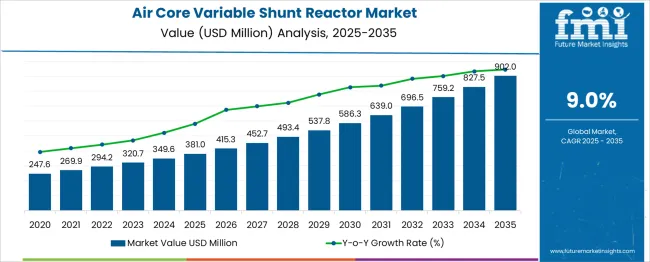

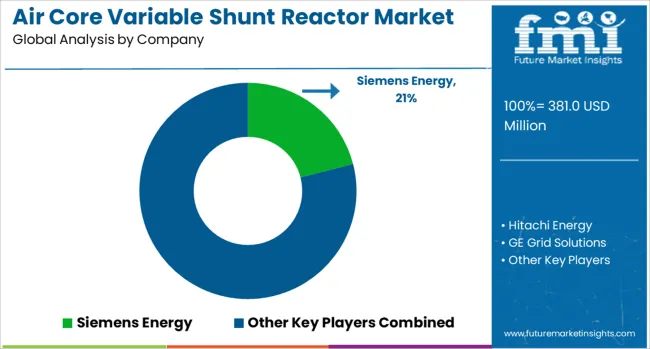

The air core variable shunt reactor market is estimated to be valued at USD 381.0 million in 2025 and is projected to reach USD 902.0 million by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period. Over the ten-year period, the market records a compound absolute growth of USD 521.0 million. This reflects a multiplying factor of approximately 2.37x. Year-on-year absolute additions accelerate consistently, starting with USD 34.3 million between 2025 and 2026 and reaching USD 74.5 million between 2034 and 2035. The compound nature of this growth reflects cumulative momentum, not just linear volume gains. Each year builds on a larger base, resulting in progressively higher absolute increments.

The mid-period shift, occurring between 2029 and 2031 when annual gains exceed USD 50 million for the first time, marks the onset of faster value accumulation. This stage aligns with infrastructure upgrades, increasing integration of renewable energy into grids, and rising demand for voltage control equipment in transmission systems. By 2035, the annual increment nearly doubles the first-year gain, confirming the compounding effect. The data presents a clear acceleration profile where growth is both cumulative and scalable. This structure favors suppliers with long-cycle manufacturing capabilities and capacity for multi-year utility and grid contracts.

| Metric | Value |

|---|---|

| Air Core Variable Shunt Reactor Market Estimated Value in (2025 E) | USD 381.0 million |

| Air Core Variable Shunt Reactor Market Forecast Value in (2035 F) | USD 902.0 million |

| Forecast CAGR (2025 to 2035) | 9.0% |

The air core variable shunt reactor market is evolving with grid modernization needs and widespread renewable energy integration. Leading innovators include Hitachi Energy, Siemens Energy, General Electric, Toshiba Energy and Hyosung Heavy Industries. These firms focus on smart voltage regulation systems modular reactor units and advanced materials that enhance reactive power compensation. Asia Pacific drives demand thanks to rapid power transmission expansion in China and India while North America and Europe invest in grid stability upgrades for clean energy transition. Key technical trends include high voltage three phase reactors compact designs supporting real time control and predictive diagnostics for efficient utility operations. Air core variable shunt reactors account for approximately 35% to 40% of the air core shunt reactor segment, used in high-voltage environments where oil-free solutions are preferred. Within the broader variable shunt reactor category, their share is estimated at 20% to 25%, based on their ability to adjust reactive power compensation during load variation.

In the full shunt reactor market, including fixed and oil-immersed types, air core variable models represent 5% to 8%. They hold around 10% to 12% within the transmission and distribution equipment segment, mainly for high-voltage substations and long-line networks. In the grid equipment space focused on reactive power control, these reactors contribute 15% to 20%, particularly for voltage support and harmonics suppression during dynamic grid loading.

The rising complexity of power systems, especially with the integration of renewable energy sources, has highlighted the importance of voltage stabilization and power factor correction, thereby enhancing the relevance of variable shunt reactors.

These reactors, particularly of air core design, are being preferred due to their minimal magnetic losses, reduced environmental risk, and longer operational life. Advances in digital monitoring, control systems, and modular configurations have further supported the deployment of these solutions in modern electrical networks.

The global shift toward smart grid development and the need to maintain grid stability under variable load conditions have intensified demand across utility-scale projects. As utility companies and industrial operators seek equipment that offers higher efficiency, lower maintenance, and adaptability to fluctuating grid conditions, the air core variable shunt reactor market is expected to exhibit sustained growth in the coming years..

The air core variable shunt reactor market is segmented by phase, end use, and geographic regions. The air core variable shunt reactor market is divided into three-phase and single-phase. In terms of end use, the air core variable shunt reactor market is classified into Electric utility and Renewable energy. Regionally, the air core variable shunt reactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

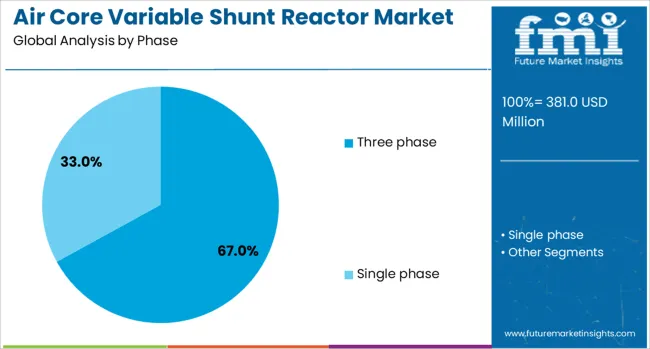

The three phase segment is projected to account for 67% of the Air Core Variable Shunt Reactor market revenue share in 2025, positioning it as the dominant configuration type. This preference has been attributed to the suitability of three-phase systems in high-voltage power transmission and large-scale grid infrastructure, where balanced power flow and stability are essential.

The ability of three phase reactors to manage higher capacity and support symmetrical load distribution has made them an integral component in energy-intensive applications. Their adoption has been reinforced by advancements in automation and digital control technologies, which have improved performance monitoring and system responsiveness.

Additionally, their compact footprint and lower total cost of ownership over time have supported widespread deployment, particularly in long-distance transmission corridors and substation installations. As electric utilities continue to modernize their grids and increase integration of renewable energy, the demand for efficient and stable reactive power control through three phase air core reactors is expected to remain strong..

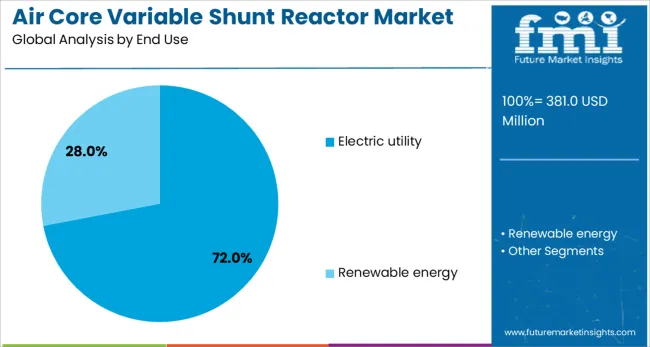

The electric utility segment is expected to capture 72% of the Air Core Variable Shunt Reactor market revenue share in 2025, establishing it as the leading end use sector. This dominant share has been supported by the continued expansion of utility-scale transmission infrastructure and the growing emphasis on grid reliability. Electric utilities have increasingly invested in air core variable shunt reactors to mitigate voltage fluctuations and ensure consistent power quality across vast transmission networks.

The need to handle peak demand variations and maintain grid integrity in the face of renewable energy integration has driven utilities to adopt advanced reactive power compensation systems. Furthermore, regulatory mandates for stable voltage operation and the rising occurrence of grid disturbances have reinforced the importance of deploying these reactors.

Their non-saturating core, minimal maintenance requirements, and adaptability to real-time operational demands have made them the preferred choice for utility providers. As the energy sector transitions toward cleaner and more distributed power generation, the role of electric utilities in deploying flexible grid equipment will continue to support market growth..

Air core variable shunt reactors are being specified for grid balancing and voltage stability in transmission and distribution systems, especially in networks with high renewable penetration. Approximately 38% of new reactive compensation projects deployed VSRs in 2024, replacing fixed reactors. These devices supported renewable grid integration and reduced transmission losses, capturing over 27% of reactive power capacity installed in solar and wind corridors. Enhanced load adaptability, ease of tuning, and rapid response to voltage swings drove operator preference. Demand growth was strongest in Asia Pacific and Europe, where frequency stability mandates and renewable ramp-up exceed the capacity of static reactive elements.

Variable shunt reactors are required where real-time reactive power compensation and voltage regulation are needed to balance intermittent generation. In grids with solar and wind integration, nearly 42% of compensation systems now include VSRs capable of adjusting reactance dynamically. Rollout of grid codes mandating voltage ride-through and frequency response has increased deployment of modular bypass-controlled reactors. Rapid tuning via motorized tap-changers allowed VSRs to match load shifts within seconds, improving voltage profile containment. Utility-scale substations and transmission hubs leveraged VSRs to reduce capacitor switching and oscillation issues. Retrofit applications in aging networks replaced fixed reactors at nearly 31% of project sites. Demand for devices with onboard control integration and remote telemetry rose due to smart grid modernization priorities.

High equipment cost and control infrastructure requirements restrict universal adoption of VSR technology. Initial procurement costs were approximately 24% higher compared to fixed-shunt alternatives. Additional integration of tap-changing motors, control relays, and diagnostic systems added nearly 15% to installation budgets. Skilled technicians were required for commissioning and calibration, extending project timelines by up to 11%. Operational complexity rose when reactive voltage setpoint programming was misaligned with grid management protocols. Maintenance of air-cooled reactor windings and mechanical tap mechanisms was reported to cause downtime in about 5 % of fielded units. Some utilities reported compatibility issues with existing SCADA platforms, necessitating gateway modules for control interoperability.

Variable shunt reactors are gaining traction in microgrid and industrial solar installations requiring responsive reactive balance. In solar park expansions, VSRs accounted for nearly 29% of dynamic reactive compensation procurement. Microgrid controllers began coordinating VSRs with battery inverters to maintain voltage stability in islanded operation modes. Emerging distribution networks in developing countries specified transportable VSR skids, capturing 18% of new installation volume in 2024. Integration with substation control systems enabled coordinated voltage regulation across feeder circuits and enhanced fault ride-through protocols. Demand increased for units capable of auto-tuning reactance under fluctuating renewable load patterns. Partnerships between transformer vendors and substation automation firms created bundled solutions for turnkey VSR-equipped grid modernization.

Smart VSR systems with remote monitoring, fault detection, and tap-change history tracking were adopted in 35% of installations. Digital control panels supported integration with IEC 61850 and enabled firmware-based tuning of voltage response curves. Modular coil configuration allowed phased scaling across substation feeders, reducing expansion costs by 22%. Battery-backed control units ensured tap operation continuity during power dips. Predictive winding temperature analytics and harmonic distortion assessment were embedded in 28 % of high-voltage VSR offerings to prevent resonance issues. Compact designs with reduced footprints became favored in urban feeder substations and rooftop installation hubs. Adaptive reactive control responding to line current and voltage thresholds improved system resilience and reduced switching delays in smart grid environments.

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

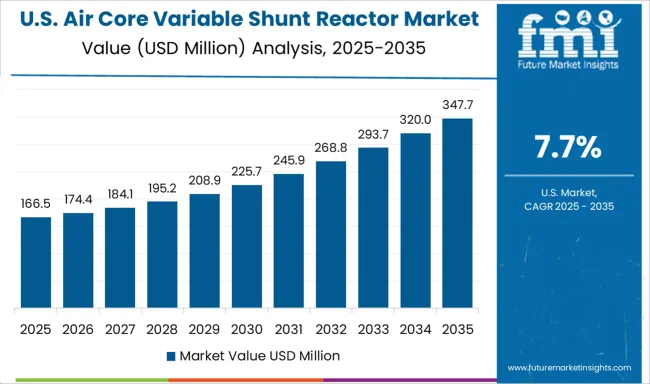

| USA | 7.7% |

| Brazil | 6.8% |

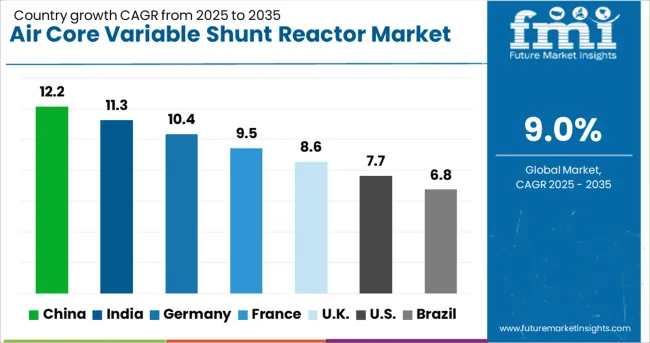

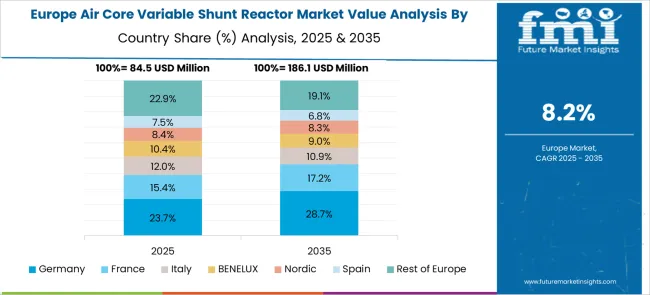

The global air core variable shunt reactor market is expected to grow at a CAGR of 9% between 2025 and 2035. China is expanding at 12.2%, which is 1.36x the global average, due to high-voltage grid modernization and integration of intermittent energy sources. India follows at 11.3% (1.25x), driven by industrial energy demand and ongoing transmission upgrades. Germany (OECD) is registering 10.4%, or 1.16x, supported by voltage control strategies in wind-intensive regions. The United Kingdom (OECD) records 8.6%, just below the global pace at 0.95x, while the United States (OECD) grows at 7.7% (0.86x), reflecting slower domestic grid enhancements. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China led the global market in 2025 with a 12.2% share due to the rapid implementation of ultra-high voltage (UHV) transmission corridors and wide-area reactive power management. Deployment of air core variable shunt reactors (VSRs) was integrated into regional grid balancing strategies to stabilize voltage swings during peak load. Projects by State Grid Corporation of China prioritized low-maintenance, thermally stable VSRs in the 500kV to 800kV class. Engineering hubs in Xi’an and Wuhan collaborated with domestic component makers to localize insulated dry-type VSRs. OEMs introduced modular designs with adjustable reactance range for fast-switching loads, aiding frequency regulation in renewable-dense zones.

India recorded an 11.3% market share in 2025, driven by integration of renewable energy across regional load centers and high grid impedance corridors. Utilities such as Power Grid Corporation of India deployed air core variable shunt reactors in high-altitude substations and coastal HV lines to correct voltage rise due to low load conditions. Designs favored compact, resin-cast air core VSRs with remote adjustability for dispatch-based reactive control. Indian manufacturers improved winding geometry and epoxy molding precision to match IEC 60076-6 standards. Pilot deployments in Gujarat and Tamil Nadu demonstrated reduced line losses in 220kV to 400kV systems using 3-phase modular VSR arrays.

Germany reached a 10.4% share in 2025 due to strong demand from heavy industrial grids and offshore wind grid integration. Air core VSRs were selected for arc suppression and harmonic damping at converter stations linked to North Sea wind farms. German utilities preferred dry-type modular VSRs with thermal fault detection and surge arrestor integration. Collaborations with energy institutes and Fraunhofer labs enabled prototype testing of VSRs with variable tap regulation. Siemens and Maschinenfabrik Reinhausen launched optimized insulation materials targeting compact installation in underground HV substations and rail corridor transformers.

The United Kingdom captured an 8.6% market share in 2025, supported by investments in flexible AC transmission systems (FACTS) and voltage smoothing devices in semi-urban zones. The National Grid incorporated air core variable shunt reactors in smart grid pilot installations in Wales and Midlands, designed for partial load operations with real-time voltage regulation. Dry-type VSRs saw increased use in urban substations where oil-free safety compliance was prioritized. UK-based engineering firms integrated digital twin monitoring into compact VSR modules for predictive fault diagnostics.

The United States held a 7.7% market share in 2025. Adoption remained steady with pilot testing concentrated in Western and Midwestern grids vulnerable to line charging effects. Dry-type air core variable shunt reactors gained attention for their fire safety and maintenance-free design. Projects in Texas and California deployed VSRs for renewable energy smoothing and dynamic voltage stabilization. USA manufacturers worked on hybrid VSR variants combining thyristor-controlled switching with passive coreless elements for flexible grid response.

The air core variable shunt reactor market is driven by companies specializing in grid voltage control, reactive power compensation, and transmission system stability. Siemens Energy manufactures air core variable shunt reactors designed to manage voltage fluctuations in high-voltage transmission networks, with models offering adjustable inductance and low electromagnetic interference.

Hitachi Energy supplies variable reactors optimized for dynamic reactive compensation, supporting renewable energy integration and long-distance transmission stability. GE Grid Solutions offers air core variable shunt reactors engineered for flexible grid operations, enabling continuous inductive regulation without saturation effects typical of iron core designs. Nissin Electric delivers compact, low-loss air core reactors for substation voltage balancing, particularly in regions with fluctuating load profiles.

Coil Innovation GmbH focuses on customized dry-type variable shunt reactors with thermally stable insulation systems suited to harsh grid environments. Trench Group provides air core solutions designed for minimal audible noise and reliable performance in open-air installations, supporting utilities managing reactive load under varying demand conditions. Market strength is determined by thermal endurance, inductance range, mechanical robustness, and compatibility with control systems for real-time grid adjustment.

Siemens Energy enhanced its reactor line with compact, low-loss designs optimized for integration into flexible AC transmission systems. Hitachi Energy supplied multiple air-core units to Scandinavian and Central European utilities, addressing grid fluctuations from renewable inputs. GE Grid Solutions focused on dynamic voltage support systems, incorporating real-time controllable shunt reactors into UHV networks. Coil Innovation GmbH delivered modular reactors across space-constrained substations. Nissin Electric and Trench Group expanded reactor production capacity to meet rising demand across Asia-Pacific and the Middle East.

| Item | Value |

|---|---|

| Quantitative Units | USD 381.0 Million |

| Phase | Three phase and Single phase |

| End Use | Electric utility and Renewable energy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, Hitachi Energy, GE Grid Solutions, Nissin Electric, Coil Innovation GmbH, and Trench Group |

| Additional Attributes | Dollar sales by reactor design (air core types) and application (transmission grid voltage control, renewable integration), demand across utilities and grid stability projects, led by Asia Pacific with North America catching up, innovation in compact modular construction and smart reactive power management. |

The global air core variable shunt reactor market is estimated to be valued at USD 381.0 million in 2025.

The market size for the air core variable shunt reactor market is projected to reach USD 902.0 million by 2035.

The air core variable shunt reactor market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in air core variable shunt reactor market are three phase and single phase.

In terms of end use, electric utility segment to command 72.0% share in the air core variable shunt reactor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA