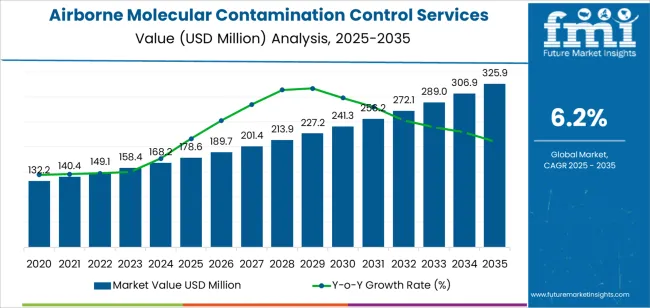

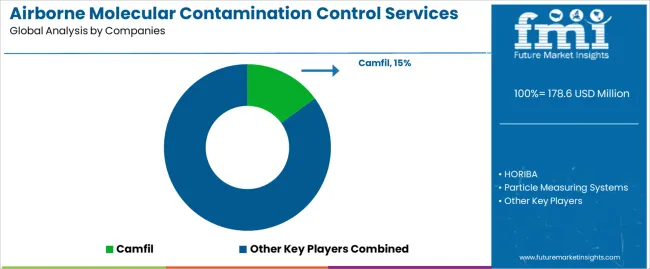

The global airborne molecular contamination control services market is valued at USD 178.6 million in 2025. It is slated to reach USD 325.9 million by 2035, recording an absolute increase of USD 147.3 million over the forecast period. This translates into a total growth of 82.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.83X during the same period, supported by increasing demand for ultra-clean manufacturing environments, growing adoption of airborne molecular contamination (AMC) control in advanced semiconductor fabrication and pharmaceutical cleanrooms, and rising emphasis on contamination prevention and product quality assurance across diverse high-technology manufacturing, precision electronics, and life sciences applications.

Between 2025 and 2030, the airborne molecular contamination control services market is projected to expand from USD 178.6 million to USD 227.2 million, resulting in a value increase of USD 48.6 million, which represents 33% of the total forecast growth for the decade. This phase of development will be shaped by increasing semiconductor manufacturing complexity driving advanced node contamination control requirements, rising pharmaceutical manufacturing quality standards and regulatory compliance demands, and growing recognition of molecular contamination impact on product yields and manufacturing reliability. Technology manufacturers and cleanroom operators are expanding their AMC control capabilities to address the growing demand for specialized contamination monitoring and mitigation services that ensure production quality and operational excellence.

From 2030 to 2035, the market is forecast to grow from USD 227.2 million to USD 325.9 million, adding another USD 98.7 million, which constitutes 67% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced semiconductor nodes below 3nm requiring stringent molecular contamination control, the development of continuous real-time monitoring systems and predictive contamination management, and the growth of specialized applications for quantum computing cleanrooms, advanced pharmaceutical manufacturing, and precision optics production. The growing adoption of artificial intelligence in contamination prediction and Internet of Things-enabled monitoring networks will drive demand for AMC control services with enhanced detection sensitivity and predictive capabilities.

Between 2020 and 2025, the airborne molecular contamination control services market experienced accelerated growth, driven by semiconductor industry advancement toward extreme ultraviolet (EUV) lithography requiring unprecedented contamination control levels, and growing recognition of airborne molecular contaminants as critical yield detractors requiring specialized detection and mitigation services in diverse cleanroom and precision manufacturing applications. The market developed as semiconductor fabs and pharmaceutical manufacturers recognized the potential for AMC control services to prevent defects, improve yields, and support quality assurance while meeting stringent manufacturing requirements. Technological advancement in molecular detection and filtration systems began emphasizing the critical importance of maintaining parts-per-trillion contamination levels in next-generation manufacturing environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 178.6 million |

| Forecast Value in (2035F) | USD 325.9 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

Market expansion is being supported by the increasing global demand for ultra-clean manufacturing environments driven by semiconductor technology advancement, pharmaceutical quality requirements, and precision manufacturing standards, alongside the corresponding need for specialized contamination monitoring and control services that can detect molecular-level contaminants, prevent product defects, and maintain operational excellence across various semiconductor fabrication, pharmaceutical cleanrooms, electronics assembly, and precision optics applications. Modern manufacturers and cleanroom operators are increasingly focused on implementing AMC control services that can improve yield performance, reduce contamination incidents, and provide comprehensive environmental monitoring in critical production areas.

The growing emphasis on advanced semiconductor nodes and pharmaceutical quality assurance is driving demand for AMC control services that can support sub-nanometer manufacturing processes, enable regulatory compliance, and ensure comprehensive contamination prevention. High-technology manufacturers' preference for contamination control solutions that combine detection sensitivity with predictive analytics and proactive mitigation is creating opportunities for innovative AMC service implementations. The rising influence of Industry 4.0 and smart manufacturing is also contributing to increased adoption of AMC control services that can provide real-time monitoring without compromising production continuity or operational efficiency.

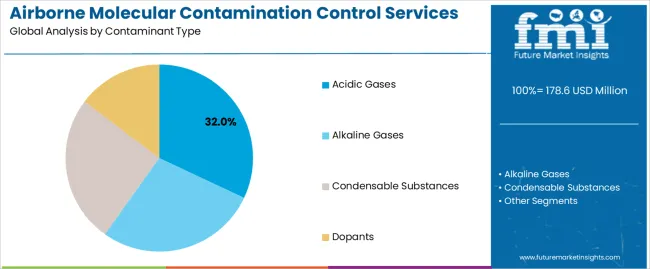

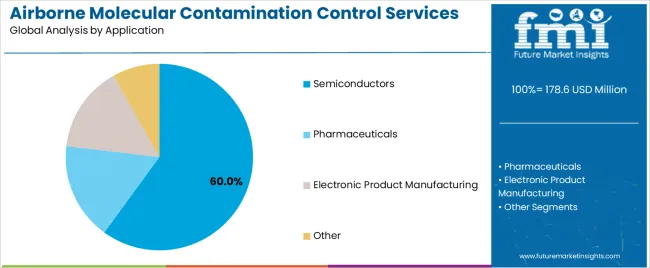

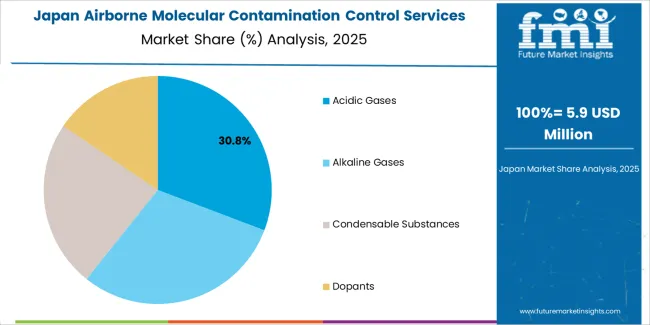

The market is segmented by contaminant type, application, and region. By contaminant type, the market is divided into acidic gases, alkaline gases, condensable substances, and dopants. Based on application, the market is categorized into semiconductors, pharmaceuticals, electronic product manufacturing, and other. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The acidic gases segment is projected to maintain its leading position in the airborne molecular contamination control services market in 2025, reaffirming its role as the most critical contaminant category requiring specialized monitoring and control in cleanroom environments. Semiconductor fabs and electronics manufacturers increasingly focus on acidic gas contamination including sulfur dioxide, nitrogen oxides, and organic acids for their proven impact on wafer surface chemistry, photoresist performance, and metal corrosion in advanced manufacturing processes. Acidic gas contamination control's proven importance and technical priority directly address the industry requirements for defect prevention and yield optimization across diverse semiconductor fabrication technologies and node generations.

This contaminant type segment forms the foundation of molecular contamination monitoring programs, as it represents the contamination category with the greatest impact on semiconductor manufacturing yields and established detection methodologies across multiple cleanroom applications and manufacturing environments. Semiconductor industry investments in contamination control infrastructure continue to strengthen acidic gas monitoring adoption among leading fabs and advanced packaging facilities. With manufacturing complexity requiring parts-per-trillion detection limits and real-time monitoring, acidic gas control services align with both technical requirements and quality objectives, making it the central component of comprehensive AMC management strategies.

The semiconductors application segment is projected to represent the largest share of AMC control services demand in 2025, underscoring its critical role as the primary driver for molecular contamination monitoring adoption across wafer fabrication, lithography operations, advanced packaging, and semiconductor equipment applications. Semiconductor manufacturers require AMC control services for cleanroom operations due to extreme sensitivity of nanoscale features to molecular contaminants, substantial yield impact from contamination incidents, and ability to prevent costly production disruptions while supporting continuous process improvement. Positioned as essential services for advanced semiconductor manufacturing, AMC control offers both yield protection advantages and quality assurance benefits.

The segment is supported by continuous semiconductor technology advancement and the growing complexity of manufacturing processes below 7nm requiring unprecedented contamination control with real-time monitoring and predictive analytics. Additionally, semiconductor manufacturers are investing in comprehensive AMC monitoring programs to support increasingly stringent process control requirements and demand for defect-free wafer production. As semiconductor nodes shrink and EUV lithography adoption expands, the semiconductors application will continue to dominate the market while supporting advanced contamination management and yield optimization strategies.

The airborne molecular contamination control services market is advancing steadily due to increasing demand for ultra-clean manufacturing environments driven by semiconductor technology shrinkage, pharmaceutical quality imperatives, and precision manufacturing requirements necessitating specialized molecular-level contamination monitoring providing enhanced detection characteristics and prevention benefits across diverse semiconductor fabrication, pharmaceutical production, electronics assembly, and precision optics applications. However, the market faces challenges, including high implementation costs for advanced monitoring systems, technical complexity related to parts-per-trillion detection requirements, and limited awareness of molecular contamination impact in emerging manufacturing segments. Innovation in real-time monitoring technologies and artificial intelligence-enabled predictive systems continues to influence service development and market expansion patterns.

The growing adoption of extreme ultraviolet (EUV) lithography and progression toward 3nm, 2nm, and sub-2nm semiconductor nodes is driving unprecedented requirements for molecular contamination control with parts-per-trillion sensitivity and real-time monitoring capabilities. Advanced node manufacturing exhibits extreme sensitivity to molecular contaminants that can cause photoresist poisoning, reticle haze, and pattern defects requiring comprehensive contamination prevention strategies. Semiconductor manufacturers are increasingly recognizing the competitive advantages of proactive AMC monitoring for yield improvement and defect reduction, creating opportunities for advanced monitoring services with real-time analytics, predictive modeling, and automated contamination response specifically engineered for next-generation fabrication facilities.

Modern AMC control service providers are incorporating continuous real-time monitoring systems, artificial intelligence algorithms, and predictive contamination modeling to enhance detection capabilities, enable proactive interventions, and support comprehensive contamination prevention through data-driven insights and automated response systems. Leading companies are developing IoT-enabled sensor networks, implementing machine learning for contamination prediction, and advancing analytical platforms that correlate contamination events with process parameters and yield impacts. These innovations improve contamination management effectiveness while enabling new service opportunities, including predictive maintenance consulting, contamination root cause analysis, and yield optimization services. Advanced digitalization integration also allows manufacturers to support comprehensive quality assurance objectives and operational excellence beyond traditional reactive contamination control approaches.

The expansion of diverse cleanroom applications including quantum computing, advanced photonics, MEMS manufacturing, and gene therapy production is driving demand for specialized AMC control services tailored to unique contamination sensitivities and process requirements. These specialized applications require customized monitoring approaches with application-specific contaminant priorities and detection methodologies, creating differentiated service offerings and premium market segments. Service providers are investing in application expertise and specialized monitoring capabilities to serve emerging high-technology segments while supporting innovation in advanced manufacturing and life sciences applications.

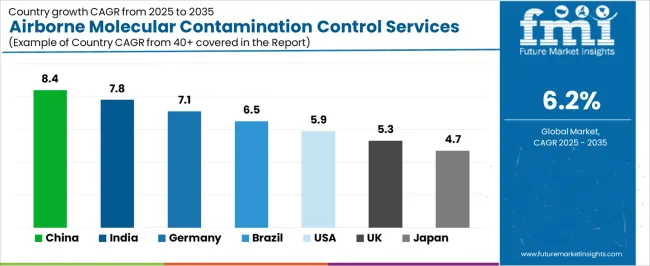

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| United States | 5.9% |

| United Kingdom | 5.3% |

| Japan | 4.7% |

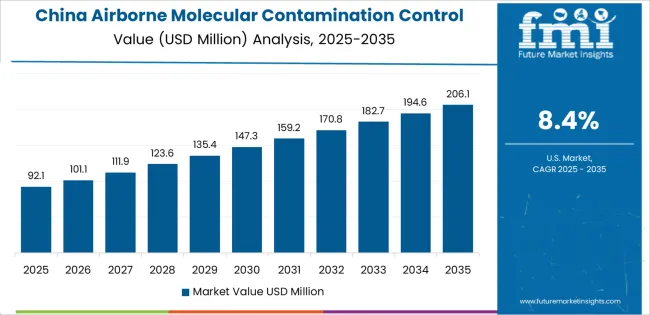

The airborne molecular contamination control services market is experiencing solid growth globally, with China leading at an 8.4% CAGR through 2035, driven by massive semiconductor manufacturing capacity expansion, growing domestic chip production capabilities, and increasing investment in advanced fabrication facilities requiring sophisticated contamination control. India follows at 7.8%, supported by expanding semiconductor and pharmaceutical manufacturing, growing cleanroom infrastructure, and increasing quality standards adoption. Germany shows growth at 7.1%, emphasizing precision manufacturing, pharmaceutical excellence, and advanced semiconductor equipment production. Brazil demonstrates 6.5% growth, supported by pharmaceutical manufacturing expansion and electronics assembly operations. The United States records 5.9%, focusing on leading-edge semiconductor manufacturing, pharmaceutical innovations, and precision technology applications. The United Kingdom exhibits 5.3% growth, emphasizing pharmaceutical manufacturing and precision electronics. Japan shows 4.7% growth, focusing on semiconductor equipment manufacturing and high-precision cleanroom applications.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from airborne molecular contamination control services in China is projected to exhibit exceptional growth with a CAGR of 8.4% through 2035, driven by aggressive semiconductor manufacturing capacity expansion and growing domestic advanced node fabrication capabilities supported by government initiatives promoting semiconductor self-sufficiency and technology advancement. The country's comprehensive semiconductor ecosystem development and increasing investment in state-of-the-art fabrication facilities are creating substantial demand for AMC control solutions. Major semiconductor manufacturers and cleanroom service providers are establishing comprehensive contamination monitoring capabilities to serve both domestic fabs and technology companies.

Revenue from airborne molecular contamination control services in India is expanding at a CAGR of 7.8%, supported by expanding semiconductor and electronics manufacturing under government initiatives, growing pharmaceutical production capacity serving global markets, and increasing adoption of international quality standards requiring comprehensive contamination control. The country's comprehensive manufacturing development and quality consciousness are driving sophisticated AMC monitoring adoption throughout technology and life sciences sectors. International service providers and domestic companies are establishing capabilities to address growing contamination control requirements.

Revenue from airborne molecular contamination control services in Germany is expanding at a CAGR of 7.1%, supported by the country's precision manufacturing capabilities, pharmaceutical industry excellence, and semiconductor equipment production requiring sophisticated cleanroom environments emphasizing contamination prevention. The nation's technological sophistication and quality standards are driving premium AMC control service capabilities throughout high-technology applications. Leading service providers and equipment manufacturers are investing extensively in advanced contamination monitoring technologies and application expertise.

Revenue from airborne molecular contamination control services in Brazil is expanding at a CAGR of 6.5%, driven by expanding pharmaceutical manufacturing serving Latin American markets, growing electronics assembly operations, and increasing quality awareness requiring contamination monitoring. Brazil's pharmaceutical sector development and electronics manufacturing are supporting investment in cleanroom quality services. Service providers and equipment suppliers are establishing capabilities for contamination monitoring applications.

Revenue from airborne molecular contamination control services in the United States is expanding at a CAGR of 5.9%, supported by the country's leading-edge semiconductor manufacturing including advanced EUV lithography adoption, pharmaceutical innovation leadership, and precision technology applications driving sophisticated contamination control requirements. The nation's technology leadership and manufacturing sophistication are driving demand for advanced AMC monitoring solutions. Leading service providers and technology companies are investing in next-generation contamination control capabilities and service innovation.

Revenue from airborne molecular contamination control services in the United Kingdom is growing at a CAGR of 5.3%, driven by the country's pharmaceutical manufacturing strength, precision electronics production, and quality consciousness requiring reliable contamination monitoring solutions. The United Kingdom's pharmaceutical expertise and precision manufacturing are supporting investment in cleanroom monitoring services. Service providers and pharmaceutical companies are establishing comprehensive contamination control programs.

Revenue from airborne molecular contamination control services in Japan is expanding at a CAGR of 4.7%, supported by the country's semiconductor equipment manufacturing leadership, precision technology applications, and sophisticated quality standards requiring advanced contamination monitoring. Japan's technological sophistication and cleanroom expertise are driving demand for premium AMC control services. Equipment manufacturers and technology companies are investing in specialized contamination monitoring capabilities.

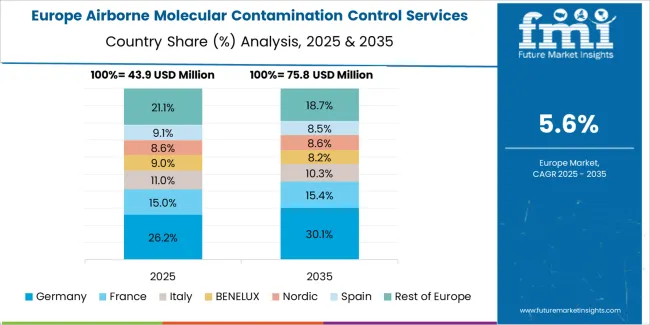

The airborne molecular contamination control services market in Europe is projected to grow from USD 46.1 million in 2025 to USD 82.6 million by 2035, registering a CAGR of 6.0% over the forecast period. Germany is expected to maintain leadership with a 27.8% market share in 2025, moderating to 27.5% by 2035, supported by pharmaceutical excellence, precision manufacturing, and semiconductor equipment production.

France follows with 18.2% in 2025, projected at 18.4% by 2035, driven by pharmaceutical manufacturing, electronics production, and aerospace applications. The United Kingdom holds 16.4% in 2025, declining slightly to 16.1% by 2035 due to market maturity. Italy commands 13.6% in 2025, reaching 13.8% by 2035, while Spain accounts for 9.8% in 2025, rising to 10.0% by 2035 aided by pharmaceutical manufacturing and electronics assembly growth. The Netherlands maintains 7.2% in 2025, up to 7.4% by 2035 due to semiconductor manufacturing and precision technology. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 7.0% in 2025 and 6.8% by 2035, reflecting development in cleanroom applications and quality manufacturing.

The airborne molecular contamination control services market is characterized by competition among specialized contamination monitoring service providers, cleanroom filtration companies, and analytical instrumentation manufacturers. Companies are investing in real-time monitoring technology development, artificial intelligence integration for predictive analytics, sensor sensitivity enhancement, and application-specific service capabilities to deliver accurate, responsive, and comprehensive AMC control solutions. Innovation in parts-per-trillion detection methods, continuous monitoring systems, and predictive contamination modeling is central to strengthening market position and competitive advantage.

Camfil offers comprehensive air filtration and contamination control solutions with focus on molecular filtration technologies and cleanroom applications. HORIBA provides advanced analytical instrumentation including molecular contamination monitoring systems with emphasis on semiconductor applications. Particle Measuring Systems delivers contamination monitoring solutions with focus on particle and molecular detection for cleanroom environments. Process Insights Inc. offers specialized AMC monitoring services with emphasis on semiconductor manufacturing applications. Eurofins Stats provides analytical testing and contamination monitoring services for pharmaceutical and technology industries. Esky Purify focuses on cleanroom air purification solutions. Air Liquide offers industrial gas solutions and contamination control expertise. American Air Filter Company Inc. provides air filtration systems for cleanroom applications. Dürr delivers industrial environmental technology solutions. CTP focuses on cleanroom technologies. Tecam Group offers air pollution control systems. Babcock & Wilcox Enterprises Inc. provides industrial environmental solutions. GreenFiltec Ltd. specializes in filtration technologies. Atlas Technology Corp. offers contamination monitoring and control systems.

Airborne molecular contamination control services represent a specialized technical services segment within semiconductor manufacturing and cleanroom operations, projected to grow from USD 178.6 million in 2025 to USD 325.9 million by 2035 at a 6.2% CAGR. These critical monitoring and mitigation services-addressing acidic gases, alkaline gases, condensable substances, and dopants-serve as essential quality assurance tools in semiconductor fabrication, pharmaceutical manufacturing, precision electronics assembly, and advanced technology production where molecular-level contamination prevention, yield optimization, and product quality assurance are essential. Market expansion is driven by advancing semiconductor technology nodes, growing pharmaceutical quality requirements, expanding cleanroom applications, and rising demand for parts-per-trillion contamination detection across diverse high-technology manufacturing segments.

How Industry Regulators Could Strengthen Standards and Quality Assurance?

How Industry Associations Could Advance Knowledge and Best Practices?

How AMC Service Providers Could Drive Innovation and Market Leadership?

How Manufacturers Could Optimize Contamination Control and Yield?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 178.6 million |

| Contaminant Type | Acidic Gases, Alkaline Gases, Condensable Substances, Dopants |

| Application | Semiconductors, Pharmaceuticals, Electronic Product Manufacturing, Other |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Camfil, HORIBA, Particle Measuring Systems, Process Insights Inc., Eurofins Stats |

| Additional Attributes | Dollar sales by contaminant type and application categories, regional demand trends, competitive landscape, technological advancements in contamination detection, real-time monitoring development, predictive analytics integration, and yield optimization strategies |

The global airborne molecular contamination control services market is estimated to be valued at USD 178.6 million in 2025.

The market size for the airborne molecular contamination control services market is projected to reach USD 325.9 million by 2035.

The airborne molecular contamination control services market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in airborne molecular contamination control services market are acidic gases, alkaline gases, condensable substances and dopants.

In terms of application, semiconductors segment to command 60.0% share in the airborne molecular contamination control services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Airborne SATCOM Equipment Market

Airborne Surveillance Market

Airborne Fire Control Radar Market Size and Share Forecast Outlook 2025 to 2035

Airborne Warning and Control System Market Growth - Trends & Forecast 2025 to 2035

Molecular Diagnostic Market Size and Share Forecast Outlook 2025 to 2035

Molecular Respiratory Panels Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biomarkers For Cancer Detection Market Size and Share Forecast Outlook 2025 to 2035

Molecular Cytogenetics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Molecular Spectroscopy Market Insights - Growth & Forecast 2025 to 2035

Molecular Breast Imaging Market – Trends & Forecast 2025 to 2035

Molecular Imaging Market is segmented by modality type, application and end user from 2025 to 2035

Molecular Microbiology Market

Molecular Quality Controls Market Overview - Trends & Forecast 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

13X Molecular Sieve Activated Powder Market Size and Share Forecast Outlook 2025 to 2035

High Molecular Ammonium Polyphosphate Market Size and Share Forecast Outlook 2025 to 2035

Orthomolecular Medicine Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA