The Airborne Warning and Control System Market is poised for impressive growth between 2025 and 2035, supported by rising global defence expenditure, growing geopolitical tensions, and increasing investments in airborne surveillance and command capabilities. An AWACS platform is essentially a flying artillery command and control centre with large theatre radar and communication equipment that can constantly look in all directions at once and relay information in real-time orderly format.

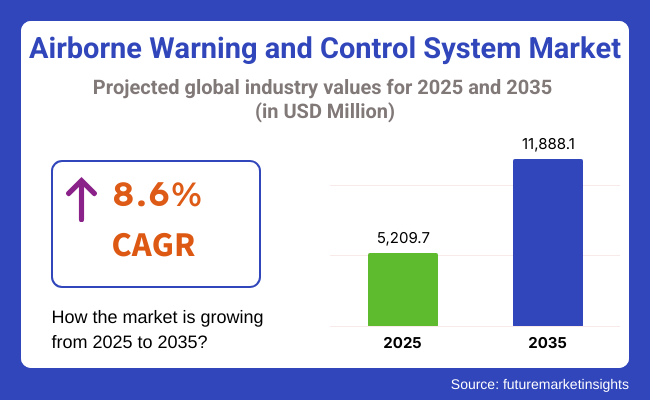

The market was valued at USD 5,209.7 Million in 2025 and expected to reach USD 11,888.1 Million by 2035, growing at a compound annual growth rate (CAGR) of 8.6% during the forecast period.

Effective airborne costs and capabilities of early warning technology are already transforming, due to increased focus on the number of dynamic technology areas, shift from network-centric operations into a more mature phase towards multi-space operations, and developments in radar, sensor merge, and artificial intelligence (AI). The abilities of AWACS are also being further improved through integration with unmanned aerial vehicles (UAVs) and satellite communications.

Radar warning receivers (RWRs) have a dominant share in the airborne warning and control system market due to their important functions in threat recognition and situational awareness for fighter jets. These systems detect incoming radar from enemy assets that threaten them and warn pilots in real-time to let them take defensive action. RWRs are a core part of airborne self-protection suites and they are widely employed in fighter jets, bombers, and reconnaissance planes.

Military forces around the globe are integrating RWRs with advanced digital signal processing and direction-finding capabilities. New RWR systems come with stockpiles of sensitivity and frequency coverage, which meets the demands of today’s radar-rich environments for detecting and classifying threats in the shortest possible time frame. They are crucial for survivability in high-threat environments due to their integration with electronic countermeasures and decoy systems.

Artificial intelligence-based threat libraries combined with passive geolocation capabilities have accelerated adoption of RWR technology. Defence agencies remain focused on procuring radar warning receivers on both new aircraft and legacy system upgrades as geopolitical tensions increase and defence war chests continue to grow, contributing to consistent growth in this segment.

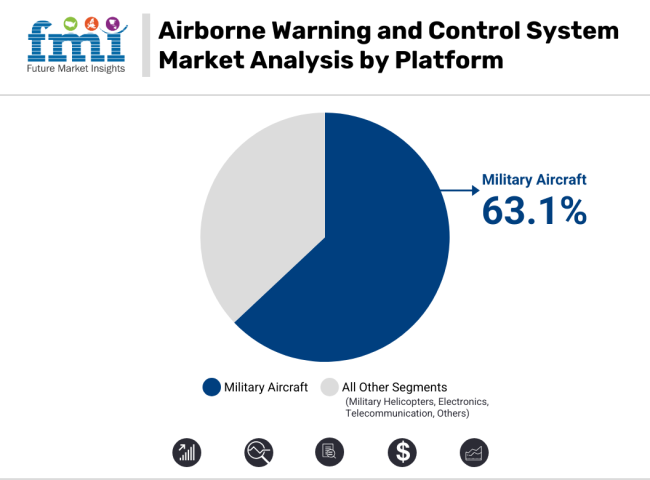

Airborne warning and control system market overview by components military aircraft in which military aircraft holds the largest market share compared to others, because they are at the frontline in ensuring air dominance, surveillance, and combat missions. These aircraft are routinely required to operate in high-threat environments, requiring on board electronic warfare systems like radar warning receivers, missile approach warning systems, and jammers to ensure mission success and to protect pilots.

Over the past three decades, North America, Europe, and Asia-Pacific governments have made major investments in next-generation combat aircraft programs F-35, Rafale, and with some emphasis on indigenous fighter platforms all of which incorporate warning and control systems by default. Likewise, the integration of modular electronic warfare systems on older aircraft has proven valuable for a significant number of air forces as a cost-efficient method of capability enhancement without a complete fleet replacement.

The growing complexity of multi-domain operations and network-centric warfare has expanded the demand for systems that can achieve both threat detection and communication jamming with an improved integration with platforms. Now, military aircraft with airborne warning and control systems are used as critical nodes within coordinated missions, able to detect dangerous activity and pass intelligence in real time. As a result of electronic warfare and aerial denial zones, the demand for such advanced airborne warning systems on military aircraft is growing rapidly.

The global AWACS market, dominated by North America, is also driven by the United States’ continuing modernization of airborne surveillance systems. Demand is being driven by USA Air Force E-3 Sentry replacement programs, investments in new-generation radar systems and cooperation with NATO allies. The region is even leading the way on open architecture designs for more rapid integration of new technologies and mission-specific upgrades.

Across Europe Joint Defence Programs and NATO Interoperability Initiatives are extending similar AWAC capabilities. Germany, the UK, and France are all investing in upgrades to their half century-old AWACS fleet, including radar, electronic warfare resistance, and AI-enabled threat assessment. Identify how the NATO Support and Procurement Agency (NSPA) will facilitate the modernization of platforms, promote procurement among nations and account for the obsolescence of systems in the supply chain.

Among regions, Asia-Pacific is expected to register the fastest growth driven by rising regional tensions and territorial disputes, especially in East and South Asia. India (AWACS), China (AWACS), Japan (AWACS / AEW) and South Korea (AEW) are among the nations increasing their airborne surveillance capabilities with large purchases of AWACS / AEW&C (Airborne Early Warning and Control) planes. Regional production capacity is further cemented by indigenous development efforts in India and China and tie-ups with western defence OEMs.

High Costs and Integration Complexity

AWACS being these complex platforms have a high procurement and maintenance cost which is one of the main challenges facing the AWACS market. The features of advanced radar, communication and AI systems often necessitate complex avionics, software and airframe compatibility, resulting in long development cycles and high capital expenditure.

Complexity and cost of deployment are further affected by the need to engage with legacy defence systems and interoperating with multinational forces. In response, a growing number of countries are migrating to modular systems and commercial off-the-shelf (COTS) components to lower costs and increase upgradability.

AI Integration and Multi-Domain Operations

The increasing significance of multi-domain situational awareness presents significant growth prospects for AWACS platforms. Faster and more precise threat detection, target tracking, and decision-making is enabled through a fusion of artificial intelligence, machine learning, and sensors. AWACS systems are similarly being refined for space-based reconnaissance, cyber defence coordination, and joint operations across air, ground, and sea.

Furthermore, the increasing employment of unmanned platforms as airborne C2 force multipliers and the creation of low-observable (stealth-compatible) radar systems is enabling more and more capabilities in airborne command and control. Next-generation AWACS solutions will be in long-term demand for defence forces focusing on digitisation, shared data, modular updates etc.

The AWACS market was growing between 2020 and 2024 as countries upgraded their airborne defence infrastructure in response to increasing geopolitical tension and changing aerial threats. There was demand for multi-role surveillance platforms that can carry out long-range detection, battle management and command control. For example, radar system upgrades, electronic warfare systems integration, and new mapped data processors.

There was heightened procurement by NATO members, nations in the Asia-Pacific region and defence ministries of the Middle East. The focus was on aircraft interoperability, real-time situational awareness and increased mission endurance. Nevertheless, challenges were posed by high acquisition and operational costs, limited bandwidth of spectrum, and the complexity of integration.

The future of the AWACS Market from 2025 to 2035 foam will be powered by AI for threat analysis, next gen radar systems and multi-domain command integration. The emergence of stealth technologies and hypersonic threats will drive the international development of advanced phased-array radar and quantum radar technology. In fact, machine learning and AI will drive real-time threat prioritization and predictive threat assessment.

Next-gen AWACS platforms will employ UAV-based support, and be able to autonomously coordinate swarm networks, and more closely couple with satellite-based data fusion, enhancing resilience and survivability. They will be modularized to allow for upgrades by cyber and space warfare capabilities on the current system and upgraded capabilities across the software and hardware spectrum, all built by expanding existing technology. Network-centric warfare driven force deployment, secure communication links, and sensor fusion-based technologies will have priority for the defence force.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Radar Capabilities | AESA radars with 360° surveillance. |

| System Intelligence | Basic data fusion and operator-guided tracking. |

| Platform Design | Manned fixed-wing aircraft platforms. |

| Command Integration | Tactical command relay with limited multi-domain ops. |

| Operational Reach | Regional monitoring with in-flight refuelling capability. |

| Modularity & Upgrades | Custom retrofitting on aging fleets. |

| Defence Strategy Role | Strategic early warning and airspace control. |

| Market Shift | 2025 to 2035 |

|---|---|

| Radar Capabilities | Quantum radar and extended-range phased-array systems with anti-stealth tracking. |

| System Intelligence | AI-powered autonomous detection, classification, and threat prioritization. |

| Platform Design | Hybrid systems with UAV-based extensions and optionally crewed variants. |

| Command Integration | Full integration across air, land, sea, space, and cyber domains. |

| Operational Reach | Global surveillance via satellite-aided coordination and extended endurance. |

| Modularity & Upgrades | Modular plug-and-play systems with rapid tech insertion. |

| Defence Strategy Role | Multi-domain command, strategic deterrence, and integrated defence coordination. |

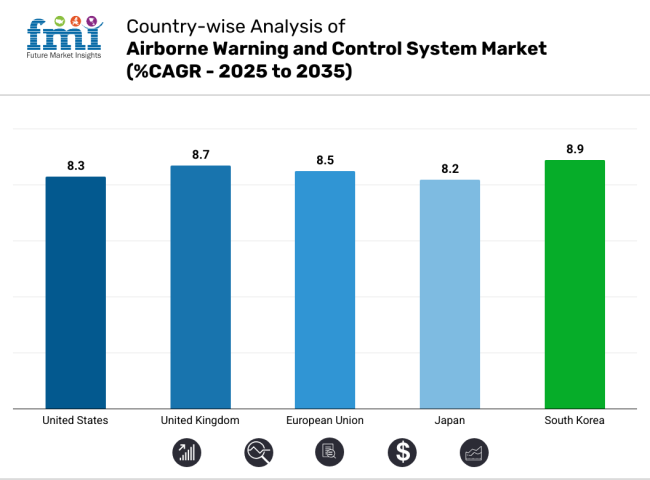

In the United States, the Airborne Warning and Control System market is expected to surpass US$ 2.5 Billion by the year 2035. Driven by rising defence budgets and modernization initiatives, the USA continues to be the global leader in deploying advanced surveillance and reconnaissance technologies.

The implementation of artificial intelligence, advancements in signal processing, and real-time data sharing platforms is stimulating the demand for next-generation AWACS. Moreover, with the geopolitical landscape becoming increasingly complex and challenges posed by NATO and allied defence commitments, the demand for these advanced aerial platforms is only set to grow.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.3% |

The market in the United Kingdom is expected to register a CAGR of 8.7% during the forecast period. The nation's commitments to replace aging E-3D Sentry aircraft with modern assets like the E-7 Wedgetail highlight the importance of airspace security and NATO interoperability.

Demand for updated airborne surveillance platforms is also driven by the UK’s participation in multinational operations, particularly across Europe and the Middle East. Also, joint defence purchase programs in the EU also support upgrades in this area.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.7% |

The European Union AWACS market is projected to grow at a CAGR of 8.5% through 2035. Increasing security threats and heightened focus on integrated air and missile defence are leading to more investment from member states in innovative airborne surveillance solutions.

Here, countries like Germany, France, and Italy are in the process of reviewing their air defence setup and also joining NATO partners on joint development programs. In addition, the higher demand for multi-domain situational awareness will drive the defence autonomy push and hence help sustain the AWACS platforms adoption in the Europe.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.5% |

The Japan AWACS market is expected to grow at a CAGR of 8.2% from 2025 to 2035. With maritime and aerial security threats increasingly of concern in the Asia-Pacific region especially in respect of contested airspace and territorial boundaries Japan has put a premium on modernizing its airborne early warning capabilities.

Japan Air Self-Defence Force (JASDF) continues to improve its fleet with a new generation of technological state-of-the-art surveillance aircraft, in terms of radar range, target tracking, and secure communications. These upgrades follow Japan’s wider defence strategy and increased engagement in multilateral defence exercises.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.2% |

South Korea AWACS Market It is anticipated that South Korea's air-to-ground data link market will grow at a forecasted CAGR of 8.9% over the forecast period. Escalating tensions on the Korean Peninsula, as well as throughout the Indo-Pacific region, are prompting large outlays in surveillance and reconnaissance assets.

The latest analysis suggests South Korea is seeking to enhance its airborne command capabilities with upgraded radar systems, data links, and interoperability with U.S. and allied defence networks. Domestic production developments are also being fortified through partnerships with international defence contractors, which provides a level of technology independence and stimulates domestic market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.9% |

Impact of Global Defence Budgets, Demand for Aerial Surveillance and the Need for Rapid Threat Detection and Response in Driving the Airborne Warning and Control System (AWACS) Market. These systems provide real-time situational awareness, command and control capabilities, and airspace management.

They emphasize extending their radar range, AI based analytics and electronic warfare resilience. Aerospace giants, advanced electronics manufacturers and defence contractors are among the players in the next-generation airborne command platform market.

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| Boeing | In 2024, upgraded its E-7 Wedgetail platform with enhanced AESA radar and advanced mission systems. |

| Rockwell-Collins | In 2025, integrated open-architecture avionics into AWACS systems for modular upgradeability. |

| Northrop | In 2025, expanded its electronic warfare capabilities within airborne surveillance systems. |

| IBM (CC-2 Computer) | In 2024, optimized on board mission computing for real-time data processing and situational analysis. |

| Delco | In 2025, introduced next-gen navigation and flight control systems for AWACS interoperability. |

Key Company Insights

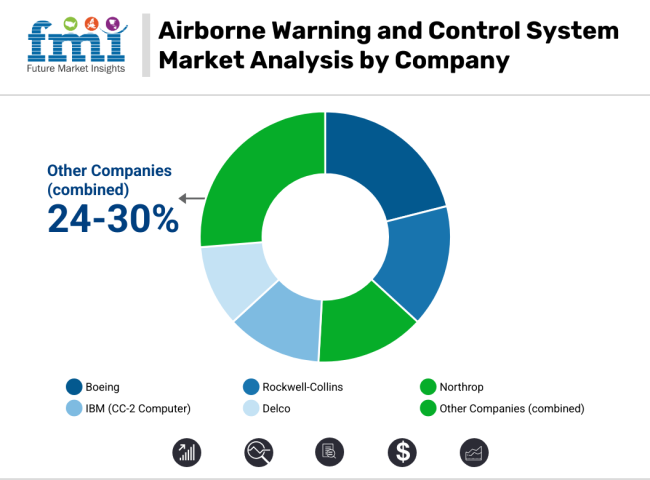

Boeing (20-24%)

Boeing leads the AWACS market with advanced aircraft platforms like the E-7 Wedgetail, delivering superior surveillance and command capabilities.

Rockwell-Collins (14-18%)

Rockwell-Collins specializes in mission avionics and modular systems, enabling efficient upgrades and system integration.

Northrop (12-16%)

Northrop enhances airborne defence systems with electronic warfare tools and high-range radar integration.

IBM (CC-2 Computer) (10-14%)

IBM supports AWACS platforms with cutting-edge computing solutions, improving speed, security, and onboard analytics.

Delco (8-12%)

Delco contributes advanced flight systems and navigation technologies, ensuring reliability and precision in airborne operations.

Other Key Players (24-30% Combined)

several legacy and specialized defence firms play a crucial role in AWACS development and modernization. These include:

The overall market size for the Airborne Warning and Control System Market was USD 5,209.7 Million in 2025.

The Airborne Warning and Control System Market is expected to reach USD 11,888.1 Million in 2035.

The demand is driven by increasing defence budgets, advancements in radar technology, and the rising need for enhanced situational awareness in military operations.

The top 5 countries driving market growth are the USA, UK, Europe, Japan and South Korea.

The Military Aircraft segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Airborne SATCOM Equipment Market

Airborne Surveillance Market

Airborne Fire Control Radar Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Lane Departure Warning (LDW) Market - Trends & Forecast 2025 to 2035

Front Collision Warning Market Growth – Trends & Forecast 2025 to 2035

Terrain Awareness and Warning System Market by System Type, Engine Type, Application, Region through 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

DWDM System Market Analysis by Services, Product, Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA