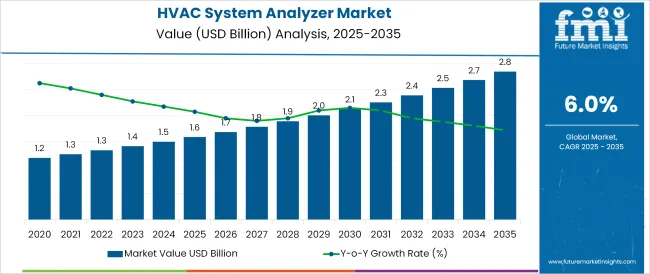

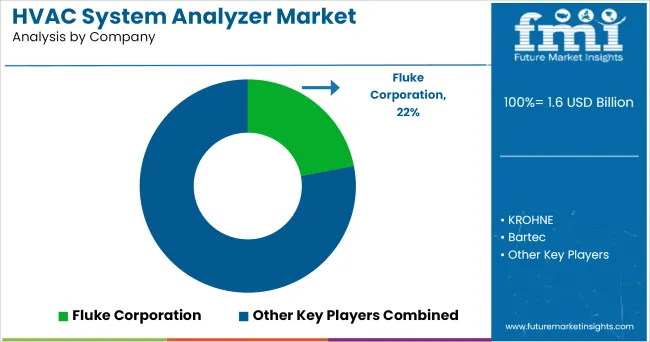

The HVAC System Analyzer Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The HVAC system analyser market is witnessing sustained growth, driven by the global emphasis on energy efficiency, preventive maintenance, and smart building management. As commercial and residential infrastructure becomes increasingly reliant on HVAC systems for climate control, demand for advanced diagnostic tools capable of real-time performance analysis has intensified.

Manufacturers are equipping analysers with digital interfaces wireless connectivity, and data logging functionalities to support predictive maintenance and remote diagnostics. The rise of smart buildings and green certification standards has made accurate HVAC monitoring essential, pushing adoption across facility management and MEP (mechanical, electrical, plumbing) services.

Additionally, increased technician mobility and field service digitization are steering demand toward compact, portable devices with intuitive display systems. Future growth is expected to stem from the integration of IoT platforms enhanced sensor capabilities, and the incorporation of cloud based reporting tools that allow for centralized data analysis, particularly in large-scale commercial environments.

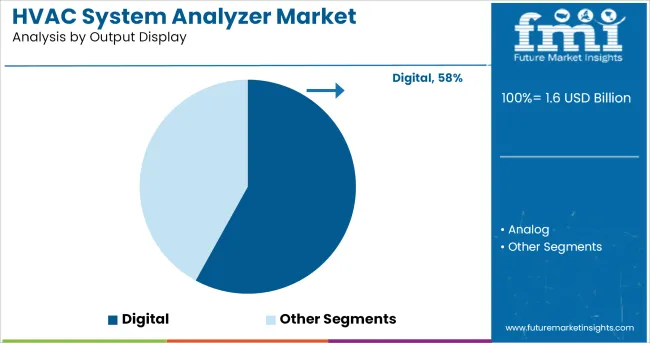

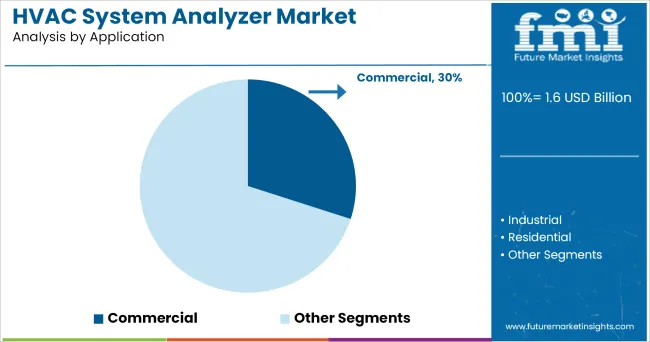

The market is segmented by Output Display, Application, and Configuration and region. By Output Display, the market is divided into Digital and Analog. In terms of Application, the market is classified into Commercial, Industrial, Residential, Automotive & Transportation, and Others.

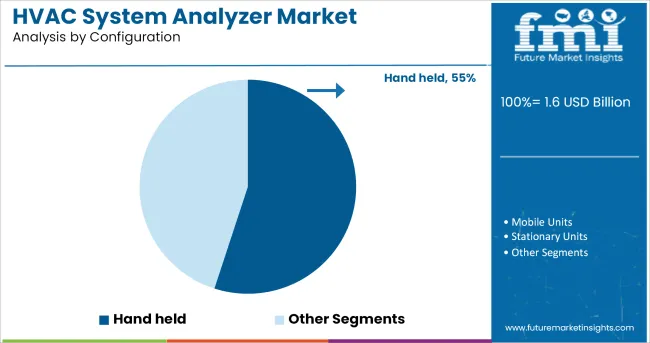

Based on Configuration, the market is segmented into Hand held, Mobile Units, and Stationary Units. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

In the output display category, digital analysers are expected to hold 58.0% of total revenue share in 2025, emerging as the preferred format for modern HVAC diagnostics. This leadership is attributed to their superior readability, user interface precision, and data storage capabilities compared to analog counterparts.

Digital displays enable technicians to interpret complex measurements such as refrigerant pressure, airflow rate, and temperature gradients with greater clarity and speed, reducing the potential for manual errors. Additionally, these displays often support backlighting, multi-metric visualization, and touchscreen functionalities, improving field usability in varying environmental conditions.

The transition to paperless reporting and the rising need for real-time data interpretation have further accelerated demand for digital output models. Their integration with Bluetooth or mobile apps has also made digital analysers a critical tool in remote diagnostics and connected building ecosystems.

The commercial application segment is projected to account for 30.0% of the HVAC system analyser market’s revenue in 2025, establishing itself as the largest vertical by application. This dominance is underpinned by the complexity and scale of HVAC installations across offices, shopping malls, hospitals, data centers, and hospitality establishments, where system efficiency and uptime are directly tied to operational continuity and occupant comfort.

Regular diagnostics using advanced analysers are essential in these settings to meet energy compliance standards, detect inefficiencies, and minimize maintenance costs. Facility managers are increasingly deploying analysers to monitor system performance, optimize energy usage, and align with building automation systems.

The adoption of predictive maintenance strategies in commercial environments, alongside government incentives for green infrastructure upgrades, has bolstered the need for reliable HVAC analysis tools contributing to this segment’s leading share.

Handheld analysers are projected to lead the configuration category with a 55.0% revenue share in 2025, solidifying their status as the most utilized form factor. Their dominance is being driven by the rising demand for portability, ease of use, and field-service adaptability among HVAC technicians. Designed for on-the-go diagnostics, handheld devices support fast setup, minimal calibration, and real-time readings across a variety of HVAC components.

Their lightweight construction and ergonomic designs have made them particularly well suited for use in constrained spaces and rooftop installations. As mobile workforces expand and service response times shorten, the preference for compact, multifunctional analysers has grown significantly.

Integration with wireless communication technologies and smartphone apps has further enhanced their functionality, allowing users to store, share, and analyse data seamlessly across service teams and maintenance platforms. These features have secured handheld analysers as essential tools for both independent contractors and enterprise-level

Monitoring of HVAC systems in terms of key operating parameters as well as leakages and emissions is considered to be a precursor to HVAC System Analyzer market growth. With HVAC systems installation rate growing at a rapid pace across transportation, residential, commercial and industrial building establishments, working efficiencies and safety concerns in operation of HVAC equipment is expected to rise.

System analyzers provide a reliable system not only in detecting harmful gases and leakages but also monitoring of key parameters such as moisture content, ambient air quality and flow rate, system temperature, etc. It can help end users save money by improving air quality and lowering energy expenses.

The use of HVAC equipment has risen as a result of a variety of factors, including technological developments and safety concerns. The increased complexity and safety concerns have increased demand for HVAC equipment. As a result, the market is expected to increase significantly in the approaching years.

Automotive and commercial based HVAC systems are expected to lead the end user demand owing to heightened frequency of repair and maintenance services in the mentioned applications. The services include refrigerant gas optimal level monitoring, duct air flow rate with other miscellaneous parameter checks.

The majority of developing countries are increasing their investments in this equipment in order to enhancing air quality and increase long-term safety. The demand for new cooling systems is predicted to rise as a result of the HVAC system analyzer's ability to save money and enhance energy efficiency. The government's initiatives in the areas of energy efficiency and system longevity serve to enhance the economy.

Focus on smart connected device configuration is being devised and offered by the concerned OEMs of HVAC analyzers wherein remote user interface, real time data projections and fundamental analysis of key parameters monitored are being provided.

Omni-channel sales of online and offline sales channels are being pursued by the device manufacturers to leverage their sales footprint

China is one of the prominent consumer of air conditioning equipment, with the greatest unit sales forecast for 2024. Another factor is the regional market expansion in china with presence of enterprises providing low-cost equipment in China and adjacent countries.

Manufacturing enterprises will have more opportunities in the long run as the industrial sector grows and the workforce grows. With this concrete economy and supremacy in other developing countries, demand for HVAC system analyzers will undoubtedly expand in the next years, with China remaining one of the fastest growing markets in this cluster.

North America is predicted to acquire a significant portion of market share with continued growth rate build up over the forecast period. Because of the region's expanding industrial and contemporary equipment sector, the regional market is also predicted to expand in the coming years.

Subsidies and tax reductions have been offered by the government to encourage the use of energy-efficient and modern hi-tech systems. Another factor driving market growth in North America is the growing demand for technical advancements and safety concerns. As a result, the future appears to be quite progressive and revenue-oriented.

Key examples of the testing device manufacturers included

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global HVAC system analyzer market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the HVAC system analyzer market is projected to reach USD 2.8 billion by 2035.

The HVAC system analyzer market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in HVAC system analyzer market are digital and analog.

In terms of application, commercial segment to command 30.0% share in the HVAC system analyzer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HVAC Market Size and Share Forecast Outlook 2025 to 2035

HVAC Valve Market Size and Share Forecast Outlook 2025 to 2035

HVAC Air Quality Monitoring Market Size and Share Forecast Outlook 2025 to 2035

HVAC Centrifugal Compressors Market Size and Share Forecast Outlook 2025 to 2035

HVAC Fan & Evaporator Coil Market Size and Share Forecast Outlook 2025 to 2035

HVAC Software Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

HVAC Insulation Market Trends & Forecast 2025 to 2035

HVAC Control System Market Growth – Trends & Forecast 2024-2034

HVAC Blower and Fan Systems Market Growth - Trends & Forecast 2025 to 2035

Smart HVAC Controls Market Size and Share Forecast Outlook 2025 to 2035

Global HVAC Filter Market

Marine HVAC System Market Size and Share Forecast Outlook 2025 to 2035

Automotive HVAC Blower Market Trends - Size, Share & Growth 2025 to 2035

Automotive HVAC Ducts Market Growth - Trends & Forecast 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA