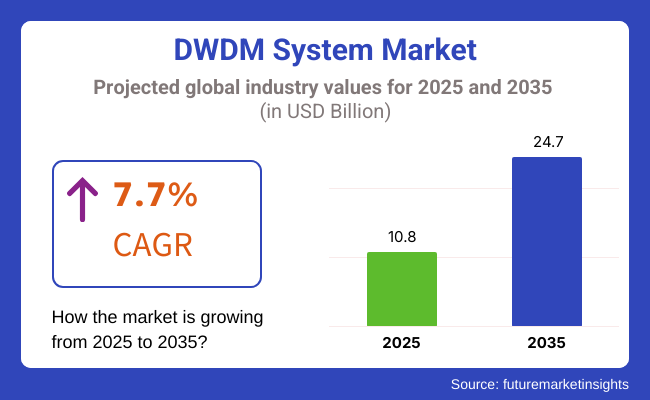

The dense wavelength division multiplexing (DWDM) system market is expected to grow immensely, with a valuation of USD 10.8 billion in 2025, expected to grow to USD 24.7 billion by 2035. The growth is likely to be at a CAGR of 7.7% during the period from 2025 to 2035, fueled by growing data traffic, high-capacity network demand, and the increasing use of 5G technology.

One of the major factors in the expansion of the DWDM system market is the rising need for high-speed internet and bandwidth-intensive applications such as video streaming, cloud computing, and IoT installations. Telecom operators are spending increasingly on DWDM technology to enhance the capacity of fiber-optic networks, reduce latency, and improve the overall network.

5G infrastructure convergence is also propelling sales forward at an accelerated rate since DWDM is instrumental in enabling ultra-high-speed data transfer necessary for the next-generation networks. Though it has a positive growth trend, there are issues involving high upfront deployment expenses as well as problems associated with supporting multiple wavelength channels.

The requirement of specialists to manage complex networks and interoperability problems among vendors in different equipment also acts as a limitation. Moreover, network security issues, especially in data-intensive sectors like finance and government, demand strong encryption and monitoring tools.

There are several major opportunities with the evolution of software-defined networking (SDN) and network function virtualization (NFV) to deliver more programmable and flexible optical networks.The rise in the use of AI-based network management tools will also contribute towards improving operational efficiency, predictive maintenance, and auto-detection of faults. Further, increased fiber-optic network expansion in growing economies provides good opportunities.

One of the major industry trends is the development of coherent optical technology, which enables increased transmission rates and enhanced spectral efficiency. The growing adoption of open optical networking is promoting greater interoperability and reducing vendor lock-in. Photonic integration and pluggable transceiver development are improving cost-effectiveness and scalability, making these systems affordable to a broader range of industries like enterprise data centers and hyperscale cloud providers.

The industry witnesses high growth with the increasing need for high-capacity data transmission, especially in telecom and data center applications. Telecom operators are increasingly deploying this technology to improve network efficiency, lower latency, and support growing data traffic fueled by 5G and fiber-optic expansions.

Data centers have the greatest need for DWDM systems, with an emphasis on scalability, ultra-low latency, and smooth cloud integration. Enterprises, though cost-conscious, are increasingly embracing DWDM for secure, high-speed connectivity in hybrid and multi-cloud environments. Government and defense agencies emphasize encryption and security to ensure safe data transmission over strategic networks.

Emerging industry trends are AI-based network automation, adaptive grid architectures, and increased spectral efficiency to maximize fiber use. The transition to software-defined networking (SDN) and smart optical networks will continue to fuel the use of these solutions, setting the industry for sustained growth in the digital age.

Between 2020 and 2024, the industry experienced strong growth due to the rising demand for high-speed data transmission, 5G rollout, and cloud computing expansion. Growing fiber-optic network installations, data center interconnects, and hyperscale cloud providers created the demand for high-capacity, low-latency solutions.

Major players such as Cisco, Ciena, Huawei, and Nokia launched AI-powered network automation, software-defined products, and power-efficient transponders to enhance spectral efficiency. Greater migration to open optical networks and disaggregated facilities provided greater interoperability and economies of scale. However, technical challenges like greater infrastructure cost, network complexity for management, and supply chain losses continued.

Between 2025 and 2035, AI-optimized network optimization, optical transmission-based quantum cryptography, and terabit-class systems will revolutionize the industry.AI-based artificial intelligence optical performance monitoring will provide real-time traffic balancing, fault discovery, and prophylactic maintenance. Coherent optical technology will shift to support higher-order schemes of modulation with very high data throughput. Silicon photonics integration will lower power and footprint.

Quantum key distribution will enhance cybersecurity for mission-critical communications. Space-division multiplexing and hollow-core fiber technologies will deliver terabit-per-second data transfer rates to revolutionize metro and long-haul networks. DWDM systems will be AI-driven, highly secure, and capable of providing exponentially growing data needs at zero latency with optimal spectral efficiency by 2035.

Comparative Market Shift Analysis from 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| 5G rollout, growth in cloud computing, and high-speed data requirement. | AI-driven optical optimization, quantum-secure DWDM, and terabit-scale transmission. |

| AI-powered network automation, software-defined DWDM, and open optical networking. | Coherent optical transmission, silicon photonics, and QKD. |

| High cost of infrastructure, network complexity in management, and supply chain complexity. | Quantum-safe encryption, SDM scalability, and real-time AI-driven traffic balancing. |

| Transition to open and disaggregated DWDM architecture for cost-effectiveness. | Adoption of AI-driven real-time monitoring, terabit networking with SDM, and green optical transmission. |

| Telcos and cloud operators extending fiber networks for 5G and data centers. | Global use of AI-controlled, quantum-secure DWDM for ultra-high-speed and secure global data transmission. |

Data traffic is increasing, and fiber-optic networks are becoming complex. There is an increasing need for high-speed communication. DWDM technology maximizes bandwidth efficiency with the capacity to transmit multiple data streams on a single fiber, allowing for long-distance transmission of data with minimal signal loss. With the increasing global connectivity needs, telecom operators and organizations increasingly employ these solutions to achieve network scalability and cost-effectiveness.

The initial investment cost and operating expenses can be high. DWDM infrastructure installation requires enormous investment in fiber-optic cable, transceivers, amplifiers, and network management systems. Support for DWDM networks will also be costly in light of the complexity of the optical component and the human talent required.

Small telecommunications companies and operators may not be able to finance such investments, limiting sales expansion.Since DWDM networks are deployed for high-speed data transmission in sensitive sectors like telecommunications, finance, and government, they pose a high-priority target for cyberattacks. Governments impose rigorous guidelines on the installation of fiber-optic networks, usage of the spectrum, and data security, requiring adherence to evolving regulations.

Manufacturing and laying fiber-optic cables are problematic in terms of sustainability, prompting companies to employ green manufacturing techniques and energy-efficient network solutions. Despite such risks, the DWDM system market continues to be the backbone of global digital infrastructure. Photonic integration innovation, AI-optimized network optimization, and advances in 5G and cloud computing will continue to propel the growth, providing high-capacity and cost-efficient optical communication solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.5% |

| UK | 7.8% |

| France | 7.5% |

| Germany | 7.9% |

| Italy | 6.8% |

| South Korea | 8.2% |

| Japan | 7.6% |

| China | 9% |

| Australia | 6.5% |

| New Zealand | 5.9% |

The USA will dominate in the DWDM system market as it has a more developed telecommunications infrastructure and a huge need for fast data transmission. Growth is being driven by heightened adoption of 5G networks, cloud computing, and data centers.

Key leaders are conducting research and development activities all the time in order to increase the scalability and efficiency of the network. Government efforts to roll out broadband across rural regions add to growth. Moreover, the explosive growth of data traffic generated by cloud and enterprise streaming applications maintains a robust growth pattern.

The UK is expected to grow steadily in the wake of rising fiber-optic network installations and government-led programs to foster connectivity. As the UK focuses on smart city development and digitalization, telecom operators are heavily investing in high-capacity optical networks. Increasing bandwidth-hungry applications, along with continued growth in hyperscale data centers, is further driving DWDM adoption. Post-Brexit infrastructure spending and regulatory policies also contribute significantly to the development.

France is witnessing huge growth driven by the growth of high-speed broadband networks and government efforts to digitize the nation. Fiber-optic network deployment in the context of the "France Très Haut Débit" initiative is driving DWDM installations. With more businesses adopting cloud computing and edge computing, the demand for high-end optical networking solutions is gaining momentum. In addition, AI and IoT app development requires secure and scalable network infrastructures, necessitating investments in DWDM.

Germany is expanding at a tremendous rate owing to aggressive digitalization and strong industrial demand for high-speed connectivity. Germany, as the largest economy in Europe, is investing hugely in next-gen network infrastructure for Industry 4.0, autonomous driving, and smart manufacturing.

The nation's telecom companies are actively rolling out their fiber-optic networks, and the advent of 5G networks also serves to support installations of DWDM systems. Government-backed digital infrastructure funding and strong data security laws also put the industry in a strong position.

Italy is growing steadily with high-speed internet and fiber-optic investment. The government of Italy is addressing the digital divide by making efforts to improve broadband penetration within rural regions. Telecoms are making investments in high-bandwidth networking infrastructure in order to be ahead of the increasing consumption of business and consumer data.

Additionally, greater dependency on video streaming and cloud computing services is contributing to further DWDM system demand. Apart from that, the government's initiative towards the growth of smart city infrastructures in Italy is progressing with network infrastructure modernization.

South Korea is experiencing robust DWDM expansion. With internet penetration among the highest in the world, the nation is a leader in 5G and future networking. Telco behemoths heavily invest in DWDM solutions to enable ultra-broadband services and roll out mobile networks.

Rising smart factories, IoT use cases, and AI-based system innovations are again propelling high-capacity optical network demand. Government initiatives to consolidate digital infrastructure solidify opportunities that continue to be promising.

Japan's DWDM market is evolving through its dense fiber-optic network and its expansion beyond 5G technology. Japan's top telecommunication providers are developing backbone networks to better handle growing data traffic. Cloud, AI, and autonomous technology investment pressures the market. Additionally, Japan's smart city development and digitalization initiatives are propelling relentless innovation in optical networking solutions that make DWDM systems the key element of future connectivity solutions.

China dominates due to massive investment in telecom infrastructure and digitalization plans. The widespread deployment of 5G on a large scale, smart city developments, and Chinese industrial IoT implementation are the growth drivers for DWDM demand in China. Increasing government initiatives promoting indigenous technological development have been giving the momentum needed, with companies in China making massive investments in optical communication technology.

The huge hyperscale data center explosion triggered by large technology companies also favors growth. The Belt and Road Initiative adds to cross-border digital connectivity projects, thereby improving DWDM adoption.

Australiais transforming at a fast pace through investment in national broadband infrastructure and increasing demand for high-speed internet services. National policies towards digital inclusion and further expansion of fiber-optic infrastructure are the key drivers of growth.

With steady growth in data centers spurred by enterprise digitalization and cloud computing, demand for high-capacity optical transmission systems is growing. Furthermore, Australia's emphasis on the 5G rollout and adoption of smart technology is further boosting the industry.

New Zealand is gradually growing with increased investments in broadband growth and fiber-optic links. The nation is investing heavily to modernize telecommunications infrastructure to facilitate digitalization and the adoption of smart technologies. Growing data consumption by enterprises and consumers is fueling a robust demand for high-bandwidth technology. Government initiatives to increase rural connectivity and encourage cloud adoption are also contributing to the growth.

With data traffic accelerating and rising cloud computing together with the demand for high-capacity optical networks, the dense wavelength division multiplexing (DWDM) system market is blooming at a very early stage.

System integration will account for the largest share in the service segment, with 40.3% by 2025. DWDM solutions need to be integrated into the client for seamless interoperability, and this is expected to reshape the optical networks industry. As telecom operators and enterprises come to terms with upgrades in the form of 5G, hyperscale data centers, and next-generation broadband services, demand for seamless integration of DWDM solutions is growing.

Advanced end-to-end DWDM integration services for seamless deployment, interoperability, and optimization of optical networks are being offered by vendors such as Cisco Systems, Ciena Corporation, and Fujitsu. Somewhere along this path, the system integration services became a business requirement. This need emerged in response to the increasing complexity created in multi-vendor environments or (more recently) near the domains of software-defined networking (SDN).

The maintenance and support segment, with a 31.0% share, closely follows as the network operators strive to maintain high uptime, low latency, and fault-tolerant optical networks. For example, companies such as Nokia, Huawei, and Infinera offer proactive monitoring, network diagnostics, and predictive maintenance solutions that ensure minimal downtime and optimal performance of DWDM systems.

AI-driven network analytics and remote troubleshooting are also being used to create more effective maintenance services, enabling providers to become proactive and detect and fix issues before they can impact network performance.

DWDM based on coherent optics, automation, and AI-driven network management will have to upgrade data. The totality of these services in the domain of integration and maintenance will continue coming in handy for next-generation high-speed optical communication.

In 2025, the Dense Wavelength Division Multiplexing (DWDM) System Market is expected to be driven by the growing need for high-speed optical communication networks, expanding 5G infrastructure, and the increasing use of hyperscale data centers. DWDM technology is getting the attention of enterprises and telecom operators for all the right reasons, with the changing needs for higher bandwidth, reduced latency, and long-distance data transmission.

Transmitters and receivers are the segments with the largest share of the optical transceivers industry at 25.6% among major product types, mainly because they are fundamental components used to convert the electrical signal into optical signal and vice versa, respectively.

Companies such as Ciena Corporation, Huawei, and Infinera are pioneering advanced coherent optical transceivers and wavelength-tunable transmitters that boost spectral efficiency and network performance. There is also a boost in demand in this space through the growing adoption of 400G and beyond optical transmission solutions.

The transmission media segment also contributes significantly, with its share representing 18.2% of the overall share, as it plays a critical role in facilitating reliable and efficient data transfer in fiber-optic networks. Top companies like Corning, Sumitomo Electric, and Prysmian Group are manufacturing low-loss optical fibers to help accommodate higher data amounts while ensuring minimal loss of signal integrity.

Another major pressure point for this segment is the rapid growth in the deployment of fiber-optic network projects across the world, especially metro and long-haul networks.

The DWDM system market has witnessed rapid growth in technology and advancement in the present era. The growing data traffic and high demand for optical communication networks are the future characteristics of this industry. The present trend is to launch innovative optical transceivers, develop signal processing efficiency, and incorporate software-defined networking (SDN) solutions to enhance their offerings.

Players in this competitive arena include large telecom equipment manufacturing companies, dedicated optical networking producers, and new companies providing cost-efficient and flexible solutions.

Extensive adoption of these systems stems from metro and long-haul fiber optic networks, data center interconnects (DCI), and submarine communications networks. The competition further intensified with the constant increase in transmission capabilities of 400G and beyond, motivating different companies to work towards reduced power consumption, improved spectral efficiency, and increased automation across networks.

AI-generated consumer-based optical performance monitoring and cloud-based network orchestration solutions also stand out as important market differentiators.

These partnerships and mergers are frequent since companies are looking for ways to expand their optical networking portfolios. For example, Ciena and Infinera have strengthened lines of product offerings through acquisitions. At the same time, companies like Nokia and Huawei are investing substantially in photonic chips. Innovation and investment in the DWMD system are more often sparked by the spreading of 5G and the demand for faster speed in broadband services.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Huawei | 25-30% |

| Ciena | 18-22% |

| Nokia | 14-18% |

| Infinera | 10-14% |

| Cisco Systems | 8-12% |

| Other Key Players | 12-16% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Huawei | Offers high-capacity solutions with AI-powered network automation for global telecom operators. |

| Ciena | Specializes in programmable optical networking solutions, focusing on 400G and 800G transmission for data centers and metro networks. |

| Nokia | Develop energy-efficient platforms with SDN integration for seamless cloud networking. |

| Infinera | Provides high-speed, photonic-integrated systems for long-haul and submarine networks. |

| Cisco Systems | Focuses on software-driven solutions with network automation for enterprise and cloud providers. |

Key Company Insights

Huawei (25-30%)

Huawei leads with its end-to-end optical networking solutions, offering high-capacity transmission and AI-driven network automation. Despite regulatory challenges in certain regions, its technology dominance remains strong in Asia and developing markets.

Ciena (18-22%)

Ciena specializes in adaptive optical networking and has a strong presence in North America and Europe. Its WaveLogic coherent technology enables high-speed 800G transmission, making it a preferred choice for large data center operators and telecom providers.

Nokia (14-18%)

Nokia focuses on SDN-enabled solutions, integrating automation and cloud-native architectures to optimize fiber networks. Its WaveFabric optical networking portfolio enhances efficiency for metro and long-haul applications.

Infinera (10-14%)

Infinera is a key player in photonic integration, offering compact and high-capacity solutions for long-haul and subsea fiber networks. Its vertical integration strategy provides cost and performance advantages.

Cisco Systems (8-12%)

Cisco emphasizes SDN-driven optical networking, providing flexible DWDM solutions for enterprise and service provider networks. Its acquisitions in the optical networking space have strengthened its market position.

Other Key Players (1h16% Combined)

The segmentation is into system integration, Consulting, and Support & Maintenance.

Key segmentation is into Transmitter and Receiver, Transmission Media, DMUX, Optical Amplifier, Regenerator, and Transponders.

The segmentation is into IT and Telecom, Government, BFSI, Manufacturing, Automotive, Healthcare, and Others.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The industry is expected to reach USD 10.8 billion in 2025.

The market is projected to grow to USD 24.7 billion by 2035.

China is expected to experience significant growth, with a CAGR of 9.0% during the forecast period.

The transmitters and receivers segment is one of the most popular categories.

Leading companies include Huawei, Ciena, Nokia, Infinera, Cisco Systems, ADVA Optical Networking, Fujitsu Optical Components, ECI Telecom, Coriant, and NEC Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Verticals, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Verticals, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Verticals, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Verticals, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Verticals, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Verticals, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Verticals, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Verticals, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Services, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Verticals, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Verticals, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Verticals, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Verticals, 2023 to 2033

Figure 17: Global Market Attractiveness by Services, 2023 to 2033

Figure 18: Global Market Attractiveness by Product, 2023 to 2033

Figure 19: Global Market Attractiveness by Verticals, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Services, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Verticals, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Verticals, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Verticals, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Verticals, 2023 to 2033

Figure 37: North America Market Attractiveness by Services, 2023 to 2033

Figure 38: North America Market Attractiveness by Product, 2023 to 2033

Figure 39: North America Market Attractiveness by Verticals, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Services, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Verticals, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Verticals, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Verticals, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Verticals, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Services, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Verticals, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Services, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by Verticals, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by Verticals, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Verticals, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Verticals, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Services, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Verticals, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Services, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by Verticals, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Verticals, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Verticals, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Verticals, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Services, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Verticals, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Services, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by Verticals, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Verticals, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Verticals, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Verticals, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Services, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Verticals, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Services, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Verticals, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Verticals, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Verticals, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Verticals, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Services, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Verticals, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Services, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Verticals, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Verticals, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Verticals, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Verticals, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Services, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Verticals, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Brake System Market Size and Share Forecast Outlook 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

X-ray System Market Analysis - Size, Share, and Forecast 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Cough systems Market

Closed System Transfer Devices Market Insights – Industry Trends & Forecast 2024-2034

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Dropper System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA