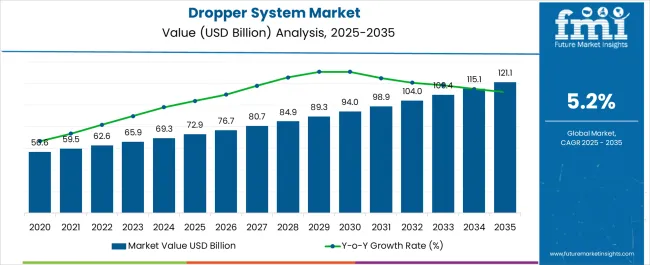

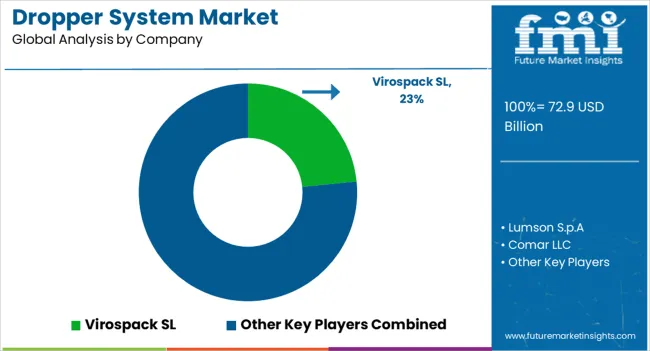

The Dropper System Market is estimated to be valued at USD 72.9 billion in 2025 and is projected to reach USD 121.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Dropper System Market Estimated Value in (2025 E) | USD 72.9 billion |

| Dropper System Market Forecast Value in (2035 F) | USD 121.1 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The dropper system market is experiencing notable growth driven by the rising demand for accurate liquid dispensing in pharmaceuticals, cosmetics, and laboratory applications. Increasing emphasis on precision dosing, especially in ophthalmic and pediatric medicines, has elevated the importance of dropper systems.

Advancements in material innovation and ergonomic designs are supporting wider adoption across both medical and consumer product industries. Regulatory focus on packaging safety and user friendly formats is further influencing product development strategies.

Additionally, the expansion of the cosmetics and personal care sector has boosted demand for droppers, particularly in essential oils, serums, and liquid formulations. The market outlook remains positive as manufacturers continue to prioritize sustainability in material selection and invest in innovative designs that combine safety, functionality, and consumer convenience.

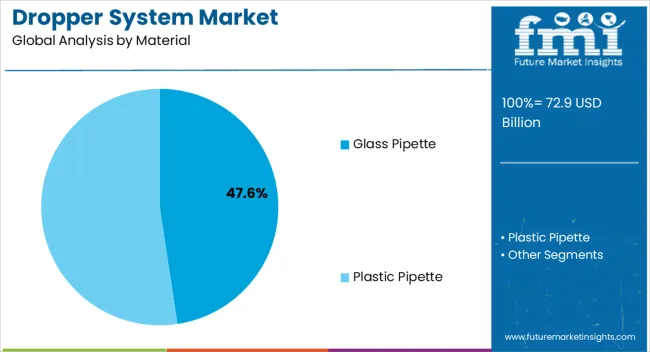

The glass pipette segment is projected to represent 47.60% of market revenue by 2025 within the material category, making it the dominant choice. Its strong adoption is attributed to superior chemical resistance, durability, and transparency, which allow precise measurement and dispensing of liquids.

Glass pipettes are highly preferred in pharmaceutical and laboratory settings where accuracy and sterility are critical.

Their compatibility with a wide range of formulations and their ability to maintain integrity without leaching substances into solutions further strengthen their dominance in this segment.

.webp)

The natural rubber bulb segment is expected to account for 42.30% of revenue share in 2025, positioning it as the leading material in the bulb category. Its wide use is driven by elasticity, durability, and cost effectiveness, which support consistent performance in liquid dispensing applications.

The material’s ability to provide a secure grip and reliable suction function has reinforced its adoption in pharmaceutical droppers and cosmetic packaging.

Its biodegradability and alignment with eco friendly packaging trends also contribute to its continued prominence in the market.

As per Future Market Insights’ (FMI) latest report, global sales of dropper systems grew at 3.5% CAGR during the historic period time frame (2020 to 2025). Total market size reached around USD 72.9 million in 2025.

Looking ahead, the worldwide dropper system market is projected to expand at 5.2% CAGR during the assessment period. It is likely to attain a valuation of USD 121.1 million by the end of 2035.

Droppers, also known as pipettes or dropper bottles, are small devices used for dispensing small amounts of liquid in a controlled manner. They typically consist of a glass or plastic tube with a tapered or narrow opening at one end and a rubber or silicone bulb at the other end.

The bulb is squeezed to create a vacuum, drawing the liquid into the tube, and then released to dispense the liquid drop by drop.

Products such as serums and essential oils require a small and certain quantity of product to be dispensed hence droppers or dropper systems are often used for these types of products.

Dropper systems are used in various sectors and applications. For instance, they find applications in sectors such as pharmaceutical & healthcare, cosmetics & personal care, laboratory and scientific research, food & beverage, and homecare. Expansion of these sectors will elevate demand for dropper systems.

Droppers are also seen as a more hygienic way to dispense cosmetics than traditional methods, such as using one’s fingers. Growing consumer interest in beauty, skincare, and haircare products has been fueling the demand for dropper systems and the trend is expected to continue through 2035.

Widening applications of essential oil in homecare, beauty & wellness, pharma, and food & beverages is further expected to boost the target market.

Growing Trend of Airless Dropper Systems Boosting the Target Market:

Airless droppers are becoming increasingly popular as a way to dispense cosmetics. Airless droppers create a vacuum when the product is dispensed, which helps to prevent oxidation and contamination. This can extend the shelf life of cosmetics and make them more effective.

Airless dropper systems do not require contact with the product, which helps to prevent the spread of bacteria. This is especially important for products that are used around the eyes or on the face. These droppers are more convenient than other counterparts.

Airless droppers are easy to use and dispense the correct amount of product each time. They are often seen as a more hygienic and convenient way to dispense cosmetics when purchasing them online. Hence, growing popularity of online beauty sales will positively impact sales of dropper systems such as airless droppers.

Increasing Awareness about Hygiene among Consumers Augmenting Dropper System Sales:

Increasing awareness about hygiene is a key driver for the dropper system market. This is due to several advantages offered by droppers or dropper systems.

Droppers are a type of packaging that is used to dispense liquids, such as lotions, serums, and oils. They are considered to be more hygienic than other types of packaging, such as jars. This is because they do not come into direct contact with the product which makes them a popular choice for consumers who are concerned about hygiene.

Droppers are also seen as being more sanitary than other types of packaging. This is because they can be easily cleaned and sterilized. This makes them a good choice for products that are used on the face, such as serums and moisturizers. Hence, increasing awareness about hygiene among consumers will continue to boost the target market.

| Country | United States |

|---|---|

| Market Share (2025) | 15.7% |

| Market Share (2035) | 14.7% |

| BPS Analysis | -10 |

| Country | Mexico |

|---|---|

| Market Share (2025) | 2.8% |

| Market Share (2035) | 2.9% |

| BPS Analysis | 10 |

| Country | Argentina |

|---|---|

| Market Share (2025) | 2.1% |

| Market Share (2035) | 2.4% |

| BPS Analysis | 30 |

| Country | China |

|---|---|

| Market Share (2025) | 5.1% |

| Market Share (2035) | 4.8% |

| BPS Analysis | -30 |

| Country | Japan |

|---|---|

| Market Share (2025) | 3.8% |

| Market Share (2035) | 3.7% |

| BPS Analysis | -10 |

| Country | India |

|---|---|

| Market Share (2025) | 4.3% |

| Market Share (2035) | 4.5% |

| BPS Analysis | 20 |

| Country | Australia & New Zealand |

|---|---|

| Market Share (2025) | 1.8% |

| Market Share (2035) | 2.2% |

| BPS Analysis | 40 |

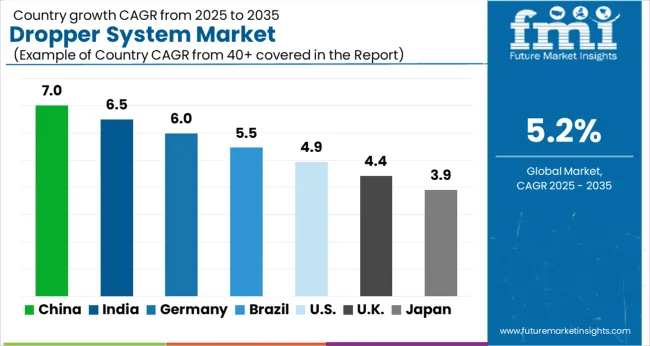

| Country | Germany |

|---|---|

| Market Share (2025) | 5.1% |

| Market Share (2035) | 4.3% |

| BPS Analysis | -80 |

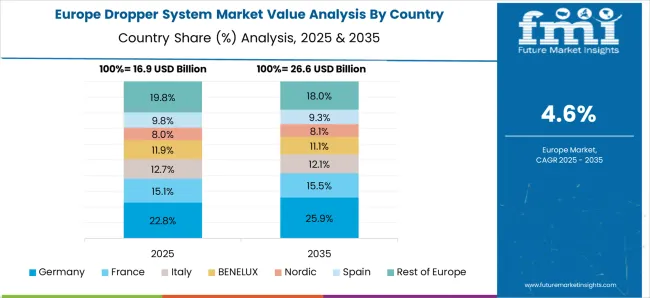

Booming Cosmetics & Personal Care Sector Fueling Dropper System Demand in Germany

Germany is one of the leading markets for dropper systems with increasing scientific innovative facilities and research centers focused on product development and regulatory compliance concerning cosmetics and personal care products.

According to the Cosmetics Europe Personal Care Association, Europe is one of the key markets for cosmetic products with Germany accounting for USD 72.9 billion in 2025 after France and Italy. This is creating a high demand for dropper systems and the trend is expected to continue through 2035.

Increasing investments and developing brands in the cosmetics sector are contributing to its growth in Germany. As a result, Germany is becoming a key market for dropper system manufacturers to increase their revenues.

Germany dropper system market is anticipated to offer an incremental opportunity of USD 121.1 million through 2035. Overall dropper system demand in Germany is likely to rise at a CAGR of 3.7% during the assessment period.

Rising Production & Consumption of Beauty Products Making China a Lucrative Market

China is emerging as one of the lucrative markets for dropper system companies, owing to rising production, consumption, and export of beauty and personal care products. China is expected to hold around 47.3% share in East Asia market in 2025.

Sales of dropper systems in China are likely to soar at a steady CAGR of around 4.5% during the forecast period of 2025 to 2035.

As per the International Trade Administration, USA Department of Commerce, the beauty and personal care sector in China recorded sales worth USD 69.3 billion in the year 2024 with y-o-y growth of 10%.

Color cosmetics and fragrances category was specifically shown impressive growth in china resulting in premium sales increase and product upgradation.

Further, the evolution of e-commerce sector, social media, and digitization in China has been increasingly influencing Chinese consumers to buy more beauty products. This in turn is positively impacting dropper system sales as they have become ideal components of various beauty and personal care products.

Growing Need for Precise & Controlled Dispensing of Medications Fueling Dropper System Demand

According to Future Market Insights (FMI), liquid medicines packaging segment is estimated to hold a market share of more than 23.0% in 2025.It is further expected to rise at a CAGR of 4.8% over the forecast period. This is due to rising need for precise & controlled dispensing of liquid medications.

Droppers are widely used for precise and controlled dispensing of liquid medications, eye drops, and other healthcare products. They have become essential healthcare tools.

The increasing prevalence of chronic diseases, expanding global population, and the need for accurate dosing contribute to the demand for droppers in the pharmaceutical sector for liquid medicines packaging.

Rising usage of dropper systems in liquid medicines packaging is anticipated to play a key role in fostering market development.

Various Advantages of Glass Pipettes Making them Highly Popular

Glass droppers offer several benefits over plastic pipettes that make them an ideal choice for fragrances, liquid medicines, essential oils, and supplements. Glass dropper bottles equipped with tight caps ensure to keep the product protected, fresh, and pure throughout the use without any spillage.

Glass dropper pipettes provide leak-proof, safe, and precise dispensing which is essential for important medications and sensitive liquids. Also, they can be sterilized and reused which makes it an eco-friendly option.

As per the latest analysis, glass pipettes will continue to dominate the global dropper system industry with a share of around 56.6% in 2025. It is likely to create an incremental opportunity worth USD 25.5 million during the forecast period.

Leading manufacturers of dropper systems are constantly innovating for developing new solutions with improved designs and user-friendly features. They are also implementing strategies such as partnerships, mergers, collaborations, acquisitions, and facility expansions to gain a competitive edge in the market.

Recent developments

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 65.9 million |

| Projected Market Value (2035) | USD 108.1 million |

| Anticipated Growth Rate (2025 to 2035) | 5.2% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Dropper Pipette (Material), Dropper Bulb (Material), Pipette Capacity, Pipette Tip Style, Bulb Style, Bulb Cap Type, End Use, Region |

| Key Countries Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Central Asia; Russia & Belarus; Balkan Countries & Baltic Countries; Middle East & Africa |

| Key Companies Profiled | Virospack SL; Lumson S.p.A; Comar LLC; AptarGroup, Inc; SONE Products Ltd; HCP Packaging Co. Ltd; Albéa Group; Quadpack SA; HEIM Pharma Tropfsysteme GmbH; Paramark Corporation; Cosmetic Specialties International, LLC; Carow Packaging Inc.; RTN Applicator Company LLC; Guangzhou Jiaxing Glass Products Co. Ltd; Hangzhou Lecos packaging Co., Ltd; Guangzhou YELLO Packaging Co., Ltd.; Bestpak Packaging Solutions, Inc.; Radcom Packaging Pvt Ltd; Taiwan K. K. Corp (COSJAR); Bormioli Pharma S.p.A.; DWK Life Sciences Ltd.; THE PLASTICOID COMPANY; Origin Pharma Packaging; SGD Pharma |

The global dropper system market is estimated to be valued at USD 72.9 billion in 2025.

The market size for the dropper system market is projected to reach USD 121.1 billion by 2035.

The dropper system market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in dropper system market are glass pipette, type i (borosilicate glass), type iii (regular soda lime glass), plastic pipette, high-density polyethylene (hdpe), low-density polyethylene (ldpe), polypropylene (pp) and polyethylene terephthalate (pet).

In terms of dropper bulb (material), natural rubber segment to command 42.3% share in the dropper system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Droppers Market Size and Share Forecast Outlook 2025 to 2035

Dropper Caps Market Report - Key Trends & Forecast 2025 to 2035

Dropper Squeeze Bottle Market Trends & Industry Growth Forecast 2024-2034

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Cosmetic Dropper Industry

Push Button Dropper Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Push Button Dropper Market Share

Child Resistant Dropper Caps Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Child Resistant Dropper Caps Manufacturers

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Systemic Infection Treatment Market

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

HVAC System Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA