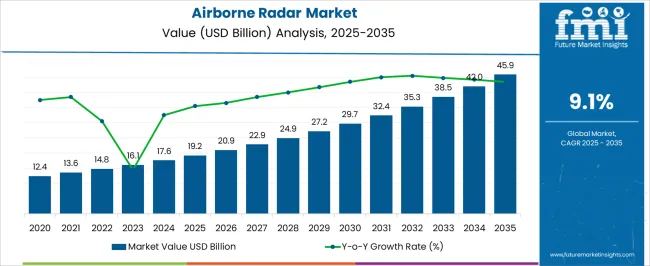

The Airborne Radar Market is estimated to be valued at USD 19.2 billion in 2025 and is projected to reach USD 45.9 billion by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period.

The airborne radar market is witnessing robust growth, supported by increasing defense expenditure, growing need for surveillance capabilities, and technological advancements in radar systems. Modern airborne radar solutions provide real-time situational awareness, terrain mapping, and threat detection, critical for both military and commercial aviation.

The integration of AI, digital signal processing, and solid-state electronics has significantly enhanced radar performance, resolution, and reliability. Rising geopolitical tensions and the modernization of air fleets have accelerated procurement of advanced radar systems globally.

The shift toward multifunctional and software-defined radar architectures is transforming system design, enabling improved adaptability and mission flexibility. With expanding applications in weather monitoring and border surveillance, the airborne radar market is expected to sustain steady growth in the coming decade.

| Metric | Value |

|---|---|

| Airborne Radar Market Estimated Value in (2025 E) | USD 19.2 billion |

| Airborne Radar Market Forecast Value in (2035 F) | USD 45.9 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

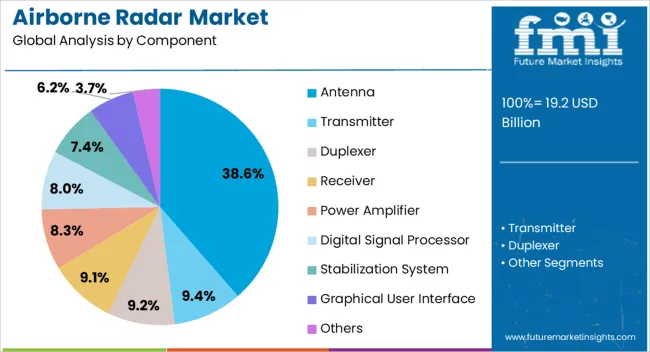

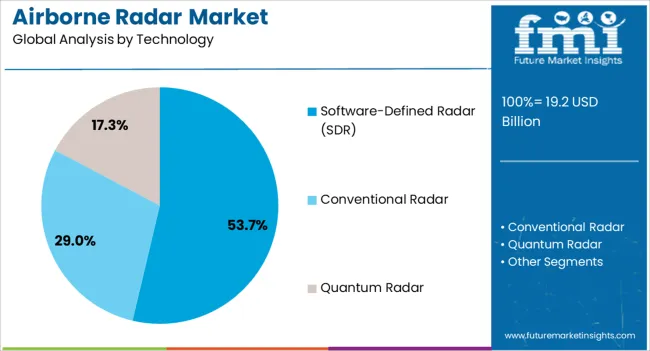

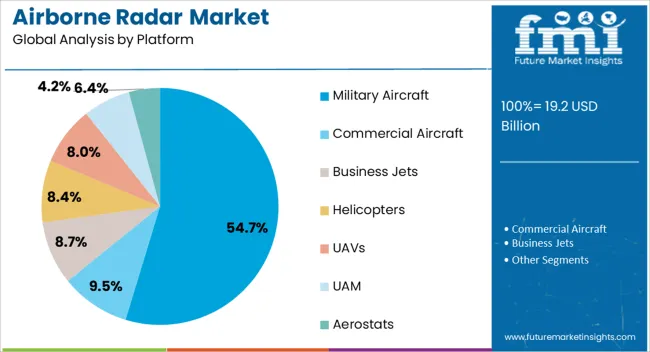

The market is segmented by Component, Technology, Platform, Installation Type, Waveform, Range, and Dimension and region. By Component, the market is divided into Antenna, Transmitter, Duplexer, Receiver, Power Amplifier, Digital Signal Processor, Stabilization System, Graphical User Interface, and Others. In terms of Technology, the market is classified into Software-Defined Radar (SDR), Conventional Radar, and Quantum Radar. Based on Platform, the market is segmented into Military Aircraft, Commercial Aircraft, Business Jets, Helicopters, UAVs, UAM, and Aerostats. By Installation Type, the market is divided into New Installation and Upgradation.

By Waveform, the market is segmented into Frequency Modulated Continuous Wave (FMCW), Doppler, and Ultra-Wideband Impulse (UWB). By Range, the market is segmented into Long Range, Very Long Range, Medium Range, Short Range, and Very Short Range. By Dimension, the market is segmented into 3D, 2D, and 4D. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The antenna segment leads the component category with approximately 38.6% share, supported by its central role in radar signal transmission and reception. Technological advancements in phased-array and conformal antenna designs have enhanced detection accuracy and operational range.

Lightweight, compact configurations are increasingly adopted to meet performance and integration requirements in modern aircraft platforms. The segment’s growth is driven by ongoing upgrades of existing radar systems and the development of next-generation airborne surveillance solutions.

With growing adoption across both defense and commercial aviation, the antenna segment is expected to sustain its dominant position throughout the forecast period.

The software-defined radar (SDR) segment dominates the technology category with approximately 53.7% share, owing to its flexibility, scalability, and upgradability. SDR systems enable real-time reconfiguration of radar functions through software updates, reducing the need for hardware modifications.

This adaptability supports mission-specific customization and long-term cost savings. The segment benefits from rapid advancements in digital signal processing, enabling improved target recognition and clutter suppression.

Increased defense funding for modern electronic warfare and intelligence programs has accelerated adoption. As radar systems evolve toward network-centric architectures, SDR technology is expected to remain the foundation for future airborne radar innovations.

The military aircraft segment holds approximately 54.7% share of the platform category, reflecting its extensive use of airborne radar for reconnaissance, targeting, and navigation purposes. Military modernization programs across major nations have prioritized radar upgrades to enhance situational awareness and mission precision.

The segment benefits from consistent funding for combat aircraft, UAVs, and surveillance platforms. Demand is reinforced by geopolitical developments driving defense readiness and advanced threat detection requirements.

As next-generation fighter programs and long-range surveillance initiatives expand, the military aircraft segment is expected to retain its dominant position, ensuring continued growth in the global airborne radar market.

The scope for global airborne radar market insights expanded at an 11.6% CAGR between 2020 and 2025. The market is anticipated to develop at a CAGR of 9.1% over the forecast period from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 11.6% |

|---|---|

| Forecasted CAGR from 2025 to 2035 | 9.1% |

The global market demonstrated robust expansion with a CAGR of 11.6% from 2020 to 2025. This growth can be attributed to several factors, including increased defense spending worldwide, technological advancements in radar systems, and a rising demand for military and commercial aviation surveillance capabilities.

The period witnessed a surge in the adoption of advanced radar technologies, such as synthetic aperture radar (SAR) and electronic scanning, enhancing the overall performance and versatility of airborne radar systems. Moreover, the market benefited from a dynamic landscape marked by intense competition among key players striving to introduce innovative solutions, contributing to the substantial growth of the sector.

The market is poised for continued development, projected to maintain a healthy CAGR of 9.1% from 2025 to 2035. This forecasted growth underpins sustained global defense investments, ongoing technological breakthroughs, and the increasing need for comprehensive surveillance and reconnaissance capabilities.

As artificial intelligence (AI) continues to play a pivotal role in radar signal processing, optimizing target detection and tracking, the market is expected to witness further advancements, solidifying its position as a critical component in both military and civilian applications over the forecast period.

| Attributes | Details |

|---|---|

| Drivers |

|

The presented table highlights the CAGRs for five countries, namely the United States, Japan, China, the United Kingdom, and South Korea, indicating their respective growth trajectories. The business environment in South Korea is dynamic and progressing swiftly, showing indications of substantial expansion with a CAGR of 11.1% expected by 2035.

South Korea is actively adopting innovative approaches, making valuable contributions across various sectors, and displaying a flourishing economic landscape. This highlights the ongoing economic evolution of the country and its readiness for notable growth in the foreseeable future.

| Countries | CAGRs from 2025 to 2035 |

|---|---|

| The United States | 9.4% |

| Japan | 10.7% |

| China | 9.9% |

| The United Kingdom | 10.4% |

| South Korea | 11.1% |

The market is extensively utilized in the United States due to the robust defense infrastructure and military capabilities. With a focus on maintaining global military superiority, the United States employs airborne radar for advanced surveillance, reconnaissance, and threat detection applications.

The technology is integral to ensuring national security, enhancing situational awareness, and supporting the effectiveness of military operations. The United States aviation sector also benefits from airborne radar for weather monitoring and navigation, further solidifying the significance of the market.

The market in Japan is pivotal in bolstering the defense capabilities of the country. With regional security challenges, Japan relies heavily on airborne radar systems for early warning, surveillance, and maritime security.

The advanced technology aids in monitoring airspace and maritime activities, contributing to the strategic defense posture. The commitment to technological innovation drives the adoption of cutting-edge radar systems, emphasizing the readiness to address evolving security concerns of the country.

The utilization of the market in China aligns with its growing military prowess and modernization efforts. Airborne radar systems are integral to defense strategy, providing critical surveillance, target acquisition, and tactical reconnaissance capabilities.

Focusing on territorial defense and regional influence, China invests significantly in radar technology to enhance its situational awareness and maintain a credible defense posture. The market in China reflects the commitment to technological advancements and military modernization.

The United Kingdom employs airborne radar extensively to reinforce its defense capabilities and contribute to international security initiatives. The airborne radar applications span maritime surveillance to air defense, supporting the commitments to NATO and global peacekeeping efforts.

The airborne radar is crucial for the Royal Air Force and the Navy, enabling effective command and control, target tracking, and threat identification. The strategic use of airborne radar aligns with its role as a key player in international defense collaborations.

The market in South Korea is significantly utilized as the country focuses on enhancing its defense capabilities amidst regional security challenges. The geopolitical landscape drives the need for advanced airborne radar systems, contributing to surveillance, threat detection, and tactical reconnaissance.

Technology also plays a vital role in securing the airspace and maritime borders of the nation. The commitment to innovation and defense modernization underscores the critical role of airborne radar in addressing evolving security dynamics in the region.Top of Form

The table below provides an overview of the airborne radar landscape on the basis of component type and technology type. Antennas are projected to lead the component type of market at an 8.8% CAGR by 2035, while software-defined radar (SDR) in the technology type category is likely to expand at a CAGR of 8.6% by 2035.

The prominence of antennas in the market is driven by their pivotal role in radar systems, where they serve as the core signal transmission and reception component. The increasing need for flexibility and adaptability in radar systems fuels the adoption of software-defined radar (SDR).

| Category | CAGR from 2025 to 2035 |

|---|---|

| Antennas | 8.8% |

| Software-Defined Radar (SDR) | 8.6% |

Antennas are anticipated to lead in the component type category, with a projected CAGR of 8.8% by 2035. This indicates a substantial growth trajectory for the antenna segment within the market, underscoring its pivotal role in radar system architecture and performance.

Software-defined radar (SDR) is poised for significant expansion in technology types, with an estimated CAGR of 8.6% by 2035. This emphasizes the increasing adoption and relevance of SDR in airborne radar systems, reflecting a shift toward more flexible and adaptable radar technologies.

The airborne radar market is witnessing intense competition with key players vying for market share through strategic initiatives and technological advancements.

Leading companies focus on research and development to introduce innovative radar systems that offer enhanced capabilities, improved performance, and increased reliability.

Collaborations, partnerships, mergers and acquisitions are prevalent strategies, allowing companies to expand their product portfolios and strengthen their global presence.Top of FormTop of Form Some important developments in the airborne radar space are mentioned below:

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 17.6 billion |

| Projected Market Valuation in 2035 | USD 42 billion |

| CAGR Share from 2025 to 2035 | 9.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | By Component, By Technology, By Platform, By Installation Type, By Waveform, By Range, By Dimension, By Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

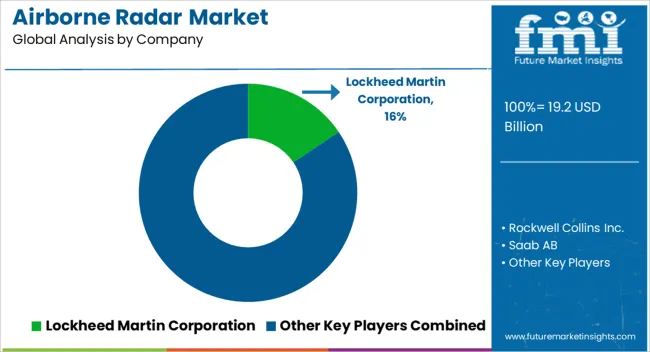

| Key Companies Profiled | Lockheed Martin Corporation; Rockwell Collins Inc.; Saab AB; Honeywell International Inc; General Dynamics Corporation; Rheinmetall AG; BAE Systems; Northrop Grumman Corporation; Raytheon Technologies; Thales Group |

The global airborne radar market is estimated to be valued at USD 19.2 billion in 2025.

The market size for the airborne radar market is projected to reach USD 45.9 billion by 2035.

The airborne radar market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in airborne radar market are antenna, transmitter, duplexer, receiver, power amplifier, digital signal processor, stabilization system, graphical user interface and others.

In terms of technology, software-defined radar (sdr) segment to command 53.7% share in the airborne radar market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Airborne Fire Control Radar Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Radar Message Signs Market Size and Share Forecast Outlook 2025 to 2035

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radar Security Market Size and Share Forecast Outlook 2025 to 2035

Radar Absorbing Materials Market Size and Share Forecast Outlook 2025 to 2035

Radar Simulators Market Size and Share Forecast Outlook 2025 to 2035

Radar & LiDAR Technology for Railways - Trends & Forecast 2025 to 2035

Radar Level Transmitter Market Analysis - Growth & Forecast 2025 to 2035

Airborne Warning and Control System Market Growth - Trends & Forecast 2025 to 2035

Radar Market Analysis by Platform, Application, Type, and Region through 2035

Airborne SATCOM Equipment Market

Airborne Surveillance Market

60GHz Radar Evaluation Kit Market Size and Share Forecast Outlook 2025 to 2035

X-Band Radar Market Size and Share Forecast Outlook 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Marine Radar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA