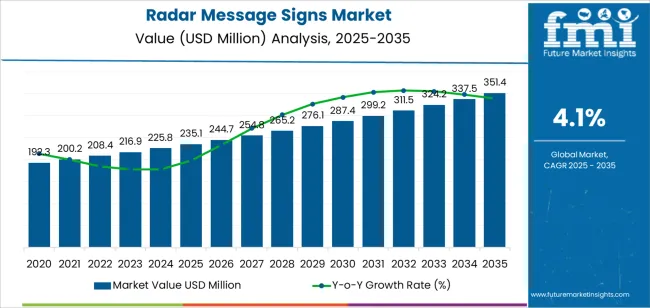

The global radar message signs market is projected to grow from USD 235.1 million in 2025 to approximately USD 351.4 million by 2035, recording an absolute increase of USD 116.3 million over the forecast period. This translates into a total growth of 49.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.1% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.5X during the same period, supported by increasing global demand for intelligent traffic management solutions, growing adoption of speed enforcement and driver awareness technologies in urban and highway environments, and rising government investment in road safety infrastructure across municipalities, transportation departments, and highway authorities driven by accident reduction objectives, smart city development initiatives, and evolving traffic calming strategies addressing pedestrian safety and community livability concerns.

The market's steady expansion trajectory reflects fundamental shifts in traffic management philosophies, with radar message signs offering critical advantages in real-time driver feedback, speed monitoring, and dynamic messaging capabilities that traditional static signage cannot provide. Modern radar speed signs combine doppler radar technology with programmable LED displays delivering immediate speed feedback to approaching drivers, proven effective in reducing average speeds by 10-20% in school zones, residential neighborhoods, and high-accident corridors.

The technology's versatility extends beyond pure speed display to include customizable messages, data collection capabilities, and solar power options enabling deployment in locations without electrical infrastructure. Municipal governments increasingly recognize radar signs as cost-effective traffic calming alternatives to expensive road reconstruction, while transportation agencies utilize them for temporary work zones, construction areas, and seasonal safety campaigns addressing specific behavioral concerns including speeding, distracted driving, and pedestrian awareness.

Regional market dynamics reveal accelerating adoption across both developed transportation networks and emerging infrastructure markets, with North America and Europe maintaining leadership through established road safety programs, comprehensive Vision Zero initiatives, and municipal traffic calming budgets supporting widespread deployment across school zones, residential streets, and pedestrian-focused areas. Asia Pacific demonstrates the strongest growth potential driven by rapid urbanization in China and India, expanding road networks requiring traffic management infrastructure, and growing government commitment to road safety addressing alarming traffic fatality statistics through engineering interventions including intelligent signage systems.

The competitive landscape intensifies as specialized traffic equipment manufacturers, traditional road sign companies expanding into electronic signage, and technology-focused startups compete through product innovation, data analytics capabilities, and integrated traffic management platforms. Technology development focuses on solar efficiency improvements enabling year-round operation in diverse climates, cellular connectivity supporting remote monitoring and data collection, and artificial intelligence integration analyzing traffic patterns, optimizing messaging strategies, and providing actionable insights to traffic engineers supporting evidence-based decision making and performance measurement across municipal transportation departments and highway safety programs.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 235.1 million |

| Market Forecast Value (2035) | USD 351.4 million |

| Forecast CAGR (2025-2035) | 4.1% |

| ROAD SAFETY & POLICY DRIVERS | TECHNOLOGY & EFFICIENCY FACTORS | URBAN PLANNING & INFRASTRUCTURE |

|---|---|---|

| Vision Zero Initiatives Accelerating adoption of Vision Zero and Safe System approaches globally committing governments to eliminating traffic fatalities through comprehensive engineering interventions including intelligent speed feedback and driver awareness technologies. School Zone Safety Growing emphasis on protecting vulnerable road users particularly children in school zones driving widespread deployment of radar speed signs providing real-time feedback to drivers approaching educational facilities. Traffic Fatality Reduction Persistent traffic accident rates and pedestrian fatalities creating urgency for cost-effective countermeasures with radar signs demonstrating proven effectiveness in behavioral modification and speed reduction. | Solar Technology Advancement Revolutionary improvements in solar panel efficiency and battery storage enabling reliable year-round operation in diverse climates eliminating electrical infrastructure requirements and reducing installation costs significantly. Data Collection Capabilities Modern radar signs equipped with traffic counting, speed distribution analysis, and trend reporting providing valuable data supporting traffic studies, enforcement planning, and infrastructure investment prioritization. Remote Management Features Cellular and wireless connectivity enabling remote message programming, real-time monitoring, and performance tracking supporting efficient fleet management across geographically distributed deployments. | Smart City Development Comprehensive smart city initiatives integrating intelligent transportation systems with radar message signs serving as data collection nodes and dynamic communication platforms supporting adaptive traffic management. Traffic Calming Programs Growing municipal emphasis on traffic calming in residential neighborhoods, pedestrian districts, and community-oriented street redesign projects utilizing radar signs as cost-effective speed management alternatives to physical infrastructure modifications. Complete Streets Policies Transportation planning evolution toward Complete Streets principles prioritizing pedestrian and cyclist safety requiring engineering measures including speed feedback systems supporting multimodal transportation and vulnerable road user protection. |

| Category | Segments Covered |

|---|---|

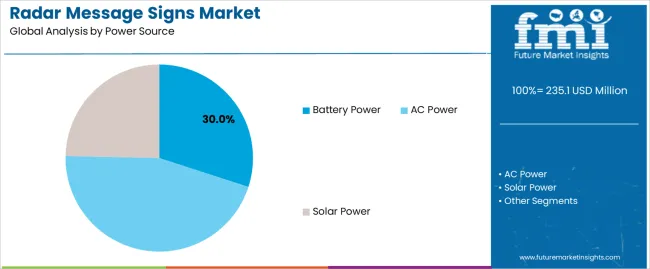

| By Power Source | Battery Power, AC Power, Solar Power |

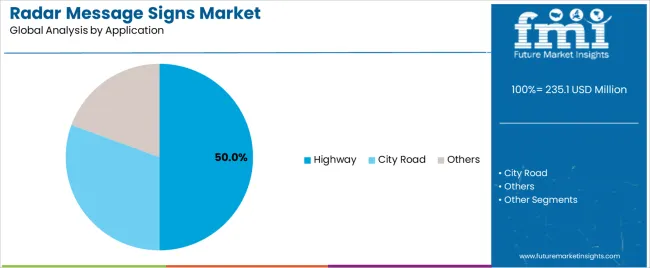

| By Application | Highway, City Road, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Solar Power | Dominant power source accounts 30% market share and representing modern standard for radar message signs combining installation flexibility, operational sustainability, and total cost advantages. Advanced solar panels with high-efficiency photovoltaic cells coupled with lithium battery storage delivering reliable 24/7 operation across diverse climatic conditions from tropical to temperate environments. Complete elimination of electrical infrastructure requirements enabling deployment in remote highway locations, rural roads, and temporary installations where AC power proves impractical or prohibitively expensive. Momentum: strong growth through 2035 driven by solar technology improvements, declining component costs, and universal preference among municipalities seeking sustainable infrastructure solutions. Market penetration accelerating in developing countries where electrical grid limitations favor off-grid power solutions. Innovation focus on extended battery life supporting multi-day operation during overcast periods, integrated theft deterrence systems protecting valuable solar components, and rapid deployment mounting systems enabling temporary installation flexibility. Watchouts: performance variability in extreme northern/southern latitudes with limited winter sunlight requiring larger solar arrays, initial capital cost premium over AC-powered alternatives despite superior lifecycle economics, battery replacement requirements after 5-7 years adding maintenance considerations. |

| AC Power | Traditional power source maintaining presence in urban environments with readily available electrical infrastructure and applications requiring continuous high-intensity display operation. Direct electrical connection eliminating concerns about battery depletion, solar panel shading, or weather-dependent performance supporting consistent operation in demanding high-visibility applications. Lower initial equipment costs compared to solar alternatives appealing to budget-constrained municipalities and short-term deployments where electrical access exists. Momentum: gradual decline as solar technology achieves performance parity and cost competitiveness across broader application spectrum. Residual demand concentrated in urban corridors with existing electrical infrastructure, permanent installations where trenching costs prove manageable, and high-traffic locations requiring maximum display brightness continuously. Geographic strength in developed urban areas with comprehensive electrical grid coverage. Watchouts: installation costs including trenching, electrical work, and permitting significantly increasing total project expenses, ongoing electricity costs adding operational expenses, limited deployment flexibility constraining temporary and mobile applications where AC power unavailable. |

| Battery Power | Portable power source serving temporary deployment applications including construction zones, special events, traffic studies, and seasonal installations requiring mobility and rapid deployment capabilities. Rechargeable battery systems supporting multi-day operation between charging cycles enabling flexible positioning and relocation without infrastructure dependencies. Lightweight, compact configurations facilitating manual handling and trailer-mounted mobility supporting dynamic traffic management and temporary speed enforcement initiatives. Momentum: moderate growth concentrated in temporary application segments and rental equipment markets. Innovation in battery technology extending operational duration and reducing weight supporting enhanced portability. Growing adoption by traffic management contractors and event organizers requiring flexible speed control solutions. Watchouts: limited operational duration requiring regular recharging or battery swaps constraining extended deployment applications, weight considerations for battery capacity versus portability tradeoffs, total cost of ownership challenges for permanent installations where solar alternatives prove more economical long-term. |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Highway | Dominant application segment with 50% market share representing critical safety infrastructure on high-speed roadways, interstate highways, and limited-access facilities where excessive speed contributes significantly to accident severity and fatality rates. Radar message signs deployed approaching dangerous curves, bridge structures, work zones, and high-accident corridors providing real-time speed feedback and safety messaging to drivers at highway speeds. High-visibility display requirements with large character heights, maximum brightness levels, and long detection ranges ensuring adequate driver reaction time at 55+ mph travel speeds. Momentum: strong growth driven by expanding highway networks in developing countries, aging infrastructure rehabilitation including safety improvements in developed markets, and work zone safety regulations requiring positive driver awareness measures. Innovation focus on variable speed limit integration, weather-responsive messaging systems, and queue detection capabilities warning approaching drivers of stopped traffic ahead. Department of Transportation procurement programs and federal highway safety funding supporting sustained deployment across national and state highway systems. Watchouts: harsh environmental exposure requiring ruggedized construction and enhanced durability, vandalism risks in remote locations necessitating theft deterrence features, regulatory requirements for highway-grade equipment including crash testing and MUTCD compliance adding certification complexity. |

| City Road | Significant application segment encompassing urban arterials, residential streets, school zones, and municipal roadways where speed management supports pedestrian safety, neighborhood livability, and traffic calming objectives. Diverse deployment contexts ranging from high-volume commercial corridors to quiet residential neighborhoods requiring flexible messaging, aesthetic design considerations, and community acceptance. Emphasis on data collection supporting traffic studies, enforcement planning, and performance measurement demonstrating program effectiveness to elected officials and community stakeholders. Momentum: strong growth driven by Vision Zero commitments, school zone safety initiatives, and pedestrian fatality reduction programs across municipalities globally. Smart city integration providing network connectivity and centralized management capabilities supporting efficient multi-site deployments. Community traffic calming programs empowering neighborhoods to request speed feedback interventions addressing resident concerns. Watchouts: aesthetic sensitivities in historic districts and residential areas requiring design considerations balancing visibility with neighborhood character, budget constraints in smaller municipalities limiting procurement quantities, political considerations as residents debate speed enforcement approaches and traffic calming priorities. |

| Others | Diverse application category encompassing parking facilities, private roadways, campus environments, industrial sites, and specialized contexts utilizing radar message signs for speed control and driver awareness. Institutional deployments including university campuses, hospital complexes, and corporate facilities managing internal traffic and protecting pedestrians in private road networks. Parking structure applications providing speed feedback and directional guidance supporting customer safety and facility management. Construction sites and temporary road closures utilizing portable radar signs for work zone protection and driver awareness. Momentum: selective growth in specific segments including campus safety programs, industrial facility management, and private community associations implementing traffic calming measures on private streets. Innovation opportunities in specialized messaging for unique contexts including parking availability displays, event traffic management, and facility-specific safety communications. Watchouts: fragmented market with diverse purchasing authorities and procurement processes, price sensitivity among private buyers without public safety funding sources, limited market size in individual specialty segments constraining manufacturer focus and product development investment. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Road Safety Funding Sustained government investment in road safety infrastructure through federal highway programs, state transportation budgets, and municipal capital improvement plans supporting radar sign procurement as proven countermeasure for speed-related accidents and pedestrian fatalities. Pedestrian Safety Crisis Growing concern about pedestrian fatality increases particularly in urban environments driving implementation of engineering countermeasures including speed feedback systems protecting vulnerable road users in crosswalks and residential areas. Enforcement Resource Constraints Limited law enforcement capacity for manual speed enforcement creating demand for automated speed feedback technologies providing continuous presence and behavioral modification without ongoing staffing requirements. | Budget Limitations Municipal budget constraints and competing infrastructure priorities limiting capital available for traffic calming equipment despite recognized safety benefits and cost-effectiveness compared to alternative interventions. Effectiveness Skepticism Concerns about driver habituation and reduced effectiveness over time as drivers become accustomed to radar signs potentially limiting their long-term behavioral impact without periodic relocation and message variation. Regulatory Complexity Varying standards across jurisdictions regarding sign specifications, placement requirements, and MUTCD compliance creating procurement complexity and limiting standardization opportunities for manufacturers and purchasers. | Cloud-Based Management Adoption of centralized cloud platforms enabling remote configuration, real-time monitoring, and comprehensive data analytics across distributed radar sign deployments supporting evidence-based traffic management and performance measurement. Artificial Intelligence Integration Implementation of machine learning algorithms analyzing traffic patterns, optimizing message display strategies, and predicting high-risk conditions supporting proactive safety interventions and resource allocation optimization. Multi-Function Platforms Evolution toward integrated traffic management devices combining radar speed detection with traffic counting, classification analysis, and environmental monitoring creating comprehensive data collection platforms beyond simple speed feedback. Community Engagement Tools Development of public-facing dashboards and community reporting features enabling residents to access traffic data, request sign deployments, and participate in neighborhood traffic calming initiatives supporting transparency and civic engagement. |

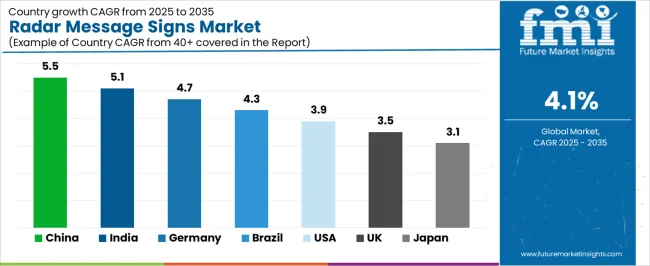

| Country | CAGR (2025-2035) |

|---|---|

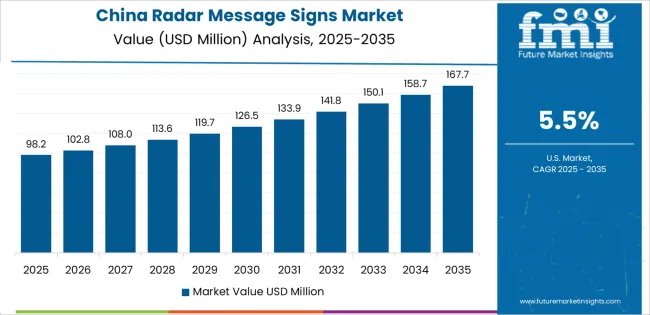

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| Brazil | 4.3% |

| United States | 3.9% |

| United Kingdom | 3.5% |

| Japan | 3.1% |

Revenue from Radar Message Signs in China is projected to exhibit strong growth with a market value of USD 84.6 million by 2035, driven by massive transportation infrastructure expansion including new highway construction, urban road network development, and comprehensive traffic management system implementation creating substantial opportunities for intelligent signage deployment across national expressways, provincial highways, and municipal arterials.

The country's rapid urbanization and motorization rates, combined with growing government emphasis on road safety addressing alarming traffic fatality statistics, are creating significant demand for proven traffic calming and speed management technologies. Municipal governments and provincial transportation departments are implementing comprehensive road safety programs requiring engineering interventions including radar message signs.

Highway network expansion connecting urban centers and facilitating economic development requires traffic management infrastructure including speed feedback systems, variable message signs, and intelligent transportation system components. Smart city initiatives across major metropolitan areas integrate radar signs as data collection nodes supporting traffic analytics and adaptive management strategies. Government procurement programs and transportation safety funding mechanisms facilitate equipment acquisition across diverse jurisdictional levels from national highways to county roads. Domestic manufacturers developing cost-competitive alternatives alongside international equipment suppliers create dynamic market serving various budget levels and specification requirements across vast geographic territory.

Revenue from Radar Message Signs in India is expanding to reach USD 72.8 million by 2035, supported by extensive road network development and comprehensive highway safety initiatives addressing India's position among countries with highest traffic fatality rates globally. The country's ambitious highway construction programs including Golden Quadrilateral completion, new expressway development, and rural road connectivity expansion create sustained demand for traffic management infrastructure including intelligent signage systems. Central and state government safety programs increasingly emphasize engineering countermeasures complementing traditional enforcement approaches. Growing urban populations and expanding metropolitan areas require municipal traffic management capabilities.

National Highway Authority of India (NHAI) specifications for highway safety infrastructure increasingly include radar message signs and intelligent transportation system components as standard safety elements in new construction and rehabilitation projects. Smart city mission initiatives across 100 cities integrate intelligent traffic management including speed feedback systems supporting urban mobility and safety objectives. State highway departments implementing safety audits and high-accident corridor improvements deploy radar signs as proven countermeasures. International funding from development banks and safety organizations supports procurement programs addressing road safety crisis through proven technological interventions.

Demand for Radar Message Signs in Germany is projected to reach USD 66.4 million by 2035, supported by the country's sophisticated traffic management capabilities and comprehensive approach to road safety through engineering, enforcement, and education integration. German municipalities maintain strong commitment to traffic calming in residential areas, school zone protection, and pedestrian-oriented urban design requiring speed management technologies. The market is characterized by high equipment specifications emphasizing durability, accuracy, and data quality supporting evidence-based traffic engineering decisions. Federal and state transportation agencies maintain comprehensive procurement frameworks and technical standards.

Vision Zero commitments across German cities drive systematic deployment of speed feedback systems supporting 30 km/h zones, school area protection, and pedestrian priority districts. Highway work zone safety regulations require positive traffic control measures including radar message signs warning approaching drivers and reducing speeds through construction areas. Municipal traffic departments utilize data collection capabilities for comprehensive traffic studies supporting infrastructure investment prioritization and safety program evaluation. Environmental considerations including solar power preference and sustainable procurement practices influence equipment selection and purchasing decisions across governmental agencies.

Revenue from Radar Message Signs in Brazil is growing to reach USD 60.6 million by 2035, driven by expanding urban traffic management capabilities and growing municipal emphasis on pedestrian safety in major metropolitan areas including São Paulo, Rio de Janeiro, and Brasília addressing high urban traffic fatality rates. The country's diverse road network spanning modern urban expressways to rural highways requires adaptable traffic management solutions. Federal highway programs and municipal transportation departments increasingly recognize radar message signs as cost-effective safety interventions. Growing middle-class motorization rates and expanding vehicle fleet create sustained traffic management challenges requiring technological solutions.

School zone safety initiatives and pedestrian protection programs drive municipal radar sign procurement supporting child safety and community livability objectives. Federal highway concession operators deploying intelligent transportation systems including variable message signs and traffic monitoring infrastructure create opportunities for radar technology integration. Traffic engineering profession maturation and growing emphasis on data-driven decision making support adoption of equipment providing comprehensive traffic analytics beyond simple speed feedback. Regional variation with advanced metropolitan areas leading adoption and smaller municipalities gradually implementing proven technologies as awareness and funding availability increase.

Revenue from Radar Message Signs in United States is projected to reach USD 55.2 million by 2035, driven by established municipal traffic calming programs and comprehensive highway safety initiatives across federal, state, and local transportation agencies. The country's extensive road network and decentralized transportation management create diverse procurement patterns across thousands of municipalities, county highway departments, and state DOTs. Vision Zero commitments in major cities including New York, San Francisco, and Seattle drive systematic speed management programs incorporating radar feedback systems. Federal highway safety programs including Highway Safety Improvement Program (HSIP) provide funding supporting radar sign procurement as eligible countermeasure for speed-related crashes.

School zone safety remains primary driver with municipalities deploying radar signs approaching educational facilities supporting child pedestrian protection and community engagement around traffic safety concerns. Work zone safety regulations and contractor best practices increasingly include radar message signs as standard traffic control devices protecting workers and motorists in construction areas. Residential neighborhood traffic calming programs respond to community concerns about speeding and cut-through traffic utilizing radar signs as visible interventions demonstrating municipal responsiveness. Technology adoption including cloud-based management platforms and data analytics capabilities support evidence-based traffic engineering and performance measurement meeting professional standards and accountability expectations.

Demand for Radar Message Signs in United Kingdom is projected to reach USD 50.4 million by 2035, expanding at a CAGR of 3.5%, driven by comprehensive community speed management programs and local authority traffic calming initiatives addressing resident concerns about speeding in residential areas and village centers. The country's emphasis on 20 mph zones in urban areas and traffic calming in rural villages creates sustained demand for speed feedback technologies supporting behavioral change and community safety objectives. Local highway authorities balance competing demands for road capacity and safety requiring cost-effective interventions. Parish councils and community associations increasingly engage in traffic management advocacy creating grassroots demand for radar sign deployment.

Department for Transport funding programs and local transport capital budgets support radar message sign procurement as approved traffic calming measure with documented effectiveness. School crossing patrol modernization and child pedestrian safety initiatives incorporate radar signs complementing traditional crossing guard programs. Rural road safety programs addressing high-speed approaches to villages utilize radar feedback providing advance warning and speed reduction supporting transition from national speed limit to lower village limits. Community engagement emphasis creates opportunities for visible traffic safety interventions demonstrating authority responsiveness to resident concerns about speeding and road danger.

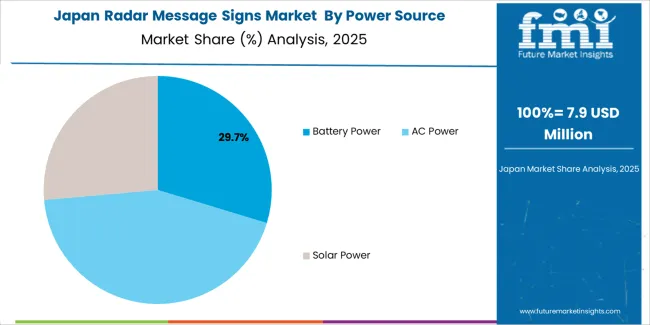

Demand for Radar Message Signs in Japan is projected to reach USD 46.2 million by 2035, supported by the country's sophisticated traffic management infrastructure and emphasis on technological integration in transportation systems. Japanese municipalities maintain comprehensive approach to traffic safety through engineering precision, advanced technology deployment, and systematic data collection supporting evidence-based planning. The market demonstrates preference for high-reliability equipment with proven durability and accurate performance meeting stringent technical specifications. School zone safety and elderly pedestrian protection receive particular emphasis reflecting demographic concerns and vulnerable road user priorities.

Urban traffic management systems in major cities integrate radar message signs as network components providing real-time data supporting centralized traffic operations centers and adaptive signal control systems. Highway work zone safety standards require comprehensive traffic control including speed feedback approaching construction areas. Compact urban environments and narrow roadways create unique deployment challenges requiring space-efficient equipment configurations and mounting solutions. Technology companies and traditional road equipment manufacturers collaborate developing integrated solutions combining radar detection with variable messaging, traffic counting, and communication capabilities serving comprehensive intelligent transportation system requirements.

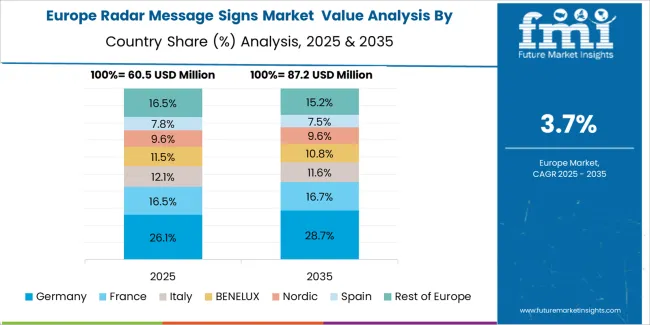

The radar message signs market in Europe is projected to grow from USD 72.8 million in 2025 to USD 108.4 million by 2035, registering a CAGR of 4.0% over the forecast period. Germany is expected to maintain its leadership position with a 33.4% market share in 2025, projected to reach 34.6% by 2035, supported by its comprehensive traffic calming programs, extensive municipal networks, and strong commitment to Vision Zero initiatives across federal, state, and local transportation agencies.

The United Kingdom follows with a 26.8% share in 2025, expected to reach 27.4% by 2035, driven by community speed management programs, 20 mph zone expansion, and rural village traffic calming initiatives addressing resident safety concerns. France holds a 18.6% share in 2025, projected to reach 19.2% by 2035, supported by national road safety programs, school zone protection emphasis, and municipal traffic calming budgets. Netherlands commands a 11.4% share, while Sweden accounts for 7.2% in 2025. The Rest of Europe region is anticipated to expand to 2.6% share by 2035, attributed to increasing traffic safety investments in Eastern European countries, Nordic traffic calming initiatives, and Southern European urban mobility programs implementing speed management infrastructure.

Japanese radar message signs operations reflect the country's emphasis on technological precision, equipment reliability, and comprehensive data integration supporting advanced traffic management systems. Major equipment manufacturers and distributors maintain rigorous quality control processes, extensive product testing protocols, and comprehensive service networks ensuring consistent performance. This creates substantial specification requirements but ensures exceptional reliability supporting critical traffic safety and management objectives across Japanese transportation networks.

The Japanese market demonstrates unique requirements including compact equipment configurations optimized for space-constrained urban environments, integration capabilities with centralized traffic management systems, and comprehensive data outputs supporting detailed traffic analysis and planning applications. Equipment manufacturers develop Japan-specific product variants addressing local requirements including language displays, metric speed units, and communication protocol compatibility with Japanese intelligent transportation system standards.

Regulatory oversight through national standards and municipal procurement specifications establishes comprehensive performance requirements, installation guidelines, and safety certifications ensuring equipment quality and operational reliability. Transportation agencies emphasize long-term equipment lifecycle, maintenance support availability, and manufacturer stability ensuring sustained service support throughout extended equipment deployment periods. Procurement decisions balance performance specifications, total cost of ownership, and proven reliability from established suppliers with comprehensive track records serving Japanese market requirements.

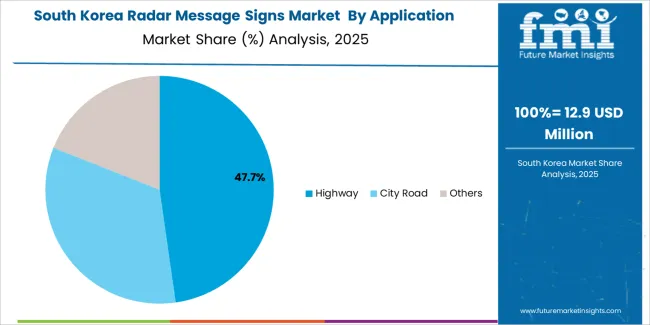

South Korean radar message signs operations reflect the country's advanced transportation infrastructure and growing emphasis on intelligent traffic management supporting urban mobility and safety objectives. Major metropolitan governments and highway authorities invest in comprehensive traffic monitoring and management systems incorporating radar message signs as network components. Government smart city initiatives and transportation technology development programs create favorable environment for advanced traffic equipment adoption. National highway safety programs addressing Korea's traffic fatality rates drive engineering countermeasure implementation including speed feedback systems.

The Korean market demonstrates growing sophistication in traffic management technology with agencies evaluating comprehensive system capabilities, data analytics platforms, and integration with existing transportation management centers. School zone safety receives particular emphasis with enhanced regulations and funding programs supporting speed management infrastructure protecting child pedestrians. Highway work zone safety standards increasingly require positive traffic control measures including radar message signs and variable speed limit systems. Domestic manufacturers and international equipment suppliers compete through technology innovation, cost competitiveness, and comprehensive service support addressing diverse agency requirements.

Regulatory frameworks establish technical standards for traffic control devices, communication protocols, and data security requirements ensuring equipment compatibility and cybersecurity protection. Agency procurement emphasizes value analysis balancing acquisition costs against performance capabilities, operational reliability, and lifecycle considerations. Supplier relationships involve comprehensive training programs, maintenance support networks, and technology updates supporting equipment optimization and agency capacity building for effective traffic management technology deployment.

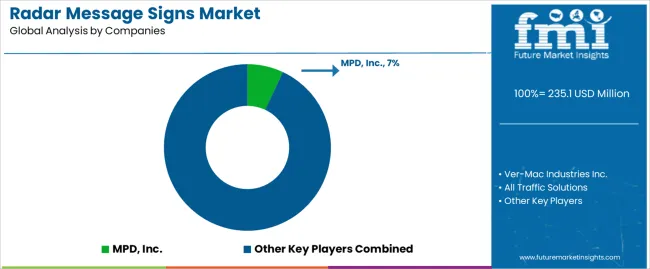

The radar message signs market exhibits moderate fragmentation with specialized traffic equipment manufacturers including MPD, Ver-Mac, All Traffic Solutions, and Traffic Logix maintaining significant presence through comprehensive product portfolios, established distribution networks, and proven track records serving municipal and transportation agency customers globally. Profit pools concentrate in premium segments where advanced features including cloud connectivity, comprehensive data analytics, and ruggedized construction enable differentiation and support price premiums over basic speed display functions, while service contracts, data subscription services, and rental equipment provide recurring revenue streams beyond initial equipment sales.

Several competitive archetypes shape market dynamics: specialized traffic equipment manufacturers focusing exclusively on intelligent signage and traffic calming devices with deep application expertise and customer relationships across municipal and DOT customers; diversified road equipment companies offering radar signs as part of broader traffic control and work zone safety portfolios leveraging existing distribution channels and customer relationships; solar technology specialists emphasizing renewable power expertise and off-grid capabilities appealing to sustainability-focused agencies; and technology-focused startups developing next-generation platforms incorporating artificial intelligence, predictive analytics, and smart city integration capabilities targeting forward-looking agencies seeking comprehensive traffic management ecosystems. Market success requires balancing product innovation with proven reliability addressing risk-averse public sector procurement, establishing distribution and service networks supporting geographically distributed customer bases, and building agency relationships through responsive technical support, training programs, and demonstrated performance supporting customer accountability and program justification.

Switching costs remain moderate as agencies standardize on specific platforms for fleet management efficiency and operational familiarity, while procurement regulations requiring competitive bidding and budget constraints create price sensitivity limiting pure brand loyalty. Equipment reliability, service responsiveness, and data platform capabilities create stickiness as agencies value consistent performance supporting critical safety objectives and avoiding operational disruptions from equipment failures. Competitive dynamics favor manufacturers demonstrating comprehensive product testing, proven durability in harsh environmental conditions, and responsive warranty support addressing public sector accountability requirements and risk management concerns.

Innovation focus centers on solar efficiency improvements and battery storage advancement enabling reliable year-round operation in extreme climates expanding addressable market across northern regions and diverse weather conditions, cellular connectivity and cloud platforms providing remote management, real-time monitoring, and comprehensive analytics supporting efficient multi-site deployments and evidence-based decision making, and artificial intelligence integration analyzing traffic patterns, optimizing messaging strategies, and providing predictive insights supporting proactive traffic management and safety intervention planning.

Integration capabilities with existing traffic management systems, GIS mapping platforms, and asset management databases create value propositions beyond standalone equipment supporting comprehensive municipal technology ecosystems. Service model evolution toward equipment-as-a-service, rental programs, and comprehensive maintenance contracts addresses budget constraints and risk preferences among smaller municipalities while creating recurring revenue opportunities supporting long-term customer relationships and market share retention.

| Items | Values |

|---|---|

| Quantitative Units | USD 235.1 million |

| Power Source | Battery Power, AC Power, Solar Power |

| Application | Highway, City Road, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, United Kingdom, France, Brazil, China, India, Japan, South Korea, and other 40+ countries |

| Key Companies Profiled | MPD Inc., Ver-Mac Industries Inc., All Traffic Solutions, Traffic Logix Corporation, TAPCO, Photonplay Systems Inc., KELIA, Radarsign LLC, Stalker Radar (Applied Concepts Inc.), Carmanah Technologies Corporation (Synapse ITS) |

| Additional Attributes | Dollar sales by power source/application, regional demand (NA, EU, APAC), competitive landscape, solar vs. AC/battery adoption trends, highway vs. city road deployment patterns, and technology innovation driving cloud connectivity, data analytics, and smart city integration supporting traffic safety and management objectives |

By Power Source

The global radar message signs market is estimated to be valued at USD 235.1 million in 2025.

The market size for the radar message signs market is projected to reach USD 351.4 million by 2035.

The radar message signs market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in radar message signs market are battery power, ac power and solar power.

In terms of application, highway segment to command 50.0% share in the radar message signs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radar Security Market Size and Share Forecast Outlook 2025 to 2035

Radar Absorbing Materials Market Size and Share Forecast Outlook 2025 to 2035

Radar & LiDAR Technology for Railways - Trends & Forecast 2025 to 2035

Radar Level Transmitter Market Analysis - Growth & Forecast 2025 to 2035

Radar Market Analysis by Platform, Application, Type, and Region through 2035

60GHz Radar Evaluation Kit Market Size and Share Forecast Outlook 2025 to 2035

X-Band Radar Market Size and Share Forecast Outlook 2025 to 2035

mmWave Radar Module Market Size and Share Forecast Outlook 2025 to 2035

Marine Radar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar On Chip Technology Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Market Growth - Trends & Forecast 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA