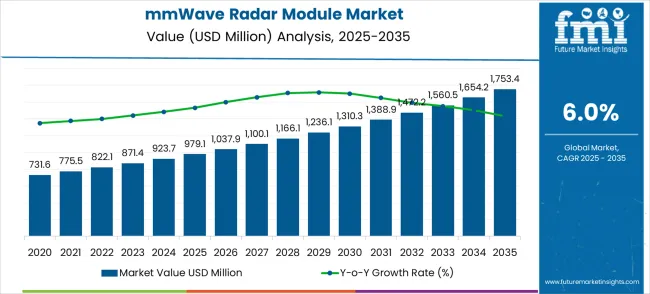

The mmWave radar module market is projected to grow steadily from USD 979.1 million in 2025 to USD 1,753.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 6%. This steady expansion is driven by increasing demand for radar modules in a wide range of applications, including automotive, telecommunications, and industrial sectors. The automotive industry, in particular, is pushing forward the adoption of mmWave radar modules for advanced driver assistance systems (ADAS) and autonomous vehicles. As safety standards in the automotive sector become stricter, the demand for mmWave radar technology is likely to rise. These modules offer high-resolution sensing capabilities, which are crucial for detecting obstacles, pedestrians, and other vehicles, making them integral to the development of next-generation driving technologies.

In the telecommunications sector, mmWave radar modules are gaining prominence due to their role in the rollout of 5G networks. As 5G infrastructure requires high-frequency bands for faster communication, the market for mmWave radar technology is poised for further growth. Similarly, their application in industrial automation and robotics is expanding, with mmWave radar modules being used for precise object detection and inventory management. The continued advancement of these technologies will drive steady market growth, as industries increasingly look for high-performance, cost-effective solutions. Overall, the mmWave radar module market is positioned for sustained growth due to the expanding application base and increasing adoption of radar technologies in emerging industries.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 979.1 million |

| Forecast Value in (2035F) | USD 1,753.4 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The mmWave radar module market holds a notable position within the broader radar systems and sensor industries, driven by growing demand for advanced detection and communication technologies. In the radar systems market, this segment contributes approximately 7.4%, as mmWave modules are key in applications like weather monitoring, automotive safety, and military surveillance. The automotive sensor market accounts for 12.1%, with mmWave radar modules playing a crucial role in autonomous vehicle systems and advanced driver-assistance systems (ADAS). Within the wireless communication equipment market, the share stands at 8.5%, due to their integration in 5G infrastructure and high-speed communication networks. The consumer electronics market contributes 5.9%, as mmWave radar is increasingly used for gesture recognition and smart home devices. In the aerospace and defense systems market, this segment holds a 10.3% share, with radar modules being essential for navigation and tactical defense systems. Collectively, these parent markets represent around 44.2%, reflecting the expanding role of mmWave radar modules in a variety of critical and high-tech applications. Their versatility in enhancing connectivity, safety, and surveillance technologies makes them indispensable in the evolving technological landscape.

The mmWave radar module market is entering a phase of practical deployment and product diversification. As automotive OEMs push advanced driver assistance and autonomous features, industrial manufacturers adopt contactless sensing for robotics and safety, and IoT players demand low-power, robust proximity sensing, mmWave modules are shifting from component experiments to volume platforms. Improvements in antenna/beamforming design, AI-based signal processing, and semiconductor integration are lowering system cost while expanding functionality (gesture, vital-sign, occupancy, traffic monitoring). Pathways that capture premium frequency segments, software + services, and regionally scaled manufacturing will capture the largest incremental pools - while adjacent verticals (defense, medical, smart buildings) provide attractive specialty margins. Below are the prioritized opportunity pathways and headline revenue pools (indicative) by 2035.

Pathway A - Automotive ADAS & Autonomous Safety (24-81 GHz integration). Automotive remains the largest scalable volume opportunity as OEMs add L2+ features and autonomous sensing redundancy. Modules certified for automotive temperature/rate profiles and multi-target tracking will command long-term contracts. Expected revenue pool: USD 200-300 million.

Pathway B - Industrial Automation & Smart Manufacturing. Robotics, intralogistics, and predictive maintenance require robust, weather-tolerant sensing. 24 GHz and 60 GHz solutions focused on dust/occlusion resilience and edge analytics will penetrate factories and logistics centers. Expected revenue pool: USD 150-250 million.

Pathway C - Premium High-Frequency Modules (77-81 GHz, 120 GHz) for high-resolution sensing. Higher frequencies enable finer resolution for lidar-like use cases (precise ranging, object classification). Vendors who commercialize compact, low-noise RF front-ends and high-performance antennas can charge a premium. Expected revenue pool: USD 100-180 million.

Pathway D - Consumer & IoT Sensing (home automation, gesture, occupancy). Ultra-low-power modules for smart home devices, wearables, and retail analytics expand the market beyond traditional industrial and automotive buyers. Cost+power optimization will drive uptake. Expected revenue pool: USD 80-140 million.

Pathway E - AI-Enabled Signal Processing & Software Services. Selling modules bundled with ML models, classification stacks, cloud/edge analytics, and calibration tools converts hardware into recurring-revenue solutions - attractive to systems integrators and large enterprises. Expected revenue pool: USD 60-120 million.

Pathway F - Geographic Expansion & Localized Manufacturing (APAC, LATAM). Local assembly, regional certifications, and tailored sales channels in China, India, and Latin America accelerate volume adoption and lower TCO for regional systems integrators. This pathway also captures government and infrastructure projects. Expected revenue pool: USD 90-160 million.

Pathway G - Specialty & Defense / Medical Niche Applications. Marine navigation, UAV sense-and-avoid, vital-sign monitoring, and security/defense sensing require customized modules with higher margins and lower price elasticity - an attractive route for diversified vendors. Expected revenue pool: USD 30-70 million.

Why is the mmWave Radar Module Market Growing?

Market expansion is being supported by the increasing global demand for autonomous vehicles and the corresponding need for high-precision sensing technologies that can deliver accurate object detection and range measurement while maintaining performance across various environmental conditions. Modern automotive manufacturers are increasingly focused on implementing safety systems that can reduce accident rates, enable advanced driver assistance features, and provide reliable sensing capabilities for autonomous driving applications. mmWave radar modules' proven ability to deliver superior detection performance, weather-independent operation, and versatile sensing applications make them essential components for contemporary automotive safety and industrial automation solutions.

The growing emphasis on industrial automation and smart manufacturing is driving demand for mmWave radar modules that can support robotics applications, enable predictive maintenance systems, and provide precise motion detection capabilities. Industrial processors' preference for sensing technologies that combine high accuracy with operational reliability and cost-effectiveness is creating opportunities for innovative mmWave radar implementations. The rising influence of IoT connectivity and edge computing trends is also contributing to increased adoption of radar modules that can provide intelligent sensing solutions without complex infrastructure requirements.

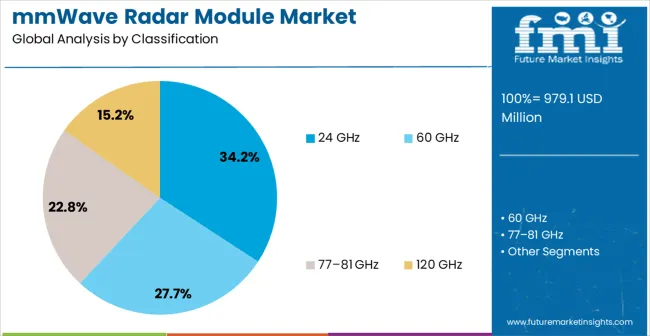

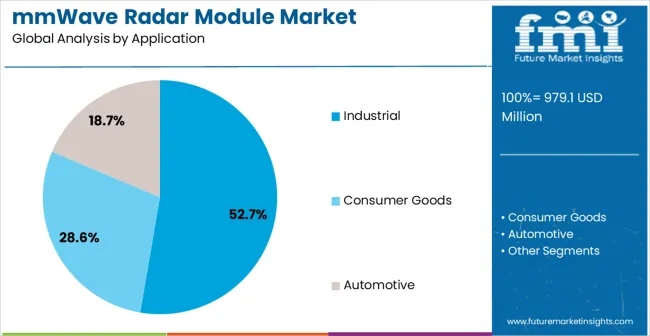

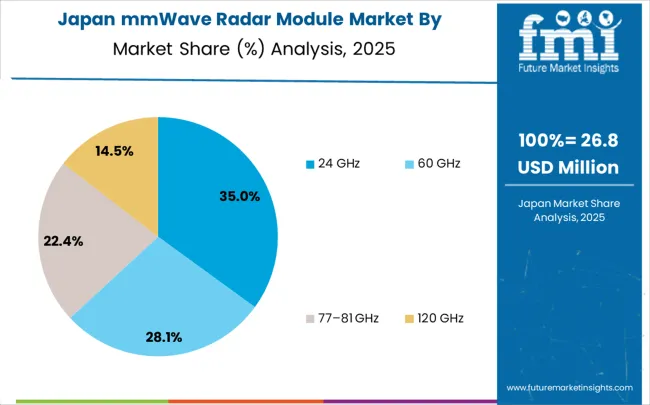

The market is segmented by frequency type, application, and region. By frequency type, the market is divided into 24 GHz, 60 GHz, 77–81 GHz, and 120 GHz. Based on application, the market is categorized into industrial, consumer goods, and automotive. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The 24 GHz segment is projected to account for 34.2% of the mmWave radar module market in 2025, reaffirming its position as the leading frequency category. Industrial manufacturers increasingly utilize 24 GHz radar modules for their superior penetration capabilities, reliable performance in harsh environments, and cost-effectiveness in motion detection applications across security systems, traffic monitoring, and industrial automation. 24 GHz radar technology's established processing capabilities and consistent detection accuracy directly address the industrial requirements for reliable sensing performance and operational efficiency in large-scale deployment scenarios.

This frequency segment forms the foundation of modern industrial sensing operations, as it represents the technology with the greatest versatility and established market demand across multiple application categories and environmental conditions. Processor investments in enhanced signal processing algorithms and antenna design continue to strengthen adoption among industrial manufacturers. With companies prioritizing consistent detection performance and cost-effective implementation, 24 GHz radar modules align with both operational efficiency objectives and budget constraints, making them the central component of comprehensive industrial sensing strategies.

Industrial applications are projected to represent 52.7% of mmWave radar module demand in 2025, underscoring their critical role as the primary commercial consumers of radar sensing technologies for manufacturing automation, security systems, and process monitoring applications. Industrial companies prefer mmWave radar modules for their reliability, precise detection capabilities, and ability to enhance operational safety while reducing maintenance complexity and installation costs. Positioned as essential components for modern industrial automation, radar modules offer both performance advantages and operational benefits.

The segment is supported by continuous innovation in industrial IoT development and the growing availability of specialized radar processing technologies that enable advanced sensing applications with enhanced environmental adaptability. Additionally, industrial manufacturers are investing in predictive maintenance systems to support large-scale sensor deployment and data analytics capabilities. As smart manufacturing demand becomes more prevalent and automation requirements increase, industrial applications will continue to dominate the end-user market while supporting advanced sensing utilization and operational optimization strategies.

The mmWave radar module market is advancing rapidly due to increasing demand for autonomous vehicle technologies and growing adoption of advanced sensing systems that provide superior detection accuracy and environmental resilience across diverse industrial and automotive applications. However, the market faces challenges, including high development costs for advanced frequency modules, regulatory compliance across different regions, and the need for specialized signal processing expertise. Innovation in antenna design technologies and AI-enhanced processing algorithms continues to influence product development and market expansion patterns.

The growing adoption of advanced driver assistance systems and autonomous driving technologies is enabling automotive manufacturers to integrate premium mmWave radar modules with superior range resolution, enhanced object classification, and multi-target tracking capabilities. Advanced radar systems provide improved safety performance while allowing more efficient vehicle operation and consistent detection across various weather conditions and driving scenarios. Manufacturers are increasingly recognizing the competitive advantages of advanced radar capabilities for vehicle differentiation and safety rating improvements.

Modern mmWave radar module producers are incorporating artificial intelligence algorithms and machine learning capabilities to enhance target recognition, reduce false alarms, and enable adaptive sensing performance across various environmental conditions and application scenarios. These technologies improve detection accuracy while enabling new applications, including gesture recognition, vital sign monitoring, and predictive maintenance capabilities. Advanced processing integration also allows manufacturers to support premium product positioning and expanded application versatility beyond traditional sensing requirements.

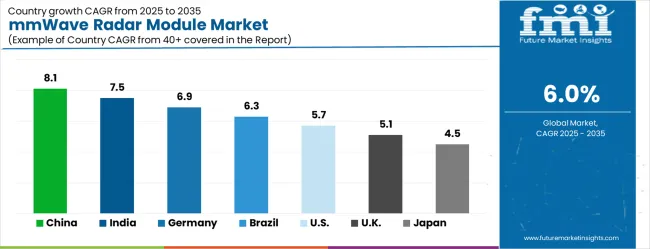

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| Brazil | 6.3% |

| USA | 5.7% |

| UK | 5.1% |

| Japan | 4.5% |

The mmWave radar module market is experiencing strong growth globally, with China leading at an 8.1% CAGR through 2035, driven by the expanding automotive industry, growing investment in autonomous vehicle development, and significant expansion of manufacturing automation infrastructure. India follows at 7.5%, supported by rapid industrialization, increasing automotive production, and growing adoption of smart manufacturing technologies. Germany shows growth at 6.9%, emphasizing automotive innovation and premium sensor technology development. Brazil records 6.3%, focusing on industrial automation expansion and automotive sector modernization. The USA demonstrates 5.7% growth, prioritizing advanced driver assistance systems and defense applications. The UK exhibits 5.1% growth, emphasizing automotive technology development and industrial IoT adoption. Japan shows 4.5% growth, supported by precision manufacturing and advanced automotive component development.

The mmWave radar module market in China is expanding at a CAGR of 8.1%, fueled by rapid growth in the automotive, industrial automation, and defense sectors. China’s booming automotive market, with increasing investments in autonomous driving technologies and smart vehicles, is a key driver of demand for mmWave radar modules. The country’s industrial expansion, particularly in robotics and automation, also contributes to market growth. Additionally, China’s government push for technological advancements in defense and security systems further boosts the adoption of radar technologies across various sectors.

The mmWave radar module market in India is projected to grow at a CAGR of 7.5%, supported by the expanding automotive and industrial sectors. India’s increasing demand for advanced automotive technologies, such as collision avoidance, autonomous driving, and smart mobility, is driving the need for mmWave radar modules. Additionally, the rise in automation in manufacturing and heavy industries further accelerates the demand for radar modules to enhance precision and efficiency. India’s growing focus on defense modernization also creates further demand for radar solutions in security applications.

The mmWave radar module market in Germany is growing at a CAGR of 6.9%, driven by the strong automotive and industrial automation sectors. Germany’s leadership in automotive manufacturing, particularly in electric vehicles (EVs) and autonomous driving technologies, is a primary driver for mmWave radar modules in the country. Additionally, Germany’s focus on Industry 4.0, robotics, and advanced manufacturing technologies continues to fuel the demand for radar modules to improve operational efficiency. The country’s emphasis on innovation and sustainability in both industrial and defense sectors further accelerates market growth.

The mmWave radar module market in Brazil is projected to grow at a CAGR of 6.3%, supported by the expansion of automotive and industrial sectors. Brazil’s rising automotive production and growing demand for advanced safety features in vehicles fuel the adoption of mmWave radar modules. The country’s increasing emphasis on industrial automation and smart manufacturing further supports the market. As Brazil invests in defense and security technologies, the demand for radar solutions to improve surveillance and monitoring also grows, providing additional momentum to the market.

The mmWave radar module market in the United States is growing at a CAGR of 5.7%, driven by the rising demand for autonomous driving technologies, smart vehicles, and industrial automation. The USA automotive industry’s increasing focus on safety features such as collision avoidance, adaptive cruise control, and autonomous driving systems drives the demand for radar solutions. Moreover, investments in advanced manufacturing technologies and the growing use of robotics in industries such as logistics and material handling continue to support market growth.

The mmWave radar module market in the United Kingdom is growing at a CAGR of 5.1%, driven by rising demand for radar systems in automotive safety, industrial automation, and defense applications. The UK automotive industry’s focus on enhancing safety features and developing autonomous driving technologies continues to propel the adoption of mmWave radar modules. Furthermore, the country’s push towards Industry 4.0 and smart manufacturing solutions in sectors like logistics, aerospace, and defense supports the growth of radar technologies across multiple industries.

The mmWave radar module market in Japan is expanding at a CAGR of 4.5%, with key demand coming from the automotive, robotics, and defense sectors. Japan’s advancements in autonomous driving and smart mobility technologies continue to drive the need for mmWave radar solutions. The country’s strong focus on robotics and automation in manufacturing further supports the demand for precision radar systems in industrial processes. Additionally, Japan’s defense sector investments contribute to the steady growth of radar modules for surveillance and monitoring applications.

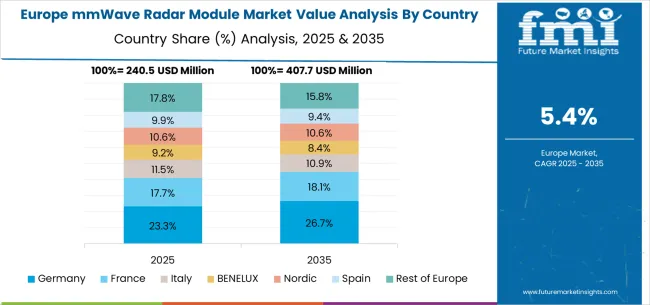

The mmWave radar module market in Europe is projected to grow from USD 195.8 million in 2025 to USD 350.7 million by 2035, registering a CAGR of 6.0% over the forecast period. Germany is expected to maintain its leadership position with a 28.0% market share in 2025, moderating slightly to 27.5% by 2035, supported by its strong automotive industry, advanced radar technology development, and comprehensive automotive component supply network serving major European markets.

The United Kingdom follows with a 22.0% share in 2025, projected to reach 22.3% by 2035, driven by robust demand for automotive safety systems, IoT sensor development, and advanced driver assistance system integration, combined with established technology companies developing radar applications. France holds an 18.0% share in 2025, expected to increase to 18.2% by 2035, supported by strong automotive manufacturing and growing emphasis on autonomous vehicle development, but facing competitive pressures from German and Nordic technology suppliers. Italy commands a 14.0% share in 2025, projected to reach 14.1% by 2035, while Spain accounts for 8.0% in 2025, expected to reach 8.2% by 2035. The Netherlands maintains a 4.0% share in 2025, growing to 4.1% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to lose momentum from 6.0% to 5.6% by 2035, attributed to increasing adoption of industrial automation in Nordic countries and growing automotive technology development across Eastern European markets, implementing modernization programs.

The mmWave radar module market is characterized by competition among established semiconductor companies, specialized radar technology providers, and integrated automotive component manufacturers. Companies are investing in advanced signal processing research, antenna design optimization, AI algorithm development, and comprehensive product portfolios to deliver consistent, high-performance, and cost-effective radar sensing solutions. Innovation in frequency domain processing, beamforming techniques, and miniaturization technologies is central to strengthening market position and competitive advantage.

Acconeer leads the market with a strong market share, offering comprehensive ultra-low power radar solutions with a focus on IoT applications and consumer electronics integration. Chengdu Song Yuan Technology Co., Ltd provides specialized automotive radar capabilities with an emphasis on Chinese market requirements and cost-effective solutions. ALLTEK MARINE ELECTRONICS CORP delivers innovative marine radar systems with a focus on navigation and collision avoidance applications. Nisshinbo Micro Devices Inc. specializes in semiconductor-based radar components for automotive and industrial markets. Murata focuses on advanced antenna technology and integrated radar modules for consumer and automotive applications. Vayyar Imaging offers specialized imaging radar solutions with an emphasis on healthcare and automotive cabin sensing.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 979.1 Million |

| Frequency Type | 24 GHz, 60 GHz, 77–81 GHz, 120 GHz |

| Application | Industrial, Consumer Goods, Automotive |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Acconeer, Chengdu Song Yuan Technology Co., Ltd, ALLTEK MARINE ELECTRONICS CORP, Nisshinbo Micro Devices Inc., Murata, and Vayyar Imaging |

| Additional Attributes | Dollar sales by frequency type and application category, regional demand trends, competitive landscape, technological advancements in radar processing, antenna design innovation, AI integration, and supply chain optimization |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global mmWave radar module market is estimated to be valued at USD 979.1 million in 2025.

The market size for the mmWave radar module market is projected to reach USD 1,753.4 million by 2035.

The mmWave radar module market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in mmWave radar module market are 24 ghz, 60 ghz, 77–81 ghz and 120 ghz.

In terms of application, industrial segment to command 52.7% share in the mmWave radar module market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radar Message Signs Market Size and Share Forecast Outlook 2025 to 2035

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Radar Detectors Market Size and Share Forecast Outlook 2025 to 2035

Radar Security Market Size and Share Forecast Outlook 2025 to 2035

Radar Absorbing Materials Market Size and Share Forecast Outlook 2025 to 2035

Radar Simulators Market Size and Share Forecast Outlook 2025 to 2035

Radar & LiDAR Technology for Railways - Trends & Forecast 2025 to 2035

Radar Level Transmitter Market Analysis - Growth & Forecast 2025 to 2035

Radar Market Analysis by Platform, Application, Type, and Region through 2035

60GHz Radar Evaluation Kit Market Size and Share Forecast Outlook 2025 to 2035

X-Band Radar Market Size and Share Forecast Outlook 2025 to 2035

Marine Radar Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Radar Test System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Military Radar Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar On Chip Technology Market Size and Share Forecast Outlook 2025 to 2035

Automotive Radar Market Growth - Trends & Forecast 2025 to 2035

Off Highway Radar Sensors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA