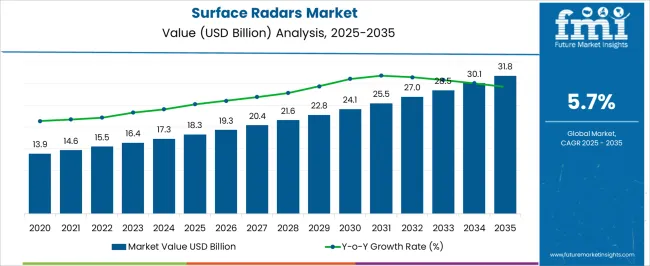

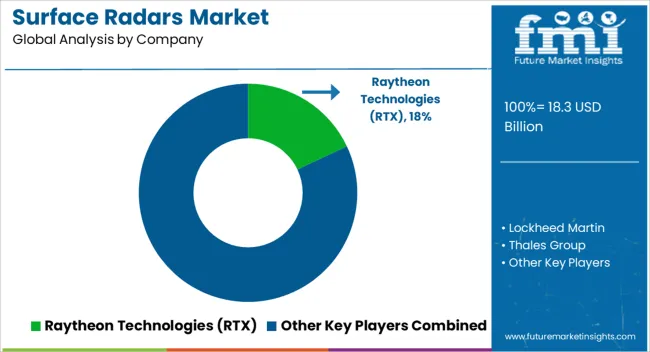

The surface radars market is estimated to be valued at USD 18.3 billion in 2025 and is projected to reach USD 31.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

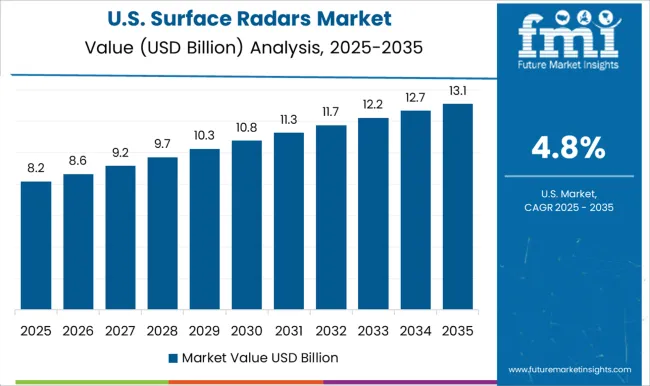

From 2020 to 2025, the market grew from USD 13.9 billion to USD 18.3 billion, reflecting rising procurement of ground-based and coastal surveillance radars for border protection, maritime safety, and airspace monitoring. This period marked the replacement of older analog systems with digital solid-state radars, which improved detection range, resilience against jamming, and overall system reliability. Between 2026 and 2030, the market is expected to expand from USD 19.3 billion to USD 24.1 billion, supported by growing adoption of multifunction surface radars capable of simultaneously managing surveillance, tracking, and fire-control tasks. This transition reshapes competitive dynamics, with suppliers of legacy single-purpose radars gradually losing share to integrators offering advanced, software-defined systems optimized for modular upgrades.

Geopolitical tensions in Asia-Pacific and Europe drive share gains for firms providing mobile, network-centric radars that can be rapidly deployed in conflict-sensitive regions. From 2031 to 2035, the market strengthens further, rising from USD 25.5 billion to USD 31.8 billion, as radar networks become increasingly linked with unmanned aerial vehicles (UAVs) and space-based assets, enabling integrated, multi-domain situational awareness. Companies leveraging artificial intelligence for predictive threat detection, automated data fusion, and electronic counter-countermeasures secure notable competitive advantage, while players tied to older mechanical scanning technologies face declining relevance

| Metric | Value |

|---|---|

| Surface Radars Market Estimated Value in (2025 E) | USD 18.3 billion |

| Surface Radars Market Forecast Value in (2035 F) | USD 31.8 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The surface radars market holds a vital yet diversified role within the defense and surveillance ecosystem, with distinct shares across application domains and industrial categories. Within the global military radar industry, surface radars contribute approximately 24–26%, supported by their extensive use in coastal surveillance, battlefield monitoring, and air defense systems. In the broader defense electronics sector, their share is estimated around 14–16%, as avionics and communication systems remain larger revenue contributors. Within the naval radar category, surface radars account for nearly 30–32%, reflecting their critical integration in warships and patrol vessels for target detection and tracking.

In the homeland security and border control segment, surface radars contribute about 10–12%, driven by their use in perimeter monitoring and smuggling prevention. Within the air defense radar segment, surface radars maintain a 15–17% share, reinforcing their role in providing situational awareness for land-based missile defense systems. Their relevance is further strengthened in commercial sectors, where port monitoring and airfield surveillance rely on advanced radar solutions, contributing a smaller yet consistent 5–6% share. Growth prospects are influenced by procurement budgets, regional security threats, and integration of advanced detection technologies. With modernization programs expanding across Asia, Europe, and North America, the position of surface radars as a central component in global defense and surveillance infrastructure continues to be reinforced.

The market is experiencing consistent growth, supported by increasing demand for advanced surveillance, navigation, and security solutions across defense, maritime, and commercial applications. Advancements in radar signal processing, miniaturization of components, and improved power efficiency are enhancing operational capabilities, enabling these systems to detect and track targets with higher precision.

The integration of digital technologies, including artificial intelligence and machine learning, is further improving the adaptability and accuracy of radar systems in dynamic operational environments. Growing geopolitical tensions and the need for robust border and coastal security are driving sustained investments from governments and defense organizations.

Additionally, modernization programs in both developed and emerging economies are creating new opportunities for deployment The ability of surface radars to operate effectively under challenging environmental conditions and deliver real-time situational awareness positions them as critical assets in modern defense strategies, ensuring strong long-term demand and continued innovation within the market.

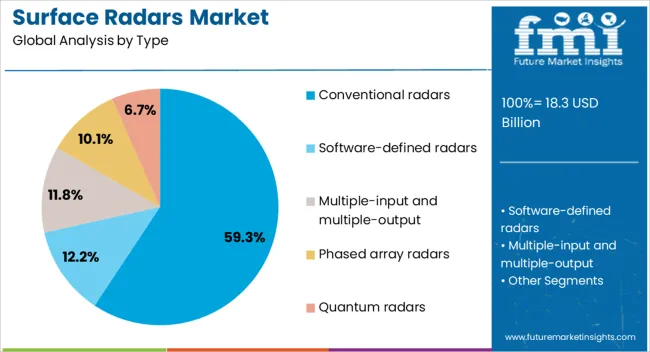

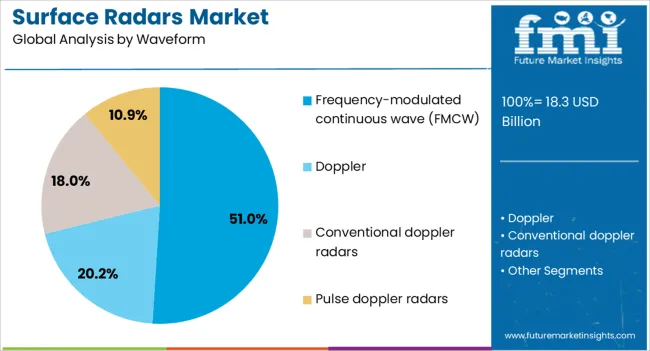

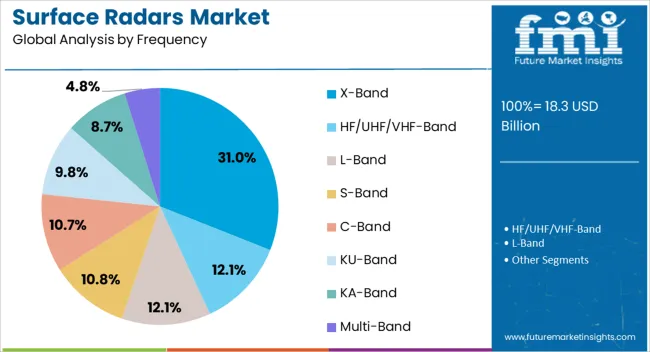

The surface radars market is segmented by type, waveform, frequency, dimension, range, platform, application, and geographic regions. By type, surface radars market is divided into conventional radars, software-defined radars, multiple-input and multiple-output, phased array radars, and quantum radars. In terms of waveform, surface radars market is classified into frequency-modulated continuous wave (FMCW), doppler, conventional doppler radars, and pulse doppler radars. Based on frequency, surface radars market is segmented into X-Band, HF/UHF/VHF-Band, L-Band, S-Band, C-Band, KU-Band, KA-Band, and multi-Band. By dimension, surface radars market is segmented into 3D, 2D, and 4D. By range, surface radars market is segmented into medium, short, and long. By platform, surface radars market is segmented into shipborne, critical infrastructure, airports, seaports, military bases & command centres, vehicle-mounted, and unmanned surface vehicles. By application, surface radars market is segmented into surveillance, air defense, perimeter security, battlefield ISR, and others. Regionally, the surface radars industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional radars segment is projected to account for 59.30% of the surface radars market revenue share in 2025, making it the dominant type category. This leadership position has been supported by the long-standing reliability, cost-effectiveness, and proven performance of conventional radar systems across various applications. These radars have been widely adopted in military, coastal, and airspace monitoring programs due to their robustness and ability to operate in diverse weather and environmental conditions. The segment has benefited from gradual enhancements in signal processing, enabling better target detection and tracking while maintaining operational simplicity. Additionally, their compatibility with existing infrastructure and ease of integration into established networks have reinforced their continued preference. Governments and defense organizations have maintained significant investment in conventional radar systems as they offer a balance between performance and affordability The segment’s strong position is further supported by ongoing upgrades and retrofitting programs that extend service life and enhance operational efficiency.

The frequency modulated continuous wave (FMCW) waveform segment is expected to hold 51% of the market revenue share in 2025, positioning it as the leading waveform type. This dominance has been influenced by the capability of FMCW radars to provide high-resolution data and accurate target detection over varying ranges. The technology’s ability to operate with low power consumption while minimizing signal interference has made it highly suitable for both defense and civilian applications. FMCW radars are particularly valued for their enhanced performance in cluttered environments, where precise object discrimination is essential. The segment’s growth has also been supported by increasing adoption in coastal surveillance, navigation systems, and airspace monitoring, where reliability and precision are critical. Additionally, the continuous advancements in signal processing algorithms have enabled improved detection capabilities, even in challenging operational conditions The adaptability of FMCW radars to both stationary and mobile platforms has further strengthened their leading market position.

The X Band frequency segment is projected to capture 31% of the market revenue share in 2025, making it the leading frequency band. This segment’s growth has been supported by its optimal balance between range resolution and target detection capabilities, enabling effective monitoring in both short- and medium-range operations. The X Band’s ability to deliver high-frequency signals with superior image clarity has made it highly suitable for maritime navigation, coastal defense, and weather monitoring applications. Its relatively compact antenna size allows for easier integration into a wide range of platforms, including ships, land-based stations, and mobile units. The demand for X Band systems has also been driven by their strong performance in adverse weather conditions, ensuring uninterrupted operational readiness Continuous improvements in radar signal processing and the integration of advanced tracking algorithms have further reinforced the value proposition of X Band frequencies, sustaining their leadership in the overall Surface Radars market.

Surface radars are central to defense, border, and civilian monitoring applications, driven by rising security demands. Despite cost and integration hurdles, their importance across global defense and infrastructure sectors continues to expand.

Surface radars have experienced significant adoption due to their growing integration in military surveillance and homeland security programs. Nations across Asia, Europe, and North America are expanding their radar procurement budgets to improve border monitoring and maritime defense. Rising security threats and the need for advanced situational awareness are pushing investments toward radar systems with greater range and detection accuracy. Coastal surveillance and battlefield monitoring represent core applications, where governments prioritize modern radars over outdated platforms. This shift is supported by partnerships between radar manufacturers and defense ministries, enhancing system customization. The continuous requirement for real-time threat detection ensures surface radars remain a priority in military modernization strategies worldwide.

Civilian adoption of surface radars has grown as airports, ports, and industrial facilities integrate these systems for monitoring and safety applications. Airfield surveillance systems rely on surface radars to track aircraft and vehicles during low visibility, reducing operational risks. Ports utilize radar technology for vessel tracking, collision avoidance, and coastal monitoring, ensuring smoother operations. Industrial complexes deploy surface radars to manage perimeter security and prevent intrusions, highlighting their role beyond defense. The growing need for integrated monitoring solutions presents opportunities for manufacturers to serve both military and civilian markets. By offering radars tailored to non-defense sectors, companies can diversify revenues and reduce reliance on defense procurement cycles.

The surface radar industry is shaped by established defense contractors and specialized radar system developers who compete on performance, customization, and compliance with military standards. Leading players focus on long-range detection, multi-target tracking, and integration with command-and-control networks. Competitive positioning is strengthened through partnerships with armed forces, joint ventures, and acquisition of radar technology startups. Manufacturers with global supply networks and advanced engineering expertise maintain advantages in meeting complex defense requirements. Differentiation is further supported by enhanced radar resilience against countermeasures, which increases system credibility in sensitive environments. This competitive environment creates a mix of large multinational firms and niche technology specialists, ensuring diverse solutions within the global radar market.

Surface radars face challenges tied to high procurement costs, lengthy installation processes, and the need for specialized operators. Developing nations often struggle to allocate sufficient budgets for large-scale radar deployment, limiting adoption beyond select defense programs. Integration with legacy defense infrastructure presents another difficulty, as new radars often require significant system upgrades. Furthermore, supply chain disruptions and restricted access to critical components can slow production cycles. The increasing sophistication of electronic warfare tactics also challenges radar reliability, requiring continuous updates to maintain performance. While surface radars maintain strategic importance, these challenges restrict faster adoption, particularly in budget-sensitive markets.

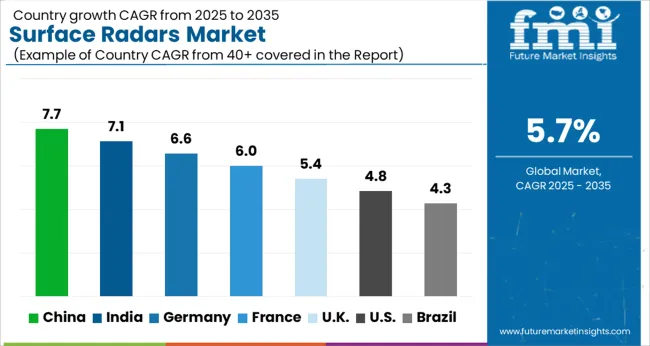

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

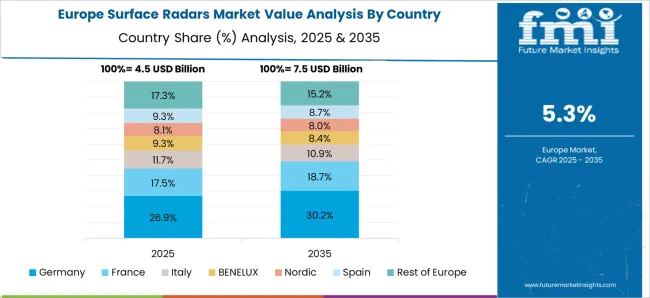

The surface radars market is projected to grow globally at a CAGR of 5.7% from 2025 to 2035, supported by expanding defense modernization programs and broader adoption in coastal surveillance and homeland security. China leads with a CAGR of 7.7%, backed by heavy investments in naval defense and large-scale procurement for border security applications. India follows at 7.1%, where military upgrades and the expansion of aerospace and defense projects contribute significantly to radar deployment. Germany posts 6.6%, aided by advanced engineering, NATO-related defense initiatives, and integration into industrial monitoring. France records a 6.0% CAGR, supported by aerospace defense projects and strong demand in naval surveillance. The United Kingdom grows at 5.4%, with adoption guided by maritime security requirements and airport monitoring solutions. The United States records 4.8%, reflecting steady demand driven by defense procurement but slower compared to Asian markets. Together, these growth patterns underline the rising importance of surface radars in addressing evolving security needs worldwide.

The CAGR for the surface radars market in the United Kingdom was measured at 4.6% during 2020–2024 and is projected at 5.4% for 2025–2035, staying slightly below the global average of 5.7%. The earlier period grew at a measured pace as upgrades focused on selective coastal sites and integration constraints limited fleetwide deployment. Growth improves in the next phase as maritime domain awareness projects, airport ground-movement monitoring, and NATO interoperability programs prioritize networked surface radars. Procurement quality is expected to be favored over unit volume, with emphasis on long-range detection, clutter rejection, and all-weather reliability. Civil aviation surveillance and critical-infrastructure perimeters add incremental demand, supporting a durable yet disciplined expansion path for the UK.

China’s surface radars market posted 6.5% CAGR during 2020–2024 and is anticipated at 7.7% for 2025–2035, marking a firm step-up. The first phase was supported by steady naval procurement, coastal tracking networks, and integration within port authorities. The next phase intensifies as blue-water naval ambitions require layered surveillance, multi-target tracking, and wider littoral coverage. Expanded shipbuilding, coastal guard modernization, and port congestion management create a broad base of end users. System localization and vertically integrated component supply are expected to compress lead times and stabilize pricing. With capacity scaled at both military and civilian nodes, China is positioned to remain the primary volume engine for surface radar deployments.

The United States posted 4.1% CAGR during 2020–2024 and is projected at 4.8% for 2025–2035, indicating a measured uplift. Early growth tracked selective recapitalization of coastal sites and targeted homeland security deployments, with budgets channelled to competing priorities. The next leg is supported by modernization of legacy systems, integration with multi-sensor command networks, and resilience against electronic countermeasures. Airport ground-surveillance programs and port-security grants contribute steady civilian orders. Emphasis is expected on capability over count, favoring long service life, software upgrades, and higher availability metrics. While pace remains behind Asia, the United States maintains a stable, capability-driven demand profile.

India recorded a 6.2% CAGR during 2020–2024 and is forecast at 7.1% for 2025–2035, indicating a clear acceleration. Earlier gains came from coastal security build-outs after multi-agency audits emphasized gaps in low-altitude coverage. The later period benefits from multi-year capital allocations, Make-in-India sourcing, and layered surveillance across island territories and energy corridors. Airport expansions across tier-2 locations introduce new surface movement needs, while naval acquisitions extend radar fits across patrol vessels and auxiliaries. Lifecycle support frameworks and local MRO capacity are set to improve uptime and reduce total ownership cost. This combination positions India for sustained share gain within Asia’s radar ecosystem.

France achieved 5.1% CAGR during 2020–2024 and is estimated at 6.0% for 2025–2035, showing steady improvement. Initial growth was carried by naval refits, coastal monitoring around critical straits, and selective airport upgrades. The next period advances as defense programs emphasize integrated air and surface pictures and improved cueing for interception assets. Export-oriented radar manufacturing and joint programs within Europe create predictable order pipelines, while homeland applications in critical-site perimeter security add recurring demand. Focus on performance under heavy sea clutter and harsh weather strengthens the technical bar for procurements, which favors premium systems. Overall momentum points to a firm, high-quality expansion curve.

The surface radars market is dominated by a blend of global defense contractors and specialized radar system developers, each leveraging technology, scale, and integration expertise. Raytheon Technologies (RTX) remains a leader, offering advanced surface radars with strong adoption in naval and coastal defense programs worldwide. Lockheed Martin emphasizes multi-domain radar systems with proven capabilities in long-range detection and battlefield monitoring. Thales Group holds a strong European presence, supplying radar solutions for naval vessels and air defense networks. Saab AB contributes with modular radar platforms that cater to both land and sea-based applications. Northrop Grumman plays a pivotal role in supplying highly advanced radar systems integrated with command-and-control solutions, reinforcing its position in USA defense contracts.

Leonardo strengthens its share through European and Middle Eastern defense collaborations, with radars tailored for both homeland and military security. HENSOLDT is a significant European radar manufacturer with innovative detection technologies designed for complex electronic warfare environments. BAE Systems expands its radar footprint through naval and land-based systems that emphasize resilience and interoperability. Competitive differentiation in this market is shaped by system range, integration capability, electronic countermeasure resistance, and alignment with defense modernization programs. Global contractors dominate procurement-heavy regions, while European players focus on innovation and regional defense collaborations.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.3 billion |

| Type | Conventional radars, Software-defined radars, Multiple-input and multiple-output, Phased array radars, and Quantum radars |

| Waveform | Frequency-modulated continuous wave (FMCW), Doppler, Conventional doppler radars, and Pulse doppler radars |

| Frequency | X-Band, HF/UHF/VHF-Band, L-Band, S-Band, C-Band, KU-Band, KA-Band, and Multi-Band |

| Dimension | 3D, 2D, and 4D |

| Range | Medium, Short, and Long |

| Platform | Shipborne, Critical infrastructure, Airports, Seaports, Military bases & command centres, Vehicle-mounted, and Unmanned surface vehicles |

| Application | Surveillance, Air defense, Perimeter security, Battlefield ISR, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Raytheon Technologies (RTX), Lockheed Martin, Thales Group, Saab AB, Northrop Grumman, Leonardo, HENSOLDT, BAE Systems, and Others |

| Additional Attributes | Dollar sales, share, defense procurement trends, regional demand outlook, technology integration needs, competitor positioning, pricing benchmarks, supply chain gaps, and future growth opportunities. |

The global surface radars market is estimated to be valued at USD 18.3 billion in 2025.

The market size for the surface radars market is projected to reach USD 31.8 billion by 2035.

The surface radars market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in surface radars market are conventional radars, software-defined radars, and others.

In terms of waveform, frequency-modulated continuous wave (fmcw) segment to command 51.0% share in the surface radars market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Trends, Growth, and Share Analysis from 2025 to 2035

Surface Disinfectant Chemicals Market Growth & Demand 2025 to 2035

Surface Disinfectant Market is segmented by product type, form and end user from 2025 to 2035

Surface Disinfectant Products Market Growth - Trends and Forecast 2025 to 2035

Competitive Overview of Surface Printed Film Companies

Surface Water Sports Equipment Market Growth – Size, Trends & Forecast 2024-2034

Surface Plasmon Resonance System Market Analysis – Growth & Forecast 2024-2034

Surface Protection Services Market Growth – Trends & Forecast 2024-2034

Surface Measurement Equipment And Tools Market

Surface Drilling Rigs Market

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Hard Surface Flooring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA