The surface protection service market is witnessing strong demand, driven by increasing industrialization, asset preservation requirements, and the need for corrosion-resistant coatings in harsh environments. Growth in the oil and gas, marine, and chemical processing sectors has accelerated adoption of specialized protection services for critical infrastructure.

Technological advancements in coating formulations and application processes have enhanced performance and durability. Companies are investing in preventive maintenance programs to reduce operational downtime and extend equipment lifespan.

Additionally, stringent regulatory standards related to environmental protection and workplace safety have encouraged industries to adopt advanced surface treatment solutions. As global infrastructure and industrial output continue to expand, the market is poised for sustained growth across multiple sectors.

| Metric | Value |

|---|---|

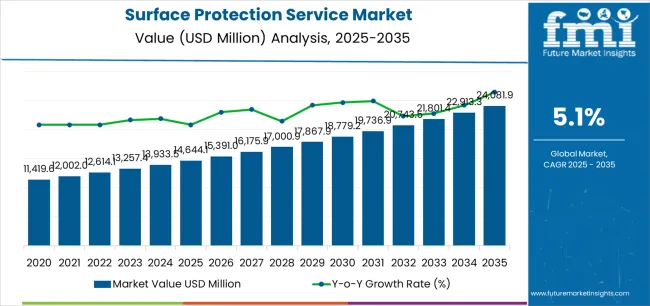

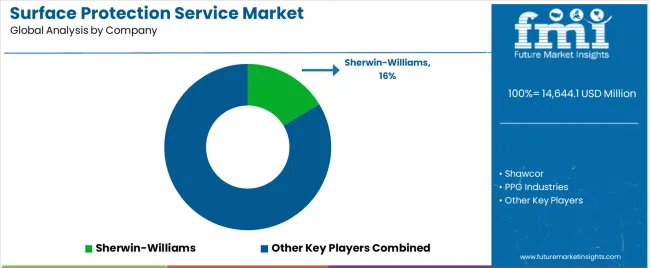

| Surface Protection Service Market Estimated Value in (2025 E) | USD 14644.1 million |

| Surface Protection Service Market Forecast Value in (2035 F) | USD 24081.9 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

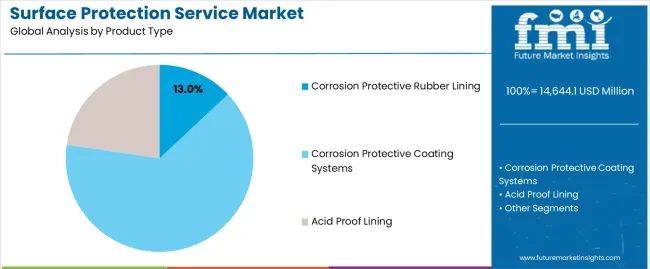

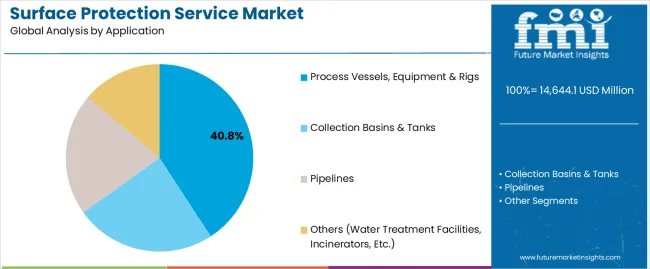

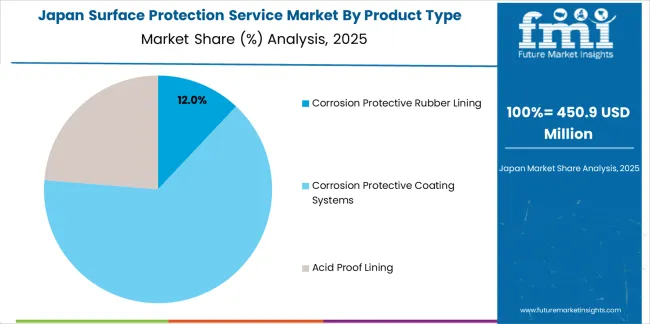

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Corrosion Protective Rubber Lining, Corrosion Protective Coating Systems, and Acid Proof Lining. In terms of Application, the market is classified into Process Vessels, Equipment & Rigs, Collection Basins & Tanks, Pipelines, and Others (Water Treatment Facilities, Incinerators, Etc.).

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The corrosion protective rubber lining segment dominates the product type category, driven by its ability to provide superior chemical resistance and mechanical protection in corrosive environments. This segment’s growth is linked to extensive use in storage tanks, reactors, pipelines, and other process equipment exposed to aggressive chemicals.

Rubber linings enhance durability and minimize maintenance requirements, offering long-term cost savings to operators. Advances in vulcanization and adhesive bonding techniques have improved lining longevity and adhesion properties.

With industries focusing on reliability and environmental compliance, demand for rubber-based corrosion protection continues to strengthen. The segment’s established performance record and broad industrial acceptance ensure its leading market position.

The process vessels, equipment, and rigs segment holds approximately 40.8% share in the application category, reflecting its extensive use in oil refining, chemical processing, and marine operations. Corrosion protection in these systems is critical to maintaining operational efficiency and preventing contamination.

The segment benefits from increasing investment in upstream and downstream oil and gas projects, as well as in chemical manufacturing facilities. Surface protection services are being adopted to extend the service life of expensive assets operating under extreme pressure and temperature conditions.

With continued expansion of global industrial capacity and heightened focus on preventive maintenance, this segment is expected to sustain strong growth through the forecast period.

| Historical CAGR | 4.70% |

|---|---|

| Forecast CAGR | 5.10% |

The historical performance of the surface protection service market indicates a CAGR of 4.70%, reflecting steady growth over the past years. However, the forecasted CAGR of 5.10% suggests a slight increase in growth rate moving forward.

Looking ahead, several factors may influence the forecasted CAGR of 5.10%.

Rising Adoption in the Automotive Sector

The automotive industry's focus on vehicle aesthetics, durability, and longevity is propelling the demand for surface protection services, including paint protection films and ceramic coatings, to safeguard automotive surfaces from scratches, UV damage, and contaminants.

Increasing Application in Industrial Manufacturing

Surface protection services are witnessing higher adoption in industrial manufacturing sectors, including aerospace, marine, and machinery, to extend the lifespan of equipment, prevent corrosion, and enhance operational efficiency.

Demand from Electronic Devices

With the proliferation of electronic devices, there is a growing need for surface protection services to safeguard delicate components from moisture, dust, and other contaminants, ensuring optimal performance and longevity.

Focus on Anti-Graffiti Solutions

Urban areas and public infrastructure are increasingly targeted by graffiti vandalism. As a result, there is a rising demand for anti-graffiti surface protection services that facilitate easy removal of graffiti without damaging the underlying surface.

Shift towards Sustainable Packaging

The packaging industry is moving towards sustainable materials and practices. Surface protection services are crucial in extending the shelf life of eco-friendly packaging materials, such as paper-based products, by providing barrier coatings that protect against moisture, oxygen, and UV radiation.

This section provides detailed insights into specific segments in the surface protection service industry.

| Top Product Type | Corrosion Protective Coating Systems |

|---|---|

| Market Share in 2025 | 64.30% |

Corrosion protective coating systems emerge as the dominant category, capturing a significant market share of 64.30% in 2025.

| Dominating Application Segment | Process Vessels, Equipment & Rigs |

|---|---|

| Market Share in 2025 | 40.80% |

Process vessels, equipment & rigs emerge as the dominant application segment, commanding a substantial market share of 40.80% in 2025.

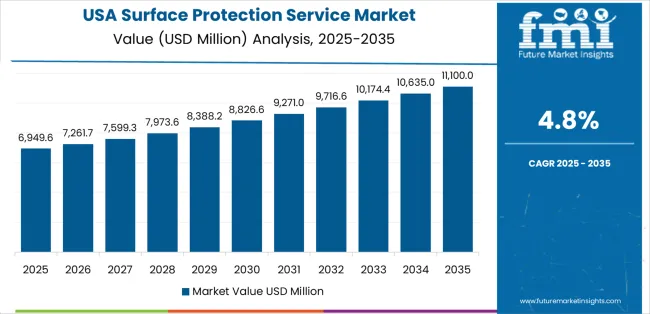

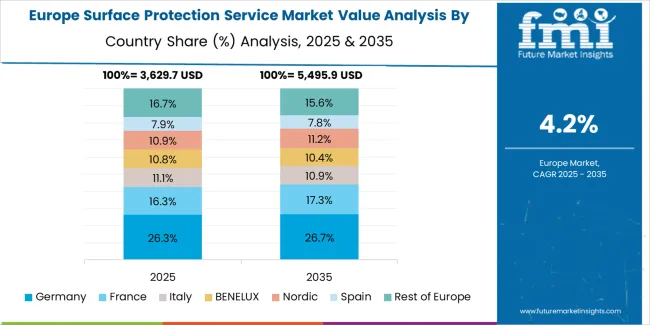

The section analyzes the surface protection service market across key countries, including the United States, United Kingdom, China, Japan, and Germany. The analysis delves into the specific factors driving the demand for surface protection services in these countries.

| Countries | CAGR |

|---|---|

| United States | 30.4% |

| United Kingdom | 10.7% |

| China | 25.7% |

| Japan | 12.4% |

| Germany | 15.3% |

The surface protection service industry in the United States is anticipated to rise at a CAGR of 30.4% through 2035.

The surface protection service industry in the United Kingdom is projected to rise at a CAGR of 10.7% through 2035.

China’s surface protection service industry is likely to witness expansion at a CAGR of 25.7% through 2035.

Japan's surface protection service industry is projected to rise at a CAGR of 12.4% through 2035.

Germany's surface protection service market is expected to rise at a 15.3% CAGR through 2035.

Companies are relentlessly innovating, formulating next-generation coatings boasting superior performance, enhanced durability, and eco-friendliness. Nanotechnology, self-healing properties, and specialized functionalities are paving the way for transformative solutions.

Environmental consciousness is driving a shift towards sustainable practices. Companies are prioritizing the development of eco-friendly formulations, minimizing waste generation, and exploring circular economy solutions to reduce their environmental footprint and cater to environmentally responsible clients.

Industry leaders are consolidating their strengths through strategic mergers and acquisitions, expanding their service portfolios and geographical reach. Recognizing the power of collaboration, companies are forging strategic partnerships with research institutions, startups, and even competitors to tackle complex projects and develop groundbreaking solutions.

Companies are strategically focusing on specialized niches, offering unique solutions for specific applications like concrete protection, high-temperature environments, or temporary protection during construction. This trend fosters innovation and caters to diverse client needs. Recognizing the importance of local nuances, regional players are adapting to specific regulations and challenges, offering culturally relevant solutions, and building strong relationships with local clients to enhance their competitive edge.

Recent Developments in the Surface Protection Service Industry:

The global surface protection service market is estimated to be valued at USD 14,644.1 million in 2025.

The market size for the surface protection service market is projected to reach USD 24,081.9 million by 2035.

The surface protection service market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in surface protection service market are corrosion protective rubber lining, corrosion protective coating systems, acid proof lining, ceramic & brick lining, tile lining and thermoplastic lining.

In terms of application, process vessels, equipment & rigs segment to command 40.8% share in the surface protection service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surface Water Sports Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Disinfectant Chemicals Market Growth & Demand 2025 to 2035

Surface Disinfectant Market is segmented by product type, form and end user from 2025 to 2035

Surface Disinfectant Products Market Growth - Trends and Forecast 2025 to 2035

Competitive Overview of Surface Printed Film Companies

Surface Plasmon Resonance System Market Analysis – Growth & Forecast 2024-2034

Surface Measurement Equipment And Tools Market

Surface Drilling Rigs Market

Surface Protection Film Market Forecast and Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Hard Surface Flooring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA