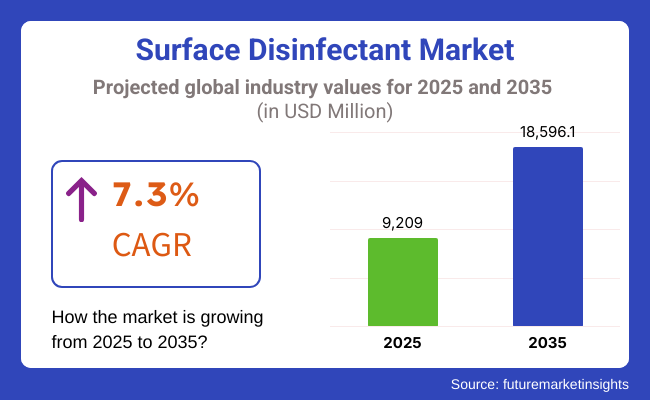

The global market for surface disinfectant is forecasted to attain USD 9,209.0 million by 2025, expanding at 7.3% CAGR to reach USD 18,596.1 million by 2035. In 2024, the revenue of this market was around USD 8,626.8 million.

Surface disinfectants are projected to achieve large growth from expanding awareness for hygiene and infection prevention. There has been rising demand for high-quality disinfectants applied within health care systems as HAIs increase. Infection prevention, rigorously stressed by the CDC and WHO, has further increased pressure on the market to extend further.

The rise in interest in maintaining public spaces, business properties, and residences as clean as possible has also accelerated the application of surface disinfectants.

COVID-19 increased health concerns about transmission of pathogens and precipitated unprecedented and long-lasting growth in disinfectant demand. Companies and establishments have already embraced rigorous sanitization protocols that will continue long after the pandemic ends.

On top of that, technological advancement of disinfection solutions, i.e., nontoxic, noncorrosive, environmentally friendly solutions, are becoming the industry trend in parallel with stronger environmental regulations demanding higher sustainability in technologies. Escalating concerns around antimicrobial resistance are similarly spurring innovatively designed and powerful broad-spectrum disinfectants from producers.

Going forward, the market is expected to witness higher application of automated disinfection technologies, such as UV-based and electrostatic sprayers. More robust healthcare infrastructure in developing countries will provide further impetus to demand. With innovations and a continuous focus on infection control, the market for surface disinfectants is poised for steady growth in the coming years.

The demand for surface disinfectants has risen with a rise in infection control and hygiene levels. Initially, alcohol, chlorine-based compounds, and quaternary ammonium compounds were applied by healthcare settings to deter infections. When hospital-acquired infections (HAIs) rose, the regulations became tougher, and more effective disinfectants were applied by healthcare providers.

As time went by, industries including food processing, hospitality, and public transportation had adopted surface disinfection into their processes. Pathogen transmission issues heightened the demand further in both commercial and household applications. Industry players adapted through increased production levels and creation of new formulations, some of them being eco-friendly.

Currently, companies and institutions still put emphasis on surface disinfection as one of the infection prevention practices. The industry still has stable growth with firms innovating and evolving with respect to new laws and changing consumer demands.

The North American market for surface disinfectants keeps increasing due to the exorbitant healthcare spending in the region, strict infection control regulations, and an increased emphasis on public sanitation.

The USA market is dominated because of the accessibility of rigorous rules by the FDA, EPA, and CDC, which enforce thorough disinfection policies in public institutions, food facilities, and medical centers. The rising hospital-acquired infection rate is stimulating the use of superior disinfection systems like antimicrobial coatings and UV-based systems in hospitals and clinics.

But control of the toxicity of certain disinfectant chemicals, particularly the quaternary ammonium compounds, is proving to be difficult for producers. Customer pressure for non-toxic, environmentally friendly, and hypoallergenic disinfectants is also driving companies to produce safer products, such as botanically-derived and probiotic disinfectant products.

Higher investments in smarter sanitizing products, such as hands-free disinfectant dispensers and artificial intelligence-based hygiene sensors, are also shaping the industry's development.

European surface disinfectant market is subject to the robust regulatory environment of the region and growing focus on sustainability. Germany, France, and the UK lead top demand for disinfectants because of their interest in healthcare safety, public hygiene, and infection control in food and beverages.

While the robust approval procedures under the European Chemicals Agency (ECHA) and the Biocidal Products Regulation (BPR) present huge hurdles for market entry.

Firms are addressing this by making biodegradable, plant-based disinfectants that comply with the EU's stringent environmental guidelines. The industry also witnesses increased demand for long-lasting antimicrobial coatings that ensure reduced repeated disinfection requirements.

In addition to this, usage of electrostatic sprayers, UV-C disinfection machines, and AI-facilitated compliance hygiene tools is also gaining momentum, primarily in hospitals and public transport facilities. Cross-seeding between academic institutions and private companies is further driving innovation with safer, toxin-free disinfectant formulation.

The fastest-growing market in the world for surface disinfectants, Asia-Pacific, has seen a slew of changes due to increasing concerns for hygiene, health care spending, and sanitation projects sponsored by the government. Rapid urbanization and population concentration, coupled with increased incidence of infectious diseases in countries like China, India, and Japan, drive demand for disinfectants.

Economic disparity in regulation, price affordability, and access to fake disinfectant products are severe impediments to market growth. Such entry of local manufacturers selling their low-priced yet quality disinfectants is intensifying competition in the region. Additionally, the commercialization of robotic and automated disinfectant solutions in the health and industrial sectors will spur innovation.

Alcohol-based disinfectants maintain high demand, especially from the pandemic preparedness perspective. However, there is a growing trend in the consumer population with regard to natural, herb-based formulations, and hence companies are likely to begin stretching yoga and traditional medicine-based formulations.

Growing concern over antimicrobial resistance

Emerging concerns about antimicrobial resistance in surface disinfectants began offering challenges in the market. The continuous and improper employment of disinfectants silently created resistant strains of bacteria and viruses, leaving the available chemicals lax in their efficacy.

This forces manufacturers into something reminiscent of a snail's pace movement in advancing their formulations, which can be expensive and require time-consuming regulatory clearances- granting the much-needed permissions for new formulations.

Following increasing resistance among disinfectants in health care facilities, one can be more predisposed to HOI; hence, infect control becomes a more difficult task. Moreover, sectors that depend on surface disinfection must sustain strong antimicrobial strength within human and environmental safety limits.

Regulatory bodies have tightened their grip over guidelines and practices for disinfectants and now ban many chemicals which would otherwise contribute to the resistance.

Essentially, it will take continuous research and development to have disinfectants that would still be effective without causing resistance toward it. Manufacturers shall also be empowering users on the proper method of disinfection to avoid AMR without compromising hygiene and infection control.

Growing demand for eco-friendly and non-toxic disinfectants present lucrative growth opportunity

The surface disinfectant market presents a bright opportunity in terms of increasing demand for environmentally safe and non-toxic disinfectants.

As governments of countries tighten regulations on harsher ingredients in disinfectants, while consumers favor eco-friendliness, it gives manufacturers a chance to innovate into using plant-based, biodegradable, and hydrogen peroxide-based disinfectants, which can be said to have efficient antimicrobial efficacy without recent environmental and health problems.

Industries such as health care and food processing, as well as hospitality, are on the lookout to better align their disinfection standards with newer technologies that are deemed safer for both the user and the surface. There are several businesses investing in green-cleaning initiatives to suit a corporate sustainability strategy.

New technologies such as probiotic-based disinfectants and antimicrobial coatings could add up to possible growth. By focusing on innovation and regulatory compliance- companies will lay claim to the shifting preference toward sustainable solutions in disinfection towards the long-term growth of the market.

The Evolving Landscape of Surface Disinfectants: Safer and More Effective Solutions

The market for surface disinfectants is growing fast as more individuals put infection control higher on their agendas at home, in the workplace, and in healthcare. The necessity of hand hygiene and hospital-grade disinfectants was furthered by the COVID-19 pandemic; thus, the demand skyrocketed. Environmentally conscious companies are rising to meet the demands of sustainability and trend toward products that are biodegradable.

Most current world-class disinfectant formulations contain quaternary ammonium compounds, alcohol, and hydrogen peroxide. Increasing innovation is further increasing efficacy against the stubborn germs.

Meanwhile, regulatory agencies such as the EPA and FDA have further increased their scrutiny of safety and efficacy. With the growing concern for hygiene, the industry has begun to move away from the traditionally safe formulations to those that achieve enhanced protection while balancing safety for everyday use.

From Chemicals to Smart Solutions: The Evolution of Disinfectants

Green disinfectants are becoming a popular choice for nature-friendly and plant-based disinfectants, as customers now prefer to have disinfectants containing thymol and citric acid free from the toxic ones. To this, the companies are developing environmentally friendly disinfectants that work great but do not leave behind toxic residues.

Hospitals, schools, and offices are establishing long-lasting antimicrobial coatings that maintain protective surfaces for longer periods of time, obviating the need for constant disinfecting. An easy daily cleaning regimen is maintained, ensuring a healthy environment for everyone.

Technology is redefining the concept of hygiene. Clever disinfecting technologies, such as IoT-connected dispensers and self-cleaning surfaces, serve to further simplify the maintenance of cleanliness in public environments.

Aware of indoor air quality, disinfectant sprays and foggers for indoor use have been on the rise. Ultimately, with great propagation of hygiene awareness, the market is moving towards smarter, greener, and more convenient ways in which to keep clean indoors.

During the previous four years which is 2020 to 2024, the market for surface disinfectants boomed, mainly due to the increased awareness of health and hygiene brought about by the outbreak of COVID-19. Increased growth was supported by rising demand in health facilities, households, and public places to prevent cross-infection. Newly developed modern disinfectants and eco-friendly products also contributed to the furtherance of this growth area.

Emerging trends that would go on fuel growth include novel formulations of eco-friendly and biodegradable disinfectants and adoption of the new technologies like ultraviolet (UV) disinfection and artificial intelligence (AI) for real-time monitoring of surfaces. With the advent of e-commerce platforms, product availability will increase among many more consumers.

In addition, stringent regulatory requirements and increased spending on health facilities, especially in emerging economies, are expected to spur the demand for effective surface disinfectants in the longer term.

This is expected to usher in a new era for the increasing maturity of the market in which innovation, sustainability, and strategic alliances are expected by manufacturers and service providers to meet the diverse and growing needs of consumers and institutions globally.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focus on the safety and effectiveness of disinfectant products, with regulatory authorities enabling quicker approval amidst the pandemic. |

| Technological Advancements | Implementation of newer formulation methods involving organic and natural compounds to satisfy consumers' preferences for non-toxic products. |

| Consumer Demand | Elevated consciousness resulting in greater demand for efficient and quick-acting disinfectants, targeting high-touch surfaces in homes and offices. |

| Market Growth Drivers | Diversification of product lines towards various forms of disinfectants (sprays, wipes, liquids) to serve different applications, driven by increased awareness of hygiene as a result of the pandemic. |

| Sustainability | Early movement in the development of environmentally friendly production processes and a decrease in the environmental footprint of packaging materials, with a few brands switching to recyclable or biodegradable materials. |

| Supply Chain Dynamics | Dependence on well-established distribution channels, emphasizing making disinfectant products widely available across healthcare centers, retail outlets, and digital platforms to keep up with the high demand. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of detailed guidelines for sustainable and environment-friendly disinfectants with regulated certifications and quality checks. |

| Technological Advancements | Embracing the use of AI and UV-C technologies to perform real-time monitoring of surfaces and automated disinfection systems to make processes more efficient and effective.. |

| Consumer Demand | Increased demand for eco-friendly, multitasking disinfectant products that resonate with environmental consciousness and provide additional benefits, including pleasant scents or skin-friendly characteristics. |

| Market Growth Drivers | Fortification of public-private alliances to augment research and development aimed at more innovative, sustainable, and technology-oriented disinfection products to respond to changing consumer and institutional requirements. |

| Sustainability | Large-scale adoption of green practices, such as the application of biodegradable and recyclable packaging, the implementation of green chemistry practices in formulation, and energy-efficient manufacturing, all as per global environmental norms. |

| Supply Chain Dynamics | Supply chain optimization via digital platforms and e-commerce channels, enhancing product availability in remote and underserved areas, and providing transparency, efficiency, and resilience across the distribution chain. |

The market for surface disinfectants in the USA is booming because consumers and businesses are increasingly focusing more on hygiene. Stringent infection control protocols in healthcare, food processing, and public places have caused further institutional demand.

Regulatory guidelines along with a focus on avoiding disease transmission further drive growth in the market. Such market gains will focus on innovating formulating and applying disinfectants.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

Market Outlook

Germany's surface disinfectant market is growing because of strict hygiene regulations and a highly advanced healthcare system driving demand. Food processing units, hospitals, and public venues emphasize strict disinfection protocols.

Strict regulations are implemented by government agencies, promoting the use of advanced and eco-friendly disinfectants, with consequent stable market growth in business and healthcare sectors.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.1% |

Market Outlook

China's surface disinfectant market is expanding due to urbanization and public health initiatives driving demand. Regulation by the government gives high priority to stringent hospital, food processing plant, and public place sanitation.

Rising awareness of infection prevention and heightened industrialization also drive adoption, which drives innovation in formulation and application technology for disinfectants across industry segments.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.2% |

Increasing Health Awareness and Government Sanitation Efforts--The Indian Historic Surface Disinfectant Market is growing rapidly. The Demand flows from such initiatives that stimulate good hygiene in health care, public, and private homes.

Several initiatives, strict infection control policies, urbanization, and many other factors are hindering the use and are leading suppliers to innovate and manufacture for affordable different-disinfectant uses.

Reasons behind Growth of the Market

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 11.4% |

In Brazil, the domain of surface disinfectant is witnessing growth propelled by infrastructure improvements supported by an increased focus on preventive care. With neurological disorders now so common, advanced neurosurgical devices have become a necessity.

The market considers public and private healthcare providers that deliver postgraduate courses on minimally invasive neurosurgeries. The possible economic disparities and regional differences in healthcare access could also be some constraints to the growth of the market.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 8.3% |

High level disinfectants are expected to dominate the market as they provide broad-spectrum antimicrobial activity

High-level disinfectants account for the majority of surface disinfectants due to their broad-spectrum antimicrobial properties against bacteria, viruses, fungi, and even bacterial spores. These disinfectants are commonly used in critical healthcare settings, such as hospitals, laboratories, in surgical instruments, endoscopes, or high-touch areas in intensive care units (ICUs).

"Due to the rise in rates of HAIs and their increasing adoption in everyday infection procedures, there was an increase in demand for cleaning and disinfection products effective against COVID-19 and other antimicrobial-resistant pathogens.

North America and Europe lead in the use of such high-level disinfectants across continents, with their rigorous infection control regulations; Asia-Pacific is experiencing rapid growth on the other hand since more and more countries are investing in the construction of healthcare infrastructures and implementing infection awareness programs.

Future innovations will include artificial intelligence-powered automated monitoring for disinfection; biogradable high-level disinfectants that will provide eco-friendly sterilization; and nanotechnology-based antimicrobial coatings for long-term protection. The intermediated level dis-infectant segment accounts for the second highest share due to their widespread use in the healthcare setting.

Intermediate-level disinfectants segment holds the second largest share due to their wide use in healthcare system

Non-spore-forming intermediate-level disinfectants are widely used in health care, food processing, and public spaces for the elimination of most bacteria, viruses, and fungi. Tuberculocidal, fungicidal, virucidal against all strains of hepatitis B and C and influenza viruses, this product is useful for non-critical medical equipment and instruments used for diagnostic purposes, as well as for most frequently touched surfaces in healthcare and commercial settings.

The trend towards non-corrosive and fast-acting disinfectants and the increasing focus on workplace hygiene has been instrumental in driving the market growth of infection prevention measures.

Markets in North America and Europe are increasingly leaning toward the use of intermediate-level disinfectants, whereas the Asia-Pacific region is seeing considerable growth due to several health care and food safety regulations.

Future trends will include smart disinfectant dispensers with tracking for real-time tracking, AI-integrated ad-hoc disinfection robots for large-scale applications, and plant-based intermediate disinfectants for safer, non-toxic sterilization.

Liquid Disinfectants segment will dominate the market due to their cost-effective nature

Liquid disinfectants enjoy the highest share of the surface disinfectants market because they are extremely adaptable, affordable, and can be used in commercial and medical procedures. They find most applications in hospitals, manufacturing facilities, and residential homes as floor cleaners, surface wippers, and pieces of equipment for sterilization.

Growing demand for hospital-grade disinfectants, rising hygiene and sanitation awareness, and growing uses of environmentally friendly and non-hazardous liquid disinfectant solutions are making the market surge. North America and Europe dominate the market in liquid disinfectant usage, while the Asia-Pacific region exhibits a high growth rate because of urbanization and government-sponsored hygiene campaigns.

Some emerging trends are biodegradable liquid disinfectants, automated dilution systems based on artificial intelligence for optimal concentration, and alcohol-free long-lasting antiviral products.

Wipes is also a key segment due to their convenience, portability, and ease of use.

Disinfectant wipes are also on the rise, especially for applications in healthcare, travel, hospitality, and cleaning households, based on the fact that they are convenient to use, easy, and portable. Pre-moistened disinfectant wipes are useful in rapid disinfecting frequently touched surfaces including medical equipment, handrails, phone sets, food preparation counters, and doorknobs.

Emerging demand for disinfection wipes-on-the-go, rising usage for non-toxic and gentle-wipe-on-the-skin varieties, and accelerating regulatory expectations on healthcare-associated infection control are driving market growth. North America and Europe dominate in disinfectant wipe penetration, with the Asia-Pacific region facing growing demand across commercial and public hygiene markets.

Emerging technologies span biodegradable disinfectant wipes, artificial intelligence -based UV disinfecting wipes, and probiotic-reinforced surface wipes offering prolonged antimicrobial functionality.

The market for surface disinfectants is extremely competitive, fueled by growing hygiene and infection control awareness, healthcare-associated infection (HAI) rates, and regulatory requirements for sanitation in medical, commercial, and residential environments. Hospital-grade disinfectants, green formulations, and next-generation surface protection technologies are being invested in by companies to stay competitive.

The market is influenced by established chemical companies, healthcare product firms, and new hygiene solution providers, all contributing to the changing landscape of surface disinfection.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 5.8% |

| 3M Company | 5.6% |

| DuPont | 5.5% |

| Procter & Gamble | 5.3% |

| Reckitt Benckiser Group PLC | 5.1% |

| Other Companies (combined) | 72.6% |

| Company Name | BASF SE |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Expanded its range of disinfectant products through the introduction of eco-friendly, biodegradable solutions for healthcare and industrial application, meeting mounting sustainability needs. |

| Company Name | 3M Company |

|---|---|

| Year | 2025 |

| Key Offerings/Activities | Founded an innovative surface disinfection line for frequent-contact surfaces, enhanced with advanced innovative antimicrobial technology for protection against pathogens even in intensive care use by hospitals and public facilities. |

| Company Name | DuPont |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Developed innovative and the most promising antimicrobial surface treatments which can prevent the transmission of infectious diseases in hospitals, schools, and other close-contact high-use environments on a long-lasting performance basis. |

| Company Name | Procter & Gamble |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Unveiled a new line of home-use surface disinfectants that introduced non-toxic and highly efficient cleaning agents-for-example, have advanced fragrances as well as environmental advantages-to appeal to environmentally conscious consumers. |

Key Company Insights

BASF SE (5.8%)

BASF SE is a world leader in producing disinfectant solutions for industrial application, including the healthcare sector. BASF has been expanding its portfolio to incorporate surface disinfectants that have sustainable properties and can be used in strict hygiene applications.

BASF is also working to understand how it can get its solutions to perform well in the longer term and how this can be used to provide better protection against germs.

3M (5.6%)

3M Company is among the major surface disinfectant firms that employ a comprehensive range of health care and industrial cleaning and disinfecting products. 3M is committed to creating high-performance disinfectants with higher activity against viruses, bacteria, and other forms of microbial life.

3M also integrates next-generation antimicrobial technologies in its products for the provision of sustained protection and convenience to customers.

DuPont (5.5%)

DuPont is also well known for producing a broad scope of disinfectant and cleaning chemicals for highly hygiene-demanding sectors such as healthcare and food processing.

DuPont focuses on producing innovative disinfectants that have improved effectiveness in antimicrobial activity and are also environmentally friendly. DuPont is also trying through research to manufacture non-toxic and environmentally friendly disinfectants that do not lose their effectiveness against a wide range of pathogenic microorganisms.

Procter & Gamble (5.3%)

Procter & Gamble, the consumer goods multinational, has shaken up the surface disinfectant industry with its launch of its disinfecting cleaners for domestic and business use.

P&G is seeking to create effective and safe disinfectants in line with the consumer's agenda of sustainability and safety, as well as launching eco-friendly products that will not sacrifice effectiveness. The company is also seeking to grow through its growing portfolio to address future infection control needs

Reckitt Benckiser Group PLC (5.1%)

Reckitt Benckiser is a top surface disinfectant market player with specifically designed products for household and professional use. Reckitt Benckiser has been innovating continuously through new disinfectant launches with stronger germ-killing capabilities.

Reckitt Benckiser also emphasizes sustainability in its product offerings, offering green disinfectants that meet evolving hygiene and safety requirements across different industries. The company emphasizes advancing disinfectant technology to offer long-term protection and convenient solutions.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The global surface disinfectant industry is projected to witness CAGR of 7.3% between 2025 and 2035.

The global surface disinfectant market stood at USD 8,626.8 million in 2024.

The global surface disinfectant market is anticipated to reach USD 18,596.1 million by 2035 end.

China is expected to show a CAGR of 9.3% in the assessment period.

The key players operating in the global surface disinfectant industry are BASF SE, 3M, DuPont, Procter & Gamble, Reckitt Benckiser Group PLC, The Clorox Company, Dow Inc., Evonik Industries AG, Stepan Company, Lonza Group, Paul Hartmann AG and others

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Form Type, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Form Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 8: Global Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Form Type, 2019 to 2034

Table 14: North America Market Volume (Unit Pack) Forecast by Form Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 16: North America Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 20: Latin America Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Form Type, 2019 to 2034

Table 22: Latin America Market Volume (Unit Pack) Forecast by Form Type, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 24: Latin America Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Western Europe Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Form Type, 2019 to 2034

Table 30: Western Europe Market Volume (Unit Pack) Forecast by Form Type, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 32: Western Europe Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Form Type, 2019 to 2034

Table 38: Eastern Europe Market Volume (Unit Pack) Forecast by Form Type, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 40: Eastern Europe Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Form Type, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Unit Pack) Forecast by Form Type, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 52: East Asia Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Form Type, 2019 to 2034

Table 54: East Asia Market Volume (Unit Pack) Forecast by Form Type, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 56: East Asia Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Form Type, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Unit Pack) Forecast by Form Type, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Unit Pack) Forecast by End User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Form Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Form Type, 2019 to 2034

Figure 14: Global Market Volume (Unit Pack) Analysis by Form Type, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Form Type, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Form Type, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 18: Global Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 21: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Form Type, 2024 to 2034

Figure 23: Global Market Attractiveness by End User, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Form Type, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 34: North America Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Form Type, 2019 to 2034

Figure 38: North America Market Volume (Unit Pack) Analysis by Form Type, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Form Type, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Form Type, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 42: North America Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 45: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Form Type, 2024 to 2034

Figure 47: North America Market Attractiveness by End User, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Form Type, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 58: Latin America Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Form Type, 2019 to 2034

Figure 62: Latin America Market Volume (Unit Pack) Analysis by Form Type, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Form Type, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Form Type, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 66: Latin America Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Form Type, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Form Type, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Form Type, 2019 to 2034

Figure 86: Western Europe Market Volume (Unit Pack) Analysis by Form Type, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Form Type, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Form Type, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 90: Western Europe Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Form Type, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Form Type, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Form Type, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Unit Pack) Analysis by Form Type, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Form Type, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Form Type, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Form Type, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Form Type, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Form Type, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Unit Pack) Analysis by Form Type, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Form Type, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Form Type, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Form Type, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Form Type, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 154: East Asia Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Form Type, 2019 to 2034

Figure 158: East Asia Market Volume (Unit Pack) Analysis by Form Type, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Form Type, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Form Type, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 162: East Asia Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Form Type, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Form Type, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Form Type, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Unit Pack) Analysis by Form Type, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Form Type, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form Type, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Unit Pack) Analysis by End User, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Form Type, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Surface Disinfectant Chemicals Market Growth & Demand 2025 to 2035

Surface Disinfectant Products Market Growth - Trends and Forecast 2025 to 2035

Surface printed Film Market Size and Share Forecast Outlook 2025 to 2035

Surface Treatment Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounting Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Mounted Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Surface Radars Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Market Size and Share Forecast Outlook 2025 to 2035

Surface Mount Technology Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Protection Film Market Trends, Growth, and Share Analysis from 2025 to 2035

Competitive Overview of Surface Printed Film Companies

Surface Water Sports Equipment Market Growth – Size, Trends & Forecast 2024-2034

Surface Plasmon Resonance System Market Analysis – Growth & Forecast 2024-2034

Surface Protection Services Market Growth – Trends & Forecast 2024-2034

Surface Measurement Equipment And Tools Market

Surface Drilling Rigs Market

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Hard Surface Flooring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA