The surface water sports equipment market is experiencing steady expansion, fueled by growing consumer interest in outdoor recreational activities and health-conscious lifestyles. Industry trade publications and sporting goods company reports have pointed to a surge in water-based leisure participation, particularly in paddle sports, as consumers seek active experiences that combine fitness with nature immersion.

The expansion of tourism infrastructure, coastal resorts, and adventure clubs has broadened the market base and introduced new customer segments. Product innovations focusing on lightweight, durable materials and ergonomic designs have enhanced usability and broadened appeal across age groups and skill levels.

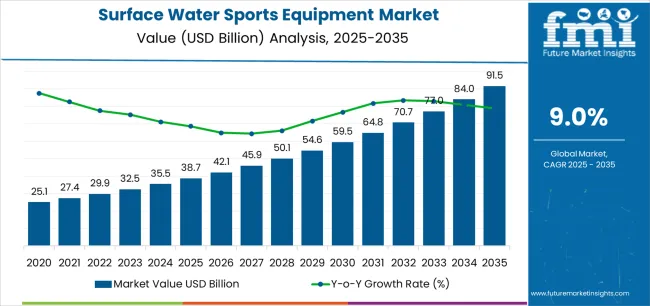

| Metric | Value |

|---|---|

| Surface Water Sports Equipment Market Estimated Value in (2025 E) | USD 38.7 billion |

| Surface Water Sports Equipment Market Forecast Value in (2035 F) | USD 91.5 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

Additionally, sporting brands are investing in digital retail experiences and athlete collaborations to strengthen brand engagement. Future growth is expected to be driven by seasonal travel demand, experiential tourism, and government-supported programs promoting physical activity. Segmental expansion will likely remain strongest in paddle sports equipment, adult consumers, and intermediate-level users, each reflecting a balance of performance demand, purchase readiness, and recreational consistency.

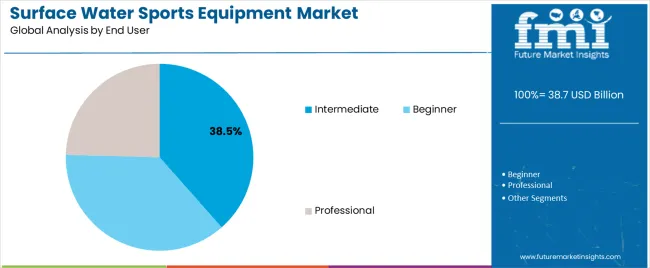

The market is segmented by Product Type, Consumer Orientation, End User, and Sales Channel and region. By Product Type, the market is divided into Paddle Sports Equipment, Ski Sports Equipment, and Board Sports Equipment. In terms of Consumer Orientation, the market is classified into Adults and Kids. Based on End User, the market is segmented into Intermediate, Beginner, and Professional. By Sales Channel, the market is divided into Online Retailers, Hypermarkets/ Supermarkets, Multi-brand Stores, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Paddle Sports Equipment segment is projected to account for 44.6% of the surface water sports equipment market revenue in 2025, maintaining its leadership in product category share. Growth of this segment has been driven by increased participation in kayaking, paddleboarding, and canoeing, particularly in regions with abundant lakes and coastal areas.

Sporting goods brands have emphasized paddle sports due to their accessibility, minimal entry barriers, and compatibility with solo or group activities. Additionally, advancements in board and paddle construction—such as inflatable materials, carbon fiber paddles, and stability-focused hull designs—have improved safety and performance, attracting a broad consumer base.

The growth of paddle sport events and guided tour services has reinforced product demand across leisure and competitive categories. As more consumers seek low-impact water sports that provide cardiovascular and muscular benefits, the Paddle Sports Equipment segment is expected to continue driving market momentum.

The Adults segment is projected to contribute 62.3% of the surface water sports equipment market revenue in 2025, solidifying its position as the leading consumer group. This segment’s dominance has been supported by greater spending capacity, wellness-driven lifestyles, and a preference for experience-based leisure.

Industry insights from sports apparel companies and recreational gear manufacturers have shown a clear trend in adult consumers prioritizing personal fitness and outdoor activity over traditional gym-based exercise. Adults have demonstrated a higher adoption rate of premium equipment and tend to participate in planned water sports vacations or training routines.

Social media exposure and online content featuring scenic paddleboarding, rowing, and water fitness routines have increased adult participation and purchase intent. Furthermore, adult consumers have been more responsive to sustainability-focused brands and performance-based equipment upgrades. These factors are expected to sustain adult dominance in the consumer orientation segment, particularly in mature recreational markets.

The Intermediate segment is forecasted to account for 38.5% of the surface water sports equipment market revenue in 2025, representing the largest share among end-user skill levels. Growth in this segment has been supported by the progression of recreational users from beginner to more engaged skill levels, often influenced by repeated participation and community involvement.

Sporting equipment makers have introduced intermediate-specific gear lines that balance performance with comfort, providing users with better control, speed, and durability compared to entry-level products. Additionally, outdoor clubs and guided group tours often cater to intermediate participants, creating demand for equipment that supports multi-day or extended use.

The intermediate user group has shown consistent purchasing behavior, driven by evolving proficiency and a desire to invest in better quality gear without the complexity or price tag of expert-level equipment. As skill development programs and adventure training services expand globally, the Intermediate segment is expected to remain central to market expansion.

This table presents a numerical comparison of the surface water sports equipment market growth and trends. For a thorough analysis of the industry’s anticipated growth, the CAGR has been analyzed in semi-annual intervals. This includes a comparison for the historical period of 2020 to 2025 and the forecast period of 2025 to 2035.

| Particular | Value CAGR |

|---|---|

| H1 | 6.3% (2020 to 2035) |

| H2 | 7.1% (2020 to 2035) |

| H1 | 9.3% (2025 to 2035) |

| H2 | 8.7% (2025 to 2035) |

Industry’s expansion accelerated at a CAGR of 6.3% in the first half (H1) of the 2020 and 2025 period and then increased slightly to 7.1% in the second half (H2) of the same period. Throughout the projection period, which runs from H1 2025 to H2 2035, the CAGR is forecasted to initially increase to 9.3% before slowing down to 8.7% in the second half.

Sustainability Trends has become a Key Differentiator for Success

Consumers nowadays are becoming more concerned about sustainable products and ways of production. Several water sports equipment manufacturing firms have therefore ensured they find ways and means of being sustainable.

Sustainability activities extend from buying recycled items to practicing eco-friendly methods on production floors. Firms are striving to mitigate the impact of their business on the environment to meet the growing demand of conscious consumers.

Sustainability is no longer viewed as a peripheral force within the sector’s competition and purchasing system. It is one of the most critical drivers that influence customers’ decisions towards certain products. Sustainability is creating investment opportunities in companies developing innovative water sports equipment.

To gain the most with this opportunity, HO Sports launched its new Sabre Water Ski, in November 2025. This firm partnered with California-based Checkerspot to launch the new product.

This new addition to the water-skiing equipment boasts of a biobased foam core that was designed through Checkerspot’s WING® Platform that creates algae-derived biomaterials that are tailored to stay within specific performance characteristics while using fewer fossil fuels.

This partnership aims to exhibit Checkerspot’s next-generation capabilities in the industries of biotechnology and material science for the achievement of innovative, higher-performing, and more sustainable water skis.

Democratization of Access is an Integral Revenue Booster

The penetration of water sports activities is rising, as access to the opportunities has been liberalized and provided to a larger amount of people. The rise of direct-to-consumer sales by water sports equipment brands has made it easier to obtain these products.

Establishments involved in rentals, water sports organizations, and society are making it easier for the consumer who may not afford to purchase some of the apparatus. Rental options, membership, or discounted packages are effective strategies that businesses use to attract more clients and introduce new recurring revenue models.

This improved access is increasing the scope of opportunities for water sports activities. They enable companies to gain a stronger position and increase sales of related products in a competitive environment.

eCommerce and Digital Marketing Expands the Reach of Businesses

The rise of e-commerce and its impact on brick-and-mortar stores has been incredible. Due to digitalization and the advances in technology across the world, firms in the water sports equipment industry are using e-commerce platforms and digital marketing as a means to expand access and sales.

The increased number of online retail channels allows companies to unlock new sources of demand and capture new customers and segments. Marketing strategies like SEO, social media advertisement, and influencer marketing are employed to create brand recognition engage the audience and increase conversion rates.

The role of brand ambassadors, athletes, and influencers in promoting water sports equipment is highly impactful in augmenting sales. With the help of digital technologies, companies can remain relevant and successfully adapt to modern tendencies for digital services consumption.

The demand for surface water sports equipment rose at a 6.7% CAGR between 2020 and 2025. The industry generated revenue amounting to USD 25,084.1 million in 2020 and surpassed USD 32,513 million in 2025.

Enhanced economic situations and higher levels of disposable income in many parts of the world have made it possible for consumers to spend on leisure and related equipment. With an increase in discretionary income being put into leisure and activities, especially outdoors, the water sports equipment industry has continuously grown.

Several water sports rental services and tour operators have entered the industry hence making these activities easily available to people. Larger numbers of permanent visitors tourists and casual participants provide such services like equipment rental or guided tours, basically positively influencing the industry. Venture capital and private equity funding for promising water sports startups are also creating a positive impact.

Appeal of cultural changes relative to leisure and outdoor activities values consumer buying behavior as experience versus possessions. The fun derived from water sports are effective means of venting off accumulated stresses by engaging with nature, which in turn has made its popularity and hence, the demand for relevant equipment constant.

The increased focus on living a healthy lifestyle has made more people embrace water activities as a way of exercising and escaping stress. This trend has been beneficial for the industry.

The future of the industry looks bright, expanding at a 9% CAGR till 2035. Future advancements in materials science, manufacturing, and incorporation of technology will create new waves in water sports equipment. Integrated technologies, new lightweight materials, and environmental solutions will enhance performance and safety and make customers who use them progress hence stimulating sales.

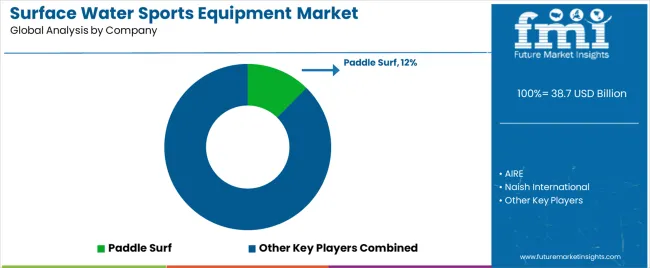

Tier 1 companies include top leaders in the surface water sports equipment market, generating around USD 16,256.5 million in revenue, which is about 50% of the global industry share.

Leading brands like BRP Inc., Yamaha Motor Co., Ltd., MasterCraft Boat Holdings, Inc., Malibu Boats, Inc., and Brunswick Corporation dominate this industry with their strong presence and quality offerings. Their products are widely available due to their extensive distribution networks.

Tier 2 companies include Correct Craft, Kawasaki Heavy Industries, Marine Products Corporation, Hobie Cat Company, and Tahe Outdoors. They have a strong reputation as they provide robust products at affordable prices. These companies cover about 35% of the global industry value share, with a valuation of USD 11,379.5 million.

They frequently co-ordinate with retailers, and online portals to improve their positioning and distribution channels. Offering customer loyalty awards and effective marketing promotions assists in creating a loyal customer base.

Naish International, Starboard, Fanatic, JP Australia and Liquid Force fall under the Tier 3 companies. These companies hold revenue of USD 4,876.9 million or around 15% of the industry shares worldwide.

These companies may be more flexible and can react to needs more effectively, often specializing in particular segments or individual product attributes. New brands tend to emphasize the core values of sustainability and ethical approaches to business and products, which younger and environmentally friendly consumers value.

This section gives insights into the future surface water sports equipment market forecast in top countries. Information on regions like North America, Europe, Asia Pacific, and others has been granulated, focusing on the top countries. Australia is expected to be at the forefront, expanding at a 7.5% CAGR until 2035.

India follows next, expanding at a 5.4% CAGR until 2035. Lastly, China is also on the list, thriving at a 5.1% CAGR until 2035. This data indicates that the Asia Pacific region is likely to make remarkable progress in the coming years.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Australia | 7.5% |

| India | 5.4% |

| China | 5.1% |

The sales of surface water sports equipment in Australia are predicted to surge at a 7.5% CAGR until 2035. Travel and tourism is today one of the most dynamic industries in Australia, and it is instrumental in rallying millions of vacationing tourists to Australia’s water sports sites.

An increased number of tourists leads to increased demand for rental services, equipment, or anything associated with water activities. Australia has a long coastal line which makes it some of the most serene and unpopulated coastline, bays, and rivers for sailing and other water activities.

Such natural provision of easily accessible water bodies results in many water-related activities. Arranging international surfing championships, yachting competitions, and other water sports fosters these activities and raises the popularity of equipment locally.

The demand for surface water sports equipment in India is anticipated to increase at a 5.4% CAGR till 2035. Currently, local manufacturers and startups are seeking opportunities to supply water sports equipment, which are cheaper than imported ones.

This helps the industry expand since more people can gain access to equipment they might have been previously locked out from due to the high cost of equipment. Technological improvements have LED to the availability of water sports equipment at cheaper prices hence increased uptake.

The tourism sector in India is on the rise, proving the increased interest of both domestic and foreign travelers looking for various experiences. With states along the coastline like Goa, Kerala, and Maharashtra becoming ideal locations for water sports, there is increasing demand for apparatus and services.

The sales of surface water sports equipment in China will amplify at a 5.1% CAGR till 2035. People in China are beginning to pay more heed to their health and well-being. Aquatic sports are recommended as enjoyable and effective in promoting fitness utility for enhancing athletes’ performance, hence the rising participation rate.

To curb the rising cases of obesity and diseases that are associated with the lack of exercise, the Chinese government has been encouraging people to engage in sporting activities and recreational exercises.

Government policies designed to spur tourism and sports-related investments such as water sports have been key in expanding industry size. Marinas, water parks, and other measures related to water sports have improved owing to large investments in developing coastal and inland water sports.

This section takes a closer look at the surface water sports equipment market segmentation by product type and consumer orientation. The research indicates that paddle sports equipment is the leading product type, holding 45.2% of industry shares in 2025. Based on consumer orientation, adults dominate with 87.3% of shares captured in 2025.

| Segment | Paddle Sports Equipment (Product Type) |

|---|---|

| Value Share (2025) | 45.2% |

Paddle sports encompass diverse activities. These include recreational paddling. Also touring fishing, racing, and white-water adventures. This versatility caters to varying interests. It allows for different experiences with the same equipment. Paddle sports offer full-body workouts.

They improve cardiovascular health. They also enhance muscle strength and endurance. The low-impact nature of paddling makes it an excellent exercise option for people of all fitness levels.

Advances in materials technology have LED to the development of lighter and more durable paddle sports equipment. Innovations such as inflatable kayaks and SUPs have simplified transportation and storage. This has increased their accessibility significantly across the industry.

| Segment | Adults (Consumer Orientation) |

|---|---|

| Value Share (2025) | 87.3% |

With higher disposable incomes adults possess more financial resources to spend on recreational activities. They can allocate funds towards sports equipment. This economic stability allows them to invest in quality water sports gear. A growing trend exists among adults to seek adventure sports offering thrilling and unique experiences.

Water sports cater to this desire for adventure and exploration. Their popularity is boosted by exposure in media, including social media, films, and television. Adults are inspired by influencers celebrities and peers sharing their water sports experiences online. These traits boost consumer orientation for adults in the industry.

The competitive landscape of the surface water sports equipment industry is characterized by dynamic mix of established global brands emerging local manufacturers and innovative startups. International players like Hobie Cat. BIC Sport and Aqua Marina dominate the industry. They leverage their extensive research and development capabilities.

Brand recognition and extensive distribution networks bolster their position. These companies have significant competitive advantage due to their ability to innovate. They adapt to evolving consumer preferences. They offer a wide range of high-quality products. These cater to various segments of the industry from recreational users to professional athletes.

Recent Developments

The sector has been classified into Paddle Sports Equipment, Ski Sports Equipment, and Board Sports Equipment.

The industry bifurcates into Kids and Adults.

The sector is segmented into Wholesalers/ Distributors, Hypermarkets/ Supermarkets, Exclusive Stores, Multi-brand Stores, Franchise Sports Chain Outlets, Independent Sports Outlets, and Online Retailers.

The industry trifurcates into Beginner, Intermediate, and Professional.

The sector bifurcated into Mass and Premium.

Analysis of the industry has been conducted in the countries of North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa (MEA).

The global surface water sports equipment market is estimated to be valued at USD 38.7 billion in 2025.

The market size for the surface water sports equipment market is projected to reach USD 91.5 billion by 2035.

The surface water sports equipment market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in surface water sports equipment market are paddle sports equipment, ski sports equipment and board sports equipment.

In terms of consumer orientation, adults segment to command 62.3% share in the surface water sports equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Surface Conditioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Mining Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Kids Sports Equipment and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Surface Levelling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Desalination Equipment Market Size, Growth, and Forecast for 2025 to 2035

Sports and Leisure Equipment Retailing Industry Analysis by Product Type, by Consumer Demographics, by Retail Channel, by Price Range, and by Region - Forecast for 2025 to 2035

Surface Measurement Equipment And Tools Market

Water Quality Testing Equipment Market Growth – Trends & Forecast 2018-2027

Underwater Welding Equipment Market Growth – Trends & Forecast 2024-2034

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Water Desalination and Purification Equipment Market Size and Share Forecast Outlook 2025 to 2035

Municipal Sludge Dewatering Equipment Market Size and Share Forecast Outlook 2025 to 2035

Advanced Water Management And Filtration Equipment Market Size and Share Forecast Outlook 2025 to 2035

South America Residential Water Treatment Equipment Market Trends – Growth & Forecast 2022 to 2032

Sports Medicine Sutures Market Size and Share Forecast Outlook 2025 to 2035

Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA