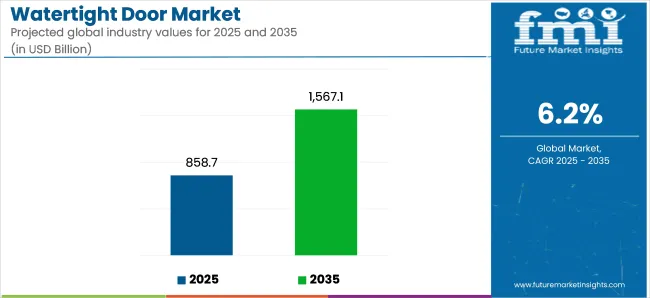

The global watertight door market is set to reach USD 1.6 billion by 2035, up from USD 858.7 million in 2025, at a CAGR of 6.2%. Growth is being driven by global shipyard expansions and stricter compliance norms under SOLAS and class society mandates. Watertight doors are now being specified earlier in the vessel design cycle, with growing demand for automation-compatible, corrosion-proof solutions.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 858.7 million |

| Projected Market Value (2035F) | USD 1.6 billion |

| Value-based CAGR (2025 to 2035) | 6.2% |

The USA and South Korea are major contributors to this market. USA shipyards are steadily modernizing legacy fleets, while South Korea focuses on large-scale offshore and tanker projects. Sliding doors are widely adopted in naval and offshore units due to their space efficiency and mechanical sealing reliability.

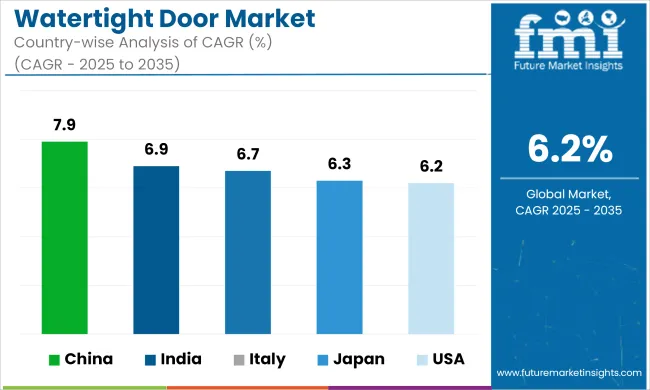

China is the fastest-growing country market with 7.9% CAGR, driven by its expanding shipbuilding output. As per recent guidelines from the International Maritime Organization and class societies like DNV and ABS, automated watertight door systems are increasingly recommended in new builds, including offshore support vessels and polar-class ships.

Additionally, classification societies such as Lloyd’s Register, Bureau Veritas, and ClassNK have tightened performance and installation standards for door actuation, monitoring, and fail-safe operation. Since January 2024, the IMO has also enforced stricter reporting on door operation logs and remote closure tests, especially for passenger ships and offshore units.

This regulatory push is compelling shipbuilders to adopt pre-certified door systems with integrated sensor diagnostics and remote control panels, enhancing accountability and on board safety compliance.

The table projects the estimated CAGR for the global watertight door market over semi-annual periods ranging from 2024 to 2025. The analysis provides organizations with a better understanding of the growth over the year by divulging crucial shifts in performance and growth patterns of the industry. The first half (H1) of 2024 spans from January to June. The second half or H2 includes July to December.

Figures showcased in the below table showcase the growth rate for each half from 2024 to 2025. The industry is estimated to grow at a CAGR of 5.5% in the first half (H1) of 2024. The second half of the same year is anticipated to witness a spike in the CAGR at 6.1%.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.5% |

| H2(2024 to 2034) | 6.1% |

| H1 (2025 to 2035) | 5.9% |

| H2 (2025 to 2035) | 6.5% |

Moving in the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to dip to 5.9% in the first half (H1) and then substantially increase to 6.5% in the second half (H2). In the first half (H1), the industry is anticipated to experience an increase of 40 BPS while the second half (H2) is also predicted to witness an increase of 40 BPS.

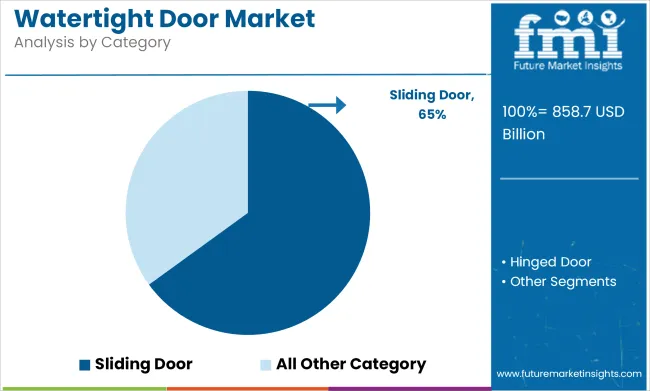

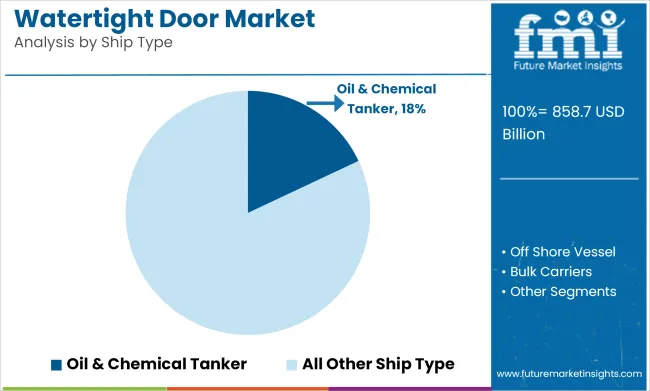

The watertight door market is projected to grow with key segments such as sliding doors and oil & chemical tankers playing dominant roles. Sliding doors are expected to capture a significant share, while oil & chemical tankers will remain a key segment due to their importance in global trade and maritime safety regulations.

Sliding watertight doors are expected to dominate the market, capturing approximately 65% of the market share by 2025. These doors are highly valued for their robust sealing technology and efficient use of space. The sliding mechanism allows them to operate smoothly in confined spaces, making them particularly well-suited for marine vessels and offshore structures where space optimization is crucial.

Sliding doors are essential for maintaining water-tightness, preventing leakage, and enhancing overall safety in critical areas like engine rooms, cargo holds, and bulkheads. Innovations in automated control systems, as well as the use of corrosion-resistant materials, are enhancing their performance and durability.

Companies such as Epiroc, Wartsila, and Kongsberg are developing advanced sliding watertight doors that offer greater reliability and safety in harsh marine environments. The increasing focus on shipbuilding activities and stringent maritime safety regulations worldwide is expected to drive the adoption of sliding doors, reinforcing their dominant position in the watertight door market.

Oil and chemical tankers are projected to capture 18% of the watertight door market share by 2025. These vessels play a critical role in global trade by transporting petroleum products and chemicals across oceans, making the integrity of their compartments essential to preventing environmental hazards and maintaining cargo safety.

The specialized requirements of oil and chemical tankers necessitate watertight doors that can withstand harsh marine environments and resist chemical corrosion. Leading manufacturers in the market, including ABB, MAN Energy Solutions, and Konecranes, are focusing on providing customized solutions for oil and chemical tankers, meeting these demanding specifications.

The growing demand for energy resources and chemicals, combined with the increasing focus on safety and environmental protection, is expected to drive the adoption of advanced watertight doors in this segment. As safety regulations become stricter and new technologies are integrated into tanker fleets, the oil and chemical tanker segment is expected to maintain its significant share of the watertight door market.

Increasing Development of Floating Production Storage and Offloading Vessels (FPSO)

Transportation of oil and gas involves high costs and prominent risk factors. Transport through large vessels therefore becomes economic compared to small carriers. Large vessels are, however, hard to transport and have several risks associated with it. This has surged the demand for floating production storage and offloading vessels.

Floating production storage and offloading vessels are estimated to leverage opportunities as alternatives to shore-based port development. Instead of investing large capital in port development, measurably small investments in floating production storage and offloading vessels can offer a efficient solution for oil and gas transportation.

The analysis of weather conditions in the floating region is a vital element in assessing the reliability and suitability of a floating terminal operation. Indonesia has the largest density of floating gas terminals, with approximately 60 terminals in total.

Commissioning of new regasification and liquefaction terminals is a new trend, with the emergence of several new projects, particularly in Australia, Malaysia, Pakistan, and a few other African countries. The aforementioned trends play a pivotal role in the development of a positive curve for the global sales of the watertight doors.

Growth of Coastal and Marine Tourism Driving Sales

Coastal tourism can be defined as land and sea-based travel for pleasure taking place along the coast and within proximity to the sea. Marine tourism is similar to coastal tourism but is inclined on sea-based activities. The tourism industry, from a global perspective, has witnessed healthy growth during the recession era, recording 1 million tourists for the first time in 2012 while continuing to grow annually at 4%.

This has positively impacted coastal and marine tourism with Europe pegged as the world's most visited tourist region. The number of tourists arriving in Europe has been growing by 6% annually, according to estimates published by WTO, with a large percentage of tourists (an average of 200 million visitors yearly) concentrating on the Mediterranean coastal region.

This trend of tourists taking part in marine tourism has led to an increase in the sales of marine vessels such as farriers, boats, and cruise ships and thus, has been indirectly contributing to the sales of these doors. According to a study published by E.C. 2011, more than 60% of tourists prefer to visit coastal areas over inner lands.

High Demand for Offshore Vessels and Construction of New Ships to Propel Demand

Watertight doors are crucial for all marine vessels including commercial, yachts, cruisers, coastal military patrol vessels, and combat ships as they restrict the entry of water.

The increasing significance and criticality of marine surveillance through maritime naval patrol vessels has positively impacted demand for watertight doors as they reduce flooding during grounding, collision, and structural damages, thereby minimizing the risk of sinking.

Shortage of Skilled Labor to Put Pressure

Looking at the future, one of the biggest challenges faced by watertight door manufacturers will be a growing shortage of skilled labor. Many companies are finding it difficult to secure a qualified workforce from their countries. Regions like Northern Europe have to draw in the workforce from the Eastern Europe countries. Respective yards are facing an exodus of their best workers to higher paid alternatives overseas.

In addition, one of the strengths of a region lies in its labor force for this particular market. However, with the ongoing trend the ship repair, maintenance, and related products industry is expected to witness a shortfall of workforce to continue the operations

Labor productivity across several regions varies considerably. Europe, Korea, and Japan observe a high value whereas, China shows a lower figure of labor productivity in the ship repair and maintenance services. Subsequently, high lead time caused due to low productivity also hinders growth.

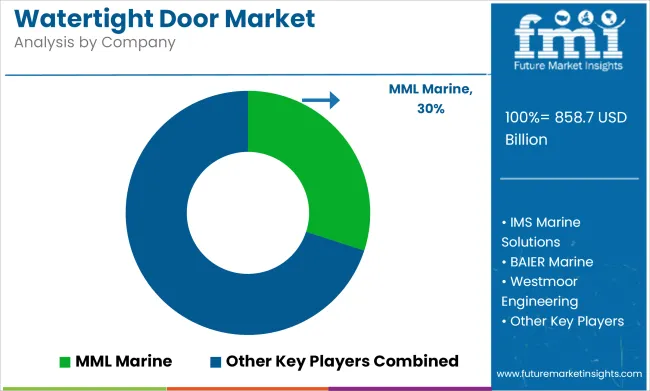

Tier 1 companies include leaders with annual revenues exceeding USD 200 million. These companies currently capture a significant share of 8% to 10% globally. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. These firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include MML Marine, Westmoore Engg, Ocean Group, and AdvanTec among others.

Tier 2 includes small-scale companies operating at the local level and serving niche watertight doors vendors with low revenue. These companies are notably oriented toward fulfilling local demands. They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized segment, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The below section offers organizations with an overview of the industry. It consists a detailed examination of the emerging trends and opportunities on a country-by-country basis. This country-specific analysis of the dynamics of the industry is anticipated to assist businesses in understanding the complex nature of the industry.

The analysis comprises of key factors, potential challenges, and forecasts impacting the demand, production, and consumption of the market within each country. This section aims to help organizations in making informed decisions and developing strategies customized to individual countries.

China is predicted to dominate the country-wise growth in the industry during the assessment period with a projected CAGR of 7.9%. India, Italy, and Japan are estimated to follow behind China to become the key countries in the industry with forecasted CAGRs of 6.9%, 6.7%, and 6.3% respectively.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 7.9% |

| India | 6.9% |

| Italy | 6.7% |

| Japan | 6.3% |

| United States | 6.2% |

Watertight door demand in the United States is expected to increase at a CAGR of 6.2% over the forecast period. These doors are required in the maritime and offshore industries, including shipbuilding and offshore oil and gas exploration, to improve safety and protection. Growing activities in this industry help to drive regional expansion.

The adoption of stringent safety requirements and standards by regulatory organizations in North America is likely to increase the demand for watertight doors. These regulations are intended to safeguard the safety of persons and assets in maritime and offshore operations.

Improvements in door manufacturing technology, such as better sealing mechanisms and materials, improve the performance and durability of these doors. These technical breakthroughs attract clients and propel the market forward.

Japan is a major maritime operator with a huge fleet of tankers, cargo ships, and bulk carriers, which necessitates a strong need for watertight doors. These doors are critical to the safety and security of the ships.

The nation's growing shipbuilding sector is investing in cutting-edge technology to improve ship safety. Given Japan's reliance on sea traffic, sophisticated watertight doors with automation and remote monitoring are becoming increasingly common.

China has a huge and rapidly growing maritime industry that comprises of cargo ships, tankers, and navy boats. With such a huge fleet, ship safety and security are crucial, and watertight doors play an important role in preventing water entry and floods.

China's strong focus on modernizing its shipbuilding industry drives the need for advanced safety features. Shipyards are investing in the latest technologies to enhance their vessels' safety, and doors with improved sealing and automation are becoming essential components.

China's strategic location along the prominent shipping routes means that maritime safety is a top priority. The country is increasingly concerned about marine safety and security, which boosts the demand for reliable watertight doors.

Key players in the industry include MML Marine, IMS Marine Solutions, BAIER Marine, Westmoor Engineering, and Ocean Group. The watertight doors industry is highly competitive, with several prominent companies and a variety of creative solutions. Key competitors include manufacturers that specialize in maritime, industrial, and commercial applications.

Companies distinguish themselves through modern technology, such as improved sealing systems and long-lasting materials, as well as tailored solutions to specific regulatory and environmental needs.

The market is being driven by increased infrastructure development, stringent safety standards, and the growing demand for flood protection. Strategic collaborations, technology breakthroughs, and a focus on sustainability are critical to achieving a competitive advantage in this expanding market.

Industry Updates

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 858.7 million |

| Projected Market Size (2035) | USD 1.6 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2023 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Category Types Analyzed (Segment 1) | Sliding Doors, Hinged Doors |

| Ship Types Analyzed (Segment 2) | Oil and Chemical Tanker, Offshore Vessel, Bulk Carriers, General Cargo, Container Ships, Gas Carriers, Passenger Ships, Yachts, Naval Ships |

| Sales Channels Analyzed (Segment 3) | OEM, Aftermarket |

| Actuation Types Analyzed (Segment 4) | Hydraulically-operated, Electric-operated |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Watertight Door Market | MML Marine, IMS Marine Solutions, BAIER Marine, Westmoor Engineering, Ocean Group, AdvanTec Marine, Wine, SeaNet Group, Zhiyou Marine, Shanghai Zhiyou Marine & Offshore Equipment Co., Ltd, Walz & Krenzer, Inc., TEBUL OY, Momec AB, Schoenrock Hydraulik GmbH, Gard AS, Advanced Pneumatic Marine GmbH, AdvanTec Manufacturing (Diamond Sea Glaze) |

| Additional Attributes | Market growth driven by oil and chemical tanker demand, Adoption of sliding door technology for enhanced sealing, Regional aftermarket trends, OEM contracts for shipbuilding, Advancements in hydraulic and electric actuation systems |

| Customization and Pricing | Customization and Pricing Available on Request |

Category is segmented into in sliding doors and hinged doors

Oil and chemical tanker, off shore vessel, bulk carriers, general cargo, container ships, gas carriers, passenger ships, yachts, and naval ships are the ship types.

Sales channel is segregated into OEM and aftermarket.

Actuation type is classified into hydraulically-operated and electric operated.

The industry is spread across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa.

The market is predicted to reach USD 858.7 million in 2025.

The industry is estimated to reach a size of USD 1.6 billion by 2035.

MML Marine, IMS Marine Solutions, BAIER Marine, Westmoor Engineering, and Ocean Group.

It withstands the water column or water pressure from both sides.

The market is projected to witness a CAGR of 6.2% during the assessment period.

China is estimated to dominate with a CAGR of 7.9% during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Doors Market Size and Share Forecast Outlook 2025 to 2035

Door Hardware Market

Door Controller Systems Market

Indoor Rotary High Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Indoor Cable Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Indoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Indoor Air Quality Monitor Market Size and Share Forecast Outlook 2025 to 2035

Indoor Location Market Size and Share Forecast Outlook 2025 to 2035

Indoor Space Heater Market Size and Share Forecast Outlook 2025 to 2035

Indoor Farming Market Analysis - Size, Share, and Forecast 2025 to 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indoor Farming Market

Outdoor Boundary Vacuum Load Switch Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Commercial Grills Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Furniture Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Safety Locks Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA