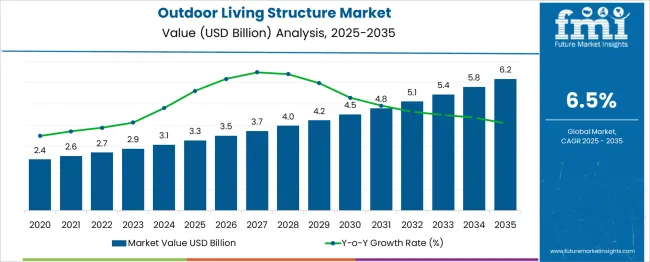

The Outdoor Living Structure Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 6.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. Initial growth from 2025 to 2028 remains steady, increasing by USD 0.2 billion annually, reaching USD 4.0 billion. This early phase reflects foundational demand stability without abrupt market triggers or pricing fluctuations.

No inflection behavior or slope shift is detected during this period. Instead, the values move along a predictable path shaped by consistent adoption across residential and commercial outdoor applications. A breakpoint begins to emerge after 2028 as annual value increments shift from USD 0.2 billion to approximately USD 0.3-0.4 billion by 2031. Between 2028 and 2031, the market accelerates from USD 4.0 billion to USD 5.1 billion.

This change represents a modest pivot in the growth gradient, suggesting incremental demand enhancement or product mix variation. Post-2031, the market grows from USD 5.1 billion to USD 6.2 billion, sustaining this higher annual addition. The breakpoint around 2028 to 2029 marks the start of a more vigorous phase in the cycle, characterized by intensified procurement and structural outdoor investments without disrupting the market’s overall linear expansion pattern.

| Metric | Value |

|---|---|

| Outdoor Living Structure Market Estimated Value in (2025 E) | USD 3.3 billion |

| Outdoor Living Structure Market Forecast Value in (2035 F) | USD 6.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The outdoor living structure market is expanding rapidly as homeowners and commercial developers invest in pergolas gazebos pavilions outdoor kitchens and sunrooms. Major innovators shaping the industry include Trex Company known for recycled composite structures Azenco Outdoor recently acquired by Hunter Douglas and Renson with luxury garden concept showcases.

Leading trends include modular customizable structures built from eco friendly materials lightweight composites and smart climate control features. North America leads adoption with strong residential retrofit demand Asia Pacific grows quickly due to urban expansion and rising incomes while hospitality projects in Middle East drive high end pavilion growth.

The market draws demand from several parent markets. The home improvement sector leads with a 35% share, driven by DIY upgrades like pergolas and sheds. Residential real estate follows at 25%, as outdoor spaces boost property values.

Landscaping accounts for 15%, focusing on custom designs, while hospitality contributes 10% through commercial installations. Construction materials supply 8% of market needs, and e-commerce holds 5% through direct sales. Luxury custom projects make up the remaining 2%. Together, home improvement and real estate dominate, representing 60% of the market's foundation.

The Outdoor Living Structure market is undergoing a significant transformation due to the rising demand for aesthetically pleasing and functional outdoor environments. A growing emphasis on lifestyle enhancement, outdoor entertainment, and wellness-focused spaces has been driving the adoption of customizable structures such as pergolas, gazebos, and pavilions. Consumers are increasingly investing in exterior home improvements, particularly in urban and suburban residential settings, where outdoor extensions are being utilized for leisure, dining, and recreation.

Factors such as increasing disposable income, the influence of home improvement media, and the expansion of e-commerce platforms for modular outdoor kits are also contributing to market expansion. Climate adaptability, durability, and sustainability are becoming central considerations, with smart lighting, weatherproof materials, and low-maintenance designs shaping future product innovation.

As a result, manufacturers are responding with modular, durable, and easily installed systems tailored to evolving consumer preferences. The market is anticipated to grow steadily, fueled by a mix of design innovation, environmental awareness, and the increasing desire to blur the lines between indoor and outdoor living..

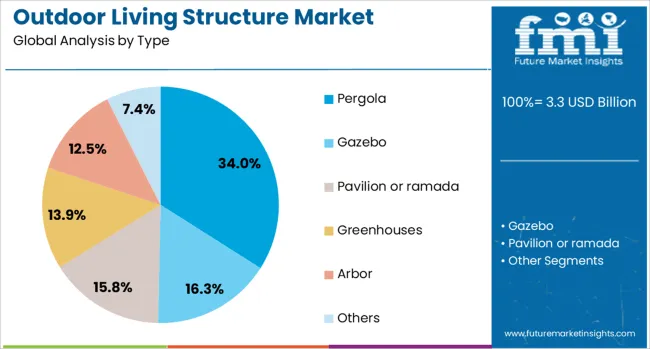

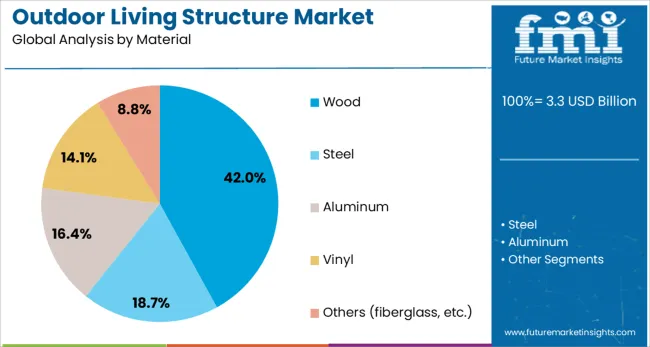

The outdoor living structure market is segmented by type, material, end-use, and distribution channel and geographic regions. By type of the outdoor living structure market is divided into Pergola, Gazebo, Pavilion or ramada, Greenhouses, Arbor, and Others. In terms of material of the outdoor living structure market is classified into Wood, Steel, Aluminum, Vinyl, and Others (fiberglass, etc.).

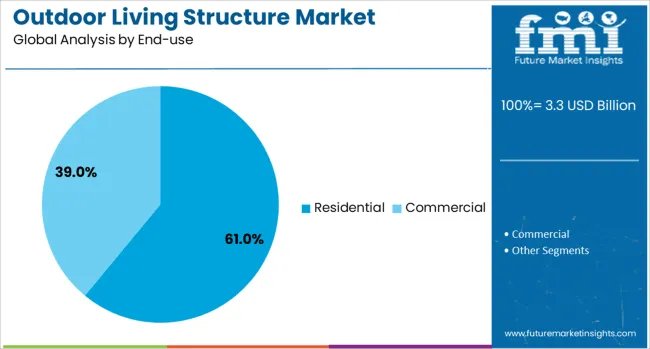

Based on end-use of the outdoor living structure market is segmented into Residential and Commercial. By distribution channel of the outdoor living structure market is segmented into Direct and Indirect. Regionally, the outdoor living structure industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pergola type segment is projected to account for 34% of the Outdoor Living Structure market revenue in 2025, making it the most dominant among structure types. The appeal of pergolas has been reinforced by their ability to deliver both functional shading and architectural appeal in outdoor environments. These structures have been widely used to define transitional spaces between indoor and outdoor areas while supporting vertical landscaping, lighting, or canopies.

Pergolas have also been favored for their design versatility, allowing integration with modern, rustic, or traditional aesthetics based on consumer preference. Growth in this segment has been further strengthened by the availability of prefabricated kits and customizable options that meet varying spatial and budgetary requirements.

The segment’s leadership is also supported by the role pergolas play in enhancing property value and user comfort, especially in residential renovation projects. With homeowners increasingly prioritizing open-air extensions for leisure and wellness, the pergola type has remained the most chosen outdoor living solution..

The wood material segment is anticipated to hold 42% of the Outdoor Living Structure market revenue share in 2025, making it the leading material category. This segment has grown steadily due to the natural aesthetic appeal, strength, and thermal insulation that wood offers in outdoor construction. Consumers have continued to prefer wood for its warm finish and timeless design compatibility with residential landscapes.

Its ability to be stained, treated, or painted for weather resistance and style flexibility has reinforced its suitability for various climates. Sustainability considerations have also played a role, with responsibly sourced and engineered wood gaining favor in eco-conscious construction.

Moreover, the tactile quality and customizable nature of wood have aligned with consumer demand for bespoke outdoor experiences. Despite the emergence of composite and synthetic alternatives, wood has retained its leading share due to its perceived authenticity, craftsmanship appeal, and enduring connection to outdoor living traditions..

The residential end-use segment is expected to contribute 61% of the Outdoor Living Structure market revenue share in 2025, making it the most prominent consumer group. The segment’s growth has been largely driven by increasing interest in enhancing private outdoor spaces for relaxation, entertainment, and wellness. Residential property owners have been investing in structural additions to optimize backyard and garden utility, driven by lifestyle changes that emphasize work-from-home arrangements and home-centered recreation.

Home renovation trends, combined with rising disposable income, have spurred spending on customized outdoor living environments. The adoption of outdoor structures in residential areas has also been supported by easy installation technologies, availability of modular kits, and expanding access through online retail platforms.

Additionally, the rising value placed on property aesthetics and real estate resale potential has made outdoor improvements a strategic investment for homeowners. The residential segment continues to lead due to its direct alignment with evolving lifestyle demands and a strong emotional value placed on personalized outdoor spaces..

Demand for outdoor living structures returned strongly as homeowners prioritized backyard enhancements and wellness spaces. Social and backyard events led to nearly 41 % of new installations involving pergolas, gazebos, or modular shade units. In 2024, the patio furniture and garden structures segment contributed approximately 29 % of total outdoor residential upgrade spend. Growth was concentrated in North America and Western Europe, with Asia Pacific gaining momentum through urban residential developments featuring balcony structures. Commercial installations such as hotel poolside pavilions and outdoor workspaces captured roughly 18 % of volume. Designs featuring wood–aluminum hybrid frames, low-maintenance cladding, and screened-sunshade treatments were adopted for improved durability and aesthetic appeal.

Growing focus on at-home relaxation and outdoor wellness drove installations of living structures such as pergolas, arbors, and garden rooms. Nearly 44 % of suburban households in key markets added outdoor shade or lounge structures. Outdoor-only meeting pods and garden studios were installed by 22 % of work-from-home professionals who sought dual indoor-outdoor wellness spaces. Hatched pavilions with mosquito-resistant netting and UV-treated roofing were adopted by 27 % of mid-tier home renovation projects. Urban townhome communities and condominium rooftops specified retractable pergolas in 18 % of common-area redesigns. Ease of installation, prefabricated aluminum posts, and weather-resistant slats enhanced appeal in DIY and contractor-led projects.

Outdoor living structures often face higher permitting and construction costs relative to standard deck or patio installations. In 23 % of municipal jurisdictions, structural permits and setback restrictions added expenses of as much as 15 % to the project's total. Product units incorporating integrated HVAC or electrical features raised budgets by around 18 %. In HOA or urban areas, restricted roof cover regulations and building envelope limitations prevented installation in 8 % of residential upgrade attempts. Warranty exclusions relating to wind loads and snow cover reduced adoption among buyers in northern climates. Maintenance and cleaning considerations also deterred uptake in 12 % of high-traffic community settings when operation costs and warranty coverage were considered.

Hybrid structures combining insulated roof panels with outdoor kitchen and living features gained traction in 26 % of new build projects. Smart roofs with remote-controlled slats, rain-sensing closure, and ambient lighting systems were integrated into 22 % of luxury patio suites. Cabin-like garden rooms with triple-glazed panels and mini HVAC systems targeted seasonal usage in 19 % of temperate climate installations. Commercial hospitality and glamping ventures adopted modular living pods with power-ready infrastructure in 15 % of new site layouts. Partnerships between outdoor structure makers and tech integrators enabled product bundles with solar lighting kits, smart shading modules, and app-enabled controls for added consumer convenience.

Prefabricated modular living structures are now preferred in nearly 34 % of residential projects for their speed of installation and cost predictability. Recycled aluminum framing and composite decking materials appeared in 21 % of new builds, driven by sustainability preferences. Custom-finish claddings and color-matched kits were offered in over 27 % of product lines to improve aesthetic consistency with home exteriors. Integration with existing decking, fencing, or garden leveling platforms improved modular adaptability in 23 % of retrofit installations. Smart accessories have been packaged with 18 % of new structures, providing turnkey solutions that merge utility, comfort, and curb appeal.

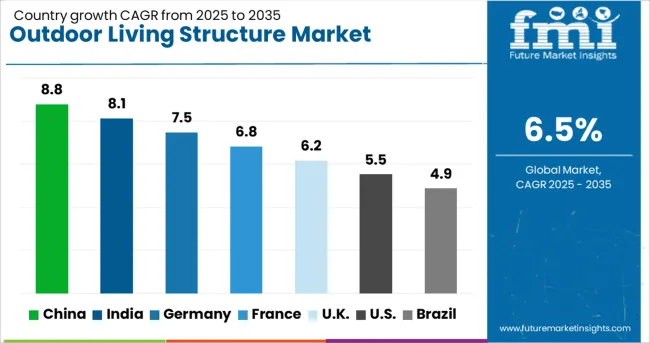

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The Outdoor Living Structure Market is forecasted to grow at a global CAGR of 6.5% during 2025-2035. China commands the highest market value at USD 8.8 billion, outpacing the global growth average due to higher urban residential development and evolving consumer preferences for premium outdoor spaces.

India follows with USD 8.1 billion, backed by climate suitability and increasing investments in real estate infrastructure. Germany, with USD 7.5 billion, benefits from consistent demand in modular and eco-friendly construction. The UK and USA reflect comparatively lower values at USD 6.2 billion and USD 5.5 billion, respectively. The report provides an extensive breakdown across 40+ countries, with five leading nations shared here for strategic reference.

The outdoor living structure market in China is projected to expand at a CAGR of 8.8% from 2025 to 2035. Growth has been stimulated by increased investment in high-rise residential and community housing developments. Developers have prioritized premium rooftop decks, pergolas, and multi-use outdoor enclosures to cater to changing lifestyle preferences. Use of moisture-resistant materials such as composite wood and powder-coated aluminum has been rising.

Regulatory shifts to promote outdoor thermal comfort in new buildings are prompting design upgrades. Architects are integrating automated shading and rain-screen systems as part of new residential landscapes. Rising popularity of open-air dining zones in semi-urban developments is also influencing product demand. Landscaping companies have diversified services to meet design demands from high-density city zones.

India’s outdoor living structure market is expected to record a CAGR of 8.1% between 2025 and 2035. Semi-urban and Tier II city demand is driving installations of budget-friendly gazebos, patios, and pergola roofs. Growth in holiday home ownership has increased structural enhancements around lawns and terrace zones.

Developers in residential townships are introducing modular garden elements to differentiate property value. Polycarbonate roofing, eco-treated bamboo, and thermoplastic composites are gaining acceptance due to local climate variations. Retail hardware and DIY sectors have expanded offerings to support self-installation needs. Resort and hospitality chains have begun retrofitting outdoor entertainment zones with modern tensile roofing and retractable seating options, impacting B2B adoption patterns.

Germany is anticipated to see a CAGR of 7.5% in its outdoor living structure market over the forecast period. The focus has shifted toward energy-efficient structures featuring retractable glass enclosures and insulated patio roofs. Regulations mandating outdoor design for multi-family residential blocks have boosted demand for space-efficient pergolas. Acoustic-enhancing and heat-retaining materials are being used more frequently to optimize usage during colder months.

The integration of outdoor kitchens and bio-climatic shelters in suburban developments has accelerated over the past two years. Design-build firms are emphasizing eco-certified modular components for new installations. Market activity is expanding beyond private residences into healthcare and educational premises, where landscaped courtyards are being retrofitted with semi-permanent structures.

The UK outdoor living structure market is projected to grow at a CAGR of 6.2% from 2025 to 2035. Consumer interest in weather-adaptable outdoor rooms has driven installations of retractable awnings, pergolas, and wind-rated patio covers. A growing number of residential properties are incorporating bioclimatic roofing systems and sliding glass walls to extend seasonal usability.

Retail brands have expanded prefabricated product lines tailored to limited garden spaces in urban locations. Regulatory efforts to promote residential energy optimization have spurred interest in solar-compatible canopies. The demand for light-framed timber pergolas has surged due to home office and leisure-related extensions. Partnerships between modular home manufacturers and landscaping solution providers are also influencing unit sales.

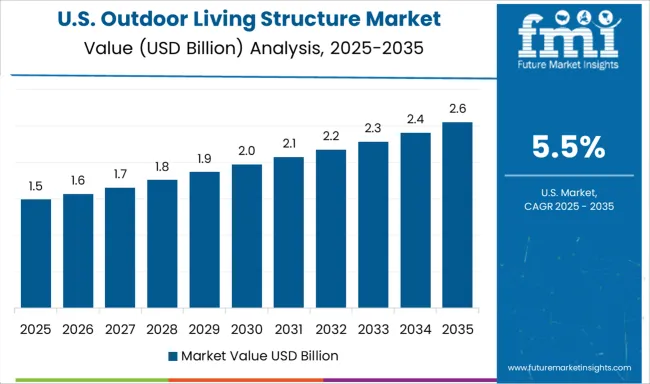

The USA outdoor living structure market is estimated to register a CAGR of 5.5% during 2025 to 2035. Demand is being driven by suburban home renovations where covered patios, sunrooms, and pergolas are being added to enhance property utility. Interest in staycation-oriented outdoor upgrades surged post-2020 and has remained strong across high-income counties.

Timber-framed pavilions, steel arbors, and insulated roof systems are increasingly selected in climate-variant states. Custom outdoor kitchens and fireplace-ready patios are influencing design specifications. The rise of smart automation systems, including retractable roofing and lighting integrations, is shaping premium segment growth. Builders are favoring galvanized steel framing due to longevity and wind load compliance in hurricane-prone zones.

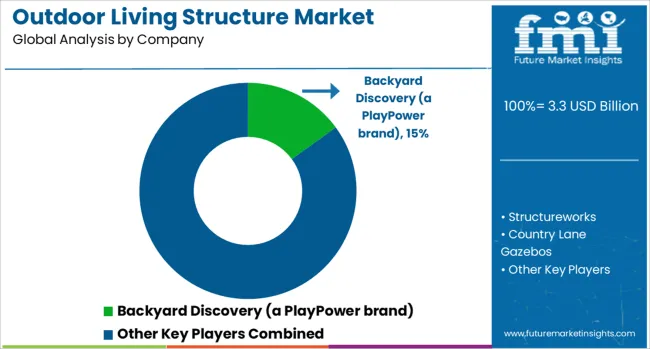

The outdoor living structure market comprises manufacturers of pergolas, gazebos, pavilions, sunrooms, and patio covers, primarily targeting residential landscapes and recreational spaces. Backyard Discovery, part of PlayPower, offers modular wood and steel structures with DIY-friendly assembly and weather-resistant finishes, catering to North American homeowners.

Structureworks specializes in commercial-grade aluminum and fiberglass pergolas for hospitality and institutional clients, emphasizing design flexibility and custom engineering. Country Lane Gazebos focuses on handcrafted wood and vinyl structures, supplying premium Amish-built units across the USA with dealer-supported distribution. The Vinyl Outlet targets the Northeast USA with custom-designed, low-maintenance outdoor vinyl structures, while TEMO Sunrooms Inc. delivers insulated patio enclosures and pergolas with engineered roof panels.

Yardistry Limited supplies pre-cut wooden kits through major retail channels like Costco and Home Depot, appealing to consumers seeking upscale DIY upgrades. Palram manufactures polycarbonate patio covers and garden structures optimized for harsh weather conditions and UV resistance. Sunjoy Group exports metal-framed gazebos and canopies with integrated netting and LED features for seasonal outdoor use. The market remains competitive through ease of installation, durable material combinations, and retail partnerships. Growth is driven by rising interest in outdoor entertainment and garden-based home enhancement.

Demand grew for pergolas, gazebos, and pavilions equipped with integrated lighting, fans, and outdoor kitchens.

Builders introduced modular and customizable structures to suit compact and large properties. In North America, new residential construction favored permanent patios and wall-mounted pergolas, while Asia-Pacific saw rising adoption in urban homes. Consumers focused on aesthetics, comfort, and property value, driving sales of premium, weather-resistant materials and tech-enabled outdoor systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Type | Pergola, Gazebo, Pavilion or ramada, Greenhouses, Arbor, and Others |

| Material | Wood, Steel, Aluminum, Vinyl, and Others (fiberglass, etc.) |

| End-use | Residential and Commercial |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Backyard Discovery (a PlayPower brand), Structureworks, Country Lane Gazebos, The Vinyl Outlet, TEMO Sunrooms Inc., Yardistry Limited, Palram, and Sunjoy Group |

| Additional Attributes | Dollar sales by structure type (gazebos, pergolas, patios) and application (residential backyards, commercial resorts, hospitality), demand rising in luxury landscaping and wellness retreats, led by Asia‑Pacific with North America catching up, innovation in modular eco‑materials and smart shading. |

The global outdoor living structure market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the outdoor living structure market is projected to reach USD 6.2 billion by 2035.

The outdoor living structure market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in outdoor living structure market are pergola, gazebo, pavilion or ramada, greenhouses, arbor and others.

In terms of material, wood segment to command 42.0% share in the outdoor living structure market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Outdoor Boundary Vacuum Load Switch Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Commercial Grills Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Furniture Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Safety Locks Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Power Equipment Market Analysis Size and Share Forecast Outlook 2025 to 2035

Outdoor Toys Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Public Safety Market Growth Size, Demand & Forecast 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Outdoor Dining Table Market Trends - Growth & Forecast 2025 to 2035

Outdoor Bar Furniture Market

Outdoor Cat Houses & Furniture Market

Outdoor TV Market Analysis – Growth & Forecast 2022 to 2032

Outdoor Noise Barrier Market

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA