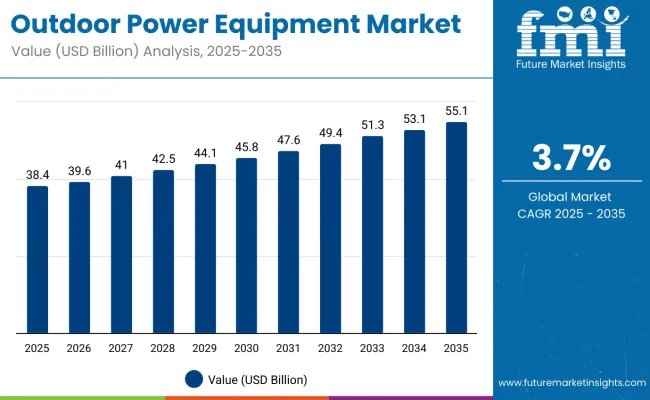

The global outdoor power equipment market is projected to grow from USD 38.4 billion in 2025 to approximately USD 55.1 billion by 2035. This represents an absolute value addition of USD 16.7 billion over the decade, reflecting a total increase of 43.5% and an expected CAGR of 3.7%. Market size is anticipated to grow by nearly 1.44X during the forecast period, driven by growing landscaping activities, electrification of garden tools, and expansion in residential and commercial green space maintenance.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 38.4 billion |

| Industry Size (2035F) | USD 55.1 billion |

| CAGR (2025-2035) | 3.7% |

Between 2025 and 2030, the outdoor power equipment market is projected to expand from USD 38.4 billion to USD 45.8 billion, adding USD 7.4 billion in value. This phase is expected to be led by rising homeowner interest in DIY landscaping and gardening, especially in North America and parts of Europe. Growth in battery-powered and low-emission equipment is also influencing replacement cycles for mowers, trimmers, and hedge cutters. Manufacturers are responding with modular platforms and app-based diagnostics to improve tool interoperability and user experience.

From 2030 to 2035, the market is projected to grow from USD 45.8 billion to USD 55.1 billion, registering a value addition of USD 9.3 billion. Demand will be reinforced by municipal investments in park maintenance and sports facility upgrades, along with commercial landscaping companies standardizing on robotic mowers and electric ride-on solutions. Regulatory trends toward noise and emission control in urban zones will continue to influence product development, especially for multi-purpose outdoor systems and autonomous equipment.

Between 2020 and 2025, the outdoor power equipment market expanded from USD 33.2 billion to USD 38.4 billion, recording an absolute growth of USD 5.2 billion. The period marked a transition from traditional gasoline-powered tools to electric and hybrid formats across key product categories such as lawn mowers, chainsaws, string trimmers, and snow blowers.

Lockdowns during 2020 and 2021 temporarily boosted residential landscaping demand as homeowners invested in lawn care and outdoor renovation, particularly in North America and parts of Europe. The demand gradually normalized by 2022, but the preference for battery-powered and noise-compliant equipment became more prominent.

Commercial buyers, especially landscaping firms and facility managers, began adopting zero-emission equipment to comply with evolving city ordinances and sustainability mandates. Manufacturers prioritized the development of brushless motors, modular battery platforms, and compact equipment with improved ergonomics to meet both residential and light commercial expectations.

The growth of the outdoor power equipment market is supported by rising demand for battery-powered tools, expanding urban landscaping projects, and stricter noise and emission regulations across developed and developing economies. The transition away from internal combustion engines is influencing both product development and procurement practices globally.

A key driver is the push toward sustainability and environmental compliance. Regulatory bodies in the United States, Europe, and parts of East Asia have introduced or proposed restrictions on gasoline-powered equipment, encouraging municipalities and commercial buyers to shift toward battery-electric alternatives. Residential users are increasingly choosing quieter, lighter, and low-maintenance products, accelerating the adoption of cordless tools for yard maintenance and gardening.

The market is also benefitting from improvements in lithium-ion battery performance, enabling longer runtime and faster charging, making battery-powered solutions more viable even for heavy-duty applications. Meanwhile, DIY trends and increased home ownership in suburban zones have expanded the user base of outdoor equipment, particularly in North America.

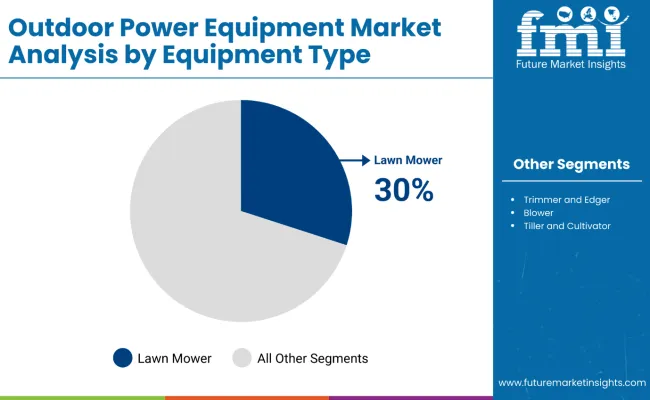

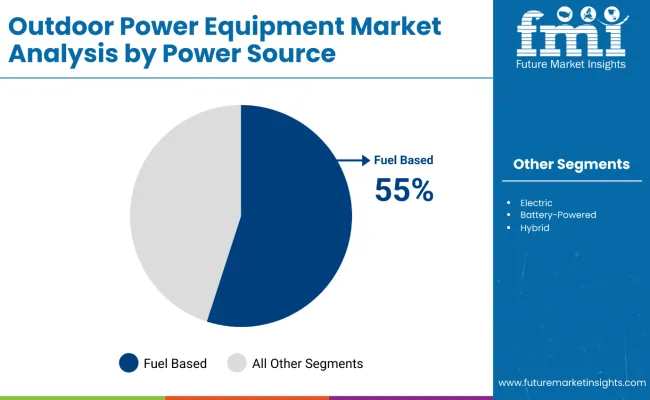

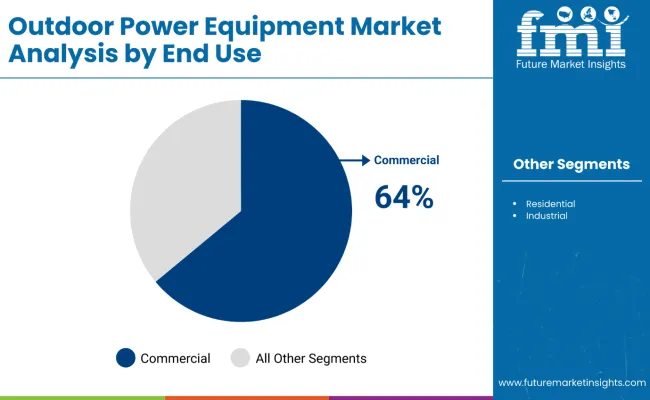

The market is segmented by equipment type into lawn mowers, chainsaws, trimmers and edgers, blowers, tillers and cultivators, snow throwers, and others, supporting a range of landscaping and outdoor maintenance functions. Power source segmentation includes fuel-based, electric, battery-powered, and hybrid systems, offering varying degrees of mobility, runtime, and emissions control. End-use categories are divided into commercial, residential, and industrial users, each exhibiting distinct procurement behavior based on operational intensity, budget constraints, and equipment lifecycle priorities.

Lawn mowers captured 30% of the market in 2025 and are projected to grow at a CAGR of 3.5% through 2035. Their widespread use in both residential and commercial lawn care continues to support consistent demand across developed regions. The segment benefits from broad product availability ranging from manual push mowers to robotic and ride-on variants.

Increasing emphasis on green space maintenance, particularly in municipalities and large real estate developments, has sustained volume demand. Features such as variable cutting height, GPS navigation, and noise reduction are being incorporated into newer models, particularly battery-powered ones, to appeal to eco-conscious buyers and commercial users alike.

Fuel-based outdoor equipment accounted for 55% of total sales in 2025, maintaining its lead due to high output suitability in intensive tasks. Despite regulatory pushback over emissions, gasoline-powered units remain widely used in commercial mowing, snow removal, and tilling due to their torque delivery and runtime flexibility. A CAGR of 3.1% is forecast for this segment through 2035, with demand being sustained in emerging economies and rural areas. However, urban restrictions and rising fuel costs are prompting a gradual shift toward battery-powered models, particularly in mid-size applications.

Commercial applications represented 64% of the overall outdoor equipment market in 2025 and are anticipated to expand at a CAGR of 3.6% over the forecast period. Landscaping contractors, municipalities, facility managers, and infrastructure developers are the primary consumers in this segment. Procurement cycles are typically driven by equipment durability, service support, and low total cost of ownership.

Increasing focus on labor efficiency, noise control, and sustainability is influencing equipment selection, particularly in high-use environments like parks, airports, and educational campuses. Electrification and automation are gradually being introduced to enhance performance metrics in this user category.

The outdoor power equipment market is witnessing significant transformation due to the convergence of environmental mandates, electrification trends, and digital integration. The shift from gas-powered to electric and battery-operated tools is altering both the consumer and commercial landscaping segments. However, price sensitivity, performance expectations, and runtime limitations continue to shape buying behavior across regions.

Battery Innovation Accelerates Market Penetration

The evolution of battery platforms is acting as a key enabler for the transition from gasoline to electric-powered outdoor equipment. Advancements in lithium-ion battery density, thermal management, and fast-charging capabilities are supporting broader deployment across lawnmowers, hedge trimmers, and leaf blowers. Manufacturers are increasingly offering modular battery packs that are compatible across tool ecosystems, reducing operational complexity and boosting convenience for residential users.

Commercial-grade battery-powered equipment is also gaining traction as runtimes improve beyond 60 minutes per charge, and dual-battery configurations become common. Additionally, energy efficiency gains and regenerative braking technologies are emerging in premium robotic lawnmowers and autonomous garden tools. These battery innovations are accelerating replacement cycles in mature markets and opening up opportunities in urban regions where fuel use is restricted.

Emission Regulations Drive Shift to Low-Noise, Electric Equipment

Stringent emission and noise regulations are compelling both municipalities and private property owners to transition toward electric outdoor equipment. In the United States, states like California have announced bans on gas-powered landscaping tools in public areas, while the EU continues to enforce limits on carbon emissions and decibel thresholds for equipment used in dense residential and urban zones.

Contractors and landscaping service providers are under pressure to adopt cleaner tools that align with environmental regulations and community noise ordinances. The demand for battery-operated and hybrid tools is growing in city parks, golf courses, school campuses, and healthcare facility grounds where quiet, emission-free operation is prioritized. This transition is being supported by incentive programs that subsidize equipment upgrades and offer tax relief for adopting electric models.

Cost Parity and Runtime Constraints Continue to Impact Adoption

Despite rapid innovation, electric outdoor equipment still faces challenges related to cost competitiveness and uninterrupted operational performance. Battery-powered models generally carry a higher initial purchase price than gasoline variants, particularly in high-horsepower tools such as commercial mowers and snow blowers. For large property owners, municipalities, and commercial users, the cost of upgrading entire fleets remains a barrier, especially when factoring in charging infrastructure and battery replacement cycles.

Runtime limitations are also a constraint in high-duty-cycle operations like golf course maintenance or commercial landscaping, where continuous operation is needed for several hours a day. While dual-battery solutions and fast-charging stations are addressing this issue, the limitations in power delivery and torque for heavy-duty applications remain a restraint to full market conversion. As a result, a hybrid procurement model mixing electric for light-duty and gasoline for heavy-duty continues to prevail in many organizations.

Integration of Smart Features Enhances Product Appeal

The incorporation of IoT and smart connectivity into outdoor power equipment is emerging as a key differentiator in both consumer and professional segments. Equipment with app-based control, remote diagnostics, performance tracking, and anti-theft systems is being increasingly favored by users looking for better control, efficiency, and asset protection. Fleet managers in commercial landscaping businesses are using telemetry-enabled tools to monitor usage hours, battery status, and maintenance schedules in real time.

For residential users, robotic mowers with intelligent scheduling, boundary mapping, and weather-responsive features are growing in popularity, particularly in Europe and North America. These smart capabilities are enabling automation of routine landscaping tasks, reducing manual labor and improving outcomes.

| Countries | Share (2025) |

|---|---|

| Germany | 19% |

| UK | 16% |

| Russia | 15% |

| France | 9% |

| Italy | 9% |

| Spain | 8% |

| BENELUX | 4% |

| Rest of Europe | 20% |

| Countries | Share (2035) |

|---|---|

| Germany | 18% |

| UK | 15% |

| Russia | 13% |

| France | 10% |

| Italy | 10% |

| Spain | 9% |

| BENELUX | 5% |

| Rest of Europe | 20% |

The outdoor power equipment market in Europe is forecast to grow from USD 9.1 billion in 2025 to USD 11.6 billion by 2035, registering a CAGR of 2.6%. Germany continues to lead the region, although its market share is projected to decline slightly from 19% to 18% as growth stabilizes in its mature consumer base. The UK follows with a share adjustment from 16% to 15%, influenced by a more competitive aftermarket and increased imports.

Russia’s share is expected to drop from 15% to 13%, reflecting slower economic activity and constrained investment in residential landscaping. France and Italy are projected to gain ground, each increasing their share by 1%, supported by strong consumer adoption of electric lawn and garden tools and local manufacturing initiatives. Spain and BENELUX are also set for modest gains.

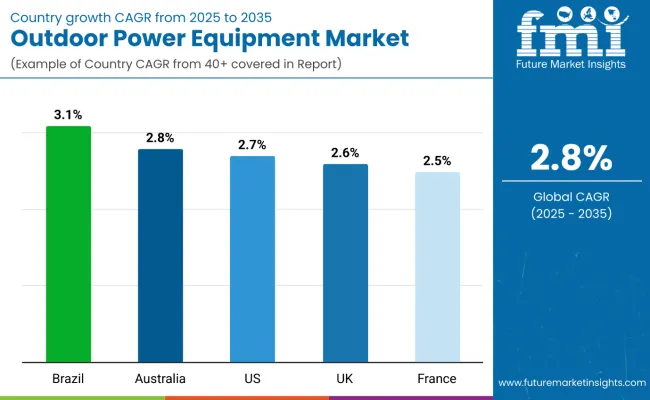

Brazil is projected to grow at a CAGR of 3.1%, the highest among the five countries shown. Residential gardening is expanding due to increased housing activity in urban peripheries. Public landscaping initiatives in medium-sized cities are also supporting equipment deployment in parks and municipal gardens.

Australia is expected to grow at 2.8% CAGR, supported by strong demand from hobby farmers, semi-urban homeowners, and aged care landscaping contractors. Electric and cordless tools are gaining traction as noise ordinances tighten in residential suburbs.

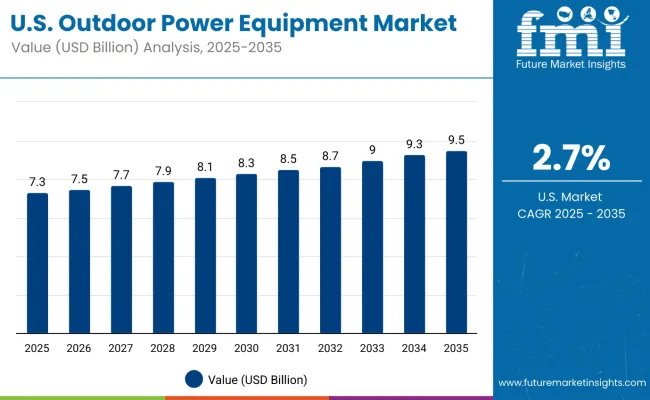

The USA outdoor power equipment market is projected to grow at a CAGR of 2.7%, with steady purchases from homeowners and service professionals. Robotic mowers, smart irrigation controllers, and cordless chainsaws are showing increased adoption.

The UK is anticipated to grow at 2.6% CAGR, with a notable focus on emission-compliant equipment for use in city parks and recreational areas. There is growing interest in compact, quiet electric tools among residential users with limited space.

France is forecast to register a 2.5% CAGR, with demand sustained by both public sector procurement and consumer purchases in suburban communes. Government focus on green urban areas and rising preference for robotic lawn mowers are influencing trends.

Gasoline-based equipment is estimated to represent 40% of total sales in 2025, sustained by its dominance in high-torque lawn mowers, trimmers, and blowers. Battery-powered tools are expected to account for 30%, supported by growing urban demand, emissions regulations, and convenience-led preferences. Electric (corded) tools maintain a 25% share due to lower operational costs and niche usage in fixed landscaping operations. Hybrid power systems, though limited, contribute around 5%, primarily in premium or large-area applications.

Landscaping contractors, facility managers, and municipal service providers are investing in performance tools with reliability and extended runtimes. The residential segment is close behind with a 40% share, driven by expanding suburban housing and DIY culture. Industrial users hold a 15% share, with applications spanning construction site cleanup, facility maintenance, and heavy brush clearance.

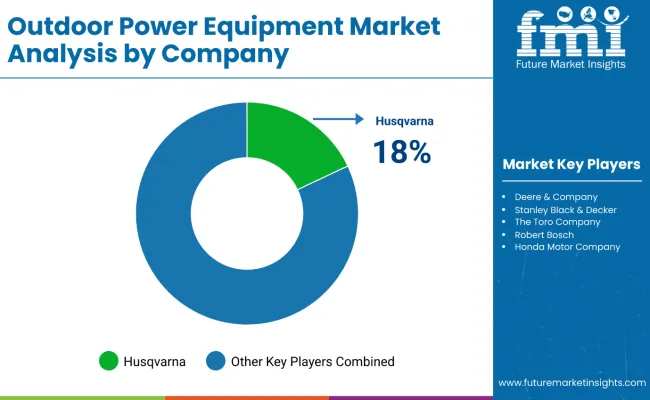

Competition in the outdoor power equipment market is intensifying as players expand portfolios with high-performance and electric solutions. New product launches are addressing the needs of professional landscapers and commercial users, offering enhanced power, durability, and user comfort. The integration of advanced battery systems, smart fleet management, and zero-emission capabilities is gaining traction, reflecting the shift toward sustainable operations.

Companies are investing in innovation to differentiate offerings across chainsaws, blowers, trimmers, and commercial-grade mowers. The market is being shaped by the combination of performance-driven upgrades, electrification trends, and technology-enabled fleet solutions, creating a highly competitive landscape focused on efficiency and sustainability.

| Item | Value |

|---|---|

| Quantitative Units | USD 38.4 Billion (2025) |

| Equipment Type | Lawn Mowers, Saws (Chainsaws), Trimmers and Edgers , Blowers, Tillers and Cultivators, Snow Throwers, Others |

| Power Source | Fuel Based (Gasoline-powered), Electric, Battery-powered, Hybrid |

| End Use | Commercial, Residential, Industrial |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, China |

| Key Companies Profiled | Husqvarna Group, Honda Motor Co. Ltd., STIHL Group, Briggs & Stratton LLC, Deere & Company, Robert Bosch GmbH, MTD Products Inc., Stanley Black & Decker Inc., The Toro Company, Makita Corporation |

The global outdoor power equipment market is estimated to be valued at USD 38.4 billion in 2025.

The market is projected to reach approximately USD 55.1 billion by 2035.

The market is expected to grow at a CAGR of 3.7% between 2025 and 2035.

Lawn mowers are projected to remain the leading equipment category due to high demand from both residential and commercial end users.

Battery-powered tools are witnessing rapid growth driven by increased adoption in noise-sensitive urban zones and sustainability efforts.

Key companies include Husqvarna, Honda, STIHL, Briggs & Stratton, Bosch, Toro, and Stanley Black & Decker, among others.

The market is segmented into commercial, residential, and industrial applications, with commercial holding the largest share.

Asia Pacific, led by China and India, is expected to offer significant growth opportunities due to increasing urbanization and landscaping activities.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Compact Power Equipment Rental Market Growth - Trends & Forecast 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Power Equipment Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Pet Backpack Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Boundary Vacuum Load Switch Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA