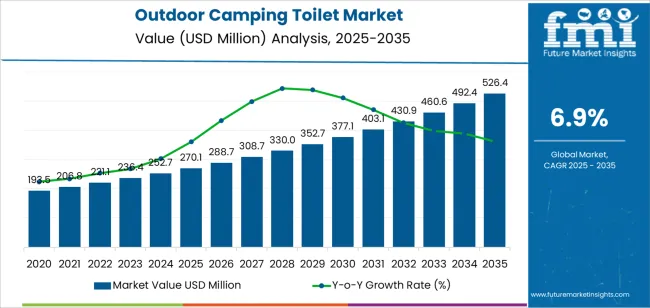

In 2025, the global outdoor camping toilet market is valued at USD 270.1 million and is projected to reach USD 526.5 million by 2035, indicating a CAGR of 6.9% and producing an absolute dollar opportunity of USD 256.4 million. Demand growth in the early years reflects increasing participation in recreational camping, greater use of portable sanitation products, and expanding outdoor tourism infrastructure across multiple regions.

Between 2025 and 2030, the market experiences a clear acceleration phase, supported by rising outdoor activity trends and broader adoption of lightweight, easy-to-clean toilet units. Product upgrades such as stronger waste-sealing mechanisms and improved carrying designs help lift year-over-year growth rates through this period.

From 2030 to 2033, the market enters a moderate acceleration pattern, with growth still moving upward but beginning to level as penetration increases in established camping markets. After 2033, growth shifts toward a deceleration phase, driven by maturing demand in North America and Europe and a gradual transition to replacement-driven sales. Even so, consistent product innovation, expanding recreational facilities, and increasing interest in off-grid travel continue to support market progression through 2035.

Between 2025 and 2030, the Outdoor Camping Toilet Market increases from USD 270.1 million to USD 403.1 million, placing the sector within the Late Growth Stage of the maturity curve. Annual unit demand rises from roughly 330.0 thousand to 403.1 thousand units, supported by expanding outdoor recreation participation, higher campsite occupancy rates, and increased adoption of portable sanitation solutions for RVs, off-grid cabins, and long-distance hiking. Product preference shifts toward units with 10-20 L waste capacity, improved sealing systems to limit odor release, and lightweight composites below 6.5 kg for enhanced portability. By 2030, more than 58 % of new purchases originate from recreational users, while commercial operator’s campgrounds, rental services, and tour companies drive structured fleet upgrades based on hygiene standards and usage durability.

From 2030 to 2035, the market advances from USD 403.1 million to USD 526.5 million, transitioning into the Early Maturity Stage of the adoption lifecycle. Unit demand rises to 526.5 thousand, with growth increasingly driven by replacement cycles as users shift to models featuring reinforced polypropylene shells, upgraded flush mechanisms, and chemical-efficient waste treatment cartridges. Long-distance overlanding, event-based outdoor activities, and guided expedition operators account for a larger share of recurring purchases. Technological improvements focus on leak-resistant valves, higher structural load capacity above 150 kg, and modular waste canisters that reduce maintenance time. Regional production expansion across Asia-Pacific and Eastern Europe contributes 11-13 % of new supply capacity, while late adopters’ rural households, small lodges, and eco-camp operators-increase uptake as sanitation standards rise across outdoor recreation markets.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 270.1 million |

| Market Forecast Value (2035) | USD 526.5 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

Demand for outdoor camping toilets is increasing as more households participate in camping, overlanding, hiking, and remote travel where access to formal sanitation is limited. Portable toilets provide controlled waste containment, improving hygiene and reducing environmental impact in parks and dispersed camping areas. Manufacturers offer lightweight designs using durable plastics, biobased bags, and simplified sealing mechanisms to support easy transport and odor control. Growth in RV travel and car-camping trends reinforces adoption of compact flush and dry toilet systems that fit within small vehicles or tents. Public land agencies promote responsible waste management, encouraging campers to use pack-out solutions instead of improvised methods. These factors drive steady demand across North America, Europe, and expanding adventure-tourism regions.

Market expansion is also supported by the need for dependable sanitation during festivals, disaster relief, and temporary work camps. Users prioritize stable seating, leak-resistant waste chambers, and quick-change liners that reduce handling time. Manufacturers refine venting pathways, biodegradable waste-gel packets, and locking lids to improve odor suppression and user comfort. E-commerce channels increase access for first-time campers and small outfitter businesses seeking durable, low-maintenance options. Although storage space and disposal logistics remain barriers for some buyers, ongoing improvements in collapsible structures, lightweight polymers, and integrated privacy enclosures expand usability. As outdoor recreation broadens across diverse age groups and environments, portable toilets remain essential for safe, environmentally responsible sanitation in remote settings.

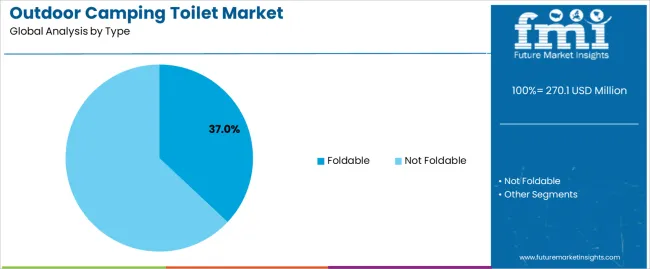

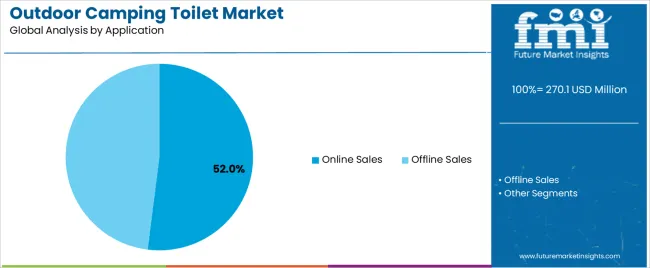

The outdoor camping toilet market is segmented by type, application, and region. By type, the market is divided into foldable and not foldable models. Based on application, it is categorized into online sales and offline sales. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differences in portability expectations, purchasing habits, and regional outdoor recreation trends that influence product selection and sales patterns.

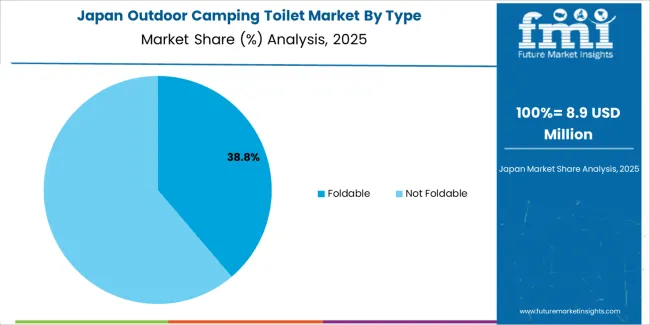

The foldable segment accounts for approximately 37.0% of the global outdoor camping toilet market in 2025, making it the leading type category. This position is supported by the segment’s suitability for lightweight travel, compact packing, and flexible campsite use. Foldable units appeal to users seeking portable sanitation options for hiking, car camping, and temporary outdoor setups where storage capacity and gear weight matter. Their structures typically rely on simple locking frames and collapsible panels that allow quick assembly and disassembly while retaining basic stability for short-duration use.

Manufacturers refine these products with reinforced joints, easy-wash surfaces, and liners designed for predictable waste containment. Adoption is strong among recreational users in North America and Europe, where camping activities often involve frequent site movement or limited vehicle space. Foldable toilets also suit public-land areas with minimal infrastructure, creating recurring demand among seasonal campers. Their convenience, combined with compatibility with disposable bags or compact waste cartridges, supports steady use in environments where long-term installation is not feasible. The foldable category maintains its lead because it offers portable functionality, simple maintenance, and storage advantages valued by users managing limited space and variable outdoor conditions.

The online sales segment represents about 52.0% of the total outdoor camping toilet market in 2025, making it the dominant application category. Its leadership stems from the broad availability of product variations offered through e-commerce platforms, where buyers can compare features, portability, and material durability across multiple brands. Online channels support detailed product information, which helps consumers evaluate load capacity, folding mechanisms, and waste-containment options before purchase.

Growth is reinforced by the expansion of outdoor recreation markets in North America, Europe, and East Asia, where e-commerce forms a primary purchasing pathway for camping gear. Retail platforms provide access to niche models that are not always stocked in local stores, enabling users to select toilets matched to specific pack sizes or campsite conditions. Online sales also benefit from frequent promotional cycles and bundled accessory offerings, which encourage higher-volume purchasing among new campers preparing gear kits. Manufacturers support these channels with standardized packaging suited for direct shipment and clear assembly documentation. The online sales segment continues to lead because its convenience, product variety, and broad availability align with the purchasing behavior of both occasional and frequent outdoor users.

The outdoor camping toilet market is expanding as recreational camping, overlanding and remote travel increase across regions. Users seek portable sanitation solutions that offer hygiene, ease of setup and waste-containment reliability away from established facilities. Growth is supported by rising participation in RV travel, car camping and guided outdoor activities. Demand also benefits from stricter campsite waste-management rules. Adoption is limited by price sensitivity, variability in product durability and reluctance among some users to manage waste disposal. Manufacturers are introducing lighter materials, improved sealing systems and compact folding designs to meet diverse outdoor conditions.

Demand increases as more households engage in weekend camping, remote touring and off-grid stays. Campsites without restrooms require portable toilet options that maintain hygiene and limit environmental impact. RV and van-conversion users often add compact toilets to support multi-day travel. Growing awareness of Leave No Trace practices also encourages adoption of contained waste-management solutions. These factors collectively strengthen the market for portable toilets that are reliable, simple to transport and suited to various outdoor setups.

Adoption remains limited by cost concerns, particularly for units with flushing features or chemical cartridges. Some users prefer improvised or low-cost alternatives, reducing willingness to invest in dedicated portable systems. Handling and disposal of waste can be uncomfortable for inexperienced campers, affecting purchase decisions. Durability issues in low-grade plastics and variations in sealing performance limit repeat use. Storage space in small vehicles also restricts adoption among minimal-gear campers. These practical constraints slow market penetration despite growing recreational activity.

Key trends include collapsible or fold-flat designs that reduce storage requirements, stronger sealing lids to prevent odour escape and bio-based waste-treatment packets that reduce chemical use. Manufacturers are producing lightweight units suited for backpacking as well as larger, more stable models for vehicle-based camping. Interest is increasing in reusable liners and simplified cleaning features. Demand for rugged, hard-shell toilets is rising among overlanding and expedition users. As outdoor recreation diversifies, camping toilet designs continue shifting toward portability, durability and easier waste-handling solutions.

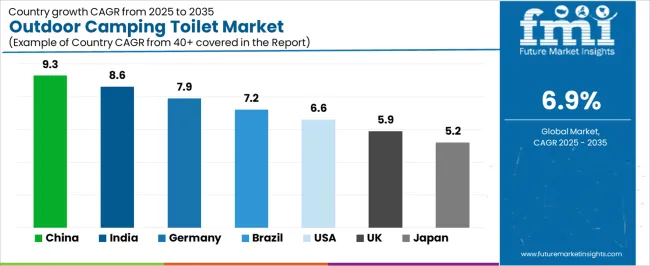

| Country | CAGR (%) |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| Brazil | 7.2% |

| USA | 6.6% |

| UK | 5.9% |

| Japan | 5.2% |

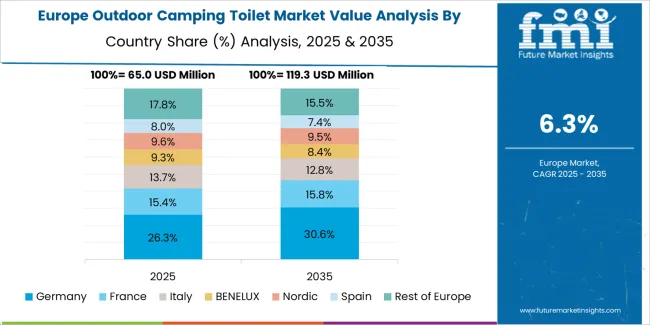

The Outdoor Camping Toilet Market is expanding rapidly worldwide, with China leading at a 9.3% CAGR through 2035, fueled by growing outdoor recreation activities, increased adoption of portable sanitation solutions, and strong manufacturing capability. India follows at 8.6%, driven by rising interest in adventure tourism, expanding disposable incomes, and demand for affordable portable hygiene products. Germany records 7.9%, reflecting high camping participation rates, strict hygiene standards, and preference for durable, eco-friendly toilet systems. Brazil grows at 7.2%, supported by expanding outdoor leisure activities and improved availability of portable sanitation products. The USA, at 6.6%, remains a mature market influenced by RV culture and innovation in compact designs, while the UK (5.9%) and Japan (5.2%) focus on lightweight, high-quality, and environmentally friendly camping toilet solutions.

China is projected to grow at a CAGR of 9.3% through 2035 in the outdoor camping toilet market. Growth in recreational vehicle ownership, expanding camping parks, and rising outdoor tourism participation increase demand for portable sanitation units. Manufacturers develop compact tanks, reinforced seals, and odor-control systems suitable for varied climates. Retailers expand product lines across online marketplaces, improving consumer access in multiple regions. Public outdoor facilities require rugged, easy-to-service models supporting predictable maintenance schedules. Advancements in lightweight materials and collapsible components improve mobility for remote travel. Demand aligns with national interest in organized camping activities and multi-day outdoor journeys.

India is forecast to grow at a CAGR of 8.6% through 2035 in the outdoor camping toilet market. Expanding adventure tourism, rising camp-site developments, and increasing group travel activities drive interest in portable toilet units. Local manufacturers produce durable tanks, simplified flushing modules, and compact waste compartments. Distribution networks support sales across mountain regions, coastal zones, and forest destinations. Rental operators servicing trekking groups and tour operators increase procurement. Consumer preference for lightweight, foldable, and easy-clean options shapes product design. Market activity aligns with national travel patterns favoring weekend camping, road trips, and seasonal adventure events across multiple states.

Germany is expected to expand at a CAGR of 7.9% through 2035 in the outdoor camping toilet market. Demand rises as caravanning, motorhome travel, and structured camping facilities become more widely adopted. Manufacturers emphasize odor-control reliability, durable housings, and easy-service components meeting regional safety expectations. Retailers supply compact cassette units favored by motorhome owners. Interest in multi-day cycling tours and remote cabin stays increases purchases of lightweight portable systems. Campsite operators procure high-capacity models designed for predictable maintenance. Engineering improvements in seals and flushing components ensure longer service life under varied European conditions across both family camping and organized outdoor activities.

Brazil is projected to grow at a CAGR of 7.2% through 2035 in the outdoor camping toilet market. Expanding eco-tourism zones, coastal camping areas, and river-tour activities increase demand for portable sanitation. Manufacturers supply corrosion-resistant tanks and stable bases designed for humid regions. Retail channels distribute compact models suitable for remote Amazon destinations and long-distance vehicle travel. Operators of hiking trails and guided expeditions prioritize durable units with simplified cleaning. Rising interest in weekend camping supports steady consumer purchasing. Partnerships between outdoor-gear suppliers and rental companies broaden product availability across diverse terrain. Market expansion aligns with tourism growth in natural regions.

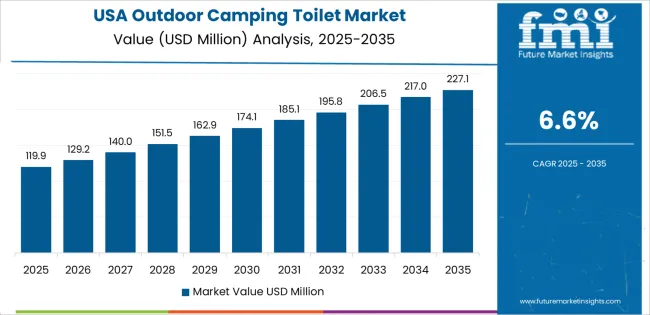

USA is forecast to grow at a CAGR of 6.6% through 2035 in the outdoor camping toilet market. Rising participation in national-park camping, off-grid travel, and recreational vehicle touring drives consistent demand. Manufacturers design heavy-duty bases, leak-resistant tanks, and compact flushing mechanisms suited for repeated use. Retailers expand offerings for van-conversion owners and overlanding groups. Seasonal demand peaks during long-distance travel periods across federal and state parks. Operators of guided outdoor programs procure rugged units that support predictable maintenance. Growing interest in lightweight gear influences product development across consumer categories. Market adoption aligns with expanding participation in extended outdoor trips nationwide.

UK markets are projected to grow at a CAGR of 5.9% through 2035 in the outdoor camping toilet market. Demand rises as coastal camping, motorhome touring, and organized walking routes gain traction across national regions. Manufacturers improve compact designs, reinforced waste compartments, and leak-resistant components suited to varied weather conditions. Campsite operators adopt larger units for seasonal visitor peaks. Outdoor retailers expand portable models appealing to car campers and hikers. Interest in short-duration trips and countryside weekends strengthens demand. Product development focuses on reduced weight and durable fittings. Market growth aligns with increasing participation in structured and independent camping activities.

Japan is expected to grow at a CAGR of 5.2% through 2035 in the outdoor camping toilet market. Interest in lightweight camping gear, compact vehicle travel, and organized outdoor programs increases procurement of portable toilets. Manufacturers emphasize small form factors, stable bases, and reliable odor-control features suited for dense urban storage constraints. Retailers expand sales targeting car-camping groups and multi-day hikers. Outdoor service operators in mountainous regions require robust units capable of repeated deployment. Consumers prioritize reliability and ease of cleaning. Market expansion aligns with national interest in short-duration camping, road-tRIP travel, and remote nature recreation across varied landscapes.

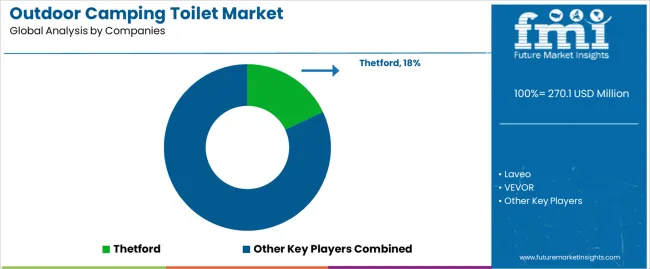

The global outdoor camping toilet market shows moderate fragmentation, shaped by manufacturers producing portable sanitation systems for camping, overlanding, boating, and emergency-use environments. Thetford maintains a strong position with flush-type and chemical portable toilets recognized for durability and ease of service. Laveo and VEVOR strengthen the segment with self-contained and power-assisted units designed for odor control and minimal maintenance.

Dometic Group and Camco support a wide user base through lightweight molded-plastic designs suited for recreational vehicles and general outdoor use. Wrappon, Cleanwaste, and Joolca contribute specialized approaches emphasizing waste-sealing mechanisms, rapid setup, and compatibility with off-grid conditions where water supply is limited. Competition in this tier is shaped by reliability, portability, and waste-capacity efficiency.

Kohree, TRIPTIPS, Wakeman, and Outsmart Gadgets add mid-range offerings intended for casual campers and short-duration travel, focusing on compact form factors and simplified cleaning. Reliance Outdoors, Separett, and Stansport expand market diversity through composting, waterless, and ruggedized toilet systems tailored for extended outdoor stays.

Competition across this segment depends on odor-reduction performance, ease of emptying, and structural durability under repeated field use. Strategic differentiation relies on lightweight materials, integrated waste-management features, and the ability to function without external water or power sources. As outdoor recreation participation grows, manufacturers offering reliable, hygienic, and low-maintenance designs are positioned to secure long-term adoption across consumer and professional applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Foldable, Not Foldable |

| Application | Online Sales, Offline Sales |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Thetford, Laveo, VEVOR, Dometic Group, Camco, Wrappon, Cleanwaste, Joolca, Kohree, TRIPTIPS, Wakeman, Outsmart Gadgets, Reliance Outdoors, Separett, Stansport |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across key outdoor recreation markets, competitive landscape of portable sanitation system manufacturers, design and material innovations (odor control, sealing systems, lightweight polymers), replacement-driven demand cycles, integration with RV, overlanding, hiking, and emergency-use sanitation setups |

The global outdoor camping toilet market is estimated to be valued at USD 270.1 million in 2025.

The market size for the outdoor camping toilet market is projected to reach USD 526.4 million by 2035.

The outdoor camping toilet market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in outdoor camping toilet market are foldable and not foldable.

In terms of application, online sales segment to command 52.0% share in the outdoor camping toilet market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Outdoor Boundary Vacuum Load Switch Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Commercial Grills Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Furniture Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Safety Locks Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Power Equipment Market Analysis Size and Share Forecast Outlook 2025 to 2035

Outdoor Living Structure Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Toys Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Public Safety Market Growth Size, Demand & Forecast 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Outdoor Dining Table Market Trends - Growth & Forecast 2025 to 2035

Outdoor Bar Furniture Market

Outdoor Cat Houses & Furniture Market

Outdoor TV Market Analysis – Growth & Forecast 2022 to 2032

Outdoor Noise Barrier Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA