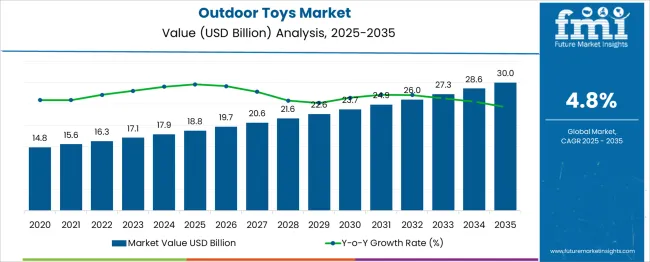

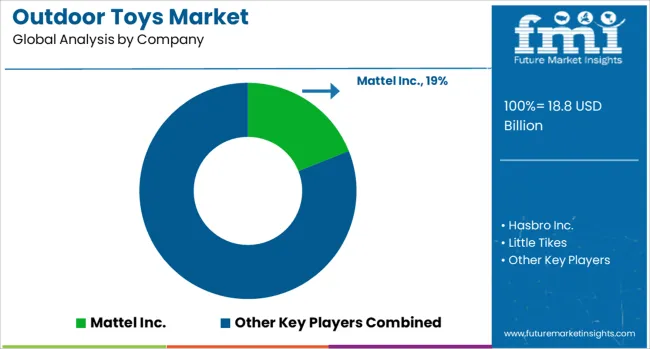

The Outdoor Toys Market is estimated to be valued at USD 18.8 billion in 2025 and is projected to reach USD 30.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period. This pattern indicates low elasticity in response to macroeconomic fluctuations. Traditional discretionary spending categories typically display higher sensitivity to inflation, interest rate cycles, or consumer sentiment. However, this market maintains predictable year-on-year expansion, suggesting resilience to external economic variables. Demand elasticity remains limited due to the sustained role of outdoor toys in child development, seasonal gifting, and wellness-related play.

While economic downturns may influence high-end or licensed product categories, core outdoor segments such as ride-ons, sports kits, and water play structures continue to register baseline demand. The market appears partially insulated from short-term income shocks and employment cycles. Demographic stability, school-age population size, and retailer promotions play a more influential role than macroeconomic volatility. Furthermore, value-tier offerings and non-branded products help maintain volume even under constrained household budgets. Based on the available data, the outdoor toys market shows low growth elasticity relative to macroeconomic indicators, supported by steady consumption behavior and broad product accessibility.

| Metric | Value |

|---|---|

| Outdoor Toys Market Estimated Value in (2025 E) | USD 18.8 billion |

| Outdoor Toys Market Forecast Value in (2035 F) | USD 30.0 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Outdoor Toys market is experiencing consistent expansion, driven by growing awareness around the importance of outdoor physical activity for children's development. This market has gained momentum as parents increasingly prioritize toys that promote physical health, motor skill development, and social interaction. Rising concerns about screen time and digital device exposure have further strengthened the demand for engaging outdoor alternatives.

Manufacturers have responded with innovations that focus on safety, durability, and age-appropriate functionality. The rising population of children in developing economies, coupled with increasing disposable income and urbanization, is creating a broader consumer base for outdoor toys. Seasonal sales cycles, especially during summer and festive periods, continue to support predictable growth patterns across regions.

Future outlook remains optimistic as sustainability trends, such as the demand for eco-friendly materials, are integrated into product design and packaging. This shift is expected to further boost brand differentiation and long-term customer retention in the global Outdoor Toys market..

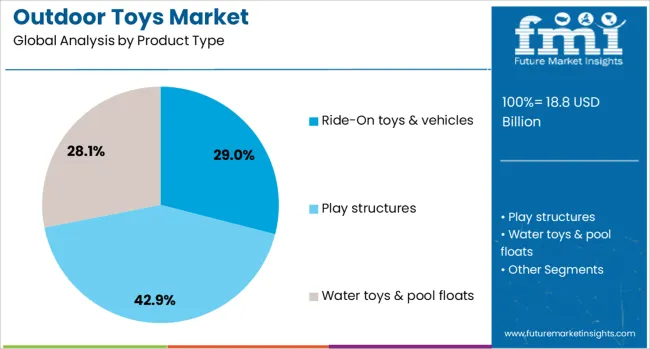

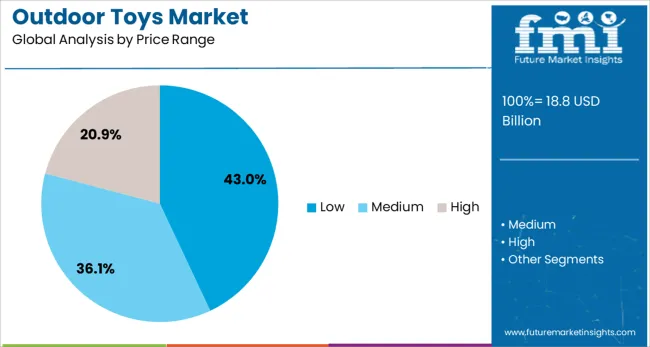

The outdoor toys market is segmented by product type, price range, age group, material, end use, distribution channel, and geographic regions. The outdoor toys market is divided by product type into Ride-On toys & vehicles, Play structures, Water toys & pool floats, Sporting equipment, and Others (trampolines, seasonal toys, etc.). The outdoor toys market is classified into Low, Medium, and High price ranges.

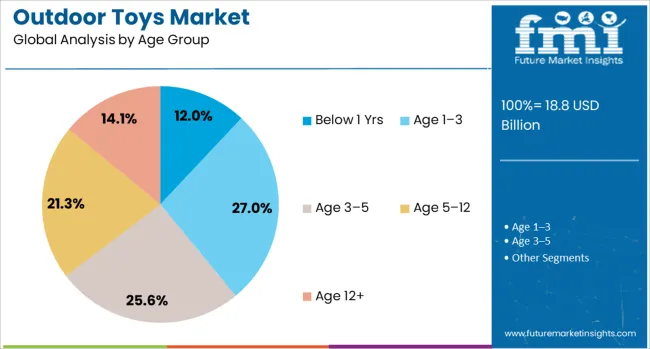

The outdoor toys market is segmented into the following age groups: Below 1 Yrs, Age 1–3, Age 3–5, Age 5–12, and Age 12+. The outdoor toys market is segmented by material into Plastic, Wooden, Metal, Fabric, and Biodegradable/organic material. The outdoor toys market is segmented by end use into Individual and Commercial. By distribution channel, the outdoor toys market is segmented into Online and Offline. Regionally, the outdoor toys industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ride-on toys and vehicles subsegment is projected to account for 29% of the Outdoor Toys market revenue share in 2025, positioning it as the leading product type. This dominance has been attributed to the increasing preference for toys that offer a blend of physical engagement and imaginative play. Ride-on toys and vehicles have gained popularity for supporting balance, coordination, and gross motor skill development in young children.

Their design versatility allows usage across multiple age groups, from toddlers to older children, enhancing their utility and longevity in households. In addition, the availability of themed and character-branded ride-on vehicles has enhanced their appeal among children, while the perceived developmental benefits have influenced parental buying decisions.

Manufacturers have also invested in product durability, safety features, and ergonomic design, making these toys a favored choice for outdoor environments. This has resulted in sustained demand across residential, institutional, and recreational spaces, reinforcing the segment's leadership position in the market..

The low price range subsegment is expected to hold a leading 43% share of the Outdoor Toys market revenue in 2025. This growth has been driven by the affordability and accessibility of outdoor toys within this pricing tier, especially in price-sensitive markets. The segment has gained traction as manufacturers expand their offerings in budget-friendly ranges without compromising on basic safety and quality standards.

Mass production, global sourcing, and cost-efficient materials have enabled competitive pricing, making these toys accessible to a larger demographic base. Seasonal promotions and discounts offered by both online and offline retailers have further supported volume sales in this category.

Parents seeking value-for-money options for rapidly growing children often prefer the low-price range, especially for toys with shorter usage cycles. As inflation concerns continue to impact consumer spending patterns, the low-price segment is expected to retain its dominance by delivering functional and entertaining products at scale..

The below 1 year age group is projected to register strong interest within the Outdoor Toys market in 2025. Although toys for this age category tend to be fewer in variety, demand has grown steadily as parents seek age-specific products that support early sensory and physical development.

Toys for infants below 1 year have been designed to ensure high safety standards, with non-toxic materials, rounded edges, and minimal assembly requirements. Increased emphasis on outdoor stimulation at an early developmental stage has encouraged caregivers to introduce outdoor play in controlled environments such as home gardens or daycare centers.

Market growth has also been supported by the rising popularity of gifts and early developmental toys during baby showers and milestone celebrations. As parenting trends evolve toward more proactive physical and cognitive engagement from infancy, the below 1 year segment is expected to see continued product innovation and expanding shelf presence across retail formats..

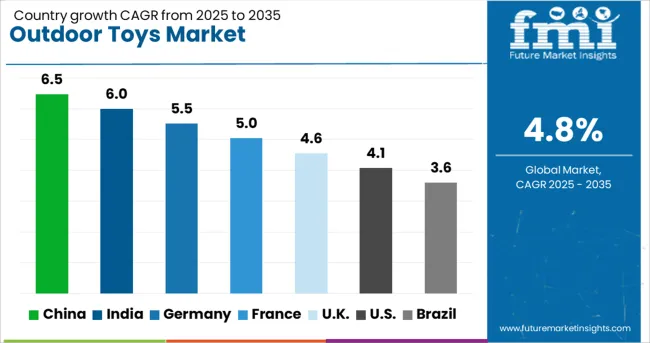

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global outdoor toys market is projected to grow at a CAGR of 4.8% between 2025 and 2035. China leads with a CAGR of 6.5%, growing 35% faster than the global average. India follows at 6.0%, outpacing the global rate by 25%, driven by its youthful population and increasing urban play infrastructure. Germany, with a 5.5% CAGR, grows 15% faster than the global average, reflecting consistent demand for premium products. The UK, at 4.6%, slightly trails the global rate, while the US, at 4.1%, grows approximately 14% slower than the global average. Stronger momentum in BRICS countries contrasts with more tempered expansion in OECD economies. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China accounted for a 6.5% share in 2025 due to increased parental spending on outdoor play equipment and a growing preference for physical activity in early childhood education. Local manufacturers in Guangdong and Zhejiang focused on mid-sized and large toy structures, including plastic slides, trampolines, and water play systems. Licensing of domestic cartoon characters enabled co-branded outdoor toy lines with greater appeal among preschoolers. UV-resistant and modular plastic materials were prioritized for durability under regional climate variations. Sales grew through online platforms, where JD.com and Tmall promoted bundled outdoor toy packages.

India posted a 6.0% share in 2025 as urban consumers shifted towards backyard-friendly outdoor toys. Sales were concentrated in tier 1 and tier 2 cities, where space constraints influenced demand for compact units like see-saws, balance boards, and portable swings. Indian manufacturers in Delhi NCR and Tamil Nadu used rotational molding and HDPE materials for lightweight, transportable toy sets. Toy rental startups in Mumbai and Bengaluru increased product rotation rates and exposure to imported designs. Government-led toy clusters also supported domestic component sourcing.

Germany held a 5.5% share in 2025, driven by strong demand for safety-certified wooden and hybrid material toys. Outdoor playhouses, climbing frames, and sandboxes were preferred by households with private gardens. Manufacturers prioritized TÜV-certified toys with eco-friendly coatings and anti-fall features. DIY kits and expandable play systems gained popularity through e-commerce. Suppliers in Bavaria and Saxony invested in CNC-based wood processing to produce pre-cut modular toy parts for easy assembly. Consumer preferences leaned toward non-toxic, splinter-free, and weatherproof units.

The United Kingdom accounted for a 4.6% share in 2025, with peak demand during spring and summer months. Households prioritized weather-resistant outdoor toys that could be disassembled or stored post-use. Telescopic climbing nets, pop-up tents, and multi-sport sets gained traction in suburban households. Retailers such as Argos and Smyths facilitated short-run promotions for branded outdoor toys from global franchises. Rising interest in inclusive play equipment led to broader product lines with balance-enhancing and adaptive features. Lightweight, easy-assembly outdoor toy models dominated warehouse-style retail outlets.

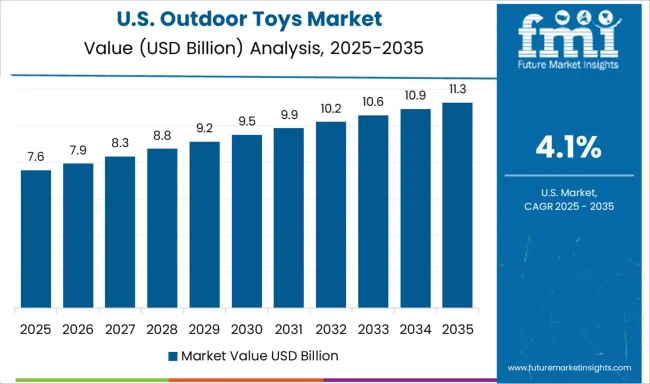

The USA posted a 4.1% market share in 2025, led by steady demand for weatherproof outdoor toys suitable for year-round use. Playsets with UV-protected plastic and galvanized steel components dominated consumer preferences. Backyard-based products such as splash pads, inflatable pools, and climbing towers gained relevance in states with warmer climates. Retailers like Walmart and Target promoted in-store pickup for bulky outdoor toy items. American manufacturers also introduced tech-augmented outdoor toys, including Bluetooth-enabled trampolines and interactive climbing walls.

The market is shaped by companies producing activity-based, ride-on, and play structure toys for children, targeting seasonal sales and long-term backyard use. Mattel Inc. offers outdoor play options through its Fisher-Price brand, including ride-on vehicles, water play tables, and toddler slides designed for motor skill development. Hasbro Inc. participates through Nerf-branded blasters and sports toys, emphasizing action-based group play and outdoor engagement. Little Tikes, owned by MGA Entertainment, dominates the outdoor plastic toy category with products like the Cozy Coupe®, sandboxes, and multi-functional playhouses made for durable backyard use. Step2 Company specializes in rotationally molded outdoor toys, offering large-format slides, water tables, and climbers designed for preschoolers, commonly sold through direct-to-consumer and retail channels. MGA Entertainment supports outdoor sales through themed inflatables, character-based splash toys, and water blasters linked to its IP-driven brands. Spin Master provides compact, kinetic outdoor toys such as flying discs, remote-controlled cars, and air-powered projectiles, focusing on portability and impulse purchase appeal. Competitive positioning depends on material durability, safety certification, weather resistance, ease of assembly, and alignment with seasonal play trends and character licensing strategies.

Between 2023 and 2025, the outdoor toys market evolved through product expansions, strategic partnerships, and feature-rich innovations from global and regional firms. Spin Master expanded offerings with kinetic sensory playsets and ride-on products under major franchise licenses. Simba Dickie Group introduced biodegradable water toys and wooden playhouses to diversify its outdoor range. Springfree-Trampoline launched app-connected trampolines with motion-sensor gamification to blend tech and active play. Brands like Hasbro and Mattel refreshed ride-on and blaster lines to capture crossover indoor-outdoor demand. New entrants developed interactive water blasters, splash pads, and RC toys tailored for summer engagement.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.8 Billion |

| Product Type | Ride-On toys & vehicles, Play structures, Water toys & pool floats, Sporting equipment, and Others (trampolines, seasonal toys, etc.) |

| Price Range | Low, Medium, and High |

| Age Group | Below 1 Yrs, Age 1–3, Age 3–5, Age 5–12, and Age 12+ |

| Material | Plastic, Wooden, Metal, Fabric, and Biodegradable/organic material |

| End Use | Individual and Commercial |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mattel Inc., Hasbro Inc., Little Tikes, Step2 Company, MGA Entertainment, and Spin Master |

| Additional Attributes | Dollar sales by toy type (playhouses, ride-ons, water toys) and application (backyard, poolside, playground), demand from families and hospitality sectors, led by Asia‑Pacific with North America catching up, innovation in durable eco‑materials and interactive smart play features. |

The global outdoor toys market is estimated to be valued at USD 18.8 billion in 2025.

The market size for the outdoor toys market is projected to reach USD 30.0 billion by 2035.

The outdoor toys market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in outdoor toys market are ride-on toys & vehicles, _bicycles, _scooters, _pedal cars, _others (electric ride-ons, etc), play structures, _swing sets, _climbing frames, _slides, _playhouses, water toys & pool floats, _pool noodles, _inflatable rafts, _water pistols, sporting equipment, _balls, _nets, _others (rackets, etc.) and others (trampolines, seasonal toys, etc.).

In terms of price range, low segment to command 43.0% share in the outdoor toys market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Outdoor Boundary Vacuum Load Switch Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Commercial Grills Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Kitchen Appliances Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Furniture Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Safety Locks Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Power Equipment Market Analysis Size and Share Forecast Outlook 2025 to 2035

Outdoor Living Structure Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Public Safety Market Growth Size, Demand & Forecast 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Outdoor Dining Table Market Trends - Growth & Forecast 2025 to 2035

Outdoor Bar Furniture Market

Outdoor Cat Houses & Furniture Market

Outdoor TV Market Analysis – Growth & Forecast 2022 to 2032

Outdoor Noise Barrier Market

Rental Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA