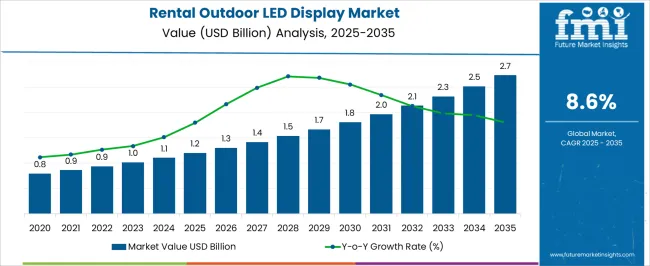

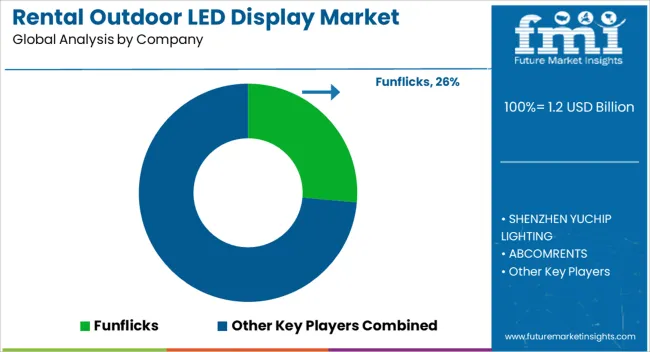

The Rental Outdoor LED Display Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

| Metric | Value |

|---|---|

| Rental Outdoor LED Display Market Estimated Value in (2025 E) | USD 1.2 billion |

| Rental Outdoor LED Display Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The Rental Outdoor LED Display market is experiencing significant growth due to the rising demand for large-scale visual solutions in events, advertising, and entertainment sectors. The market is being driven by rapid urbanization, growing live event culture, and increasing investments in digital infrastructure across both developed and emerging regions.

Advances in LED technology, including enhanced brightness, energy efficiency, and modular designs, have facilitated flexible deployments that can be scaled or relocated based on specific event requirements. Increasing adoption of rental models over ownership is being influenced by cost efficiency, reduced maintenance responsibilities, and the flexibility to access the latest technology without long-term investment.

Additionally, growing popularity of live concerts, sports events, and outdoor campaigns has accelerated the adoption of dynamic display solutions capable of delivering high-quality visuals under varying environmental conditions As production houses, event organizers, and advertising agencies prioritize audience engagement and immersive experiences, the Rental Outdoor LED Display market is positioned for continued expansion with opportunities in technology upgrades, content management solutions, and energy-efficient display systems.

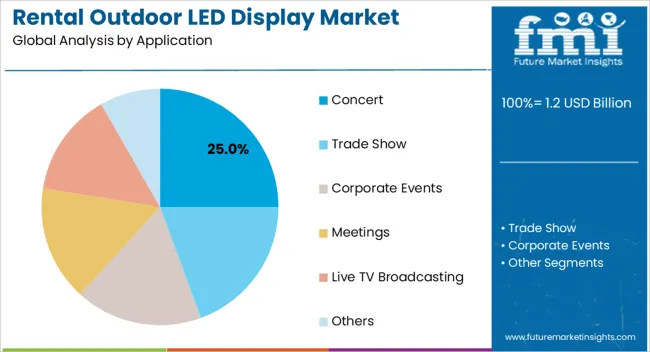

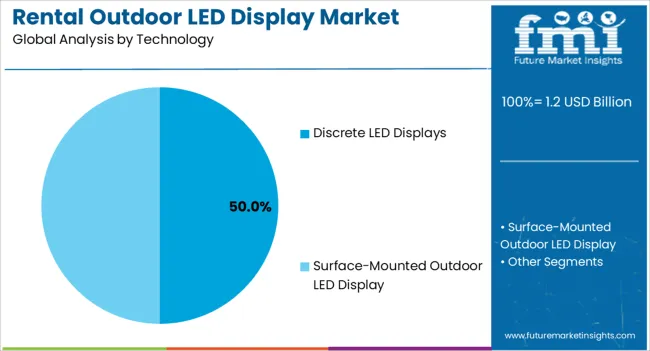

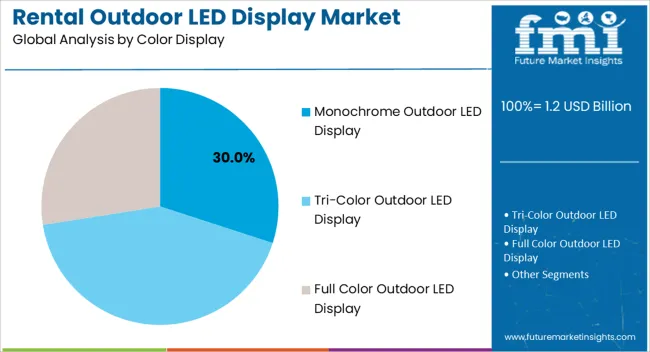

The rental outdoor led display market is segmented by application, technology, color display, and geographic regions. By application, rental outdoor led display market is divided into Concert, Trade Show, Corporate Events, Meetings, Live TV Broadcasting, and Others. In terms of technology, rental outdoor led display market is classified into Discrete LED Displays and Surface-Mounted Outdoor LED Display. Based on color display, rental outdoor led display market is segmented into Monochrome Outdoor LED Display, Tri-Color Outdoor LED Display, and Full Color Outdoor LED Display. Regionally, the rental outdoor led display industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The concert application segment is expected to hold 25.00% of the Rental Outdoor LED Display market revenue share in 2025, positioning it as a leading application area. This growth is being driven by the increasing number of large-scale music festivals, live performances, and cultural events requiring high-quality visual displays to enhance audience experience.

Demand has been further supported by the need for dynamic and customizable content that can be managed remotely, enabling event organizers to deliver engaging visuals in real time. The rental model has been particularly favored as it allows event planners to access state-of-the-art LED displays without incurring heavy upfront costs.

High-resolution, weather-resistant, and modular designs have also made these displays highly adaptable to diverse venues and crowd sizes As audience expectations for immersive and visually impactful experiences rise, the concert segment is projected to maintain a strong growth trajectory, leveraging software-controlled display systems and scalable hardware configurations to meet evolving requirements.

Discrete LED displays are projected to account for 50.00% of the total market revenue in 2025, emerging as the dominant technology segment. This leadership is being attributed to the superior brightness, durability, and energy efficiency offered by discrete LED modules, making them ideal for outdoor use in variable lighting conditions. Adoption has been driven by the ability to deliver uniform and high-quality visuals over large areas, coupled with low maintenance requirements and flexible configuration options.

Discrete LED displays are preferred for applications requiring precise color rendering, high contrast ratios, and reliable performance under continuous operation. The modular nature of these displays allows for easy installation, repair, and expansion, supporting the scalability demands of rental operations.

Furthermore, software-controlled calibration and content management capabilities enhance the value proposition of discrete LED technology, enabling real-time adjustments and seamless integration into dynamic events As event organizers and advertisers increasingly seek impactful outdoor displays, the discrete LED segment is expected to retain its leading position in the market.

The monochrome outdoor LED display segment is anticipated to hold 30.00% of the Rental Outdoor LED Display market revenue in 2025, making it a significant contributor to overall growth. This prominence is being influenced by the cost-effectiveness, simplicity, and durability of monochrome displays, which remain suitable for basic messaging, text-based information, and static signage in outdoor environments.

Monochrome displays require lower power consumption and offer longer operational life compared to full-color alternatives, making them attractive for rental providers aiming to maximize ROI while reducing maintenance and energy costs. Their ease of installation and compatibility with standard control systems further support adoption in event and advertising applications where dynamic visuals are not the primary focus.

Despite the growing popularity of full-color and high-definition displays, monochrome solutions continue to serve niche requirements effectively, particularly in scenarios where clarity, visibility, and operational efficiency are prioritized The segment is expected to sustain steady growth due to ongoing demand for functional, reliable, and low-cost outdoor LED solutions.

The rising importance of advertisements, promotions, marketing, and message displaying in the public areas is resulting into increasing demand for the rental outdoor LED displays to display the content. Rental outdoor LED displays are now a days in demand for displaying the content.

The term rental in ‘rental outdoor LED display‘ shows the availability of these outdoor LED displays on a rent for temporary basis. The rental outdoor LED displays are in demand now a days as they offer a brightness to the best possible high level and due to this features these displays are increasingly used.

The applications of rental outdoor LED displays are increasing rapidly now a days as these displays are very preferred outdoor displays for the billboards, store signs, and digital name plates in transport vehicles. Due to the large size and bright colors available in the rental outdoor LED displays, the demand for these displays from event organizer and also for conferences is increasing.

Rental outdoor LED display consists of LED - Light Emitting Diode displays which are a flat surface panel displays and uses a light emitting diodes for the displaying a video format content on a display. The rental outdoor LED display are made up of number of display panels and these every display consists of large number of light emitting diodes.

Rental outdoor LED displays are used increasingly for the instead of others as LED is more preferred than other technologies now a days.

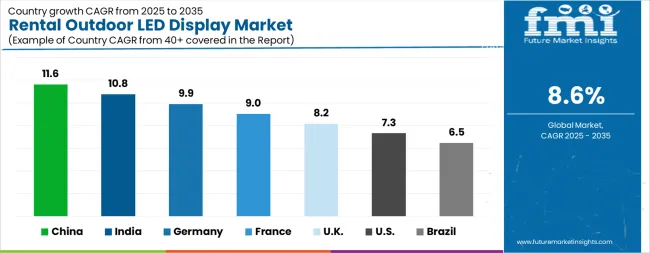

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9.0% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

The Rental Outdoor LED Display Market is expected to register a CAGR of 8.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.6%, followed by India at 10.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.5%, yet still underscores a broadly positive trajectory for the global Rental Outdoor LED Display Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.9%. The USA Rental Outdoor LED Display Market is estimated to be valued at USD 434.4 million in 2025 and is anticipated to reach a valuation of USD 879.6 million by 2035. Sales are projected to rise at a CAGR of 7.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 60.1 million and USD 36.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Application | Concert, Trade Show, Corporate Events, Meetings, Live TV Broadcasting, and Others |

| Technology | Discrete LED Displays and Surface-Mounted Outdoor LED Display |

| Color Display | Monochrome Outdoor LED Display, Tri-Color Outdoor LED Display, and Full Color Outdoor LED Display |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Funflicks, SHENZHEN YUCHIP LIGHTING, ABCOMRENTS, SHENZHEN LEDSINO OPTOELECTRONIC, Promosa, SW Event Technology, Fonix LED, Leyard Optoelectronic, Mobile LED, and ADI Group |

The global rental outdoor LED display market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the rental outdoor LED display market is projected to reach USD 2.7 billion by 2035.

The rental outdoor LED display market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in rental outdoor LED display market are concert, trade show, corporate events, meetings, live tv broadcasting and others.

In terms of technology, discrete LED displays segment to command 50.0% share in the rental outdoor LED display market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Monochrome Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

LED Modular Display Market

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Africa LED & OLED Market Report – Growth & Forecast 2016-2026

LED and OLED lighting Products and Display Market Size and Share Forecast Outlook 2025 to 2035

Standby Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Light Emitting Diode (LED) Backlight Display Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Pet Backpack Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

LED Solder Paste Market Size and Share Forecast Outlook 2025 to 2035

LED Digital Speed Limit Sign Market Size and Share Forecast Outlook 2025 to 2035

LED Light Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Boundary Vacuum Load Switch Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA