The LED and OLED lighting products and display market is witnessing strong growth driven by technological advancements and the increasing demand for energy-efficient, sustainable, and high-performance lighting solutions. The market outlook remains positive due to the rising adoption of OLED technology in displays and lighting applications, propelled by its superior color accuracy, flexibility, and thin form factor. Increasing awareness of energy conservation, coupled with government initiatives promoting efficient lighting systems, is further supporting market expansion.

The integration of LED and OLED technologies in smart devices, automotive lighting, and architectural applications is reshaping product innovation and competitiveness. Manufacturers are focusing on advanced materials, miniaturization, and improved luminous efficacy to enhance durability and efficiency.

The continuous evolution of display technologies in consumer electronics and the expansion of connected lighting solutions across residential and commercial spaces are also influencing long-term growth prospects As the global focus shifts toward sustainable illumination and premium display quality, the market is anticipated to experience steady and diversified growth.

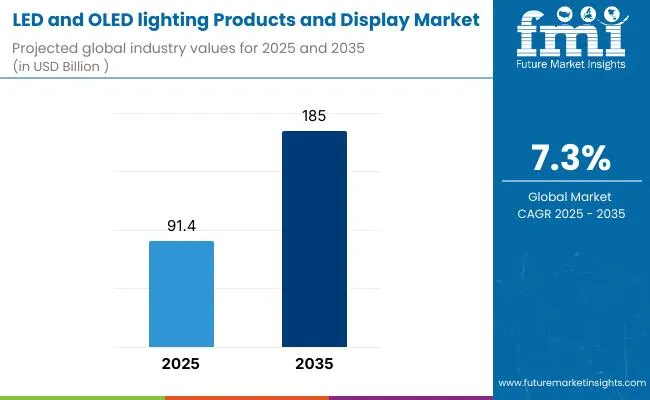

| Metric | Value |

|---|---|

| LED and OLED lighting Products and Display Market Estimated Value in (2025 E) | USD 91.4 billion |

| LED and OLED lighting Products and Display Market Forecast Value in (2035 F) | USD 185.0 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The market is segmented by Product, Application, and End Use and region. By Product, the market is divided into Mobile Display, Consumer Television Display, Outdoor LED Display, and Others. In terms of Application, the market is classified into Smartphones, Television, Tablet, Smartwatch, and Others. Based on End Use, the market is segmented into Residential and Commercial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

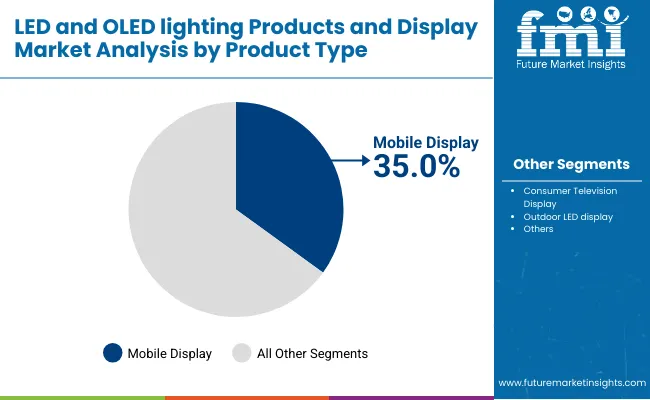

The mobile display segment is projected to hold 35.00% of the LED and OLED lighting products and display market revenue share in 2025, making it the leading product category. The dominance of this segment is driven by the surging demand for high-resolution, energy-efficient, and flexible displays integrated into modern smartphones, tablets, and wearable devices.

Continuous advancements in OLED and micro-LED technologies have enhanced color contrast, brightness, and power efficiency, making mobile displays the preferred choice for device manufacturers. The miniaturization of display components has enabled thinner and more durable screens, while improvements in material efficiency have reduced manufacturing costs.

The widespread adoption of OLED-based displays for their superior visual experience and reduced power consumption has reinforced the growth of this segment Furthermore, increasing consumer inclination toward premium devices with advanced display features continues to support the dominance of mobile displays in the overall market landscape.

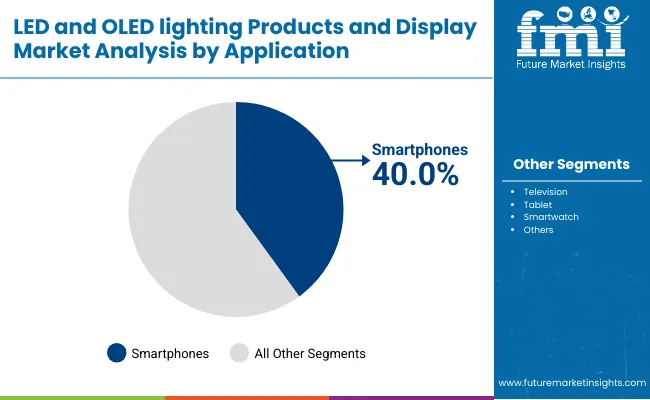

The smartphones application segment is expected to account for 40.00% of the LED and OLED lighting products and display market revenue share in 2025, establishing itself as the dominant application area. This leadership has been attributed to the consistent integration of OLED and advanced LED panels in smartphones to achieve enhanced brightness, clarity, and color accuracy.

The segment has benefited from rising consumer preference for high-performance displays with low power consumption, which improves battery efficiency. Continuous innovation in flexible OLED displays has allowed for the introduction of foldable and edge-to-edge screen designs, contributing to growing market penetration.

Increasing global smartphone shipments, coupled with shorter product replacement cycles, has also accelerated the adoption of advanced lighting and display technologies The emphasis on enhanced visual experiences and reduced energy usage is expected to further strengthen the position of the smartphone application segment in the forecast period.

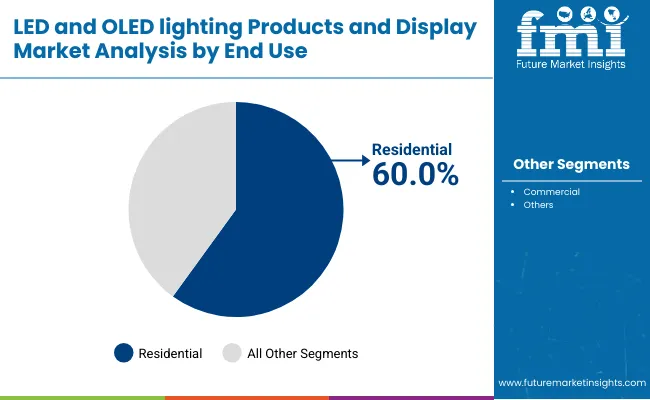

The residential end-use segment is anticipated to capture 60.00% of the LED and OLED lighting products and display market revenue in 2025, making it the leading segment. The growth of this segment is being driven by increasing urbanization, rising disposable incomes, and growing consumer awareness about sustainable lighting solutions. The widespread replacement of traditional lighting systems with LED and OLED alternatives is contributing to significant energy savings and longer product lifespans.

Advancements in smart lighting systems that integrate with home automation platforms have also accelerated adoption in the residential sector. The aesthetic flexibility and design appeal of OLED lighting panels are supporting their use in decorative and ambient lighting.

Additionally, supportive government policies promoting energy-efficient homes and infrastructure development are fostering higher market demand As consumers continue to prioritize energy efficiency, cost-effectiveness, and modern design aesthetics, the residential end-use segment is expected to maintain its leading position in the coming years.

The below table presents the expected CAGR for the global LED and OLED Lighting Products and Display market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the LED and OLED Lighting Products and Display industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 6.7%, followed by a slightly higher growth rate of 7.7% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 6.7% (2025 to 2035) |

| H2 | 7.7% (2025 to 2035) |

| H1 | 6.3% (2025 to 2035) |

| H2 | 7.8% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 6.3% in the first half and remain higher at 7.8% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS while in the second half (H2), the market witnessed an increase of 10 BPS.

Mobile Display Technologies are gaining traction due to the surge in mobile device usage, especially in fast-growing digital markets

The growing demand for display technologies and it offers superior resolution, color accuracy and energy efficiency. Mobile display technologies include AMOLED and OLED screens are at the lead of evolution and it provide users to enhanced visual experiences and longer battery life.

According to government of India the Digital India initiative, is propelling digital connectivity and encouraging technology adoption which includes the adoption of mobile display technologies. In 2025, Samsung's deals with major tech firm to supply AMOLED displays for next-generation smartphones highlights the importance of technologies. AMOLED displays hold 30% of the global mobile display market due to rising demand for high-quality mobile screens continues to increase.

Perimeter Lighted Boards Outdoor LED Displays are increasingly used in stadiums and arenas to enhance audience engagement with vivid displays

The boards are strategically placed around perimeter of sports venues to provide real-time game updates, advertisements and interactive content that will capture the attention of audience. This will enhance the overall fan experience by delivering high visuals that are visible from all angles around the stadium.

According to USA Federal Government's "Smart Stadiums" initiative encourages the integration of digital technologies in public venues to improve audience experiences. This initiative line up with investments in upgrading sports facilities with LED display technologies. In 2025, Daktronics and Major League Soccer secured contracts to supply LED perimeter displays for several MLS stadiums showcasing the propelling demand for technologies.

Video Walls OLED Displays offer unique opportunities in corporate settings, where high-definition, immersive displays are essential for presentations and meetings

OLED video walls provide image quality with vibrant colors, deep blacks and ultra-high resolution for creating impactful visual experiences in boardrooms and conference centers. The flexibility and modular design allow seamless integration into various corporate environments helps in enhancing the effectiveness of visual communications.

According to UK government the Digital Infrastructure Investment Fund supports the upgrade of public sector meeting rooms and conference facilities with advanced display technologies. This helps to improve collaboration and communication through high-quality visual tools which includes OLED video walls.

Samsung completed a major installation of OLED video walls in Singapore. This deployment showcases the growing adoption of OLED technology in corporate reflecting its role to enhance business communications and decision-making.

Complex Installation and Maintenance of large-scale video walls can increase operational challenges and costs

The installation of systems requires planning and precise execution for ensuring seamless integration and optimal performance. Large video walls involve complex setups such as mounting multiple display panels, managing wiring and connectivity and calibrating the displays to achieve uniform color and brightness across entire screen.

Regular upkeep is required to confirm that all components include LED modules or OLED panels remain in optimal condition. Maintenance tasks will include troubleshooting display issues, replacing faulty panels and recalibrating the system to maintain display quality.

The rising need for specialized technicians and the potential for lengthy downtime during maintenance activities further increase operational costs. This complexity in installation and maintenance in both of them can limit for some organizations particularly for those with limited resources or technical expertise will impact the adoption of advanced video wall technologies in the market.

From 2020 to 2025, the global sales of LED and OLED lighting products and displays saw significant growth, propelling for rising adoption of Mobile displays, consumer television displays and Outdoor LED Displays. This growth seen in various sectors such as consumer electronics, energy-efficient displays became standard in mobile devices and televisions.

The OLED screens in flagship smartphones significantly increased sales in mobile display segment. he global sales of LED an OLED lighting products and display grows at a CAGR 5.9% from 2020 to 2025.

From 2025 to 2035, the demand for products is anticipated to increase even more with advancements in display technologies and expansion of smart infrastructure projects globally. The Outdoor LED Display segment such as billboards and perimeter lighted boards is set to benefit from increased investments in advertising technologies, governments and private sectors in Asia and Europe driving these changes.

The Consumer Television Display segment, with OLED and AMOLED technologies, is likely to see surge in demand as consumers increasingly prefer high-definition, immersive viewing experiences. From 2025 to 2035 suggests a growth trajectory, with demand outpacing supply as these advanced display technologies become central to both consumer and commercial applications.

Tier 1 vendors dominating in the market with wide global reach, strong brand recognition and substantial R&D investments in overall market. Vendors such as Samsung Electronics, LG Display and Philips Lighting are the major giants for both consumers display and commercial lighting segments, offering advanced OLED and LED solutions for high-end smartphones, televisions and large-scale outdoor displays. Tier 1 vendors caters 55% to 60% of overall market accounting for a significant share of global revenue and setting industry standards with cutting-edge technology.

Tier 2 vendors have strong regional presence and competitive product offerings. Tier 2 vendors include Osram, Acuity Brands and Panasonic provides robust LED lighting and display product across different markets and caters around 10% to 15% of overall market. These vendors focus on applications such as industrial lighting or specialized outdoor displays and propelling market growth in emerging regions.

Tier 3 vendors are smaller companies and local manufacturers caters to niche markets or specific geographic areas. Tier 3 vendors specialize in cost-effective or customized products serving particular segments like small-scale outdoor displays or residential lighting. Vendors such as Havells, Cree Lighting and various regional players fit into this category. Tier 3 caters around 25% to 30% in overall LED and OLED Lighting Products and Display market.

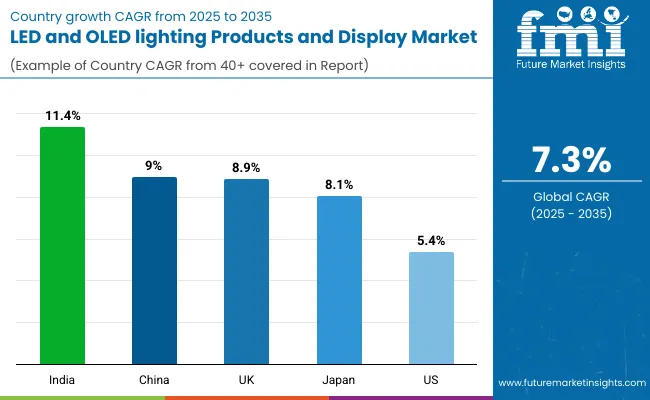

The section highlights the CAGRs of countries experiencing growth in the LED and OLED Lighting Products and Display market, along with the latest advancements contributing to overall market development. Based on current estimates, India, USA and Japan are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 11.4% |

| China | 9.0% |

| UK | 8.9% |

| Japan | 8.1% |

| United States | 5.4% |

The government of India and their initiatives propelling the market demand for advanced LED and OLED displays. The Digital India initiative goals to increase internet penetration and smartphone usage across urban and rural areas. The Indian government introduced schemes such as production linked incentive to propel domestic manufacturing of electronics components such as LED and OLED displays.

This initiative is projected to fuel a significant increase in production. Samsung committed to invest over 91.4 million in India operations focused on display technology. The market for LED and OLED lighting and display is anticipated to witness substantial at a CAGR 11.4% from 2025 to 2035 in the LED and OLED lighting products and display market indicating increase in demand over the next five years.

According to government of China the initiative such as Made in China 2025 is a key driver focused on technology and innovation in different sectors, including electronics. This initiative aims to boost domestic production capabilities and it will enhance the integration of cutting-edge technologies such as OLED displays into consumer devices.

Huawei and Xiaomi committed resources to R&D for display technologies. It has allocated around 1 billion to its R&D efforts with a substantial portion for developing advanced OLED display technologies. The Chinese government’s shift towards digital infrastructure and smart technology adoption is adopting growth in the tablet market.

With an estimated 20% increase in tablet sales over the next few years, propel by both domestic consumption and export demands. China LED and OLED Lighting Products and Display market is anticipated to grow from 6,453.7 Million in 2025 to 15,452.4 Million by 2035

According to government of UK “Industrial Strategy Challenge Fund” supports the development of cutting-edge technologies such as OLED displays. The fund allocates significant resources to increase technological advancements and foster the growth in high-tech sectors which directly benefit to smart wearable market.

The government commitment to smart technology and digital infrastructure is patent in significant public and private investments. The government focused on spending on digital innovation with an estimated USD 1.8 billion allocated to technology and infrastructure projects in the 2025 budget.

This investment will support the broader technology ecosystem such as adoption of advanced display technologies in consumer electronics. UK is anticipated to see substantial growth at a CAGR 8.9% from 2025 to 2035 in the LED and OLED Lighting Products and Display market.

The section contains information about the leading segments in the industry. By end use, the commercial segment is estimated to grow at a CAGR of 8.0% throughout 2035. Additionally, the mobile panel segment is foreseen to expand at 9.5% until 2035.

| Enterprise Size | Billboard |

|---|---|

| Value Share (2025) | 25.4% |

The billboard segment accounts for almost 25.4% of the share in 2025. Due to their high visibility and effectiveness in advertising. According to UK government regeneration and growth fund allocated USD 600 million to enhance urban infrastructure such as digital signage and billboard technology.

This initiative will help to renew public spaces and improve urban environments which will benefit directly to billboard LED display market. In 2025, Clear Channel Outdoor committed over USD 150 million to innovate and upgrade its digital billboard networks globally. This investment focused on improving display brightness, durability and energy efficiency.

| Industry | Commercial |

|---|---|

| CAGR (2025 to 2035) | 8.0% |

The commercial industry LED and OLED lighting products and displays mostly lucrative to enhance visual appeal in high-traffic environments. The technologies offer superior brightness, color accuracy and energy savings compared to traditional lighting. According to USA government energy efficiency and conservation block grant program allocates funds to support the adoption of energy-efficient technologies for LED lighting.

In 2025, USD 350 million kept for energy-efficient infrastructure projects which will benefit directly for commercial applications of LED and OLED displays. For Instance, Philips Lighting invested over USD 200 million in research to develop next-generation LED solutions to offer enhanced energy efficiency and longer lifespan.

Also Samsung Display committed approximately 91.4 million annually to improve OLED technology focused on increasing brightness, durability and color accuracy for commercial use. The commercial industry segment grows at a CAGR 8.0% from 2025 to 2035.

The competitive outlook in the LED and OLED display market is categorized by continuous innovation and strategic partnerships. Vendors are focusing on developing technologies for enhancing display quality, energy efficiency and versatility. Key Vendors are focused on investment in research and development to introduce advanced products that will meet diverse applications from commercial displays to residential interiors.

Strategic collaborations and mergers are common and which will aim to broaden product portfolios and leverage complementary strengths. The market is witnessing increased competition as firms will strive to differentiate themselves through technological advancements and performance.

Industry Update

In terms of product, the industry is divided into mobile display, consumer television display, outdoor LED display and others.

In terms of application, the industry is segregated into smartphones, television, tablet, smartwatch and others.

In terms of end use, the industry is segregated into residential and commercial.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa.

The global LED and OLED lighting products and display market is estimated to be valued at USD 91.4 billion in 2025.

The market size for the LED and OLED lighting products and display market is projected to reach USD 185.0 billion by 2035.

The LED and OLED lighting products and display market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in LED and OLED lighting products and display market are mobile display, consumer television display, outdoor LED display and others.

In terms of application, smartphones segment to command 40.0% share in the LED and OLED lighting products and display market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Africa LED & OLED Market Report – Growth & Forecast 2016-2026

LED Digital Speed Limit Sign Market Size and Share Forecast Outlook 2025 to 2035

LED Light Market Size and Share Forecast Outlook 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LEDPackaging Market Size and Share Forecast Outlook 2025 to 2035

LED Neon Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Driver IC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LED Grow Lights Market Analysis by Product, Installation Type, Application and Region Through 2035

LED Light Bar Market Analysis - Trends, Growth & Forecast 2025 to 2035

LED Phosphor Material Market

LED Driver Market

LED Tester Market

LED Cable Market

LED Modular Display Market

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA