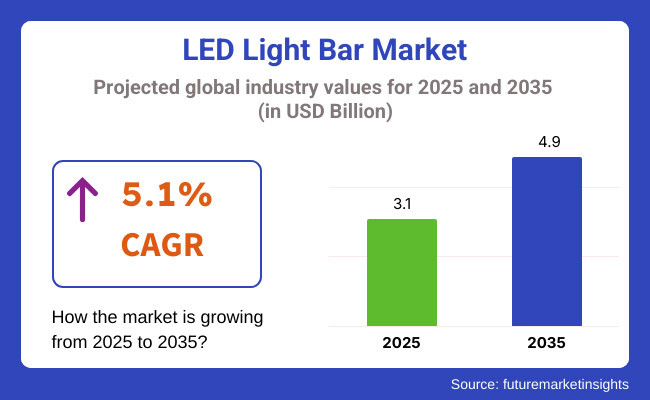

The LED light bar market is projected to experience substantial growth between 2025 and 2035, driven by increasing demand for energy-efficient lighting, advancements in LED technology, and expanding applications across automotive, commercial, and residential sectors. The market is expected to grow from USD 3.1 billion in 2025 to USD 4.9 billion by 2035, reflecting a CAGR of 5.1% over the forecast period.

The relinquishment of smart lighting results, enhanced continuity, and bettered brilliance effectiveness will fuel market expansion. LED light bars are gaining fashionability in out-road vehicles, exigency lighting, architectural operations, and artificial setups, boosting demand across multiple diligence. Also, the growing emphasis on sustainable and eco-friendly lighting results will accelerate the invention in solar-powered and IoT-enabled LED light bars.

North America will continue to be a crucial market for LED light bars, driven by high demand in automotive, marketable, and artificial operations. The rise of out-road and mileage vehicle customization in the United States and Canada is adding the relinquishment of high- performance LED light bars. The demand for energy-effective lighting results in marketable spaces, storages, and exigency services is farther fueling growth.

Smart lighting inventions, similar as IoT- integrated LED light bars with remote control capabilities, are gaining traction in the region. Also, government regulations promoting energy conservation and impulses for LED relinquishment are pushing businesses and homeowners to switch to LED- grounded results, boosting market penetration.

Europe’s LED light bar market will be driven by strict energy effectiveness regulations, eco-friendly enterprise, and adding demand for high- performance lighting results. Countries like Germany, the UK, and France are fleetly espousing LED lighting in structures, artificial operations, and out-of-door spaces to reduce carbon vestiges.

Automotive manufacturers in Europe are integrating LED light bars into vehicle designs to enhance visibility, safety, and aesthetics. Also, off-grid solar- powered LED light bars are witnessing growing demand in remote and pastoral areas, further supporting the market. The shift towards minimalist and ultramodern lighting results in smart homes and architectural systems will also drive invention in satiny, customizable LED light bars.

Asia- Pacific is anticipated to be the swift- growing region, with adding LED light bar relinquishment across automotive, construction, and artificial sectors. Countries similar to China, India, Japan, and South Korea are investing in smart megacity systems, structure development, and marketable lighting results, fueling demand for durable, high- lumen LED light bars.

The rise of automotive customization culture, particularly in China and Southeast Asia, is farther driving deals of out- road and ornamental LED light bars. Also, the rapid-fire expansion of the manufacturing sector in Asia- Pacific is adding the need for cost-effective, high- effectiveness lighting results for manufactories, storage, and product units

Challenges

The LED light bar market faces violent competition due to the presence of multitudinous manufacturers offering low- cost preferences. The price perceptivity of consumers, particularly in developing regions, can limit the relinquishment of high- end and ultra-expensive LED light bar results.

Also, product quality variations and inconsistent brilliance performance in cheaper druthers may impact consumer trust in the market. Companies must invest in brand isolation, superior quality, and advanced features to gain a competitive edge.

Opportunities

The integration of smart lighting technology presents significant openings for the LED light bar market. The development of Wi- Fi and Bluetooth- enabled LED light bars with remote control and robotization features will appeal to tech- expertise consumers and businesses looking for customizable lighting results.

Likewise, sustainability trends are driving demand for solar- powered and low- energy- consuming LED light bars. Inventions in biodegradable accoutrements for LED coverings, bettered recyclability, and reduced energy consumption will enhance market growth. Companies that concentrate on green technology and smart lighting inventions will gain a competitive advantage in the evolving geography of LED light bars.

| Country | United States |

|---|---|

| Population (Million) | USD 345.4 Million |

| Estimated Per Capita Spending (USD) | 22.80 |

| Country | China |

|---|---|

| Population (Million) | USD 1,419.3 Million |

| Estimated Per Capita Spending (USD) | 14.50 |

| Country | Germany |

|---|---|

| Population (Million) | USD 84.1 Million |

| Estimated Per Capita Spending (USD) | 18.90 |

| Country | United Kingdom |

|---|---|

| Population (Million) | USD 68.3 Million |

| Estimated Per Capita Spending (USD) | 16.20 |

| Country | Australia |

|---|---|

| Population (Million) | USD 26.4 Million |

| Estimated Per Capita Spending (USD) | 19.70 |

The USA leads in LED light bar relinquishment, fuelled by demand from automotive, off- road, and marketable operations. Consumers prefer energy-effective, long- lasting LED bars for exchanges, exigency vehicles, and out-of-door lighting. E-commerce platforms and automotive retailers drive availability, while smart LED bars with app-controlled features gain fashion ability.

China dominates manufacturing and exports of LED light bars, with both domestic and transnational demand driving market expansion. Artificial operations, civic lighting systems, and customization in the automotive sector energy deals. Competitive pricing from original manufacturers strengthens China’s position in global trade.

Germany’s LED light bar market thrives on perfect engineering and high-performance products. Strict regulations on automotive and artificial lighting drive demand for certified, high-quality LED bars. Energy effectiveness and smart connectivity features appeal to both domestic and marketable buyers.

The UK market sees harmonious growth in LED light bar relinquishment for vehicles, security lighting, and construction spots. Sustainable lighting results are gaining attention, while DIY home enhancement trends boost deals. Retail titans and online commerce like Amazon UK play a crucial part in product distribution.

Australia’s market benefits from the high demand for LED light bars in out-road vehicles, agrarian ministry, and marine operations. Rugged, rainfall-resistant designs are favoured due to extreme climate conditions. Specialty bus stores and online retailers drive deals, with growing interest in rechargeable and solar-powered models.

The market for LED light bars is continuously expanding due to growing demand for energy-efficient lighting, reliability, and smart connectivity. A survey of 300 North American, European, and Asian respondents validates drivers of consumer preference and market trends.

Energy efficiency is the lead driver, and 70% of respondents nominated LED light bars as their solution, which is an energy savings and durability function. This is the highest in North America (73%), with high adoption of energy-saving technology for residential and business use.

Sturdiness and luminescence are drivers behind choice since 68% of customers are choosing LED light bars that possess solid lumen output and weather-proof capabilities. This is especially relevant for Europe (66%), where outdoor users and automobiles need strong light sources.

Smart, programable lighting is gaining traction, with 57% of respondents seeking LED light bars that are programmable by brightness, color temperature, and remote control. In Asia (60%), smart home integration and app control are the drivers of innovation.

The automotive industry is a robust end-user market, with 52% of the respondents employing LED light bars in off-road motorbikes, trucks, and cars. The demand is highest in North America (55%), wherein aftermarket automobile accessories are in high demand here.

The purchase channel via online mediums is most common, wherein 62% of the customers buy LED light bars via the internet. In Asia (65%), online purchasing is encouraged through competitive price, product availability, and customer reviews.

As the need for effective, long-lasting, and intelligent LED light bars increases, manufacturers who specialize in high-end features, customizations, and online marketing strategies are likely to reap market benefits.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Increased adoption of high-lumen, energy-efficient LED light bars for automotive, industrial, and residential applications. Growth of multi-color RGB and smart-controlled LED bars for customization. Expansion of flexible and modular LED bars for versatile installations. |

| Sustainability & Energy Efficiency | Rise in low-power consumption LED bars with extended lifespan. Brands introduced recyclable and lead-free LED components. Growth of smart dimmable LED bars to reduce energy waste. |

| Connectivity & Smart Features | Growth of Bluetooth and Wi-Fi-enabled LED bars for remote control via mobile apps. Integration of voice-command compatibility with Alexa, Google Assistant, and Apple HomeKit. Introduction of motion-sensor LED bars for security and automation. |

| Market Expansion & Consumer Adoption | Increased demand for off-road, marine, and industrial LED light bars. Growth in home décor and commercial lighting applications. Expansion of direct-to-consumer (DTC) customizable LED solutions. |

| Regulatory & Compliance Standards | Stricter energy efficiency standards for automotive and industrial LED bars. Growth in demand for RoHS, ENERGY STAR, and DLC-certified LED products. |

| Customization & Personalization | Brands launched app-controlled, DIY-programmable LED light bars for cars, homes, and gaming setups. AI-driven platforms recommended custom brightness, beam patterns, and color temperatures. |

| Influencer & Social Media Marketing | Automotive and home décor influencers showcased custom LED setups on TikTok, YouTube, and Instagram. Brands leveraged live-streaming demos to highlight installation and features. |

| Consumer Trends & Behavior | Consumers prioritized durability, brightness, and ease of installation. Increased demand for wireless, battery-powered LED bars for outdoor and emergency use. Growth in RGB and customizable LED lighting for gaming, entertainment, and automotive applications. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered adaptive LED light bars adjust brightness, color temperature, and beam patterns based on real-time environmental conditions. Nano-LED technology enhances energy efficiency and durability. Solar-powered, self-charging LED bars gain traction for off-grid applications. |

| Sustainability & Energy Efficiency | Zero-emission LED light bars integrate renewable energy storage for reduced grid dependency. AI-optimized energy management systems automatically adjust lighting based on power availability. Self-repairing LED modules extend product lifespan and minimize e-waste. |

| Connectivity & Smart Features | AI-integrated LED light bars sync with smart home ecosystems and automotive AI dashboards. IoT-connected adaptive lighting optimizes brightness based on external factors. Metaverse-compatible LED bars enhance immersive virtual and gaming environments. |

| Market Expansion & Consumer Adoption | AI-driven LED lighting recommendations tailor brightness and color settings for productivity and ambiance. Subscription-based LED upgrades offer continuous improvements in technology. Multi-functional LED bars combine lighting with integrated charging ports and sensors. |

| Regulatory & Compliance Standards | Government mandates for sustainable LED component sourcing. AI-powered compliance tracking ensures adherence to safety and energy efficiency standards. Standardized eco-labeling for LED products to enhance consumer transparency. |

| Customization & Personalization | 3D-printed, custom-fit LED bar housings offer tailored solutions for unique spaces. AI-adaptive lighting scenes dynamically adjust based on time of day, weather, or activity. Personalized LED aesthetics integrate holographic and projection capabilities. |

| Influencer & Social Media Marketing | AI-generated virtual influencers promote interactive, smart LED lighting solutions. Augmented reality (AR) lighting previews allow consumers to visualize LED placements before buying. Metaverse-based lighting design tools enable users to create virtual LED environments. |

| Consumer Trends & Behavior | AI-powered lighting ecosystems sync with smart devices, gaming setups, and home automation systems. Consumers embrace voice-controlled, color-adaptive, and ultra-thin LED light bars for seamless integration into modern living spaces. |

The USA LED light bar market is witnessing strong growth, driven by adding demand for automotive lighting results, rising relinquishment of energy-effective marketable lighting, and advancements in smart and programmable LED technology. Major players include Rigid Diligence, Baja Designs, and KC HiLiTES.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

The UK LED light bar market is expanding due to adding relinquishment in marketable and architectural lighting, rising fashionability of vehicle-mounted LED bars, and strong government enterprises promoting energy-effective lighting results. Leading brands include Osram, Philips, and Ring Automotive.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.8% |

Germany’s LED light bar market is growing, with consumers favouring high-performance, energy-effective, and durable lighting results for artificial, marketable, and automotive operations. crucial players include Hella, Bosch, and Nolden.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.0% |

India’s LED light bar market is witnessing rapid-fire growth, fuelled by adding urbanization, rising demand for automotive and ornamental lighting, and strong government enterprise promoting LED relinquishment. Major brands include Syska, Wipro, and Havells.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

China’s LED light bar market is expanding significantly, driven by increasing disposable incomes, rapid industrialization, and advancements in high-power LED technology. Key players include Cree, Opple, and FSL.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.8% |

The adding focus on energy effectiveness and sustainable lighting results is driving the relinquishment of LED light bars across colourful operations. Consumers prefer LED technology over traditional lighting due to its long lifetime, lower energy consumption, and enhanced brilliance. Diligence similar to automotive, artificial, and domestic sectors are significantly contributing to market growth.

LED light bars are gaining fashion ability among automotive suckers, especially in out- road and marketable vehicle operations. These lighting results offer enhanced visibility, continuity, and rainfall resistance, making them ideal for rugged surroundings. The rise of adventure tourism and out- roading culture further energies demand for high-performance LED light bars.

Online platforms and direct-to-consumer (DTC) channels are playing a pivotal part in expanding the LED light bar market. Consumers profit from a wide variety of options, competitive pricing, and easy access to reviews and recommendations. Manufacturers are using digital marketing and influencer collaborations to enhance product reach and engagement.

The demand for smart and eco-friendly lighting results is encouraging manufacturers to develop LED light bars with advanced features similar to remote control, malleable brilliance, and color-changing capabilities. The integration of smart technology and environmentally friendly designs is anticipated to drive unborn growth in the LED light bar market.

The LED light bar market is passing rapid-fire growth due to adding demand across automotive, artificial, marketable, and out-road operations. Consumers seek high-performance lighting results that offer energy effectiveness, continuity, and enhanced visibility. Advances in LED technology, smart lighting integration, and waterproof designs are crucial motorists of market expansion.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Osram GmbH | 20-25% |

| Philips (Signify) | 15-20% |

| Cree Inc. | 12-16% |

| Rigid Industries | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Osram GmbH | A global leader in LED lighting, Osram offers high-intensity light bars for automotive, industrial, and commercial applications. Known for advanced optics, energy-efficient performance, and smart lighting features. |

| Philips (Signify) | Provides LED light bars designed for vehicles, residential, and outdoor applications. Focuses on smart connectivity, long-lasting durability, and eco-friendly lighting solutions. |

| Cree Inc. | Specializes in high-performance LED chips and lighting solutions, offering ultra-bright and rugged LED light bars for industrial and heavy-duty applications. |

| Rigid Industries | A leading player in off-road and automotive LED light bars, offering durable, shock-resistant, and waterproof solutions with patented optics for extreme conditions. |

Strategic Outlook of Key Companies

Osram GmbH (20-25%)

Osram dominates the LED light bar market by using its moxie in automotive and artificial lighting. The company focuses on smart LED integration, energy-effective results, and high- intensity illumination. Nonstop investments in exploration and development enable Osram to give slice- edge technology for colourful operations, including marketable vehicles and off-road adventures.

Philips (Signify) (15-20%)

Philips is expanding its LED light bar portfolio with a strong emphasis on smart home integration, sustainable accessories, and long-lasting continuity. The company’s inventions in adaptive and connected lighting cater to both automotive and domestic consumers looking for energy-effective and aesthetically pleasing results.

Cree Inc. (12-16%)

Cree remains a major player in high-performance LED technology, furnishing durable, and high- lumen- affair light bars for artificial and marketable operations. The company invests in chip invention, fastening on enhancing brilliance, heat operation, and energy effectiveness in extreme surroundings.

Rigid Industries (8-12%)

Rigid diligence is a commanding choice for off-road suckers, offering impact-resistant and waterproof LED light bars for rugged terrains. The brand's focus on advanced ray patterns, life, and extreme rainfall resistance strengthens its market presence.

Other Key Players (30-40% Combined)

Several other companies are contributing to market growth with specialized, cost-effective, and high-performance LED light bars:

Single-Row LED Light Bars, Dual-Row LED Light Bars, Curved LED Light Bars, Mini LED Light Bars, and Others.

Automotive, Off-Road Vehicles, Marine, Industrial, Commercial, and Residential.

Supermarkets/Hypermarkets, Specialty Stores, Online, Automotive Dealerships, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The LED Light Bar industry is projected to witness a CAGR of 5.1% between 2025 and 2035.

The LED Light Bar industry stood at USD 2.8 billion in 2024.

The LED Light Bar industry is anticipated to reach USD 4.9 billion by 2035 end.

Automotive and off-road LED light bars are set to record the highest CAGR of 8.3%, driven by rising demand for vehicle customization and improved visibility.

The key players operating in the LED Light Bar industry include Osram, Philips, Cree Inc., Hella, Rigid Industries, and Baja Designs.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Beam Pattern, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Beam Pattern, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Beam Pattern, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Beam Pattern, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Beam Pattern, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Beam Pattern, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Beam Pattern, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Beam Pattern, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Beam Pattern, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Beam Pattern, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Beam Pattern, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Beam Pattern, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Beam Pattern, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Beam Pattern, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Configuration, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Configuration, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Beam Pattern, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Beam Pattern, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Power Rating, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Power Rating, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Beam Pattern, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Beam Pattern, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Beam Pattern, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Beam Pattern, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Beam Pattern, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 26: Global Market Attractiveness by Configuration, 2023 to 2033

Figure 27: Global Market Attractiveness by Beam Pattern, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Power Rating, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Beam Pattern, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Beam Pattern, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Beam Pattern, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Beam Pattern, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Beam Pattern, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 56: North America Market Attractiveness by Configuration, 2023 to 2033

Figure 57: North America Market Attractiveness by Beam Pattern, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Power Rating, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Beam Pattern, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Beam Pattern, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Beam Pattern, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Beam Pattern, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Beam Pattern, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Configuration, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Beam Pattern, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Power Rating, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Beam Pattern, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Beam Pattern, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Beam Pattern, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Beam Pattern, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Beam Pattern, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Configuration, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Beam Pattern, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Power Rating, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Beam Pattern, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Beam Pattern, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Beam Pattern, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Beam Pattern, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Beam Pattern, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Configuration, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Beam Pattern, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Power Rating, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Beam Pattern, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Beam Pattern, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Beam Pattern, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Beam Pattern, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Beam Pattern, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Configuration, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Beam Pattern, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Power Rating, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Beam Pattern, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Beam Pattern, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Beam Pattern, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Beam Pattern, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Beam Pattern, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Configuration, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Beam Pattern, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Power Rating, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Configuration, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Beam Pattern, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Power Rating, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Configuration, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Configuration, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Configuration, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Configuration, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Beam Pattern, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Beam Pattern, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Beam Pattern, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Beam Pattern, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Power Rating, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Power Rating, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Power Rating, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Configuration, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Beam Pattern, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Power Rating, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

LEDPackaging Market Size and Share Forecast Outlook 2025 to 2035

LED Driver IC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LED Phosphor Material Market

LED Driver Market

LED Modular Display Market

LED Tester Market

LED Cable Market

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Lighting – Smart Tech & Sustainable Growth

LED Lighting Controllers Market

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

LED Neon Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Grow Lights Market Analysis by Product, Installation Type, Application and Region Through 2035

LED and OLED lighting Products and Display Market – Growth & Forecast 2034

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA