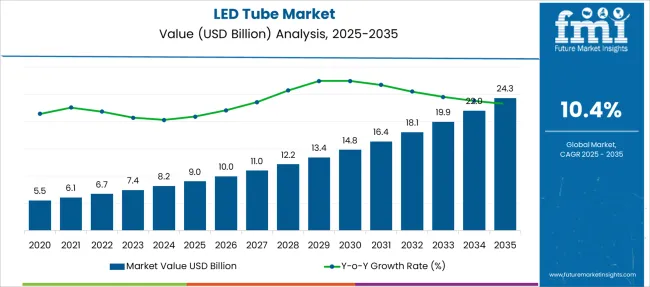

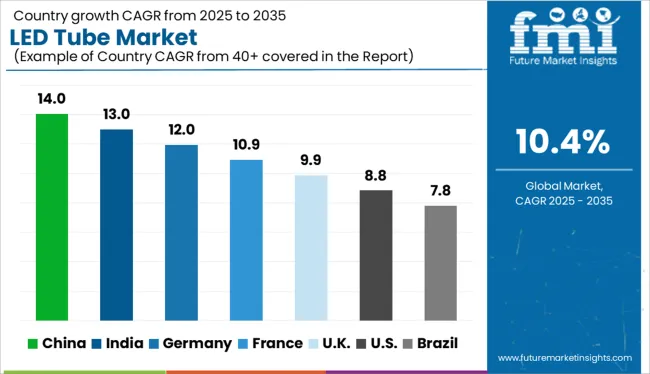

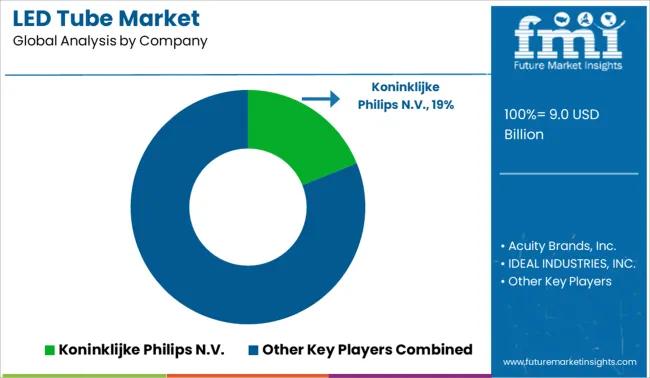

The LED Tube Market is estimated to be valued at USD 9.0 billion in 2025 and is projected to reach USD 24.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period.

| Metric | Value |

|---|---|

| LED Tube Market Estimated Value in (2025 E) | USD 9.0 billion |

| LED Tube Market Forecast Value in (2035 F) | USD 24.3 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

The LED tube market is experiencing steady growth, driven by global energy efficiency mandates, phase-outs of fluorescent lighting, and increased retrofitting across commercial infrastructure. Regulatory alignment on carbon footprint reduction and rising electricity tariffs have accelerated the transition toward LED lighting, especially in cost-sensitive economies.

Product advancements such as flicker-free illumination, longer lifespan, and low heat emissions are encouraging broader adoption across diverse building environments. The commercial sector's rapid digitalization has further influenced the demand for smart lighting infrastructure compatible with automated systems.

Additionally, extended government subsidies and rebate programs are lowering adoption barriers for large-scale replacements. The market outlook remains favorable, with rising construction activity, refurbishment of legacy systems, and heightened awareness about the environmental and economic benefits of LED lighting expected to fuel long-term growth.

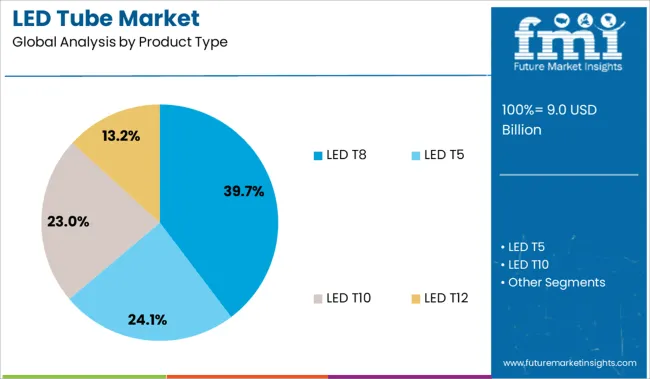

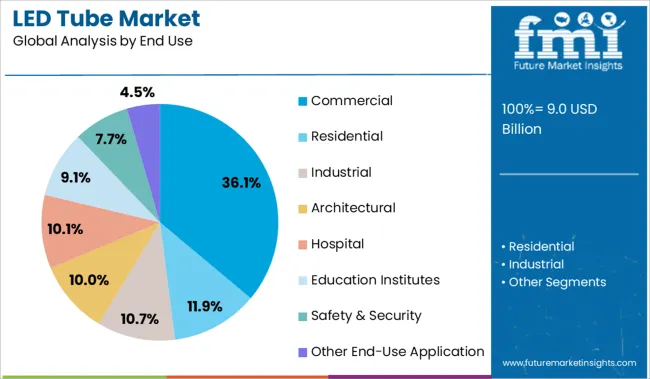

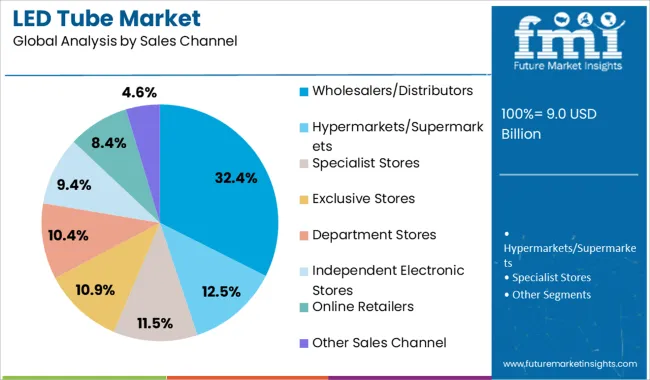

The market is segmented by Product Type, End Use, and Sales Channel and region. By Product Type, the market is divided into LED T8, LED T5, LED T10, and LED T12. In terms of End Use, the market is classified into Commercial, Residential, Industrial, Architectural, Hospital, Education Institutes, Safety & Security, and Other End-Use Application. Based on Sales Channel, the market is segmented into Wholesalers/Distributors, Hypermarkets/Supermarkets, Specialist Stores, Exclusive Stores, Department Stores, Independent Electronic Stores, Online Retailers, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The LED T8 segment is projected to account for 39.7% of the overall market share in 2025, making it the leading product type. This dominance is attributed to its standardized size compatibility with legacy fluorescent fixtures, allowing for easy retrofitting without major infrastructure changes.

Enhanced energy savings, longer service life, and reduced maintenance costs have positioned LED T8 tubes as the preferred choice for institutions and facilities aiming to modernize lighting without operational disruptions. The segment has also benefited from innovation in ballast compatibility and integrated driver technology, which simplifies installation.

With increasing global initiatives targeting the elimination of mercury-based lighting, LED T8 continues to gain traction as a sustainable, future-ready alternative.

The commercial sector is expected to hold 36.1% of the total LED tube market revenue in 2025, making it the top end-use segment. This prominence is being shaped by extensive lighting requirements across office spaces, educational institutions, retail environments, and hospitality venues.

LED tubes are being adopted to reduce operational costs, improve lighting quality, and comply with green building standards. Their integration into building automation systems and smart lighting networks is driving higher penetration within new constructions and retrofits.

The growing focus on employee well-being and visual ergonomics is also encouraging facilities managers to transition toward uniform, glare-free lighting. Government-driven energy audits and building performance certifications are reinforcing replacement cycles in the commercial space, sustaining segment growth.

Wholesalers and distributors are projected to command 32.4% of the total market revenue in 2025, positioning them as the leading sales channel for LED tubes. Their dominance stems from established supply chain networks, strong relationships with electrical contractors, and inventory access across multiple brands and specifications.

This channel plays a critical role in meeting bulk procurement needs for large-scale commercial and municipal projects. Additionally, distributors offer value-added services such as technical consultation, custom lighting solutions, and post-sale support, which have enhanced buyer confidence.

As small-to-medium enterprises continue to upgrade legacy lighting, the accessibility and flexibility provided by wholesalers and distributors are expected to maintain their leadership in the sales ecosystem.

Light-emitting diode (LED) tube lighting has evolved into the finest energy-efficient type of tube lighting. With superior energy conservation function and greater durability, led lights are dramatically changing fluorescent tube lights, often used in commercial and residential structures. LED tube lights, unlike fluorescent lights, function reliably with control systems.

Moreover, the improvement in the design of creative infrastructure in residential and public locations for decorating has created a greater market for LED tubes all over the world. The prevalence of these light tubes in theme-based restaurants, events and performances, and cafes are propelling the LED tube industry worldwide. On the back of these factors, the market is estimated to grow at a 10.40% CAGR during the forecast period.

Many factors are driving the adoption of LED tubes in the USA, including the growing demand for energy-efficient lighting systems, the decline in LED prices, and strict government regulations. As a relatively recent source of illumination, LEDs have seen rapid technological and economic development in the country, attracting investments.

The USA is one of the leading innovators, adopters, and investors in the global LED market. As LED tube lights become increasingly available in domestic products, the number is growing significantly. Local manufacturers, such as Acuity Brands, are key innovators both internationally and domestically.

Cree's new LED product, Cadiant, has brought new developments to the LED market. According to Cree, LED-based lamps in the United States no longer have a cost premium. In light of the inherent energy savings and long lifetime of LEDs, many consumers may continue using them over the forecast period, which is expected to increase the market growth significantly.

A growing trend in smart homes has led to an increased demand for LED tube systems that can be controlled remotely and are connected to other electronic devices. In addition to making connected lighting more accessible at the regional level, regional market vendors have also been bringing innovation globally.

A new generation of LED flat panels, L-Grid Edge Xtreme XL Select, with a selectable CCT and wattage option, has been launched by USA LED Ltd in July 2024. It is designed to deliver superior visual comfort to retail stores and offices while accelerating installation time.

As power shortages and outages continue to increase across Japan, LED tubes have become increasingly popular. The growing demand for energy-efficient light bulbs is a major driving force behind the Japan LED tube market.

Furthermore, the Japanese government has begun the phase-out of incandescent light bulbs, which has accelerated the demand for LED tubes. The government also aimed to phase out fluorescent light tubes in 2024 as they were considered inefficient. Combined with a gradual shift toward sustainable products, this has stimulated the demand for LED tubes in Japan, creating a positive outlook for LED products. The selling prices of LED in Japan have also declined significantly, another significant factor contributing to the growth of the industry.

Other factors contributing to the market growth include infrastructure development and smart city projects across Japan. Due to these factors, the market is expected to grow moderately during the forecast period.

Incentives and rebates on LED tube lighting and the ban on less-efficient lighting sources are expected to drive the market significantly due to stringent government regulations. As well as regulating the safety and performance of indoor commercial lighting, the region also has several standards governing garage illumination, road illumination, and parking illumination.

As a result of the growth of the regional automotive and information technology industries, the European commercial & industrial sector is flourishing as well. Furthermore, increasing awareness about energy conservation is boosting the Europe LED tube market. As the need for commercial spaces is on the rise, the construction industry has also witnessed significant growth over the past few years from the commercial and industrial sectors.

Stringent regulations on the import of lighting products are benefiting European LED tube manufacturers. Due to rising trade tensions between the USA and China, European companies have benefited from the American market's demand for European LED tubes. There are several prominent players in the market, including Signify Holdings, Acuity Brands Lighting Inc., OSRAM GmbH, Eaton, and LEDVANCE GmbH. Increasing market share requires market leaders to expand their capabilities and venture into new areas like horticultural lighting and U.V. lighting.

LED tube light solutions based on Li-Fi and sensor technology are disrupting the industry with new entrants. LED light companies use mergers and acquisitions to expand their product portfolios, grow geographically, and gain market share.

A rapid decline in LED tube prices in Korea demonstrates the increasing adoption of LED tubes in residential applications. Taking advantage of successive technological advances, LED tube production costs have been significantly reduced in Korea.

LED tube in Korea is expected to see promising growth with consistent growth in residential construction activities. In addition to the implementation of government regulations and incentives for using energy-efficient lights, the residential segment is expected to grow rapidly.

Due to their energy efficiency and long life, LED solutions are quickly replacing conventional light sources in major markets. In addition, increasing consumer awareness about the long-term cost benefits is motivating Korean customers to switch to LED tube lights instead of conventional lighting.

Social and Economic Transformation in the Country to Boost the Sales of LED Tubes

As per FMI, India is considered to be one of the fastest-growing markets for LED tubes and is predicted to hold a significant share of the South Asia LED tubes market. The market in India is anticipated to rise at a CAGR of 22.8% during the forecast period.

Rapid economic and social developments in the country are contributing to increased urbanization. As a result, there is a growing need for energy-efficient tubes in India. Meanwhile, the number of nuclear families fuels the use of featured LED tubes, boosting India's LED tube market.

Favorable Government Measures in Russia to Aid the Growth of the LED Tube Market

The Russian government has implemented significant initiatives to improve the energy efficiency of the lighting industry. This includes laws mandating a certain percentage of LED products in national or provincial construction projects.

Furthermore, the Russian government banned incandescent bulbs, hastening the adoption of LED light bars. Other factors driving the LED light bar business in the country include strong demand in the commercial sector, significant international athletic events, and big infrastructure projects.

China LED Tube Market to Benefit from Rising Construction Activities in the Country

China is one of the most lucrative East Asia LED tube markets and is expected to account for mammoth's share in the market. The LED tube market in China is anticipated to rise due to rising development in industry and urbanization. Also, the transitioning preference of customers towards eco-friendlier products is fueling the demand in the country.

Furthermore, China's large population has increased government initiatives such as airports, motorways, and renewable energy projects. As diverse construction equipment, techniques, and vehicles are integrated with LED tubes, the rising projects will likely boost demand for LED tubes in the country.

LED T8 has High Demand and is Mostly Preferred in the LED Tube Market

Based on the product type, the LED T8 holds a considerable share in the overall sales of the LED tubes market. A T8 LED tube consumes only 17 watts and emits 2200 lumens. T8 LED light bulbs have a 50,000-hour lifetime rating, more than three times the 15,000-hour typical lifespan of fluorescent lights. Also, consider the warranty length; LED equivalents are for 5 years from the date of purchase.

Commercial Sector to Generate Maximum Revenue in the LED Tube Market

In terms of end-user, commercial use is expected to hold a significant share during the forecast tenure. The commercial segment consists of cyber hubs, malls, clubs, restaurants, and other places. Interior lighting fixtures play an important role due to the extensive use of lights. The LED tubes feature an ongoing ability that allows commercial places to leverage the long time use of the lights. Hence there is a high demand for LED tubes from the commercial sector.

Specialty Stores Are Anticipated to Drive the Sales in LED Tube Market

Regarding sales channels, specialist stores are expected to hold a significant share of the LED tube market, which is anticipated to grow steadily during the forecast tenure. Specialist stores offer a wide range of selections of LED tubes. They also provide unique light solutions and suggestions for the area space based on consumer preference and fixtures.

Moreover, specialty store experts help to identify budget-friendly products. Meanwhile, in upcoming years the online retailers market is also anticipated to rise rapidly and will support the growth of the LED tube market.

]

]

To enhance the worldwide footprint and grab a large revenue share, market players are focused on new product launches and mergers and acquisitions. To meet the growing demand for LED tubes throughout the world, producers are working on expanding product lines or incorporating innovative goods into their individual portfolios.

For instance:

Don't Stay in the Dark - Get Lit with LED Tube Options from OSRAM, Syska, And Toshiba

LED tube is a great way to make the commercial property more energy efficient. LED tubes are used in many different settings, including warehouses, manufacturing plants, offices, and retail stores. LED tubes are becoming a popular option for decorative lighting for homes too!

Osram Licht AG is a German manufacturer of electric lighting with headquarters in Munich and Premstätten (Austria). Osram sees itself as a high-tech photonics firm with a growing emphasis on sensor technologies, visualization, and light treatment. Customers are served by the corporation in the consumer, automotive, healthcare, and industrial technology sectors. Osram's operating firm is Osram GmbH.

The company has been dedicated to innovation, research, and development, leading to its recent product offering. An adjustable backlight that uses advanced sensor technology is one of their most innovative products. It gives the option of manually adjusting the light for brightness or automatic mode with different light levels, providing ultimate convenience for all customer needs.

In May 2025, OSRAM, a global pioneer in optical solutions, announced the launch of the OSLON Optimal family of LEDs for horticulture lighting, based on the newest ams OSRAM 1mm2 chip, which offers a fantastic mix of high efficiency, dependable performance, and great value.

Another prominent player, Syska, is an India-based manufacturer of LED lighting systems. LED bulbs, LED tube lights, power banks, dry irons, street lights, smartwatches, shavers, and other goods are available from the firm, allowing consumers to obtain new and energy-efficient lighting solutions.

This year, Syska is excited to introduce a new, improved line of LED tubes. The newest models offer high-quality lighting while using up to 80% less energy than traditional fluorescent bulbs.

In June 2024, Syska introduced two new LED lighting products in India: The T5 LED Batten-SSK-SQ2201 (PC-polycarbonate) and the Syska T5 LED Batten (AL-Aluminum)-SSK-SQ2201 (Rs 449 and Rs 549, respectively).

Moreover, Toshiba Corporation, abbreviated TOSHIBA, is a Japanese global conglomerate corporation based in Minato, Tokyo, Japan. Its wide range of goods and services includes power systems, industrial and social infrastructure, escalators and elevators, electronic components, semiconductors, hard disk drives (HDD), printers, batteries, and lights, as well as IT solutions like quantum cryptography, which was developed at Cambridge Research Laboratory and Toshiba Europe, situated in the United Kingdom, and is now being commercialized.

Toshiba Singapore LED Lighting Systems announced the launch of its E-CORE LED bulbs and reflector lamps in the area, which are long-lasting, high-quality, and energy-efficient. These items are generally intended for commercial and industrial applications, as well as residential and general use. Toshiba Lighting is devoted to producing lighting solutions that meet every demand by focusing on quality, lumen class, and design innovation.

| Attribute | Details |

|---|---|

| Estimated Market Size 2025 | USD 9.0 billion |

| Projected Market Value (2035) | USD 24.3 billion |

| Value CAGR (2025 to 2035) | 10.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania & Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, France, Spain, Italy, Russia, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia & New Zealand |

| Key Segments Covered | Product Type, End Use, Sales Channel, and Region |

| Key Companies Profiled | Koninklijke Philips N.V.; Acuity Brands, Inc.; IDEAL INDUSTRIES, INC.; Eaton Corporation; SAVANT TECHNOLOGIES LLC.; OSRAM Gmbh; Seoul Semiconductor; Zumtobel Group; Bajaj Electricals; Wipro Ltd; NEPTUN lights inc; Havells; Syska; Foshan Electrical and Lighting Co., Ltd; LED Tube Lighting Pty. Ltd.; Panasonic Corporation; Opple Lighting Co., Ltd.; Crompton Greaves Consumer Electricals Limited.; HPL Electric & Power Ltd; Toshiba Ltd; Other (on request) |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global LED tube market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the LED tube market is projected to reach USD 24.3 billion by 2035.

The LED tube market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in LED tube market are LED t8, LED t5, LED t10 and LED t12.

In terms of end use, commercial segment to command 36.1% share in the LED tube market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fueled Fire-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

LED Solder Paste Market Size and Share Forecast Outlook 2025 to 2035

LED and OLED lighting Products and Display Market Size and Share Forecast Outlook 2025 to 2035

LED Digital Speed Limit Sign Market Size and Share Forecast Outlook 2025 to 2035

LED Light Market Size and Share Forecast Outlook 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LEDPackaging Market Size and Share Forecast Outlook 2025 to 2035

LED Neon Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Driver IC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LED Grow Lights Market Analysis by Product, Installation Type, Application and Region Through 2035

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

LED Driver for Lighting Market Analysis – Growth & Forecast 2025 to 2035

LED Light Bar Market Analysis - Trends, Growth & Forecast 2025 to 2035

LED Phosphor Material Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA