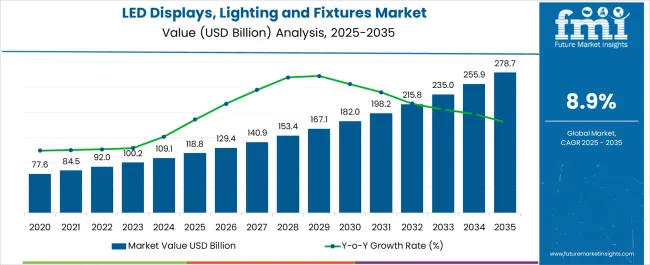

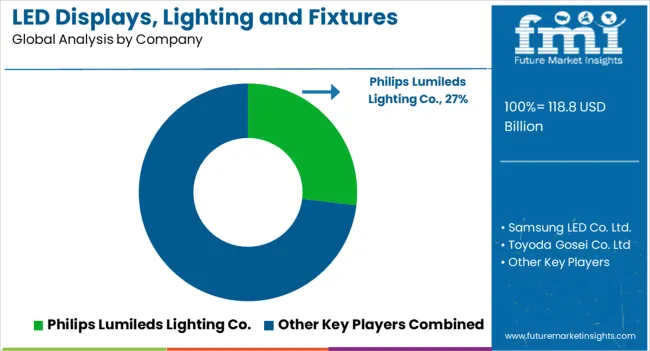

The LED Displays, Lighting and Fixtures Market is estimated to be valued at USD 118.8 billion in 2025 and is projected to reach USD 278.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

| Metric | Value |

|---|---|

| LED Displays, Lighting and Fixtures Market Estimated Value in (2025 E) | USD 118.8 billion |

| LED Displays, Lighting and Fixtures Market Forecast Value in (2035 F) | USD 278.7 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The LED displays lighting and fixtures market is expanding rapidly due to widespread adoption across consumer electronics, automotive, and commercial sectors. The increasing demand for energy efficient lighting solutions, coupled with regulatory restrictions on incandescent and fluorescent technologies, has accelerated the shift toward LED based systems.

Advancements in brightness, color accuracy, and form factor flexibility have broadened application potential, ranging from architectural installations to large scale display panels. The growing integration of smart features, such as IoT enabled lighting control and adaptive brightness systems, is further strengthening market penetration.

Supportive government initiatives, declining production costs, and rising awareness of energy conservation are contributing to long term growth. With continuous innovation in miniaturization and display quality, the market outlook remains positive as LEDs evolve into the default standard for both functional and decorative lighting solutions.

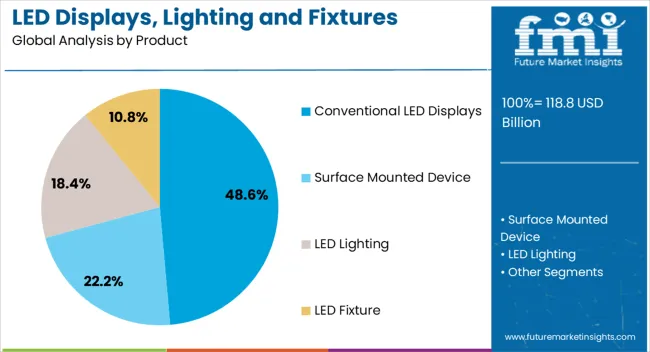

The conventional LED displays segment is expected to hold 48.60% of total market revenue by 2025 within the product category, making it the dominant segment. This share is being driven by the long established reliability, cost efficiency, and durability of conventional LED displays.

Their use in large scale installations, digital signage, and commercial advertising has reinforced steady demand. In addition, the lower cost of deployment compared to emerging variants has made conventional LED displays attractive for widespread adoption across price sensitive markets.

Their ability to deliver consistent brightness and performance over long operating lifespans continues to support their market leadership.

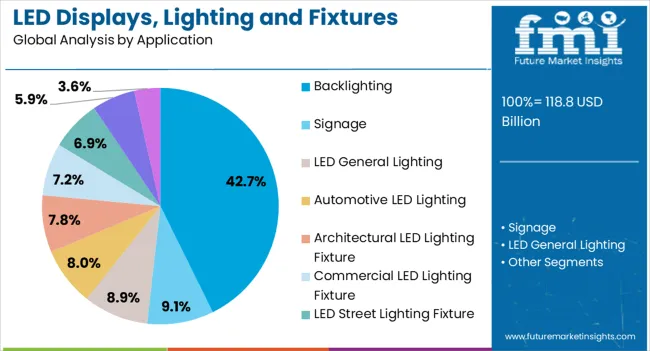

The backlighting application segment is expected to contribute 42.70% of total revenue by 2025, establishing itself as the most prominent application area. Growth is being driven by the extensive use of LEDs in televisions, laptops, tablets, and smartphones, where uniform illumination and energy savings are highly valued.

The technology’s compatibility with slim form factor devices and its ability to deliver enhanced brightness and longer operational life have reinforced its adoption. Continuous improvements in display technology, coupled with consumer preference for higher resolution and energy efficient devices, are fueling demand.

The segment’s prominence is further supported by the growing integration of LED backlighting in automotive dashboards and industrial displays, making it a critical driver of overall market expansion.

Global LED displays, lighting, and fixture sales increased at 12% CAGR during the period from 2020 to 2024. For the next ten years, the worldwide market will exhibit a CAGR of 8.9%. It will create an absolute $ opportunity of USD 123 billion during the forecast period.

Energy efficiency is one of the main factors contributing to the expansion of the market for LED displays, lighting, and fixtures.

Compared to conventional lighting sources such as incandescent bulbs and fluorescent lights, LED technology is more energy-efficient, which lowers energy consumption and reduces energy costs.

Cost-effectiveness is another important factor impacting market development. Although LED lighting fixtures may cost more than conventional lighting sources, they last longer and need less maintenance, which results in long-term cost savings.

The rapid population growth is likely to expand real estate markets across the world. This expansion in real estate will increase the demand for lighting systems, and today's homeowners and builders favor LED lighting over incandescent lighting.

The real estate industry is expected to rise and play an important role in the United Nations’ (UN) sustainable development goals (SDGs). Because of the projected growth in the real estate sector, the market for LED displays, lighting and fixtures is projected to expand during the assessment period.

According to the United Nations, the population of the world will increase to around 278.7 billion by 2035. This rapid growth in the population will propel LED displays, lighting and fixture demand during the assessment period.

Automakers are also implementing LED lighting and displays in their cars. This is because they are much brighter than their halogen counterparts and can also improve visibility in the dark drastically.

LED Lamps are much more durable than traditional headlamps and can last longer than traditional halogen lamps. Therefore, rising production and sales of vehicles will fuel expansion of LED displays, lighting and fixtures industry.

North America LED displays, lighting, and fixtures market size reached USD 118.8 billion in 2025. Between 2025 and 2035, LED displays, lighting, and fixture sales in North America will rise at a robust pace. By 2035, North America market will reach a valuation of USD 83 billion.

North America is a significant consumer of energy in the world with primary energy consumption of 113 exajoules in 2024. With the rise in energy consumption and energy costs in the region, people are implementing LED lighting. This is spurring growth in the market.

Similarly, rising usage in automobiles is creating opportunities for LED displays, lighting and fixture manufacturers. There were around 109.1 million cars sold in North America in 2024.

As LED is widely utilized in the automobile industry for the lighting needs of the car, rising demand for cars in the region will trigger LED lighting sales.

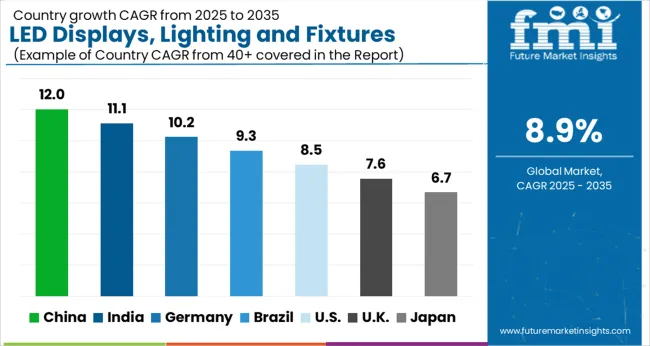

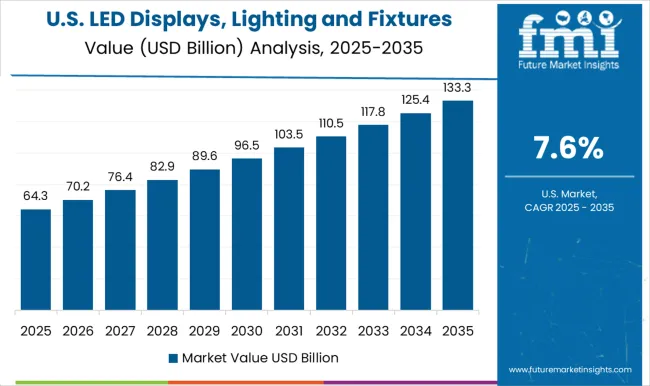

| Country | United States |

|---|---|

| Projected CAGR (2025 to 2035) | 7.7% |

| Historical CAGR (2020 to 2024) | 10.5% |

| Market Value (2035) | USD 278.7 billion |

| Country | United Kingdom |

|---|---|

| Projected CAGR (2025 to 2035) | 8.0% |

| Historical CAGR (2020 to 2024) | 10.8% |

| Market Value (2035) | USD 11.1 billion |

| Country | China |

|---|---|

| Projected CAGR (2025 to 2035) | 9.9% |

| Historical CAGR (2020 to 2024) | 13.6% |

| Market Value (2035) | USD 18.6 billion |

| Country | Japan |

|---|---|

| Projected CAGR (2025 to 2035) | 8.3% |

| Historical CAGR (2020 to 2024) | 11.2% |

| Market Value (2035) | USD 15.7 billion |

| Country | South Korea |

|---|---|

| Projected CAGR (2025 to 2035) | 9.3% |

| Historical CAGR (2020 to 2024) | 12.8% |

| Market Value (2035) | USD 109.1 billion |

High Usage in Automotive Sector Fueling LED Displays and Lighting Demand in the USA

The United States LED displays, lighting and fixtures market will cross USD 278.7 billion mark in 2035. From 2020 to 2024, LED displays, lighting, and fixture sales in the USA grew at 10.5% CAGR.

As per the report, the USA market will exhibit a growth rate of 7.7% CAGR between 2025 and 2035. Rising demand for LED displays, lighting, and fixtures from thriving automotive industry will boost the USA market.

In 2024, the United States produced around 109.1 million cars which increased to about 9.1 million in 2024. LED lighting is widely utilized in automobile lighting because of its durability and longer lifespan than its halogen counterparts.

LED lights also provide brighter illumination that can provide better visibility during the night. Therefore, the rising demand for automobiles will elevate the demand for LED lights in the country.

Similarly, rising usage of LED signage for marketing and advertising purposes will boost sales in the United States.

Increasing Government Initiatives to Encourage Adoption of LED Lighting Will Boost Sales in the United Kingdom

The United Kingdom market is projected to exhibit a CAGR of 8.0% from 2025 to 2035. It will generate an absolute $ opportunity of USD 5.9 billion over the next ten years. By 2035, the United Kingdom market will reach around USD 11.1 billion.

Changing preference towards energy-efficient lighting solutions is a key factor driving the United Kingdom market. Besides this, rising government support will boost LED display, lighting, and fixture sales.

About 6.5 million lighting columns are currently installed in the United Kingdom. As LEDs are more durable than halogens and consume less energy than halogen bulbs, the government has started phasing out halogen bulbs from the country to meet its sustainable development goals.

With the implementation of LED lights all across the country, demand for LED lights is projected to expand. This in turn will boost the United Kingdom LED displays, lighting and fixtures market through 2035.

Surface Mounted Device Will Remain the Top Selling Category

Based on product, demand remains high for surface mounted device LEDs globally. The target segment grew at a CAGR of 11.5% from 2020 to 2024. Over the next decade, it will exhibit a CAGR of 8.8%.

Surface-mounted devices are generally used for the creation of the individual pixels that make up the display. These pixels can be arranged in different configurations to create various types of displays such as outdoor billboards, and indoor signs.

Surface mounted devices can allow for high-resolution displays with excellent color accuracy and brightness. Rising usage of outdoor billboards is likely to increase demand for surface mounted devices. Therefore, the market for this segment is set to expand during the assessment period.

LED Street Lighting Fixture to Create Lucrative Revenues for the Market

As per Future Market Insights, LED street lighting fixtures will remain the most lucrative applications. This is due to rising adoption of LED street lighting fixtures globally. From 2020 to 2024, LED street lighting fixture segment registered a CAGR of 11.0%. Between 2025 and 2035, it is likely to rise at 8.7% CAGR.

LED street lighting has gained popularity in recent years due to its numerous benefits over traditional street lighting systems such as sodium lamps and metal halide lamps.

LED street lighting is more energy efficient and can save around 50% to 70% of energy. LED lamps also have a longer lifespan of around 50,000 hours, resulting in reduced maintenance costs. They also produce better lighting than their traditional counterparts.

Amid rising trend of energy conservation, energy-efficient lighting such as LEDs is being implemented to cut down energy costs. With the rapid phasing out of halogen bulbs across various countries, demand for LED street lighting systems will expand at a robust pace.

Philips Lumileds Lighting Co., Samsung LED Co. Ltd., Toyoda Gosei Co. Ltd, Seoul Semiconductor Co. Ltd, LG Innotek Co. Ltd., Barco NV, Brodwax Lighting, Cooper Lighting, LLC, SMART Global Holdings, and Epistar Corp are leading manufacturers of LED displays, lighting, and fixtures.

New product launches remain the go-to strategy of these key players. Besides this, they are also adopting other strategies such as partnerships, mergers, collaborations, and acquisitions.

Recent Developments:

In March 2025, Philips Lumileds Lighting Co. launched Philips Ultinon Pro6001. This new product will provide better automotive lighting solutions for clear visibility. The Ultinon pro 6001 was certified by the French authorities allowing French drivers to legally upgrade from traditional halogen lamps.

In February 2025, Fluence launched its new intercanopy lighting solution VYNE. Vyne can be extremely beneficial in indoor farming such as greenhouses. This new solution is equipped with multiple spectral options that can enable farmers to balance light efficiency and crop quality.

In June 2020, Samsung launched its new line of QLED 8K Signage displays globally. The newly launched display has a significant improvement in resolution than the previous models. It also has an AI upscaling technology through which content can be produced in lower resolution but still will be displayed in 8K resolution. This launch expands the product portfolio of the company significantly

| Attribute | Details |

|---|---|

| Current Market Size (2025) | USD 92.0 billion |

| Projected Market Size (2035) | USD 215.0 billion |

| Anticipated Growth Rate (2025 to 2035) | 8.9% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; and the Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, and others. |

| Key Segments Covered | Product, Application, and Region |

| Key Companies Profiled | Philips Lumileds Lighting Co.; Samsung LED Co. Ltd.; Toyoda Gosei Co. Ltd; Seoul Semiconductor Co. Ltd; LG Innotek Co. Ltd.; Barco NV; Brodwax Lighting; Cooper Lighting, LLC; SMART Global Holdings; Epistar Corp. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers Restraints Opportunity Trends Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global LED displays, lighting and fixtures market is estimated to be valued at USD 118.8 billion in 2025.

The market size for the LED displays, lighting and fixtures market is projected to reach USD 278.7 billion by 2035.

The LED displays, lighting and fixtures market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in LED displays, lighting and fixtures market are conventional LED displays, surface mounted device, LED lighting and LED fixture.

In terms of application, backlighting segment to command 42.7% share in the LED displays, lighting and fixtures market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED Digital Speed Limit Sign Market Size and Share Forecast Outlook 2025 to 2035

LED Light Market Size and Share Forecast Outlook 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LEDPackaging Market Size and Share Forecast Outlook 2025 to 2035

LED Neon Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Driver IC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LED Grow Lights Market Analysis by Product, Installation Type, Application and Region Through 2035

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

LED Light Bar Market Analysis - Trends, Growth & Forecast 2025 to 2035

LED Phosphor Material Market

LED Driver Market

LED Modular Display Market

LED Tester Market

LED Cable Market

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA