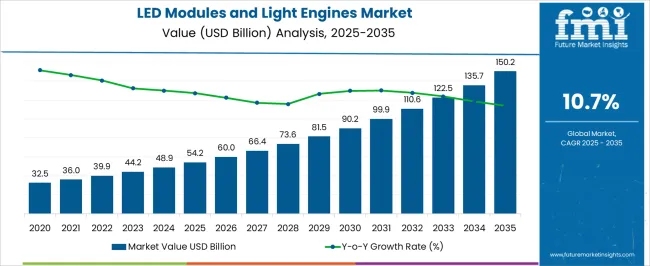

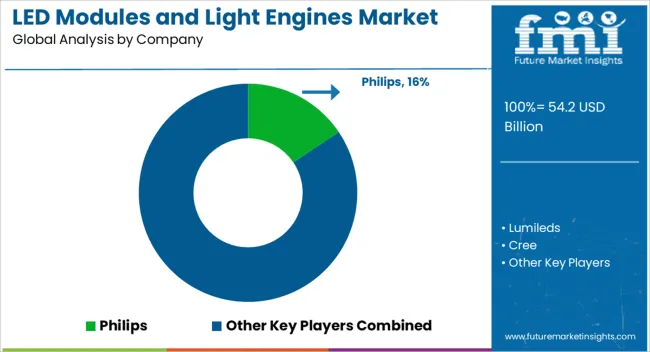

The LED Modules and Light Engines Market is estimated to be valued at USD 54.2 billion in 2025 and is projected to reach USD 150.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.7% over the forecast period.

| Metric | Value |

|---|---|

| LED Modules and Light Engines Market Estimated Value in (2025 E) | USD 54.2 billion |

| LED Modules and Light Engines Market Forecast Value in (2035 F) | USD 150.2 billion |

| Forecast CAGR (2025 to 2035) | 10.7% |

The LED modules and light engines market is advancing steadily, propelled by rising demand for energy-efficient lighting solutions and the global transition toward sustainable building infrastructure. Industry publications and corporate reports have emphasized the adoption of LEDs as a critical factor in reducing carbon emissions and lowering operational costs across multiple sectors. The proliferation of smart building technologies and government initiatives promoting energy conservation have further accelerated market penetration.

Manufacturers have responded with innovations in modular LED systems that enable flexible design, extended product lifespans, and reduced maintenance requirements. Additionally, declining costs of LED components and improvements in luminous efficacy have enhanced adoption in both developed and emerging economies.

Looking ahead, growth prospects are expected to be supported by the integration of LED modules into connected lighting systems, expansion of commercial construction projects, and rising demand for advanced form factors tailored to architectural and functional lighting needs.

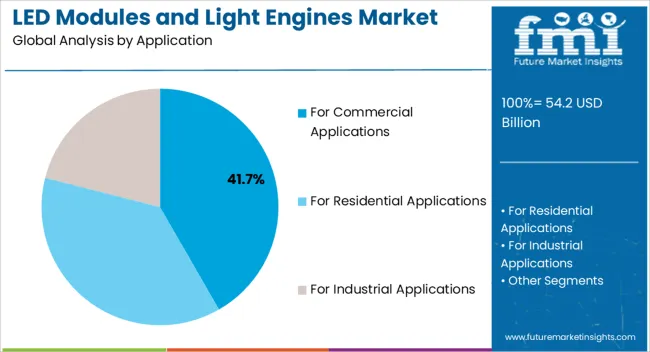

The For Commercial Applications segment is projected to account for 41.70% of the LED modules and light engines market revenue in 2025, securing its position as the leading application area. Growth in this segment has been influenced by the rapid adoption of energy-efficient lighting in offices, retail spaces, hospitality venues, and institutional buildings. Facility managers and developers have increasingly prioritized LEDs due to their ability to reduce energy costs while meeting stringent green building certification standards.

Corporate sustainability initiatives have also fueled investment in commercial LED retrofitting and new construction lighting solutions. Additionally, advancements in dimmable and tunable white LED systems have enabled customized lighting environments that enhance workplace productivity and customer experience.

With ongoing investments in commercial infrastructure and regulatory mandates for energy-efficient lighting, the For Commercial Applications segment is expected to remain a key driver of market demand.

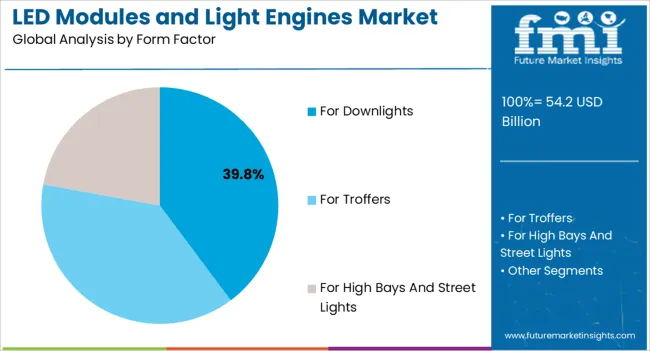

The For Downlights segment is projected to capture 39.80% of the LED modules and light engines market revenue in 2025, maintaining its leading share among form factors. This dominance has been shaped by the widespread use of downlights in residential, commercial, and institutional settings where focused, recessed lighting is preferred. Manufacturers have enhanced downlight modules with compact designs, higher lumen outputs, and improved thermal management, making them suitable for diverse architectural applications.

Reports from the lighting industry have highlighted the growing popularity of downlights in modern interior design due to their aesthetic appeal and versatility. Furthermore, the replacement of traditional halogen and compact fluorescent downlights with LED alternatives has contributed significantly to market expansion.

As building developers continue to favor efficient and visually appealing lighting solutions, the For Downlights segment is expected to sustain strong growth, reinforced by ongoing innovation in modular design and compatibility with smart lighting systems.

From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 10.2%. The primary and foremost feature for the use of LED modules and light engines over its straight competitors like light bulbs is that LED modules and light engines are easy to manufacture, more efficient, and provide more reliable products than its straight competitors.

LED modules and light engines market gained hype due to the boom in the LED TV market and monitor backlight market. Some other markets that contribute to the growth of LED modules and light engine market are cell phone flash, architectural lighting, and automobile lighting. The overall demand for LED modules and light engines is projected to grow at a CAGR of 11.2% between 2025 and 2035, totaling around USD 115,729.3 Million by 2035.

With the increasing adoption of smart/connected lighting and LED luminaires and lamps in different sectors, LED modules and light engines are proliferating. Henceforth, the primary driver for LED modules and light engines market is the use of these products in many applications across sectors like automobile, electronics, healthcare, etc.

LED modules and light engines are used in these sectors and in broad sectors like commercial, residential, industrial, and outdoor sectors, making it a vast market with several opportunities. Moreover, the decline in prices and an improved light quality and flexibility provided by LED modules and light engines drive its growth in the market.

The major challenge faced by the LED modules and light engines market is that it plays by the rules of one company. The other competitors report that the market is closed due to specifications followed by just one company, making it a closed manufacturer's standard.

In addition to this, a few of the LED modules and light engines suffer from 120Hz flicker, which reduces the efficiency to almost 83%. This impedes the growth of the LED modules and light engines market.

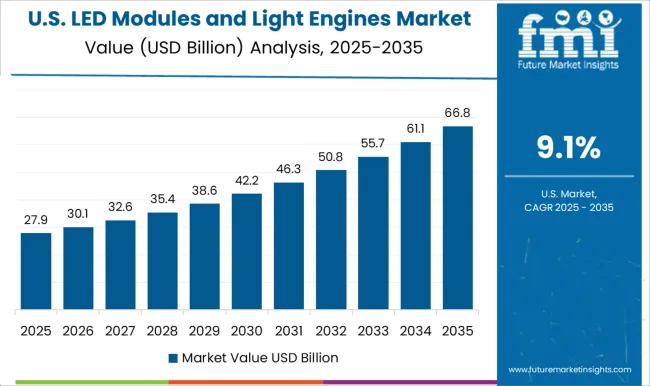

Increasing Adoption of LEDs Driving Market Growth in North America

The North America LED modules and light engines market is expected to accumulate a market share of 22.1% in 2025. North America is expected to dominate during the forecast period owing to the adoption of LEDs and applications, including LEDs on a common utility purpose by several industries.

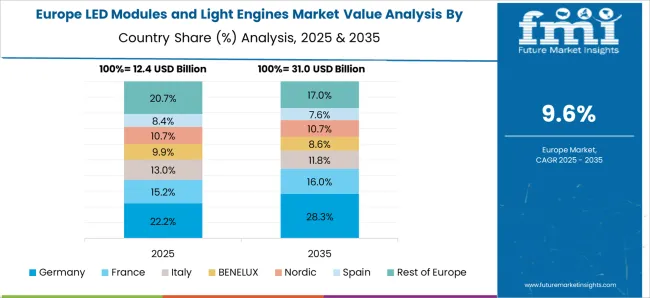

Demand from Residential and Architectural Segments to Boost Market Growth in Europe

The European region is anticipated to be one of the leading LED modules and light engine markets, with a share of 18.9%. European countries are implementing LED Lights technologies in residential and architectural segments, and such a high adoption of LED Lights is most visible in countries including the UK, France, Germany, and Italy.

Some key players in the LED Modules and Light Engines market are Nanoleaf, EcoSense Lighting, Lumenpulse, LIFX, Urban Gro and many more.

Prominent players in the LED Modules and Light Engines market are Philips Lumileds, Cree, Osram Opto, GE, Everlight, Nichia, Sharp, Toyoda Gosei, Samsung LED, Seoul Semiconductor, LG Innotek, and various other regional manufacturers.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.7% from 2025 to 2035 |

| Market Value in 2025 | USD 54.2 billion |

| Market Value in 2035 | USD 150.2 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Form Factor, Application, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa (MEA) |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Philips; Lumileds; Cree; Osram Opto; General Electric Company; Everlight; Nichia; Sharp Corporation; Toyoda Gosei; Samsung LED; Seoul Semiconductor; LG Innotek |

| Customization | Available upon Request |

The global LED modules and light engines market is estimated to be valued at USD 54.2 billion in 2025.

The market size for the LED modules and light engines market is projected to reach USD 150.2 billion by 2035.

The LED modules and light engines market is expected to grow at a 10.7% CAGR between 2025 and 2035.

The key product types in LED modules and light engines market are for commercial applications, for residential applications and for industrial applications.

In terms of form factor, for downlights segment to command 39.8% share in the LED modules and light engines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED Light Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Light Bar Market Analysis - Trends, Growth & Forecast 2025 to 2035

LED Lighting Controllers Market

OLED Lightening Panels Market

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

LED Neon Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Grow Lights Market Analysis by Product, Installation Type, Application and Region Through 2035

LED and OLED lighting Products and Display Market Size and Share Forecast Outlook 2025 to 2035

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

LED Driver for Lighting Market Analysis – Growth & Forecast 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

Outdoor LED Lighting Market Size and Share Forecast Outlook 2025 to 2035

Light Emitting Diode (LED) Backlight Display Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Heat Resistant LED Light Market Analysis by End Use Industry, Material, and Region: Forecast for 2025 to 2035

Africa LED & OLED Market Report – Growth & Forecast 2016-2026

Radiation Tolerant LED Light Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA