The LED Control Unit Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 7.4 billion by 2035, registering a compound annual growth rate (CAGR) of 9.6% over the forecast period.

| Metric | Value |

|---|---|

| LED Control Unit Market Estimated Value in (2025 E) | USD 3.0 billion |

| LED Control Unit Market Forecast Value in (2035 F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

The LED control unit market is advancing steadily, fueled by rising adoption of energy-efficient lighting technologies across automotive, industrial, and consumer applications. Industry updates and company announcements have highlighted the growing emphasis on intelligent lighting solutions that offer enhanced control, customization, and efficiency. Increasing regulatory pressure to reduce energy consumption and carbon emissions has accelerated the integration of advanced LED systems equipped with programmable control units.

In the automotive sector, the demand for adaptive lighting functions such as dimming, beam shaping, and spotlighting has been expanding, reflecting consumer preference for safety, visibility, and design flexibility. Advancements in microelectronics and sensor integration have enabled the development of compact, reliable, and multifunctional LED control units, enhancing performance and lifespan.

Strategic investments in smart infrastructure and connected lighting ecosystems are also providing growth opportunities. Looking ahead, continued innovation in adaptive lighting, miniaturized designs, and integration with IoT platforms is expected to further strengthen the market’s trajectory, with leading contributions from dimming functions, low-beam applications, and spotlight types.

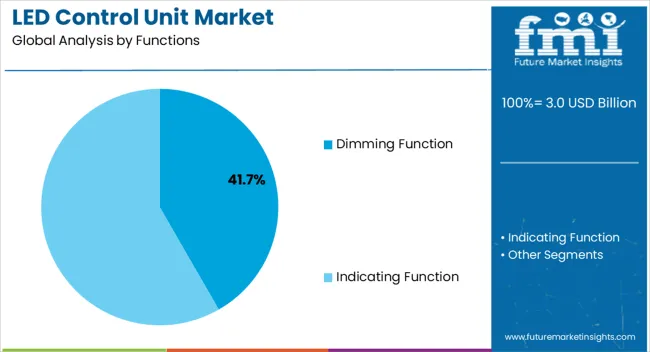

The Dimming Function segment is projected to account for 41.70% of the LED control unit market revenue in 2025, maintaining its leading position among functional categories. This dominance has been supported by growing demand for adaptable lighting solutions that balance energy savings with user comfort and safety. Dimming control units have been widely deployed due to their ability to extend LED lifespan, optimize energy efficiency, and allow dynamic adjustment of light intensity in real time.

Automotive manufacturers and commercial building operators have increasingly integrated dimming functions into LED systems, reflecting regulatory standards that prioritize energy conservation. Moreover, technological advancements in sensors and microcontrollers have improved the precision and responsiveness of dimming units, further enhancing their value.

As energy regulations tighten globally and consumers prioritize customizable lighting experiences, the Dimming Function segment is expected to sustain its leadership in the market.

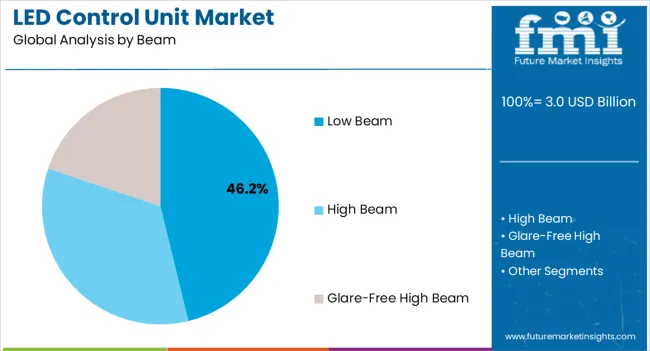

The Low Beam segment is projected to contribute 46.20% of the LED control unit market revenue in 2025, positioning it as the leading beam category. This segment’s growth has been influenced by the rising adoption of advanced automotive lighting systems designed to improve driver safety and visibility. Low-beam LED control units have been integrated extensively in passenger and commercial vehicles, providing clear illumination without causing glare to oncoming traffic.

Industry reports have indicated that regulatory requirements for road safety have accelerated the adoption of low-beam technologies in both developed and emerging automotive markets. Additionally, the compatibility of low-beam systems with adaptive driving beam technologies has enhanced their functionality, allowing for automated adjustment based on road conditions and traffic environments.

With growing consumer demand for safety-focused lighting and continuous automotive innovation, the Low Beam segment is anticipated to remain the most significant contributor in the beam category.

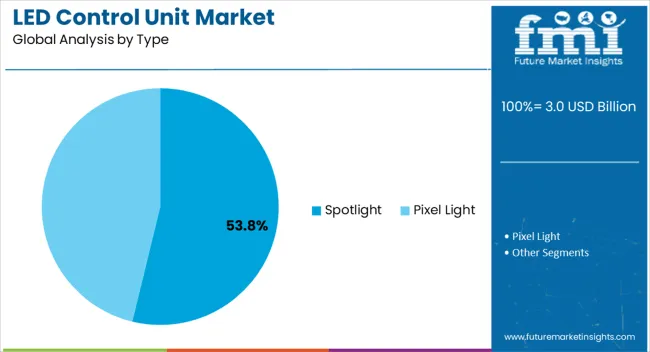

The Spotlight segment is projected to hold 53.80% of the LED control unit market revenue in 2025, establishing itself as the dominant type. Growth of this segment has been attributed to the high demand for concentrated, directional lighting across multiple applications including automotive, architectural, industrial, and event lighting. Spotlights have been favored for their ability to deliver focused illumination, enhancing visibility and design aesthetics.

Industry publications have noted an increasing shift toward LED-based spotlights, driven by their superior energy efficiency, longevity, and customizable beam angles. Technological progress in LED optics and driver circuitry has enabled spotlights to deliver high brightness with precision control, strengthening their adoption in both professional and consumer environments.

Furthermore, the expansion of smart lighting ecosystems and IoT-enabled controls has supported the integration of spotlight units into connected environments. These advantages are expected to ensure the Spotlight segment retains its leadership within the type category of the LED control unit market.

The global LED control unit market size developed at a CAGR of 8.0% from 2020 to 2025. In 2020, the global market size stood at USD 1,798.5 million. The market witnessed remarkable growth in the following years, accounting for USD 2,451.3 million in 2025.

As LED component costs have continuously dropped over time, LED lighting has become more accessible. Higher adoption rates stemmed from the increased availability of LED control units due to lower costs for consumers and enterprises. More effective and adaptable LED control units have been created through LED technology, microcontrollers, and wireless connectivity developments. Consumers and organizations find these devices more appealing since they can provide dynamic lighting effects, color modifications, and interaction with smart systems.

Future technical advancements in the LED control unit market are projected to produce lighting solutions that are more intelligent and efficient. The capabilities of LED control units will be improved by developments in wireless connection, sensor technologies, data analytics, and AI, making them even more adaptable and user-friendly. More sophisticated LED control units will lead to the development of new applications. These might include Li-Fi connectivity, sophisticated horticultural lighting for vertical farming, and more interactive lighting experiences at shows and other events.

| Historical CAGR (2020 to 2025) | 8.0% |

|---|---|

| Projected CAGR (2025 to 2035) | 10.1% |

According to our lead research consultant at FMI, the dimming function segment acquired 63.4% of the global market share in 2025. In a variety of settings, an LED dimming system helps create the desired atmosphere and environment. Brighter lighting is appropriate for work demanding concentration and focus, whereas soft and subtle lighting can promote a relaxing atmosphere. This adaptability is widely valued in applications for residences, companies, and hospitality businesses.

On the other hand, due to the increased usage of Industry 4.0, automation, and robotics, the indication function is anticipated to have substantial expansion throughout the projection period. LED indicators are used in automation and robotics to signal the status of equipment, robots, and manufacturing lines. They assist engineers and operators in quickly identifying problems, minimizing downtime, and boosting productivity.

According to our lead research consultant at FMI, the high beam LED control unit segment captured nearly 43.2% of the global market share in 2025. In the automotive industry, adaptive lighting systems frequently include high beam LED control units. Based on variables like as oncoming traffic, road curvature, and weather conditions, these systems are capable of automatically adjusting the high beam's strength and direction. With this adaptive feature, visibility is improved while glare for other drivers is reduced. Dynamic management of individual LED segments is possible with modern high beam LED control modules. This makes it possible to design "smart" lighting patterns that adapt to the design of the road, the flow of traffic, and the surroundings, enhancing overall driving safety and comfort.

| Segment | Dimming Function |

|---|---|

| Value Share in Global Market (2025) | 63.4% |

| Segment | High Beam LED Control Units |

|---|---|

| Value Share in Global Market (2025) | 43.2% |

According to our lead research consultant at FMI, India captured a gigantic 16.5% of the market share for LED control units in 2025. Numerous programs, like the "Make in India" campaign and the "Unnat Jyoti by Affordable LEDs for All" (UJALA) program, have been created by the Indian government to promote energy efficiency and sustainability.

These programs include financial aid, tax breaks, and other measures that promote the use of LED lighting, which in turn increases the demand for LED control units. India has one of the top rates of urbanization in the world. The need for effective and environmentally friendly lighting solutions, such as LED control units for smart infrastructure and public places, is increasing as cities grow.

In 2025, the LED control unit market in China occupied 13.2% of the global market shares. China has established itself as an important vendor of electronics and technological goods, such as LED lighting and control systems. Due to the nation's strong manufacturing capacities, economical production methods, and supply chain infrastructure, LED control units are widely available and priced competitively.

LED research and development have seen substantial funding from China, which is speeding up technological development. These developments pave the way for more advanced LED control units with attributes like wireless connectivity, smart controls, and Internet of Things integration.

In 2025, Germany acquired 9.2% of the global LED control unit market shares. Germany is renowned for its steadfast dedication to sustainability and energy efficiency. The country's objectives of cutting energy use, and carbon emissions, and encouraging eco-friendly technology are compatible with LED lighting and control devices.

Germany is famous for having very strong manufacturing and quality control requirements. Consumers respect items that offer dependability, longevity, and constant performance, which reputation extends to LED control units.

| Countries | CAGR (2025) |

|---|---|

| India | 16.5% |

| China | 13.2% |

| Germany | 9.2% |

Startups in this industry are utilizing cutting-edge technologies to develop ground-breaking solutions that offer increased efficiency, personalization, and integration with intelligent systems. They are working to create LED control systems that are fully compatible with smart home ecosystems. With the help of voice assistants, home automation platforms, and mobile apps, these devices may be operated to change the lighting remotely and produce custom lighting situations.

With LED control units made specifically for those industries' particular needs, startups are targeting niche market segments including agricultural, automotive, and retail. For example, an LED monitoring system made for indoor agriculture can offer customized light spectra for the best plant growth.

Technology Giants Strive to Enable New Capabilities in LED Control Units

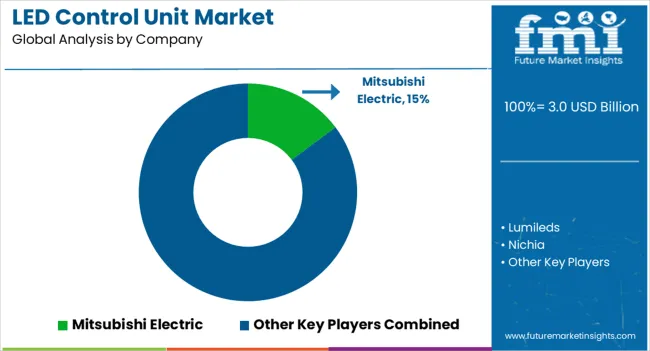

The LED control unit market has a dynamic and varied competitive environment, with a mix of well-established businesses, new startups, and technology innovators contending for market dominance. The landscape is influenced by aspects including technology advancement, product offers, global reach, clientele, and strategic alliances.

Companies that create cutting-edge components, including sophisticated sensors or wireless communication technologies, improve the competitive environment by giving LED control units access to new possibilities.

Recent Developments Observed by FMI:

| Company | Fulham |

|---|---|

| Month and Year of Development | May 2025 |

| Details |

|

| Company | Casambi |

|---|---|

| Month and Year of Development | April 2025 |

| Details |

|

| Company | Mineglow |

|---|---|

| Month and Year of Development | September 2025 |

| Details |

|

| Company | Berghaus Verkehrstechnik |

|---|---|

| Month and Year of Development | September 2025 |

| Details |

|

Key Takeaways:

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 9.6% from 2025 to 2035 |

| Market Value in 2025 | USD 3.0 billion |

| Market Value in 2035 | USD 7.4 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | By Functions, By Beam, By Light Type, By End-user, By Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, China, Japan, South Korea, Malaysia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Israel |

| Key Companies Profiled |

Mitsubishi Electric; Lumileds; Nichia; Samsung Electronics; Seoul Semiconductor; Photonic Corporation; Continental Company; CCS Inc.; Sesaly Company; APL Machinery Pvt. Ltd. |

| Customization | Available Upon Request |

The global LED control unit market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the LED control unit market is projected to reach USD 7.4 billion by 2035.

The LED control unit market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in LED control unit market are dimming function and indicating function.

In terms of beam, low beam segment to command 46.2% share in the LED control unit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED Light Market Size and Share Forecast Outlook 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LEDPackaging Market Size and Share Forecast Outlook 2025 to 2035

LED Neon Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Driver IC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LED Grow Lights Market Analysis by Product, Installation Type, Application and Region Through 2035

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

LED Driver for Lighting Market Analysis – Growth & Forecast 2025 to 2035

LED Light Bar Market Analysis - Trends, Growth & Forecast 2025 to 2035

LED and OLED lighting Products and Display Market – Growth & Forecast 2034

LED Phosphor Material Market

LED Driver Market

LED Modular Display Market

LED Tester Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA