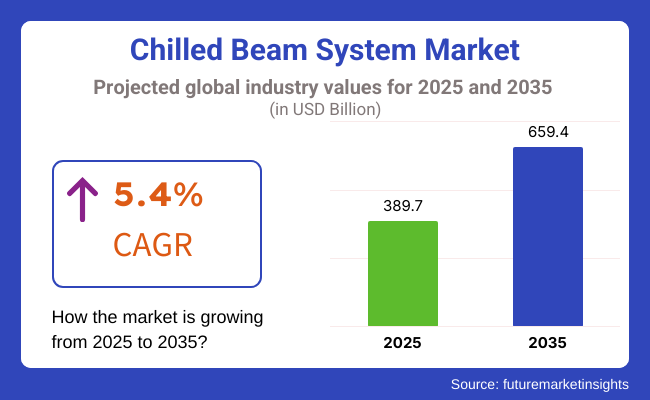

The global chilled beam system market is projected to reach USD 659.4 billion by 2035, up from an estimated USD 389.7 billion in 2025, advancing at a compound annual growth rate (CAGR) of 5.4%. This demand of chilled beam system has been underpinned by the rapid adoption of energy-efficient HVAC technologies in response to increasingly stringent global building codes and environmental mandates.

Greater emphasis has been placed by regulatory bodies on reducing carbon footprints in the built environment, leading to chilled beam systems being adopted across a range of commercial and institutional applications. These systems, which operate through radiant and convective cooling via ceiling-mounted units, consume significantly less energy compared to conventional HVAC setups, while simultaneously improving indoor air quality and thermal comfort.

Implementation has accelerated in countries prioritizing sustainable infrastructure. In the European Union, policies tied to the Energy Performance of Buildings Directive (EPBD) have catalysed the use of low-carbon ventilation technologies, especially in refurbished commercial properties.

In Australia, chilled beam systems have been incorporated into high-performance green buildings such as Chifley Tower in Sydney, where designers pursued passive energy control to meet NABERS sustainability benchmarks. Similarly, in Canada, their use has expanded in hospitals and research centers seeking to meet LEED Platinum and WELL certification standards, where both air purity and energy efficiency are prioritized.

Increasing attention toward occupant health has played a pivotal role in reshaping HVAC strategies post-COVID-19. Chilled beam systems have been deployed in healthcare environments and modern office buildings to reduce air recirculation and maintain stable humidity levels-factors shown to limit the spread of airborne pathogens. For example, chilled beam technology has been adopted in the Karolinska University Hospital in Sweden, where the system's low noise levels and high thermal comfort support both patient recovery and energy-saving mandates.

Smart building integration has also contributed to market momentum. Innovations in IoT-enabled climate control systems and building automation have allowed chilled beam units to respond dynamically to occupancy patterns, ambient conditions, and energy pricing. In Japan, several pilot projects within Tokyo’s smart city initiatives have featured chilled beams combined with AI-based energy management platforms, optimizing temperature regulation while minimizing emissions.

Structural advantages have also influenced the decision to deploy chilled beams in high-rise construction. The compact design of chilled beam systems enables reduced ductwork, allowing for lower floor-to-ceiling heights and increased usable space-an architectural benefit critical in dense urban markets such as Hong Kong, New York, and Singapore. Reduced need for mechanical room space and fewer air handling units translate into construction and operational cost savings, which continue to be highlighted by developers aiming to balance green certifications with return on investment.

In addition to operational benefits, global supply chains have adapted to rising chilled beam demand. Manufacturers have been reconfiguring production lines to include modular systems tailored for retrofit applications, particularly in North America and Western Europe, where aging HVAC infrastructure requires low-disruption replacements. Government-backed building energy upgrade programs in the United States (e.g., through the Inflation Reduction Act) and Germany (via the KfW Energy Efficiency Program) have provided financial incentives to accelerate this transition.

Active chilled beam systems are expected to hold approximately 45% of the global market share in 2025, maintaining their lead due to proven energy performance in commercial and institutional settings. These systems have been adopted in high-profile developments such as the Karolinska Institute in Sweden and the University of Chicago’s Lab Schools, where consistent indoor climate control and silent operation are critical. The energy savings achieved-up to 30% compared to traditional HVAC systems-have reinforced their role in LEED- and BREEAM-certified buildings.

In contrast, passive chilled beams are projected to grow at a CAGR of 7.8% between 2024 and 2030, driven by global demand for low-maintenance, ductless climate systems. Their application has been encouraged in Scandinavian schools, UK healthcare facilities, and Australian green housing developments, where natural convection supports silent cooling without mechanical fans. This not only minimizes noise but also supports space-efficient ceiling configurations-an advantage in buildings with stringent architectural constraints.

Cooling-only chilled beams are forecasted to account for 48.4% of total global revenues in 2025, gaining favor in environments prioritizing air quality and low energy consumption. In hospitals across Singapore and research labs in Germany, these systems have been deployed to eliminate air recirculation-thereby reducing cross-contamination risks. Facilities like Mayo Clinic (USA) have integrated cooling-only chilled beams to maintain sterile conditions while reducing HVAC maintenance overheads.

Meanwhile, dual-function systems offering both cooling and heating have gained traction in climate-diverse regions such as Northern Europe, Canada, and Japan, where year-round temperature regulation is essential. These units simplify HVAC design by eliminating the need for separate heating equipment, allowing facility managers to achieve operational efficiency. Energy dashboards from retrofitted office parks in the Netherlands and South Korea have shown measurable reductions in lifecycle costs after switching to chilled beam systems with dual functionality.

The commercial office segment is anticipated to maintain the largest market share by end-use in 2025 at around 31%, supported by ongoing retrofits in metropolitan business centers. Leading tech companies in California, Germany, and South Korea have adopted chilled beam systems to align with ESG targets and improve occupant productivity. These systems have been prioritized for their ability to reduce HVAC-related energy consumption by up to 50%, according to data from green building assessments in Toronto’s financial district.

The hospitality sector, with a projected CAGR of 7.1% through 2035, is emerging as a fast-growing segment. New hotel developments in Dubai, Singapore, and Milan are specifying chilled beams to deliver quiet, efficient, and guest-comfort-focused HVAC performance. For example, Marriott International has piloted passive chilled beams in select European hotels to enhance indoor air quality while minimizing operational disruptions. The low noise output is particularly valued in premium accommodations aiming to deliver restful and health-conscious stays.

North America claims the biggest share in the chilled beam system market, because of increasing energy-efficient cooling technologies awareness, government regulations on emissions, and the high number of green buildings. The United States and Canada put a lot of money in the development of environmental infrastructure, in this area LEED-certified and net-zero energy projects play the first fiddle in the adoption of chilled beam systems.

The growth of commercial offices, healthcare facilities, and educational institutions is the main reason for steady demand for chilled beam installations. USA Green Building Council's sustainability standards and ASHRAE energy-efficiency codes are compelling architects and HVAC designers to include chilled beams in new construction.

Conversely, in North America, the retrofit market is also driving growth as older buildings are upgrading their HVAC systems to become more energy-efficient to comply with energy codes. Likewise, the adoption of smart building automation is such that it allows us to leverage the integration of chilled beams that are IoT-enabled, which in turn results in real-time monitoring and proper climate control.

Though the costs of the initial investment are high, the gains of decreased operational expenses, energy savings, and improved occupant comfort are those which are pushing the market to expand. The North American market is expected to grow at a moderate pace, with the major cities being the first to introduce green-building policies to encourage low-energy cooling solutions.

Europe continues to be a leading market for chilled beam systems, supported by stringent environmental policies, carbon reduction targets, and proactive investments in green buildings. Germany, the UK, France, and Scandinavia are among the top countries in terms of energy-efficient construction, hence chilled beams becoming the HVAC choice of preference for commercial and institutional applications.

The European Union's 2030 energy efficiency plans are pushing forward the uptake of low-energy cooling solutions. In light of its heavy emphasis on cutting carbon emissions, European governments are promoting the implementation of radiant cooling and demand-controlled ventilation solutions, in which chilled beams particularly excel.

The building and office education segments are leading the charge, with European corporate offices, universities, and research institutions clamoring for low-maintenance HVAC solutions. Incorporating intelligent climate control systems in contemporary buildings is also increasing the efficiency of chilled beams, making them a central part of green urban planning.

In addition, escalating energy prices in Europe are urging building owners to invest in cost-effective cooling solutions with long-term cost benefits. Rapid development in prefabricated and modular building is adding further momentum to the market for compact and adaptable chilled beam systems in new as well as retrofit construction.

The Asia-Pacific chilled beam system market is poised to record the highest CAGR owing to factors such as rapid urbanization, development of commercial infrastructure, and smart, energy-efficient building construction.

Asian countries are among the fastest-growing economies in the world and they are taking the lead in building the HVAC solutions of the future, primarily those in the building segment which are next in line for this innovation.

China, being the largest construction market in the world, is currently witnessing augmented uptake of smart contracting technology in large buildings and office high-rises. This is all due to government programs that support the use of environmentally friendly technologies such as China’s Three-Star Rating System thus bolstering governments' intentions. India has experienced growth in the commercial sector which is also caused by the increase in IT parks, hospitals, and smart cities. Thus, the need for chilled beam technology will increase. The Indian

government’s focus on sustainable urban development is expected to speed up the adoption of passive and active chilled beam systems in the near future. Japan and South Korea are the pioneering countries when it comes to the application of energy-efficient and advanced HVAC technologies in the market. High

reliance on emerging technologies, such as smart homes, automated office buildings, and zero-energy buildings (ZEBs), has been a game-changer in the field of cooling solutions. These markets are expected to lead the adoption of chilled beam technology as a response to the expected demand for compact, high-performance cooling systems that are also low carbon emitting.

However, lack of awareness and high upfront installation costs are some of the challenges that may hinder further implementation in developing countries. For that reason, development and investment in the structure and infrastructure in the countries of the region together with different educating programs and the use of government incentives will be the major boost of securing the market.

Challenges

High initial cost and installation complexity: In contrast to traditional HVAC systems, chilled beams need to be controlled for precise humidity to avoid condensation, which adds to system design complexity and demands skilled professionals for proper installation.

Another issue is market awareness. Europe and North America are mature markets for chilled beam systems, but developing markets still use conventional air conditioning as a result of lack of awareness and skilled personnel. Manufacturers and industry associations have to work on raising awareness among contractors, engineers, and building owners regarding the long-term advantages of chilled beam technology.

Moreover, lack of space in current buildings can hinder opportunities for retrofitting chilled beams since they need special ceiling heights and compatibility with ventilation systems. Overcoming these challenges will demand technological innovations in small and modular chilled beam designs.

Opportunities

The increasing green building and smart city trend provides tremendous growth potential for chilled beam systems. Carbon reduction regulations, government incentives, and strict energy-efficiency norms are fuelling demand for low-energy HVAC technology, making chilled beams a sustainable cooling option of choice.

Combination of smart climate control, IoT-based HVAC, and AI-backed energy optimization is further boosting chilled beam market value. Growing utilization of hybrid chilled beam systems integrating displacement ventilation and radiant cooling brings new opportunities to commercial, healthcare, and education markets.

In addition, increasing investments in prefabricated and modular buildings are generating demand for space-efficient, lightweight HVAC systems, in which chilled beams are superior. Compact, high-performance, and economical design manufacturers will be the winners in the unfolding market.

From 2020 to 2024, the chilled beam system market witnessed substantial growth as the demand for energy-efficient, sustainable, and high-performance HVAC solutions increased. As commercial buildings and industries looked for low-energy cooling options, chilled beam systems became a popular choice for lowering operational expenses, improving indoor air quality, and complying with green building standards. Governments and regulatory authorities implemented strict energy efficiency standards, fuelling adoption in offices, healthcare facilities, schools, and hospitality industries.

The building construction industry, especially in commercial and institutional buildings, saw growing application of passive and active chilled beam systems. The systems provided low-noise operation, low maintenance, and high thermal comfort, making them a desirable option compared to conventional HVAC units.

Concerns about lowering carbon footprints, enhancing indoor environmental quality (IEQ), and obtaining LEED certification also supported market demand. Furthermore, advances in automation, intelligent sensors, and adaptive air control mechanisms improved chilled beam solutions' performance and efficiency.

The healthcare sector was among the early adopters of chilled beam systems, especially for hospitals, laboratories, and pharmaceutical manufacturing plants, where exact temperature and humidity control was important. The COVID-19 crisis brought increased recognition of airborne infection transmission, with facility managers taking steps to purchase ventilation systems with better air movement while minimizing contamination risk.

Low-air-movement chilled beam systems, which are low in cross-contamination potential, became more popular in the healthcare sector to provide a healthy and comfortable environment for patients and staff.

Even with robust market growth, issues like high upfront costs of investment, low awareness in developing economies, and retrofitting limitations in aging buildings created obstacles for mass adoption. Industry players, however, concentrated on affordable installation methods, enhanced compatibility with existing HVAC systems, and hybrid chilled beam product development to overcome these challenges.

Building automation system (BAS) advancements, demand-controlled ventilation, and real-time energy monitoring also helped promote market growth. The chilled beam system market will keep developing with a robust focus on energy-efficient innovation, intelligent climate management, and sustainable building integration.

With industries shifting towards green cooling solutions, AI-driven automation, and high-performance HVAC technologies, chilled beam manufacturers need to embrace next-generation chilled beam designs, fault-tolerant energy distribution models, and smart ventilation systems to remain competitive globally.

The market for chilled beam systems, during 2025 to 2035, will be revolutionized through smart climate control technologies, decarbonisation policy, and building management system adoption of AI technologies. Sustainable cooling technologies, low-GWP refrigerants, and net-zero buildings will see a global drive in the transformation of the market space.

The convergence of IoT and AI in HVAC equipment will maximize energy optimization, real-time performance monitoring, and proactive maintenance. Intelligent chilled beams will come with adaptive cool algorithms, temperature control depending on occupancy levels, and automatically regulated climate control for greater overall building efficiency. There will be an increasing need for hybrid systems integrating chilled beams with geothermal cooling, radiant heating, and ERV as multi-functional, high-performance solutions for contemporary buildings.

The commercial space will be driving market expansion, with corporate space, skyscrapers, and schools being the leaders in embracing sustainable HVAC systems. Governments will enforce tighter energy codes and building standards, which will require the adoption of low-energy cooling solutions. The concept of smart cities, smart buildings, and green infrastructure will enhance the use of chilled beam systems.

The residential market will also see an increasing demand for chilled beam cooling, especially in luxury apartment buildings, upscale housing complexes, and green homes. With homeowners looking for quiet, energy-efficient, and attractive cooling systems, chilled beam technology will become a preferred choice over traditional air conditioning. The widespread use of district cooling networks and renewable energy-powered HVAC systems will supplement chilled beam installations, maximizing overall cooling efficiency.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments promoted energy-efficient cooling standards and green building certifications. |

| Technological Advancements | Companies developed smart chilled beams, automated airflow control, and hybrid cooling systems. |

| Industry Applications | Chilled beam systems were widely used in commercial offices, healthcare, and educational buildings. |

| Environmental Sustainability | Companies adopted low-energy cooling strategies and demand-controlled ventilation. |

| Market Growth Drivers | Demand was driven by sustainability objectives, thermal comfort requirements, and reduced operational expenses. |

| Production & Supply Chain Dynamics | Supply chains faced installation complexities, high material costs, and limited adoption in retrofits. |

| End-User Trends | Businesses prioritized green building solutions and energy-efficient HVAC systems. |

| Infrastructure Development | High-rise buildings and commercial spaces drove chilled beam system demand. |

| Health & Indoor Air Quality | Awareness of airborne contaminants and ventilation efficiency increased adoption. |

| Investment in R&D | Companies developed improved heat exchangers and integrated climate control sensors. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter carbon-neutral HVAC policies and mandatory low-energy cooling solutions will dominate regulations. |

| Technological Advancements | Future innovations will focus on AI-driven optimization, thermal energy storage, and IoT-enabled predictive cooling. |

| Industry Applications | Expansion into luxury residential complexes, smart city infrastructures, and net-zero energy buildings. |

| Environmental Sustainability | Industry-wide adoption of water-efficient, zero-emission, and fully recyclable chilled beam systems. |

| Market Growth Drivers | Growth will be fuelled by smart climate control, AI-powered predictive maintenance, and integration of renewable energy. |

| Production & Supply Chain Dynamics | Companies will invest in modular chilled beam solutions, localized manufacturing, and sustainable material sourcing. |

| End-User Trends | Future demand will emphasize smart HVAC integration, noise-free cooling, and adaptive climate control. |

| Infrastructure Development | Increased investments in smart buildings, autonomous climate control, and AI-driven energy management systems. |

| Health & Indoor Air Quality | Future designs will focus on air-purifying coatings, allergen-free cooling, and personalized climate zones. |

| Investment in R&D | Research will expand into biodegradable materials, nanotechnology-driven cooling, and advanced thermal adaptation systems. |

United States chilled beam system market is growing substantially due to increased demand for energy-efficient HVAC systems in schools, hospitals, and commercial buildings. With increasing sustainability goals and green building ratings such as LEED (Leadership in Energy and Environmental Design), there is an increased focus on reducing energy consumption in heating, ventilation, and air conditioning (HVAC) systems.

The intersection of smart building technologies and rising electricity costs are also propelling the adoption of chilled beam systems, which are defined by reduced energy consumption and improved thermal comfort compared to traditional air-based HVAC systems.

USA federal and state energy efficiency regulations, such as the Department of Energy (DOE) and Environmental Protection Agency (EPA), are encouraging green HVAC solutions, and demand for active and passive chilled beam systems is on the rise. Additionally, developments in air conditioning and dehumidification have led to improved chilled beam performance, reducing the likelihood of condensation and improving energy efficiency in humid climates like Florida and Texas.

High-rise business structures in major metropolitan areas such as New York, Chicago, and San Francisco now incorporate chilled beam technology to reduce HVAC energy consumption by up to 30%, resulting in significantly reduced operating costs. The medical field is a significant adopter, as chilled beam systems help eliminate airborne pathogens, and are thus optimally designed for use in hospitals and labs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

Growing UK chilled beam system is becoming familiar with the market due to energy efficiency regulation rigidity, net-zero carbon ambitions, and increasing use in commercial office buildings. As part of the UK government's decarbonization efforts for the built environment, HVAC solutions such as chilled beams are gaining popularity due to their low energy consumption and ability to reduce the overall greenhouse gas emissions.

Green Building Council (UKGBC) deems currently occupied office buildings and schools in cities such as London, Manchester, and Birmingham to be some of the most ideal locations for the application of the UKGBC's sustainability platform. One can also note the tighter regulation of energy usage in buildings, for example, Part L of the UK Building Regulations, which is driving developers and facility managers to replace traditional HVAC systems with chilled beam technology.

Market growth in the UK as a result of an increasing need for smart buildings is a salient factor. A large number of commercial building owners and property developers are among the first to get IoT-plus-HVAC systems, which are key to having live data on the condition of the air such as airflow, temperature as well as humidity. This is providing a necessary improvement in energy efficiency and indoor air quality in office.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

European Union chilled beam system market is witnessing fast growth through stringent environmental regulations, rising implementation of green buildings, and great emphasis on cutting HVAC energy use. Germany, France, and the Netherlands are at the forefront of the use of chilled beams in new as well as renovated buildings based on EU directives towards carbon neutrality and building energy efficiency.

The EU's Energy Performance of Buildings Directive (EPBD) requires high energy efficiency levels for commercial and residential buildings, promoting the adoption of low-energy HVAC solutions like chilled beam systems. The need for hybrid ventilation and cooling solutions is increasing in office buildings, minimizing reliance on energy-hungry air conditioning systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.3% |

Japan's chilled beam system market is strongly growing owing to technological progress, energy efficiency regulations, and accelerating adoption in hi-tech commercial buildings. Japan possesses an advanced real estate and infrastructure market, which makes it a primary market for smart cooling solutions.

The energy saving policies of the government in Japan, like the Zero Energy Building (ZEB) scheme, are encouraging the use of green cooling technologies, like chilled beams. Japan's own hot and humid climate has long presented challenges to chilled beam implementation, but new devices, like humidity-controlled active chilled beams, are bypassing these disadvantages.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea's chilled beam market is expanding with increasing demand for energy-efficient HVAC solutions, urbanization, and the growth of smart cities. The nation is leading in smart infrastructure, with Seoul and Busan being the key cities to invest in green building.

As the Korean government has set ambitious carbon neutrality targets, commercial and public buildings are becoming more inclined to use sustainable cooling systems. Corporate giants like Samsung and LG are also pushing innovation in the HVAC sector, and as a result, smart chilled beam technologies with built-in humidity control and air purification capabilities are being developed.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The market for chilled beam systems is transforming at a fast pace, spurred by growing needs for energy-efficient HVAC systems, green cooling technologies, and better indoor air quality. Market players emphasize high-end cooling efficiency, minimal carbon footprint, and connectivity with smart building management systems.

The market consists of global market leaders and niche manufacturers, all driving technological innovations and business expansion in commercial properties, healthcare facilities, schools, and homes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Halton Group | 12-16% |

| FläktGroup | 10-14% |

| TROX GmbH | 9-12% |

| Swegon Group | 7-11% |

| Caverion Corporation | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Halton Group | Specializes in active and passive chilled beams for commercial buildings and healthcare facilities. Focuses on customized indoor climate solutions. |

| FläktGroup | Offers modular and integrated chilled beam systems with energy-efficient airflow control for office spaces and educational institutions. |

| TROX GmbH | Develops advanced chilled beam systems with smart air management technology, integrating demand-based ventilation controls. |

| Swegon Group | Manufactures high-efficiency chilled beams for indoor climate optimization, emphasizing sustainability and CO2 reduction. |

| Caverion Corporation | Provides smart building solutions with chilled beam integration, ensuring thermal comfort and reduced operational costs. |

Key Company Insights

Halton Group (12-16%)

Halton Group is a global leader in chilled beam systems, providing customized indoor climate solutions for commercial environments, healthcare, and schools. The company is specialized in high-performance air distribution technology and energy-efficient cooling solutions to address the needs of the global market for effective HVAC systems.

FläktGroup (10-14%)

FläktGroup is a specialist in modular chilled beam systems, enhancing air quality and energy efficiency in commercial buildings. The company incorporates smart airflow management in its systems, aligning with contemporary building automation trends.

TROX GmbH (9-12%)

TROX GmbH is known for its intelligent air management technology, offering smart-controlled chilled beams. The company invests in high-performance heat exchange technology, ensuring superior cooling efficiency in offices, hotels, and educational facilities.

Swegon Group (7-11%)

Swegon Group produces high-efficiency chilled beams that concentrate on sustainable indoor climate control. The company focuses on CO2 reduction and energy-efficient HVAC solutions, which makes it a popular choice for green building projects.

Caverion Corporation (5-9%)

Caverion Corporation integrates chilled beam technology with smart building solutions, ensuring thermal comfort and operational cost reduction. The company specializes in customized climate control for modern buildings, enhancing indoor air quality.

Several other companies contribute to technological advancements, cost-effective solutions, and regional expansion. These include:

The overall market size for Chilled Beam System was USD 389.7 Billion in 2025.

The Chilled Beam System is expected to reach USD 659.4 Billion in 2035.

The demand for chilled beam is expected to rise due to its widespread use in chemicals, pharmaceuticals, and agriculture. Its role as an intermediate in fine chemicals, pesticides, and industrial solvents drives market growth. Advancements in chemical synthesis and the shift toward sustainable production further boost adoption. Additionally, increasing demand in coatings, resins, and fragrances supports market expansion.

The top 5 countries which drives the development of Chilled Beam Systemare USA, UK, Europe Union, Japan and South Korea.

Concealed Chilled Beam Systems are anticipated to hold a significant share of the market over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chilled Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Chilled Processed Food Market Analysis by Ready Meal, Processed Meat, Processed Fish or Seafood Through 2035

Chilled Soup Market Analysis by Packaging Type and Distribution Channels Through 2035

Analysis and Growth Projections for Chilled Meal Kits Market

Market Share Breakdown of Chilled Food Packaging Manufacturers

Chilled Water Storage System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chilled Beams Market Size and Share Forecast Outlook 2025 to 2035

Beam Expander Market

Hornbeam Market Analysis by Source, Application, End-user, Distribution channel, and Region through 2035

Bumper Beam Market

Electron Beam (EB) Based Coating Market

Electronic Beam Machining Market

Artificial Wood Beams Market

Automotive Cross Car Beam Market Size and Share Forecast Outlook 2025 to 2035

System-On-Package Market Size and Share Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Systemic Sclerosis Treatment Market - Trends & Forecast 2025 to 2035

System on Module Market Growth – Trends & Forecast 2025 to 2035

SLE Drugs Market Insights - Growth & Forecast 2025 to 2035

Systemic Mastocytosis Treatment Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA