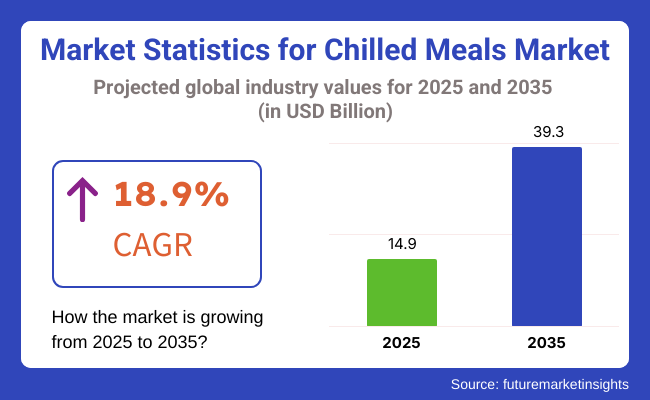

The global Chilled Meal Kits Market is poised to reach a value of USD 14979.3 Million by 2025 and is projected to reach a value of USD 39395.6 Million by 2035, reflecting a compound annual growth rate of 18.9% over the assessment period 2025 2035.

The market for chilled meal kits has shown outstanding expansion because customers want efficient and nutritious food preparation methods. The meal kits contain fresh ingredients and step-by-step recipes which enable home cooking without needing to visit grocery stores or make planning meals.

The market flourishes because people with active modern lifestyles require speedy nutritious meals. Since chilled meal kits combine ease of use with health-conscious eating habits their market recognition continues to rise.

The market thrives because consumers now strongly prefer eating foods which are both fresh and organic in nature. Persons who focus on their health seek out meal solutions which respect their nutritional targets. Chilled meal kits come available in different diet-friendly categories such as vegan, vegetarian and gluten-free which suits numerous dietary requirements.

The COVID-19 pandemic caused people to adopt home-cooking practices while demanding contactless delivery options which significantly expanded the market. Meals offered through subscriptions enable consistent delivery of food which strengthens customer brand commitment.

Two major drivers affecting the growth of the chilled meal kits market are innovation along with sustainability interests. Companies invest in sustainable package solutions while minimizing waste by serving perfectly designed ingredient packages. Assistance from new technologies in logistics systems has made meal kit delivery more efficient resulting in higher product freshness and quality standards.

Collaborations between chilled meal kits providers and local farmers and suppliers allow businesses to procure fresh and seasonal ingredients from local sources. The growth and innovative developments in the chilled meal kits market will expand due to increasing consumer environmental consciousness.

Personalized meal plans catering to dietary preferences and restrictions.

The chilled meal kits market has experienced a significant growth trend because customers can now obtain personalized meal plans according to their dietary choices and restrictions. These options allow customers to select dishes according to their particular nutritional requirements that include vegan, vegetarian, gluten-free, keto, paleo and additional dietary limitations and sensitivities.

Meal kit providers use their broad selection to serve various customers who are looking for meals that fit individual dietary demands and personal taste preferences.

Tailored meal plans bring numerous advantages by offering dietary flexibility to users. Searches for proper dining choices become difficult for food-sensitive people with allergy or intolerance to certain substances. The customer selects their dietary limitations through personalized meal plans which enables providers to provide secure ingredient combinations along with appropriate recipes.

Customization at this level performs dual functions by making food consumption more satisfying for customers while maintaining better health standards in dining areas.

The use of personal meal plans enables the support of customer health objectives and dietary requirements. Numerous individuals use particular diets because they want to reach specific health-related goals which may include reducing weight while building muscle or enhancing their digestive system.

Meal kit providers deliver specialized meal plans which assist their consumers to meet their health objectives so they can succeed with their dietary commitments. Weight loss plans consist of low-calorie nutrient-dense meals whereas muscle gain plans prioritize high-protein choices for the meals

Eco-friendly packaging and reduced food waste initiatives.

The market for chilled meal kits depends on sustainable packaging materials as well as finding methods to minimize food waste. Companies now use environmentally-friendly methods because customer awareness regarding pollution has increased and because these steps draw conscious buyers and minimize their environmental impact.

The technique of eco-friendly packaging requires biodegradable together with compostable and recyclable materials. Sustainable packaging solutions now take the place of standard plastic manufacturing through incorporation of plant-based plastics together with paper-based materials and reusable container products.

The decomposing materials do not pollute the environment because they break down through natural processes. Parameter-switching protective packaging formats manufactured by companies combine vacuum-sealed plastic bags with portion size solutions to provide protective storage together with efficient resource management.

The selection of environmental-friendly packaging strategies enables meal kit providers to reach multiple objectives of environmental improvement without compromising customer brand loyalty.

The chilled meal kits market works to decrease food waste levels as a primary approach. Consumers get exact recipe measurements through meal kits since the packages contain predetermined ingredient portions. The specified approach eliminates consumer-level leftover ingredients to decrease food losses throughout the process.

Companies in the market have adopted local supplier and farmer partnerships to procure ingredients thus decreasing both food transportation distances and waste output.

Introduction of diverse and exotic meal options.

Exotic and diverse meals represent an important trend in the chilled meal kits market because they let consumers enjoy distinctive culinary experiences. People today explore new culinary tastes because global travel and culinary exploration have become easier thus they actively pursue distinctive and appealing Flavors.

The increase in food diversification emerges as meal kit suppliers present many recipes featuring worldwide ingredients and culinary methods.

Diversifying meal offerings brings advantages to organizations by serving eaters who want to try new dishes. These taste-seeking customers search for cuisine beyond traditional staples because they want to explore World tastes through experimentation. These consumers will respond to meal kit companies offering unique ingredient combinations and unusual food items which enables differentiation against other providers.

Diverse ingredients in meal options let meal kit providers both teach cultural knowledge to customers while developing their cooking talents. Most meal kits deliver recipe cards with comprehensive background material about the dish along with source information regarding its origins and component ingredients.

The combination of superior cooking experience and educational opportunities regarding various cultural cuisines improves the overall kitchen skills of consumers. Customers increase their cooking abilities while deepening their understanding of food traditions through home preparation of meal kit recipes.

Budget-friendly meal kits appealing to a wider audience.

Budget-friendly meal kits have gained significant popularity within the chilled section of meal kits because they target customers who need inexpensive home cooking solutions. The kits enable consumers to create homemade food because they eliminate the high expenses people face when eating outside their home or purchasing multiple food items separately.

The provision of affordable meal kits allows providers to capture price-conscious customers who extend their market potential.

Discounted meal kits provide financial benefits through their economical characteristics. The kits include bulk-bought ingredients which lowers total costs to allow providers charge lower prices in the market. The integration of locally sourced seasonal food items helps companies reduce expenses which they can distribute as price reductions to their customers.

The low prices of meal kits enable providers to attract varying types of consumers spanning from students to families as well as persons with limited financial means.

The main advantage of affordable meal kits includes their convenience features as well as their budget-friendly characteristics. The convenience and affordability emerge from reducing store visits which saves both time and money along with shrinking ingredient volume dangerous for waste production.

The pre-packaged components in meal kits provide precise portions to their subscribers so they need less food while minimizing waste and delivering superior cost-per-meal value. The convenience features attract people who need to prepare homemade food but prefer doing so with minimal effort and reduced-price tags.

During the period 2020 to 2025, the sales grew at a CAGR of 18.9% and it is predicted to continue to grow at a CAGR of 10.2% during the forecast period of 2025-35.

The chilled meal kits industry experienced significant market growth over past years because consumers changed their lifestyles and food preferences. These meal kits started serving mostly convenience-seeking urban professionals who worked long hours. The market expanded due to consumers who discovered how home-made fresh meals eliminate grocery store visits while offering convenience.

Lockdowns combined with health concerns pushed more consumers to prepare their meals at home because of the pandemic. The market shift led businesses to expand their selection by adding multiple diet-related options along with different food varieties.

Companies devoted large funds to packaging research and logistics supply chain upgrades in order to keep food ingredients safe from deterioration while moving through the supply network.

Research indicates that the chilled meal kits industry will maintain its strong growth pattern throughout the forthcoming years. The market analysts predict that over 2023 to 2033 it will expand by 16.3% annually and amount to USD 26,436.6 million in total value.

The market will experience strong growth through two main factors which are rising consumer interest in healthy convenient meals and increased sustainability consciousness. The market will see businesses implement sustainable packaging solutions while decreasing food waste because customers expect these changes. The business will unlock growth potential through its strategic market entry into Asian and South American communities alongside its expansion

Tier 1: Major businesses holding leading positions in the chilled meal kits market include Tyson Foods, Inc. (Tyson Taste Makers) and HelloFreshSE together with Campbell’s. The sizeable market presence and national distribution capabilities of these firms enables them to serve numerous consumers easily. The market leadership of their brands continues because they invest heavily in marketing strategies along with innovation developments.

Tier 2: HomeChef (The Kroger Company) and Blue Apron Holdings Inc and Gousto operate within the second competitive level. These businesses have effectively built a dependable customer base while establishing themselves as major market competitors.

Their platforms include numerous dining choices while they have strengthened their technology base and shipping infrastructure to enhance user experience. The companies keep a strong market standing through their commitment to high quality products and satisfied customers.

Tier 3: The emerging third tier includes Martha & Marley Spoon and Sunbasket as well as Lina’s Matkassel (LMK Group AB), My Food Bags Ltd, Dinner (MMM Consumer brand Inc.), Purple Carrot, Gobble Inc., and Hungryroot. The companies within this category succeed by presenting special meal choices while focusing their services on specific consumer segments.

The companies have gained market share via innovative methods as well as their sustainability focus to draw consumers seeking different meal choices.

The following table shows the estimated growth rates of the significant three geographies sales. USA and Germany are set to exhibit high consumption, recording CAGRs of 13.8% and 17.3% respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 13.8% |

| Germany | 17.3% |

| India | 21.7% |

The chilled meal kits market in the USA has transformed through new packaging methods and delivery systems. The process of meal component delivery relies on state-of-the-art materials which consist of vacuum-sealed packaging systems along with temperature-regulated packaging to preserve freshness before delivery.

The improved packaging methods ensure better meal kit quality while establishing freshness levels which lead to greater customer contentment about their food reaching their kitchen intact.

The logistics behind delivering meal kits to consumers has undergone substantial advancement efforts. Real-time tracking systems entered delivery processes to enable companies to track shipments for accurate delivery times.

The technology improves the safety of delivery by minimizing spoiling risks and maintaining product freshness from factory to customer dining table. The move towards eco-friendly packaging materials helps businesses build consumer loyalty because it satisfies increasing sustainability demands which leads to better market competitiveness.

The German chilled meal kit industry receives its vitality through recent technological developments in delivery and packaging approaches. Changes in this market result from consumer demands for ease of use combined with sustainability interests. The market now uses improved packaging techniques which include vacuum-sealed bags together with temperature-controlled containers.

The technologies enable safe and fresh delivery of meal kit ingredients to customers because safety plays a main role in consumer experience. These packaging solutions increase ingredient shelf life which enables consumers to get nutritious high-quality products that maintain their taste quality.

Real-time tracking systems enable companies to monitor deliveries and achieve on-time delivery through improved logistics management of meal kit services. This technological integration lets meal kit providers ensure their products deliver to customers without damage which lowers spoilage risks and creates better delivery experience.

Eco-friendly package materials are appearing more frequently in the market because consumers want sustainable approaches for their products. Companies strengthen their appeal with environmentally sensitive customers through their transition towards biodegradable and compostable and recyclable packaging materials.

An increasing need for easy meal solutions in India serves as one of the main forces which drives the growth of the chilled meal kits market. Many Indian consumers who face urbanization and speed-of-life challenges now need speedy accessible meals.

Chilled meal kits resolve real-life needs by preparing each ingredient portion before adding step-by-step food preparation instructions which decreases the necessity of elaborate meal planning and shopping at stores.

Indian consumers who display increasing health awareness have also driven up demand for these meal kits. Indian consumers now recognize the value of nutritionally balanced meals so they seek easy solutions to maintain healthy diets while still having convenience in their daily lives. Chilled meal kits provide what consumers need by offering various diet-specific options such as low-calorie and high-protein and vegan foods.

| Segment | Value Share (2025) |

|---|---|

| Functional Beverages (Application) | 55% |

Global vegetarianism trends have produced widespread effects on the market for chilled meal kits. The surge in dietary choice toward vegetarianism because of wellness and ethical and ecological reasons has made providers of meal kits create more vegetarian meal options.

Chilled meal kits today provide diverse plant proteins together with fresh vegetables in addition to creative recipes for people choosing meatless dietary options. The market transformation enables vegetarians to shop along with flexitarians and consumers focused on dietary health who plan to decrease their meat intake through these plant-based meal choices.

The demand for vegetarian meal kits has made them a vital component of modern market segments.

Market innovation in the meal kits industry has accelerated because of growing vegetarianism trends. The market presents new and unique culinary creations by providers who demonstrate vegetable-based ingredients through varied and original recipe developments.

Vegetarian meal kits present consumers with thrilling sets of dietary options which combine classic vegetarian modifications of conventional dishes with newly invented culinary masterpieces. Companies focus on acquiring fresh top-quality ingredients which delivers healthy meals while reinforcing the attraction of vegetarian dietary choices.

| Segment | Value Share (2025) |

|---|---|

| Citrus Flavour (Synthetic Flavour) | 90% |

Various variables exist that explain why males prefer their meal kits to be chilled. The timed efficiency of these kits suits active lifestyles and enables men to make their meals with minimal commitment to planning or shopping trips. Chilled meal kits provide different types of meals including large servings with protein which satisfy male taste preferences.

Pre-portioned recipes together with minimal cooking requirements attract men who lack advanced culinary abilities because the experience is straightforward. Most male consumers find chilled meal kits appealing because they offer convenient delivery and various prepared options in addition to streamlined preparation steps.

Major chilled meal kits market competitors include Tyson Foods Inc. (Tyson Taste Makers) together with HelloFresh SE and Campbell's who are leading this market segment toward growing intensity. Through its deep food production experience Tyson Taste Makers provides prepped ingredients together with user-friendly recipes to serve consumers who want convenience alongside quality food.

The global meal kits sector experiences further market growth through HelloFresh SE's ongoing expansion as the company presents its customers with diverse meal choices along with ingredients of fresh high-quality standards. The company has achieved market leadership status through satisfying its customers well and through innovative marketing approaches.

Campbell's targets devoted customers through brand recognition to provide its large product selection of traditional and innovative dining solutions. The companies hold intense competition by delivering convenience alongside high quality meals while offering various choices to serve customers seeking effective healthy eating in this fast-transforming industry.

The market is expected to grow at a CAGR of 18.9% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 39395.6 Million.

Europe is expected to dominate the global consumption.

Tyson Foods, Inc. (Tyson Taste Makers); HelloFreshSE; Campbell’s; HomeChef(The Kroger Company

Table 1: Global Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Value (US$ million) Forecast by Product, 2018 to 2033

Table 4: Global Volume (MT) Forecast by Product, 2018 to 2033

Table 5: Global Value (US$ million) Forecast by Customer Age, 2018 to 2033

Table 6: Global Volume (MT) Forecast by Customer Age, 2018 to 2033

Table 7: Global Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 9: Global Value (US$ million) Forecast by Gender, 2018 to 2033

Table 10: Global Volume (MT) Forecast by Gender, 2018 to 2033

Table 11: North America Global Value (US$ million) Forecast by Country, 2018 to 2033

Table 12: North America Global Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Global Value (US$ million) Forecast by Product, 2018 to 2033

Table 14: North America Global Volume (MT) Forecast by Product, 2018 to 2033

Table 15: North America Global Value (US$ million) Forecast by Customer Age, 2018 to 2033

Table 16: North America Global Volume (MT) Forecast by Customer Age, 2018 to 2033

Table 17: North America Global Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 18: North America Global Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 19: North America Global Value (US$ million) Forecast by Gender, 2018 to 2033

Table 20: North America Global Volume (MT) Forecast by Gender, 2018 to 2033

Table 21: Latin America Global Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: Latin America Global Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Global Value (US$ million) Forecast by Product, 2018 to 2033

Table 24: Latin America Global Volume (MT) Forecast by Product, 2018 to 2033

Table 25: Latin America Global Value (US$ million) Forecast by Customer Age, 2018 to 2033

Table 26: Latin America Global Volume (MT) Forecast by Customer Age, 2018 to 2033

Table 27: Latin America Global Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 28: Latin America Global Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Global Value (US$ million) Forecast by Gender, 2018 to 2033

Table 30: Latin America Global Volume (MT) Forecast by Gender, 2018 to 2033

Table 31: Europe Global Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: Europe Global Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Global Value (US$ million) Forecast by Product, 2018 to 2033

Table 34: Europe Global Volume (MT) Forecast by Product, 2018 to 2033

Table 35: Europe Global Value (US$ million) Forecast by Customer Age, 2018 to 2033

Table 36: Europe Global Volume (MT) Forecast by Customer Age, 2018 to 2033

Table 37: Europe Global Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 38: Europe Global Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 39: Europe Global Value (US$ million) Forecast by Gender, 2018 to 2033

Table 40: Europe Global Volume (MT) Forecast by Gender, 2018 to 2033

Table 41: East Asia Global Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: East Asia Global Volume (MT) Forecast by Country, 2018 to 2033

Table 43: East Asia Global Value (US$ million) Forecast by Product, 2018 to 2033

Table 44: East Asia Global Volume (MT) Forecast by Product, 2018 to 2033

Table 45: East Asia Global Value (US$ million) Forecast by Customer Age, 2018 to 2033

Table 46: East Asia Global Volume (MT) Forecast by Customer Age, 2018 to 2033

Table 47: East Asia Global Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 48: East Asia Global Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Global Value (US$ million) Forecast by Gender, 2018 to 2033

Table 50: East Asia Global Volume (MT) Forecast by Gender, 2018 to 2033

Table 51: South Asia Global Value (US$ million) Forecast by Country, 2018 to 2033

Table 52: South Asia Global Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia Global Value (US$ million) Forecast by Product, 2018 to 2033

Table 54: South Asia Global Volume (MT) Forecast by Product, 2018 to 2033

Table 55: South Asia Global Value (US$ million) Forecast by Customer Age, 2018 to 2033

Table 56: South Asia Global Volume (MT) Forecast by Customer Age, 2018 to 2033

Table 57: South Asia Global Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 58: South Asia Global Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 59: South Asia Global Value (US$ million) Forecast by Gender, 2018 to 2033

Table 60: South Asia Global Volume (MT) Forecast by Gender, 2018 to 2033

Table 61: Oceania Global Value (US$ million) Forecast by Country, 2018 to 2033

Table 62: Oceania Global Volume (MT) Forecast by Country, 2018 to 2033

Table 63: Oceania Global Value (US$ million) Forecast by Product, 2018 to 2033

Table 64: Oceania Global Volume (MT) Forecast by Product, 2018 to 2033

Table 65: Oceania Global Value (US$ million) Forecast by Customer Age, 2018 to 2033

Table 66: Oceania Global Volume (MT) Forecast by Customer Age, 2018 to 2033

Table 67: Oceania Global Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 68: Oceania Global Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 69: Oceania Global Value (US$ million) Forecast by Gender, 2018 to 2033

Table 70: Oceania Global Volume (MT) Forecast by Gender, 2018 to 2033

Table 71: MEA Global Value (US$ million) Forecast by Country, 2018 to 2033

Table 72: MEA Global Volume (MT) Forecast by Country, 2018 to 2033

Table 73: MEA Global Value (US$ million) Forecast by Product, 2018 to 2033

Table 74: MEA Global Volume (MT) Forecast by Product, 2018 to 2033

Table 75: MEA Global Value (US$ million) Forecast by Customer Age, 2018 to 2033

Table 76: MEA Global Volume (MT) Forecast by Customer Age, 2018 to 2033

Table 77: MEA Global Value (US$ million) Forecast by Sales Channel, 2018 to 2033

Table 78: MEA Global Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 79: MEA Global Value (US$ million) Forecast by Gender, 2018 to 2033

Table 80: MEA Global Volume (MT) Forecast by Gender, 2018 to 2033

Figure 1: Global Value (US$ million) by Product, 2023 to 2033

Figure 2: Global Value (US$ million) by Customer Age, 2023 to 2033

Figure 3: Global Value (US$ million) by Sales Channel, 2023 to 2033

Figure 4: Global Value (US$ million) by Gender, 2023 to 2033

Figure 5: Global Value (US$ million) by Region, 2023 to 2033

Figure 6: Global Value (US$ million) Analysis by Region, 2018 to 2033

Figure 7: Global Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Value (US$ million) Analysis by Product, 2018 to 2033

Figure 11: Global Volume (MT) Analysis by Product, 2018 to 2033

Figure 12: Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Global Value (US$ million) Analysis by Customer Age, 2018 to 2033

Figure 15: Global Volume (MT) Analysis by Customer Age, 2018 to 2033

Figure 16: Global Value Share (%) and BPS Analysis by Customer Age, 2023 to 2033

Figure 17: Global Y-o-Y Growth (%) Projections by Customer Age, 2023 to 2033

Figure 18: Global Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 21: Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 22: Global Value (US$ million) Analysis by Gender, 2018 to 2033

Figure 23: Global Volume (MT) Analysis by Gender, 2018 to 2033

Figure 24: Global Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 25: Global Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 26: Global Attractiveness by Product, 2023 to 2033

Figure 27: Global Attractiveness by Customer Age, 2023 to 2033

Figure 28: Global Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Global Attractiveness by Gender, 2023 to 2033

Figure 30: Global Attractiveness by Region, 2023 to 2033

Figure 31: North America Global Value (US$ million) by Product, 2023 to 2033

Figure 32: North America Global Value (US$ million) by Customer Age, 2023 to 2033

Figure 33: North America Global Value (US$ million) by Sales Channel, 2023 to 2033

Figure 34: North America Global Value (US$ million) by Gender, 2023 to 2033

Figure 35: North America Global Value (US$ million) by Country, 2023 to 2033

Figure 36: North America Global Value (US$ million) Analysis by Country, 2018 to 2033

Figure 37: North America Global Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Global Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Global Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Global Value (US$ million) Analysis by Product, 2018 to 2033

Figure 41: North America Global Volume (MT) Analysis by Product, 2018 to 2033

Figure 42: North America Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 43: North America Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 44: North America Global Value (US$ million) Analysis by Customer Age, 2018 to 2033

Figure 45: North America Global Volume (MT) Analysis by Customer Age, 2018 to 2033

Figure 46: North America Global Value Share (%) and BPS Analysis by Customer Age, 2023 to 2033

Figure 47: North America Global Y-o-Y Growth (%) Projections by Customer Age, 2023 to 2033

Figure 48: North America Global Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 49: North America Global Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 50: North America Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: North America Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: North America Global Value (US$ million) Analysis by Gender, 2018 to 2033

Figure 53: North America Global Volume (MT) Analysis by Gender, 2018 to 2033

Figure 54: North America Global Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 55: North America Global Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 56: North America Global Attractiveness by Product, 2023 to 2033

Figure 57: North America Global Attractiveness by Customer Age, 2023 to 2033

Figure 58: North America Global Attractiveness by Sales Channel, 2023 to 2033

Figure 59: North America Global Attractiveness by Gender, 2023 to 2033

Figure 60: North America Global Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Global Value (US$ million) by Product, 2023 to 2033

Figure 62: Latin America Global Value (US$ million) by Customer Age, 2023 to 2033

Figure 63: Latin America Global Value (US$ million) by Sales Channel, 2023 to 2033

Figure 64: Latin America Global Value (US$ million) by Gender, 2023 to 2033

Figure 65: Latin America Global Value (US$ million) by Country, 2023 to 2033

Figure 66: Latin America Global Value (US$ million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Global Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Global Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Global Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Global Value (US$ million) Analysis by Product, 2018 to 2033

Figure 71: Latin America Global Volume (MT) Analysis by Product, 2018 to 2033

Figure 72: Latin America Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 73: Latin America Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 74: Latin America Global Value (US$ million) Analysis by Customer Age, 2018 to 2033

Figure 75: Latin America Global Volume (MT) Analysis by Customer Age, 2018 to 2033

Figure 76: Latin America Global Value Share (%) and BPS Analysis by Customer Age, 2023 to 2033

Figure 77: Latin America Global Y-o-Y Growth (%) Projections by Customer Age, 2023 to 2033

Figure 78: Latin America Global Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 79: Latin America Global Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 80: Latin America Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 81: Latin America Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 82: Latin America Global Value (US$ million) Analysis by Gender, 2018 to 2033

Figure 83: Latin America Global Volume (MT) Analysis by Gender, 2018 to 2033

Figure 84: Latin America Global Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 85: Latin America Global Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 86: Latin America Global Attractiveness by Product, 2023 to 2033

Figure 87: Latin America Global Attractiveness by Customer Age, 2023 to 2033

Figure 88: Latin America Global Attractiveness by Sales Channel, 2023 to 2033

Figure 89: Latin America Global Attractiveness by Gender, 2023 to 2033

Figure 90: Latin America Global Attractiveness by Country, 2023 to 2033

Figure 91: Europe Global Value (US$ million) by Product, 2023 to 2033

Figure 92: Europe Global Value (US$ million) by Customer Age, 2023 to 2033

Figure 93: Europe Global Value (US$ million) by Sales Channel, 2023 to 2033

Figure 94: Europe Global Value (US$ million) by Gender, 2023 to 2033

Figure 95: Europe Global Value (US$ million) by Country, 2023 to 2033

Figure 96: Europe Global Value (US$ million) Analysis by Country, 2018 to 2033

Figure 97: Europe Global Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Global Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Global Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Global Value (US$ million) Analysis by Product, 2018 to 2033

Figure 101: Europe Global Volume (MT) Analysis by Product, 2018 to 2033

Figure 102: Europe Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 103: Europe Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 104: Europe Global Value (US$ million) Analysis by Customer Age, 2018 to 2033

Figure 105: Europe Global Volume (MT) Analysis by Customer Age, 2018 to 2033

Figure 106: Europe Global Value Share (%) and BPS Analysis by Customer Age, 2023 to 2033

Figure 107: Europe Global Y-o-Y Growth (%) Projections by Customer Age, 2023 to 2033

Figure 108: Europe Global Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 109: Europe Global Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 110: Europe Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 111: Europe Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 112: Europe Global Value (US$ million) Analysis by Gender, 2018 to 2033

Figure 113: Europe Global Volume (MT) Analysis by Gender, 2018 to 2033

Figure 114: Europe Global Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 115: Europe Global Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 116: Europe Global Attractiveness by Product, 2023 to 2033

Figure 117: Europe Global Attractiveness by Customer Age, 2023 to 2033

Figure 118: Europe Global Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Europe Global Attractiveness by Gender, 2023 to 2033

Figure 120: Europe Global Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Global Value (US$ million) by Product, 2023 to 2033

Figure 122: East Asia Global Value (US$ million) by Customer Age, 2023 to 2033

Figure 123: East Asia Global Value (US$ million) by Sales Channel, 2023 to 2033

Figure 124: East Asia Global Value (US$ million) by Gender, 2023 to 2033

Figure 125: East Asia Global Value (US$ million) by Country, 2023 to 2033

Figure 126: East Asia Global Value (US$ million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Global Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: East Asia Global Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Global Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Global Value (US$ million) Analysis by Product, 2018 to 2033

Figure 131: East Asia Global Volume (MT) Analysis by Product, 2018 to 2033

Figure 132: East Asia Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 133: East Asia Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 134: East Asia Global Value (US$ million) Analysis by Customer Age, 2018 to 2033

Figure 135: East Asia Global Volume (MT) Analysis by Customer Age, 2018 to 2033

Figure 136: East Asia Global Value Share (%) and BPS Analysis by Customer Age, 2023 to 2033

Figure 137: East Asia Global Y-o-Y Growth (%) Projections by Customer Age, 2023 to 2033

Figure 138: East Asia Global Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 139: East Asia Global Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 140: East Asia Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: East Asia Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: East Asia Global Value (US$ million) Analysis by Gender, 2018 to 2033

Figure 143: East Asia Global Volume (MT) Analysis by Gender, 2018 to 2033

Figure 144: East Asia Global Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 145: East Asia Global Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 146: East Asia Global Attractiveness by Product, 2023 to 2033

Figure 147: East Asia Global Attractiveness by Customer Age, 2023 to 2033

Figure 148: East Asia Global Attractiveness by Sales Channel, 2023 to 2033

Figure 149: East Asia Global Attractiveness by Gender, 2023 to 2033

Figure 150: East Asia Global Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Global Value (US$ million) by Product, 2023 to 2033

Figure 152: South Asia Global Value (US$ million) by Customer Age, 2023 to 2033

Figure 153: South Asia Global Value (US$ million) by Sales Channel, 2023 to 2033

Figure 154: South Asia Global Value (US$ million) by Gender, 2023 to 2033

Figure 155: South Asia Global Value (US$ million) by Country, 2023 to 2033

Figure 156: South Asia Global Value (US$ million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Global Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia Global Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Global Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Global Value (US$ million) Analysis by Product, 2018 to 2033

Figure 161: South Asia Global Volume (MT) Analysis by Product, 2018 to 2033

Figure 162: South Asia Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 163: South Asia Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 164: South Asia Global Value (US$ million) Analysis by Customer Age, 2018 to 2033

Figure 165: South Asia Global Volume (MT) Analysis by Customer Age, 2018 to 2033

Figure 166: South Asia Global Value Share (%) and BPS Analysis by Customer Age, 2023 to 2033

Figure 167: South Asia Global Y-o-Y Growth (%) Projections by Customer Age, 2023 to 2033

Figure 168: South Asia Global Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 169: South Asia Global Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 170: South Asia Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 171: South Asia Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 172: South Asia Global Value (US$ million) Analysis by Gender, 2018 to 2033

Figure 173: South Asia Global Volume (MT) Analysis by Gender, 2018 to 2033

Figure 174: South Asia Global Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 175: South Asia Global Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 176: South Asia Global Attractiveness by Product, 2023 to 2033

Figure 177: South Asia Global Attractiveness by Customer Age, 2023 to 2033

Figure 178: South Asia Global Attractiveness by Sales Channel, 2023 to 2033

Figure 179: South Asia Global Attractiveness by Gender, 2023 to 2033

Figure 180: South Asia Global Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Global Value (US$ million) by Product, 2023 to 2033

Figure 182: Oceania Global Value (US$ million) by Customer Age, 2023 to 2033

Figure 183: Oceania Global Value (US$ million) by Sales Channel, 2023 to 2033

Figure 184: Oceania Global Value (US$ million) by Gender, 2023 to 2033

Figure 185: Oceania Global Value (US$ million) by Country, 2023 to 2033

Figure 186: Oceania Global Value (US$ million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Global Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: Oceania Global Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Global Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Global Value (US$ million) Analysis by Product, 2018 to 2033

Figure 191: Oceania Global Volume (MT) Analysis by Product, 2018 to 2033

Figure 192: Oceania Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 193: Oceania Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 194: Oceania Global Value (US$ million) Analysis by Customer Age, 2018 to 2033

Figure 195: Oceania Global Volume (MT) Analysis by Customer Age, 2018 to 2033

Figure 196: Oceania Global Value Share (%) and BPS Analysis by Customer Age, 2023 to 2033

Figure 197: Oceania Global Y-o-Y Growth (%) Projections by Customer Age, 2023 to 2033

Figure 198: Oceania Global Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 199: Oceania Global Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 200: Oceania Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 201: Oceania Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 202: Oceania Global Value (US$ million) Analysis by Gender, 2018 to 2033

Figure 203: Oceania Global Volume (MT) Analysis by Gender, 2018 to 2033

Figure 204: Oceania Global Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 205: Oceania Global Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 206: Oceania Global Attractiveness by Product, 2023 to 2033

Figure 207: Oceania Global Attractiveness by Customer Age, 2023 to 2033

Figure 208: Oceania Global Attractiveness by Sales Channel, 2023 to 2033

Figure 209: Oceania Global Attractiveness by Gender, 2023 to 2033

Figure 210: Oceania Global Attractiveness by Country, 2023 to 2033

Figure 211: MEA Global Value (US$ million) by Product, 2023 to 2033

Figure 212: MEA Global Value (US$ million) by Customer Age, 2023 to 2033

Figure 213: MEA Global Value (US$ million) by Sales Channel, 2023 to 2033

Figure 214: MEA Global Value (US$ million) by Gender, 2023 to 2033

Figure 215: MEA Global Value (US$ million) by Country, 2023 to 2033

Figure 216: MEA Global Value (US$ million) Analysis by Country, 2018 to 2033

Figure 217: MEA Global Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: MEA Global Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Global Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Global Value (US$ million) Analysis by Product, 2018 to 2033

Figure 221: MEA Global Volume (MT) Analysis by Product, 2018 to 2033

Figure 222: MEA Global Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 223: MEA Global Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 224: MEA Global Value (US$ million) Analysis by Customer Age, 2018 to 2033

Figure 225: MEA Global Volume (MT) Analysis by Customer Age, 2018 to 2033

Figure 226: MEA Global Value Share (%) and BPS Analysis by Customer Age, 2023 to 2033

Figure 227: MEA Global Y-o-Y Growth (%) Projections by Customer Age, 2023 to 2033

Figure 228: MEA Global Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 229: MEA Global Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 230: MEA Global Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 231: MEA Global Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 232: MEA Global Value (US$ million) Analysis by Gender, 2018 to 2033

Figure 233: MEA Global Volume (MT) Analysis by Gender, 2018 to 2033

Figure 234: MEA Global Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 235: MEA Global Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 236: MEA Global Attractiveness by Product, 2023 to 2033

Figure 237: MEA Global Attractiveness by Customer Age, 2023 to 2033

Figure 238: MEA Global Attractiveness by Sales Channel, 2023 to 2033

Figure 239: MEA Global Attractiveness by Gender, 2023 to 2033

Figure 240: MEA Global Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chilled Beams Market Size and Share Forecast Outlook 2025 to 2035

Chilled Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Chilled Water Storage System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chilled Beam System Market Analysis - Size and Demand Forecast Outlook 2025 to 2035

Chilled Processed Food Market Analysis by Ready Meal, Processed Meat, Processed Fish or Seafood Through 2035

Chilled Soup Market Analysis by Packaging Type and Distribution Channels Through 2035

Market Share Breakdown of Chilled Food Packaging Manufacturers

Meal Voucher Market Size and Share Forecast Outlook 2025 to 2035

Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Meal Replacement Products Market Analysis by Product type, source, application and region Through 2035

Meal Kit Delivery Service Market - Trends & Forecast 2025 to 2035

Meal Replacement Shake Market Trends - Powder & Liquid Analysis

UK Meal Replacement Products Market Trends – Growth, Demand & Forecast 2025-2035

Oatmeal market Analysis by Nature, Type and Sales Channel Through 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA