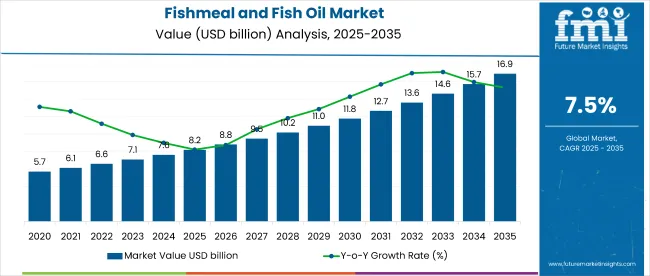

The global fishmeal and fish oil market is projected to grow from USD 8.2 billion in 2025 to USD 16.9 billion by 2035, registering a CAGR of 7.5%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8.2 billion |

| Industry Value (2035F) | USD 16.9 billion |

| CAGR (2025 to 2035) | 7.5% |

Growth in this market is being driven by rising global demand for sustainable protein sources, particularly in aquaculture and the dietary supplement industry. Fishmeal continues to play a vital role in animal nutrition due to its high digestibility and balanced amino acid profile, while fish oil is in growing demand as a source of omega-3s for human health.

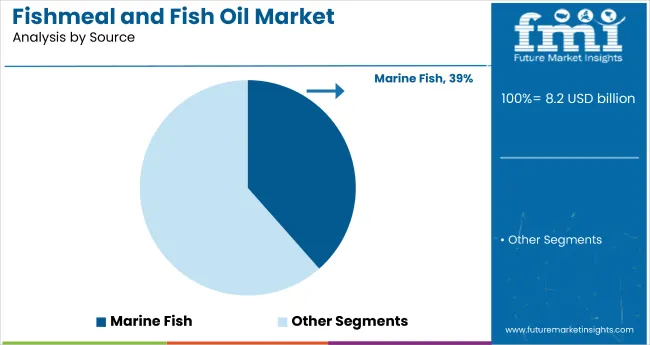

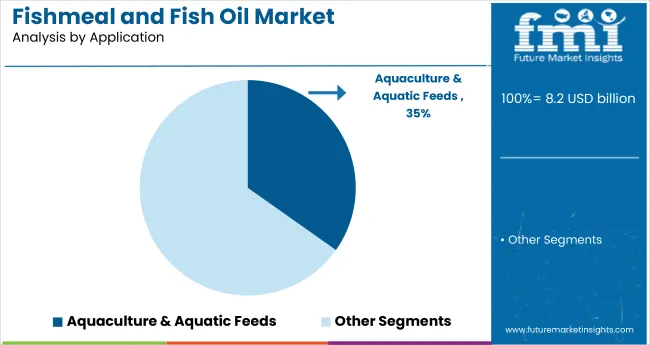

The market holds an estimated 100% share in the marine-derived animal nutrition segment, reflecting its exclusive importance in high-performance animal feed. Within the aquaculture feed ingredients market, it commands approximately 35%, while contributing around 14% to the global omega-3 supplement market, and nearly 5% to the overall animal feed additives market. However, within the broader global food ingredients market, its share remains below 0.1%, reflecting its niche yet strategic role.

Regulatory influence stems from international feed safety standards and traceability frameworks. Certifications like IFFO RS and MSC guide sourcing and processing practices. Governments in China, the EU, and the USA support circular bioeconomy approaches using fish by-products. FAO guidelines and national aquaculture health protocols are directing demand toward consistent, high-grade fishmeal and oil.

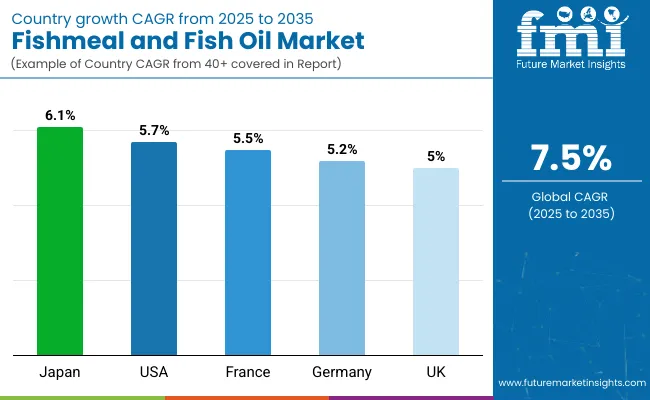

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 6.1% from 2025 to 2035. Marine fish will lead the source segment with a 38.5% share, while aquaculture & aquatic feeds will dominate the application segment with a 34.8% share. The USA and UK are also expected to grow steadily at CAGRs of 5.7% and 5%, respectively.

The market is segmented by source, application, and region. By source, the market includes salmon & trout, marine fish, crustacean, tilapia, and carps. By application, the market is divided into aquaculture & aquatic feeds, land animal feeds and livestock, agriculture and fertilizers, pharmaceuticals, and dietary supplements. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Marine fish are projected to capture 38.5% of the source segment by 2025 driven by their high protein content, omega-3 richness, and broad global availability, making them the preferred raw material for fishmeal and oil extraction.

Aquaculture and aquatic feeds are projected to dominate the application segment with a 34.8% market share in 2025, driven by rising demand for nutrient-dense feed in commercial fish and shrimp farming.

The global fishmeal and fish oil market is witnessing steady growth, driven by increasing demand for high-protein feed ingredients in aquaculture and livestock sectors. Fishmeal’s rich nutritional profile and functional benefits as a sustainable protein source are boosting its adoption in animal feed formulations worldwide. Additionally, rising awareness about the importance of quality feed for improving animal health and productivity supports market expansion.

Recent Trends in the Fishmeal and Fish Oil Market

Challenges in the Fishmeal and Fish Oil Market

Japan shows the highest growth among OECD nations, driven by demand from aquaculture and livestock sectors adopting automation and incorporating plant-based alternatives into marine protein feeds. Domestic producers focus on nutrient-efficient systems and blended formulations to improve feed conversion ratios. Germany and France maintain stable demand under EU rules that favor clean-label inputs and certified sustainable sourcing. The USA is expected to expand at a 5.7% CAGR, supported by inland aquaculture and specialty applications in pet food and animal nutrition.

The UK follows at 5%, influenced by regulatory realignment and rising use of marine lipids in performance feeds. Germany grows at 5.2%, with innovation centered on organic livestock feed and circular aquafeed models. These five OECD countries are advancing at 0.85-1.05x the global average, supported by regulatory compliance, supply innovation, and targeted demand from evolving feed systems.

The report includes granular market data from 40+ countries; below are highlights from five top-performing OECD nations.

The Japan fishmeal and fish oil revenue is forecasted to grow at a CAGR of 6.1% from 2025 to 2035. Growth is supported by advanced aquaculture practices and feed innovations focused on sustainability and clean-label principles.

The USA fishmeal and fish oil market is projected to grow at 5.7% CAGR, driven by innovation in specialty feed formulations, pet food diversification, and large-scale consistency.

The French fishmeal and fish oil revenue is expected to expand at a 5.5% CAGR, benefiting from EU sustainability mandates and increasing demand for premium and organic feed products.

The demand for fishmeal and fish oil is growing at 5.2% CAGR during the forecast period, backed by EU regulations on feed safety and increased adoption of organic and functional feed ingredients.

The UK fishmeal and fish oil revenue is expected to grow at 5% CAGR, the slowest among the top five, supported by wellness-focused trends and feed regulation aimed at animal health.

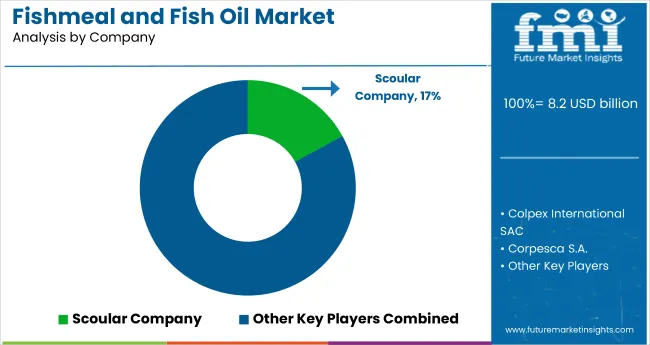

The market is moderately consolidated, with prominent players such as Scoular Company, Colpex International SAC, Corpesca S.A., Corporacion Pesquera Inca S.A.C., and Croda International PLC leading global production and supply. These companies offer a broad spectrum of fishmeal products tailored to aquaculture, livestock feed, and pet nutrition industries.

Scoular Company emphasizes sustainable sourcing and feed traceability, while Colpex International SAC specializes in premium-grade fishmeal derived from pelagic species. Corpesca S.A. and Corporacion Pesquera Inca S.A.C. are known for vertically integrated production processes ensuring quality and volume scalability. Croda International PLC, with its strong biotechnology orientation, delivers omega-rich feed supplements and marine-derived functional ingredients.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 8.2 billion |

| Projected Market Size (2035) | USD 16.9 billion |

| CAGR (2025 to 2035) | 7.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Source Analyzed | Salmon & Trout, Marine Fish, Crustaceans, Tilapia, and Carps |

| Application Analyzed | Aquaculture & Aquatic Feeds, Livestock & Land Animal Feeds, Agriculture & Fertilizers, Pharmaceuticals, and Dietary Supplements |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | Scoular Company, Colpex International SAC, Corpesca S.A., Corporacion Pesquera Inca S.A.C., Croda International PLC, Tasa, FMC Corporation, Gc Rieber Oil, Marvesa Holding NV, Mukka Sea Foods Industries Pvt. Ltd., Oceana Group Ltd., Omega Protein Corporation, Orizon S.A., Pesquera Exalmar S.A.A., Pioneer Fishing, SURSAN, Austevoll Seafood ASA, TripleNine Group A/S, FF Skagen A/S |

| Additional Attributes | Dollar sales by equipment type, share by power, regional demand growth, policy influence, automation trends, competitive benchmarking |

In this segment Salmon & Trout, Marine Fish, Crustaceans, Tilapia, Carps are included in the report

Various applications like Aquaculture & Aquatic Feeds, Land Animal Feeds and Livestock, Agriculture and Fertilizers, Pharmaceuticals, Dietary Supplements are considered in the report

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, and Oceania

The market is valued at USD 8.2 billion in 2025.

The market is forecasted to reach USD 16.9 billion by 2035, reflecting a CAGR of 7.5%.

Marine fish will lead the source segment, accounting for 38.5% of the global market share in 2025.

Aquaculture and aquatic feeds will dominate the application segment with a 34.8% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zero-Fishmeal Feed Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA