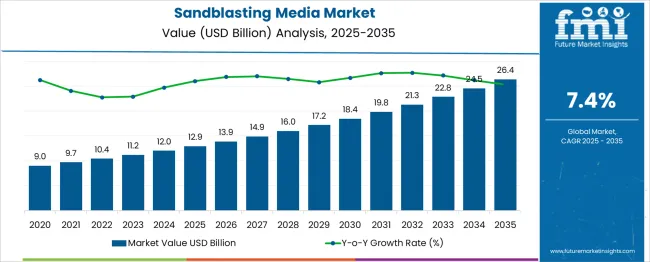

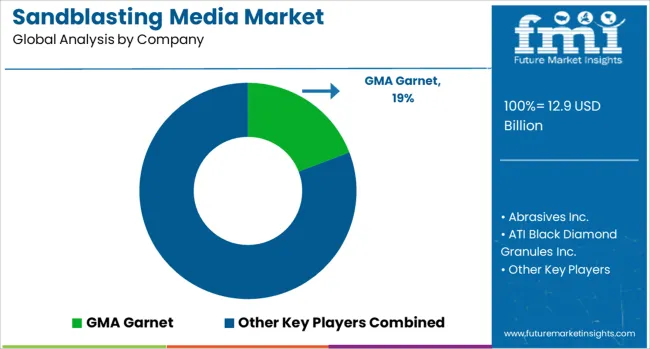

The Sandblasting Media Market is estimated to be valued at USD 12.9 billion in 2025 and is projected to reach USD 26.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

| Metric | Value |

|---|---|

| Sandblasting Media Market Estimated Value in (2025 E) | USD 12.9 billion |

| Sandblasting Media Market Forecast Value in (2035 F) | USD 26.4 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The sandblasting media market is growing steadily as industries emphasize surface preparation and finishing quality in manufacturing processes. The demand for efficient abrasive materials has been fueled by rising production activities in metalworking and automotive sectors.

Technological advances have improved the performance and sustainability of sandblasting media, leading to higher reuse rates and reduced environmental impact. Increasing focus on product durability and surface smoothness has encouraged the adoption of specialized abrasives.

Moreover, stricter regulatory standards regarding surface treatment and emissions have promoted the use of advanced media. Expansion in construction, shipbuilding, and infrastructure maintenance has also contributed to market growth. The market is expected to expand further with growing industrial output and advancements in blasting technologies. Segment growth is likely to be driven by Aluminum Oxide as the preferred product and Metalworking as the primary end-user industry.

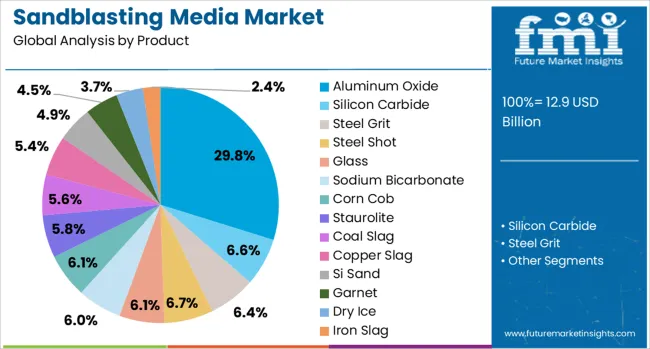

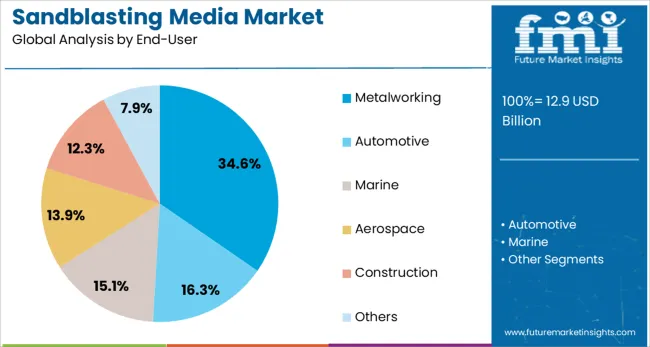

The sandblasting media market is segmented by product and end-user, and geographic regions. The sandblasting media market is divided into Aluminum Oxide, Silicon Carbide, Steel Grit, Steel Shot, Glass, Sodium Bicarbonate, Corn Cob, Staurolite, Coal Slag, Copper Slag, Si Sand, Garnet, Dry Ice, Iron Slag, Nut Shells, and Others. In terms of end-users, the sandblasting media market is classified into Metalworking, Automotive, Marine, Aerospace, Construction, and Others. Regionally, the sandblasting media industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Aluminum Oxide segment is projected to hold 29.8% of the sandblasting media market revenue in 2025, establishing itself as the leading product category. Its popularity stems from high hardness and durability, which enable effective surface cleaning and finishing across various materials.

Aluminum oxide is favored for its consistent abrasive properties and ability to produce a smooth surface without damaging the substrate. The material’s suitability for multiple applications including metal, glass, and plastic treatment has widened its adoption.

Users appreciate its recyclability, which contributes to cost efficiency and environmental compliance. As industries increasingly require precise surface textures and contamination removal, Aluminum Oxide media remains the material of choice for many sandblasting operations.

The Metalworking segment is expected to contribute 34.6% of the sandblasting media market revenue in 2025, maintaining its position as the largest end-user category. Growth in this segment is driven by the ongoing need for surface preparation prior to painting, coating, and welding operations.

Metalworking industries rely on sandblasting to remove rust, scale, and old coatings to ensure adhesion and structural integrity. The rise in manufacturing activities and maintenance of industrial machinery has led to consistent demand for effective blasting media.

Furthermore, metal fabricators and repair shops benefit from media that provide precision and efficiency. As production standards evolve and the demand for high-quality metal finishes increases, the Metalworking segment is expected to sustain its market leadership.

Demand for sandblasting media is increasing as surface preparation standards rise across industrial coatings, automotive refinishing, and infrastructure maintenance. Sales of eco-friendly alternatives and specialized media for precision applications are accelerating, particularly in regions enforcing stricter regulatory and environmental protocols.

Eco-compliant sandblasting media demand rose by 26% in 2025, prompted by regulatory bans on silica-based abrasives in industrial and shipyard settings. Operators adopted alternatives such as crushed glass, garnet, and aluminum oxide to meet safety and emissions requirements. Facilities that transitioned to non-silica media recorded a 34% reduction in respiratory hazard incidents while maintaining surface profile tolerance within ±5 µm. Growth remains strongest in North America and Western Europe, where occupational health laws now require substitution of hazardous abrasives.

Sales of fine-grade and specialty blast media rose 29% year-over-year in 2025, driven by use in automotive repair shops, aerospace prep lines, and industrial maintenance units. Fine media enabled precision profiling on curved and sensitive components, lowering material over-cutting by 21%. Refinishers using walnut shell media for paint stripping extended cabinet lifespan by 17% due to reduced abrasion. Steel shot adoption in chemical plants and turbine centers accelerated rust removal, shortening prep cycles by 33%. Vendors combining media guidance with operator training saw repeat business grow by 22%.

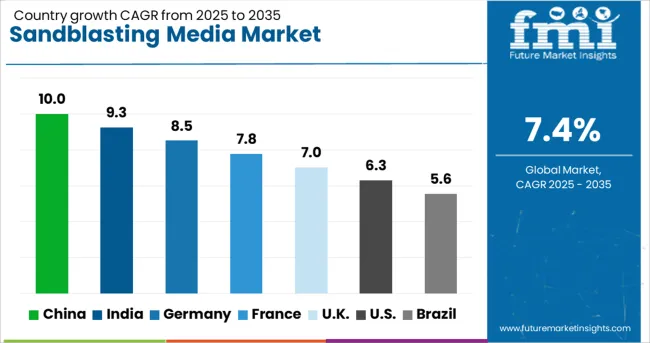

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

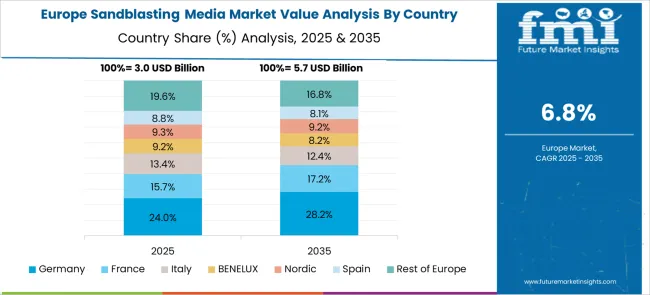

The global market is projected to expand at a CAGR of 7.4% between 2025 and 2035, driven by increased demand for surface preparation across aerospace, automotive, shipbuilding, and metal fabrication sectors. China is expected to lead with a CAGR of 10.0%, supported by large-scale manufacturing, shipyard expansion, and rising preference for efficient abrasives. India will follow at 9.3%, as industrial cleaning, infrastructure growth, and energy sector projects adopt eco-friendly media. Germany is likely to grow at 8.5%, aided by EU regulations and widespread use of synthetic abrasives. The United Kingdom is forecast at 7.0%, reflecting marine upkeep, architectural preservation, and precision tooling applications. The United States will grow at 6.3%, driven by aerospace retrofitting and replacement of silica-based products. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is expected to grow at a 10.0% CAGR, driven by its vast manufacturing base, expansion of shipyards, and infrastructure upgrades. Demand for advanced blasting media such as aluminum oxide, steel grit, and garnet is rising to meet stringent quality requirements in automotive and heavy machinery sectors. Local manufacturers are scaling production of recyclable and low-dust abrasives to comply with safety norms. Shipbuilding clusters in coastal provinces contribute significantly to consumption as marine maintenance and new vessel construction accelerate. Export-oriented industries are adopting automated blasting systems integrated with robotic arms, increasing the use of premium synthetic media. Partnerships with foreign OEMs for precision blasting technologies further strengthen the market.

India is forecast to grow at a 9.3% CAGR, supported by infrastructure development, industrial cleaning requirements, and energy sector growth. Cement plants, refineries, and thermal power stations increasingly utilize eco-friendly abrasives such as garnet and glass beads for surface preparation. Government projects in highways, bridges, and metro systems drive demand for blasting media in steel fabrication and corrosion control. Domestic manufacturers are expanding facilities for cost-effective abrasives to meet local demand while exploring export opportunities. Adoption of automated sandblasting equipment in automotive and foundry applications is accelerating. Strategic collaborations with EPC contractors ensure supply chain efficiency for large-scale infrastructure projects.

Germany is projected to grow at a 8.5% CAGR, propelled by EU environmental standards and advanced surface finishing needs in industrial sectors. Automotive and aerospace industries lead adoption of high-performance abrasives such as aluminum oxide and silicon carbide for precision applications. Demand for synthetic and recyclable blasting media is increasing to minimize environmental impact and improve operational safety. German equipment manufacturers integrate abrasive blasting with robotic systems and closed-loop recovery solutions for sustainability. Growth is reinforced by architectural restoration projects requiring gentle cleaning media like glass beads and plastic abrasives. Export demand for premium German-made blasting media remains strong across Europe and Asia.

The United Kingdom is forecast to grow at a 7.0% CAGR, driven by applications in marine upkeep, architectural conservation, and precision tooling. Ports and shipyards are adopting eco-friendly abrasives like garnet for hull cleaning and corrosion prevention. Heritage building maintenance is boosting consumption of mild abrasives such as glass beads and walnut shells to preserve structural integrity. Demand from industrial tooling and fabrication sectors is rising, especially for deburring and surface treatment of metal components. OEMs emphasize portable and dust-free blasting solutions to meet workplace safety regulations. Increased investments in offshore wind farms also drive use of abrasives for structural maintenance..

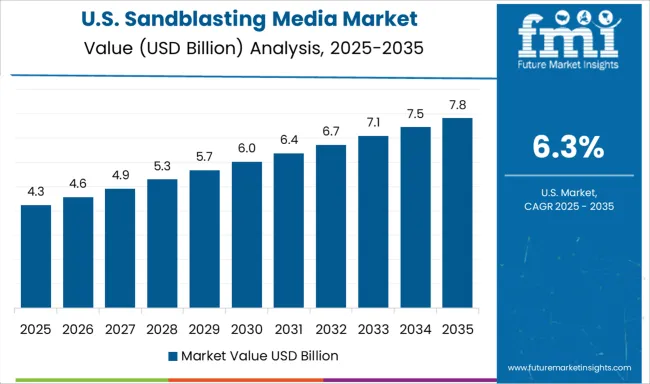

The United States is expected to expand at a 6.3% CAGR, supported by aerospace retrofitting and industrial compliance requirements. Demand is shifting from silica-based abrasives to safer alternatives such as aluminum oxide, garnet, and steel grit due to OSHA regulations. Aerospace and defense sectors utilize precision abrasives for component refurbishment and coating preparation. Automotive restoration and heavy machinery maintenance are also contributing to steady growth. USA manufacturers focus on producing recyclable media compatible with automated blasting systems for operational efficiency. Rising investment in pipeline maintenance and petrochemical infrastructure further boosts abrasive consumption in corrosion control applications.

GMA Garnet leads the market with a significant share, supported by global demand for its premium garnet abrasives used in shipbuilding, infrastructure, and petrochemical cleaning. Barton International has a strong USA presence, offering a diverse range of mineral abrasives. ATI Black Diamond Granules Inc. dominates the coal slag segment, widely used in industrial cleaning applications across North America. The Chemours Company supplies high-purity sand products to the aerospace and electronics sectors. Crystal Mark Inc. and Cym Materiales S.A. are gaining traction in niche applications across Latin America. Harsco Metals, Opta Minerals, and USA Minerals Inc. are expanding through bulk contracts with defense, oil and gas, and construction clients.

In April 2024, GMA Garnet launched PyroBlast, a pyroxene-based abrasive that removes coatings 35% faster than crushed glass while significantly reducing dust emissions and media waste.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.9 Billion |

| Product | Aluminum Oxide, Silicon Carbide, Steel Grit, Steel Shot, Glass, Sodium Bicarbonate, Corn Cob, Staurolite, Coal Slag, Copper Slag, Si Sand, Garnet, Dry Ice, Iron Slag, Nut Shells, and Others |

| End-User | Metalworking, Automotive, Marine, Aerospace, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GMA Garnet, Abrasives Inc., ATI Black Diamond Granules Inc., Barton International, Blastech, Crystal Mark Inc., Cym Materiales S.A., Eisenwerk Würth GmbH, Harsco Metals & Minerals, Opta Minerals Inc., Prince Minerals LLC, The Chemours Company, and USA Minerals Inc |

| Additional Attributes | Dollar sales by media type (e.g., aluminum oxide, garnet, glass, organic shells) and application (automotive, aerospace, construction), demand dynamics across corrosion removal and surface prep, regional leadership in Asia-Pacific vs North America, innovation in robotic systems and recyclable abrasives, and environmental impact from dust emissions and material reuse. |

The global sandblasting media market is estimated to be valued at USD 12.9 billion in 2025.

The market size for the sandblasting media market is projected to reach USD 26.4 billion by 2035.

The sandblasting media market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in sandblasting media market are aluminum oxide, silicon carbide, steel grit, steel shot, glass, sodium bicarbonate, corn cob, staurolite, coal slag, copper slag, si sand, garnet, dry ice, iron slag, nut shells and others.

In terms of end-user, metalworking segment to command 34.6% share in the sandblasting media market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Media Processing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Media Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Media Editing App Market Size and Share Forecast Outlook 2025 to 2035

Media Monitoring Tools Market Size and Share Forecast Outlook 2025 to 2035

Intermediate Bulk Container (IBC) Market Forecast and Outlook 2025 to 2035

Loop-Mediated Isothermal Amplification Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down Market Share in Intermediate Bulk Containers

Western Europe Intermediate Bulk Container Market Growth – Trends & Forecast 2023-2033

Korea Intermediate Bulk Container Market Growth – Trends & Forecast 2023-2033

Japan Intermediate Bulk Container Market Insights – Growth & Forecast 2023-2033

Multimedia Projectors Market Analysis – Growth & Industry Trends 2023-2033

AI in Media and Entertainment Market Size and Share Forecast Outlook 2025 to 2035

APOL1 Mediated Kidney Disease Market - Demand, Growth & Forecast 2025 to 2035

Social Media Records Management Market Size and Share Forecast Outlook 2025 to 2035

Social Media Engagement Applications Market Size and Share Forecast Outlook 2025 to 2035

Social Media Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Social Media and Destination Market Share & Provider Insights

Social Media and Destination Market Analysis by Platform, by Destination Type, by Region - Forecast for 2025 to 2035

Social Media Content Creator Market

Social Media Analytics Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA