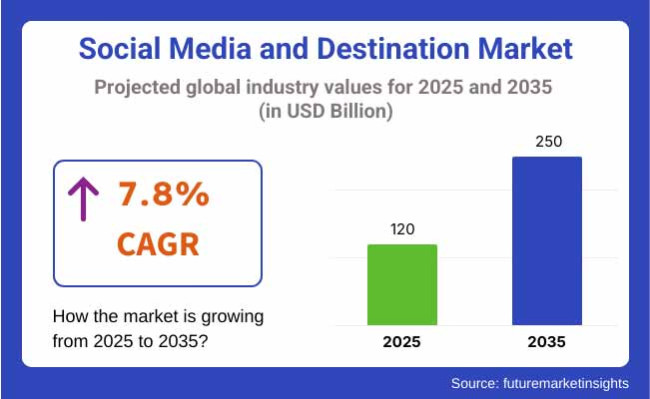

The total value of social media and destination market is USD 120 billion in 2025 and is expected to grow at a CAGR of 7.8% to USD 250 billion by 2035. AI personalization, influencer-marketing, and immersive virtual experiences are the new game changers for how destinations appeal to travelers.

He said some other read more larger tourism boards and brands such as Visit Dubai, Travel Oregon and Japan National Tourism Organization (JNTO) read more are using AI-powered marketing tools, VR-based previews and micro-influencers to cater to a read more laser-focused audience. So, Instagram and TikTok become critical not-to-miss, real-time engagement channels in our destinations, while AI chatbots and predictive analytics engage and facilitate the traveler decision process.

The market grew at a 5.2% CAGR from 2020 to 2024, primarily due to digital travel marketing transformation. Travelers have grown accustomed to virtual experiences, live-streamed destination previews and interactive online content, thanks to the pandemic.

The future looks bright for the industry though, allowing it to grow rapidly thanks to AI-generated recommending content like on TikTok to immersive AR/VR travel previews launched by Instagram. Destination marketing organizations (DMOs) are investing more in AI-based analytics, influencer partnerships and real-time engagement tactics.

| Country | Estimated Ad Spend (2025) |

|---|---|

| United States | USD 20 Billion |

| China | USD 15 Billion |

| France | USD 10 Billion |

| UAE | USD 8 Billion |

| Brazil | USD 6 Billion |

| Australia | USD 5 Billion |

| India | USD 9 Billion |

| Thailand | USD 7 Billion |

| South Africa | USD 4 Billion |

AI-Powered Personalization

Artificial Intelligence is changing the game of social media-driven destination marketing with hyper-personalized experiences. AI analyzes user behavior, prior search history, and engagement metrics to curate travel recommendations. For example, Visit Iceland uses AI-powered tools that generate personalized itinerary recommendations based on users’ interactions on Instagram, so every traveler gets ideas for content that aligns with what they like. The same goes for Google’s AI-driven advertising to optimize targeting by predicting users’ travel interests like adventure, wellness or cultural travel.

This technology helps DMOs and tourism brands get the most out of their marketing budgets, by making sure the right audience sees the right message at the right time. AI-enabled bots in platforms like Facebook Messenger and WeChat provide contextually aware customer support, helping businesses increase response rates and reducing drop rates. As machine learning enables better predictive analytics, brands can rapidly adapt their marketing strategies to the seasonal travel landscape, as well as real-time consumer sentiment.

Influencer-Led Destination Campaigns

And influencers are at the forefront of this transformation, providing authentic, experiential promotions that push travelers to book. Destinations are working with micro and nano-influencers to organize viral travel content instead of standard ads. Switzerland Tourism’s campaign with Roger Federer and Trevor Noah reached millions worldwide, cementing Switzerland as a premium travel choice. Likewise, Bali’s tourism board teamed up with TikTok travel influencers, introducing them to lesser-known sites, oasis locations to drive visitor interest beyond “mainstream” attractions, driving new interest among visitors.

Data-driven influencer marketing platforms including Traackr and AspireIQ help brands assess the effectiveness of campaigns through engagement rates, conversion numbers, and actual bookings. Influencer-led campaigns generate not only tourism demand itself, but also the benefit of brand credibility, using trusted voices of the travel community. As they look for experiences that feel relatable and that bring them closer to the places they visit, influencer partnerships will remain the hot ticket for social media-driven destination marketing.

Virtual & Augmented Reality Travel Previews

The world of travel is changing as virtual reality and augmented reality are helping travelers preview destinations pre-booking. Japan National Tourism Organization, for instance, introduced virtual reality-based cherry blossom previews, giving potential visitors access to the peak bloom before deciding whether to plan their trip.

Likewise, Visit Dubai has 360-degree city tours that allow travelers to virtually visit the top attractions, including the Burj Khalifa and Dubai Marina. Hotels, and resorts use AR too to enrich the booking experience a Marriott AR-powered hotel preview helps potential guests visualize both rooms and amenities in real-time.

VR is so popular that an airline like Lufthansa uses it to give immersive previews of cabin classes, allowing travelers to make more informed purchasing decisions. Tourism boards and travel companies leverage VR/AR experiences in their digital campaigns to create deeper engagement and build excitement before travel. Travelers will become more confident with the help of virtual tourism experiences, which is essential for destination marketing as the technology advances leading to higher bookings.

User-Generated Content (UGC) and Community Engagement

Brian Solis coined the term “UGC” in 2005, short for “user-generated content,” and this has since turned into a brawn in destination marketing, driving authenticity and organic engagement. In fact, travelers are now relying more on fellow tourists than traditional advertisements. More recently, hashtags like #VisitScotland and #ExploreCanada have prompted travelers to share experiences about their journeys, a snowball effect for inspiration.

DMOs (Destination Marketing Organizations) such as Tourism Australia actively showcase user generated content on their official social media pages to boost authenticity, credibility and relatability. Tools like TINT and CrowdRiff are also driven by AI that help brands curate the most effective UGC, to tell the best visual stories in social media.

Moreover, social media platforms have also integrated UGC-driven booking options Instagram’s ‘Book Now’ button enables users to book trips directly from influencer posts. Thus, through the alchemy of community engagement and user-generated incentives, destinations extend the reach of their brand expression while cultivating an authentic voice in a medium perfect for modern travel marketing.

| Factor | Impact on Social Media & Destination Marketing |

|---|---|

| AI & Predictive Analytics | Enhancing audience targeting and content recommendations. |

| VR & AR Tourism Previews | Improving destination engagement and pre-booking confidence. |

| Sustainable Travel Campaigns | Promoting eco-conscious tourism choices. |

| Micro & Nano Influencers | Increasing authenticity in travel marketing. |

| AI-Powered Chatbots | Streamlining traveler interactions and recommendations. |

Industry Challenges

In a time where mobile browsing is now the main source of booking, Instagram influencers and TikTok voiceovers are the new destination marketers. Instagram remains the go-to platform for travel content thanks to its visual-first approach, and its features--like Stories, Reels and Guides-allow brands to share immersive experiences.

Tourism boards partner with travel influencers on Instagram to build content that showcases the destination through stunning imagery, increasing brand credibility in reaching a new audience. For instance, Visit Dubai uses Instagram Reels to promote upscale travel experiences, cultural attractions, and adventure tourism, attracting thousands to millions of views.

TikTok, conversely, attracts short-form and high-engagement content that resonates with younger travelers. #TikTokTravel has amassed billions of views, and viral trends have influenced travel decisions. One such community is the ‘TravelTok’ that has contributed significantly towards flourishing lesser-known destination like the Faroe Islands and Cappadocia through authentic storytelling.

DMOs are active partners of TikTok influencers to generate an organic engagement. In 2024, Visit Norway’s campaign-let’s part with Netflix-that highlighted drone footage of fjords and midnight sun expeditions generated more than 20 million views, driving search queries and bookings.

Both platforms are implementing AI-powered tools to enhance content targeting. On Instagram, they display the most active travel content that is most suitable for you, while TikTok’s ‘For You’ page personalizes content. Similarly, new experiential travel live streams have exploded, with brands like Expedia running live Q&As with travel influencers to connect with audiences.

Instagram & TikTok: the future turned viral destination marketing. DMOs and travel brands aiming to connect with audiences worldwide cannot do without their focus on interactive content, influencer-led messaging, and AI-enabled exploration.

At the intersection of this trend lie adventure and wellness travel, which represent segments of destination marketing that are currently witnessing astronomical growth due to consumer trends emphasizing imaginary health and mental well-being experiences. Meanwhile, social media helps propel trends like these, with Instagram and TikTok featuring adrenaline-fueled adventures and tranquil wellness retreats that inspire travelers worldwide.

Adventure travel is in world’s of visually loud, immersive storytelling. Social media outlets such as TikTok have catapulted interest in extreme sports destinations, like New Zealand’s Queenstown, where influencers go bungee jumping off Kawarau Bridge or skydiving above Lake Wakatipu. Likewise, Instagram Reels feature trips to Patagonia’s Torres del Paine National Park, luring hikers with stunning glacial scenery and eco-lodges. Extreme sports athletes work with brands like Red Bull and GoPro to produce viral content, creating demand for adventure tourism but cementing brands as experts, too.

Wellness travel has risen too, as destinations brand themselves sanctuaries for recalibration. Bali’s COMO Shambhala and Thailand’s Kamalaya Wellness Sanctuary use influencer partnerships and social media campaigns to attract mindfulness-focused travelers. TikTok videos showcasing yoga at sunrise on Ubud’s rice terraces or Ayurveda retreats in Kerala have spurred huge engagement, causing travelers to book holistic wellness experiences. Destination marketing organizations, or DMOs, are marketing digital detox retreats, where resorts ban mobile devices and promote mindfulness, such as Copenhagen’s Vipp Shelter, which offers secluded, nature-infused accommodations and is perfect for social media-fatigued travelers wanting to reconnect with nature.

Therefore, the more beautiful and experience-driven content there is, the more content about adventure and wellness it will generate and the more innovative posts will be pushed up in the social media algorithms. Many platforms now include booking capabilities that help users move seamlessly from inspiration to action. With consumers targeting immersive travel experiences, adventure tourism and wellness tourism will continue to be leading growth drivers in destination marketing globally, reinforcing the influence of social media on worldwide travel trends.

Made in the USA: The United States, based on a powerful digital ecosystem and high travel spend, leads the global social media and destination marketing business, powered by modern AI based marketing. Tourism boards and brands have spent millions on social media campaigns, trying to capture the attention of travelers on platforms like Instagram, TikTok and YouTube. Visit California uses an interactive, AI-powered personalization tool to suggest relevant itineraries based on user interactions; Discover Puerto Rico utilizes real-time engagement metrics to optimize its partnerships with influencers.

There was a time when USA destinations marketed themselves on social media as rare and individual entities. Instagram’s travel guides include places like New York’s Hudson Valley, where boutique hotels and vineyard tours are promoted via influencer partnerships. TikTok’s viral #VanLife trend has also driven a wave of domestic road trip tourism, prompting states like Montana and Colorado to create dedicated digital campaigns to appeal to adventure travelers.

One another common use case of AR is the creation of interactive experience previewing target product or service – which is the case of Disney-where you can explore theme park via the AR-powered Instagram filters, which makes it more interesting and increases the likelihood of pre-booking.

Traveling giants utilize AI for ads to maximize returns on investment. (Make your ad-box competition evenerate-Every ad-weather you bought: Google’s Performance Max campaigns allow airlines and hotels to find the people most interested in traveling based on how they browse the internet, which helps move a lot more of them through the booking cycle.)

Likewise, Marriott and Hilton use AI to produce social media content that highlights sustainable travel efforts, catering to eco-conscious travelers. The USA government’s commitment to sustainable tourism is also visible in campaigns such as “Leave No Trace,” which national parks promote on social media to help educate visitors on responsible travel.

USA-based businesses still boast the most robust infrastructure, the widest array of influencer partnerships, and the deepest commitment to maintaining their edge in social media-driven prospect marketing and valuable AI innovations. As digital campaigns adapt to immersive technologies, USA travel brands will maintain their role in dictating industry with standards established in AI-powered, influencer-enabled travel marketing being adopted worldwide.

The Chinese social media and destination marketing industries are both booming, fueled by a digital-native consumer cohort, government-backed tourism initiatives, and a sophisticated, AI-led advertising ecosystem. Chinese travelers, via their own platforms-WeChat, Xiaohongshu (Little Red Book) and Douyin (TikTok’s Chinese version)-rule the market, dictating how destinations engage with them. The China National Tourism Administration uses AI content across its platforms to drive domestic travel activity, making individual travel suggestions based on user behavior with machine learning algorithms.

Destinations have gained notoriety with short-form video edit. Viral travel campaigns on Douyin, like “Hidden Gems of Sichuan,” have dramatically increased interest in off-the-beaten-path destinations, sending tourism soaring in provinces other than Beijing and Shanghai. Travel influencers share multimedia posts on Xiaohongshu, highlighting luxury wellness resorts like the Aman Summer Palace in Beijing or thrill-packed destinations like Tiger Leaping Gorge in Yunnan, where you can go trekking. They garner millions of engagements, underscoring China’s position as the vehicle of AI-led destination marketing.

The tech giants of China are also pushing to reimagine the industry. AI-powered travel assistants by Tencent and Alibaba that recommend real-time itinerary changes based on weather, local events, and user preferences. With AI-powered search capabilities, Baidu makes it easier to target your advertisements to high-intent travelers. Hotel chains such as Shangri-La and Trip. which you wayfinding AI chatbots on WeChat, simplifying the customer approach and reservations process.

China’s commitment to sustainable tourism shows up in its digital campaigns, too. AI-powered green travel recommendations from the government encourage eco-tourism, such as low-carbon travel and nature reserves. In Hangzhou, an electric boat tour on West Lake is promoted through social media campaigns, appealing to environmentally responsible tourism.

And with AI driven personalization, well integrated social commerce, and government-backed digital tourism initiatives, China is also leading the way in what the future of destination marketing could look like. With WeChat, Douyin and Xiaohongshu iterating on AI led engagement, China’s prowess in social media led travel marketing will only expand.

The industry of global social media and destination marketing is specialized in many major technology companies as well as next generation digital marketing players making it turbulent and highly competitive. Data privilege is controlled by not only the major players such as Meta (Facebook & Instagram), ByteDance (TikTok & Douyin), and Google (YouTube & AI-driven ads) who have global reach but also some region-specific platforms such as WeChat and Xiaohongshu which construct local travel characteristics. The AI behind Spotify or Netflix iteratively improves and surfaces the content that makes sure people stay on their feet, consuming high-intent travel conversions.

The biggest travel brands and DMOS double down on influencer partnerships, AI-optimised advertising targeting, and interactive content strategies. Visit Dubai partners with international influencers, creating millions of interactions through Instagram and TikTok campaigns featuring luxury experiences. Likewise, Japan National Tourism Organization (JNTO) be blind to adventure travelers with AI-powered video ads promoting everything from cherry blossom season to climbing the Japanese Alps.

Startups are revolutionizing the industry with novel abstractions to problem solving. For example, influencer analytics companies Traackr and AspireIQ have built tools that allow brands to measure their social media campaigns’ direct impact. Blockchain-based loyalty programs, like the ones used at Expedia and Trip. com, motivates traveler engagement through clear rewards systems.

Social media have been progressively becoming the boat people sail in to plan holidays, and as demand grows, so does the competition among platforms and brands trying to capture consumers attention. In the coming years, market leaders will be characterized by AI-powered engagement, hyper-personalization of content, and seamless integrations with booking partners. This means the competitive dynamic within the industry will persist to evolve, with digital-first strategies at the forefront of destination marketing.

Recent Developments in Social Media & Destination Marketing

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Segments Covered | Platform, Destination Type, Region |

| Key Companies Profiled | Meta, TikTok, Google, WeChat, Instagram |

The social media and destination market is valued at USD 120 billion in 2025 and is expected to reach USD 250 billion by 2035, growing at a CAGR of 7.8%.

The industry's growth is driven by the increasing influence of AI-powered content personalization, the rise of influencer-led campaigns, the adoption of immersive digital experiences, and the expansion of data-driven marketing strategies by tourism boards and travel brands.

North America, Europe, and Asia-Pacific dominate the market, with the USA, China, UAE, and Australia leading in AI-driven travel marketing, influencer collaborations, and immersive tourism campaigns.

Technology is revolutionizing the industry through AI-driven audience targeting, VR/AR-powered travel previews, blockchain-enabled loyalty programs, and real-time chatbot interactions that enhance customer engagement and decision-making.

Sustainability plays a crucial role as brands and DMOs invest in eco-friendly travel campaigns, carbon-neutral tourism initiatives, and responsible tourism marketing strategies that align with consumer demand for ethical travel experiences.

Major players include Meta (Facebook & Instagram), TikTok, Google (YouTube & AI-driven ads), WeChat, and LinkedIn, along with destination marketing organizations (DMOs) such as Visit Dubai, Travel Oregon, and Japan National Tourism Organization.

Challenges include increasing data privacy regulations, algorithm-dependent content visibility, competition for digital engagement, and the need for continuous innovation in content creation and audience targeting. Stakeholders can overcome these hurdles by leveraging AI-driven insights, diversifying digital channels, and prioritizing authentic, high-value content strategies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Types of Marketing, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Marketing Tools, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Social Media Platforms, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Types of Marketing, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Marketing Tools, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Social Media Platforms, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Types of Marketing, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Marketing Tools, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Social Media Platforms, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Types of Marketing, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Marketing Tools, 2018 to 2033

Table 26: Western Europe Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 28: Western Europe Market Value (US$ Million) Forecast by Social Media Platforms, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 31: Eastern Europe Market Value (US$ Million) Forecast by Types of Marketing, 2018 to 2033

Table 32: Eastern Europe Market Value (US$ Million) Forecast by Marketing Tools, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Social Media Platforms, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: South Asia and Pacific Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 38: South Asia and Pacific Market Value (US$ Million) Forecast by Types of Marketing, 2018 to 2033

Table 39: South Asia and Pacific Market Value (US$ Million) Forecast by Marketing Tools, 2018 to 2033

Table 40: South Asia and Pacific Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Social Media Platforms, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: East Asia Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Types of Marketing, 2018 to 2033

Table 46: East Asia Market Value (US$ Million) Forecast by Marketing Tools, 2018 to 2033

Table 47: East Asia Social Media an d Destination Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 48: East Asia Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Social Media Platforms, 2018 to 2033

Table 50: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 52: Middle East and Africa Market Value (US$ Million) Forecast by Types of Marketing, 2018 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Marketing Tools, 2018 to 2033

Table 54: Middle East and Africa Market Value (US$ Million) Forecast by Application Outlook, 2018 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 56: Middle East and Africa Market Value (US$ Million) Forecast by Social Media Platforms, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Types of Marketing, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Marketing Tools, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Social Media Platforms, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Types of Marketing, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Types of Marketing, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Types of Marketing, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Marketing Tools, 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Marketing Tools, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Marketing Tools, 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Social Media Platforms, 2018 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Social Media Platforms, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Social Media Platforms, 2023 to 2033

Figure 29: Global Market Attractiveness by Service Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Types of Marketing, 2023 to 2033

Figure 31: Global Market Attractiveness by Marketing Tools, 2023 to 2033

Figure 32: Global Market Attractiveness by Application Outlook, 2023 to 2033

Figure 33: Global Market Attractiveness by Tourist Type, 2023 to 2033

Figure 34: Global Market Attractiveness by Social Media Platforms, 2023 to 2033

Figure 35: Global Market Attractiveness by Region, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Types of Marketing, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Marketing Tools, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Social Media Platforms, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Types of Marketing, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Types of Marketing, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Types of Marketing, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Marketing Tools, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Marketing Tools, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Marketing Tools, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Social Media Platforms, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Social Media Platforms, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Social Media Platforms, 2023 to 2033

Figure 64: North America Market Attractiveness by Service Type, 2023 to 2033

Figure 65: North America Market Attractiveness by Types of Marketing, 2023 to 2033

Figure 66: North America Market Attractiveness by Marketing Tools, 2023 to 2033

Figure 67: North America Market Attractiveness by Application Outlook, 2023 to 2033

Figure 68: North America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 69: North America Market Attractiveness by Social Media Platforms, 2023 to 2033

Figure 70: North America Market Attractiveness by Country, 2023 to 2033

Figure 71: Latin America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 72: Latin America Market Value (US$ Million) by Types of Marketing, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Marketing Tools, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Social Media Platforms, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) Analysis by Types of Marketing, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Types of Marketing, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Types of Marketing, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Marketing Tools, 2018 to 2033

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Marketing Tools, 2023 to 2033

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Marketing Tools, 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 93: Latin America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Social Media Platforms, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Social Media Platforms, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Social Media Platforms, 2023 to 2033

Figure 99: Latin America Market Attractiveness by Service Type, 2023 to 2033

Figure 100: Latin America Market Attractiveness by Types of Marketing, 2023 to 2033

Figure 101: Latin America Market Attractiveness by Marketing Tools, 2023 to 2033

Figure 102: Latin America Market Attractiveness by Application Outlook, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Social Media Platforms, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 107: Western Europe Market Value (US$ Million) by Types of Marketing, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) by Marketing Tools, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Social Media Platforms, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Western Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Types of Marketing, 2018 to 2033

Figure 120: Western Europe Market Value Share (%) and BPS Analysis by Types of Marketing, 2023 to 2033

Figure 121: Western Europe Market Y-o-Y Growth (%) Projections by Types of Marketing, 2023 to 2033

Figure 122: Western Europe Market Value (US$ Million) Analysis by Marketing Tools, 2018 to 2033

Figure 123: Western Europe Market Value Share (%) and BPS Analysis by Marketing Tools, 2023 to 2033

Figure 124: Western Europe Market Y-o-Y Growth (%) Projections by Marketing Tools, 2023 to 2033

Figure 125: Western Europe Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 126: Western Europe Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 127: Western Europe Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Social Media Platforms, 2018 to 2033

Figure 132: Western Europe Market Value Share (%) and BPS Analysis by Social Media Platforms, 2023 to 2033

Figure 133: Western Europe Market Y-o-Y Growth (%) Projections by Social Media Platforms, 2023 to 2033

Figure 134: Western Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 135: Western Europe Market Attractiveness by Types of Marketing, 2023 to 2033

Figure 136: Western Europe Market Attractiveness by Marketing Tools, 2023 to 2033

Figure 137: Western Europe Market Attractiveness by Application Outlook, 2023 to 2033

Figure 138: Western Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Social Media Platforms, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 141: Eastern Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) by Types of Marketing, 2023 to 2033

Figure 143: Eastern Europe Market Value (US$ Million) by Marketing Tools, 2023 to 2033

Figure 144: Eastern Europe Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Social Media Platforms, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 149: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 150: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 152: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 153: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 154: Eastern Europe Market Value (US$ Million) Analysis by Types of Marketing, 2018 to 2033

Figure 155: Eastern Europe Market Value Share (%) and BPS Analysis by Types of Marketing, 2023 to 2033

Figure 156: Eastern Europe Market Y-o-Y Growth (%) Projections by Types of Marketing, 2023 to 2033

Figure 157: Eastern Europe Market Value (US$ Million) Analysis by Marketing Tools, 2018 to 2033

Figure 158: Eastern Europe Market Value Share (%) and BPS Analysis by Marketing Tools, 2023 to 2033

Figure 159: Eastern Europe Market Y-o-Y Growth (%) Projections by Marketing Tools, 2023 to 2033

Figure 160: Eastern Europe Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 164: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 165: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 166: Eastern Europe Market Value (US$ Million) Analysis by Social Media Platforms, 2018 to 2033

Figure 167: Eastern Europe Market Value Share (%) and BPS Analysis by Social Media Platforms, 2023 to 2033

Figure 168: Eastern Europe Market Y-o-Y Growth (%) Projections by Social Media Platforms, 2023 to 2033

Figure 169: Eastern Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 170: Eastern Europe Market Attractiveness by Types of Marketing, 2023 to 2033

Figure 171: Eastern Europe Market Attractiveness by Marketing Tools, 2023 to 2033

Figure 172: Eastern Europe Market Attractiveness by Application Outlook, 2023 to 2033

Figure 173: Eastern Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 174: Eastern Europe Market Attractiveness by Social Media Platforms, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 176: South Asia and Pacific Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Value (US$ Million) by Types of Marketing, 2023 to 2033

Figure 178: South Asia and Pacific Market Value (US$ Million) by Marketing Tools, 2023 to 2033

Figure 179: South Asia and Pacific Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 180: South Asia and Pacific Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Social Media Platforms, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 184: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 185: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 187: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 188: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 189: South Asia and Pacific Market Value (US$ Million) Analysis by Types of Marketing, 2018 to 2033

Figure 190: South Asia and Pacific Market Value Share (%) and BPS Analysis by Types of Marketing, 2023 to 2033

Figure 191: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Types of Marketing, 2023 to 2033

Figure 192: South Asia and Pacific Market Value (US$ Million) Analysis by Marketing Tools, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Marketing Tools, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Marketing Tools, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 196: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 197: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 198: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 199: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 200: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 201: South Asia and Pacific Market Value (US$ Million) Analysis by Social Media Platforms, 2018 to 2033

Figure 202: South Asia and Pacific Market Value Share (%) and BPS Analysis by Social Media Platforms, 2023 to 2033

Figure 203: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Social Media Platforms, 2023 to 2033

Figure 204: South Asia and Pacific Market Attractiveness by Service Type, 2023 to 2033

Figure 205: South Asia and Pacific Market Attractiveness by Types of Marketing, 2023 to 2033

Figure 206: South Asia and Pacific Market Attractiveness by Marketing Tools, 2023 to 2033

Figure 207: South Asia and Pacific Market Attractiveness by Application Outlook, 2023 to 2033

Figure 208: South Asia and Pacific Market Attractiveness by Tourist Type, 2023 to 2033

Figure 209: South Asia and Pacific Market Attractiveness by Social Media Platforms, 2023 to 2033

Figure 210: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 211: East Asia Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 212: East Asia Market Value (US$ Million) by Types of Marketing, 2023 to 2033

Figure 213: East Asia Market Value (US$ Million) by Marketing Tools, 2023 to 2033

Figure 214: East Asia Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 215: East Asia Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 216: East Asia Market Value (US$ Million) by Social Media Platforms, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 220: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 222: East Asia Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 223: East Asia Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 224: East Asia Market Value (US$ Million) Analysis by Types of Marketing, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Types of Marketing, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Types of Marketing, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Marketing Tools, 2018 to 2033

Figure 228: East Asia Market Value Share (%) and BPS Analysis by Marketing Tools, 2023 to 2033

Figure 229: East Asia Market Y-o-Y Growth (%) Projections by Marketing Tools, 2023 to 2033

Figure 230: East Asia Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 231: East Asia Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 232: East Asia Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 233: East Asia Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 234: East Asia Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 235: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 236: East Asia Market Value (US$ Million) Analysis by Social Media Platforms, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Social Media Platforms, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Social Media Platforms, 2023 to 2033

Figure 239: East Asia Market Attractiveness by Service Type, 2023 to 2033

Figure 240: East Asia Market Attractiveness by Types of Marketing, 2023 to 2033

Figure 241: East Asia Market Attractiveness by Marketing Tools, 2023 to 2033

Figure 242: East Asia Market Attractiveness by Application Outlook, 2023 to 2033

Figure 243: East Asia Market Attractiveness by Tourist Type, 2023 to 2033

Figure 244: East Asia Market Attractiveness by Social Media Platforms, 2023 to 2033

Figure 245: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 246: Middle East and Africa Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 247: Middle East and Africa Market Value (US$ Million) by Types of Marketing, 2023 to 2033

Figure 248: Middle East and Africa Market Value (US$ Million) by Marketing Tools, 2023 to 2033

Figure 249: Middle East and Africa Market Value (US$ Million) by Application Outlook, 2023 to 2033

Figure 250: Middle East and Africa Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 251: Middle East and Africa Market Value (US$ Million) by Social Media Platforms, 2023 to 2033

Figure 252: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 254: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 255: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 257: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 258: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Types of Marketing, 2018 to 2033

Figure 260: Middle East and Africa Market Value Share (%) and BPS Analysis by Types of Marketing, 2023 to 2033

Figure 261: Middle East and Africa Market Y-o-Y Growth (%) Projections by Types of Marketing, 2023 to 2033

Figure 262: Middle East and Africa Market Value (US$ Million) Analysis by Marketing Tools, 2018 to 2033

Figure 263: Middle East and Africa Market Value Share (%) and BPS Analysis by Marketing Tools, 2023 to 2033

Figure 264: Middle East and Africa Market Y-o-Y Growth (%) Projections by Marketing Tools, 2023 to 2033

Figure 265: Middle East and Africa Market Value (US$ Million) Analysis by Application Outlook, 2018 to 2033

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Application Outlook, 2023 to 2033

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application Outlook, 2023 to 2033

Figure 268: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Social Media Platforms, 2018 to 2033

Figure 272: Middle East and Africa Market Value Share (%) and BPS Analysis by Social Media Platforms, 2023 to 2033

Figure 273: Middle East and Africa Market Y-o-Y Growth (%) Projections by Social Media Platforms, 2023 to 2033

Figure 274: Middle East and Africa Market Attractiveness by Service Type, 2023 to 2033

Figure 275: Middle East and Africa Market Attractiveness by Types of Marketing, 2023 to 2033

Figure 276: Middle East and Africa Market Attractiveness by Marketing Tools, 2023 to 2033

Figure 277: Middle East and Africa Market Attractiveness by Application Outlook, 2023 to 2033

Figure 278: Middle East and Africa Market Attractiveness by Tourist Type, 2023 to 2033

Figure 279: Middle East and Africa Market Attractiveness by Social Media Platforms, 2023 to 2033

Figure 280: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaluating Social Media and Destination Market Share & Provider Insights

Social Tourism Market Forecast and Outlook 2025 to 2035

Social Publishing Application Market Size and Share Forecast Outlook 2025 to 2035

Social TV Market Size and Share Forecast Outlook 2025 to 2035

Social Commerce Market Size and Share Forecast Outlook 2025 to 2035

Social Video Advertising Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market Size, Growth, and Forecast for 2025 to 2035

Social Advertising Tools Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market in Korea – Industry Outlook & Forecast 2025 to 2035

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Social Software As A Collaborative ERP Tool Market

Social and Emotional Learning Market Forecast Outlook 2025 to 2035

Social Media Records Management Market Size and Share Forecast Outlook 2025 to 2035

Social Media Engagement Applications Market Size and Share Forecast Outlook 2025 to 2035

Social Media Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Social Media Content Creator Market

Social Media Analytics Market

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA