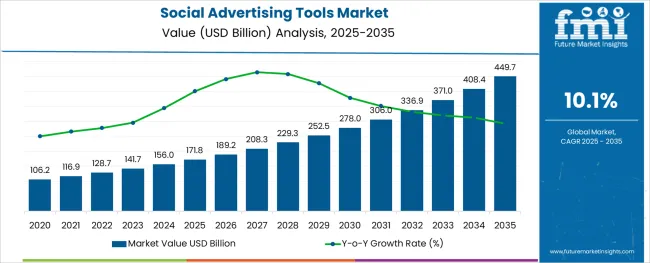

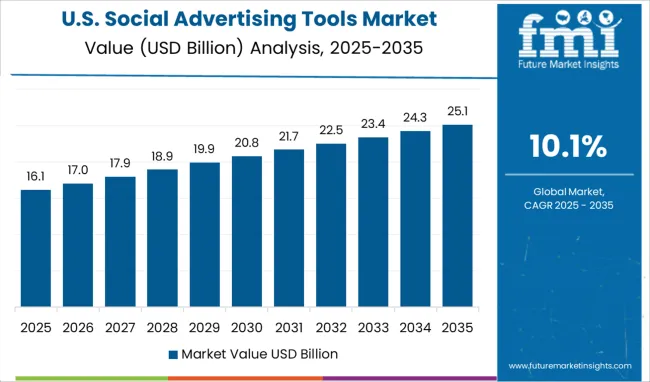

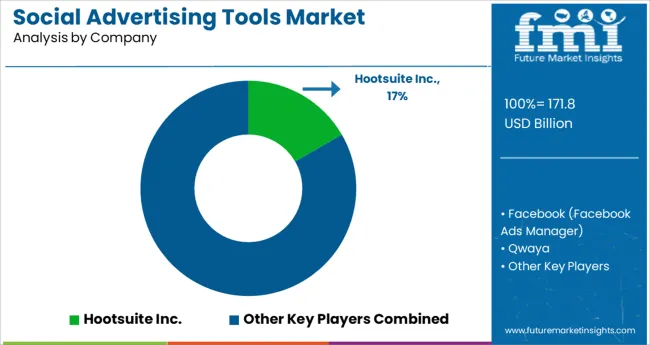

The Social Advertising Tools Market is estimated to be valued at USD 171.8 billion in 2025 and is projected to reach USD 449.7 billion by 2035, registering a compound annual growth rate (CAGR) of 10.1% over the forecast period.

The social advertising tools market is expanding steadily as businesses increasingly leverage social platforms to optimize campaign performance, reach segmented audiences, and improve customer acquisition. The growing dependence on data-driven advertising strategies has prompted widespread adoption of tools that automate content scheduling, budget optimization, audience analytics, and A/B testing.

As privacy regulations evolve, platforms are investing in privacy-safe targeting technologies, including AI-powered contextual advertising and machine learning models trained on first-party data. Meanwhile, micro and small enterprises are adopting social advertising tools to compete effectively with larger players by capitalizing on performance tracking and creative testing at lower costs.

The continued growth of direct-to-consumer brands and expansion of influencer marketing ecosystems are creating further demand for platform-native advertising solutions. Future opportunities are expected to emerge from AI-generated creatives, retail media integrations, and advanced omnichannel campaign orchestration, ensuring ongoing evolution and investment across this market.

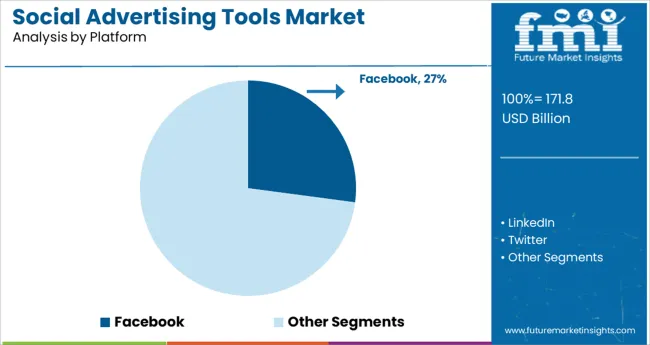

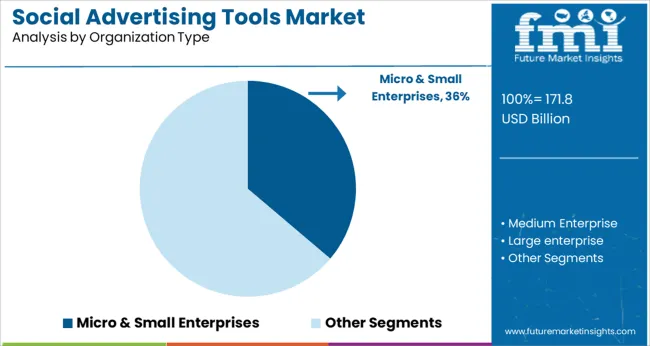

The market is segmented by Platform, Organization Type, and End Use and region. By Platform, the market is divided into Facebook, LinkedIn, Twitter, Instagram, Pinterest, and Others. In terms of Organization Type, the market is classified into Micro & Small Enterprises, Medium Enterprise, and Large enterprise.

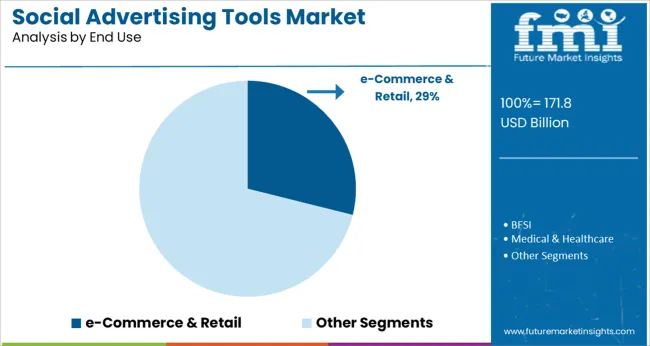

Based on End Use, the market is segmented into e-Commerce & Retail, BFSI, Medical & Healthcare, Transportation & Logistics, Media & Entertainment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Facebook is expected to account for 27.1% of platform-based revenue share in 2025, marking it as the leading platform within the social advertising tools market. This leadership is driven by its expansive user base, sophisticated ad targeting capabilities, and seamless integration with e-commerce and third-party tools.

Businesses have prioritized Facebook due to its robust ad formats, including video, carousel, and dynamic ads, which offer measurable ROI across industries. Enhanced automation features such as campaign budget optimization, lookalike audience generation, and pixel-based conversion tracking have further strengthened its appeal.

Facebook’s continued investment in privacy-safe targeting and integration of AI-driven tools has maintained its relevance, particularly for businesses seeking full-funnel visibility and precise performance insights. These attributes have reinforced Facebook's position as the preferred platform for scalable, measurable social advertising strategies.

Micro and small enterprises are projected to hold 36.2% of the market revenue share in 2025 under the organization type segment, positioning them as the dominant user group. This prominence has been shaped by their rising adoption of digital-first customer acquisition strategies and the accessibility of low-cost, intuitive advertising tools.

These businesses have increasingly embraced self-service platforms that provide templated creatives, smart recommendations, and performance analytics without requiring large marketing teams or agency support. The growth of e-commerce, freelancing, and creator-led businesses has further catalyzed the shift toward personalized social advertising at scale.

Affordability, ease of use, and short-term campaign flexibility have enabled micro and small enterprises to harness the full value of social ad tools for audience targeting, remarketing, and lead generation. Their agility and high digital penetration have made them instrumental in driving overall market expansion.

The e-commerce and retail segment is projected to account for 28.9% of end-use revenue in 2025, making it the leading vertical in the social advertising tools market. This leadership is a result of intense competition among online retailers and marketplace sellers to capture consumer attention in real time.

The segment has benefited from advancements in ad targeting, shoppable posts, dynamic product feeds, and retargeting automation, which have been essential in shortening the consumer journey. Retailers are increasingly relying on social platforms to drive traffic directly to product pages and mobile apps, optimizing ad spend through AI-generated insights and user behavior analytics.

Seasonal campaigns, flash sales, and loyalty integrations have further accelerated social ad spend in this segment. With growing convergence between social commerce and direct checkout features, e-commerce and retail brands are expected to deepen their reliance on social advertising tools for performance-driven digital merchandising.

Increasing social media users in tandem with expanding social media communication volumes are expected to surge the demand for social advertising tools to a significant extent. Moreover, the constant rise in the number of time people spend on social media contributes to the growth of the global social advertising tools market. The rising focus on delivering personalized content based on overall user behaviour & preference holds sway over the global social advertising tools adoption trends.

The future market trends are augured well by the expanding small and medium-sized enterprises (SMEs) and continuous preference for social media adverting tools to reach customers. However, constraints on lack of proper insights into whether social media advertising channels have generated any revenue business are identified as restraints that likely deter the progression of the global social advertising tools market.

With an anticipated market share of 35.5% in terms of revenue in 2025, North America is expected to lead the social advertising tools market over the forecast period, boosted by technological developments in virtual reality and augmented reality.

Additionally, the social advertising tools market growth is being accelerated by the region's rapidly increasing internet user population. The market in this region is also anticipated to be driven by the rising investments in digital advertising, particularly in social media consulting.

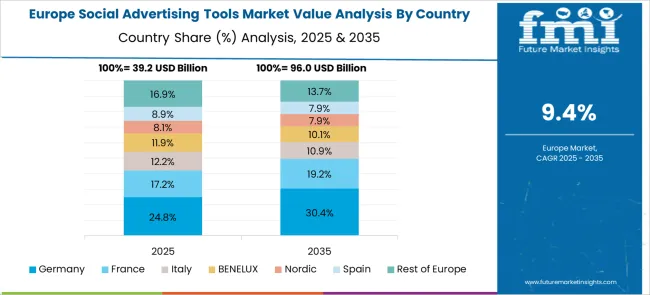

By 2025, Europe social advertising tools market is likely to get hold of a share of about 23.4% in 2025. The adoption of social advertising tools is expected to grow as a result of the estimated sharp increase in smartphone penetration and the rising number of users who have access to the internet in the region.

The World Bank reports that Germany has a sizable population of frequent internet users, which has aided in the development of social media, where one of the main ways to access social media content is through smartphones.

Business models change over time, sometimes as a result of market changes and other times as a result of technological advancements, which leads to the emergence of exciting new trends.

A legion of start-ups in the social advertising tools market is proliferation from various countries, bringing about emerging trends in the social advertising tools market.

For example, one of the latest start-ups, Sprinklr, is a software for managing the customer experience in the cloud. The platform enables businesses to use public discourse on cutting-edge platforms to gain useful insights for bettering marketing, advertising, customer service, product development, and other areas. Accenture, Cognizant, Deloitte, IBM, RichRelevance, SHIFT, and this moment are some of the partners. It acquired Scup, Branderati, Dachis Group, TBG, GetSatisfaction, and Pluck in addition to new brand analytics.

The market for social advertising tools is highly competitive with various key players involving in strategies such as mergers & acquisitions, partnerships, collaborations, etc., in turn shaping the social advertising tools market trends and forecast.

Some of such recent developments:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 10.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Platform, Organization Type, End Use, Region |

| Regions Covered | North America; Latin America; Asia Pacific; The Middle East and Africa; Europe |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Hootsuite Inc.; Facebook (Facebook Ads Manager); Qwaya; AdEspresso, Inc.; Social Ads Tool; ADSTAGE; goraPulse; Sprout Social, Inc..; Driftrock Ltd.; AdRoll.com |

| Customization | Available Upon Request |

The global social advertising tools market is estimated to be valued at USD 171.8 billion in 2025.

It is projected to reach USD 449.7 billion by 2035.

The market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types are facebook, linkedin, twitter, instagram, pinterest and others.

micro & small enterprises segment is expected to dominate with a 36.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Social and Emotional Learning Market Forecast Outlook 2025 to 2035

Social Tourism Market Forecast and Outlook 2025 to 2035

Social Publishing Application Market Size and Share Forecast Outlook 2025 to 2035

Social Media Records Management Market Size and Share Forecast Outlook 2025 to 2035

Social Media Engagement Applications Market Size and Share Forecast Outlook 2025 to 2035

Social TV Market Size and Share Forecast Outlook 2025 to 2035

Social Commerce Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market Size, Growth, and Forecast for 2025 to 2035

Social Media Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market in Korea – Industry Outlook & Forecast 2025 to 2035

Evaluating Social Media and Destination Market Share & Provider Insights

Social Media and Destination Market Analysis by Platform, by Destination Type, by Region - Forecast for 2025 to 2035

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Social Media Content Creator Market

Social Media Analytics Market

Social Software As A Collaborative ERP Tool Market

Social Video Advertising Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA