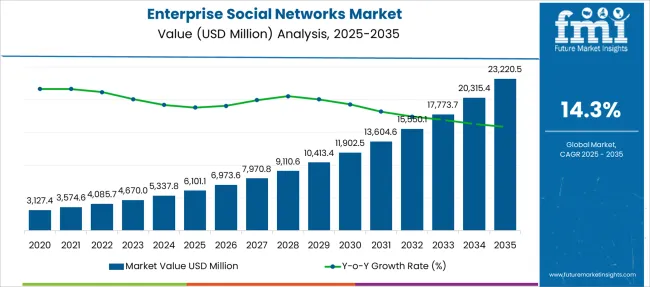

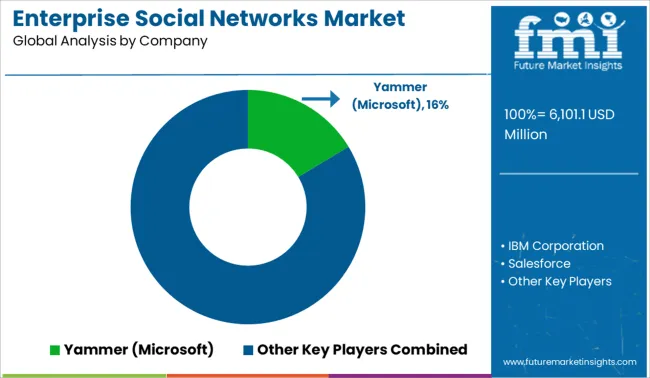

The Enterprise Social Networks Market is estimated to be valued at USD 6101.1 million in 2025 and is projected to reach USD 23220.5 million by 2035, registering a compound annual growth rate (CAGR) of 14.3% over the forecast period.

| Metric | Value |

|---|---|

| Enterprise Social Networks Market Estimated Value in (2025 E) | USD 6101.1 million |

| Enterprise Social Networks Market Forecast Value in (2035 F) | USD 23220.5 million |

| Forecast CAGR (2025 to 2035) | 14.3% |

The enterprise social networks market is expanding steadily, driven by organizations’ increasing focus on enhancing internal communication and collaboration. Digital transformation initiatives have accelerated the adoption of platforms that enable seamless knowledge sharing and employee engagement across distributed teams.

Cloud and web-based social network solutions have become particularly popular due to their scalability, ease of deployment, and integration with existing enterprise applications. Small and medium enterprises (SMEs) are leading adoption rates as they seek cost-effective tools to improve productivity and foster a connected workplace culture.

In addition, the education sector has shown growing interest in enterprise social networks to facilitate collaboration among faculty, staff, and students, especially with the rise of remote and hybrid learning models. Future market growth is expected to be driven by continuous innovation in platform features, including AI-powered analytics and mobile accessibility. Segmental leadership is anticipated from cloud/web-based platforms, SMEs by enterprise size, and the education industry in vertical adoption.

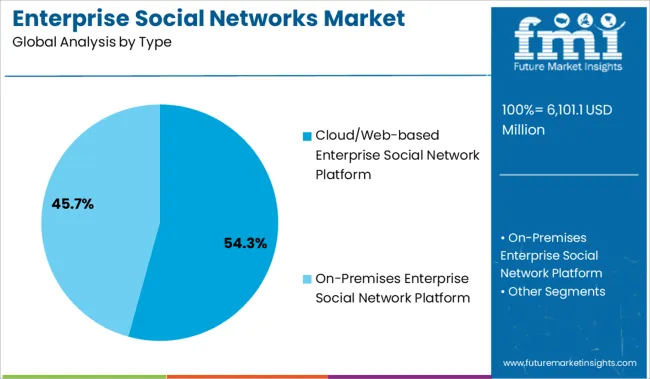

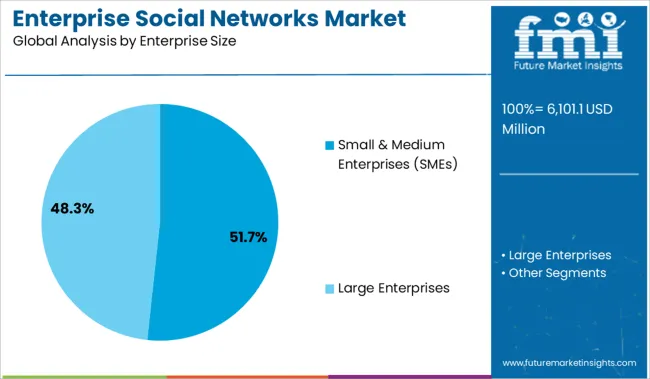

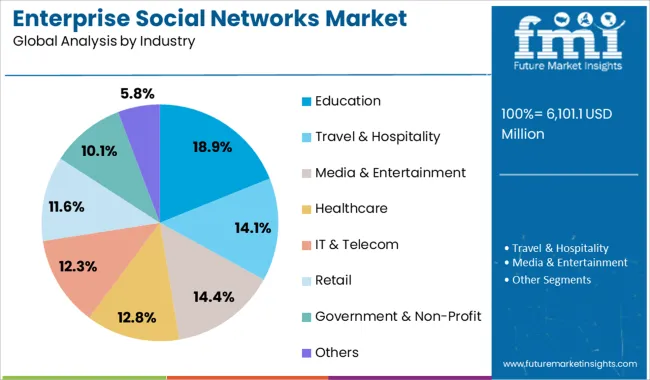

The market is segmented by Type, Enterprise Size, and Industry and region. By Type, the market is divided into Cloud/Web-based Enterprise Social Network Platform and On-Premises Enterprise Social Network Platform. In terms of Enterprise Size, the market is classified into Small & Medium Enterprises (SMEs) and Large Enterprises. Based on Industry, the market is segmented into Education, Travel & Hospitality, Media & Entertainment, Healthcare, IT & Telecom, Retail, Government & Non-Profit, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Cloud/Web-based Enterprise Social Network Platform segment is projected to hold 54.3% of the market revenue in 2025, maintaining its position as the dominant platform type. This segment’s growth can be attributed to its flexibility in deployment and ability to support remote workforce collaboration without heavy IT infrastructure investments.

Organizations have preferred cloud platforms for their rapid implementation and automatic updates, which ensure continuous feature enhancements. The ease of integration with productivity and communication tools has further enhanced adoption.

Cloud platforms also provide secure access from multiple devices supporting a mobile and dynamic workforce. As businesses continue to embrace hybrid work models, cloud and web-based platforms are expected to remain the preferred choice for enterprise social networking solutions.

The Small & Medium Enterprises (SMEs) segment is expected to contribute 51.7% of the enterprise social networks market revenue in 2025, leading all enterprise size categories. SMEs have increasingly sought social network platforms to drive collaboration and employee engagement while managing limited IT budgets.

The affordability and scalability of cloud-based solutions have made them accessible for SMEs to implement without large upfront costs. Furthermore, SMEs value platforms that improve communication flow and knowledge sharing to support agile decision-making and innovation.

The segment has also benefited from vendor offerings tailored specifically to SME needs including user-friendly interfaces and simplified administration. As SMEs continue to digitalize their operations, this segment is poised to sustain its market dominance.

The Education segment is projected to hold 18.9% of the enterprise social networks market revenue in 2025, positioning it as a leading vertical in adoption. This growth has been driven by the need for improved communication and collaboration among educators, administrators, students, and parents.

The rise of distance learning and hybrid education models has underscored the importance of social platforms that support interaction and community building within educational institutions. Schools and universities have leveraged enterprise social networks to facilitate real-time updates, knowledge sharing, and peer support.

Additionally, education institutions value platforms that enhance remote learning engagement and administrative coordination. With increasing investments in education technology, the Education segment is expected to continue growing as digital collaboration becomes integral to the sector’s operations.

This below table presents the expected CAGR for the Global enterprise social networks market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 10.0%, followed by a slightly higher growth rate of 10.7% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1 | 10.0% (2025 to 2035) |

| H2 | 10.7% (2025 to 2035) |

| H1 | 14.8% (2025 to 2035) |

| H2 | 13.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 14.8% in the first half from 2025-2035 and remain relatively moderate at 13.9% in the second half 2025-2035. In the first half (H1) 2025 the market witnessed a decrease of 70 BPS while in the second half (H2) 2025 the market witnessed an increase of 90 BPS.

Rising Investment in Digital Transformation Initiatives, including the Adoption of Social Network Platforms to Modernize Communication and Collaboration

The growing funding in digital transformation tasks with the aid of organizations across various industries. These tasks aim to integrate virtual technologies into all regions of an enterprise, basically changing businesses operate and supply price to customers. A key device of this digital transformation is the adoption of social community platforms designed to modernize communication and collaboration within and among agencies.

The adoption of company social network systems is pushed via the need to enhance inner communication and collapse down storage within agencies. In a digitally converted business surroundings, information desires to point freely and efficaciously across all ranges and departments.

Social community systems facilitate this by means of growing an open and transparent conversation culture, wherein personnel without problems get right of entry to the records they need and share their insights and expertise. This is simplest improves choice-making however additionally fosters a sense of community and collaboration among employees.

Growing Demand for Comprehensive Training and Support Services to Boost User Adoption of Enterprise Social Networks

The complexity of cutting-edge employer social networks and those platforms regularly derived with a wide range of features and functionalities, from real-time messaging and institution discussions to document sharing and mission management equipment.

While those competencies offer substantial potential for improving verbal exchange and collaboration, they also can be overwhelming for users who aren't familiar with such technologies. Comprehensive education applications are crucial to make sure that personnel understand how to effectively use those things to maximize their advantages.

The demand for education and assist offerings is the desire to gain high tiers of user adoption and engagement. Simply deploying a business enterprise social network isn't always sufficient; companies must actively promote its use and display its fee to personnel.

This demand for ongoing schooling and assist efforts to cope with consumer worries, provide guidance on pleasant practices, and show off fulfillment stories that highlight the platform’s effect on collaboration and productiveness.

Increasing Adoption of Video and Multimedia Content in Enterprise Social Networks to Enhance Communication and Engagement

As virtual transformation initiatives keep to reshape the place of work, organizations are leveraging these dynamic content formats to foster a greater interactive surroundings. This shift is pushed through the recognition that traditional text-primarily based verbal exchange strategies frequently fall quick in taking pictures interest and conveying complicated statistics effectively.

Video content material, particularly, has emerged as an effective device for reinforcing communication inside agency social networks. Unlike text, video can convey tone, emotion, and context, making messages greater relatable and less difficult to recognize.

For instance, enterprise announcements, education periods, and project updates delivered via video can substantially improve message retention and comprehension. This is especially critical in far off and hybrid work settings, where face-to-face interactions are limited. Video lets in leaders to preserve a personal reference to employees, reinforcing a feel of network and shared motive.

Growing Concerns over Data Security and Privacy Hinder the Adoption of Enterprise Social Networks

The hazard of information breaches in enterprise social networks often save a wealth of facts, consisting of worker communications, proprietary enterprise strategies, consumer facts, and other sensitive content material. If those networks aren't accurately secured, they turn out to be appealing targets for cybercriminals.

A records breach can bring about extensive financial losses, prison liabilities, and harm to a company’s reputation. The fear of such incidents makes corporations careful approximately completely embracing these systems, particularly in enormously regulated industries which includes finance, healthcare, and criminal services, where the stakes are even higher.

The integration of company social networks with different commercial enterprise packages additionally increases safety concerns. While integration can enhance capability and streamline workflows, it additionally creates additional entry points for cyberattacks. Ensuring secure integration requires comprehensive security features, which includes encryption, multi-factor authentication, and regular protection audits, which may be aid-intensive.

The Global enterprise social networks market recorded a CAGR of 10.6% during the historical period between 2020 and 2025. The growth of enterprise social networks industry was positive as it reached a value of USD 4,670.0 million in 2025 from USD 3,121.0 million in 2020.

From 2020 to 2025, the landscape changed and characterized by using widespread investments in virtual transformation projects, with corporations increasingly integrating social community organizations into their IT ecosystems. This integration become supported by way of advancements in cloud computing, artificial intelligence, and machine learning knowledge which superior the functionalities of those networks, making them extra user-pleasant.

Additionally, the proliferation of mobile devices and the development of internet infrastructure globally enabled seamless get right of entry to employer social networks, further boosting their adoption and sales.

Looking ahead, the demand forecast for employer social networks from 2025 to 2035 is predicted to maintain on an upward trajectory, driven by using several key elements.

Firstly, the method in the direction of far off and competitive landscapes models is probable to persist, necessitating the continued use of superior verbal exchange and collaboration equipment. Enterprise social networks are poised to turn out to be even extra critical to enterprise operations as agencies strive to hold agility and productivity in a bendy running environment.

Moreover, the growing emphasis on worker engagement and nicely-being will power the demand for company social networks. These systems provide capabilities which can help create a more inclusive and work way of life, along with social popularity, peer remarks, and virtual team-constructing sports.

As groups focus extra on employee delight and retention, the function of corporation social networks in fostering a high quality paintings environment becomes greater said.

Tier 1 companies are the dominant players in the enterprise social networking market, commanding significant share and influencing industry trends. These companies typically have extensive resources, robust R&D capabilities, and a comprehensive feature set that caters to large enterprises. Key players in this layer include Microsoft with its Yammer platform, Facebook's Workplace and Slack (now part of Salesforce).

These platforms offer advanced features such as integration with other enterprise tools (eg Microsoft Teams, Salesforce CRM), enhanced security features, and scalable solutions suitable for global organizations. Their strong brand presence, extensive customer support and constant innovation keep them at the forefront.

Tier 2 vendors not as dominant as Tier 1 players, preserve a massive presence inside the business enterprise social networks. These agencies often cater to mid-sized firms and provide competitive functions that address unique enterprise needs. Notable Tier 2 players include Zoho Connect, Jive Software (an Aurea company), and Chatter by means of Salesforce.

These platforms offer a balance of functionality and affordability, making them appealing to organizations that require robust social networking skills without the top rate pricing of Tier 1 solutions. Tier 2 organizations frequently recognition on niche markets or specific industry verticals, letting them carve out a devoted purchaser base.

Tier 3 vendors are rising players and niche carriers inside the agency social networks market. These corporations generally have a smaller share and cater to precise segments or particular use cases inside the broader sector. Tier 3 players consist of Flock, MangoApps, and Ryver.

These platforms regularly appeal small to medium-sized agencies (SMBs) and startups because of their fee-effectiveness and tailor-made functions. Tier 3 corporations may offer specialized functionalities, consisting of industry-unique compliance features or localized language support, to appeal clients with precise needs.

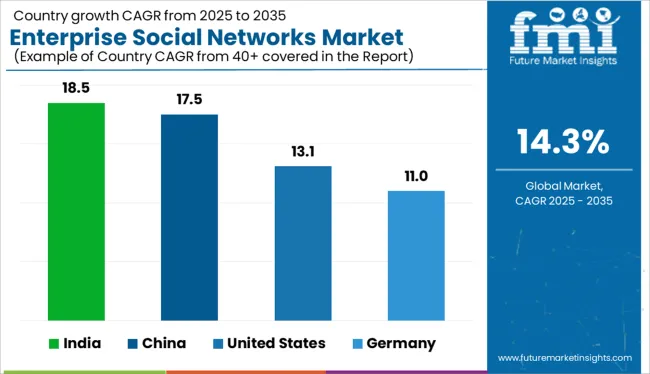

This below section covers the industry analysis for the enterprise social networks market for different countries. Leading adoption of enterprise social networks due to tech-savvy workforce and focus on collaboration soar industry global industry presence.

United States is anticipated to remain at the forefront in North America. In South Asia and Pacific, India is projected to witness a CAGR of 18.5% by 2035 with digital transformation initiatives and increasing focus on employee engagement and productivity.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| India | 18.5% |

| China | 17.5% |

| United States | 13.1% |

| Germany | 11.0% |

The United States industry is projected to register a CAGR of 13.1% through 2035. It is set to reach a valuation of USD 4,403.7 million by 2035.

United States claims a fairly professional tech staff amend for its expertise in digital technology, software development, and innovation. Silicon Valley, placed in California, serves as a hub for technological innovation and homes a number of the arena's main tech companies. This concentration of expertise and information propel the improvement of current ESN arrangements and solutions, leveraging superior technologies like artificial intelligence and machine learning.

The cultural beliefs inside the United States places a robust emphasis on collaboration, teamwork, and innovation. American groups embrace a culture of open conversation, recognize & sharing, and pass-purposeful collaboration, which might be imperative beliefs of a success ESN implementations.

This cultural inclination toward collaboration fosters a surroundings wherein ESN platforms thrive as essential equipment for enhancing productivity, fostering creativity, and driving commercial enterprise results.

Germany holds around 22.6% share by 2025 in Western Europe enterprise social networks industry, amounting to a valuation of USD 6101.1 million by 2025.

German agencies are known for embracing contemporary technology and incorporating them into their operations. They leverage cloud computing, statistics analytics, artificial intelligence (AI), and Internet of Things (IoT) solutions to enhance productiveness and streamline workflows. The integration of these technologies into ESN platforms enables German companies to harness the power of records-driven insights, automation, and selection-making within their social collaboration frameworks.

Germany's strong recognition on collaborative commercial enterprise practices further reinforces its position inside the ESN marketplace. German corporations price teamwork, expertise sharing, and collaboration as vital drivers of fulfillment.

ESN platforms are necessary to facilitating these collaborative practices through presenting capabilities which include group discussions, assignment control tools, report sharing, and virtual team spaces. This collaborative surroundings empowers personnel to work together effectively, change ideas, innovate collectively, and force business effects.

The uptake of ESNs in China is the government's emphasis on virtual transformation as a part of its broader financial improvement strategies. The Chinese government has mentioned ambitious plans, which includes "Made in China 2025" and "Internet Plus," aimed toward accelerating the US transition to a time-pushed economic system. These projects prioritize virtual innovation, automation, and the integration of statistics technology into conventional industries.

Government-sponsored applications and incentives play a pivotal position in selling digital innovation and assisting the adoption of ESNs. For instance, subsidies, tax incentives, and investment possibilities are regularly provided to corporations investing in virtual technology, including ESN systems.

These economic incentives lessen the obstacles to adoption and encourage companies of all sizes to embrace social collaboration equipment as a part of their virtual transformation adventure. China is expected to hold its dominance and it currently holds around 50.4% share of the East Asia corporation social networks enterprise.

This section contains information about the leading segments in the industry. By type, the cloud/web-based enterprise social network platform segment is estimated to grow at a CAGR of 15.5% throughout 2035. Additionally, by enterprise size, small and medium-sized enterprises (SMEs) segment is projected to expand at 14.9% till 2035.

| By Type | Cloud/Web-based Enterprise Social Network Platform |

|---|---|

| Value Share (2025) | 54.3% |

The cloud/web-based segment dominates the market in terms of revenue and will account for almost 54.3% of the share in 2025. Cloud solution provide scalability via permitting agencies to without difficulty scale their ESN infrastructure up or down based on converting enterprise needs, person call for, and increase trajectories.

This scalability guarantees that agencies can accommodate increasing consumer volumes, information garage necessities, and feature improvements without full-size infrastructure investments or operational complexities.

Cloud-primarily based ESN systems provide inherent flexibility, allowing businesses to get entry to and use the platform from everywhere, at any time, and on any device with net connectivity. This flexibility promotes personnel mobility, faraway collaboration, and seamless communique throughout distributed groups, far thrown workplaces, and international places. Users can engage in real-time discussions, percentage updates, collaborate on projects, and get entry to ESN capabilities and functionalities through internet browsers or cellular apps, improving productiveness and connectivity.

| Enterprise Size | Small and Medium-sized Enterprises (SMEs) |

|---|---|

| CAGR (2025 to 2035) | 14.9% |

The small and medium-sized enterprises venues segment is poised to exhibit a CAGR of 14.9% between 2025 and 2035. Cloud-based ESN systems provide subscription-based pricing approaches which is greater price-effective for SMEs compared to massive companies that could require complicated on-premises solutions.

The decrease initial funding and decreased implementation complexity make ESNs available to SMEs with limited IT resources and budgets, permitting them to leverage superior collaboration equipment without huge financial constraints.

SMEs regularly have compliment organizational systems and less hierarchical barriers compared to large businesses. This organizational agility and openness facilitate smoother adoption and integration of ESNs into day by day workflows. SMEs can quick onboard personnel, encourage participation, and foster a culture of collaboration, innovation, and understanding sharing via ESN platforms, using productiveness and engagement across the corporation.

Key players operating in the enterprise social networks market are investing in advanced technologies and also entering into partnerships. Key enterprise social networks providers have also been acquiring smaller players to grow their presence to further penetrate the market across multiple regions.

Recent Industry Developments in Enterprise Social Networks Market:

The industry is divided into cloud or web-based enterprise social and on-premises enterprise social network platform.

The segment is segregated into small and medium-sized enterprises (SMEs) and large enterprises.

The industry is classified by education, travel and hospitality, media and entertainment, healthcare, IT and telecom, retail, government and non-profit and others.

A regional analysis has been carried out in key countries of North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe.

The global enterprise social networks market is estimated to be valued at USD 6,101.1 million in 2025.

The market size for the enterprise social networks market is projected to reach USD 23,220.5 million by 2035.

The enterprise social networks market is expected to grow at a 14.3% CAGR between 2025 and 2035.

The key product types in enterprise social networks market are cloud/web-based enterprise social network platform and on-premises enterprise social network platform.

In terms of enterprise size, small & medium enterprises (smes) segment to command 51.7% share in the enterprise social networks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Metadata Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Rights Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Enterprise LLM Market Size and Share Forecast Outlook 2025 to 2035

Enterprise VSAT Systems Market Size and Share Forecast Outlook 2025 to 2035

Enterprise AI Governance and Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Content Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IoT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise WLAN Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA