The enterprise asset management market is witnessing robust expansion, fueled by the growing need to optimize asset utilization, reduce downtime, and enhance operational visibility across industries. Organizations are increasingly adopting digital asset management solutions to improve lifecycle performance and maintenance scheduling.

Cloud-based platforms are gaining traction due to scalability, real-time analytics, and lower deployment costs. Integration of AI, IoT, and predictive maintenance tools has further enhanced the value proposition of EAM solutions.

The market is benefiting from industrial digitalization, regulatory compliance requirements, and a growing emphasis on cost-efficient asset monitoring. As companies pursue greater operational efficiency and sustainability, the enterprise asset management market is expected to maintain strong growth momentum globally.

| Metric | Value |

|---|---|

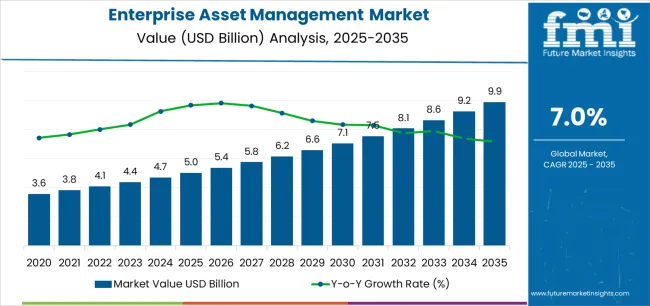

| Enterprise Asset Management Market Estimated Value in (2025 E) | USD 5.0 billion |

| Enterprise Asset Management Market Forecast Value in (2035 F) | USD 9.9 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

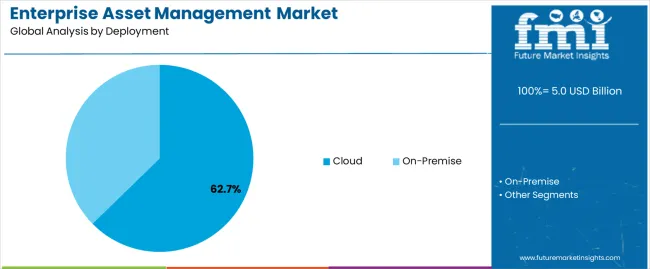

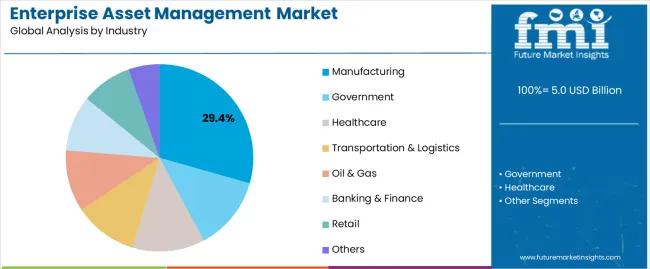

The market is segmented by Deployment and Industry and region. By Deployment, the market is divided into Cloud and On-Premise. In terms of Industry, the market is classified into Manufacturing, Government, Healthcare, Transportation & Logistics, Oil & Gas, Banking & Finance, Retail, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud segment leads the deployment category with approximately 62.7% share, reflecting the rapid shift toward flexible and cost-effective asset management solutions. Cloud-based EAM enables remote monitoring, real-time data analytics, and streamlined collaboration across distributed operations.

Enterprises prefer cloud deployment for its scalability, faster implementation, and reduced infrastructure overheads. The segment’s dominance is supported by the adoption of SaaS-based models and increased confidence in data security.

As organizations continue to modernize IT infrastructure, the cloud segment is projected to remain the preferred deployment model, driving ongoing digital transformation in asset management practices.

The manufacturing segment dominates the industry category with approximately 29.4% share, driven by the sector’s heavy reliance on asset-intensive operations and preventive maintenance strategies. EAM systems in manufacturing enable predictive analytics, real-time performance tracking, and optimized resource allocation, minimizing downtime and improving productivity.

Adoption has been reinforced by Industry 4.0 advancements and the integration of IoT sensors in production lines.

As manufacturers pursue greater efficiency, sustainability, and compliance with safety standards, the demand for comprehensive asset management solutions is expected to remain strong, ensuring this segment’s leading position in the global market.

The global enterprise asset management market was valued at USD 3,809.31 million in 2020. From 2020 to 2025, the global enterprise asset management (EAM) market experienced a CAGR of around 4.1%. The overall market value was about USD 4,466.25 million by 2025.

The COVID-19 pandemic posed many problems for the global economy and a variety of economic sectors, including in the enterprise asset tracking market during 2025 and 2025. However, equipment management market participants utilized this crisis period as a chance to restructure and reassess their present strategies and sophisticated product portfolio.

| Attributes | Details |

|---|---|

| Enterprise Asset Management Market Value (2020) | USD 3,809.31 million |

| Market Revenue (2025) | USD 4,466.25 million |

| Market Historical Growth Rate (CAGR 2020 to 2025) | 4.1% CAGR |

Integration of IoT with EAM software is expected to play an important role in developing smart cities. Smart cities monitor the conditions of all critical infrastructure. Increased data analysis accuracy, decision-making improvements, and asset management software outcomes are among the major factors driving the growth of enterprise asset management demand across many economies.

To protect employees well enough and ensure efficiency and productivity, many businesses across sectors have chosen the work-from-home model, resulting in a surge in demand for cloud-based solutions. The need for EAM solutions will continue to rise as more businesses invest in their IT infrastructure instead of investing more in physical infrastructure.

The table below lists countries anticipated to create better growth opportunities for enterprise asset management solution providers over the next ten years.

| Regional Market Comparison | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| Japan | 8.2% |

| Germany | 6.5% |

| Australia | 10.5% |

| China | 7.5% |

The United States regional market is expected to witness a year-on-year growth rate of 3.9% from 2025 to 2035.

The enterprise asset management industry in Germany is expected to expand at a rate of 6.5% per year till 2035.

China holds attractive growth potential for the enterprise asset performance management market, with an estimated CAGR of 7.5% between 2025 and 2035.

The adoption of enterprise asset management in Japan is poised to increase at a rate of 8.2% CAGR between 2025 and 2035.

Demand for enterprise asset management solutions is anticipated to rise at the most lucrative rate of 10.5% between

Based on solution type, the enterprise asset management market contributes more than half of the global demand. In 2025, this segment is figured out to contribute almost 54% of the revenue share.

| Attributes | Details |

|---|---|

| Top Solution Type or Segment | Enterprise Asset Management |

| Market Share in 2025 | 54% |

Based on enterprise size, large enterprises with 500 to 999 employees create the most demand for the asset lifecycle management market. This segment is expected to account for 35.41% of the market revenue in 2025.

| Attributes | Details |

|---|---|

| Top Enterprise Size or Segment | Large Enterprises (500 to 999 Employees) |

| Market Share in 2025 | 35.41% |

The information technology (IT) & telecom companies are the leading users of EAM systems. This segment is expected to contribute 21.6% of the revenue share generated by the market in 2025.

| Attributes | Details |

|---|---|

| Top End User Industry Type or Segment | IT & Telecom |

| Market Share in 2025 | 21.6% |

Key Enterprise asset management (EAM) software developers are investing their efforts in surpassing traditional asset management, as companies are now seeking additional benefits from EAM solutions. In addition to providing access to organizational asset information to every department and employee at every location, the latest industry trend includes EAM software solutions that also involve energy usage, lifecycle costs, maintenance histories, warranty catalogs, purchase orders, audit records, and others.

Recent Developments in the Global Enterprise Asset Management Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 4,717.07 million |

| Projected Market Size (2035) | USD 9,279.09 million |

| Anticipated Growth Rate (2025 to 2035) | 7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America, Latin America, Europe, Middle East & Africa (MEA), East Asia, South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Solution Type, By Service Type, By Enterprise Size, By End Use Industry, and By Region |

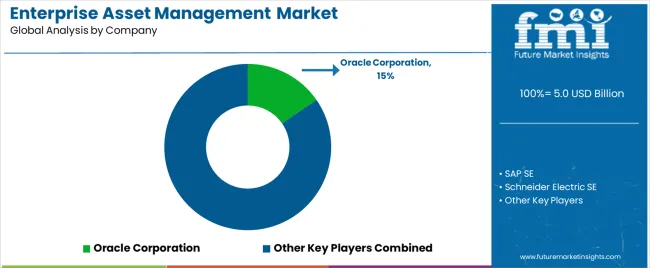

| Key Companies Profiled |

Oracle Corporation;SAP SE;Schneider Electric SE;ABB Ltd.;MRI Software LLC;CGI Inc.;Industrial and Financial Services (IFS) AB;Infor Inc.;Ramco Systems Limited;Rockwell Automation Inc.;Bentley Systems Incorporated |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global enterprise asset management market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the enterprise asset management market is projected to reach USD 9.9 billion by 2035.

The enterprise asset management market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in enterprise asset management market are cloud and on-premise.

In terms of industry, manufacturing segment to command 29.4% share in the enterprise asset management market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asset Management Services Market Size and Share Forecast Outlook 2025 to 2035

Asset Management System Market

IT Asset Management Market Size and Share Forecast Outlook 2025 to 2035

AI Asset Management Tool Market Analysis – Growth & Outlook 2024-2034

Enterprise Key Management Market Report – Trends & Growth Forecast 2023-2033

Enterprise Data Management Market Size and Share Forecast Outlook 2025 to 2035

Asset Integrity Management Market Growth - Trends & Forecast 2025 to 2035

Enterprise Drone Management Solutions Market Analysis 2025 to 2035 by Type, Technology, Application, and Region

Asset Performance Management Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Rights Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Fixed Asset Management Software Market Size and Share Forecast Outlook 2025 to 2035

Media Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Content Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Metadata Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Remote Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA