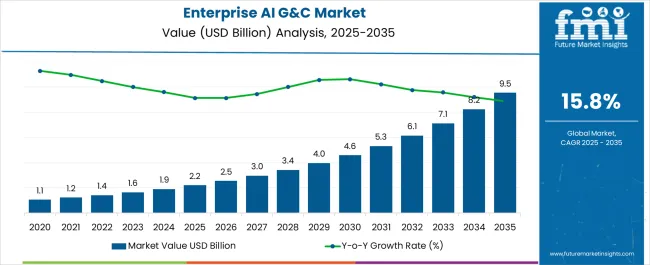

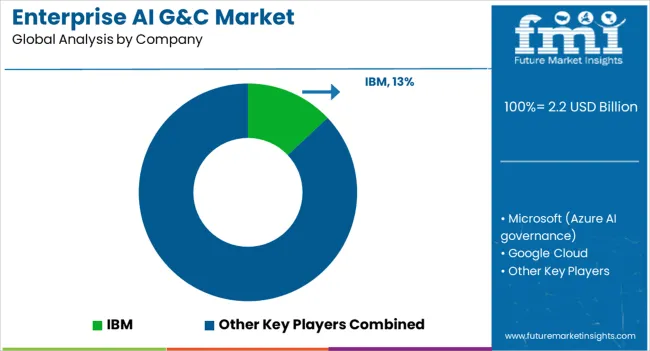

The global enterprise AI governance and compliance market is projected to grow from USD 2.2 billion in 2025 to reach USD 9.5 billion by 2035, reflecting an absolute increase of USD 7.3 billion over the forecast period. This translates into a growth of 332% over the decade, with the market forecast to expand at a compound annual growth rate (CAGR) of 15.8% between 2025 and 2035. The overall market size is expected to grow by approximately 4.3X during the same period, supported by the rising integration of artificial intelligence governance frameworks across enterprise operations and regulatory compliance requirements.

The enterprise AI governance & compliance market is growing because AI is moving from pilot-projects to wide deployment in mission-critical operations, which raises risks around ethics, bias, data privacy, security, transparency, and legal liability. Tightening regulations (like the EU’s AI Act), scrutiny from regulators, consumers, and investors are pushing companies to build governance frameworks to stay compliant. Enterprises also want to protect brand reputation and avoid litigation from misuse of AI, which motivates adoption of model auditing, explainability tools, risk management, and monitoring. The proliferation of generative AI adds urgency, as unintended harms (bias, misinformation, IP issues) can emerge quickly, making governance a strategic necessity.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.2 billion |

| Industry Size (2035F) | USD 9.5 billion |

| CAGR (2025 to 2035) | 15.8% |

Between 2020 and 2025, the enterprise AI governance and compliance market expanded from USD 0.4 billion to USD 2.2 billion, representing a cumulative growth of 450% over the five-year period. This remarkable expansion was driven by increasing enterprise AI deployments, emerging regulatory frameworks, and growing awareness of AI-related risks across industries. The period witnessed the establishment of foundational governance practices, with organizations beginning to implement formal AI ethics committees, model governance frameworks, and compliance monitoring systems.

Early adoption was concentrated among large financial institutions and technology companies, which faced immediate regulatory pressure and reputational risks associated with AI deployments. The development of specialized governance platforms emerged during this period, with vendors focusing on creating tools for model lifecycle management, bias detection, and explainability. Government initiatives such as the NIST AI Risk Management Framework and early versions of the EU AI Act provided structural guidance that shaped enterprise governance strategies.

Between 2025 and 2030, the enterprise AI governance and compliance market is projected to expand from USD 2.2 billion to USD 4.9 billion, resulting in a value increase of USD 2.7 billion during this period. This phase of growth will be shaped by rising enterprise adoption of AI systems across financial services, healthcare, and government sectors, coupled with stringent regulatory frameworks such as the EU AI Act and emerging national AI governance policies. Organizations are expected to prioritize comprehensive governance platforms that enable risk assessment, model monitoring, and compliance reporting to meet evolving regulatory standards.

The integration of cloud-based AI governance solutions is anticipated to accelerate during this period, as enterprises seek scalable platforms that support multi-jurisdictional compliance requirements. Financial institutions and healthcare organizations are driving significant demand for automated compliance reporting tools and audit-ready documentation systems. Technology providers are focusing on developing integrated governance toolkits that combine risk management, ethical AI frameworks, and regulatory reporting capabilities within unified platforms.

From 2030 to 2035, the market is expected to grow from USD 4.9 billion to USD 9.5 billion, adding another USD 4.6 billion in value. This second phase is projected to be characterized by mature regulatory environments, standardized governance protocols, and advanced AI accountability frameworks. Enterprise adoption of hybrid deployment models is expected to increase as organizations balance security requirements with operational flexibility. The evolution of industry-specific compliance standards and the integration of real-time monitoring capabilities will drive demand for sophisticated governance solutions.

The growth of the enterprise AI governance and compliance market is being driven by the convergence of regulatory pressures, ethical considerations, and operational risk management requirements. As artificial intelligence becomes embedded in critical business processes, organizations face increasing scrutiny from regulators, stakeholders, and consumers regarding the responsible deployment of AI systems. Regulatory frameworks such as the EU AI Act, GDPR AI provisions, and emerging national AI governance policies are creating mandatory compliance requirements that necessitate formal governance structures.

Enterprise risk management has evolved to encompass AI-specific risks including algorithmic bias, model drift, data privacy violations, and decision transparency requirements. Organizations are implementing comprehensive governance frameworks to address these risks while maintaining competitive advantages from AI innovations. The increasing complexity of AI systems and their potential impact on business outcomes has made governance a strategic priority rather than merely a compliance requirement.

Financial institutions face particular pressure due to existing regulatory frameworks that now extend to AI decision-making processes, while healthcare organizations must navigate patient safety considerations and clinical AI regulations. Technology companies are implementing governance measures to address public trust concerns and prepare for anticipated regulatory requirements. The market growth reflects the transition from ad-hoc AI governance practices to systematized, technology-enabled compliance frameworks.

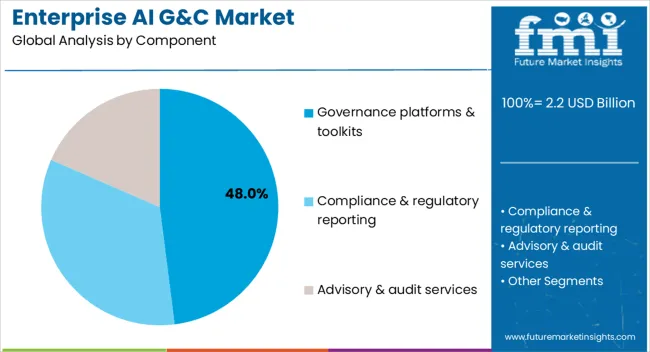

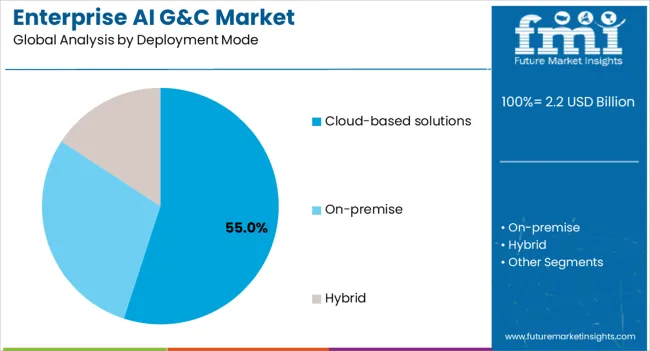

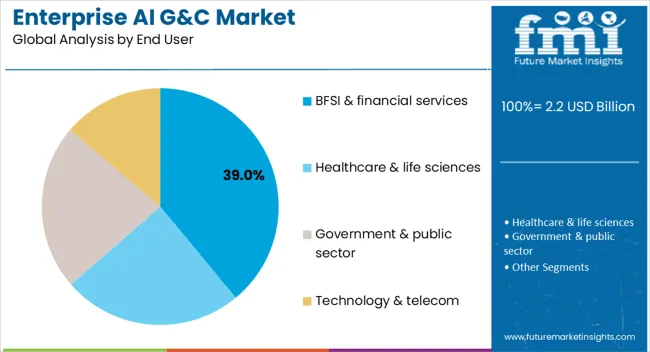

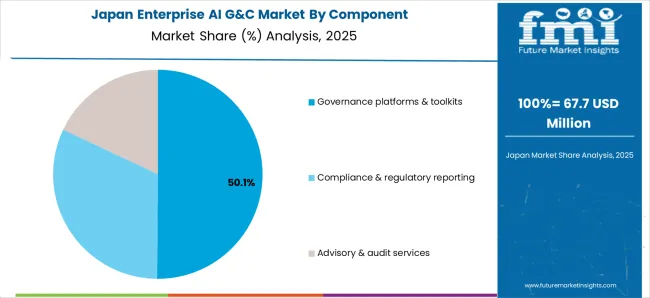

The market is segmented by component into governance platforms and toolkits, compliance and regulatory reporting solutions, and advisory and audit services, reflecting the diverse technological and professional service requirements for AI governance. Deployment modes include cloud-based solutions, on-premise implementations, and hybrid models, addressing varying security, scalability, and integration needs across enterprises. End-user segments encompass BFSI and financial services, healthcare and life sciences, government and public sector, and technology and telecom, each with distinct regulatory requirements and AI governance priorities.

Governance platforms and toolkits are estimated to hold 48% of the market share in 2025, driven by enterprise demand for integrated solutions that address multiple aspects of AI governance within unified platforms. These solutions provide capabilities including model lifecycle management, risk assessment frameworks, policy enforcement tools, and stakeholder collaboration features. Organizations prefer comprehensive platforms that reduce integration complexity while providing centralized visibility into AI governance activities across departments and business units.

The dominance of this segment reflects the maturation of AI governance practices, with enterprises moving beyond manual processes to technology-enabled governance frameworks. Platform vendors are incorporating advanced features such as automated bias detection, model performance monitoring, and compliance dashboard capabilities. Integration with existing enterprise systems including data governance platforms, risk management systems, and business intelligence tools has become a critical requirement driving adoption.

Cloud-based solutions are projected to account for 55% of deployment preferences in 2025, supported by the scalability, cost-effectiveness, and rapid deployment capabilities offered by cloud platforms. Enterprise adoption of cloud-based AI governance solutions is driven by the ability to access advanced capabilities without significant infrastructure investments, while benefiting from continuous platform updates and security enhancements provided by vendors.

The preference for cloud deployment reflects the distributed nature of modern AI development and deployment processes, which often span multiple business units, geographical locations, and technology platforms. Cloud-based governance solutions enable centralized policy management and monitoring across diverse AI implementations, while supporting collaborative governance processes involving multiple stakeholders. Integration with cloud-based AI development platforms and data management systems provides additional operational efficiencies.

BFSI and financial services are expected to represent 39% of market demand in 2025, reflecting the heavily regulated nature of the financial industry and the extensive use of AI in critical financial processes. Financial institutions face stringent regulatory requirements regarding algorithmic decision-making, particularly in areas such as credit scoring, fraud detection, and automated trading systems. Regulatory frameworks including fair lending laws, consumer protection regulations, and emerging AI-specific financial regulations necessitate comprehensive governance frameworks.

The segment's leadership is reinforced by the high-stakes nature of financial AI applications, where governance failures can result in significant regulatory penalties, reputational damage, and financial losses. Financial institutions are implementing sophisticated governance frameworks that address model validation, ongoing monitoring, documentation requirements, and stakeholder reporting obligations. The complexity of financial AI applications and their potential impact on consumer outcomes drives demand for advanced governance capabilities.

The enterprise AI governance and compliance market is experiencing rapid evolution driven by regulatory developments, technological advancements, and changing stakeholder expectations. Organizations are transitioning from reactive compliance approaches to proactive governance strategies that embed ethical considerations and risk management throughout AI development and deployment processes. However, the market faces challenges including the complexity of implementing governance across diverse AI technologies, the shortage of specialized governance professionals, and the need to balance innovation with compliance requirements.

The implementation of comprehensive regulatory frameworks such as the EU AI Act, emerging USA federal AI regulations, and industry-specific AI governance requirements is creating standardized compliance obligations that drive market demand. Organizations operating in multiple jurisdictions face complex compliance landscapes requiring sophisticated governance platforms capable of addressing diverse regulatory requirements while maintaining operational efficiency.

Regulatory frameworks are establishing specific obligations regarding AI risk assessment, documentation, human oversight, and stakeholder transparency that necessitate formal governance processes and supporting technology infrastructure. The emergence of regulatory enforcement mechanisms and potential penalties for non-compliance is elevating AI governance from voluntary best practices to mandatory business requirements. Organizations are implementing governance frameworks that provide audit trails, compliance reporting capabilities, and evidence of due diligence in AI development and deployment processes.

The integration of AI governance solutions with existing enterprise risk management, data governance, and compliance systems is becoming essential for organizations seeking comprehensive governance frameworks. Enterprises require governance platforms that integrate with identity and access management systems, data lineage tools, model development platforms, and business intelligence systems to provide holistic visibility into AI-related risks and compliance status.

Vendor differentiation increasingly depends on the ability to provide seamless integration capabilities that minimize implementation complexity while maximizing governance effectiveness. Organizations are prioritizing solutions that leverage existing data infrastructure, security frameworks, and workflow processes rather than requiring parallel governance systems. The trend toward integrated governance reflects the maturation of enterprise AI practices and the recognition that AI governance must be embedded within broader organizational governance structures.

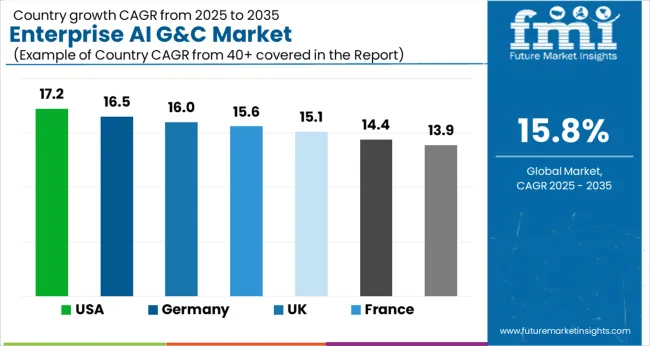

The United States enterprise AI governance and compliance market is projected to grow at the highest CAGR of 17.2% from 2025 to 2035, driven by comprehensive federal and state-level AI governance initiatives. The implementation of the AI Bill of Rights, NIST AI Risk Management Framework adoption across federal agencies, and emerging sector-specific regulations are creating substantial demand for governance solutions across enterprises. Major technology companies headquartered in the USA are implementing comprehensive governance frameworks that serve as industry benchmarks, while financial institutions are adapting existing risk management practices to address AI-specific requirements.

The USA market benefits from the presence of leading AI governance technology vendors and extensive enterprise AI adoption across industries. Federal procurement requirements for AI systems are establishing governance standards that influence commercial practices, while state-level privacy regulations such as the California Consumer Privacy Act are extending to AI applications. The market is characterized by significant investment in governance platform development and the emergence of specialized consulting services focused on AI compliance.

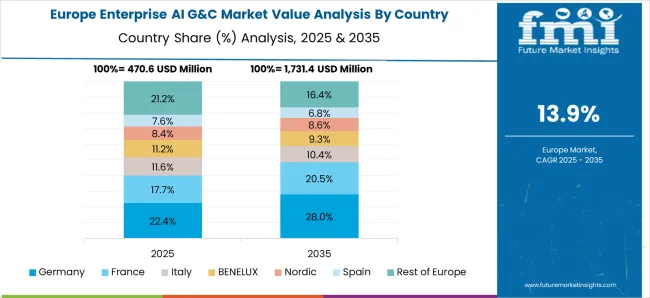

Germany's enterprise AI governance and compliance market is forecast to grow at 16.5% CAGR through 2035, supported by the country's leadership role in EU AI Act implementation and strong industrial AI adoption. German enterprises across automotive, manufacturing, and financial sectors are implementing comprehensive governance frameworks to address EU regulatory requirements while maintaining competitive advantages in AI innovation. The country's robust data protection framework under GDPR provides a foundation for extending governance practices to AI applications.

German enterprises are developing sector-specific governance approaches that address the intersection of AI governance with existing industrial safety, quality management, and regulatory compliance frameworks. The automotive industry's extensive use of AI in autonomous systems and manufacturing processes is driving demand for specialized governance solutions that address safety-critical applications. Financial institutions are implementing governance frameworks that integrate with existing risk management practices while addressing AI-specific regulatory requirements.

The UK enterprise AI governance and compliance market is projected to grow at 16.0% CAGR from 2025 to 2035, driven by the development of distinctive AI governance approaches following Brexit and the establishment of AI governance sandbox programs. The UK's approach emphasizes innovation-friendly regulation while maintaining robust consumer protection and ethical standards. Financial services firms in London are implementing governance frameworks that address both UK-specific requirements and international compliance obligations for global operations.

The UK government's investment in AI governance research and the establishment of specialized regulatory bodies focused on AI oversight are creating demand for sophisticated governance solutions. Technology companies operating in the UK are developing governance frameworks that balance innovation requirements with regulatory compliance, while healthcare organizations are implementing governance approaches for NHS AI applications and medical device regulations. The UK's emphasis on AI safety research and governance innovation is attracting investment in specialized governance technology development.

France's enterprise AI governance and compliance market is expected to grow at 15.6% CAGR through 2035, supported by the country's national AI strategy and CNIL oversight framework for AI applications. French enterprises are implementing governance solutions that integrate with existing data protection practices while addressing AI-specific ethical and regulatory requirements. The government's investment in AI research and development is coupled with emphasis on responsible AI deployment across public and private sectors.

French financial institutions are developing governance frameworks that address both EU AI Act requirements and domestic financial regulations, while healthcare organizations are implementing governance approaches for AI medical devices and patient data protection. The country's focus on AI sovereignty and domestic technology development is driving demand for governance solutions that support innovation while ensuring compliance with ethical and regulatory standards. Manufacturing and aerospace companies are implementing governance frameworks that address safety-critical AI applications and international certification requirements.

India's enterprise AI governance and compliance market is projected to grow at 15.1% CAGR from 2025 to 2035, driven by rapid enterprise AI adoption across technology, financial services, and healthcare sectors. The government's responsible AI guidelines and emerging regulatory framework are creating demand for governance solutions that support innovation while addressing ethical and compliance requirements. Indian technology companies serving global markets are implementing comprehensive governance frameworks that address multiple jurisdictional requirements.

The country's large technology services sector is developing governance capabilities to support AI implementations for international clients, while domestic enterprises are adopting governance frameworks that address local regulatory requirements and stakeholder expectations. Financial institutions are implementing governance solutions that integrate with existing compliance frameworks while addressing AI-specific risks. Healthcare organizations are developing governance approaches for AI applications in diagnostics, treatment planning, and operational optimization.

Japan's enterprise AI governance and compliance market is forecast to grow at 14.4% CAGR through 2035, supported by METI and MIC initiatives for AI accountability and the country's advanced industrial AI adoption. Japanese enterprises across automotive, electronics, and manufacturing sectors are implementing sophisticated governance frameworks that integrate AI oversight with existing quality management and safety systems. The country's emphasis on Society 5.0 and digital transformation is driving comprehensive governance approaches that address ethical, regulatory, and operational requirements.

Financial institutions in Japan are developing governance frameworks that address both domestic regulatory requirements and international compliance obligations for global operations. Healthcare organizations are implementing governance solutions for AI medical devices and clinical applications, while technology companies are developing governance capabilities that support both domestic and international AI deployments. The integration of AI governance with traditional Japanese management practices and quality systems is creating distinctive approaches to enterprise AI oversight.

Canada's enterprise AI governance and compliance market is expected to grow at 13.9% CAGR from 2025 to 2035, driven by the AI and Data Act implementation and the country's leadership in AI research and development. Canadian enterprises are implementing governance frameworks that address federal regulatory requirements while supporting innovation across technology, financial services, and natural resources sectors. The country's emphasis on ethical AI development and indigenous data sovereignty is creating comprehensive governance approaches that address diverse stakeholder requirements.

Financial institutions are developing governance solutions that integrate with existing regulatory compliance frameworks while addressing AI-specific requirements under federal legislation. Technology companies are implementing governance approaches that support both domestic compliance and international market expansion. Healthcare organizations are developing governance frameworks for AI applications in diagnostics and treatment planning, while government agencies are establishing comprehensive oversight mechanisms for AI deployment across public services.

The enterprise AI governance and compliance market is characterized by intense competition among technology vendors, consulting firms, and specialized governance solution providers. IBM maintains market leadership with approximately 13% share in 2025, leveraging its comprehensive Watson governance platform and extensive enterprise relationships. Microsoft, Google Cloud, and AWS are rapidly expanding their AI governance capabilities, integrating governance tools with their cloud platforms and AI development services.

Professional services firms including PwC and Deloitte are developing specialized AI governance consulting practices that complement technology solutions, while emerging vendors such as DataRobot and Credo AI are focusing on innovative governance capabilities and industry-specific solutions. The competitive landscape is evolving rapidly as vendors seek to differentiate through integration capabilities, regulatory expertise, and industry-specific features.

Market consolidation is expected as established technology vendors acquire specialized governance companies to enhance their platform capabilities. The emergence of industry-specific governance requirements is creating opportunities for specialized vendors that develop deep expertise in particular sectors or regulatory frameworks. Competition is increasingly focused on providing comprehensive solutions that integrate governance capabilities with existing enterprise systems while supporting diverse regulatory requirements across multiple jurisdictions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Component | Governance Platforms & Toolkits, Compliance & Regulatory Reporting, Advisory & Audit Services |

| Deployment Mode | Cloud-based Solutions, On-premise, Hybrid |

| End User | BFSI & Financial Services, Healthcare & Life Sciences, Government & Public Sector, Technology & Telecom |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, France, India, Japan, Canada |

| Key Companies Profiled | IBM, Microsoft, Google Cloud, Amazon Web Services, SAS Institute, FICO, PwC, Deloitte, DataRobot, Credo AI |

| Additional Attributes | Dollar sales by solution type and deployment model, regional adoption trends, competitive landscape, buyer preferences for on-premises versus cloud-based platforms, integration with regulatory compliance and risk management frameworks, innovations in explainable AI, automated auditing, policy enforcement, model monitoring, and AI lifecycle management for ethical, secure, and transparent enterprise operations |

The global enterprise AI governance and compliance market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the enterprise AI governance and compliance market is projected to reach USD 9.5 billion by 2035.

The enterprise AI governance and compliance market is expected to grow at a 15.8% CAGR between 2025 and 2035.

The key product types in enterprise AI governance and compliance market are governance platforms & toolkits, compliance & regulatory reporting and advisory & audit services.

In terms of deployment mode, cloud-based solutions segment to command 55.0% share in the enterprise AI governance and compliance market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Metadata Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Rights Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Enterprise LLM Market Size and Share Forecast Outlook 2025 to 2035

Enterprise VSAT Systems Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Content Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IoT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise WLAN Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Video Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA