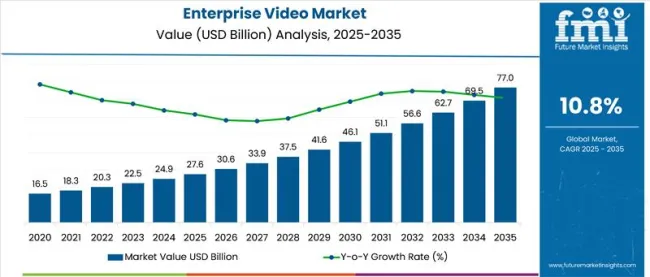

The global Enterprise Video market is poised for significant growth, expanding from USD 27.6 billion in 2025 to USD 77 billion by 2035. The market grows at a CAGR 10.8% from the period 2025 to 2035.

The enterprise video is growing due to the growing need for seamless communication and collaboration tools across industries such as BFSI, healthcare and IT. The organizations are focused on adopting enterprise video solutions to enhance corporate communication, training and development and client engagement especially in the era of hybrid work environments.

| Attributes | Description |

|---|---|

| Historical Size, 2024 | USD 24,950.1 million |

| Estimated Size, 2025 | USD 27.6 billion |

| Projected Size, 2035 | USD 77 billion |

| Value-based CAGR (2025 to 2035) | 10.8% CAGR |

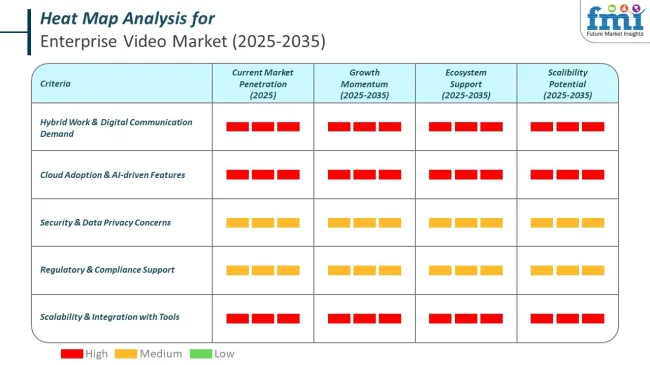

The digitally transformed momentum demands video conferencing, webcasting tools, and video content management systems to ensure efficient business operations while keeping teams at remote places and global partners connected. At the same time, compliance complexity is rising through the GDPR in Europe, which amplifies the need for security and scale in video solutions for data-sensitive communication.

North America are dominating the market due to the advanced IT infrastructure, rapid adoption of cloud-based solutions and the presence of key solution providers. Countries such as India and Australia are growing due to the increased adoption of enterprise video tools fueled by the growing need for digital communication in their expanding business ecosystems.

The market is in growth and it will further have supported by innovations in AI-driven analytics, offering features such as real-time transcription and personalized video experiences to enhance productivity and engagement.

Enterprise video is no longer just about call quality it's about what happens after the call ends. With AI rapidly embedding into mainstream platforms, the focus has shifted from passive viewing to active, searchable, and system-integrated knowledge reuse. When used correctly, these tools don’t just save time they compress comprehension cycles and make insights instantly accessible across teams, geographies, and languages.

New startup challengers in the enterprise video space are focusing on niche pain points neglected by incumbents. Companies like Descript, Fireflies.ai, and Vowel are unbundling meetings, offering instant transcription, searchable recaps, speaker analytics, and async-first interfaces. Unlike legacy platforms, they prioritize post-call usability over call fidelity. AI-native startups also push tighter integration with Slack, Notion, and CRMs, embedding meeting intelligence directly into workflows. The real disruption? These tools aren’t just cheaper—they're workflow-native and memory-rich, reshaping how teams consume and act on conversations. The incumbents now risk being just another “dumb pipe” unless they evolve beyond real-time and into recall.

The below table presents the expected CAGR for the global enterprise video market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the memory interconnect industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half (H1) of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 10.5%, followed by a slightly higher growth rate of 11.0% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 10.5% (2024 to 2034) |

| H2 | 11.0% (2024 to 2034) |

| H1 | 10.1% (2025 to 2035) |

| H2 | 11.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 10.1% in the first half and remain higher at 11.7% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS and in the second half (H2), the market witnessed an increase of 70 BPS.

Increasing demand for seamless communication in hybrid work environments is propelling the growth of video conferencing solutions

This increasing demand for seamless communication between hybrid conditions is fueling exposure to video conferencing solutions. Organizations are venturing into these solutions to provide real-time connectivity and collaboration between teams across geographies. Providing such capability to the teams is becoming prevalent with hybrid work patterns, and organizations are harnessing video conferencing to narrow the disparities between in-office and remote employees regarding productivity and engagement.

Governments across the world are also advocating the adoption of digital tools to bring up better connectivity. According to the American Rescue Plan from the USA government allocated USD 7 billion to schools and libraries to upgrade their digital infrastructure in support of both online learning and remote work.

The businesses are encouraged to adopt heavy-duty communication tools, further boosting the demand for video conferencing solutions. By the end of 2025, a global video conferencing market is said to keep rising as the need arises in the public and private sectors for reliable and secure communication methods.

Integration of video content management solutions with cloud platforms is fueling the shift to scalable and flexible solutions

The shift toward scalable and flexible solutions is strengthened the integration of video content management solutions with cloud platforms. Vendors are adopting cloud-based video management systems for the effective storage, management and distribution of video content. The cloud helps for real-time access and collaboration on video content possible anywhere, which significantly increases agility for an organization.

Government are also shifting towards cloud adoption. For instance, the European Union's Digital Decade Plan in 2023 allocated 20% of its budget to supporting digital infrastructure, including cloud services. This has contributed to a rise in cloud video content management adoption across industries. By migrating to the cloud, organizations will scale their video systems quickly, to ensure data security and help to streamline compliance with regional regulations like GDPR.

Increasing interest in virtual events and online broadcasting Creates Lucrative opportunities for innovative webcasting solutions

The online conferences, webinars and live streaming are in action and the demand for webcasting tools has increased significantly. It offers more interactive features such as live Q&A, polls and engagement tracking to enhance the experience of the attendees. Governments encourage and it will boost further digital engagement.

The UK Government's Digital Strategy is converging to support 5G and broadband infrastructure in the country to improve connectivity for virtual events. According to the strategy by the end of 2025, 85% of the UK should be connected to a high-speed internet provision for laying down a firm foundation for webcasting platform proliferation.

Rise in digital events creates new opportunities to exploit webcasting technology for businesses to reach international audiences, improve engagement with clients, and enhance visibility of brands.

Security concerns related to video content storage and data privacy will hinder widespread adoption of video conferencing solutions

As the organizations are mostly relying on video conferencing for remote communication and collaboration the need to protect sensitive information becomes very critical. Video conferences involve discussions of confidential business strategies, customer data or proprietary information which if compromised that will lead to severe financial and reputational damage.

Many video conferencing solutions are cloud-based, where data is stored on third-party servers. It helps to creates potential vulnerabilities, especially if platforms do not comply with stringent security standards or if they are exposed to cyber threats. Governments and regulatory bodies such as the General Data Protection Regulation in Europe will enforce strict data protection laws, making it challenging for organizations to meet the requirements when using video conferencing software.

The global enterprise video market showed a steady increase from 2020 to 2024. The cloud-based communication solutions, increasing adoption of video conferencing software such as Zoom, Microsoft Teams, Cisco WebEx and even the increasing needed remote collaboration tools in different sectors such as BFSI, healthcare and IT are the major factors for the growth. The market is expected to grow from USD 16,682.8 million in 2020 to 24,950.1 million by 2024 and poised at a CAGR of 9.7%.

The demand for enterprise solution videos is likely to accelerate even further, but at a lower rate since the market has matured and the adoption of hybrid work environments is widely to homes. AI-driven video analytics and immersive technologies like virtual or augmented reality will drive the innovation and the creation of new growth opportunities. The market is expected to grow from 27,557.8 million in 2025 to 68,192.3 million by 2035, with a CAGR of about 10.8%.

Tier 1 vendors contains the highest market share and strong enterprise players usually recognized by their brand names, product offerings and global footprints. The vendors dominate the enterprise video market by advanced solutions, robust customer support and continuous innovations.

The Tier 1 vendors include Zoom Video Communications, Microsoft (Teams), Cisco (WebEx), Google (Google Meet), and LogMeIn (GoToMeeting). Tier 1 vendor cater around 40% to 45% of total market share.

Tier 2 vendors are the primary players in providing competitive information technology solutions; however, they do not command quite as much of the market as Tier 1 companies. Tier 2 vendors in the enterprise video solution space include Polycom (Plantronics), BlueJeans by Verizon, Lifesize, RingCentral, and Avaya.

The companies together account for about 15% to 20% of the market by bringing innovative solutions such as cloud-based video conferencing, being specialized in content management, or offering narrower video communication tools for niche sectors.

Tier 3 vendors are still significant in each market but have a smaller market presence and are generally focused on niche markets or particular types of specialized products that do not scale very well. Many of these vendors are newer entrants or smaller companies with compellingly innovative but not widely disseminated solutions.

Some of the Tier 3 vendors include: Pexip, Vidyo, VDO360, Kaltura, and Chime. These vendors collectively hold about 30% to 35% of the total market share. These products are generally geared toward the provision of customizable video solutions for specific enterprise needs, such as small businesses, educational institutions, or regional markets.

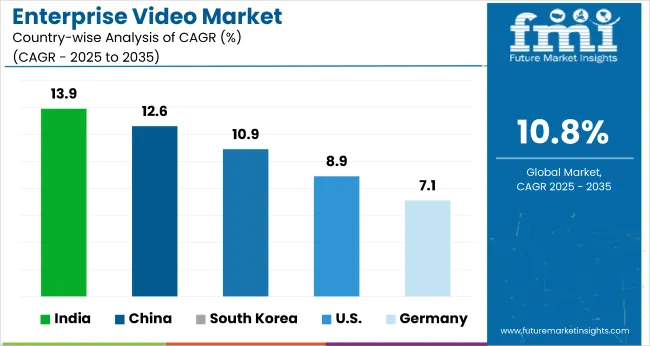

The section highlights the CAGRs of countries experiencing growth in the Enterprise Video market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 13.9% |

| China | 12.6% |

| Germany | 7.1% |

| South Korea | 10.9% |

| United States | 8.9% |

The growth of enterprise video solutions in China has accelerated in the last few years owing to rapid advancement in digital infrastructure, especially in terms of corporate communications and collaborations. Adoption is mainly driven by government initiatives in technological innovation and digitalization in businesses.

Under the scheme Made in China 2025, unveiled by the Chinese government in 2020, technological capabilities are aimed to be improved in various industries, including communications. This helps in heavy investments in cloud computing, as well as 5G networks and video communication platforms.

The Chinese government allocated USD 2 billion for technology development to boost digital transformation in 2023, making the market for enterprise video even larger. Organizations in different industries, from construction to IT, leverage such improvements for efficient internal and external communication.

Growth in corporate video usage in China is expected over the next five years at an annual growth rate of 18%, driven by increasing demands for remote collaborations and secured video communication tools. China is anticipated to see substantial growth at a CAGR 12.6% from 2025 to 2035 in the Enterprise Video market.

Training and development solutions, especially video-based learning applications, have been in huge demand at present more than ever in India's booming education industry and corporate sectors. The government of India supports and encourages digital learning via initiatives such as Digital India program, which enhances online education access to citizens.

The Ministry of Education also allocated USD 3 billion in 2022 for improving digital education infrastructure directed at direct adoption by enterprises adopting video training solutions. In addition, the COVID-19 pandemic has propelled the online major shift in training programs within organizations where conferencing and learning take place on-demand video platforms.

Given the tremendous increase of about 20% adoption of corporate e-learning year after year, India is likely to become one of the fastest-growing emerging markets for video training solutions. There will be constant demand from organizations that have already adapted to work-from-home and digital learning for video content management and interactive training sessions. India Enterprise Video market is anticipated to expand from 990.5 Mn in 2025 to 3,254.5 Million by 2035 and poised at a CAGR 13.9% during this period.

The most robust types of opportunities for training & development solutions is the rise of remote work and hybrid workplace models in the USA The government has played a significant role in promoting development through workforce initiatives like the Workforce Innovation and Opportunity Act-a program that supports skills and training development. In 2021, the USA government allocated USD 2.5 billion on workforce training programs, where a huge amount was directed to developing digital skills.

This has seen the increase in video-based training solutions since organizations are relying more on digital means of upskilling their employees. The USA market for remote training and development video solutions is expected to have a CAGR of 15% due to the need for flexible, scalable, and effective training approaches.

As organizations are continuously leaning toward upskilling or reskilling their employees, enterprise video solutions will play an important role in this aspect. USA is anticipated to see substantial growth from 2025 to 2035 at a CAGR 8.9% in Enterprise Video market significantly holds dominant share of 83.1% in 2025.

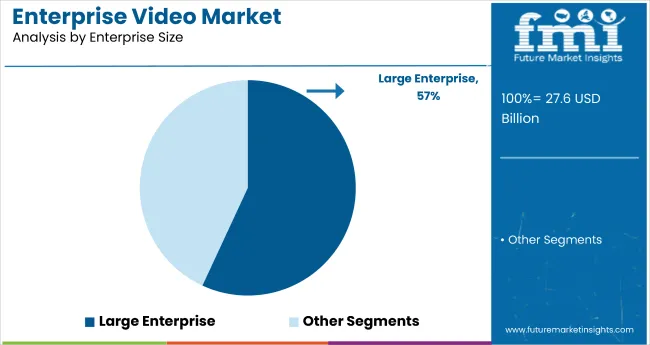

The section provides detailed insights into key segments of the enterprise video market. The enterprise size category includes small & medium enterprise and large enterprise. The industry category such as BFSI, IT & Telecom, Healthcare, Manufacturing and Others. Among these, BFSI are growing quickly. The large enterprise hold largest market share in Enterprise Video.

The BFSI sector is significantly growing due to the increasing assurances in digital transformation and customer experience levels. As it unveils itself training most of the entry technologies, there is a growing need for enterprises in the direction of organizing video solutions for aiding corporate communications, client affiliation, as well as remote services.

The BFSI sector has adapted the video conferencing, webcasting, and video content management system modules into its collection, enabling efficient operations, improving customer interactions, and engaging in virtual consultations, especially during the times of the pandemic.

This help for boosting the USA government with a bunch of initiatives like the Financial Innovation Act, which seeks to promote digital transformation and innovation in the financial sector. The USA spend more than USD 1.5 billion on funding for digital financial services and cybersecurity programs in 2025, with a great part targeting enhancements in virtual banking solutions.

With increasing regulatory frameworks like GDPR and CCPA coming to North America, the demand for enterprise video solutions in BFSI would gain momentum in driving and increasing uptake for secure and compliant communication channels. The BFSI is anticipated to see substantial growth at a CAGR 8.7% from 2025 to 2035 in the Enterprise Video market.

| Segment | BFSI (Industry) |

|---|---|

| CAGR (2025 to 2035) | 12.4% |

Corporate giants are the primary consumers and vendors in the enterprise video solution market. Such companies have very high operational demand around the globe and bigger budgets when compared to peers in the same business.

They use enterprise video applications for various functions like corporate communications, training, client engagement, and marketing within the company. Given the high scale and complexity of operations, solutions need to be robust, safe, and scalable to meet these requirements for large IT teams, enhancement of collaboration experience, and compliance with different industry regulations.

Government initiatives have been a major driver of enterprise video adoption across the largest enterprises. The government launch Modernizing Government Technology program in the USA in 2020, which set aside USD 1.3 billion for modernizing the government's IT infrastructure, including infrastructure for video communication in large programs.

Such investment in adoption has propelled the use of enterprise video across public- and private-sector enterprises. The imposition of regulation by compliance, such as GDPR in Europe and CCPA in California, has also pushed large enterprises to adopt video platforms that are safe and compliant with data privacy and regulation adherence. Large Enterprise are estimated to dominate the Enterprise Video market, capturing a substantial share of 56.9% in 2025.

| Segment | Large Enterprise (Enterprise Size) |

|---|---|

| Value Share (2025) | 56.9% |

Currently, the enterprise video market is extremely competitive, with main players continuing their focus on technology advancements and strategic alliances. These include companies such as Zoom, Microsoft, Cisco, and Google, which have been at the forefront of comprehensive video solutions for enterprises.

Other new entrants are niche players providing very specific video solution offerings that are tailored to individual industries. As demand increases for more scalable, AI-based, and cloud-capable solutions, competition will also high. Continued improvement in video content management, security, and integration with other enterprise systems will be critical to keeping a competitive edge.

Industry Update

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 27.6 billion |

| Projected Market Size (2035) | USD 77 billion |

| CAGR (2025 to 2035) | 10.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million users/licenses for volume |

| Solutions Analyzed (Segment 1) | Video Conferencing, Video Content Management, Webcasting Tools, Others |

| Deployment Modes Analyzed (Segment 2) | Cloud-Based, Web-Based, On-Premise |

| Enterprise Sizes Analyzed (Segment 3) | Small & Medium Enterprises, Large Enterprises |

| Industries Analyzed (Segment 4) | BFSI, IT & Telecom, Healthcare, Manufacturing, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Germany, France, United Kingdom, Italy, China, Japan, India, South Korea, Australia, UAE, South Africa |

| Key Players influencing the Enterprise Video Market | Zoom Video Communications, Microsoft Corporation, Cisco Systems, Google (Alphabet Inc.), Poly, BlueJeans (Verizon), GoTo, Veeva Systems, Pexip, Vidyo |

| Additional Attributes | Dollar sales growth driven by demand for remote collaboration, BFSI leading in secure video communication for client services, large enterprises driving volume through internal communications and training, cloud-based models gaining traction for scalability and cost-efficiency, Asia Pacific and North America witnessing high adoption due to hybrid work environments and digital infrastructure expansion. |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of solution, the segment is divided into video conferencing, video content management, webcasting tool and others.

In terms of Deployment Mode, the segment is segregated into cloud-based, web based and on premise.

In terms of enterprise size, the segment is segregated into small & medium enterprise & large enterprise.

In terms of industry, the segment is segregated into BFSI, IT & telecom, healthcare, manufacturing and others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA).

The Global Enterprise Video industry is projected to witness CAGR of 10.8% between 2025 and 2035.

The Global Enterprise Video industry stood at USD 27.6 billion million in 2025.

The Global Enterprise Video industry is anticipated to reach USD 77 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 13.3% in the assessment period.

The key players operating in the Global enterprise video industry Zoom Video Communications, Microsoft Corporation, Cisco Systems, Google (Alphabet Inc.), Poly (formerly Plantronics), BlueJeans (acquired by Verizon), GoTo (formerly LogMeIn), Veeva Systems, Pexip, Vidyo.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise Video Content Management Market

Connected Enterprise Video Surveillance Solutions Market

North America Enterprise Video Market - Growth & Outlook 2025 to 2035

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Metadata Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Rights Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Enterprise LLM Market Size and Share Forecast Outlook 2025 to 2035

Enterprise VSAT Systems Market Size and Share Forecast Outlook 2025 to 2035

Enterprise AI Governance and Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Content Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IoT Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA