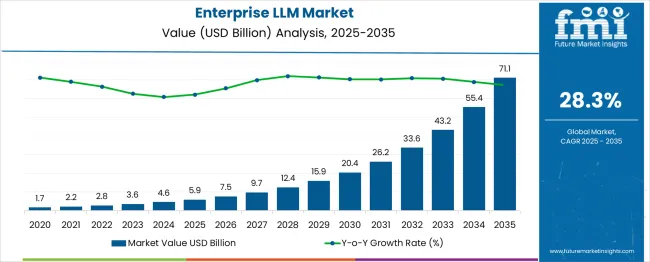

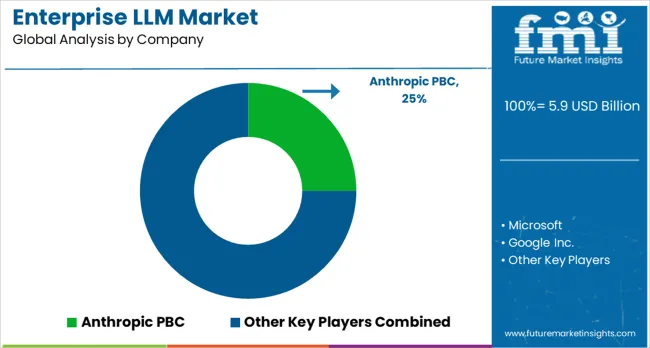

The enterprise LLM market is estimated at USD 5.9 billion in 2025 and is forecast to reach USD 71.1 billion by 2035, registering a CAGR of 28.3%. Five-year growth block analysis highlights accelerated expansion phases, with each block contributing significantly to overall market scaling. The high CAGR indicates strong growth momentum, fueled by increasing enterprise adoption of AI driven language models for automation, analytics, and decision support. Early blocks show foundational investment in infrastructure and model integration, while later blocks reflect widespread deployment, enhanced capabilities, and ecosystem maturation. The market’s growth momentum is reinforced by rising demand for efficiency, personalization, and large scale data processing, positioning the enterprise LLM sector as a high growth and transformative technology space.

| Metric | Value |

| Estimated Value in (2025E) | USD 5.9 billion |

| Forecast Value in (2035F) | USD 71.1 billion |

| Forecast CAGR (2025 to 2035) | 28.3% |

The market has demonstrated notable growth over the past few years, fueled by increasing demand for AI-driven business intelligence, automation, and large-scale data analysis solutions. YoY growth has, shown some variability, reflecting both rapid adoption cycles and technological maturation. Early-stage years recorded strong growth of around 20% to 25% YoY, driven by early adopters implementing large language models for customer support, content generation, and knowledge management. Mid-period years exhibited slightly moderated increases, averaging 15% to 18% YoY, as more enterprises scaled their deployments and integration complexity increased. These fluctuations are captured in the market’s volatility index, which measures the standard deviation of annual growth rates over the period, indicating moderate instability due to evolving market dynamics, competitive pressures, and technological refinements.

The volatility index suggests that the market may continue to experience moderate ups and downs as adoption spreads across different enterprise segments and regions. Factors such as regulatory developments, AI governance frameworks, and integration challenges can temporarily impact growth rates, while innovation in model efficiency and domain-specific applications is likely to restore acceleration. Despite these fluctuations, the trajectory remains strongly upward, with YoY growth stabilizing gradually as enterprises mature in their AI adoption strategies. The volatility index provides a useful gauge for stakeholders to anticipate periods of rapid growth or temporary slowdowns, highlighting that the market is dynamic yet resilient, with long-term potential for expansion.

Market expansion is being supported by the increasing enterprise awareness about the transformative potential of artificial intelligence in business operations and the corresponding demand for intelligent automation solutions. Modern organizations are increasingly focused on digital transformation initiatives that can enhance productivity, reduce operational costs, and improve customer experiences. Enterprise LLMs' proven efficacy in natural language processing, content generation, and decision support makes them preferred technologies in advanced business automation strategies.

The growing focus on data-driven decision making and intelligent business processes is driving demand for LLM solutions that can analyze complex information, generate insights, and automate routine tasks. Enterprise preference for scalable solutions that combine language understanding with business intelligence capabilities is creating opportunities for innovative implementations. The rising influence of AI evangelists and technology consultants is also contributing to increased enterprise adoption across different industries and organizational sizes.

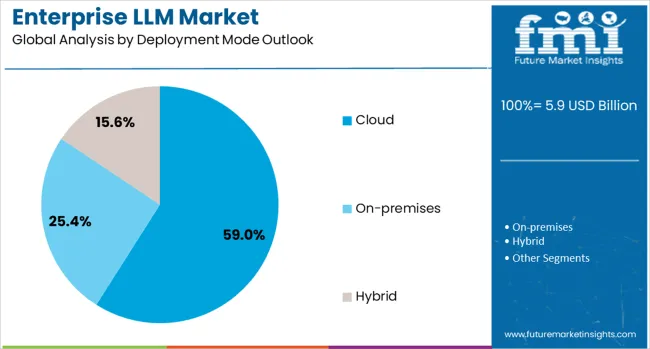

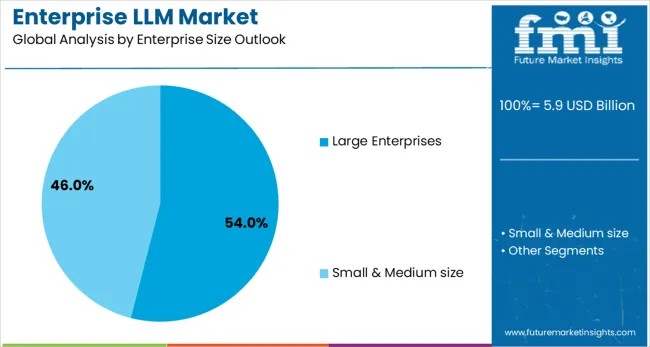

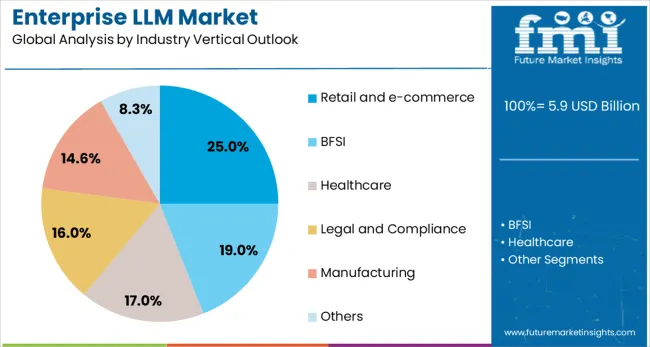

The market is segmented by model type, component, deployment mode, enterprise size, industry vertical, and region. By model type, the market is divided into general-purpose LLMs, domain-specific LLMs, and custom/proprietary LLMs. Based on component, the market is categorized into software, hardware, and services. In terms of deployment mode, the market is segmented into cloud, on-premises, and hybrid. By enterprise size, the market is classified into large enterprises and small & medium size enterprises. By industry vertical, the market is divided into retail and e-commerce, BFSI, healthcare, legal and compliance, manufacturing, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The general-purpose LLMs segment is projected to account for 41.6% of the enterprise LLM market in 2025, reaffirming its position as the category's leading model type. Organizations increasingly understand the versatility and broad applicability of general-purpose models across multiple business functions, from customer service automation to content generation and data analysis. These models' well-documented capabilities in handling diverse language tasks directly address enterprise needs for flexible, multi-functional AI solutions.

This segment forms the foundation of most enterprise AI strategies, as it represents the most adaptable and cost-effective approach to implementing language AI across organizations. Technology vendor endorsements and ongoing performance improvements continue to strengthen confidence in general-purpose LLM implementations. With enterprises seeking comprehensive AI solutions that can serve multiple departments and use cases, general-purpose LLMs align with both operational efficiency and strategic scalability goals. Their broad applicability across industries ensures market dominance, making them the central growth driver of enterprise LLM demand.

Hardware components are projected to represent 39.4% of enterprise LLM market demand in 2025. Hardware is widely in demand for enterprise LLMs because running large models requires significant computational power, memory bandwidth, and storage capacity that traditional IT infrastructure cannot deliver efficiently. Enterprises deploying LLMs for tasks such as customer support, knowledge management, and product development need high-performance GPUs, AI accelerators, and scalable server clusters to ensure low latency and reliability.

Demand also rises from the need to process proprietary data securely on-premises rather than relying solely on cloud resources. As organizations scale usage across departments, investing in specialized hardware becomes essential to optimize costs, enhance performance, and maintain control over sensitive information.

The cloud deployment mode is forecasted to contribute 59% of the enterprise LLM market in 2025, reflecting the growing intersection of cloud computing and enterprise AI adoption. Organizations are increasingly choosing cloud-based LLM solutions for their scalability, cost-effectiveness, and reduced infrastructure requirements. This aligns with the digital transformation movement, which focuses agility, remote accessibility, and pay-as-you-scale business models.

Cloud deployment provides enterprises with immediate access to cutting-edge LLM capabilities without significant upfront investments in hardware or specialized IT infrastructure. The segment also benefits from organizational preferences for managed services that include automatic updates, security management, and technical support. With heightened focus on business agility and operational flexibility, cloud deployment serves as a powerful enabler, making it a critical driver of adoption and growth in the enterprise LLM category.

The large enterprises segment is projected to account for 54% of the enterprise LLM market in 2025, reflecting the resource advantages and strategic priorities of major organizations. Large enterprises possess the technical infrastructure, budget allocation, and change management capabilities necessary to implement sophisticated LLM solutions across multiple business units and use cases. Their commitment to digital transformation and competitive differentiation drives substantial investments in advanced AI technologies.

This segment benefits from comprehensive vendor support, custom implementation services, and enterprise-grade security features that justify premium pricing. Large organizations also serve as early adopters and case study examples that influence broader market adoption patterns. With their focus on operational excellence and innovation leadership, large enterprises will continue to drive significant demand for enterprise LLMs, establishing best practices and use cases that benefit the entire market ecosystem.

The retail and e-commerce segment is forecasted to contribute 25% of the enterprise LLM market in 2025, reflecting the industry's intensive focus on customer experience optimization and operational automation. Retailers increasingly leverage LLMs for personalized shopping experiences, automated customer service, inventory management, and marketing content generation. This aligns with the omnichannel commerce movement, which focuses seamless, intelligent customer interactions across all touchpoints.

The segment benefits from LLMs' ability to process customer data, generate product descriptions, automate support interactions, and provide personalized recommendations at scale. Retail organizations' willingness to invest in customer experience technologies and their measurable ROI from AI implementations make them ideal candidates for LLM adoption. With growing focus on competitive differentiation through superior customer service and operational efficiency, the retail and e-commerce sector serves as a primary growth driver in the market.

The market is advancing rapidly due to increasing organizational awareness about AI automation benefits and growing demand for intelligent business solutions. The market faces challenges including data privacy concerns, implementation complexity, and competition from alternative AI technologies. Innovation in model customization and industry-specific applications continue to influence product development and market expansion patterns.

The growing adoption of cloud computing platforms is enabling organizations to access sophisticated LLM capabilities without significant infrastructure investments. Cloud-based solutions offer scalability, cost efficiency, and rapid deployment that influence enterprise adoption decisions. Hybrid deployment models and edge computing integrations are driving technology accessibility and implementation flexibility, particularly among organizations with specific security or compliance requirements.

Modern enterprise LLM providers are incorporating industry-specific training data, domain expertise, and specialized workflows to enhance relevance and effectiveness for particular business sectors. These customizations improve the accuracy and applicability of LLM outputs while reducing implementation time and training requirements. Advanced customization techniques also enable organizations to maintain competitive advantages through proprietary AI capabilities and specialized business intelligence applications.

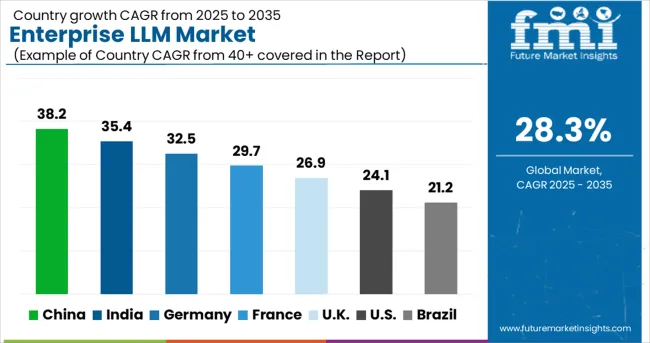

| Country | CAGR (2025-2035) |

| China | 38.2% |

| India | 35.4% |

| Germany | 32.5% |

| France | 29.7% |

| UK | 26.9% |

| USA | 24.1% |

The global enterprise LLM market is projected to grow at a CAGR of 28.3% between 2025 and 2035, driven by increasing adoption of AI-driven business solutions and demand for automation in enterprise operations. China leads with 38.2% growth, supported by rapid digital transformation initiatives and large-scale integration of AI platforms in enterprises. India follows at 35.4%, reflecting growing investments in AI infrastructure and adoption of language models for customer service and analytics. Germany records 32.5%, driven by demand for AI-enabled business intelligence and process automation. France is projected at 29.7%, supported by expanding enterprise AI solutions and digital workflow enhancements. The UK grows at 26.9% with adoption of AI for operational efficiency, while the USA expands at 24.1%, influenced by widespread implementation of enterprise-scale AI applications and advanced language model technologies.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is expected to record the highest CAGR of 38.2% between 2025 and 2035, fueled by government support for AI innovation and rapidly expanding enterprise digitization. Enterprises have adopted LLMs for intelligent data analysis, automated customer engagement, and process optimization. Technology firms have developed regionally optimized LLM models for Mandarin and regional dialects to enhance business relevance. National AI strategies and investment in cloud infrastructure have accelerated adoption in banking, e commerce, and logistics sectors. Collaboration between domestic AI developers and international firms has enhanced capabilities and market reach. As enterprises increasingly focus on AI driven transformation, China’s market is expected to lead globally in both adoption rates and technological integration.

India is forecasted to grow at a CAGR of 35.4% from 2025 to 2035, driven by widespread adoption of digital enterprise platforms and AI initiatives. LLMs are being applied in IT services, customer support, content generation, and knowledge management across mid-sized and large enterprises. Cloud adoption, AIaaS, and startups offering specialized LLM solutions have accelerated market growth. Indian enterprises have leveraged LLMs to automate repetitive tasks, enhance business intelligence, and improve operational efficiency. Collaborations between domestic AI firms and multinational corporations have expanded access to advanced models. Government initiatives supporting AI innovation and increased enterprise readiness have positioned India as a high growth market for LLM adoption over the forecast period.

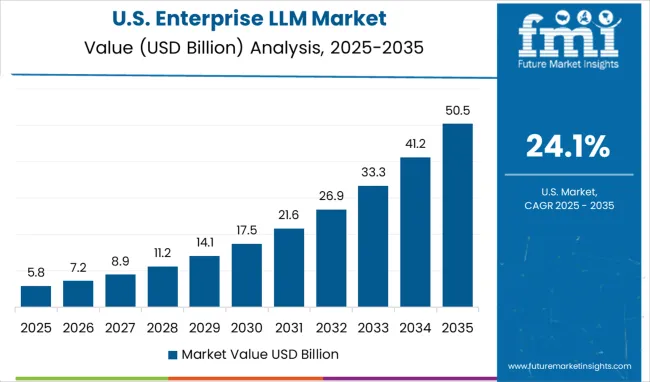

The market in the United States is projected to grow at a CAGR of 24.1% between 2025 and 2035, driven by widespread digital transformation and adoption of AI powered enterprise solutions. Large corporations have increasingly deployed LLMs for automating customer support, generating content, and enhancing business analytics. Cloud based AI infrastructure and AIaaS platforms have accelerated adoption, while regulatory frameworks around data privacy and AI usage have influenced deployment strategies. Major tech firms such as Microsoft, OpenAI, and IBM have formed partnerships with enterprises to integrate LLMs across CRM, ERP, and knowledge management systems. Demand is further fueled by efficiency gains, cost reduction, and competitive differentiation, with organizations focusing on leveraging AI for strategic decision making.

Germany is expected to grow at a CAGR of 32.5% during 2025–2035, supported by strong industrial digitization and AI integration across manufacturing, logistics, and finance sectors. Enterprises have applied LLMs for process automation, predictive analytics, and knowledge management. Cloud adoption and enterprise AI initiatives have accelerated deployment in large corporations. Strict data protection regulations have influenced model selection and deployment strategies, with a focus on compliance and security. Leading AI service providers have partnered with German enterprises to integrate LLMs across ERP, CRM, and document automation systems. Technological investments in AI and digital transformation initiatives have created a favorable environment for market growth in Germany.

The United Kingdom is forecasted to grow at a CAGR of 26.9% during 2025–2035, supported by rapid AI adoption in enterprise workflows and cloud based AI infrastructure. Organizations have increasingly implemented LLMs for automated content creation, customer engagement, analytics, and knowledge management. Tech companies have developed specialized LLM models optimized for English language business processes. Investment in AI research, digital transformation programs, and AI as a service solutions have accelerated adoption. Large corporates, SMEs, and startups have adopted LLMs to improve operational efficiency and data driven decision making. Regulatory focus on AI ethics and data privacy has shaped deployment, ensuring responsible usage across sectors.

France is projected to expand at a CAGR of 29.7% between 2025 and 2035, influenced by government AI initiatives and enterprise digitization programs. Large corporations have adopted LLMs for content generation, customer interaction automation, and business intelligence. Regulatory frameworks emphasizing data security and ethical AI usage have shaped deployment strategies. AI technology providers have partnered with French enterprises to implement LLMs in cloud and on-premise environments. Demand has been driven by operational efficiency gains, reduced turnaround times, and improved decision making. With AI awareness and investment increasing across sectors such as banking, telecom, and logistics, France is expected to maintain steady LLM adoption over the forecast period.

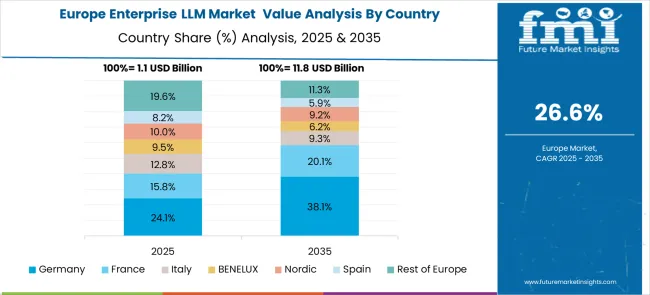

The market in Europe demonstrates mature development across major economies with Germany showing strong presence through its engineering-focused approach to AI implementation and organizational appreciation for technically robust language processing solutions, supported by companies leveraging industrial expertise to develop effective LLM integrations that enhance manufacturing processes, supply chain optimization, and quality management systems.

France represents a significant market driven by its technology innovation heritage and sophisticated understanding of AI applications in business, with organizations pioneering enterprise LLM implementations that combine French technological excellence with advanced natural language processing capabilities for enhanced customer service, content localization, and business intelligence applications.

The UK exhibits considerable growth through its embrace of digital transformation and technology adoption, with enterprises leading the implementation of versatile LLM solutions and comprehensive organizational change management for AI integration. Italy and Spain show expanding interest in intelligent automation solutions, particularly in premium LLM implementations targeting customer experience enhancement and operational efficiency improvements. BENELUX countries contribute through their focus on innovative business technologies and scalable AI solutions, while Eastern Europe and Nordic regions display growing potential driven by increasing awareness of AI benefits and expanding access to enterprise-grade language processing technologies across diverse industry sectors.

Microsoft, Google, IBM, and NVIDIA Corporation have focused on large-scale language model infrastructure, offering cloud-based platforms, enterprise APIs, and fine-tuning tools for business applications. Oracle, Meta, H2O.ai, Apple Inc., Anthropic PBC, and Alibaba Cloud have targeted custom enterprise solutions, providing AI frameworks for document processing, customer engagement, and workflow automation. Product brochures highlight model performance, multilingual capabilities, and secure deployment options suitable for diverse corporate environments.

Regional and niche providers have differentiated through industry-specific solutions and adaptability. Enterprise clients benefit from tools enabling knowledge extraction, automated summarization, and conversational AI integration. Microsoft and IBM showcase end-to-end solutions for large enterprises, Google and NVIDIA promote high-performance computing and model optimization, while Anthropic and H2O.ai focuses safety, interpretability, and regulatory compliance. Brochures communicate model architecture, training methodologies, and integration capabilities, presenting these platforms as reliable business tools.

Competition in the market is driven by model efficiency, deployment flexibility, and enterprise-grade security. Meta and Apple highlight on-device AI and privacy-conscious frameworks, while Oracle and Alibaba Cloud focus on hybrid cloud integration and scalability. Brochures communicate performance metrics, security certifications, and use case versatility, positioning companies as trusted partners in digital transformation. The market is increasingly defined by computational power, data security, and seamless integration, with product literature serving as a critical tool to convey reliability and enterprise value.

| Items | Values |

| Quantitative Units (2025) | USD 5.9 billion |

| Model Type | General-Purpose LLMs, Domain-Specific LLMs, Custom/Proprietary LLMs |

| Component | Software, Hardware, Services |

| Deployment Mode | Cloud, On-premises, Hybrid |

| Enterprise Size | Large Enterprises, Small & Medium size |

| Industry Vertical | Retail and e-commerce, BFSI, Healthcare, Legal and Compliance, Manufacturing, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Anthropic PBC, Microsoft, Google Inc., IBM Corporation, NVIDIA Corporation, Oracle, Meta, H2O.ai, Apple Inc., and Alibaba Cloud |

| Additional Attributes | Dollar sales by model complexity and customization level, regional adoption trends, competitive landscape, enterprise preferences for cloud versus on-premises deployment, integration with existing business systems, innovations in domain-specific applications, scalability optimization, and enterprise security compliance |

The global enterprise llm market is estimated to be valued at USD 5.9 billion in 2025.

The market size for the enterprise llm market is projected to reach USD 71.1 billion by 2035.

The enterprise llm market is expected to grow at a 28.3% CAGR between 2025 and 2035.

The key product types in enterprise llm market are general-purpose llms, domain-specific llms and custom/proprietary llms.

In terms of component outlook , software segment to command 35.0% share in the enterprise llm market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA