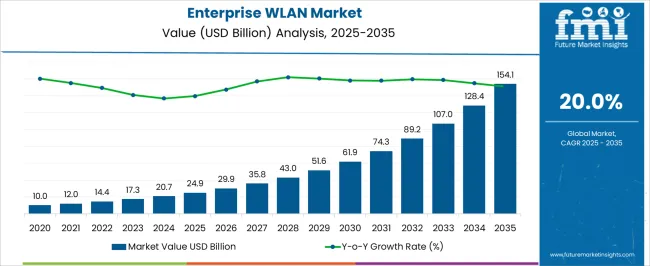

The enterprise WLAN market is projected to grow significantly from USD 24.9 billion in 2025 to approximately USD 154.1 billion by 2035, registering a robust CAGR of 20.0% during the forecast period. Growth is driven by rising adoption of wireless connectivity solutions in enterprise environments, accelerated digital transformation initiatives, and the rapid integration of IoT devices into business operations.

The widespread transition to hybrid work models and increasing demand for high-speed, secure, and scalable wireless infrastructure are further fueling investments in advanced WLAN solutions. Between 2025 and 2030, the market is expected to expand steadily, supported by the deployment of Wi-Fi 6/6E and the early emergence of Wi-Fi 7, which offer higher throughput, reduced latency, and greater efficiency.

From 2030 to 2035, growth is projected to accelerate, driven by AI-powered network management, cloud-based WLAN architectures, and the need to support advanced enterprise applications such as augmented reality (AR), virtual reality (VR), and real-time analytics. Technological advancements, evolving workplace requirements, and the strategic importance of seamless wireless connectivity are expected to sustain strong market expansion throughout the forecast horizon.

| Metric | Value |

|---|---|

| Enterprise WLAN Market Estimated Value in (2025 E) | USD 24.9 billion |

| Enterprise WLAN Market Forecast Value in (2035 F) | USD 154.1 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

The enterprise WLAN market is witnessing steady growth driven by digital transformation initiatives, increased remote and hybrid work models, and rising bandwidth requirements across corporate networks. The demand for high-throughput, secure, and scalable wireless connectivity has grown significantly with the proliferation of smart devices, cloud-based applications, and collaboration tools.

Enterprise IT departments are increasingly investing in infrastructure upgrades to meet quality-of-service expectations, ensure uninterrupted operations, and address emerging cybersecurity challenges. Regulatory mandates around data protection, the shift toward edge computing, and IoT integration have further elevated the need for robust WLAN solutions.

The market outlook remains strong, supported by ongoing developments in Wi-Fi 6/6E technologies, AI-powered network management, and growing adoption across education, manufacturing, and healthcare verticals.

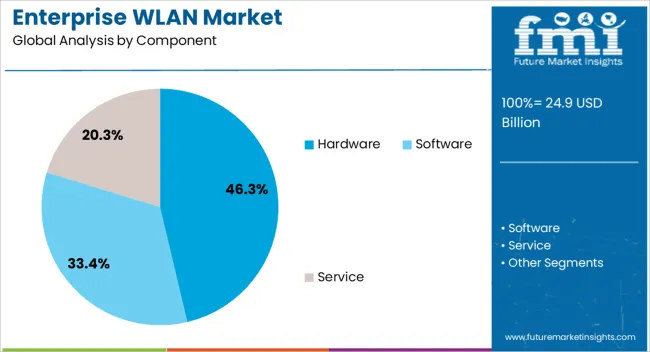

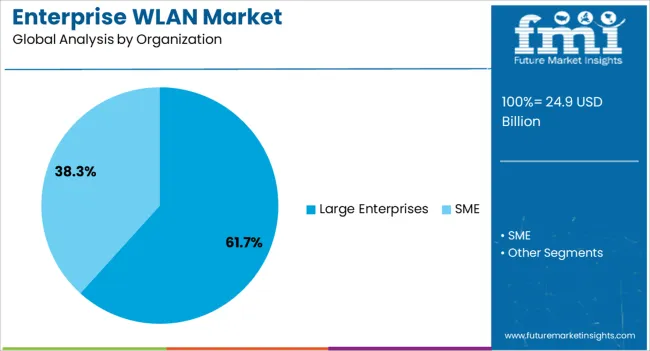

The enterprise WLAN market is segmented by component, organization, and geographic regions. By component of the enterprise WLAN market is divided into Hardware, Software, and Service. In terms of organization of the enterprise WLAN market is classified into Large Enterprises and SME. Regionally, the enterprise WLAN industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hardware is projected to contribute 46.30% of the total revenue in the enterprise WLAN market by 2025, establishing it as the leading component segment. This dominance is attributed to sustained investment in access points, controllers, and wireless switches, which form the core infrastructure of WLAN deployments.

As enterprises expand geographically and adopt hybrid workplace strategies, the demand for high-performance hardware capable of supporting high-density user environments has intensified. Integration of Wi-Fi 6/6E standards into access points is enhancing data throughput, reducing latency, and enabling advanced security protocols.

Additionally, hardware is being upgraded to support seamless cloud management and AI-enabled diagnostics, thereby lowering downtime and simplifying network scalability. Continued modernization efforts in large IT networks have reinforced hardware’s share in overall enterprise WLAN investments.

Large enterprises are anticipated to account for 61.70% of the overall market revenue in 2025, positioning them as the leading organizational user group in the enterprise WLAN market. This leadership is being driven by complex multi-site operations, high device densities, and stringent performance requirements.

Large corporations are prioritizing investments in secure and agile WLAN infrastructures to support their growing mobile workforce, cloud adoption, and digital operations. These organizations are more likely to implement advanced features such as AI-driven network optimization, IoT device onboarding, and location-based services.

Centralized management, enhanced analytics, and better threat detection capabilities are also pushing enterprise-scale WLAN deployment. As digital transformation accelerates across industries, large enterprises continue to lead in both spending and innovation in wireless network infrastructure.

Enterprise WLAN growth is fueled by hybrid work models, IoT integration, stronger security requirements, and advanced analytics. These dynamics are reshaping deployment strategies to deliver faster, safer, and more intelligent wireless connectivity.

Enterprise WLAN adoption is accelerating as organizations restructure office layouts and connectivity strategies to support hybrid work. Secure, high-speed wireless access is essential for seamless collaboration between in-office and remote employees. This has fueled demand for scalable WLAN architectures capable of handling increased device density, video conferencing traffic, and cloud application use. Businesses are deploying cloud-managed WLAN platforms to simplify network management across distributed sites. Enhanced security features, such as zero-trust frameworks and AI-driven threat detection, are being integrated to protect sensitive data. The shift toward flexible workspace models ensures that WLAN remains a priority investment, offering both performance reliability and administrative efficiency for diverse enterprise settings.

The growing number of connected devices in enterprises, from laptops and smartphones to IoT sensors and smart building systems, is reshaping WLAN requirements. Network capacity must accommodate high traffic volumes without compromising performance. Enterprises are upgrading to Wi-Fi 6 and Wi-Fi 6E to benefit from greater throughput, lower latency, and better handling of multiple simultaneous connections. The integration of IoT devices for energy management, security surveillance, and operational monitoring requires WLAN infrastructure that can segment traffic and enforce strict access control. These demands are driving investment in intelligent access points and enhanced network orchestration to optimize connectivity across all device types.

With cyber threats evolving, enterprises are prioritizing WLAN security to safeguard corporate networks and meet compliance standards. Advanced encryption protocols, multi-factor authentication, and network access control systems are being widely deployed. WLAN architectures now incorporate deep packet inspection and AI-enabled anomaly detection to identify and mitigate threats in real time. Compliance with data privacy regulations such as GDPR, HIPAA, and industry-specific mandates has become a critical driver for upgrading legacy WLAN systems. Organizations in sectors like finance, healthcare, and government are investing in end-to-end security integration within WLAN deployments to protect sensitive information and ensure uninterrupted operational workflows.

Analytics is becoming central to enterprise WLAN strategies, enabling IT teams to monitor performance, user behavior, and application usage patterns. Real-time analytics help identify congestion points, optimize bandwidth allocation, and predict potential failures before they impact users. Cloud-based dashboards provide unified visibility across multiple locations, streamlining network adjustments. Predictive insights from analytics tools allow for proactive maintenance, reducing downtime and improving user experience. In competitive industries, these capabilities are leveraged to support digital initiatives, enhance operational efficiency, and maintain high service levels. The ability to transform WLAN performance data into actionable strategies is now a differentiator for enterprise network planning.

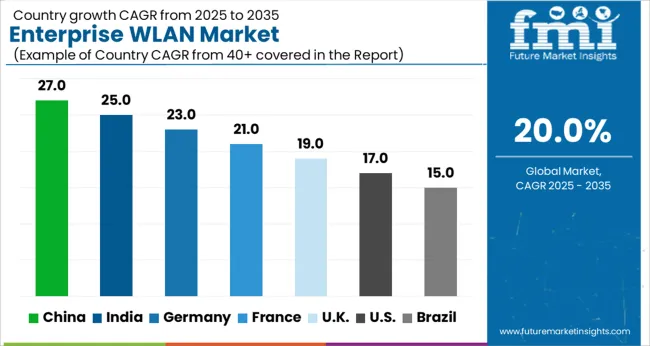

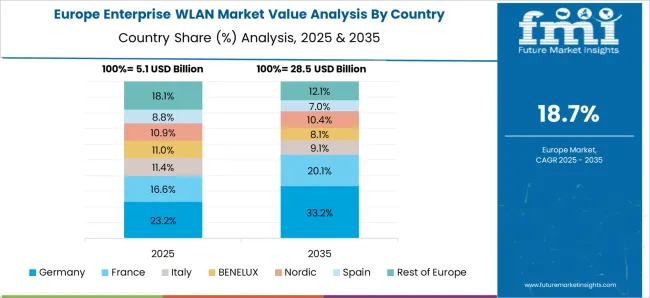

The enterprise WLAN market is projected to grow globally at a CAGR of 20.0% from 2025 to 2035, fueled by hybrid work adoption, IoT integration, and increasing demand for high-speed, secure wireless connectivity. China leads with a CAGR of 27.0%, driven by rapid enterprise digitization, large-scale deployment of Wi-Fi 6/6E infrastructure, and expanding smart city initiatives. India follows at 25.0%, supported by accelerating digital transformation in corporate, education, and public sectors, alongside government-led connectivity programs. Germany records a CAGR of 23.0%, reflecting strong demand from manufacturing automation, logistics hubs, and cloud-managed WLAN solutions.

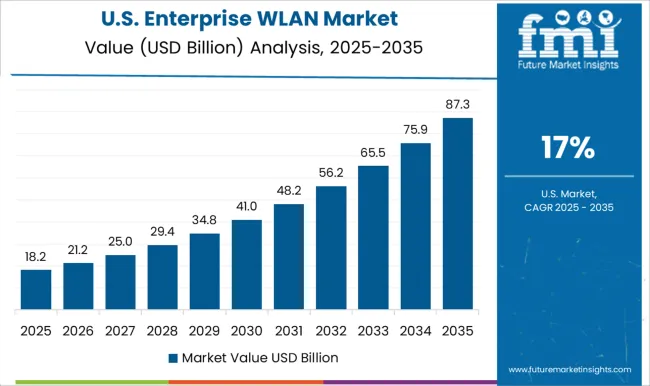

France grows at 21.0%, bolstered by investments in secure wireless for healthcare, government, and retail networks. The United Kingdom posts 19.0% CAGR, supported by hybrid office rollouts and managed service provider adoption, while the United States records 17.0%, with steady enterprise upgrades to support AI-driven analytics and advanced security features. The analysis spans over 40 global markets, with these nations serving as strategic benchmarks for monitoring enterprise WLAN technology adoption, infrastructure investment priorities, and regional deployment patterns shaping the future of wireless enterprise connectivity.

China is projected to post a CAGR of 27.0% during 2025–2035, up from about 23.5% in 2020–2024, as large enterprises upgrade to Wi-Fi 6/6E and prepare for Wi-Fi 7 rollouts across campuses and industrial parks. Demand has been propelled by device density in offices, logistics hubs, and manufacturing floors where low-latency collaboration and high throughput are required. Cloud-managed WLAN has been favored for multi-site control, analytics, and automated RF optimization. Education and healthcare networks have continued to expand coverage footprints to support digital classrooms and clinical mobility. It is believed that China will sustain a premium to the global 20.0% path given scale, faster refresh cycles, and extensive MSP ecosystems that accelerate deployments across second-tier cities.

India is expected to deliver a 25.0% CAGR for 2025–2035, improving from roughly 22.1% during 2020–2024, supported by rapid digitalization across corporate offices, IT services, and public sector institutions. Uptake has been reinforced by expanding co-working footprints and retail chains that require unified SSID policies and seamless roaming. The shift to cloud-managed networks has lowered lifecycle costs for distributed enterprises, while MSPs have packaged WLAN with managed security to meet compliance needs. Stronger fiber backhaul and data center capacity have improved reliability for high-density Wi-Fi in metro regions. In my view, India’s growth premium will persist as SMBs adopt subscription models and large enterprises standardize on analytics-driven RF planning.

France is set to grow at 21.0% in 2025–2035, up from about 18.4% in 2020–2024, with momentum centered on healthcare, government, and premium retail networks that demand assured QoS and granular segmentation. French enterprises have prioritized WPA3 adoption, NAC integration, and policy-based micro-segmentation to handle mixed corporate and guest traffic. Campus modernizations in business parks and universities have favored tri-radio and multi-gig switches to unlock higher AP throughput. Cloud observability has been used to troubleshoot roaming and application experience at scale. It is assessed that France will stay above the global 20.0% curve as compliance-driven refreshes coincide with lifecycle replacements across mature verticals.

The UK is forecasted to reach 19.0% CAGR for 2025–2035, compared with about 16.8% during 2020–2024, slightly below the global 20.0% line yet clearly accelerating. The 2025–2035 CAGR is stated at 19.0% as hybrid office rebuilds, MSP-led managed Wi-Fi, and large retail estates expand dense AP deployments. The 2020–2024 CAGR is estimated at 16.8% because cautious post-pandemic capex and supply chain friction slowed refresh cycles. The rise has been driven by normalized lead times, Wi-Fi 6E adoption in head offices, multi-gig edge switching, and analytics that improve SLA adherence for collaboration workloads. I judge that private-label MSP offerings and campus modernization will keep the UK on a durable upswing.

The USA is projected to post a 17.0% CAGR over 2025–2035, up from around 14.9% in 2020–2024, with steady growth in a mature base. Enterprises have focused on zero-trust access, identity-based segmentation, and telemetry to support hybrid work and IoT onboarding. Campus upgrades have paired Wi-Fi 6/6E APs with high-power PoE and multi-gig switches to raise per-user throughput. Retail and warehousing have scaled location analytics for inventory accuracy and task productivity. It is believed that the USA will trail faster-growing regions yet sustain large absolute deployments as refreshes synchronize with security stack modernization and AI-assisted RF optimization.

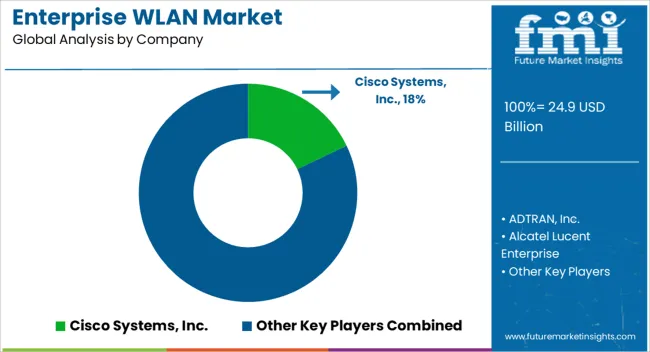

Cisco Systems, Inc. maintains a leadership position with its broad Catalyst and Meraki WLAN portfolio, offering advanced analytics, AI-driven optimization, and end-to-end security. Aruba Networks (HPE) focuses on edge-to-cloud architectures, delivering adaptive trust and unified management across wired and wireless networks.

Huawei Technologies Co., Ltd. leverages strong R&D to provide high-capacity WLAN solutions optimized for large campus and IoT-heavy deployments. Juniper Networks, Inc. differentiates with AI-native WLAN management through Mist AI, improving operational efficiency and user experience. Fortinet, Inc. emphasizes secure WLAN integration within its Security Fabric, targeting compliance-driven industries. Extreme Networks, Inc. delivers cloud-managed, high-density WLANs with automation and analytics for demanding enterprise use cases.

Commscope, Inc. and Cambium Networks, Ltd. offer competitive solutions for both high-performance enterprise and cost-sensitive SMB deployments. Strategic initiatives across the competitive landscape include expanding Wi-Fi 6/6E and Wi-Fi 7 portfolios, developing AI-based network assurance tools, strengthening MSP partnerships, and scaling manufacturing capacity to meet rising enterprise connectivity demands

| Item | Value |

|---|---|

| Quantitative Units | USD 24.9 Billion |

| Component | Hardware, Software, and Service |

| Organization | Large Enterprises and SME |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Inc., ADTRAN, Inc., Alcatel-Lucent Enterprise, Allied Telesis, Inc., Arista Networks, Inc., HPE Aruba Networking (formerly Aruba Networks), Boingo Wireless, Inc., Cambium Networks, Ltd., CommScope, Inc., D-Link Corporation, Dell Technologies, Inc., Extreme Networks, Inc., Fortinet, Inc., New H3C Technologies Co., Ltd., Huawei Technologies Co., Ltd., Juniper Networks, Inc., LANCOM Systems GmbH, NETGEAR, Inc., Ruijie Networks Co., Ltd., TP-Link Technologies Co., Ltd., Ubiquiti Inc.. |

| Additional Attributes | Dollar sales, share, regional demand trends, competitive positioning, adoption rates of Wi-Fi 6/6E/7, pricing benchmarks, key vertical market performance, channel distribution analysis, technology upgrade cycles, regulatory and security compliance impact. |

The global enterprise WLAN market is estimated to be valued at USD 24.9 billion in 2025.

The market size for the enterprise WLAN market is projected to reach USD 154.1 billion by 2035.

The enterprise WLAN market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in enterprise WLAN market are hardware, _wireless access points, _access point antennae, _wireless lan controller, _multigigabit switches, _wireless location appliance, software, _WLAN security, _WLAN analytics, _WLAN management, service, _professional service and _managed service.

In terms of organization, large enterprises segment to command 61.7% share in the enterprise WLAN market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA