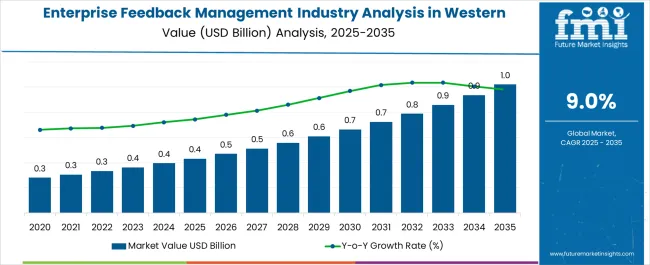

The Enterprise Feedback Management Industry Analysis in Western Europe is estimated to be valued at USD 0.4 billion in 2025 and is projected to reach USD 1.0 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Enterprise Feedback Management Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 0.4 billion |

| Enterprise Feedback Management Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 1.0 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The enterprise feedback management industry in Western Europe is expanding steadily. Growth is being driven by rising demand for structured customer insights, regulatory emphasis on data privacy, and increasing integration of analytics in business decision-making. Current industry dynamics highlight the strong adoption of enterprise-grade solutions across multiple verticals, supported by investments in digital transformation and cloud-based platforms.

The future outlook is shaped by advancements in artificial intelligence, automation, and predictive analytics, which are enhancing the accuracy and usability of feedback systems. Companies are prioritizing customer experience as a strategic differentiator, and feedback management tools are being deployed to support engagement, retention, and compliance requirements.

Growth rationale is anchored in the region’s strong regulatory environment, increasing customer expectations, and the presence of established enterprises seeking advanced tools for feedback collection and analysis With consistent technological upgrades and expanding vendor partnerships, the industry is expected to record sustainable growth and deeper penetration across sectors.

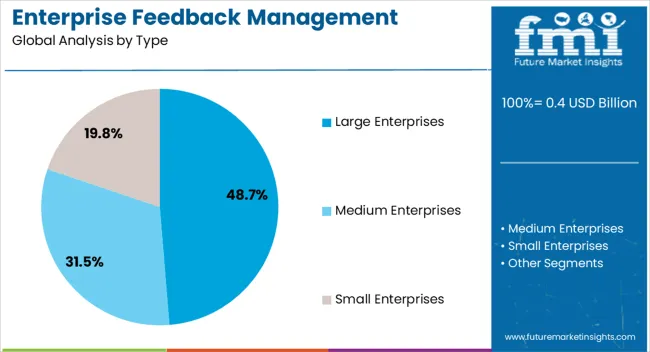

The large enterprises segment, representing 48.7% of the type category, has been dominating due to strong financial capacity to invest in advanced feedback platforms and higher data management requirements. Adoption has been accelerated by the need for scalable, customizable systems capable of integrating with existing enterprise applications.

Regulatory compliance and customer engagement strategies have reinforced adoption within this segment. Large enterprises are leveraging predictive analytics and AI-driven feedback solutions to gain actionable insights, enhance decision-making, and strengthen customer loyalty.

Growth is being supported by continued investments in digital transformation and cross-border operations that demand unified feedback management systems This segment is expected to maintain its lead position as enterprises continue to prioritize customer-centric strategies.

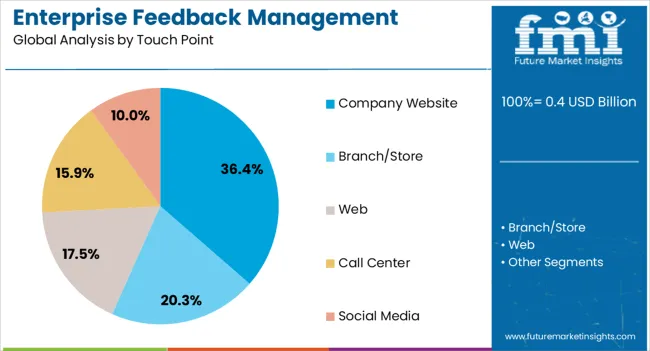

The company website segment, holding 36.4% of the touch point category, has become the primary channel for feedback collection in Western Europe. The segment’s prominence is driven by widespread digital engagement and the increasing preference of customers to share experiences through online platforms.

Integration of interactive surveys, live chat, and AI-enabled forms on company websites has enhanced data collection efficiency. Adoption has been reinforced by cost-effectiveness, real-time access to insights, and the ability to align feedback with digital marketing strategies.

As more businesses invest in strengthening their online presence, website-based feedback tools are expected to expand further, ensuring the segment’s continued market leadership.

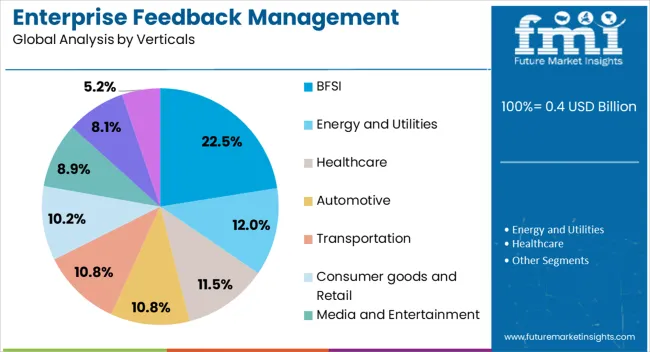

The BFSI segment, accounting for 22.5% of the verticals category, has been leading due to stringent compliance requirements and the critical role of customer trust in financial services. The segment has adopted enterprise feedback management solutions to monitor customer satisfaction, assess service quality, and address regulatory mandates on transparency and grievance redressal.

Growth is being reinforced by rising digital banking adoption and the need to analyze customer journeys across multiple channels. Investments in data-driven platforms are enabling BFSI players to improve personalization, reduce churn, and enhance brand loyalty.

Continued regulatory scrutiny and competition within the financial services sector are expected to drive sustained adoption, ensuring BFSI retains its leading position within the industry.

A thorough enterprise feedback management segmentation in Western Europe study concludes this section of the investigation. Industry players pay more attention to industry developments and demand for BFSI vertical. The large enterprises segment dominates the enterprise size sector of the industry.

Due to the vital need for customer feedback solutions in the BFSI (Banking, Financial Services, and Insurance) sector, this industry leads the demand for enterprise feedback management. Customer loyalty and satisfaction are critical for financial institutions.

| Leading Segment by Verticals | BFSI |

|---|---|

| Segment Share | 23.3% |

The BFSI sector's intense competition necessitates ongoing feedback analysis for institutions to make data-driven improvements. The sector's strong dedication to customer experience and regulatory compliance drives significant revenues.

Large enterprises dominate the sales of enterprise feedback management in Western Europe due to their significant resources, complex operational processes, and substantial need for comprehensive feedback solutions.

These large enterprises operate in Western Europe, catering to diverse consumer bases and managing extensive feedback data. They prioritize enterprise feedback management to gain competitive insights, enhance customer experience, and maintain brand reputation.

| Leading Segment by Type | Large Enterprises |

|---|---|

| Segment Share | 63.6% |

The financial resources of large enterprises enable them to make significant investments in advanced EFM platforms, custom integrations, and dedicated support teams. The strategic focus on EFM in Western Europe empowers large enterprises to make data-driven decisions and adapt to changing demands, further solidifying their leadership in enterprise feedback management sales.

The table below depicts the expected enterprise feedback management demand in Western Europe, with an emphasis on key countries United Kingdom, Germany, France, Netherlands, and Italy. According to the qualitative and quantitative investigation, the Netherlands has lucrative potential with influential enterprise feedback management service providers.

| Country | CAGR |

|---|---|

| Netherlands | 10.4% |

| United Kingdom | 9.9% |

| Germany | 8.8% |

| Italy | 8.6% |

| France | 8.0% |

The industry in Netherlands prospers due to a progressive attitude toward technology adoption and customer-centric strategies. Businesses of enterprise feedback management in the Netherlands are eager to adopt EFM to improve their products and services, thereby enhancing consumer experiences.

The industry in the United Kingdom has the potential for tremendous growth, owing to a strong emphasis on customer experience and a mature business structure. Businesses in the United Kingdom are increasingly implementing enterprise feedback management solutions to boost customer satisfaction and achieve operational gains.

The enterprise feedback management sector is growing in Germany as corporations prioritize data-driven decision-making. With a thriving industrial sector and a commitment to quality, there is a high demand for EFM systems to gather and analyze consumer feedback for continuous development.

The industry in Italy is expanding, with a focus on customer-centric techniques to drive economic growth. Businesses in Italy are wholeheartedly embracing enterprise feedback management solutions to gain essential insights, strengthen customer connections, and drive innovation in an increasingly competitive industry.

France demand for enterprise feedback management is expanding as businesses strive to improve customer interactions and loyalty. Customer service holds significant value in the French business landscape, making enterprise feedback management solution a vital investment for firms seeking to maintain their competitiveness.

The enterprise feedback management (EFM) industry is characterized by a dynamic competitive environment, with significant companies vying for industry share. Leading providers of enterprise feedback management in Western Europe continually innovate to create a seamless client experience and enhance corporate performance.

Emerging enterprise feedback management suppliers and niche players are gaining popularity by focusing on specific industrial sectors or offering distinctive features. The competitive dynamics are propelled by the growing emphasis on customer experience and enterprises' need to efficiently collect, evaluate, and act on feedback.

Recent Observations in Western Europe Players of Enterprise Feedback Management

| Attribute | Details |

|---|---|

| Estimated Valuation (2025) | USD 0.4 billion |

| Projected Valuation (2035) | USD 1.0 billion |

| Anticipated CAGR (2025 to 2035) | 9.0% |

| Historical Analysis of Enterprise Feedback Management in Western Europe | 2020 to 2025 |

| Demand Forecast for Enterprise Feedback Management in Western Europe | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Adoption Analysis |

| Key Countries Analyzed while Studying Opportunities in Enterprise Feedback Management in Western Europe | United Kingdom, Germany, France, Netherlands, Italy |

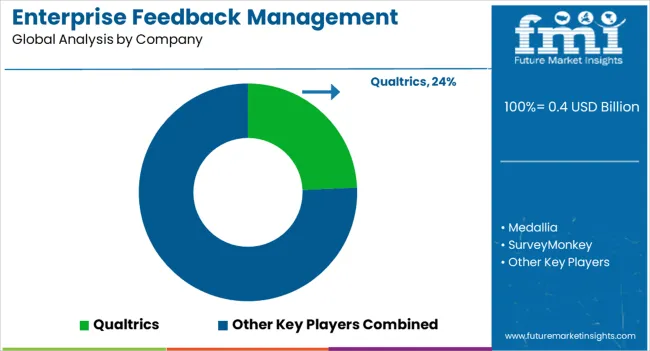

| Key Enterprise Feedback Management Companies of Western Europe | Medallia; Qualtrics; SurveyMonkey; Confirmit; InMoment; Sisense; Questback; MaritzCX; IBM Watson Experience Analytics; Mopinion |

The global enterprise feedback management industry analysis in western europe is estimated to be valued at USD 0.4 billion in 2025.

The market size for the enterprise feedback management industry analysis in western europe is projected to reach USD 1.0 billion by 2035.

The enterprise feedback management industry analysis in western europe is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in enterprise feedback management industry analysis in western europe are large enterprises, medium enterprises and small enterprises.

In terms of touch point, company website segment to command 36.4% share in the enterprise feedback management industry analysis in western europe in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise LLM Market Size and Share Forecast Outlook 2025 to 2035

Enterprise VSAT Systems Market Size and Share Forecast Outlook 2025 to 2035

Enterprise AI Governance and Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise IoT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise WLAN Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Video Market Analysis - Size, Share, and Forecast 2025 to 2035

Enterprise-Grade DLT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Flash Storage Market

Enterprise Information Archiving (EIA) Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sharing And Synchronization Market

Enterprise Manufacturing Intelligence Market Analysis by Deployment Type, Offering, End-use Industry, and Region Through 2035

Enterprise Laboratory Informatics Market Analysis by Type of Solution, Component, Delivery, Industry, and Region Through 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA