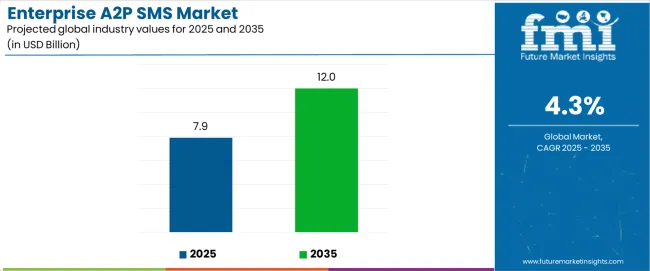

The Enterprise A2P SMS Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 12.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The enterprise A2P SMS market is experiencing robust growth. Expansion is being driven by increasing enterprise adoption of mobile messaging for customer engagement, authentication, and transactional communication. The current landscape is marked by the transition from traditional messaging frameworks to cloud-based delivery platforms that ensure scalability, speed, and reliability.

Demand is being reinforced by the widespread use of mobile devices, high open rates of SMS messages, and the growing significance of personalized communication in digital marketing strategies. Regulatory emphasis on secure communication and data privacy has prompted enterprises to adopt compliant and verified messaging platforms.

The future outlook is characterized by deeper integration of A2P SMS within omnichannel communication ecosystems, supported by API-based automation and analytics tools Growth rationale rests on expanding digital transformation initiatives, increasing enterprise dependence on real-time communication, and continued preference for SMS as a universal and effective outreach medium across industries.

| Metric | Value |

|---|---|

| Enterprise A2P SMS Market Estimated Value in (2025 E) | USD 7.9 billion |

| Enterprise A2P SMS Market Forecast Value in (2035 F) | USD 12.0 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

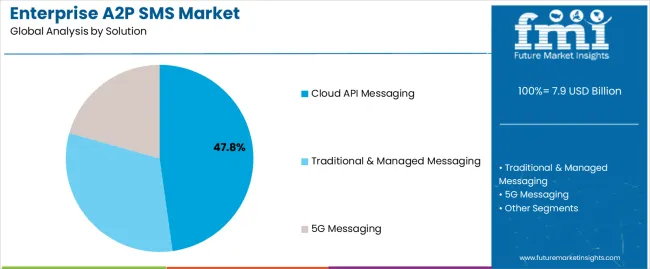

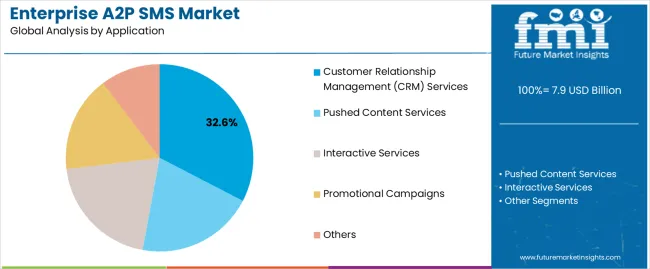

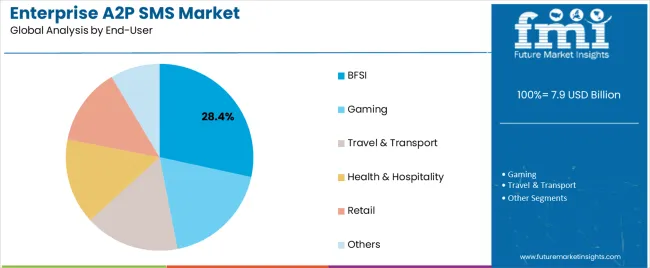

The market is segmented by Solution, Application, and End-User and region. By Solution, the market is divided into Cloud API Messaging, Traditional & Managed Messaging, and 5G Messaging. In terms of Application, the market is classified into Customer Relationship Management (CRM) Services, Pushed Content Services, Interactive Services, Promotional Campaigns, and Others. Based on End-User, the market is segmented into BFSI, Gaming, Travel & Transport, Health & Hospitality, Retail, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cloud API messaging segment, accounting for 47.80% of the solution category, has emerged as the dominant model due to its flexibility, scalability, and ease of integration with enterprise systems. Adoption has been accelerated by the shift toward digital communication platforms that support multi-channel customer interaction.

The capability of cloud APIs to enable automated messaging, real-time analytics, and secure data transmission has enhanced their value proposition for enterprises. Cost efficiency and minimal infrastructure requirements have further strengthened their appeal among small and large organizations alike.

The segment’s growth is supported by rising usage in authentication services, marketing automation, and customer notifications Continuous innovation in API architecture and security protocols is expected to sustain the leadership position of cloud API messaging, ensuring consistent demand across diverse enterprise verticals.

The customer relationship management (CRM) services segment, representing 32.60% of the application category, has maintained a strong position due to the vital role of SMS in enhancing customer engagement and retention. Integration of A2P messaging within CRM systems has enabled enterprises to deliver timely updates, promotional offers, and personalized interactions.

The effectiveness of SMS in achieving high response rates and maintaining direct communication with customers has reinforced its adoption within CRM workflows. Enterprises are leveraging data analytics to optimize message targeting and improve campaign performance.

Continuous evolution of CRM software with inbuilt SMS modules and automated response systems is strengthening this segment’s contribution to market growth The expanding use of AI-driven personalization and workflow automation is expected to further accelerate demand for SMS-enabled CRM applications.

The BFSI segment, holding 28.40% of the end-user category, has remained the leading contributor due to its extensive reliance on secure, real-time communication channels for customer authentication, transaction alerts, and service updates. The high sensitivity of financial data has necessitated the use of verified A2P SMS routes to maintain trust and regulatory compliance.

Growing digital banking penetration, online transactions, and mobile payment adoption are strengthening the segment’s dependency on messaging solutions. Financial institutions are integrating A2P SMS into risk management and fraud prevention systems to enhance security.

Additionally, the segment benefits from continuous modernization of core banking systems that support seamless messaging integration As financial ecosystems continue to digitize, the BFSI sector is expected to sustain its leading position and drive steady demand for enterprise-grade A2P SMS services globally.

| Historical CAGR | 1.6% |

|---|---|

| Forecast CAGR | 4.5% |

The historical performance of the enterprise A2P (Application-to-Person) SMS market reveals a modest CAGR of 1.6%, indicating relatively slow growth over the past years. However, the forecasted CAGR of 4.5% suggests a significant increase in growth rate in the future.

Several factors have influenced the historical performance and projected future growth of the enterprise A2P SMS market. Initially, the proliferation of mobile technology and smartphones has been a key driver of market expansion. As mobile devices become essential tools for communication and business operations, the demand for enterprise A2P SMS services has increased, supporting market growth.

The adoption of A2P SMS for various enterprise applications, such as transactional notifications, authentication codes, and marketing campaigns, has contributed to market expansion. Enterprises across industries utilize A2P SMS as a reliable and effective means of engaging with customers, delivering timely information, and driving business outcomes.

Advancements in A2P SMS technology and infrastructure have facilitated market growth. Improved network reliability, delivery rates, and security measures have enhanced the efficacy and appeal of A2P SMS services for enterprises. Additionally, the development of Application Programming Interfaces (APIs) and integration capabilities has streamlined the implementation of A2P SMS solutions for businesses, further driving market growth.

Enterprises are increasingly leveraging A2P SMS as a crucial component of their customer engagement strategies. Personalized and timely messages enable businesses to foster stronger relationships with customers, driving brand loyalty and customer satisfaction.

The adoption of RCS, an enhanced messaging protocol, is emerging as a key trend in the Enterprise A2P SMS market. RCS offers advanced features such as interactive media, branding elements, and enhanced security, providing enterprises with richer and more engaging communication channels.

Integration of A2P SMS with chatbots and artificial intelligence (AI) technologies is gaining traction among enterprises. This trend enables automated and intelligent responses to customer queries, enhancing the efficiency and effectiveness of customer support services.

Enterprises are increasingly utilizing A2P SMS for transactional messaging purposes, such as account notifications, payment confirmations, and delivery updates. The reliability and immediacy of SMS communication make it an ideal channel for delivering critical transactional information to customers.

The growth of mobile payments and banking services is fueling the demand for A2P SMS in the financial sector. A2P SMS is widely used for transactional messaging related to account notifications, OTP (one-time password) delivery, and fraud alerts, supporting the expansion of mobile banking and payment ecosystems.

This section provides detailed insights into specific segments in the enterprise A2P SMS industry.

| Leading Solution | Cloud API Messaging |

|---|---|

| Market Share in 2025 | 48.6% |

Cloud API messaging solutions reign supreme in the enterprise A2P SMS market, capturing a significant 48.6% share in 2025. Their dominance can be attributed to several key factors:

| Dominating Application Segment | Pushed Content Services |

|---|---|

| Market Share in 2025 | 33.0% |

Pushed content services lead the application segment within the enterprise A2P SMS market, holding a substantial 33.0% share in 2025. These services enable businesses to send various content types (e.g., alerts, notifications, marketing messages) directly to mobile devices, contributing to their popularity:

The section analyzes the enterprise A2P SMS market across key countries, including the United States, Australia & New Zealand, China, Japan, and Germany. The analysis delves into the specific factors driving the demand for enterprise A2P SMS in these countries.

| Countries | CAGR |

|---|---|

| United States | 1.4% |

| Australia & New Zealand | 8.0% |

| China | 5.0% |

| Japan | 1.3% |

| Germany | 1.0% |

The enterprise A2P SMS industry in the United States is anticipated to rise at a CAGR of 1.4% through 2035.

Australia and New Zealand stand out in the global enterprise A2P SMS market, projected to rise at a significant CAGR of 8.0% through 2035.

China's enterprise A2P SMS market exhibits promising potential, anticipated to grow at a CAGR of 5.0% through 2035.

Japan’s enterprise A2P SMS industry is projected to exhibit a sluggish CAGR of 1.3% through 2035.

Germany is expected to witness measured growth in the enterprise A2P SMS market at a CAGR of 1.0% through 2035.

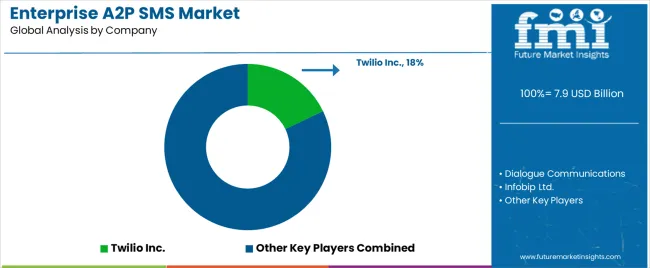

The enterprise A2P SMS industry is characterized by a mix of established players and emerging companies. Traditional telecommunications companies like AT&T and Verizon hold a significant market share due to their extensive network reach and established customer base. However, they face increasing competition from:

Companies like Twilio, Sinch, and MessageBird offer cloud-based A2P SMS solutions that are often more scalable, cost-effective, and easier to integrate compared to traditional offerings. These players are rapidly gaining traction, particularly among smaller businesses and those seeking flexible communication solutions.

Several companies specialize in A2P SMS solutions tailored to specific industries like healthcare, finance, and retail. These providers offer deep industry expertise and features that cater to the unique needs of their target markets. Strategic partnerships and collaborations are becoming increasingly common. Companies are partnering with other players in the communication ecosystem, such as cloud providers and communication platforms as service vendors, to offer integrated solutions and enhance their value proposition.

Recent Developments in the Enterprise A2P SMS Industry

The global enterprise A2P SMS market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the enterprise A2P SMS market is projected to reach USD 12.0 billion by 2035.

The enterprise A2P SMS market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in enterprise A2P SMS market are cloud API messaging, traditional & managed messaging and 5g messaging.

In terms of application, customer relationship management (crm) services segment to command 32.6% share in the enterprise A2P SMS market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Metadata Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Rights Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Enterprise LLM Market Size and Share Forecast Outlook 2025 to 2035

Enterprise VSAT Systems Market Size and Share Forecast Outlook 2025 to 2035

Enterprise AI Governance and Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Content Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IoT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise WLAN Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA