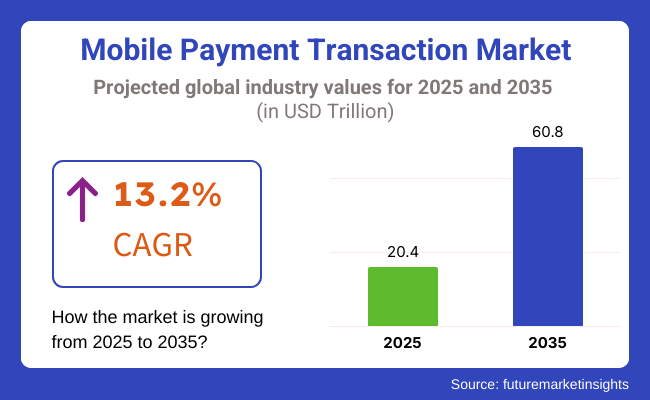

The mobile payment transaction market is expected to reach USD 20.4 trillion by 2025, with a projected growth of USD 60.8 trillion by 2035, representing a compound annual growth rate (CAGR) of 13.2% during the forecast period. The adoption of blockchain technology, enhanced security features, and stricter regulation of digital payments are driving this high growth. Furthermore, developing economies are rapidly transitioning to a cashless environment, which will further expand the industry's size and global trade share.

Mobile payment systems, including digital wallets, near-field communication (NFC)-based transactions, and QR code payment systems, are revolutionizing the way financial transactions occur between consumers and businesses. Such technologies facilitate easy instant payments; they put cash and traditional banking systems in the background.

The adoption of AI-powered anti-fraud capabilities, biometric-based authentication systems, and cross-border payment systems is driving safety, efficiency, and inclusion in digital payments, as financial institutions and fintech companies continue to invest in protecting payment infrastructure from 2021 and beyond, amid uncertainty.

Several key factors are driving the industry. Improved e-commerce, along with increased smartphone penetration and internet connectivity. The forefront of driving the explosive adoption of mobile payments.

Across the globe, governments and central banks are actively promoting digital financial inclusion through policies and programs, including open banking and real-time payments. Additionally, the growing adoption of super apps, which provide multiple financial services within a single application, is also propelling the industry considerably, simply via mobile devices.

Even with its robust growth, the mobile payment transaction industry faces challenges. Electronic payment networks, being the first ports of call for fraud and cyber threats, pose significant cybersecurity problems and data privacy concerns, which is one of the most persistent issues.

Furthermore, the lack of global regulations can serve as a barrier to smooth transactions across borders. In highly cost-conscious settings, even high transaction fees from multiple providers can be restrictive, necessitating more price-friendly schemes and increased financial inclusion.

The future of mobile payment transactions is marked by ongoing technological innovation and cross-industry partnerships. Will it be different with the introduction of central bank digital currencies (CBDCs), which are expected to increase digital payment adoption by offering a secure, government-backed alternative to traditional banking infrastructure?

The technology evolution is dynamic, utilizing more secure e-wallets, AI-powered financial management platforms, and blockchain-enabled payment systems. Meanwhile, partnerships between financial service providers, e-commerce giants, and mobile network operators make it possible globally.

While digital transformation is driving rapid change, the mobile payments industry is poised to create a lasting reinvention of global financial transactions, making payments faster, safer, and more inclusive for consumers and businesses.

Due to ease of use, accessibility, and widespread adoption in emerging markets, SMS Mobile Payment Transactions are projected to seize up to 38% share of the industry by 2025. Users would be able to make purchases, transfer funds, and pay bills through SMS, even on low-end feature phones, through this payment method.

Especially in Africa, Southeast Asia, and Latin America, where smartphone penetration is low, mobile wallets such as M-Pesa, MTN Mobile Money, and GCash rely on SMS-based authentication. Fintech firms have made cross-platform peer-to-peer lending trends more advanced, while governments and telecom operators are expanding SMS payment infrastructure, which assists in the rate of encroachment.

Bluetooth is a subset of smartphone penetration, and the global mobile internet has become increasingly indispensable. The WAP/WEB segment is expected to hold 62% of the industry share by 2025. WAP/WEB Utilized Mobile Payments Users can authenticate and pay for transactions through mobile browsers or dedicated WAP-based applications, which are more secure and user-friendly than SMS-based transactions.

WAPs in the WAP/WEB world are digital wallets and online payment platforms, such as PayPal, Apple Pay, Google Pay, and Alipay, which are used for transactions in e-commerce, retail, and in-app purchases. The proliferation of 5G networks, as well as advancements in cybersecurity, such as biometric authentication and tokenization, are also driving the shift toward WAP/WEB-based mobile payments.

As the world moves towards more digital transactions, both SMS and WAP/WEB technologies will be important. Still, WAP/WEB will likely be the front-runner, given its level of security, user experience, and compatibility with current payment ecosystems.

Due to the booming growth of e-commerce, contactless payments and digital wallets, the mobile payment industry share of this segment is predicted to rise as high as 58% by 2025. With entities for payments made on internet sites and in retail stores, consumers are increasingly turning to mobile payment transactions, opting for less cash and card use.

This space is dominated by platforms such as Apple Pay, Google Pay, Samsung Pay, PayPal, and Alipay, which provide seamless transactions across various channels, including retail stores, food delivery, and subscriptions. Moreover, the introduction of NFC (Near Field Communication), QR codes, and biometric techniques have also improved security and convenience, leading to higher adoption rates in many regions. Increased digitalization and government initiatives to promote a cashless economy are driving the growth of mobile payments in emerging economies such as India, China, and Brazil.

According to new data released in 2023, the Money Transfer segment is expected to continue expanding, with a predicted 42% market share in 2025, as P2P (peer-to-peer) payments, remittances, and financial inclusion initiatives continue to grow. Transfers are commonly made through mobile money services such as Venmo, Zelle, PayPal, WeChat Pay, and M-Pesa.

Mobile money platforms have revolutionized banking, particularly in regions such as Africa and Southeast Asia, where the unbanked population can now securely send and receive money via mobile. With the emergence of blockchain-powered remittance services and decentralized finance (DeFi), innovations in this segment are poised to thrive.

As financial services become increasingly digital, both merchandise purchases and money transfers may play a substantial role in shaping the future of mobile payments.

The mobile payment transaction industry is growing, driven by factors such as increasing smartphone penetration, the growth of contactless payments, and digital banking innovations.

Customers value secure, quick, and frictionless payment experiences, with biometric authentication and tokenization being their preferred methods for fraud protection. Merchants and retailers seek affordable, integrated solutions that expedite checkout and provide a convenient experience for customers.

Banks emphasize fraud prevention, regulatory requirements, and platform interoperability. Online shopping platforms require scalable, multi-currency payment solutions with international transaction capabilities. Businesses seek tailored, high-volume payment systems that are compatible with ERP and accounting packages.

Rising trends are AI-driven risk assessment, blockchain transactions, and biometric payments. With the growing adoption of 5G and IoT, mobile payments will become quicker, safer, and more seamless, promoting global financial inclusion and the adoption of digital payments.

| Company | Contract Value (USD million) |

|---|---|

| WhatsApp and National Payments Corporation of India (NPCI) | Approximately USD 800 - USD 1,000 |

| European Payments Initiative (EPI) and Major French Banks | Approximately USD 500 - USD 700 |

| Apple Inc. and PayPal Holdings | Approximately USD 900 - USD 1,200 |

In 2024 and the early part of 2025, the industry experienced a series of significant developments, marked by regulatory initiatives and expansionary moves. WhatsApp's nod to handle payments on behalf of over 500 million Indians is a substantial fillip to India's digital payment ecosystem.

One example of a strategic action is the creation of 'Wero' by a coalition of major French banks, the European Payments Initiative, aimed at developing a competitive European digital wallet. Apple's decision to open third-party access to its NFC technology to payment systems like PayPal and Venmo is another indication that payment systems will become more open and competitive, potentially leading to further innovation in the mobile payments sector.

These milestones show a changing and dynamic marketplace driven by advances in technology and collaborative approaches to addressing the expanding demand for secure and seamless mobile payment solutions.

Between 2020 and 2024, the industry expanded as businesses and consumers shifted toward cashless payment methods. Digital wallets, contactless payments, and peer-to-peer (P2P) transactions gained traction, supported by increasing smartphone penetration and fintech innovations. Regulatory institutions enhanced security via biometric authentication, tokenization, and AI-based fraud detection.

Technological innovation in real-time processing and decentralized finance (DeFi) improved the speed and security of transactions. The deployment of 5G networks enhanced dependability, and companies implemented AI-based financial assistants for tracking expenses and making automatic payments.

The threats included cybersecurity attack sophistication, interoperability issues, and limited access to the underbanked, thereby necessitating the development of AI-driven risk models and blockchain-protected authentication.

Mobile payments are expected to undergo significant transformation between 2025 and 2035, driven by AI-driven automation, decentralized financial networks, and quantum-encrypted wallets. AI-based finance platforms will monitor spending behavior, automate budgeting, and provide personalized financial insights. Payment technologies will be merged with brain-computer interfaces (BCIs) and gesture recognition for frictionless transactions.

Quantum computing will render encryption extremely powerful. DeFi platforms will enable borderless peer-to-peer financial transactions at low costs. Blockchain-based networks will improve the transparency and efficiency of cross-border payments, while AI-based fraud prevention and sustainable transaction models will drive secure and cost-effective payment systems.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regulators implemented mobile payment security protocols and AML compliance rules. | Governance will be quantum-secure encryption, decentralized payment networks, and AI-based fraud protection. |

| Real-time payments, AI-powered fraud detection, and biometric authentication improved security. | Brain-computer interface payments, quantum-secure digital wallets, and AI-powered financial assistants are poised to revolutionize the payments landscape. |

| Digital wallets, contactless payments, and P2P payments were embraced both by businesses and consumers. | Artificial intelligence-based personalized finance, DeFi adoption, and smart contract-based payment will fuel industry usage. |

| Smartphones, near-field communication (NFC) devices, and biometric authentication have simplified payment. | Biometric payment authentication, neural wearables, and AI-powered payment automation will power next-gen mobile payments. |

| Digital payments minimized the use of cash, simplifying business operations and consumer transactions. | AI-based energy-efficient financial platforms, decentralized payment systems, and carbon-neutral digital wallets will promote sustainability. |

| AI-based fraud protection, expense management, and individualized financial intelligence enhance the user experience. | Quantum-based predictive analytics, AI-driven financial modeling, and real-time analysis of spending behavior will revolutionize financial management. |

| Mobile payments operators rationalized cloud-based transaction infrastructure for scalability. | Artificial intelligence-tuned financial ecosystems, blockchain transactional networks, and environmentally friendly fintech development will increase accessibility. |

| Increased smartphone penetration, digitalization, and the rise of contactless payment trends fueled industry growth. | Artificial intelligence-facilitated financial automation, decentralized finance adoption, and innovations in biometric authentication will drive future growth. |

The industry is witnessing a significant surge since the smartphone population has proliferated and digital banking has been readily adopted. Moreover, security threats such as fraud, data breaches, and hacking are major risks. Companies should increase their investment in sophisticated encryption, two-factor authentication, and AI-based fraud detection to enhance transaction security and foster customer trust.

The resolve of regulatory issues differs from place to place, and consequently, it influences the distribution of mobile payment platforms. Stringent regulations related to data protection, financial transparency and anti-money laundering laws cramp operational effectiveness. Enterprises must closely liaise with the legislation and fulfil the necessary documentation to mitigate the risk of violations, fines, or the disruption of normal operations.

Network shortcomings not only decrease the effectiveness of transactions but can also result in system downtime. Problems with internet connectivity, service breakdowns, and banking network connections have a direct impact on the user experience. Firms should establish robust payment facilitators, streamline the use of cloud-based systems, and implement backup systems to ensure uninterrupted services.

The battle is intensifying, with major tech companies, financial institutions, and startup companies vying for leadership in the industry. Price decimation, reduction of transaction costs, and ulceration of the marketing campaign can respectively affect a firm’s profitability. Firms must consider the benefits of add-on services, security enhancements, and partnerships to thrive in the industry.

In the long run, companies should prioritize security, compliance with regulations, and technological resilience. Blockchain-based security mechanisms, AI-driven fraud prevention solutions, and free or low-cost cross-border payment systems are some of the means that would give an edge over rivals in light of industry dynamics.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.5% |

| UK | 8.2% |

| France | 7.9% |

| Germany | 8% |

| Italy | 7.8% |

| South Korea | 8.7% |

| Japan | 8% |

| China | 9.1% |

| Australia | 7.6% |

| New Zealand | 7.4% |

Mobile payments are booming in the USA as the industry shifts toward contactless cards, digital wallets, and the use of AI-based anti-fraud systems. The best players like Apple Pay, Google Pay, and PayPal are still in the driver's seat with aggressive growth and a lightning-fast rise in usage.

Offline and online shops are increasingly offering frictionless payment options from mobile devices, driven by growing consumer convenience. Fintech startups and banks have collaborated to enable secure, real-time mobile payments, driving the industry forward.

The interest of the US government in digital financial inclusion and blockchain technologies is driving sector growth. Industry giants like Visa and Mastercard are pioneers in the adoption of biometric authentication and tokenization, aiming to enhance transaction security.

The growing demand for peer-to-peer (P2P) payment applications, along with the increasing adoption of embedded finance solutions, is revolutionizing the financial sector. The transportation and hospitality sectors are also gradually integrating mobile payment solutions to enhance their services.

UK's mobile payment industry is expanding with growing contactless payment usage, a strong fintech ecosystem, and government-initiated digital payment promotions. New entrants such as Revolut, Monzo, and Barclays are leading with innovative leadership through simple digital payments. The increasing adoption of QR codes and NFC mobile wallets is driving consumer usage and confidence.

Public transport and retail are widely utilizing mobile payment systems, which are further increasing customer service convenience. The Bank of England's move towards digital currency research is creating new avenues for innovation. The use of AI-based financial support and personalized mobile banking services is also changing customer expectations. Cross-border payments, driven by business globalization, are also further enhancing the industry scenario.

France's mobile payment industry is experiencing constant growth, driven by the increasing number of technologically advanced citizens, expanding digital banking infrastructure, and government initiatives that encourage cashless transactions.

Home-grown firms like BNP Paribas and Lydia are at the forefront of fintech transformation to meet the evolving payment scenario. The government focuses on data protection laws and cybersecurity measures that enhance customers' trust in mobile payments.

Food service establishments and retail stores are implementing mobile payment systems to enable faster and more secure payments. Open banking initiatives are speeding up financial interconnectivity across platforms.

Synergies between telecommunications companies and banks are also driving the adoption of mobile payment services by rural communities, making them more financially inclusive. The growing use of AI-based payment authentication platforms is also enhancing transaction security.

The German mobile payment industry is expanding rapidly, driven by the uptake of digital banking, a robust regulatory framework for secure payments, and customer demand for seamless payment procedures. Leaders such as Wirecard and Deutsche Bank are spearheading the migration to mobile-enabled financial services. Expansion in internet banking and e-commerce is driving huge investment in payment infrastructure.

Government efforts to transition to a cashless system and enhance trust among customers in fintech players are driving growth. AI-based fraud prevention solutions and biometric authentication are also impacting transaction security. Additionally, Germany's robust automotive sector is embracing mobile payments for in-vehicle transactions, paving the way for new frontiers in digital payments innovation.

Italy's digital wallets and contactless payments markets are experiencing a significant boom, particularly in mainstream mobile payment markets. Nexi and Satispay are at the forefront of industry penetration through innovative financial offerings. The tourism industry, a key economic pillar, is rapidly adopting mobile payments to cater to foreign tourists.

The Italian government's digital finance strategies and tax incentives for businesses adopting cashless transactions are fueling the growth of the industry. The Italian banking sector is investing in blockchain-based payment modes to enhance the security level in transactions. Fintech companies are revolutionizing the industry by offering artificial intelligence-based analytics for payments and voice-based solutions for transactions.

South Korea's mobile payment industry is thriving, with technology giants like Samsung Pay and KakaoPay leading the way. The country's sophisticated digital infrastructure and government backing for fintech growth are driving robust uptake. AI-powered fraud prevention and blockchain technology implementation is enhancing the security of transactions and attracting more users.

Mobile payments are being used by the gaming and e-commerce industries to facilitate smooth transactions. The regulatory environment in the nation facilitates cashless payment and has made South Korea a global leader in digital finance. With biometric verification and AI-based financial services becoming increasingly sophisticated, mobile payments are being integrated into daily transactions.

The Japanese mobile payment industry is expanding, and QR code payments are gaining popularity.PayPay and Rakuten Pay are among the leading companies driving cashless payments. Government efforts to promote cashless payments, particularly ahead of major global events, are driving growth.

Retailers and shipping companies are embedding payment channels into their mobile phones for convenience. Increased investment in security technologies, such as multi-factor authentication and encryption, follows Japan's heightened focus on security in payments. In addition, growth in mobile payments-based reward loyalty schemes is also engaging consumers more. China

China dominates the mobile payment industry, with Alipay and WeChat Pay being the industry leaders. The country's cashless economy is driven by strong fintech innovation and extensive smartphone penetration. Blockchain technology and QR code payments are changing the face of digital finance.

Government-backed digital yuan projects are helping to level the playing field and promote financial inclusion. The intersection of AI-based financial services and real-time payment processing is transforming business-to-business and business-to-consumer payments. The boom in rural China and the growth of small businesses in mobile payments underscore China's continued leadership in the sector.

Australian mobile payment space is being redefined with fintech collaborations, smartphone penetration, and open banking regulations. Industry players, such as Afterpay and CommBank, are leading the way with easier and safer digital payments.

The retail and service sectors are embracing mobile payment systems to address customers' need for convenience in transactions. Cryptocurrency-based mobile wallets are also gaining popularity, indicating the nation's growing acceptance of advances in financial technology. Government policies that facilitate digital payments also further strengthen the industry.

Mobile payments in New Zealand are on the rise, driven by increased fintech investment and a growing demand for contactless payments. Paymark and ASB Bank are at the forefront of digital payment innovations.

The travel and retail industries are adopting mobile wallets to enhance convenience for tourists and locals. Government support, in the form of digital finance and AI-based security features, is making the transition to a cashless economy smooth. The growing acceptability of blockchain payments is also propelling the future of mobile payments in New Zealand.

The mobile payment transaction industry is highly competitive, driven by the growing adoption of digital wallets, contactless payment methods, and the rapid expansion of e-commerce. The demand for secure, fast, and seamless payment options has driven advancements in peer-to-peer transfers, QR code-based payments, and NFC-enabled transactions. When it comes to artificial intelligence, the industry features financial giants and fintech disruptors alike, all focused on fraud detection, increased security, and improved user experience.

Some of them are already dominating the industry with well-known names and big consumers around them, like PayPal, Apple Pay, Google Pay, Samsung Pay, and Square (Block Inc.). Furthermore, new fintech startups and local payment service providers are gaining popularity by offering localized solutions, reducing transaction costs, and providing value-added financial services.

Key factors, including a shift towards biometric authentication, regulatory changes towards digital payments, and the use of AI for fraud detection, are also driving the evolution of this industry. Firms are investing in greater cross-border transaction capabilities, blockchain-based payment solutions, and the integration of mobile payment systems into retail and banking ecosystems.

Industry Cap - The addition of new payment solutions will be crucial, with added layers of security, financial compliance, and the option to render value-added services, including Buy Now Pay Later (BNPL) and embedded finance, will influence competitive industry forces. With the increasing volume of digital transactions, brands must differentiate themselves to achieve better security, seamless user experiences, and strategic alliances to sustain themselves.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| PayPal Holdings Inc. | 25-30% |

| Apple Pay | 20-25% |

| Google Pay | 15-20% |

| Samsung Pay | 7-12% |

| Square (Block Inc.) | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| PayPal Holdings Inc. | PayPal is a global leader in digital payments, with capabilities for secure peer-to-peer payments, merchant payments, and BNPL. |

| Apple Pay | Emphasizes tight integration with iOS devices, NFC-enabled payments, and robust privacy controls. |

| Google Pay | Offers digital wallet services, UPI-based transactions , and AI fraud prevention. |

| Samsung Pay | Specializes in MST and NFC-enabled payments, allowing broad merchant acceptance. |

| Square (Block Inc.) | Provides small-business financial services with mPOS (mobile point-of-sale) solutions and peer-to-peer transfers. |

Key Company Insights

PayPal Holdings Inc. (25-30%)

PayPal is a leader in mobile payment transactions, offering various digital payment solutions, including seamless peer-to-peer transactions, merchant payment processing, and innovative Buy Now, Pay Later (BNPL) services.

Apple Pay (20-25%)

Apple Pay remains the sales leader in NFC-based mobile payment providers as it allows for a smooth and easy user experience across Apple devices. This focus on security and privacy bolsters its place in the industry.

Google Pay (15-20%)

It can also utilize Android's Native App Infrastructure, helping with AI-powered fraud detection, and it supports QR code payments and UPI-based transactions in nearly every major industry worldwide.

Samsung Pay (7-12%)

Samsung Pay's USP is that it offers both NFC and MST payment support, which means that it works with more payment terminals around the world.

Square (Block Inc.) (5-9%)

It also includes the mPOS solutions and digital payment services offered by Square, which allow small businesses and consumers to make peer-to-peer payments with a user-friendly platform.

Other Key Players (20-30% Combined)

By technology, the industry covers SMS mobile payment transactions, WAP/WEB, USSD, and NFC.

By purpose, the industry includes merchandise purchase, money transfer, bill payment, ticketing, and other purposes.

By region, the industry covers North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa (MEA).

The industry is expected to generate USD 20.4 trillion in revenue by 2025.

The industry is projected to reach USD 60.8 trillion by 2035, growing at a CAGR of 13.2%.

Key players include PayPal Holdings Inc., Apple Pay, Google Pay, Samsung Pay, Square (Block Inc.), Venmo (PayPal-owned), Alipay (Ant Group), WeChat Pay (Tencent), Stripe, and Zelle.

Asia Pacific and North America, driven by rising smartphone penetration, government initiatives promoting cashless transactions, and increasing consumer preference for digital payments.

QR code-based and contactless NFC (Near Field Communication) payments dominate due to their convenience, security, and growing acceptance in retail, transportation, and peer-to-peer transactions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Purpose, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 13: Global Market Attractiveness by Technology, 2023 to 2033

Figure 14: Global Market Attractiveness by Purpose, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 28: North America Market Attractiveness by Technology, 2023 to 2033

Figure 29: North America Market Attractiveness by Purpose, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Purpose, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Purpose, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Purpose, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Purpose, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Purpose, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Purpose, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Purpose, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Purpose, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Purpose, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Purpose, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA