The mobile car wash & detailing business segment is focused on providing on-demand automotive washing and care service that is convenient, green for washing and premium car detailing at places chosen by customers. Mobile car washing is gaining popularity due to increasing consumer demand for time-saving solutions, growth of app-based service portals, and greater focus on water-conserving car washing approaches.

Urbanization and rising subscription-based mobile detailing businesses are also driving the market while technology advancements in waterless car wash solutions are also ensuring the market growth. Additionally, increased investment in AI-enabled service car scheduling, automatic payment systems and green cleaning products are increasing business growth.

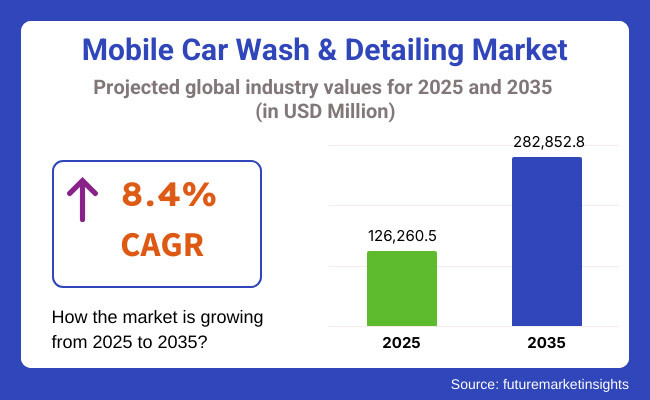

In 2025, the global mobile car wash & detailing market is projected to reach approximately USD 126,260.5 million, with expectations to grow to around USD 282,852.8 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 8.4% during the forecast period.

The projected CAGR inches at this growth potential is attributed to the rising demand for affordable and eco-friendly car maintenance options, high uptake of online booking platforms, and increasingly competitive landscape for mobile car detailing providers. Additionally, technological advancements related to steam cleaning and biodegradable cleaning products are expected to drive innovation in the market.

The mobile car wash & detailing market in North America is prominent due to its rate of ownership of vehicles, high demand for premium car detailing services, and active use of application-based booking platforms.

Growing investment in eco-friendly and water-saving car wash solution, The United States and Canada dominate subscription based mobile detailing models. Key market growth drivers include increasing partnership of car rental and ride-hailing companies with mobile detailing service providers.

Europe leads the market, with countries such as Germany, France, and the UK adopting green car wash technologies, stringent environmental laws with respect to water consumption, and upmarket auto detailing services.

The European Union's focus on the maintenance of green vehicles is boosting the growth of waterless and steam-based car cleaning services. Additionally, increasing ownership of luxury cars coupled with growing awareness regarding maintenance of cars for resale value is supporting the market growth.

The mobile car wash & detailing market in the Asia-Pacific region is projected to grow at the fastest rate due to rapid urbanization, increasing disposable income, as well as extensive vehicle ownership rates in China, India, Japan, and Australian countries.

The increasing automotive aftermarket industry in the region, increasing preference for mobile-based services, and growing environmental concern are propelling the adoption of eco-friendly carwash technologies. Other factors contributing to market growth include investments in AI-driven booking systems and water-free cleaning agents.

Challenges

Water Usage Regulations and Market Competition

Most jurisdictions will have regulations on water use and wastewater disposal on car washes the nature of mobile car wash & detailing industry will be faced with problems of restrictions on water use and ecological restrictions.

Additionally, tight competition from traditional car washes, mobile detailing franchises and do-it-yourself auto care products forces price discounts and customer attrition. The increased cost of mobile equipment, petrol and constrained labour then dented profitability.

Opportunities

Growth in Eco-Friendly, On-Demand, and AI-Powered Detailing Services

The demand for convenience-driven, water-efficient, and eco-friendly mobile car detailing services is rising, driven by busy urban lifestyles and sustainability trends. Urban lifestyles and sustainability trends are pushing demand for convenience-oriented, water-saving, eco-friendly on-demand car detailing services.

Waterless car wash technology, environmentally-safe biodegradable chemicals and AI-driven scheduling/CRM systems are improving performance and reducing environmental impact. There are also new market opportunities resulting from subscription-based detailing, fleet servicing, and AI-based mobile booking apps.

Between 2020 and 2024, driven by the factors including the growth of contactless service trends due to the Covid-19 pandemic and the online booking platform, and the growing sensitivity of consumers toward vehicle care, mobile car washing, and detailing are experiencing higher demand between 2020 and 2024. Nonetheless, high costs in green cleaning products, regulation barriers and rising competition from both end-of-cycle cleaning and automated car wash facilities limited mass adoption.

Past 2025 to 2035 the market will change, waterless, and subscription-based mobile detailing solutions. Customer experience, efficiency and sustainability will be driven by robotic cleaning systems, autonomous mobile detailing units and blockchain-enabled customer loyalty programs. There will be new streams of revenue from EV-specific detailing services and intelligent coatings that enable self-cleaning cars.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with water usage restrictions and environmental cleaning standards |

| Technology Innovations | Adoption of waterless cleaning products and mobile detailing apps |

| Market Adoption | Growth in on-demand car wash services via mobile apps and eco-friendly detailing |

| Sustainability Trends | Shift towards biodegradable cleaning solutions and reduced water consumption |

| Market Competition | Dominated by independent mobile detailers and franchise-based services (DetailXPerts, Spiffy, No-H2O, Woshbox, GoWash) |

| Consumer Trends | Demand for eco-friendly, convenient, and contactless mobile car wash services |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on wastewater management, chemical-free cleaning, and carbon-neutral mobile services |

| Technology Innovations | Advancements in AI-powered self-cleaning coatings, robotic detailing units, and blockchain-based loyalty programs |

| Market Adoption | Expansion into subscription-based car maintenance, fleet-specific services, and automated mobile wash stations |

| Sustainability Trends | Large-scale adoption of zero-water cleaning, EV-specific coatings, and carbon-offset mobile detailing |

| Market Competition | Rise of AI-driven fleet detailing startups, automated car care solutions, and autonomous vehicle cleaning systems |

| Consumer Trends | Growth in AI-powered, app-integrated detailing services, and self-cleaning vehicle coatings |

The demand for on-demand convenience-based car wash and detailing services as well as USA Mobile car wash & detailing market is surging. Market growth is also rising due to the increasing adoption of waterless and eco-friendly car wash solutions.

This demand is only fueling the growth of on-demand car detailing services through mobile apps along with advances in vehicle cleaning technologies. The increasing demand for premium detailing services like ceramic coating and interior deep cleaning is also contributing to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.7% |

The UK mobile car wash & detailing market is driven by increasing adoption of subscription car care services and growing acceptance of environmentally-friendly mobile detailing technologies. In line with green targets, customers are favouring water-saving and biodegradable cleaning agents.

The shift towards digital booking websites and mobile payments, is making life more convenient for the customer and subsequently increasing demand. In addition, a growing luxury car segment is fueling demand for advanced detailing services, such as paint protection and conditioning of the upholstery.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.2% |

Rising environmental regulations promoting water conservation and chemical-free car washing activities support the consistent growth of the EU Mobile Car Wash & Detailing market. Booming demand for mobile car detailing services in urban areas is further driving growth.

All this is happening as consumer awareness of the importance of vehicle maintenance and eco-friendly cleaning products driven by the growing number of car owners in Germany, France and Italy. And more people have electric and luxury vehicles, which is boosting demand for specialty mobile detailing services.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 8.1% |

Japan mobile car wash & detailing market is expanding as Japan is paying more attention to the hygiene and maintenance of vehicles. The market is driven by the growth of demand for premium detailing services for luxury and electric cars.

The inclination towards waterless car wash remedies and automated mobile cleaning technologies is further aiding the market growth. Furthermore, the robust technology infrastructure in Japan is facilitating the emergence of AI-based mobile car wash services and app-based appointment scheduling systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.4% |

The mobile car wash & detailing market in South Korea is growing at a healthy pace, owing to the increasing consumer inclination toward convenience-focused and eco-friendly vehicle cleaning services. Mobile app-based car wash and detailing platforms have spurted service accessibility immensely.

Growing demand in grooming market due to higher adoption of paint protection films, ceramic coatings, and high-end detailing services. Urbanization and busy lifestyles in South Korea are also driving demand for mobile car wash services.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.3% |

The basic car wash services are a high demand category for price-sensitive consumers looking for a fast yet effective car clean. Such services typically include washes and tire cleaning as well as drying the surface of the car so that it stays clean and presentable without a significant amount of detailing.

Full-service vehicle wash services are significantly driven by the strong demand for affordable/recurring vehicle cleaning. The benefit of consumers getting their cars washed every week or every two weeks is they don’t want dirt to build up, and they want to protect their paint, they want their car to look new while not having to pay the price for high-end detailing.

Apart from this, mobile wash company’s eco-friendly operating water-saving washing methods are also growing in popularity since customers are ordering green vehicle maintenance. Today, several waterless wash methods, steam wash and bio-degradable soap are used by various companies to avoid excess water consumption without reducing the cleanliness.

However, ordinary car wash services are up against car washes and self-service stations, providing similar cleans for less. Mobile car wash companies are not going out of business by bundling just a plain wash with little extras, such as quickly providing full vacuuming for the inside and dressing the tires, so more customers are satisfied and come back for more.

Deluxe car washes lure clients needing more robust cleaning and light detailing for a price not necessitating premium-tier costs. Deluxes typically include interior vacuuming, wax application, tire shine and more thorough surface cleansing to help with appearance and protection of the vehicle.

One of the main forces behind deluxe car wash services is increasing interest in regular deep cleaning treatments. The bulk of drivers undergo deluxe treatments every three months or longer to maintain paint integrity, interior space freshness and retained vehicle value.

Additionally, luxury car wash services are often used by corporate clients, fleet management businesses, and ride-sharing companies who need to keep their vehicles in pristine condition for their line of work. Many such companies now offer subscription-based luxury packages, which ensure repeat customers will receive consistent upkeep at discounted rates.

Despite offering value, top-end car washes take longer and require more energy than regular car washes, which results in higher prices and therefore fewer bookings. As a response, service providers are now deploying automated booking systems, artificial intelligence-based pricing algorithms, and loyalty programs to enable customers to avail of optimized and equitable services.

Tunnel car washes are still a preferred choice of high-traffic service stations, fleet owners, and drive-through car wash businesses. Tunnel car washes use specialized conveyor belts, pressure washing pipes and rotating bristles to wash cars in a speedy and effective manner.

A major multi-car advantage of tunnel car washes is the ability to shift a high quantity of cars over a short amount of time. The tunnel-style car washes that serve gas stations, auto service, and car rental centers provide lax cleanliness and satisfaction to customers in bulk.

Additionally, this new equipment, such as foam cannons, touchless cleaners and auto-drying units, allow for scratch-free washing and greater vehicle security. Most service providers nowadays offer custom wash designs that allow customers to add on services such as wax treatment, undercarriage cleaning, and tire treatments.

Unlike manual detailing, tunnel car washes are not suitable for high-end or luxury automobiles, as their speed limits their ability to provide a thorough cleaning and customization. Therefore, hybrid tunnel detailing options are being incorporated by most service providers, offering automated cleaning along with manual touch-up detailing for premium clients.

Rollover or in-bay car washes are widely used in self-service premises, gas stations and operators of stand-alone car wash, providing an effective cleaning solution for private car owners. The systems are capable of contactless washing, conserving water, and saving space, using robotic arms that circle the vehicle.

One of the most significant advantages of rollover / rollover car washes is the low demand for hands and practice hours, accommodating car washes for enterprises and cities. For its economical and straightforward nature, in-bay automatic car washes are the pre-processors of ultimate choice, ensuring speedy and daily-friendly vehicle upkeep with no appointments necessary.

But that same efficiency that allows customers to zip in and out of a rollover car wash may not deliver the cleanest finish, so some people prefer hybrid services that combine automated mopping up with manual detailing. A high-pressure water jet, ecological foam solutions and sensor-controlled washing cycles are now used in numerous providers and ensure optimized cleaning results with minimized use of water and energy.

The mobile car wash & detailing industry is being driven by the demand for on-demand cleaning of vehicles, eco-friendly waterless car wash solutions, as well as high-end detailing. The growth of app-enabled car wash service platforms, detailing subscription services, and the advent of green eco-friendly cleaning technology are driving demand. The demand for the market is also supported by the increasing trend toward convenience, contactless service modules, and water-conservation efforts.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Spiffy | 18-22% |

| Washos | 14-18% |

| MobileWash | 12-16% |

| Wype | 10-14% |

| AutoSpa360 | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Spiffy | Provides app-based mobile car washing and detailing, including oil changes and eco-friendly solutions. |

| Washos | Offers on-demand car wash and detailing services with flexible booking and professional technicians. |

| MobileWash | Specializes in mobile car cleaning and detailing services, offering subscription packages and real-time scheduling. |

| Wype | Develops waterless car wash services, focusing on environmentally sustainable auto cleaning solutions. |

| AutoSpa360 | Provides high-end mobile auto detailing, catering to luxury car owners and premium vehicle maintenance. |

Key Market Insights

Spiffy (18-22%)

Spiffy leads the mobile car wash and detailing market with its all-in-one app-based solution, offering waterless washes, interior detailing, and fleet maintenance.

Washos (14-18%)

Washos specializes in on-demand car detailing services, providing hand washes, waxing, and interior deep cleaning with quick booking options.

MobileWash (12-16%)

MobileWash is a leading car wash and detailing app, offering subscription-based car cleaning with customized service options.

Wype (10-14%)

Wype focuses on waterless and eco-friendly car cleaning, making it an ideal choice for environmentally conscious consumers.

AutoSpa360 (8-12%)

AutoSpa360 provides luxury mobile detailing services, including ceramic coating, paint protection, and premium interior restoration.

Other Key Players (26-32% Combined)

The overall market size for mobile car wash & detailing market was USD 126,260.5 million in 2025.

The mobile car wash & detailing market is expected to reach USD 282,852.8 million in 2035.

Increasing consumer preference for convenience, rising demand for eco-friendly waterless car wash solutions, and growing adoption of on-demand mobile services will drive market growth.

The top 5 countries which drives the development of Mobile car wash & detailing market are USA, European Union, Japan, South Korea and UK.

Tunnel car washes growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Method, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Booking, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Payment, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Method, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Booking, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Payment, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Method, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Booking, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Payment, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Method, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Booking, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Payment, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Method, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Booking, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Payment, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Method, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Booking, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by Payment, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Method, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Booking, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Payment, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Method, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Booking, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Payment, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Method, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Booking, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Payment, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Method, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Method, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Method, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Booking, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Booking, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Booking, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Payment, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Payment, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Payment, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Method, 2023 to 2033

Figure 23: Global Market Attractiveness by Booking, 2023 to 2033

Figure 24: Global Market Attractiveness by Payment, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Method, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Booking, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Payment, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Method, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Method, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Method, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Booking, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Booking, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Booking, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Payment, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Payment, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Payment, 2023 to 2033

Figure 46: North America Market Attractiveness by Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Method, 2023 to 2033

Figure 48: North America Market Attractiveness by Booking, 2023 to 2033

Figure 49: North America Market Attractiveness by Payment, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Method, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Booking, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Payment, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Method, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Method, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Method, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Booking, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Booking, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Booking, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Payment, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Payment, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Payment, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Method, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Booking, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Payment, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Method, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Booking, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by Payment, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Method, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Method, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Method, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Booking, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Booking, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Booking, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by Payment, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by Payment, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by Payment, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Method, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Booking, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by Payment, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Method, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Booking, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by Payment, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Method, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Method, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Method, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Booking, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Booking, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by Payment, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by Payment, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by Payment, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Method, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Booking, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by Payment, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Method, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Booking, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by Payment, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Method, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Method, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Method, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Booking, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by Payment, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by Payment, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Payment, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Method, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Booking, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by Payment, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Method, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Booking, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Payment, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Method, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Method, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Method, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Booking, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Booking, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Booking, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Payment, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Payment, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Payment, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Method, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Booking, 2023 to 2033

Figure 174: East Asia Market Attractiveness by Payment, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Method, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Booking, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Payment, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Method, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Method, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Method, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Booking, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by Payment, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by Payment, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by Payment, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Method, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Booking, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by Payment, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Notary Public Market Size and Share Forecast Outlook 2025 to 2035

Mobile Messaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Command and Control Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA