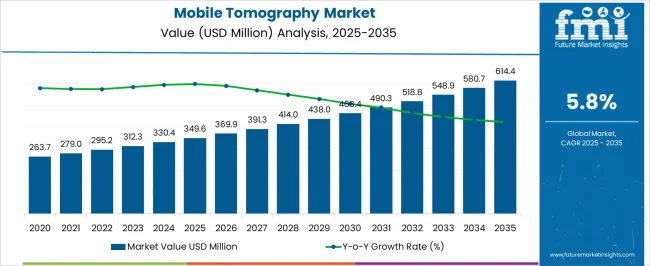

The Mobile Tomography Market is estimated to be valued at USD 349.6 million in 2025 and is projected to reach USD 614.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Mobile Tomography Market Estimated Value in (2025 E) | USD 349.6 million |

| Mobile Tomography Market Forecast Value in (2035 F) | USD 614.4 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The mobile tomography market is advancing steadily, driven by the increasing demand for point-of-care imaging, improvements in scan accuracy, and the integration of AI in radiology workflows. Rising pressure on healthcare infrastructure, especially in developing regions and remote settings, has accelerated the adoption of portable imaging systems.

Mobile tomography devices enable immediate diagnostics in emergency rooms, intensive care units, and during patient transport, reducing delays associated with traditional imaging logistics. Technological advancements in image reconstruction, radiation dose reduction, and wireless data integration have further improved diagnostic confidence and clinical efficiency.

Additionally, the growing incidence of chronic conditions such as cancer and cardiovascular diseases has reinforced the need for real-time imaging capabilities in both in-patient and out-patient care settings. Looking ahead, market growth is expected to be driven by public health system investments, adoption of AI-supported scanning platforms, and increasing deployment across home healthcare and field hospital environments.

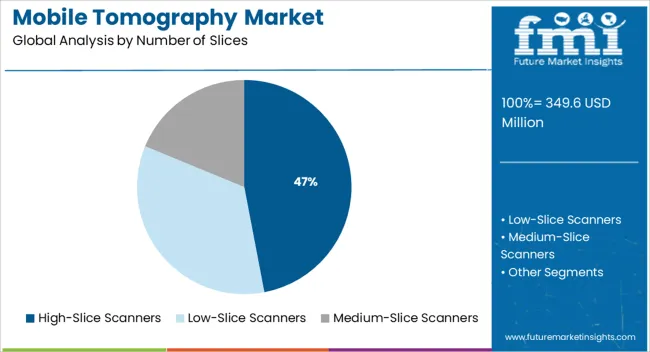

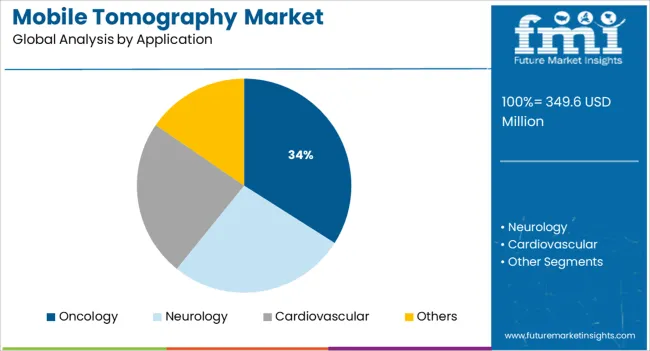

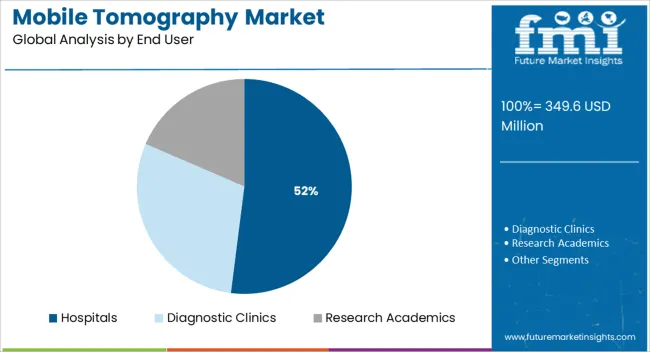

The market is segmented by Number of Slices, Application, and End User and region. By Number of Slices, the market is divided into High-Slice Scanners, Low-Slice Scanners, and Medium-Slice Scanners. In terms of Application, the market is classified into Oncology, Neurology, Cardiovascular, and Others. Based on End User, the market is segmented into Hospitals, Diagnostic Clinics, and Research Academics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

High-slice scanners are expected to account for 47.0% of total market revenue by 2025, making them the dominant segment by number of slices. Their lead is supported by faster scan speeds, improved spatial resolution, and broader diagnostic capabilities compared to lower-slice models.

These systems have been preferred in high-throughput and acute care settings where detailed imaging of soft tissue and vascular structures is essential. Mobile integration of high-slice systems has enabled broader deployment in trauma care, surgical planning, and stroke evaluation.

Advancements in modular mobility, compact design, and real-time data transmission have allowed these systems to be used effectively in dynamic hospital environments without compromising image quality or workflow efficiency.

Oncology is projected to hold 34.0% of total market share by 2025, establishing it as the leading application for mobile tomography systems. The segment’s growth is being driven by the need for frequent, precise imaging in cancer staging, treatment planning, and therapy response monitoring.

Mobile tomography units have enhanced cancer care delivery by providing high-resolution scans directly at the bedside, improving care for immunocompromised or critically ill patients who cannot be moved easily. Enhanced lesion detectability and integration with radiotherapy planning systems have made mobile tomography an important tool in oncology departments.

The trend toward personalized and adaptive cancer treatment protocols is also increasing demand for fast and frequent imaging in both hospital and ambulatory care settings.

Hospitals are anticipated to contribute 52.0% of the mobile tomography market revenue in 2025, making them the primary end-user segment. This dominance is being shaped by rising investment in in-house mobile diagnostic capabilities, especially within emergency, critical care, and surgical departments.

Hospitals benefit from reduced patient transfer risks and improved imaging turnaround times by deploying mobile tomography systems. Their ability to streamline diagnostics during peak hours and in overcrowded settings has increased operational efficiency.

Moreover, mobile systems have supported infection control measures, particularly during pandemic conditions, by minimizing patient movement and equipment reuse across departments. Continued digitalization of hospital infrastructure and integration with electronic health records (EHRs) are further driving adoption across large and mid-sized healthcare institutions.

OmniTom is Samsung's newest proof of its superiority in the mobile tomography market. In comparison to Samsung's previous generation CereTom CT scanner, the newer OmniTom model, has several notable upgrades, such as:

Next-generation CT technologies include Samsung's spectral CT with Photon Counting Detector (PCD). The healthcare solutions presented by the Samsung team include mobile CT, digital radiography, and ultrasound, all of which aim to close the gap in care delivery and increase productivity for a better patient experience. Solutions like these include:

In the ultrasound market, Samsung will showcase its whole line of ultrasound equipment, including the recently released HS60 and HS40. Three daily instructional presentations with live scanning will showcase the RS80A with Prestige, Samsung's top-tier general-imaging ultrasound system. The RS80A's cutting-edge features are a welcome boon to clinical confidence in a department as high-volume as radiology. The company is building on its success in obstetrics and gynecology ultrasonic diagnosis equipment to expand into radiology, the sector with the most promising future.

In the digital radiography market, Samsung will showcase an extensive product line-up, including the GC85 and GC70, two ceiling-mounted systems, and the GM85, a premium portable X-ray. Users will enjoy unprecedented productivity and stunning visuals because of the GM85's improved portability and simpler workflow. Samsung's low-dose technology, which aims to improve patient safety, is another way it stands apart from the competition.

Samsung will display an early model of their Specialty MRI equipment, an MRI scanner designed to image extremities. The prototype is being heralded as a game-changer in the business because of its innovative approach to MRI scanning that reduces the need for patients to place their entire bodies within the machine, saving both time and money.

As a result of several valid concerns about cost and access, mobile CT scanners are increasingly favored over permanently installed ones in hospitals. Healthcare providers in some regions, such as North America, are opting to use mobile CT scanners rather than permanently installed ones due to the long wait times and high costs associated with purchasing fixed CT.

Key advantages include less work for medical staff, shorter hospital stays, faster access to CT for outpatients, and quicker provision of essential services for inpatients. This is changing the global mobile tomography market outlook.

Patients appreciate CT scanners largely because they don't require any patient interaction beyond looking at the image on the screen. High adaptability and decreased operating and capital costs propel the CT scanners market. Mobile tomography market growth can be directly attributed to these devices' superior safety and sensitivity.

One trend helping to create opportunities in the mobile tomography market is the rising demand for mobile CT scanners in diagnostic services in both emerging and developed countries. The increasing adoption of mobile tomography to diagnose and treat neurological disorders is a major factor driving market growth. As a result of their low risk of infection and recovery time, mobile CT scanners have become increasingly popular.

However, the mobile tomography market is likely to be stymied by factors such as a clearly defined regulatory framework and a lack of suitable reimbursement. High product costs and one-time installations at individual facilities slow the mobile tomography market's expansion.

Since mobile tomography is still a novel service, a lack of trained specialists is expected to restrain the industry's expansion further. Additionally, mobile tomography is projected to have slow mobile tomography market expansion because of specific adverse effects, such as nausea and headache.

Due to factors such as increasing demand for healthcare services and diagnostic centers, as well as greater public knowledge about the importance of early disease detection, the regional North American mobile tomography market is anticipated to expand rapidly throughout the forecast period.

Greater access to high-quality medical care in industrialized nations is a major factor in why these economies generate more money than those in the developing world.

Due to factors such as the region's developing healthcare infrastructure, rising chronic disease rates, rising disposable incomes, the strength of home-grown businesses, and the rapid growth of the region's elderly population, the Asia-Pacific region presents lucrative opportunities for leaders in the mobile tomography market.

The expansion of Asia's mobile tomography market is anticipated to be bolstered by the improving economies of emerging markets like India and China. More government efforts to build new community health and oncology centers are expected to enhance the use of mobile medical imaging in underserved areas

The future of the mobile tomography market is anticipated to be shaped by the key developments of new firms. Manufacturers in the mobile tomography market are investing heavily in Research and Development to produce increasingly sophisticated mobile tomography solutions, opening numerous potential opportunities in the market. Mobile tomography is expected to increase as a market since it is widely favored by patients who have suffered a stroke due to the short time required for scanning.

Start-up company FITPU healthcare has created an image analytics platform called Mltalytics. Tissue analysis for malignant tumors is performed, and dynamic contrast-enhanced and multi-parametric imaging is supported.

Some of the key players in mobile tomography are

| Report Attribute | Details |

|---|---|

| Growth Rate | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Number of Slices, Application, End-User, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC Countries, South Africa |

| Key Companies Profiled | Xoran Technologies; LLC. NeuroLogica Corp.; Planmed OY; Brainlab AG; Dixion distribution of medical devices GmbH; United Imaging Healthcare; Sino Vision; Samsung Electronics; Olympus Corporation; Karl Storz GmbH & Co.Kg; Koninklijke Philips; Hitachi Medical Corporation; GE Healthcare; Medtronic |

| Customization | Available Upon Request |

The global mobile tomography market is estimated to be valued at USD 349.6 million in 2025.

The market size for the mobile tomography market is projected to reach USD 614.4 million by 2035.

The mobile tomography market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in mobile tomography market are high-slice scanners, low-slice scanners and medium-slice scanners.

In terms of application, oncology segment to command 34.0% share in the mobile tomography market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Computed Tomography Scanners Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA