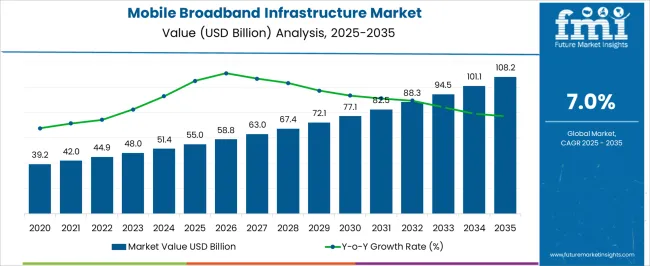

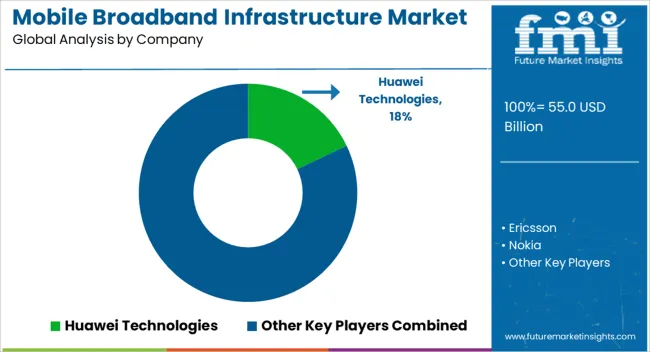

The mobile broadband infrastructure market is estimated to be valued at USD 55.0 billion in 2025 and is projected to reach USD 108.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

This market expansion is largely driven by the continuous rise in demand for high-speed internet access across the globe. The shift toward more data-heavy applications and the increasing reliance on mobile networks for everything from entertainment to business operations have created a need for more advanced and widespread mobile broadband infrastructure. Investments in both urban and rural areas are expected to significantly boost the market, enhancing connectivity and providing reliable access to mobile networks. As consumer expectations for seamless connectivity continue to grow, telecommunications companies are expected to invest heavily in improving their mobile broadband infrastructure to meet demand.

The increasing penetration of smartphones and the internet of things (IoT) is further accelerating the need for robust mobile networks. Additionally, efforts to support 5G rollout are expected to contribute significantly to market growth, as telecom providers aim to meet the escalating demand for faster, more reliable mobile broadband services. Over the next decade, as mobile internet becomes more essential, the mobile broadband infrastructure market will continue to evolve, with sustained growth expected to be driven by the ongoing need for upgraded infrastructure in both developed and emerging markets.

| Metric | Value |

|---|---|

| Mobile Broadband Infrastructure Market Estimated Value in (2025 E) | USD 55.0 billion |

| Mobile Broadband Infrastructure Market Forecast Value in (2035 F) | USD 108.2 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The mobile broadband infrastructure market is estimated to hold a notable proportion within its parent markets, representing approximately 10-12% of the telecommunications infrastructure market, around 8-9% of the wireless communication market, close to 18-20% of the 5G infrastructure market, about 6-7% of the broadband equipment market, and roughly 5-6% of the mobile network equipment market. Collectively, the cumulative share across these parent segments is observed in the range of 47-54%, indicating the central role that mobile broadband infrastructure plays in enabling high-speed communication, especially with the growing reliance on mobile data services.

The market has been propelled by the rising demand for faster, more reliable internet connections and seamless user experiences across mobile devices. Adoption has been largely influenced by the increasing investments in next-generation wireless technologies, such as 5G, and the need for upgraded infrastructure to support high-capacity mobile data transfer. Market participants have focused on enhancing the performance of broadband equipment and network infrastructure to cater to the growing consumer demand for mobile internet services.

As a result, the mobile broadband infrastructure market has not only captured a substantial share within telecommunications and wireless communication but has also significantly influenced the 5G infrastructure, broadband, and mobile network equipment markets. This reflects its key role in ensuring efficient mobile data transmission, robust connectivity, and the overall enhancement of communication networks globally.

The mobile broadband infrastructure market is undergoing significant expansion, supported by the rapid evolution of wireless communication technologies and the growing demand for high-speed connectivity worldwide. Increased data consumption driven by video streaming, cloud applications, IoT adoption, and remote working is pushing network operators to invest heavily in upgrading and expanding their infrastructure. The shift toward next-generation networks, particularly 5G, is influencing large-scale deployments of advanced base stations, antennas, and supporting hardware.

Governments and regulatory bodies in multiple regions are facilitating infrastructure development through spectrum allocation and supportive policy frameworks. Advancements in network virtualization, massive MIMO, and beamforming technologies are enhancing performance and spectrum efficiency, further driving adoption. Rising competition among service providers is also accelerating infrastructure modernization to improve coverage and quality of service.

As urbanization intensifies and rural connectivity projects gain momentum, the market is expected to experience sustained growth Ongoing investments in network resilience, energy efficiency, and integration of AI-driven network management tools are expected to play a pivotal role in shaping the industry’s long-term trajectory.

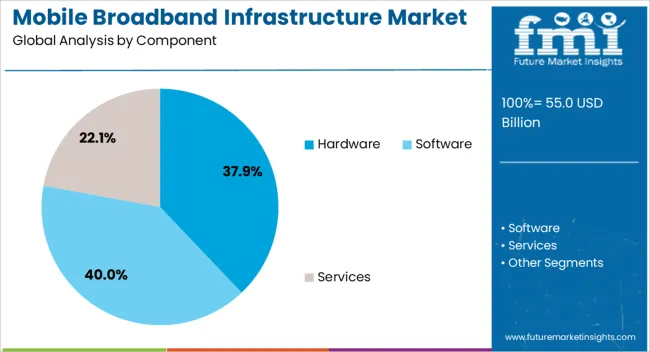

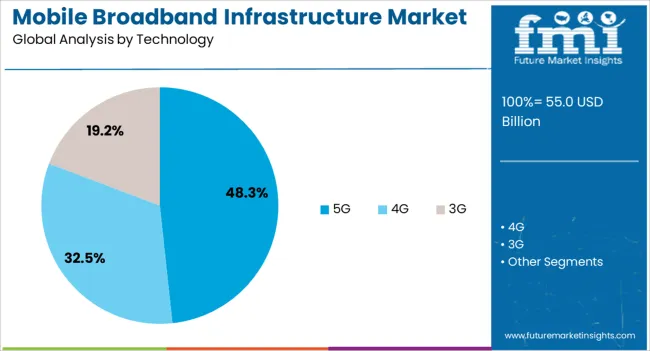

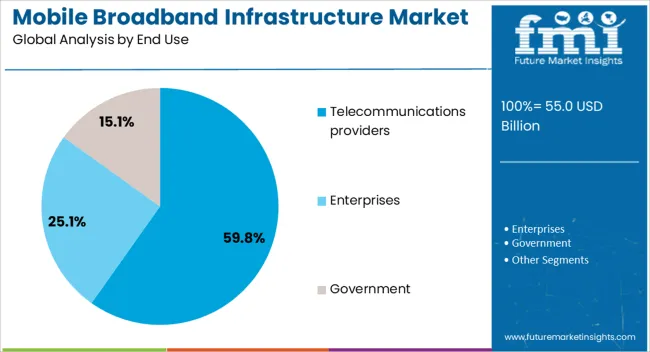

The mobile broadband infrastructure market is segmented by component, technology, end use, and geographic regions. By component, mobile broadband infrastructure market is divided into hardware, software, and services. In terms of technology, mobile broadband infrastructure market is classified into 5G, 4G, and 3G. Based on end use, mobile broadband infrastructure market is segmented into telecommunications providers, enterprises, and government. Regionally, the mobile broadband infrastructure industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment is projected to hold 40% of the mobile broadband infrastructure market revenue share in 2025, making it the leading component category. Mobile infrastructure software is in high demand due to the rapid growth of mobile data usage, 5G rollouts, and the need for seamless connectivity across devices and applications. Enterprises, telecom operators, and governments are investing heavily in solutions that ensure reliable, scalable, and secure mobile networks to support IoT, cloud services, and real-time communication.

With the rising adoption of remote work, smart devices, and mobile-first applications, robust infrastructure software has become critical for optimizing bandwidth, reducing latency, and enhancing user experience. Additionally, advancements in AI-driven network management and cybersecurity further drive demand for modern mobile infrastructure solutions.

The 5G technology segment is expected to account for 48.3% of the mobile broadband infrastructure market revenue share in 2025, making it the leading technology. Its leadership is being reinforced by the superior performance capabilities of 5G networks, which deliver ultra-low latency, significantly higher bandwidth, and the capacity to connect a massive number of devices simultaneously. The segment is experiencing rapid adoption driven by the proliferation of data-intensive applications, autonomous systems, and real-time services that demand enhanced network performance.

Telecom operators worldwide are accelerating 5G deployments to meet rising consumer and enterprise expectations, supported by strategic partnerships and large-scale capital investments. The segment’s growth is further supported by national digital transformation initiatives and industrial automation trends that rely on high-speed wireless connectivity.

Advancements in small cell deployment, millimeter-wave technology, and dynamic spectrum sharing are expanding the reach and efficiency of 5G networks As ecosystems mature, the 5G segment is expected to maintain its dominant position, enabling next-generation mobile broadband experiences.

The telecommunications providers segment is anticipated to capture 59.8% of the mobile broadband infrastructure market revenue share in 2025, establishing itself as the largest end-use category. This dominance is attributed to the central role these providers play in building, operating, and maintaining large-scale mobile networks that support millions of users. Increasing demand for high-speed mobile internet and reliable network coverage is driving telecom companies to make substantial investments in infrastructure upgrades and expansion.

The segment is also benefiting from strategic collaborations with technology vendors and equipment manufacturers to accelerate the deployment of 5G and enhance existing 4G networks. Telecommunications providers are leveraging advanced analytics, network automation, and AI-driven management systems to optimize performance and reduce downtime.

In both urban and rural regions, expanding mobile broadband coverage is a priority to meet regulatory requirements and customer expectations The emphasis on competitive differentiation through superior service quality and network performance ensures that telecommunications providers remain the primary drivers of mobile broadband infrastructure growth in the foreseeable future.

The mobile broadband infrastructure market is experiencing robust growth driven by the demand for high-speed connectivity and the shift towards 5G networks. Opportunities in rural and underserved regions present new growth avenues for service providers, while trends like 5G deployments are shaping future market dynamics. However, high infrastructure costs and intense competition remain challenges that could slow down market expansion. By addressing these hurdles, companies in the sector can capitalize on the growing demand for mobile broadband and position themselves for long-term success.

The mobile broadband infrastructure market is driven by the growing demand for high-speed mobile data and reliable internet connectivity. As mobile usage continues to surge globally, there is a rising need for faster and more efficient mobile broadband networks. This trend is particularly evident with the increasing adoption of smartphones, streaming services, and IoT devices. Operators are compelled to upgrade their infrastructure to support greater data capacity, prompting the demand for advanced mobile broadband solutions to meet consumer expectations for seamless connectivity.

One of the key opportunities in the mobile broadband infrastructure market lies in expanding services to rural and underserved regions. Many remote areas still face limited access to high-speed internet, creating an untapped market for mobile network providers. Infrastructure investments aimed at bridging the digital divide are expected to drive market growth. With government initiatives and private sector partnerships focusing on expanding mobile broadband coverage, this segment is likely to see significant development in the coming years.

The ongoing transition to 5G networks is one of the most prominent trends in the mobile broadband infrastructure market. As telecom operators focus on building and upgrading their networks to support 5G, the demand for infrastructure components such as small cells, macro cells, and fiber optic solutions is escalating. This upgrade is seen as critical to meet the growing data demands of next-generation technologies, and it is expected to drive substantial investments in the mobile broadband infrastructure market over the next few years.

Despite the growth prospects, the mobile broadband infrastructure market faces significant challenges. One of the key concerns is the high cost associated with deploying and maintaining mobile broadband networks, particularly in remote or densely populated urban areas. The need for constant upgrades and maintenance adds to operational expenses. Moreover, the market is becoming increasingly competitive, with both established players and new entrants vying for market share. This intense competition puts pressure on pricing strategies and profitability for service providers.

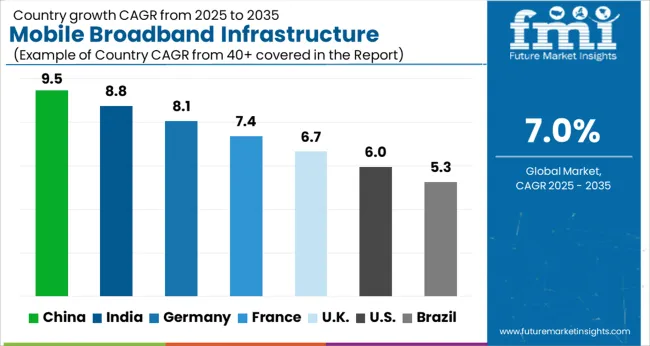

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global mobile broadband infrastructure market is projected to grow at a CAGR of 7% from 2025 to 2035. China leads with a growth rate of 9.5%, followed by India at 8.8%, and Germany at 8.1%. The United Kingdom records a growth rate of 6.7%, while the United States shows the slowest growth at 6%. This market expansion is fueled by the rising demand for high-speed internet, the proliferation of mobile devices, and the increasing need for robust connectivity solutions. In emerging markets like China and India, growing mobile broadband adoption and investments in 4G/5G infrastructure are key drivers, while in developed regions such as the USA and UK, the focus is on enhancing 5G networks and improving network capacity. This report includes insights on 40+ countries, with top markets shown here for reference.

Trend of Natural and Biodegradable Products Boosting Demand

The mobile broadband infrastructure market in China is growing at a rate of 9.5%, primarily driven by the country’s rapid digital transformation and the growing demand for high-speed mobile internet. China is a global leader in the deployment of 5G networks, and the government’s heavy investment in telecommunications infrastructure is accelerating this growth. With a large mobile user base, the country is increasingly adopting 5G and 4G technologies to cater to the growing demand for seamless connectivity. Furthermore, China’s initiatives to digitize industries such as e-commerce, entertainment, and online services are further driving the need for improved mobile broadband infrastructure.

The mobile broadband infrastructure market in India is growing at a rate of 8.8%, driven by the country’s expanding mobile user base and the increasing need for reliable high-speed internet. India is investing heavily in improving its mobile broadband network, particularly in rural and underserved areas. The introduction of 4G and the ongoing deployment of 5G networks are also major contributing factors. With the rise in internet penetration and the growing demand for digital services in education, healthcare, and entertainment, India is poised to see continued growth in mobile broadband infrastructure. Government initiatives aimed at improving internet access and affordability further support this growth.

The mobile broadband infrastructure market in Germany is growing at a rate of 8.1%, supported by the country’s focus on advancing its 5G infrastructure. Germany is making substantial investments to enhance network capacity and connectivity, particularly in urban areas. The government’s support for 5G rollouts and the growing demand for high-speed internet in both personal and business sectors are propelling this market forward. Germany’s thriving digital economy, which includes a strong emphasis on Industry 4.0 and IoT solutions, is creating an increasing need for faster, more reliable mobile broadband. Additionally, the growing demand for remote work and streaming services further boosts the market.

The mobile broadband infrastructure market in the United Kingdom is growing at a rate of 6.7%, with investments in 5G technology playing a key role in market expansion. The UK government’s push for nationwide 5G coverage, along with its focus on smart cities and connected infrastructure, is driving the demand for advanced mobile broadband solutions. In addition, the growing number of mobile users, coupled with the increased need for faster and more reliable connectivity for applications such as online learning, e-commerce, and digital healthcare, is further accelerating market growth. The UK is also focused on improving network resiliency and providing more widespread coverage.

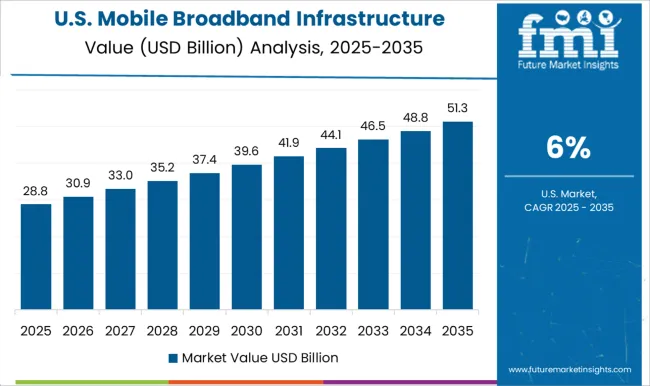

The mobile broadband infrastructure market in the United States is growing at a rate of 6%, driven by the need to enhance network capacities and the rollout of 5G services. The USA is focused on expanding 5G coverage to improve network speed and reliability for consumers and businesses. The demand for high-speed internet for applications like telemedicine, e-learning, and remote work is further driving the need for better mobile broadband infrastructure. In addition, government initiatives to provide rural areas with access to reliable broadband connectivity are expected to support the continued growth of the market. Despite the slower growth rate compared to other countries, the USA remains a significant player in the mobile broadband infrastructure market.

The mobile broadband infrastructure market is undergoing significant transformation, driven by the increasing demand for high-speed internet, seamless connectivity, and the expansion of 5G networks globally. Huawei Technologies, Ericsson, and Nokia are the dominant players in this market, offering end-to-end solutions that power the backbone of mobile networks. Huawei is known for its vast portfolio of 5G infrastructure products and services, contributing heavily to network deployment in various regions. Ericsson, with its strong presence in Europe and North America, is leading the charge in providing innovative mobile network solutions that support both 4G and 5G technologies.

Nokia focuses on building future-proof mobile broadband networks with its advanced portfolio, including 5G-ready equipment and digital services tailored to meet evolving connectivity needs. These companies are leveraging their expertise to help service providers meet the growing demand for mobile data and improve network efficiency. Other key contributors such as Cisco Systems, Samsung Electronics, and ZTE are also playing a crucial role in shaping the mobile broadband infrastructure market. Cisco, with its expertise in IP networking and data center technology, is expanding its influence in the mobile broadband space, particularly in network management and optimization.

Samsung Electronics is making significant strides in providing mobile broadband infrastructure for the rollout of 5G, emphasizing its role as a leader in high-performance telecom equipment. ZTE is a key player in delivering end-to-end mobile broadband solutions across emerging markets, ensuring that telecom operators can scale their networks efficiently. In addition, Qualcomm, CommScope, Arista Networks, and Fujitsu are bringing cutting-edge technology solutions, from wireless communication chips to network optimization tools, further enhancing the market's potential. With increasing investments in 5G technology and the global rise of data usage, the mobile broadband infrastructure market is expected to continue growing, driven by these companies' innovations and contributions.

| Item | Value |

|---|---|

| Quantitative Units | USD 55.0 Billion |

| Component | Hardware, Software, and Services |

| Technology | 5G, 4G, and 3G |

| End Use | Telecommunications providers, Enterprises, and Government |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huawei Technologies, Ericsson, Nokia, Cisco Systems, Samsung Electronics, ZTE, Qualcomm, CommScope, Arista Networks, and Fujitsu |

| Additional Attributes | Dollar sales by infrastructure type (base stations, antennas, small cells, backhaul systems) and technology (4G, 5G, Wi-Fi) are key metrics. Trends include rising demand for high-speed, reliable mobile networks, growth in 5G deployment, and increasing adoption of small cell and edge computing solutions. Regional deployment, technological advancements, and regulatory support are driving market growth. |

The global mobile broadband infrastructure market is estimated to be valued at USD 55.0 billion in 2025.

The market size for the mobile broadband infrastructure market is projected to reach USD 108.2 billion by 2035.

The mobile broadband infrastructure market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in mobile broadband infrastructure market are hardware, antennas & transceivers, and others.

In terms of technology, 5g segment to command 48.3% share in the mobile broadband infrastructure market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Notary Public Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA