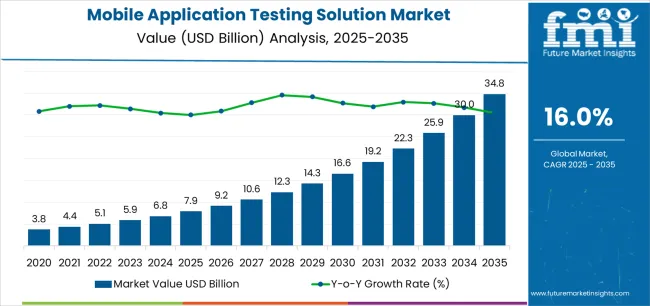

The Mobile Application Testing Solution Market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 34.8 billion by 2035, registering a compound annual growth rate (CAGR) of 16.0% over the forecast period.

The mobile application testing solution market is experiencing strong growth driven by the rapid proliferation of mobile applications, increasing demand for seamless user experiences, and the need for quality assurance across diverse devices and operating systems. Market participants are focusing on improving test accuracy, scalability, and automation capabilities to address complex application ecosystems.

The current scenario reflects a shift toward continuous testing models integrated within agile and DevOps environments, enabling faster release cycles and higher product reliability. The future outlook remains positive as organizations prioritize digital transformation, cloud-based testing frameworks, and artificial intelligence-driven testing tools to optimize performance and minimize defects.

Growth rationale is anchored in the rising complexity of mobile architectures, increasing adoption of hybrid and cross-platform apps, and growing enterprise focus on security and compliance testing These factors collectively reinforce the importance of efficient testing solutions that ensure functionality, stability, and superior end-user experiences across global markets.

| Metric | Value |

|---|---|

| Mobile Application Testing Solution Market Estimated Value in (2025 E) | USD 7.9 billion |

| Mobile Application Testing Solution Market Forecast Value in (2035 F) | USD 34.8 billion |

| Forecast CAGR (2025 to 2035) | 16.0% |

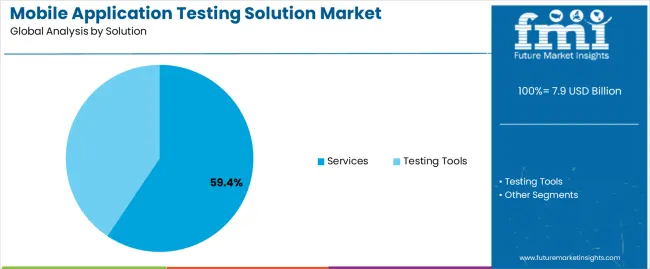

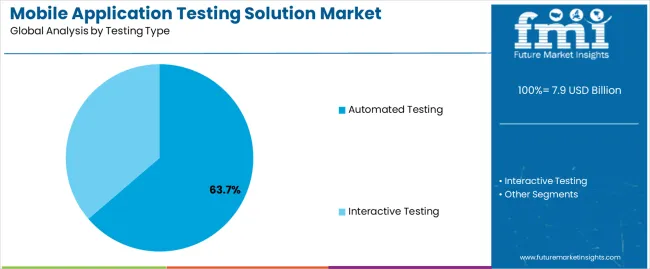

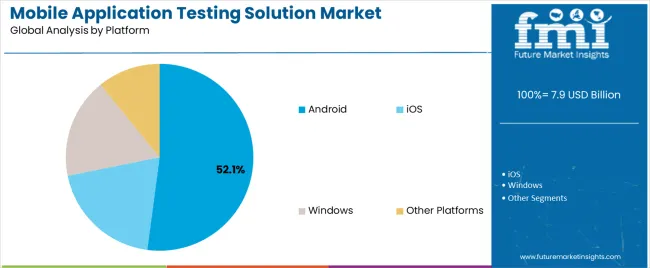

The market is segmented by Solution, Testing Type, Platform, Device, and End User and region. By Solution, the market is divided into Services and Testing Tools. In terms of Testing Type, the market is classified into Automated Testing and Interactive Testing. Based on Platform, the market is segmented into Android, iOS, Windows, and Other Platforms. By Device, the market is divided into Smartphone and Tablet. By End User, the market is segmented into Corporate and Residential. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The services segment, accounting for 59.40% of the solution category, has emerged as the leading component due to its integral role in providing end-to-end testing support, from test design and execution to maintenance and continuous optimization. Market dominance is being reinforced by the growing reliance of enterprises on third-party service providers to manage complex testing environments.

Service providers are leveraging automation frameworks, cloud infrastructure, and advanced analytics to deliver faster and more reliable testing outcomes. Demand has been further strengthened by the scalability and flexibility these services offer to accommodate diverse client requirements.

Strategic partnerships and managed testing models have enhanced service quality and reduced operational costs As digital ecosystems expand, the service segment is expected to maintain its leadership through continuous innovation, strong domain expertise, and value-added testing capabilities tailored to dynamic application landscapes.

The automated testing segment, holding 63.70% of the testing type category, has secured its leading position due to its ability to accelerate testing cycles, enhance accuracy, and support large-scale mobile deployments. Growing adoption of agile and DevOps methodologies has necessitated the integration of automation to ensure rapid release and continuous improvement.

The segment’s expansion is being supported by advancements in AI and machine learning, enabling intelligent test creation, predictive analysis, and adaptive testing strategies. Cost efficiency and reduced human error are key benefits driving market preference.

Automated frameworks compatible with multiple platforms and environments have also improved test coverage and reusability As the complexity of mobile applications increases, automated testing is expected to remain indispensable for ensuring performance, reliability, and compliance, thereby solidifying its dominant role in the overall testing ecosystem.

The Android segment, representing 52.10% of the platform category, has maintained its dominance due to the widespread use of Android devices globally and the diversity of hardware configurations requiring comprehensive testing. The segment benefits from the open-source nature of the Android ecosystem, which allows extensive customization and scalability for testing frameworks.

High market share is also attributed to the growing demand for Android-based enterprise and consumer applications, necessitating continuous validation for compatibility, performance, and security. The availability of cloud-based Android testing platforms has improved efficiency by enabling parallel testing across multiple devices.

Continuous updates to the operating system and varying device specifications have intensified the need for advanced testing solutions With expanding mobile penetration and developer adoption, the Android segment is expected to sustain its leadership, supported by innovations in test automation and continuous integration processes.

The global mobile app testing solution market was valued at USD 3.8 billion in 2020. The sales of mobile application testing solutions grew at a rate of 13.9% between 2020 and 2025. The overall market value was about USD 7.9 billion by 2025.

The mobile application testing solutions market was nearly 45% of the global application testing market until 2025. The market's growth during this period can be attributed to the increased demand for regression testing and addressing faults and malfunctions in applications across numerous devices.

| Attributes | Details |

|---|---|

| Mobile Application Testing Solution Market Value (2020) | USD 3.8 billion |

| Market Revenue (2025) | USD 7.9 billion |

| Market Historical Growth Rate (CAGR 2020 to 2025) | 13.9% CAGR |

Applications and data are becoming increasingly open and visible to external constituents, particularly customers, as a result of digital business and customer experience. Mobile testing trends and tactics change regularly to keep up with the changing demands of tech-savvy consumers and technological breakthroughs.

The expansion of the mobile application testing solutions market is being fueled by the increased popularity of m-commerce and the resulting increase in demand for mobile applications.

Applications from banking and financial institutes are likely to boost the adoption of mobile application testing services as several countries are initiating plans to digitize their economy through the adoption of mobile payment solutions.

The table below lists the countries with the most lucrative opportunities for mobile application testing solution providers.

| Regional Market Comparison | CAGR (2025 to 2035) |

|---|---|

| United States | 13.7% |

| Germany | 4.3% |

| Japan | 5.6% |

| Australia & New Zealand | 20.3% |

| China | 17.3% |

The mobile application testing services (MATS) market in the United States is anticipated to expand at a robust CAGR of 13.7% from 2025 to 2035. The country is also expected to account for over 89.5% of the total market share in the North American region.

Overall mobile application testing solutions spending in Germany is likely to increase at a rate of 4.3% from 2025 to 2035.

The mobile application testing solution industry in China is projected to expand at a CAGR of 17.3% through the projected years.

Demand for mobile application testing solutions in Japan is anticipated to thrive with a 5.6% CAGR in the upcoming ten years.

The combined region of Australia and New Zealand is expected to showcase an impressive CAGR of 20.3% over the forecast period.

Based on the solution type, the testing tool segment is estimated to garner a revenue of around 62% in 2025.

| Attributes | Details |

|---|---|

| Top Solution Type or Segment | Testing Tool |

| Market Share in 2025 | 62% |

Based on platforms, the Android mobile device segment is expected to generate a business opportunity of 38.9% in 2025.

| Attributes | Details |

|---|---|

| Top Platform Type or Segment | Android devices |

| Market Share in 2025 | 38.9% |

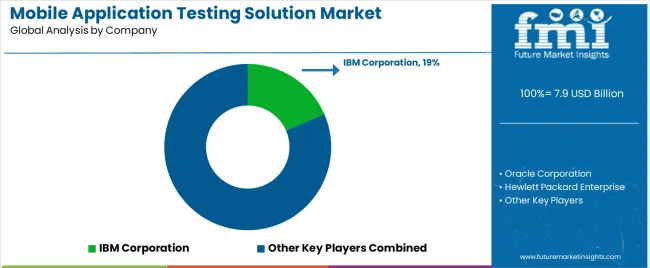

The overall market is moderately competitive as the leading software testing solution providers capture more than half of the market share. Leading developers are offering mobile application testing automation solutions that facilitate full visibility, which in turn enables testing teams to gain transparency across each issue in the application being tested.

Key providers of mobile application testing solutions are focusing on adding new innovative capabilities to their current testing solutions. This is helping them to enhance and upgrade their mobile application testing solutions portfolio.

Recent Developments in the Global Mobile Application Testing Solution Market

In April 2025, software testing platform Sofy introduced a novel mobile app testing solution SofySense. This new solution improves on Sofy's previous platform and combines artificial intelligence (AI) with no-code automation. It uses intelligent software testing with GPT integration to help with quality assurance (QA).

The platform's intelligent generative AI chatbot, Sofybot, provides precise and timely answers to particular test requests. The new tool can streamline software testing for software engineers freeing up testers to focus on other vital activities. According to Sofy, it can expedite product delivery timelines by 95%.

In May 2025, EMAS Mobile Testing introduced a cloud-based platform that offers mobile developers and businesses device testing services. Besides, offering a wide range of well-liked models, it also provides a round-the-clock service to assist app developers in identifying any hidden dangers such as software crashes, issues with compatibility, performance problems, and more. In addition, enhancing the quality of the app and user experience lowers user dropout and increases market competitiveness.

In June 2020, IBM announced the expansion of quantum computing efforts to Africa in a new collaboration with the University of the Witwatersrand (Wits University) in South Africa. Expanding the IBM Q Network to include Wits is expected to drive innovation to benefit African-based researchers.

In May 2020, SAP SE announced the project “Embrace,” a collaboration program with Microsoft Azure, Amazon Web Services, and Google Cloud as well as global strategic service partners (GSSPs). “Embrace” puts the customer’s move to SAP S/4HANA in the cloud in the language and context of their primary industry, by recommending the platform, software, and services.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 6.77 billion |

| Projected Market Size (2035) | USD 31.99 billion |

| Anticipated Growth Rate (2025 to 2035) | 16.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Type, By Platform, By Device, By End User Verticals, and By Region |

| Key Companies Profiled | Oracle Corporation; Hewlett Packard Enterprise; IBM Corporation; Microsoft Corporation; Cognizant Technology Solution Corp; SAP SE; Wipro Limited; CA Technologies; Symantec Corporation; Capgemini |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global mobile application testing solution market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the mobile application testing solution market is projected to reach USD 34.8 billion by 2035.

The mobile application testing solution market is expected to grow at a 16.0% CAGR between 2025 and 2035.

The key product types in mobile application testing solution market are services, _mobile app testing services, _consulting services, _support & maintenance, testing tools, _manual testing tool and _automated testing tool.

In terms of testing type, automated testing segment to command 63.7% share in the mobile application testing solution market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Market Analysis by Store Type, End-use, Region and Country: A Forecast from 2025 to 2035

Mobile Tracking Solution Market Size and Share Forecast Outlook 2025 to 2035

Application Crowdtesting Service Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Command and Control Solutions Market Size and Share Forecast Outlook 2025 to 2035

Compliance Testing Solutions Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Dissolution Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Application Integration Market Size and Share Forecast Outlook 2025 to 2035

Application Programming Interface (API) Security Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA