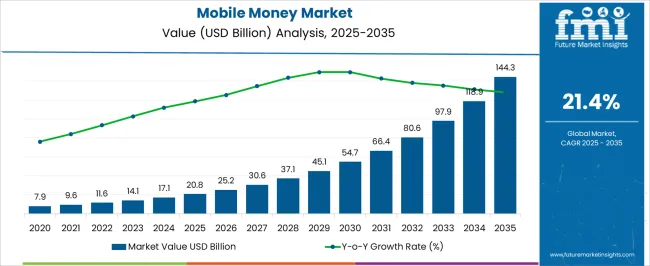

The Mobile Money Market is estimated to be valued at USD 20.8 billion in 2025 and is projected to reach USD 144.3 billion by 2035, registering a compound annual growth rate (CAGR) of 21.4% over the forecast period.

The Mobile Money market is experiencing significant growth driven by the increasing adoption of digital financial services, particularly in regions with limited access to traditional banking infrastructure. The future outlook of this market is shaped by the rising penetration of smartphones, internet connectivity, and government initiatives promoting cashless transactions. The demand for secure, fast, and convenient payment solutions has encouraged the adoption of mobile money platforms across consumer and commercial segments.

Technological advancements in mobile applications, encryption, and real-time transaction processing have enhanced user trust and experience, supporting sustained market expansion. Additionally, the growth of e-commerce, peer-to-peer payment needs, and cross-border remittances is further driving market development.

Financial inclusion programs and partnerships between telecom operators and financial institutions are accelerating the reach of mobile money services to previously underserved populations As digital payment ecosystems continue to evolve and regulatory frameworks mature, the Mobile Money market is expected to maintain strong growth, with increasing adoption across both emerging and developed economies.

| Metric | Value |

|---|---|

| Mobile Money Market Estimated Value in (2025 E) | USD 20.8 billion |

| Mobile Money Market Forecast Value in (2035 F) | USD 144.3 billion |

| Forecast CAGR (2025 to 2035) | 21.4% |

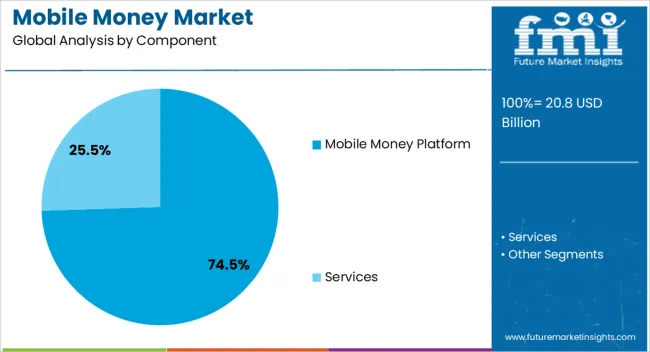

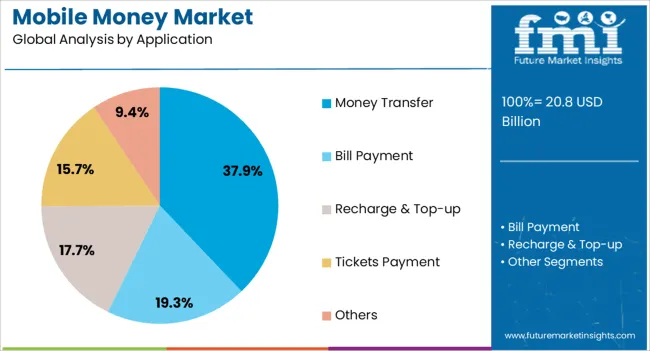

The market is segmented by Component and Application and region. By Component, the market is divided into Mobile Money Platform and Services. In terms of Application, the market is classified into Money Transfer, Bill Payment, Recharge & Top-up, Tickets Payment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Mobile Money Platform segment is projected to hold 74.5% of the Mobile Money market revenue share in 2025, making it the leading component. This dominance is driven by the platforms’ ability to provide a comprehensive digital payment infrastructure that supports multiple financial services, including money transfers, bill payments, and merchant transactions.

The high adoption of mobile money platforms is facilitated by their scalability, security features, and integration capabilities with banking and fintech systems. Increased consumer preference for convenient and cashless transactions has further reinforced the prominence of this segment.

Additionally, mobile money platforms are favored by businesses and service providers due to their ability to automate payment processes, enhance customer engagement, and reduce operational costs The consistent rollout of platform upgrades, enhanced user interfaces, and value-added services continue to expand the segment’s appeal, solidifying its position as the dominant component in the Mobile Money market.

The Money Transfer application segment is expected to account for 37.9% of the Mobile Money market revenue share in 2025, establishing it as the leading application. The growth of this segment is driven by the increasing need for secure, fast, and reliable domestic and cross-border remittance services.

Mobile money solutions provide users with convenient platforms to send and receive money without relying on traditional banking infrastructure, which is particularly impactful in regions with limited access to financial institutions. Technological enhancements, including real-time processing, fraud prevention, and user-friendly interfaces, have significantly improved transaction efficiency and trust, boosting adoption.

The segment has also benefited from the rising volume of international remittances and peer-to-peer transfers, which are critical for personal, commercial, and humanitarian purposes The continued expansion of mobile network coverage, smartphone penetration, and regulatory support for digital payments is expected to further drive the dominance of the Money Transfer application in the Mobile Money market.

Social Commerce is the New Vogue in the Market

Social media and commerce are converging, changing how people buy things. Mobile money apps are using this change by adding shopping features. This means people can buy and sell products right inside messaging apps or social media sites, without needing separate payment apps.

By doing this, mobile money apps make it easier for people to shop while they communicate. They're using the trust and familiarity people have with social media to make shopping simpler and more fun. This helps them get more users and more transactions on their apps.

By this conjunction, these apps are making shopping easier and more enjoyable for everyone, helping the market prosper.

Like, Stitch, a South African fintech startup launched WigWag in September 2025. WigWag is a social commerce payment platform that enables small businesses to accept digital payments via a unique payment link.

Cryptocurrencies are Being Integrated into Mobile Money Platforms

Mobile money platforms are now adding cryptocurrencies to their services, making it possible for people to use digital currencies alongside regular money. This is becoming popular because it offers a way to manage different types of money in one place.

It is particularly fascinating for those tech-savvy users who want to invest in digital assets and send money internationally with lower fees.

By including cryptocurrencies, the market highlights the necessity of staying adaptive and appealing to new users interested in digital money. This shows a move towards more modern and flexible financial services, meeting the changing needs of users in today's digital age.

Like, in April 2025, Fintopio, launched Fintopio DeFi Wallet. This wallet guarantees quick and easy switching between cryptocurrencies, integrates with other DeFi apps and wallets, and securely stores user deposits, giving users complete control over their assets.

| Segment | Mobile Money Platform (Component) |

|---|---|

| Value Share (2025) | 74.50% |

The mobile money platform segment holds the leading mobile money market shares in 2025. These platforms are rising because they are easy to use and make managing money simple. With just a smartphone and internet connection, users pay bills and send money to others quickly and safely.

This is especially helpful in places where traditional banks are not easy to access. Plus, mobile money apps usually have strong security measures to keep users' information safe. Because of these benefits, more people are choosing mobile money as their preferred way to handle finances, making it the leading component in the mobile money market.

| Segment | Money Transfer (Application) |

|---|---|

| Value Share (2025) | 37.90% |

The money transfer segment captured the leading mobile money market shares in 2025. Money transfer services are popular because they let people send and get money using just their phones. The process is easy and quick, making it handy for sending money to family, friends, or businesses.

Instead of going to a bank or using cash, individuals can just use their phones to transfer money. And because more people are connected globally now, there's a bigger need for fast and reliable ways to send money to different places. That's why money transfer services are preferred in the mobile money market.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 21.40% |

| Germany | 15.70% |

| Japan | 16.90% |

| China | 23.50% |

| Australia & New Zealand | 20.90% |

Market demand for mobile money services in the United States will amplify at a 21.40% CAGR by 2035. More people have begun using contactless payments, like Apple Pay and Google Pay. Mobile money platforms are helping with this shift, making transactions easy and safe.

This trend gives mobile money providers a chance to become trusted partners for both stores and customers. Also, new digital banks are changing how people do banking. Mobile money providers can work with these banks or make their digital banking services.

Apply Pay, PayPal, and Google Pay are prominently used in the United States. These mobile money platforms partner with banks and financial institutions to grow.

Mobile money service providers can benefit from the 15.70% CAGR anticipated for the market in Germany till 2035. Germany's move towards a cashless society is driven by changing consumer preferences, technology, and regulations favoring digital payments.

Mobile money providers are seizing this opportunity by offering innovative solutions tailored to German needs, positioning themselves as key players. Integration with public transit systems enhances convenience, while strong data privacy measures align with Germany's stringent regulations.

Exploring digital identity solutions and expanding into cash-heavy industries further solidifies their foothold. Partnerships with traditional financial institutions enable them to offer a broader range of services, leveraging trust and expertise. This strategic approach reflects the evolving landscape of digital finance in Germany, shaping the future of payments in the country.

The industry report on mobile money indicates expansion at a 16.90% CAGR in Japan until 2035. Japan's transit system and use of contactless payments give mobile money providers a chance to make their platforms work with trains and buses, which makes things easier for commuters. Also, they can make services that are easy for older people to use, which shows they care about everyone.

Working with shops helps get more people to use mobile payments, which goes along with the government's plan to use less cash. Helping people send money to other countries online is another way mobile money providers can grow. Making sure only the right people can access accounts by using biometrics can provide opportunities in the market.

Market demand for mobile money services in China will escalate at a 23.50% CAGR until 2035. In China, big companies like Alipay and WeChat Pay are in charge of mobile payments. People use QR codes a lot to pay for things. The government helps mobile payments grow by supporting new ideas.

Mobile payments are now in rural areas, too, where banks aren't common. They're also part of social media and games, so it's easy to pay while having fun. These companies keep coming up with new ways to help with money, like saving and borrowing.

The industry report on mobile money indicates expansion at a 20.90% CAGR in Australia & New Zealand till 2035. In Australia and New Zealand, mobile money providers like PayPal, Apple Pay, and Google Pay, are helping tourists by offering services for international payments and currency exchange. They're also benefiting from rules that encourage new ideas, like open banking.

By focusing on making sure everyone can use their services, they're reaching out to people who might not have easy access to banks, like those in rural areas or with disabilities. Partnering with retail stores and new tech companies is also helping them make their services better and reach more people.

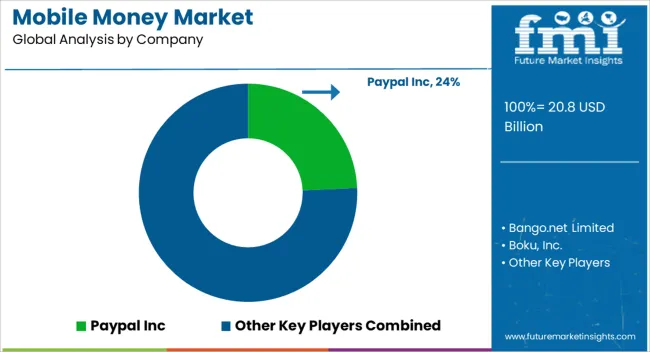

The mobile money industry is competitive, with established firms like as PayPal, Alipay, and WeChat Pay leading the way. They benefit from strong brand awareness and a large user base. However, firms such as Square, Venmo, and Cash App are challenging the market with new capabilities and easy-to-use interfaces.

Traditional financial institutions have also entered the game, investing in digital transformation to compete. This environment is further shaped by regulatory dynamics, technology improvements, and altering consumer habits, which drive innovations in the market.

Recent Developments

The global mobile money market is estimated to be valued at USD 20.8 billion in 2025.

The market size for the mobile money market is projected to reach USD 144.3 billion by 2035.

The mobile money market is expected to grow at a 21.4% CAGR between 2025 and 2035.

The key product types in mobile money market are mobile money platform and services.

In terms of application, money transfer segment to command 37.9% share in the mobile money market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Broadband Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Mobile Enterprise Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Analytics Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robotics Software Market Size and Share Forecast Outlook 2025 to 2035

Mobile Notary Public Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA