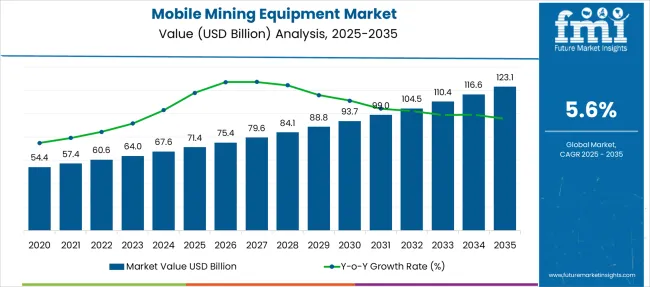

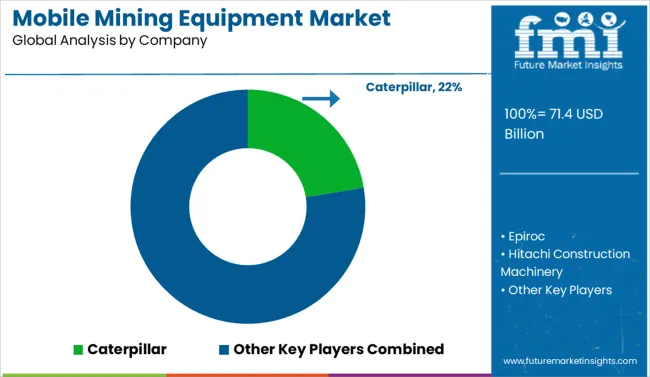

The Mobile Mining Equipment Market is estimated to be valued at USD 71.4 billion in 2025 and is projected to reach USD 123.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period. This translates to a 1.72x expansion with a CAGR of 5.6%, driven by increasing mechanization across surface and underground operations. The compound absolute growth reveals sustained demand for high-capacity machinery such as haul trucks, hydraulic shovels, and underground loaders in both greenfield and brownfield projects.

By 2030, the market is expected to reach approximately USD 93.9 billion, reflecting a USD 22.5 billion gain in the first five years. The second half of the decade is projected to contribute a larger portion of the compound growth, adding about USD 29.2 billion, or 56% of the total gain. This indicates an accelerated adoption pattern during the latter phase, supported by the rise of autonomous equipment fleets and data-integrated machine performance systems.

Firms such as Komatsu, Sandvik, and Epiroc have been expanding product lines with electrified platforms, real-time diagnostics, and AI-enabled fleet coordination. Growth in compound terms reflects not only increased unit sales but also higher equipment value per unit due to digital control modules, remote operability, and stricter emissions compliance embedded in newer models.

The industry accounts for approximately 58% of the mining equipment market, due to high deployment of drills, loaders, haul trucks, and bulldozers in active mining sites. It holds nearly 46% of the surface and underground mining solutions market, where mobile units support ore recovery and material transportation. The construction and heavy machinery market includes around 24% of mobile mining equipment demand, mostly for earthmoving tasks in mining infrastructure development. About 30% of the resource extraction and material handling market is linked to mobile units that manage in-pit movement, overburden removal, and mineral stockpiling. The industrial machinery and equipment market reflects an 18% share, where mobile platforms integrate with broader mechanical systems used in resource-based operations.

The sector is undergoing major advancements as electrification, automation, and data-driven operations redefine industry practices. Battery-electric and hybrid vehicles are replacing diesel-powered machines to meet emission regulations and reduce operating costs. Autonomous haul trucks and drilling systems are being deployed to enhance safety and productivity in both open-pit and underground mines. Advanced telematics and IoT-enabled sensors allow real-time monitoring, predictive maintenance, and remote diagnostics, minimizing downtime and optimizing fleet utilization. Modular machine designs are improving transportability and scalability across mining sites. These trends are reshaping equipment lifecycles, procurement strategies, and workforce requirements across the global mining sector.

| Metric | Value |

|---|---|

| Mobile Mining Equipment Market Estimated Value in (2025E) | USD 71.4 billion |

| Mobile Mining Equipment Market Forecast Value in (2035F) | USD 123.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The mobile mining equipment market is experiencing steady growth, driven by increasing global demand for minerals, metals, and fossil fuels required to support industrialization and infrastructure development. As mining operations scale in size and complexity, the demand for efficient, high-capacity mobile equipment continues to rise.

Equipment such as haul trucks, loaders, and drills are central to ensuring operational productivity and reducing cycle times. Although sustainability is becoming a growing concern, diesel-powered machines continue to dominate due to their power efficiency and suitability for heavy-duty applications in harsh terrains.

The outlook remains positive as key players invest in automation, predictive maintenance, and hybrid power integration to improve safety, efficiency, and environmental performance. With ongoing mining projects and capacity expansions across Asia-Pacific, Latin America, and Africa, the market is well-positionedfor continued advancement driven by both commodity demand and equipment innovation.

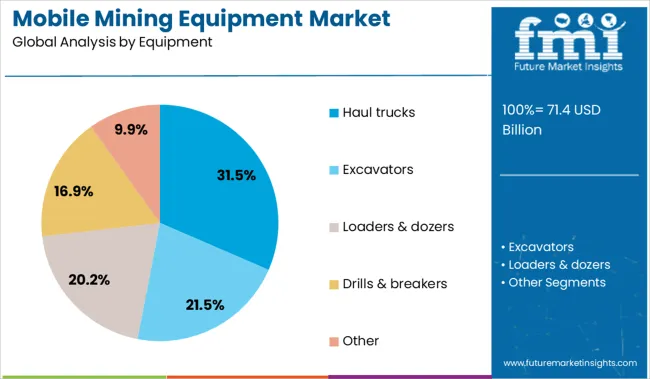

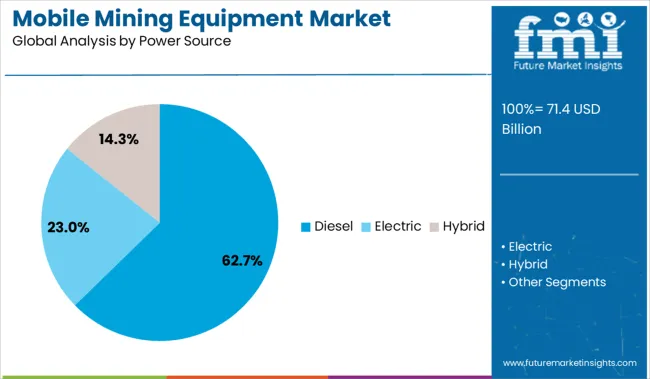

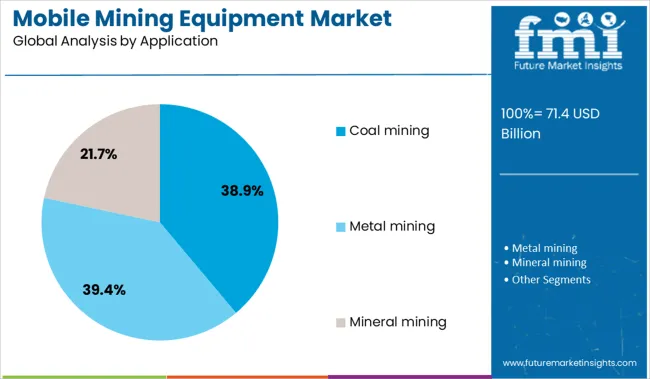

The mobile mining equipment market is segmented by equipment type, power source, application, end use, and region. By equipment, it includes haul trucks, excavators, loaders and dozers, drills and breakers, and other machinery essential for mining operations. In terms of power source, the segmentation comprises diesel, electric, and hybrid options, reflecting the growing adoption of energy-efficient alternatives. Based on application, the market is categorized into coal mining, metal mining, and mineral mining, indicating its presence across key resource extraction activities. By end use, it covers mining companies, contract miners, government and regulatory bodies, and equipment rental companies. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The haul trucks segment leads the equipment category with a 31.5% market share, highlighting its critical function in large-scale material transportation across mining operations. These trucks are integral to high-volume haulage, capable of moving significant loads of ore, overburden, and coal efficiently over extended distances.

The segment has gained traction due to advancements in payload capacity, fuel efficiency, and autonomous driving technologies, which enhance productivity and safety. OEMs are focusing on integrating onboard diagnostics, GPS-based fleet tracking, and predictive maintenance systems to minimize downtime and extend asset lifespans.

Demand is further supported by open-pit mining projects where haul trucks play a central logistical role. As mining companies prioritize cost-efficiency and operational scalability, haul trucks are expected to retain their leadership in the equipment category, driven by both fleet expansions and technology upgrades.

The diesel segment holds a dominant 62.7% market share within the power source category, underscoring its continued relevance in powering mobile mining equipment across global operations. Diesel engines are preferred for their high torque output, fuel economy, and reliability in extreme mining environments.

Despite growing interest in electrification and hybrid technologies, diesel remains the default power source due to its ability to handle heavy loads over long operating hours without the limitations of battery life or charging infrastructure. Continuous innovation aimed at reducing emissions and improving fuel efficiency has enabled diesel equipment to comply with evolving environmental standards, extending its lifecycle viability.

As mining activities intensify in remote locations with limited grid access, the robustness and autonomy offered by diesel-powered machinery are expected to sustain its market dominance over the near to medium term.

Coal mining leads the application category with a 38.9% market share, reflecting the high volume of mobile equipment deployed in both surface and underground coal extraction. Despite the global shift toward cleaner energy, coal remains a primary energy source in many emerging economies, supporting sustained mining operations.

The need for efficient excavation, haulage, and transportation of large coal volumes drives the segment’s demand for mobile equipment. Haul trucks, drills, and loaders are frequently deployed across coal mines to maintain high productivity and reduce manual labor.

Government-backed coal production targets in countries such as India and China continue to generate significant equipment procurement activity. The segment is expected to maintain its strong presence as coal remains critical to power generation and industrial processes in key global markets, especially where renewable adoption is still in transition.

Mobile mining equipment is being rapidly adopted as operators deepen pits and upgrade fleet capacity. In 2024, orders for 220-320 ton haul trucks rose by 17% year-on-year, with electric and hybrid formats accounting for 15% of new builds. Leasing activity jumped 21% in Southeast Asia and sub-Saharan Africa. OEMs now include remote-enabled loaders and drill rigs across 60% of deliveries. Real-time analytics for load, fuel burn, and idle time have cut onsite inefficiencies by over 13%. Market momentum is shaped by synchronized upgrades in haul road infrastructure and fleet telematics integration across mining platforms.

Operators are accelerating haulage modernization through electrification and real-time fleet monitoring. Battery-electric haul trucks are reducing diesel consumption by 35% during full payload cycles, while loaders fitted with torque sensors optimize bucket fill rates. Autonomous drifts increased from 11 to 18% of all rotary drill rigs in high-grade metal mines. Fleet telematics now stream vibration, hydraulic pressure, and tire load data continuously, flagging anomalies before downtime occurs. In regions with renewable microgrids, electric units align with power availability to reduce grid demand charges. Together, these measures have lowered fuel and maintenance expenditure by 21% across pilot fleets.

Field teams continue to face downtime due to parts delays, abrasive conditions, and weak support networks. In high-gradient operations exceeding 12%, transmission rebuilds increased by 19% and undercarriage components failed 22% faster than expected. OEM backlog for axle and hydraulic cylinders in remote markets averaged 5.5 weeks, delaying unit readiness. Retrofits on non-factory EV conversions report 13% integration failure rates, mainly due to mismatched battery management systems. Smaller operations in Latin America and Central Asia note a 9-11 day increase per repair event due to a lack of certified electronic technicians. These gaps are constraining fleet homogeneity and ROI on modernized assets.

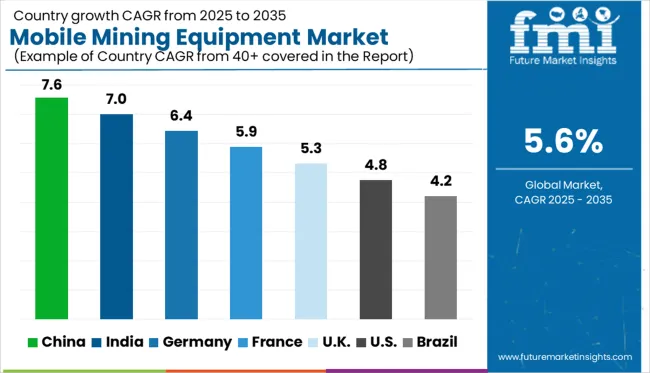

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global mobile mining equipment market is projected to grow at a CAGR of 5.6% between 2025 and 2035. Germany (OECD) leads with 6.4%, exceeding the global average by 0.8 percentage points, supported by steady demand for haul trucks and underground loaders. France (OECD) follows at 5.9%, while the UK (OECD) records 5.3%, placing it slightly below the global rate. The United States (OECD) stands at 4.8%, reflecting a more gradual replacement of older fleets. Brazil (BRICS) trails at 4.2%, lagging by 1.4 points, shaped by variable equipment cycles in its mining regions. Domestic extraction volumes, regulatory shifts, and OEM investments in next-generation machinery influence growth differences across these countries. The report features insights from 40+ countries, with the top countries shown below.

Germany’s mobile mining equipment market is projected to grow at a CAGR of 6.4% from 2025 to 2035, exceeding the global average by 0.8%. Fleet renewal has been most active in lignite and potash regions, where large surface operations rely on load-haul-dump units and battery-electric loaders. Equipment localization has improved lead time predictability, allowing faster fleet upgrades. Remote diagnostics and automation are gaining wider adoption in regions like Brandenburg and Saxony due to rising operating costs and labor shortfalls. Demand for low-emission units is expected to accelerate across brown coal extraction sites, but hard coal decline continues to drag on segment-specific volumes. OEM presence is shifting toward modular platforms with faster deployment timelines across the 20-40 tonne capacity band.

France is expected to register a 5.9% CAGR in mobile mining equipment between 2025 and 2035, placing it 0.3% above the global average. A rise in mineral activity in Nouvelle-Aquitaine and Occitanie has raised demand for tracked shovels, articulated haulers, and mobile screens. Engine regulation compliance has driven significant upgrades, particularly in Tier IV and Stage V categories. Mid-sized operators are increasingly shifting toward leasing to reduce capex burden while maintaining fleet availability. Integration of torque-sensing drills and auto-alignment crushers has been observed in shallow-depth quarries. OEM service programs have improved reach, but parts availability continues to affect rebuild cycles. Equipment utilization rates remain high in regional operations with constrained output targets.

The UK’s mobile mining equipment market is forecast to grow at a CAGR of 5.3% from 2025 to 2035, trailing the global average by 0.3%. Market demand is largely centered around aggregates and gypsum extraction in Northern England and Scotland. Compact loaders and articulated haulers dominate procurement lists, particularly under the 30-tonne class. Import volumes from East Asian OEMs surged in 2024 as buyers prioritized upfront cost over fleet origin. Predictive diagnostics adoption has grown in Welsh operations, improving asset uptime. Equipment financing remains tight, but extended service contracts are supporting sales. Contractors continue shifting toward telemetry-enabled machines for better compliance reporting and on-site tracking.

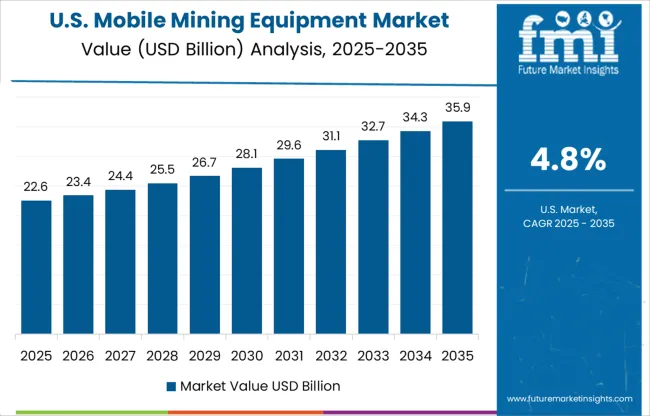

The USA market is expected to expand at a 4.8% CAGR from 2025 to 2035, 0.8% below the global average. Demand is fragmented, with lithium and sand mining showing growth while coal and iron ore lag. Automation pilots are active in Arizona, Nevada, and Montana, particularly for haul trucks and modular drills. Federal incentives have accelerated the deployment of hybrid equipment, though replacement activity remains subdued. Refurbished fleet sales are increasing among independent operators, and warranty-backed pre-owned units are contributing to broader coverage. In copper mines, plug-and-play drilling platforms are improving operational uptime and drill cycle efficiency. Demand from lithium projects has exceeded projections due to electric mobility demand.

Brazil’s mobile mining equipment market is expected to grow at a 4.2% CAGR between 2025 and 2035, 1.4% below the global average. Iron ore and bauxite continue to drive the bulk of equipment demand, but delays in port and road upgrades have slowed fleet replacement. Localized assembly programs are seeing moderate success, especially for mid-range crawler dozers and haulers. Lithium extraction in Goiás and Bahia has triggered fresh demand for compact tracked equipment and electric drills. Import taxes remain a challenge, though incentives in Minas Gerais have shifted some procurement toward battery-powered platforms. Fleet life extension is still dominant, especially among second-tier operators using legacy diesel machines.

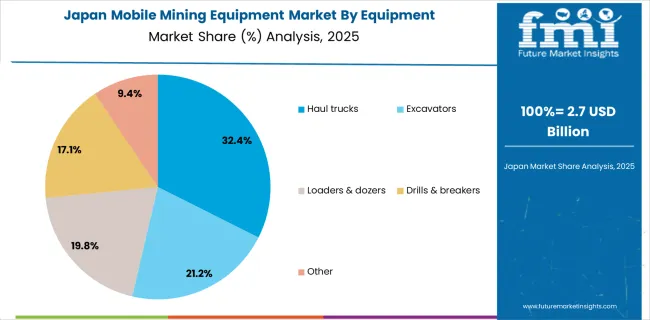

In 2025, the demand for mobile mining equipment in Japan is forecasted to be valued at USD 2.7 billion, representing around 3.8% of the USD 71.4 billion global market. Haul trucks lead the segment with a 32.4% share (approx. USD 874.8 million), followed by excavators at 21.2% (about USD 572.4 million). Loaders and dozers contribute 19.8% (nearly USD 534.6 million), while drills and breakers account for 17.1% (around USD 461.7 million). The remaining 9.4% (USD 253.8 million) comes from other equipment.

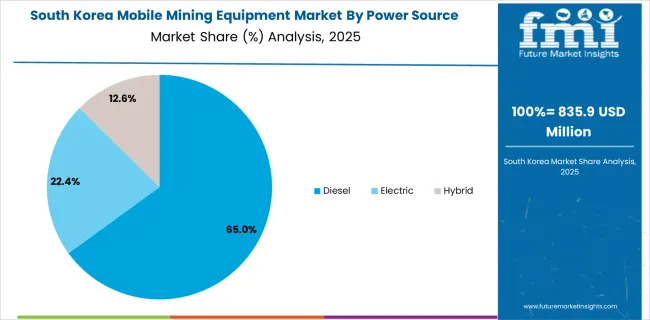

The mobile mining equipment market in South Korea is projected to be valued at USD 835.9 million in 2025, forming about 1.2% of the global market worth USD 71.4 billion. Diesel-powered machines dominate the segment with a 65.0% share, translating to approximately USD 543.3 million, mainly due to their robustness in intensive excavation. Electric-powered models hold a 22.4% share (~USD 187.2 million), gaining relevance for eco-compliant operations. Hybrid equipment makes up 12.6% or nearly USD 105.4 million, serving as a middle ground.

The global mobile mining equipment market is dominated by established OEMs with strong manufacturing footprints, dealer networks, and advanced technology integration. Caterpillar sets the global standard with a comprehensive portfolio of haul trucks, loaders, and autonomous haulage systems, leveraging predictive maintenance and data-driven performance monitoring to deliver operational continuity. Komatsu and Hitachi Construction Machinery maintain significant market share globally, emphasizing durability, hybrid-electric powertrains, and semi-autonomous solutions tailored for surface and underground operations.

Sandvik and Epiroc lead in underground mining, focusing on drill rigs, loaders, and battery-electric equipment designed for zero-emission tunneling. Their technological leadership supports compliance with stricter safety and environmental regulations in deep mining projects. Liebherr delivers ultra-large excavators and high-capacity trucks for deep-pit and bulk operations, while Volvo Construction Equipment differentiates with modular machine configurations and operator-focused ergonomics.

Emerging Chinese and Indian players such as Sany, XCMG, and Bharat Earth Movers Ltd. (BEML) compete on pricing flexibility and regional customization for mid-scale mines in Asia, Africa, and Latin America. The market is shaped by high capital barriers, regulatory compliance, and long equipment lifecycles, which make automation readiness, electrification strategies, and strong aftermarket services key competitive levers.

Key Developments in the Mobile Mining Equipment Market

Caterpillar and Komatsu are scaling autonomous haulage platforms, while Sandvik and Epiroc invest in battery-electric underground vehicles to meet zero-emission mandates. Liebherr and Volvo focus on hybrid-electric drive systems for sustainability and cost optimization. Partnerships with digital solution providers enable OEMs to offer connected mining ecosystems, integrating telematics, remote monitoring, and performance analytics. Players are also expanding localized service hubs and parts distribution networks to secure long-term maintenance contracts, enhancing lifecycle value and customer retention globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 71.4 Billion |

| Equipment | Haul trucks, Excavators, Loaders & dozers, Drills & breakers, and Other |

| Power Source | Diesel, Electric, and Hybrid |

| Application | Coal mining, Metal mining, and Mineral mining |

| End Use | Mining companies, Contract miners, Government & regulatory bodies, and Equipment rental companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, Epiroc, Hitachi Construction Machinery, Komatsu, Liebherr, Sandvik, Sany, Terex, Volvo Construction Equipment, and XCMG |

| Additional Attributes | Dollar sales by equipment type and mining method, growing demand in surface mining and contract mining operations, stable utilization in underground extraction and mineral transport, innovations in autonomous haulage systems and battery-electric vehicles improve productivity and emissions control |

The global mobile mining equipment market is estimated to be valued at USD 71.4 billion in 2025.

The market size for the mobile mining equipment market is projected to reach USD 123.1 billion by 2035.

The mobile mining equipment market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in mobile mining equipment market are haul trucks, excavators, loaders & dozers, drills & breakers and other.

In terms of power source, diesel segment to command 62.7% share in the mobile mining equipment market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA