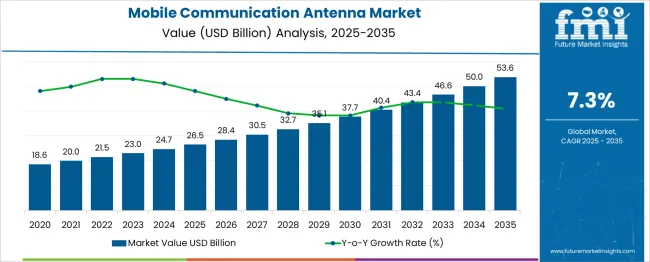

The Mobile Communication Antenna Market is estimated to be valued at USD 26.5 billion in 2025 and is projected to reach USD 53.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period. A half-decade weighted growth analysis highlights key periods of expansion. Between 2025 and 2030, the market grows from USD 26.5 billion to USD 37.7 billion, adding USD 11.2 billion in value, reflecting a CAGR of 8.0%. This phase represents the largest share of the market's growth, driven by increasing demand for mobile connectivity, 5G infrastructure deployment, and advancements in antenna technologies.

The market experiences a significant surge as mobile network operators worldwide invest heavily in expanding and upgrading their networks to support higher bandwidths and faster communication speeds. From 2030 to 2035, the market continues to grow at a more moderate pace, moving from USD 37.7 billion to USD 53.6 billion, contributing USD 15.9 billion in growth, with a CAGR of 6.2%. This period sees a deceleration in growth as the 5G rollout matures, but the market remains buoyed by continued innovations in antenna design and demand for enhanced communication systems across diverse industries, including automotive, IoT, and enterprise networks. Overall, the Half-Decade Weighted Growth analysis shows a strong initial surge followed by steady, sustained growth as the market matures.

| Metric | Value |

|---|---|

| Mobile Communication Antenna Market Estimated Value in (2025 E) | USD 26.5 billion |

| Mobile Communication Antenna Market Forecast Value in (2035 F) | USD 53.6 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The mobile communication antenna market is expanding steadily due to growing investments in 5G deployment, increased mobile data traffic, and the need for high-speed connectivity in urban and rural environments. Rapid expansion of cellular infrastructure, coupled with the need for consistent signal strength across wide areas, has elevated the demand for advanced antenna solutions.

Antenna systems are becoming more compact, efficient, and adaptive to frequency variation, supporting multi-band operations and MIMO (Multiple-Input, Multiple-Output) technologies. In parallel, integration with IoT devices, smart city infrastructure, and autonomous transportation networks is reinforcing antenna demand across varied use cases.

As communication standards evolve, particularly in emerging markets, the reliance on cost-effective and high-gain antennas will continue to drive innovation and volume growth.

The mobile communication antenna market is segmented by antenna, application, frequency, end use, and geographic regions. The mobile communication antenna market is divided into Omnidirectional and Directional. In terms of application, the mobile communication antenna market is classified into Base station, Mobile device antennas, Indoor distributed antennas, and small cell antennas. Based on frequency, the mobile communication antenna market is segmented into below 6 GHz, 6 GHz to 24 GHz, 24 GHz to 100 GHz, and above 100 GHz. The end use of the mobile communication antenna market is segmented into Telecom infrastructure, IoT and smart devices, Automotive, Defence, and others. Regionally, the mobile communication antenna industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

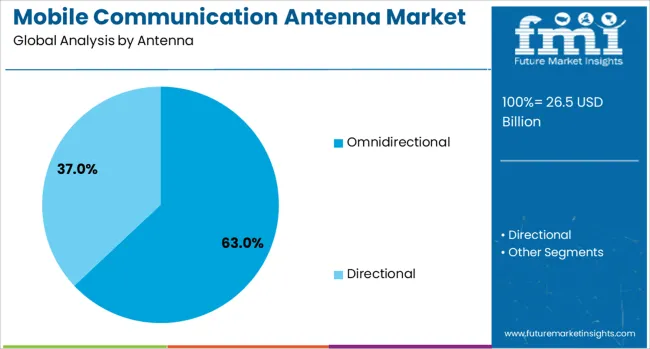

Omnidirectional antennas are expected to capture 63.0% of the market share in 2025, making them the leading antenna type in mobile communication applications. Their ability to radiate signals uniformly in all horizontal directions makes them especially valuable for broad coverage in base stations, remote areas, and distributed networks.

They offer simplicity in installation and provide reliable performance for users moving in different directions, ideal for mobile networks and fixed wireless access points.

Their cost-effectiveness and reduced need for complex alignment make them the preferred option for efficiently expanding macro and micro cell coverage.

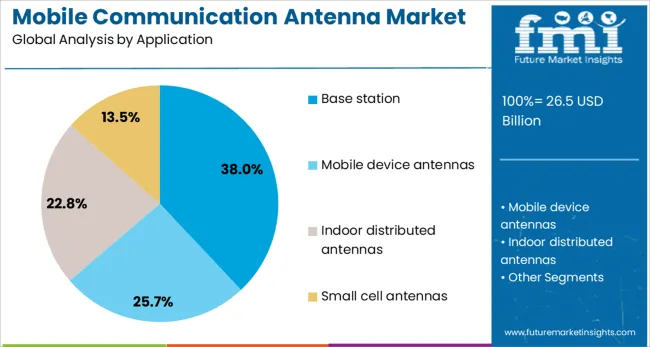

The base station segment is projected to lead the market with a 38.0% share by 2025. As base stations serve as critical nodes in telecom infrastructure, the continuous rollout of 5G and densification of 4G LTE networks is increasing the requirement for high-performance antennas that can handle growing traffic loads.

Base station antennas must support high data throughput, reduce interference, and maintain optimal network uptime.

Advanced configurations like sector antennas and smart antennas are enhancing performance, while infrastructure sharing among telecom providers is amplifying the number of antenna installations per site.

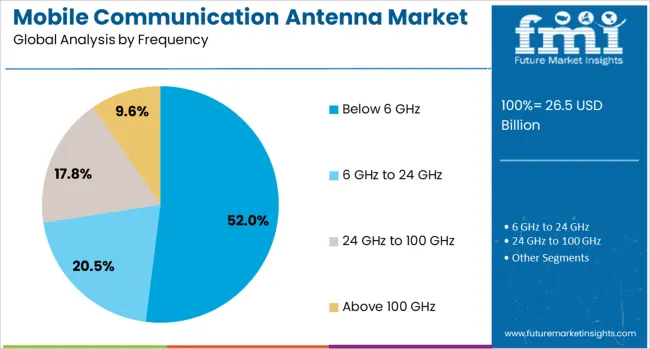

The below 6 GHz frequency band is anticipated to hold a dominant 52.0% market share in 2025. This range remains crucial for balancing coverage and capacity, offering wider area reach with fewer towers while ensuring satisfactory data rates.

It forms the backbone of early 5G rollouts and continues to support existing 4G LTE networks. Operators favor this band due to its propagation characteristics, ability to penetrate buildings, and compatibility with legacy infrastructure.

As networks evolve, below 6 GHz will continue to be indispensable for nationwide and semi-urban deployments that demand reliability and scalability.

The mobile communication antenna market is integral to the development of wireless communication networks, enabling connectivity for mobile phones, tablets, and other wireless devices. With the rise of mobile data consumption, the market has witnessed a surge in demand for high-performance antennas that support technologies like 4G, 5G, and beyond. These antennas are used in a variety of applications, including base stations, mobile handsets, and vehicle-mounted systems. As the world moves toward faster and more reliable mobile communication systems, the mobile communication antenna market is experiencing rapid growth, driven by the need for greater data throughput, expanded coverage, and improved signal quality.

The demand for mobile communication antennas is being largely driven by the global rollout of 5G technology. As 5G networks promise faster internet speeds, lower latency, and higher data transfer rates, there is a significant push for advanced antennas that can handle higher frequencies and support complex network topologies. Massive MIMO (Multiple-Input Multiple-Output) antennas and small cells, which enable efficient data transmission in dense urban areas, are becoming crucial components in this transition. As 5G technology spreads, mobile operators are investing heavily in upgrading their antenna systems to meet the increasing demand for data-intensive applications and seamless connectivity.

Technological advancements are playing a pivotal role in the evolution of mobile communication antennas. Innovations like beamforming technology, which allows antennas to focus signals more precisely, have significantly improved network performance and user experience. Furthermore, the development of smart antennas, capable of adapting to changing network conditions and minimizing interference, is making mobile networks more efficient. The integration of antennas into smaller, more compact devices is also crucial as mobile operators continue to move toward densifying networks. Antennas that can operate across a broad spectrum of frequencies, including those used by 5G, are expected to dominate the market, pushing manufacturers to invest in research and development.

While the mobile communication antenna market is growing, several challenges could limit its expansion. The installation and maintenance of antennas, particularly in rural or hard-to-reach areas, can incur significant costs. The infrastructure required for 5G deployment, including the installation of small cells and base stations, is expensive and complex. Moreover, the ongoing operational costs related to maintaining antennas, replacing outdated units, and upgrading network technology further add to the financial burden. In regions with limited resources or less developed telecommunications infrastructure, these costs may act as a barrier to the widespread adoption of advanced antenna technologies.

The integration of smart antennas is a major trend shaping the future of the mobile communication antenna market. Smart antennas, which can dynamically adjust their signal transmission patterns, offer the flexibility to meet the evolving demands of 5G and beyond. With features like beamforming and adaptive steering, these antennas can provide enhanced coverage, capacity, and signal quality, especially in high-density environments. The rollout of 5G networks has accelerated the development and deployment of smart antennas, as they are essential for supporting the high-frequency bands that 5G operates on. As the world moves toward even more advanced communication technologies, smart antennas are expected to play a critical role in the evolution of mobile networks, providing improved performance and efficiency.

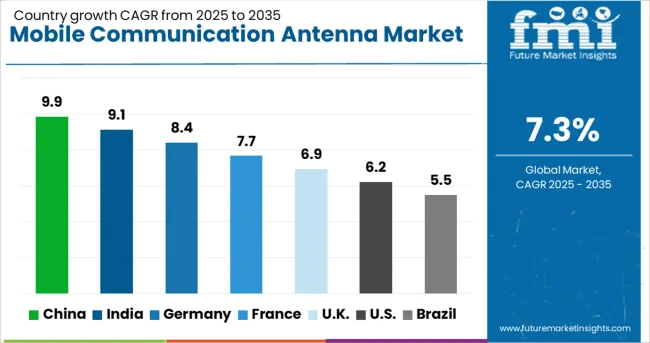

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The mobile communication antenna market is projected to grow at a CAGR of 7.3% from 2025 to 2035. China leads at 9.9%, followed by India at 9.1%, and Germany at 8.4%. The United Kingdom records 6.9%, while the United States stands at 6.2%. Growth in BRICS nations like China and India is driven by increasing mobile network penetration, 5G deployment, and the rapid expansion of mobile infrastructure. In OECD markets such as Germany, the UK, and the USA, steady growth is driven by demand for advanced antennas for 5G networks and the adoption of mobile communication technologies across various sectors. The analysis spans over 40+ countries, with the top countries shown below.

China is expected to grow at a CAGR of 9.9% through 2035, driven by its vast mobile communications infrastructure and rapid 5G deployment. As the world’s largest mobile market, China’s demand for mobile communication antennas is fueled by the massive scale of mobile network infrastructure, particularly in urban areas. The country’s investments in 5G technologies and the expansion of mobile services in rural and remote areas are key factors contributing to this growth. China’s mobile communication companies, including state-owned telecom giants, are increasingly adopting advanced antennas to support next-generation wireless communication standards.

India is projected to grow at a CAGR of 9.1% through 2035, driven by the rapid expansion of mobile communication infrastructure and the growing demand for 5G networks. With increasing internet penetration, the demand for mobile communication services is surging, leading to the adoption of advanced antenna systems. The Indian government’s push towards 5G rollout and smart city initiatives also contributes significantly to the demand for mobile communication antennas. Additionally, the increasing mobile data consumption, urbanization, and government investment in telecommunication infrastructure further fuel the market’s growth.

Germany is projected to grow at a CAGR of 8.4% through 2035, with mobile communication antenna demand increasing due to 5G network rollout and growing mobile data consumption. The automotive and industrial sectors are key drivers of the market, as more connected devices, vehicles, and infrastructure require reliable mobile communication. Germany's strong position in the European automotive sector and its focus on Industry 4.0 further push the demand for mobile communication antennas. Germany’s highly developed telecom infrastructure and growing focus on 5G technology adoption across the country also support this market expansion.

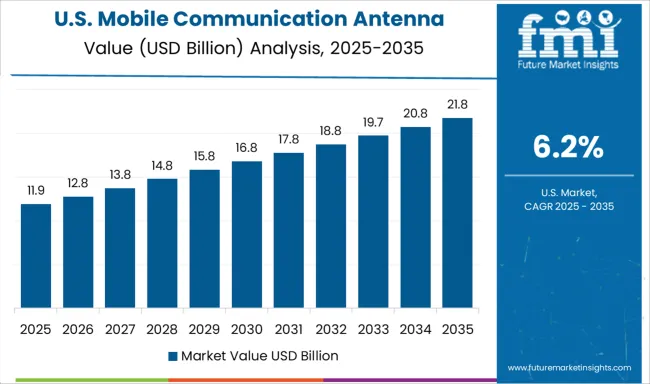

The United States is projected to grow at a CAGR of 6.2% through 2035, with demand primarily driven by 5G deployment and mobile network expansion. The USA is heavily investing in the development of 5G networks, leading to increased demand for advanced mobile communication antennas. This trend is amplified by the growing need for mobile services, including high-speed data and IoT connectivity. The rapid urbanization of the USA population, along with expanding smart city projects and autonomous vehicle development, further supports the demand for these antennas.

The United Kingdom is projected to grow at a CAGR of 6.9% through 2035, driven by the demand for advanced mobile communication antennas in support of the country’s 5G infrastructure and digital transformation. The UK is heavily investing in 5G technology, which is increasing the demand for high-performance mobile antennas to support improved wireless communication speeds. Additionally, the UK government’s initiatives to increase broadband access and improve network infrastructure drive the market for communication antennas. The growing number of connected devices and IoT applications across urban areas further supports this demand.

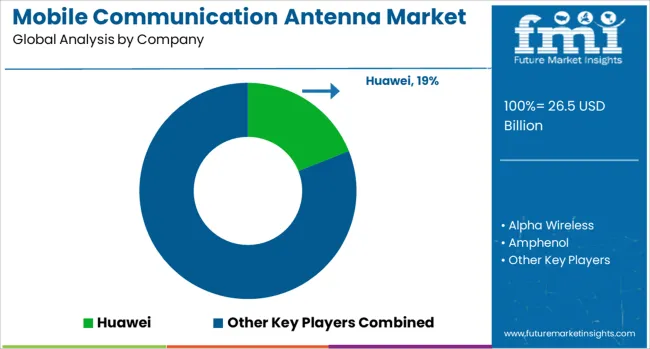

The mobile communication antenna market is led by major players specializing in advanced antenna solutions for mobile networks, wireless communication, and IoT applications. Huawei and Ericsson are market leaders, offering a wide range of mobile communication antennas that support 4G, 5G, and future wireless technologies. Their product portfolios include solutions for both urban and rural network coverage, catering to telecommunications providers and mobile network operators globally. Nokia also holds a significant share, providing comprehensive antenna systems designed for high-performance wireless communication, with a strong focus on 5G network deployment. Alpha Wireless and Amphenol are key players known for their high-quality antennas used in mobile, broadband, and wireless communication systems.

CommScope focuses on providing antenna solutions for next-generation mobile networks, including smart antennas for 5G and beyond. PCTEL offers antennas optimized for mobile broadband applications, with a focus on network optimization and performance. ZTE and Qualcomm contribute to the market by providing integrated antenna systems for mobile and IoT applications, with Qualcomm focusing on developing antennas for next-generation wireless technologies, including 5G and beyond. Competitive differentiation in this market is driven by factors such as antenna efficiency, design innovation, frequency range, and compatibility with new wireless technologies like 5G. Barriers to entry include high R&D costs, regulatory standards, and the need for partnerships with network providers. Strategic priorities include advancing multi-band, high-efficiency antennas, expanding 5G antenna solutions, and developing future-proof products for IoT and connected devices.

The development of advanced antenna solutions for 5G networks and small cells is crucial to meet the rising demand for high-speed, reliable connectivity. Strategic alliances with telecom operators and network providers enable the integration of state-of-the-art technologies. Manufacturers are also targeting emerging markets by localizing production and distribution to meet regional needs efficiently. Furthermore, there is an emphasis on designing energy-efficient and environmentally friendly antennas that maintain high performance while addressing sustainability concerns.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.5 Billion |

| Antenna | Omnidirectional and Directional |

| Application | Base station, Mobile device antennas, Indoor distributed antennas, and Small cell antennas |

| Frequency | Below 6 GHz, 6 GHz to 24 GHz, 24 GHz to 100 GHz, and Above 100 GHz |

| End Use | Telecom infrastructure, IoT and smart devices, Automotive, Defence, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huawei, Alpha Wireless, Amphenol, CommScope, Ericsson, Nokia, PCTEL, Qualcomm, and ZTE |

| Additional Attributes | Dollar sales by antenna type (smart antennas, phased array antennas, MIMO antennas, small-cell antennas) and end-use segments (telecommunications, automotive, IoT, military, consumer electronics). Demand dynamics are driven by the increasing rollout of 5G networks, the growing adoption of connected devices, and the expanding use of mobile broadband services. Regional trends show North America and Europe leading 5G antenna adoption, while Asia-Pacific remains a significant production hub and is experiencing strong growth driven by 5G deployment in emerging markets. |

The global mobile communication antenna market is estimated to be valued at USD 26.5 billion in 2025.

The market size for the mobile communication antenna market is projected to reach USD 53.6 billion by 2035.

The mobile communication antenna market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in mobile communication antenna market are omnidirectional and directional.

In terms of application, base station segment to command 38.0% share in the mobile communication antenna market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Antenna Switch Module Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Antenna, Transducer, and Radome (ATR) Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Communication Test and Measurement Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA