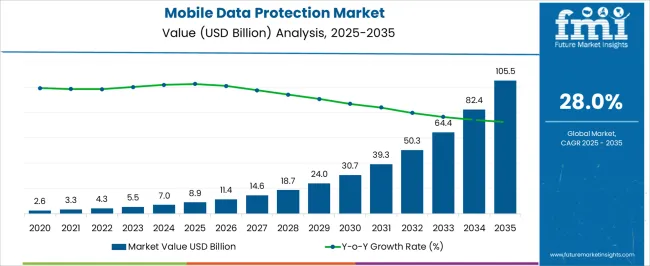

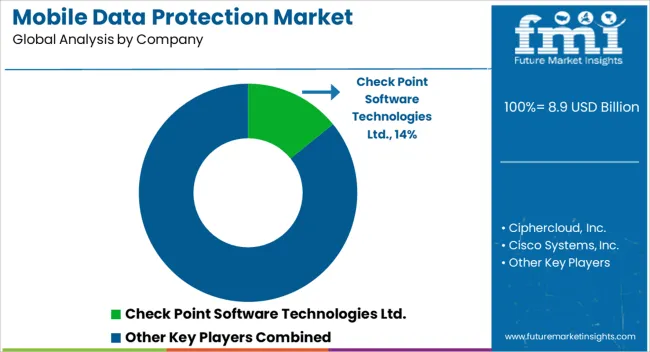

The Mobile Data Protection Market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 105.5 billion by 2035, registering a compound annual growth rate (CAGR) of 28.0% over the forecast period.

| Metric | Value |

|---|---|

| Mobile Data Protection Market Estimated Value in (2025 E) | USD 8.9 billion |

| Mobile Data Protection Market Forecast Value in (2035 F) | USD 105.5 billion |

| Forecast CAGR (2025 to 2035) | 28.0% |

The mobile data protection market is witnessing accelerated growth, supported by the increasing reliance on mobile devices for business operations and personal communication. The rise in remote work adoption, cloud connectivity, and mobile-driven transactions has heightened the need for robust data protection solutions that ensure privacy, compliance, and secure access. Enterprises and individuals alike are prioritizing mobile data security as threats such as data breaches, phishing, and malware attacks continue to rise in frequency and sophistication.

Advancements in mobile device management, encryption technologies, and secure authentication frameworks are expanding the scope of protection. Regulatory frameworks across major regions are also influencing market demand, as organizations are required to safeguard sensitive information in compliance with data privacy standards.

Growing adoption of enterprise mobility strategies and the integration of bring-your-own-device policies are further reinforcing the importance of mobile data protection With the increasing penetration of smartphones and applications in both consumer and enterprise ecosystems, the market is anticipated to remain on a robust growth trajectory, offering significant opportunities for solution providers worldwide.

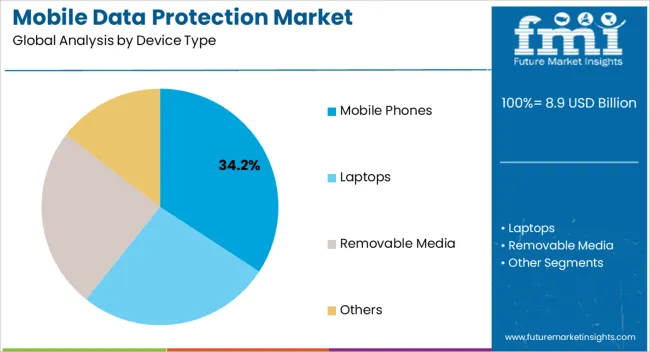

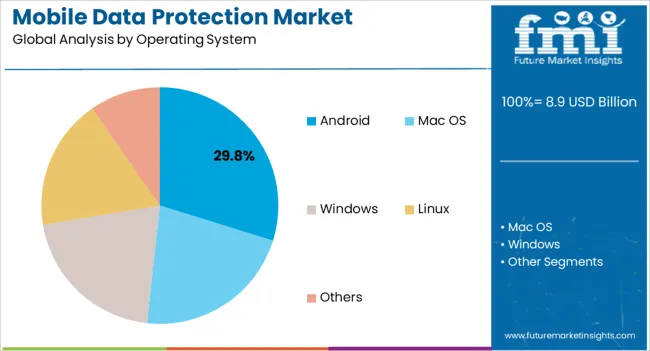

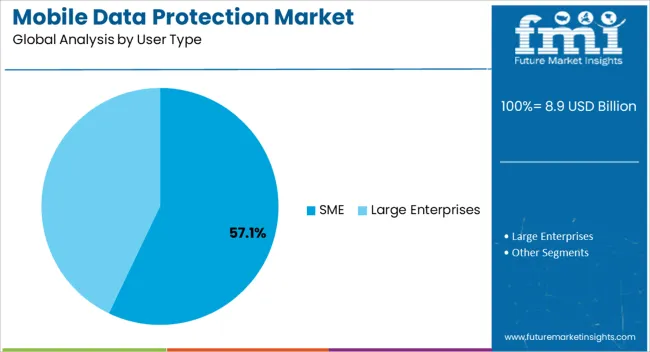

The mobile data protection market is segmented by device type, operating system, user type, verticals, and geographic regions. By device type, mobile data protection market is divided into Mobile Phones, Laptops, Removable Media, and Others. In terms of operating system, mobile data protection market is classified into Android, Mac OS, Windows, Linux, and Others. Based on user type, mobile data protection market is segmented into SME and Large Enterprises. By verticals, mobile data protection market is segmented into IT And Telecommunication, Retail, Manufacturing, Bfsi, Healthcare, Consumer Goods, Media And Entertainment, Aerospace & Defence, and Others. Regionally, the mobile data protection industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mobile phones segment is expected to hold 34.2% of the mobile data protection market revenue share in 2025, making it the leading device type. This leadership is being driven by the exponential growth in smartphone adoption, which has transformed the way individuals and organizations access, store, and share information. Mobile phones are increasingly being used as primary devices for business communications, banking transactions, and data-intensive applications, creating a higher risk profile that necessitates advanced security solutions.

The segment’s dominance is further supported by the rising prevalence of mobile-based workforces and the critical need to protect sensitive enterprise and personal data from cyberattacks. Technological advancements in mobile encryption, secure file sharing, and cloud-integrated protection systems are contributing to the segment’s expansion.

Additionally, the increasing sophistication of cyber threats targeting mobile platforms is prompting stronger investment in mobile device security solutions, ensuring the segment continues to lead The combination of convenience, ubiquity, and high vulnerability makes mobile phones the central focus of data protection strategies globally.

The Android operating system segment is projected to account for 29.8% of the mobile data protection market revenue share in 2025, positioning it as the leading operating system segment. Its dominance is being explained by its widespread global adoption, particularly in emerging markets where cost-effective devices are driving mass penetration. The open-source nature of Android provides extensive flexibility for customization but also exposes users to heightened risks of malware, unauthorized access, and data leakage, thereby driving the need for advanced protection mechanisms.

Growing concerns around security patches and fragmented updates are further stimulating demand for mobile data protection solutions tailored for Android devices. Enterprises are increasingly prioritizing Android security due to the large number of employees using these devices in bring-your-own-device environments.

Continuous developments in threat detection, endpoint protection, and encryption frameworks designed for Android ecosystems are reinforcing adoption As the Android platform continues to dominate the global smartphone market, the demand for mobile data protection solutions within this operating system segment is expected to remain strong.

The SME segment is anticipated to capture 57.1% of the mobile data protection market revenue share in 2025, making it the largest user type segment. This dominance is being supported by the growing digital transformation of small and medium enterprises, which are increasingly adopting mobile platforms to enhance operational efficiency, customer engagement, and remote working capabilities. SMEs often operate with limited IT infrastructure and cybersecurity expertise, making them highly vulnerable to cyberattacks, data breaches, and financial losses.

As regulatory pressures tighten around data security and privacy, SMEs are recognizing the importance of investing in cost-effective mobile data protection solutions. Cloud-based and subscription-driven security platforms are being widely adopted within this segment due to their scalability, affordability, and ease of deployment.

The increasing frequency of ransomware and phishing attacks targeting smaller businesses is further accelerating demand As SMEs continue to expand their digital footprints, their prioritization of mobile data protection is expected to remain a critical driver of overall market growth, solidifying the segment’s leadership position.

Key firms bring technology to other businesses, customers, and society in a way that allows for extraordinary experiences while not compromising privacy. They believe in privacy-protecting innovation and performance, as well as technologies created with those rights in mind. This 'Privacy Notice' explains how they can utilize personal information while respecting privacy rights. They offer something known as a 'Privacy Notice, in particular, which details how their goods, services, and technology use a customer's personal information. These factors are estimated to surge the adoption of mobile data protection.

Unless a second or additional privacy notice is provided, it applies to their use of personal information throughout their websites, goods, online services, software, applications, tools, and other services and capabilities they provide, both online and offline. Key firms fundamentally gather information as part of their company activities, such as providing services, responding to requests and providing customer assistance, fulfilling legal and contractual duties, and developing innovative goods, which contribute to the mobile data protection market growth.

Some of this information is provided directly by consumers, such as when they purchase a product, contact customer service, or register for an event or publication. These firms also gather information from end users through their interactions with their services and websites, such as through the use of embedded product technology and cookies. Moreover, they also get information from third sources. Virtualization technology can help consumers safeguard endpoint programs and data while maintaining a positive user experience.

Hardware-based security features provide the performance needed to help safeguard apps and data while minimizing user impact. Payment Card Industry (PCI) security requirements are increasingly being met by retailers and other businesses that accept or process credit cards. These standards compel enterprises to improve their networks, safeguard stored customer data, and encrypt data in transmission over public networks, which is likely to assist in the expansion of mobile data protection growth.

Key companies help consumers reduce their risk of data breaches and examine their security posture and setups. It finds shared storage and database resources automatically. Furthermore, by detecting shadow IT on the cloud, their data is kept in SaaS apps. Furthermore, the adoption of mobile data protection may increase amongst stores that accept credit cards and maintain tight access controls, test and monitor access on a regular basis, and have an information security policy in place for workers and contractors.

Consumers may also receive notifications about unwanted and unlawful conduct, as well as capabilities to regulate it all through the Firewall. To keep businesses safe, the Firewall employs cutting-edge next-generation protection technologies such as deep learning and intrusion prevention. The demand for mobile data protection is expected to boost since certain market players are offering a secure Unified Endpoint Management (UEM) solution that allows enterprises to spend less time and effort managing and securing traditional and mobile endpoints.

The General Data Protection Regulation (GDPR) allows people in Europe more control over their personal data while also ensuring improved data security. However, enterprises throughout Europe are walking a tightrope when it comes to data storage and privacy, and they are hurrying to adopt data security protections across their infrastructure. By keeping their data and devices safe, key players may aid end-user efforts to comply with the GDPR and reduce the risk of fines. All these factors are anticipated to expand the global mobile data protection market size.

Protection of data from theft, loss, or misuse has become crucial practice in every enterprise, as breach of data can hamper brand image and result into severe losses. In the recent past, introduction of mobility has altered the operations within an organization globally. However, in spite of the fact that use of mobile or portable devices have brought in remarkable flexibility, it is also associated with potential data security risks.

Mobile data protection is the technology that protects enterprise as well as personal data from cyber-attacks, and other such activities. It inhibits unlicensed access, as well as offers advanced device protection from malware and provides firewalls, anti-virus solutions to the organizations. Mobile data protection facilitates enhanced encryption and decryption techniques within the system enabling the operators to safely store, access, and transfer data.

It primarily secures data stored on portable systems such smartphones, removable media, or even laptops. Moreover, increasing in adoption of portable devices for data storage among organizations in various sectors has resulted in a significant increase in deployment of mobile data protection as a step towards enhancing enterprise data security.

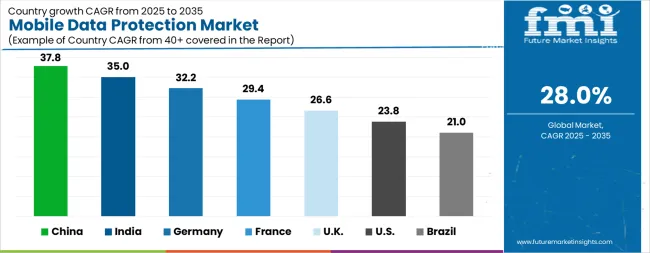

| Country | CAGR |

|---|---|

| China | 37.8% |

| India | 35.0% |

| Germany | 32.2% |

| France | 29.4% |

| UK | 26.6% |

| USA | 23.8% |

| Brazil | 21.0% |

The Mobile Data Protection Market is expected to register a CAGR of 28.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 37.8%, followed by India at 35.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 21.0%, yet still underscores a broadly positive trajectory for the global Mobile Data Protection Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 32.2%. The USA Mobile Data Protection Market is estimated to be valued at USD 3.4 billion in 2025 and is anticipated to reach a valuation of USD 28.4 billion by 2035. Sales are projected to rise at a CAGR of 23.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 419.6 million and USD 284.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Device Type | Mobile Phones, Laptops, Removable Media, and Others |

| Operating System | Android, Mac OS, Windows, Linux, and Others |

| User Type | SME and Large Enterprises |

| Verticals | IT And Telecommunication, Retail, Manufacturing, Bfsi, Healthcare, Consumer Goods, Media And Entertainment, Aerospace & Defence, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Check Point Software Technologies Ltd., Ciphercloud, Inc., Cisco Systems, Inc., Dell EMC, Druva Inc., Gemalto NV, Hewlett Packard Enterprise Development LP (HPE), McAfee LLC, Microsoft Corporation, Sophos Ltd., Symantec Corporation, and Trend Micro, Inc. |

The global mobile data protection market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the mobile data protection market is projected to reach USD 105.5 billion by 2035.

The mobile data protection market is expected to grow at a 28.0% CAGR between 2025 and 2035.

The key product types in mobile data protection market are mobile phones, laptops, removable media and others.

In terms of operating system, android segment to command 29.8% share in the mobile data protection market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA