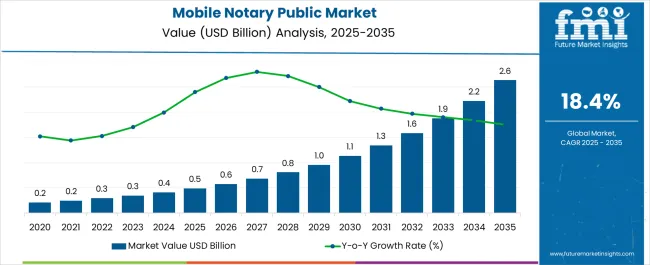

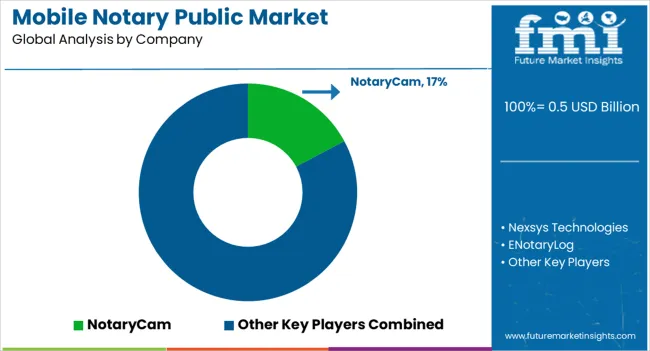

The Mobile Notary Public Market is estimated to be valued at USD 0.5 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 18.4% over the forecast period.

| Metric | Value |

|---|---|

| Mobile Notary Public Market Estimated Value in (2025 E) | USD 0.5 billion |

| Mobile Notary Public Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 18.4% |

The mobile notary public market is experiencing steady expansion, supported by the growing demand for remote and flexible notarization services across legal, financial, and real estate sectors. Industry publications and service provider reports have emphasized the rising adoption of digital platforms, particularly cloud-based solutions, to streamline document authentication and improve service accessibility.

Increasing reliance on remote work and virtual transactions has accelerated the use of mobile notary services, as organizations seek secure, compliant, and efficient solutions for identity verification and contract execution. Additionally, regulatory updates in several jurisdictions permitting remote online notarization have opened new avenues for market growth.

Enterprises are investing in digital infrastructure to reduce operational delays and improve transaction timelines, further driving demand for scalable notary platforms. Looking ahead, the market is expected to benefit from integration of advanced technologies such as blockchain and biometrics to enhance trust and compliance, alongside expanding applications in large-scale corporate transactions and cross-border agreements.

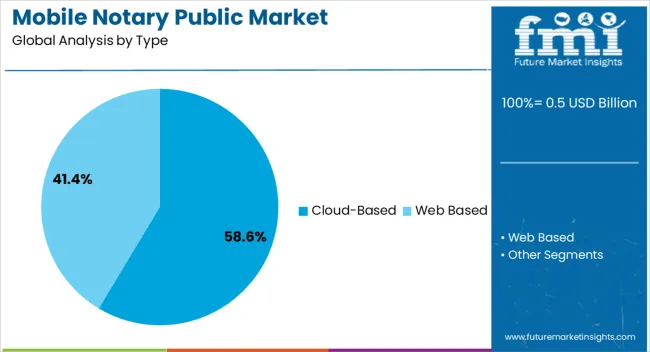

The Cloud-Based segment is projected to account for 58.6% of the mobile notary public market revenue in 2025, establishing itself as the leading technology type. Growth of this segment has been fueled by the increasing shift of enterprises and service providers toward digital ecosystems that offer scalability, security, and flexibility.

Cloud-based platforms have been favored for their ability to enable real-time access to notarization services across geographies, reducing the need for physical presence. Service provider updates and technology adoption surveys have highlighted the advantages of cloud-based notarization, including encrypted document storage, seamless integration with enterprise systems, and cost-efficient deployment.

Furthermore, cloud infrastructure has supported compliance with evolving legal frameworks for digital notarization, making it the preferred choice for regulated industries. As digital transformation initiatives accelerate across sectors, the Cloud-Based segment is expected to retain its dominant position in the market.

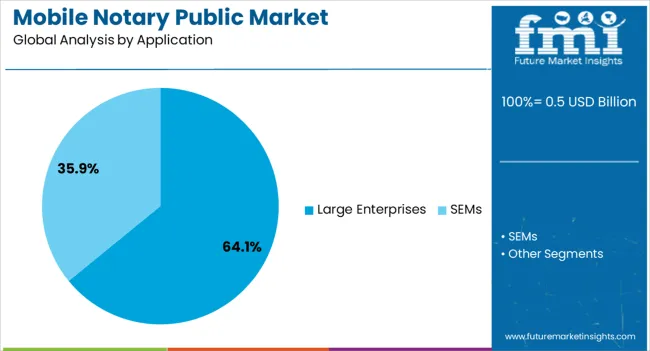

The Large Enterprises segment is projected to contribute 64.1% of the mobile notary public market revenue in 2025, positioning itself as the dominant application segment. This growth has been driven by the extensive notarization needs of large corporations in industries such as banking, insurance, and real estate, where secure documentation and compliance are critical.

Annual filings and corporate governance reports have indicated a steady rise in large-scale digital transactions requiring notarized validation, reinforcing demand for enterprise-focused mobile notary solutions. Large enterprises have prioritized efficiency and risk mitigation, adopting mobile and remote notarization services to accelerate contract processing and minimize legal exposure.

Additionally, integration of mobile notary services into enterprise resource planning systems has improved workflow automation and document traceability. With multinational corporations increasingly conducting cross-border agreements, demand for secure, scalable, and compliant notarization services is expected to sustain the leading position of the Large Enterprises segment in the market.

One of the major factors driving the growth of the mobile notary public market is the rising demand for e-notary software because of its many advantages. These advantages include increased security and convenience for businesses and consumers that deal with notarizations frequently.

With mobile notary public, notaries public, attorneys, and anyone else in need of electronic document certification have access to secure electronic notarization functionality. Businesses and clients who frequently use notarization will appreciate the added safety and ease of use that comes with the adoption of a mobile notary public.

Documents such as deeds, insurance settlements, and affidavits can all be validated with the use of mobile notary public solutions without the need for a traditional notary public. E-notary software's primary advantages lie in its ability to reduce the amount of time and energy expended on physical notarizations, as well as to keep private papers' contents secure and to provide audit trails.

Due to the fast-paced nature of modern life, it is challenging for the average person to dedicate more time to a single endeavor. There has been a rise in demand for mobile notary public because of this.

There are some good outcomes that are contributing to the rise in demand for mobile notary public, such as the fact that some e-notary software enables electronic notary journal entries, streamlining and facilitating notary procedures. As a result of these merits, the demand for mobile notary public continues to rise.

However, the increasing prevalence of internet scams is a potential roadblock for the mobile notary public industry. Nonetheless, the speed and ease of online notarization make it a worthwhile alternative. This can be done in the convenience of your own home or workplace or even while you are away on business. Due to this, e-notary programs have become increasingly popular. Furthermore, the increasing prevalence of COVID-19 may create new expansion chances for the worldwide mobile notary public market.

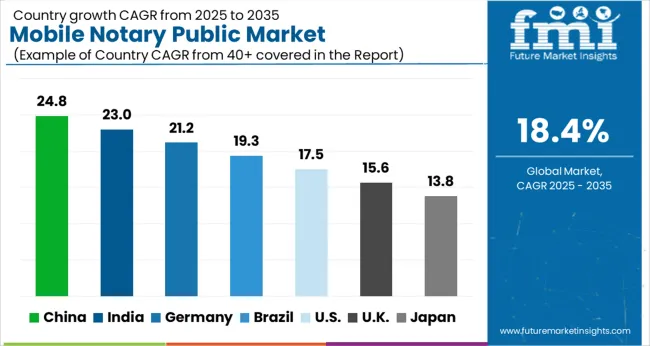

The North American mobile notary public market is well known for the purpose of e-notary software, such as the growing number of property transactions over the past few years, as well as several notary-related works being done online in this region using a variety of software. This has contributed to the widespread use of e-notary software in the North American region.

Most people in this region complete most of their jobs online because North America appears to be at the forefront of technological advancement. Additionally, the policies of the government in this region are contributing significantly to the expansion of the mobile notary public market.

One of the primary factors that are contributing to the expansion of the mobile notary public market in the Asia Pacific region is the region's rapidly expanding middle class, which is embracing new technologies at an increasing rate. Similarly, increasing curation and property transactions have led to the widespread adoption of a mobile notary public, despite the spread of the virus.

The mobile notary public market is growing rapidly, with new innovations paving the way for the success of the industry.

On July 7, 2024, the Digital Signature Powerhouse was launched. After announcing a deal for USD 30.4 million in stock from Liveoak Technologies of Austin, Texas, DocuSign planned to incorporate remote online notary services into its core set of products. Furthermore, this agreement is based on existing business relationships.

What makes this deal unique in the mobile notary public market is the signature technology from DocuSign has been integrated into the Liveoak platform. DocuSign founder Tom Gonser joined the Liveoak board last year when his firm, Seven Peaks Ventures, participated in an USD 0.4 million fundraising round at the Austin Company. Furthermore, DocuSign claims that its new DocuSign notary product is expected to be available in 2024 as part of its contract cloud suite. Notary Cam, Notaryize, and Signix are among the competitors.

Closings, Loans, and Mortgages

Notaries who go from client to client often make their living primarily via loan closings. More than half of a notary's income often comes from mortgage and loan signatures.

Unsurprisingly, the entire notary profession suffered greatly in 2008 when the housing market collapsed and the Great Recession set in. Notaries saw a decline in business from 2008 to 2012 as consumers were either unable or reluctant to buy homes in the face of economic uncertainty. The need for notaries, however, has increased since 2013 and is now higher than before the recession.

The demand for a mobile notary public is expected to keep growing as the frequency with which people sell and buy houses increases. The need for notaries is expected to rise in line with the growth and aging of the USA population since more people are likely to need their services when buying a property. This includes both millennials (buying their first home) and Baby Boomers (selling their current home and maybe downsizing).

Agreements to Settle Debts

While it's regrettable that so many people end up in debt, the increasing demand for mobile notary public related to debt settlement is good news for those in the profession. Moreover, notaries' chances of finding work improve when they form partnerships with respected businesses that offer debt settlement signature services.

Checking I-9s for Accuracy

Employers increasingly rely on freelancers and remote workers, as is well known. There has been a growth in the need for notaries as the federal government has been conducting audits of businesses to ensure that they are following the law by having each new employee fill out an I-9 form. Notaries are frequently employed by businesses to conduct identity checks on potential employees and complete any necessary paperwork on their behalf.

The I-9 forms, issued by USCIS, confirm an employee's identification and work eligibility in the USA.

Having something notarized is frequently a momentous occasion. When closing on a house, adopting a kid, getting married, or making a will, you might need the services of a notary public. For 2024, the most recent year for which data is available from the National Notary Association, there were more than 4.4 million notaries in the USA.

The number of people using online notary services, which provide the same level of security and reliability as a traditional notary public, has increased steadily over the past few years. This has led to the creation of opportunities in the market.

The Stewart-owned company NotaryCam has notarized papers for hundreds of thousands of consumers in all 50 states and more than 146 countries, making it the undisputed industry leader in online notarization and mortgage eClosing solutions. Supporting all eClosing situations (RON, IPEN, and Hybrids) with a customizable workflow for document recording and unrivaled identity verification, security, and customer base, the company's eClose360® platform provides the ideal online mortgage closing in every jurisdiction. NotaryCam's RON services, which include the execution of wills, legal documents (such as powers of attorney), and apostilles, are used by a wide range of businesses, from Fortune 500 conglomerates to small and medium-sized enterprises. Additionally, the company takes great pride in having a customer satisfaction rate of 99.8 percent and the highest Net promoter score (NPS) among the greatest worldwide technology brands.

Conceived as a meeting place for notaries and those in need of notarization, an online hybrid platform was developed by OneNotary. Clients can have their documents notarized in a timely manner through the platform, which allows them to schedule an online notarization session, upload the documents, verify their identity using personal history questions, meet their notary online for a session, and then download all the notarized documents.

One of the most important trends to emerge in 2024 is the growing demand from customers for mobile and online notary services. Due to COVID limits, many of the more common places to use a notary, such as a bank, have become less accessible, however, this has opened the door for mobile Notaries.

Notaries have developed creative responses to the evolving coronavirus outbreak, such as:

The rising popularity of remote internet notarization is another method in which notaries are broadening their clientele (RON). Nearly 40 states already offer RON in some form. Many Notaries have chosen to specialize in RON because it broadens the scope of their services, enabling them to work with clients in different states and even countries, and provides a less risky option to in-person notarizations for signers who may be vulnerable due to health concerns.

Recent Developments

| Attributes | Details |

|---|---|

| CAGR | 18.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Region Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Segments Covered | Type, Application, Region |

| Key Companies Profiled | NotaryCam; Nexsys Technologies; ENotaryLog; OneNotary; Superior Notary Services; First American Financial Corporation; The Closing Exchange; RED SEAL NOTARY; Bancserv; Mobile Notary Tampa |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global mobile notary public market is estimated to be valued at USD 0.5 billion in 2025.

The market size for the mobile notary public market is projected to reach USD 2.6 billion by 2035.

The mobile notary public market is expected to grow at a 18.4% CAGR between 2025 and 2035.

The key product types in mobile notary public market are cloud-based and web based.

In terms of application, large enterprises segment to command 64.1% share in the mobile notary public market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Public Transportation Full Payment Platform Market Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Mobile Money Market Forecast and Outlook 2025 to 2035

Mobile Application Testing Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Cardiac Telemetry System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Robots Market Size and Share Forecast Outlook 2025 to 2035

Mobile Crane Market Size and Share Forecast Outlook 2025 to 2035

Mobile Vascular Imaging Market Size and Share Forecast Outlook 2025 to 2035

Mobile Animal Inhalation Anesthesia Machine Market Size and Share Forecast Outlook 2025 to 2035

Mobile Unified Communications and Collaboration (UC&C) Solution Market Size and Share Forecast Outlook 2025 to 2035

Mobile Data Protection Market Size and Share Forecast Outlook 2025 to 2035

Mobile Medical Tablets Market Size and Share Forecast Outlook 2025 to 2035

Mobile WLAN Access Points Market Size and Share Forecast Outlook 2025 to 2035

Mobile Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Mobile Printer Market Size and Share Forecast Outlook 2025 to 2035

Public Announcement System Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Public Cloud Application Infrastructure Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA